Europe Ultra-Low Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others.

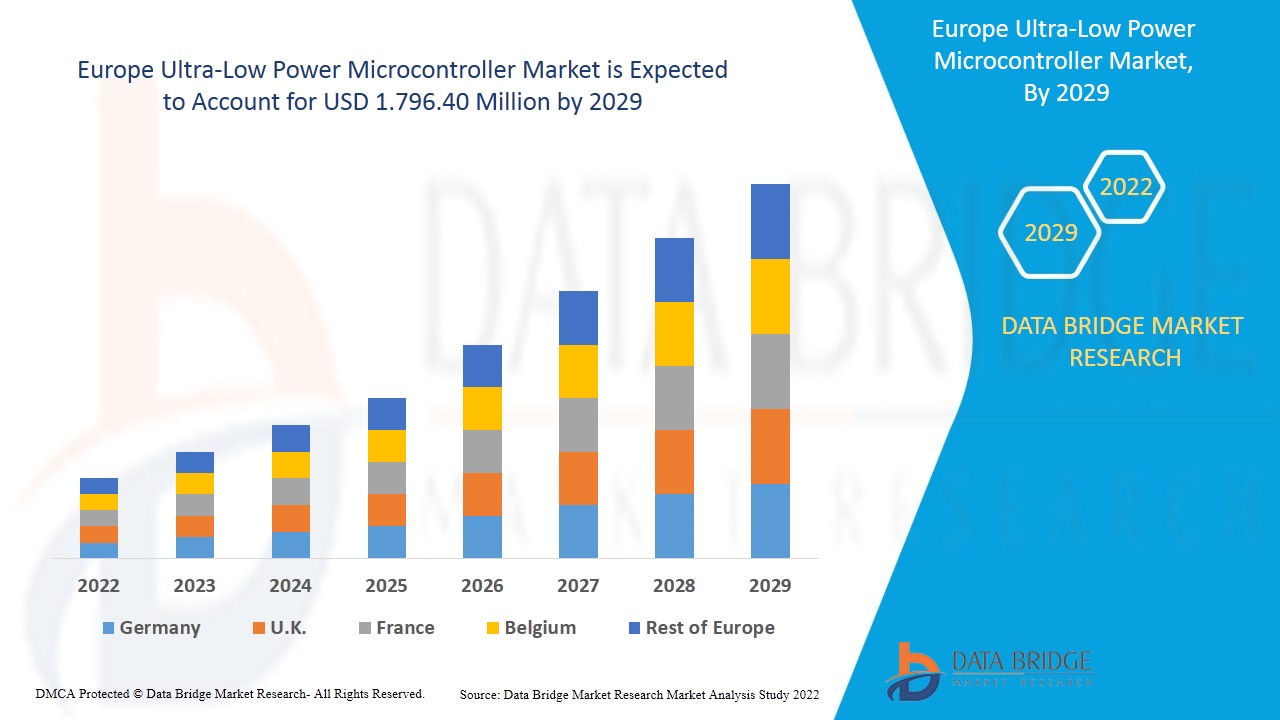

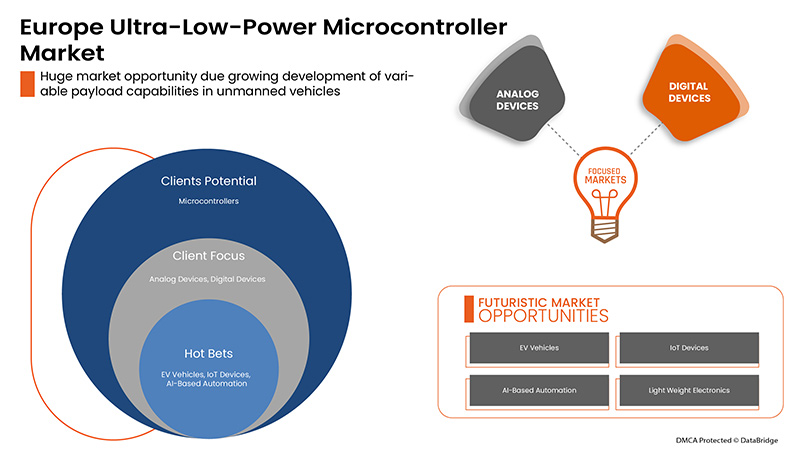

With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. Data Bridge Market Research analyses that the Europe ultra-low-power microcontroller market is expected to reach the value of USD 1.796.40 million by the year 2029, at a CAGR of 10.1% during the forecast period. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Analog Devices and Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs and Ultrasonic Sensing MCUs), Component (Hardware, Software and Services), Packaging Type (8 Bit Packaging, 16 Bit Packaging and 32 Bit Packaging), Network Connectivity (Wireless and Wired), RAM Capacity (Less Than 96 kb, 96 kb-512 kb and More Than 512 kb), retention power mode (1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and More Than 3.5 μW), Application (General Test & Measurement, Sensing, Flow Measurement and Others), End-User (Healthcare, Industrial, Manufacturing, It & Telecom, Military & Defence, Aerospace, Media & Entertainment, Automotive, Servers & Data Centers, Consumer Electronics and Others), |

|

Countries Covered |

U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Luxemburg, Rest of Europe |

|

Market Players Covered |

Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, e-peas, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electronics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc. |

Market Definition

Ultra-low-power (ULP) microcontroller allows edge nodes to intelligently process localized data with the smallest amount of system power. This allows customers to extend battery life and the time between charges allowing longer use. Smaller battery sizes and longer time between in-field product replacements provide cost-saving for end users. Ultra-low-power consumption is a very important requirement to operate with small energy sources (to reduce size) and not generate local heating issues.

The Market Dynamics of the Ultra-Low-Power Microcontroller Market Include:

- Surge in need of energy efficient power electronic components

Developments in embedded technology led to the developments in high efficiency MCUs. The power requirements for these MCUs increased proportionally with their features and capabilities. Therefore, to design energy-efficient and compact applications using embedded systems, the power consumption of microcontrollers has to be reduced. Low power consumption also aids in making the device compact by reducing the required power supply. An ultra-low-power device can work for a long period, even on a smaller battery. This has encouraged many companies to produce ultra-low-power and energy-efficient MCUs without compromising their performance, thus expected to drive the market's growth.

- Growing popularity of low-battery-powered IoT devices

There is a growing demand for ultra-low-power MCUs in IoT applications for increasing energy conservation and making the device more compact. This is expected to drive the growth in the Europe ultra-low-power microcontroller market.

- Increasing demand for low power consuming MCU in smart devices

The market for personal wellness and medical wearable applications is growing fast. New technological advancements and changing lifestyle has led to the increase of adoption of smart devices throughout the globe, this is increasing the demand for ultra-low-power microcontrollers in the market.

- Rising demand for microcontrollers in edge AI

The demand for ultra-low-power microcontrollers for performing ML at the edge has become a very hot area of development. Manufacturers are working to develop ultra-low-power microcontrollers that would allow inferencing, and ultimately training, to be executed on small, resource-constrained low-power devices, especially microcontrollers.

- Increasing demand for smart home and building management applications

With the developments and adoption in the smart home market, the demand for appliances to become sleeker and slim with a smaller form factor and more energy efficient is increasing. This has increased the demand for ultra-low-power microcontrollers.

Restraints/Challenges faced by the Ultra-Low-Power Microcontroller Market

- Huge carbon footprint issue in the semiconductor manufacturing sector

Chip manufacturers are major contributors to the climate crisis. It requires huge amounts of energy and water. Thus the resource intensive manufacturing process for a ULP microcontroller may restrain the growth of the market.

- Chip supply shortages

The leaders and executives at multinational corporations in Asia-Pacific are worried about the scarcity of semiconductors, which has hit manufacturing and sales in numerous countries, and no early solution is in sight. This poses as a significant challenge to the growth of the market.

This ultra-low-power microcontroller market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ultra-low-power microcontroller market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In September 2021, Analog Devices, Inc. announced the completion of its acquisition of Maxim Integrated. The acquisition amounted to USD 20.8 billion and helped the company boost its analog and mixed-signal portfolio and expand its reach in several markets. The company integrated both companies' human resources and technology to offer complete, cutting-edge solutions for their customers

- In February 2022, Infineon Technologies AG collaborated with SensiML, a developer of AI tools for building intelligent Internet of Things (IoT) endpoints. The companies aimed at offering developers an easy and seamless process to capture data from Infineon XENSIV sensors, train Machine Learning (ML) models, and deploy real-time inferencing models directly on ultra-low-power PSoC 6 microcontrollers (MCUs). With this, the company offered designers the right tools to develop smart applications for IoT devices spanning the smart home, industrial and fitness sectors

Europe Ultra-Low-Power Microcontroller Market Scope

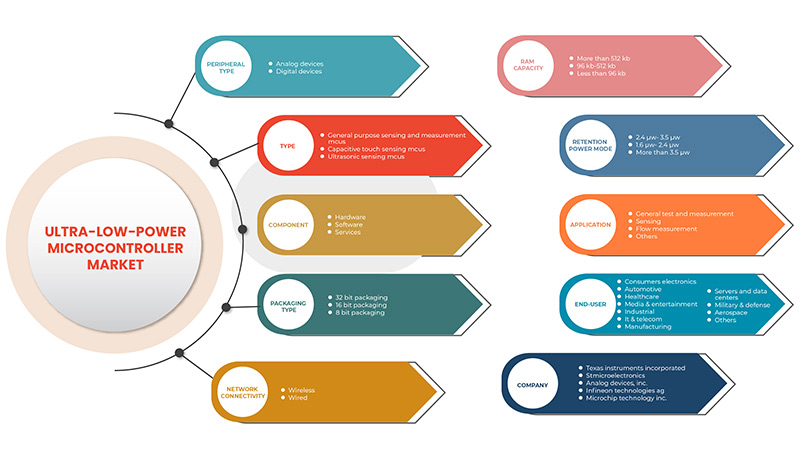

The ultra-low-power microcontroller market is segmented on the basis of peripheral type, type, component, packaging type, network connectivity, RAM capacity, retention power mode, application, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Peripheral Type

- Analog Devices

- Digital Devices

On the basis of peripheral type, the ultra-low-power microcontroller market is segmented into analog devices and digital devices.

Type

- General Purpose Sensing And Measurement MCUs

- Capacitive Touch Sensing MCUs

- Ultrasonic Sensing MCUS

On the basis of type, the ultra-low-power microcontroller market is segmented into general purpose sensing and measurement MCUS, capacitive touch sensing MCUS and ultrasonic sensing MCUS.

Component

- Hardware

- Software

- Services

On the basis of component, the ultra-low-power microcontroller market is segmented into hardware, software and services.

Packaging Type

- 8 Bit Packaging

- 16 Bit Packaging

- 32 Bit Packaging

On the basis of packaging type, the ultra-low-power microcontroller market is segmented into 8 bit packaging, 16 bit packaging and 32 bit packaging.

Network Connectivity

- Wired

- Wireless

On the basis of network connectivity, the ultra-low-power microcontroller market is segmented into wireless and wired.

RAM Capacity

- Less Than 96 kb,

- 96 kb-512 kb

- More Than 512 kb

On the basis of RAM capacity, the ultra-low-power microcontroller market is segmented into less than 96 kb, 96 kb-512 kb and more than 512 kb.

Retention Power Mode

- 1.6 μW- 2.4 μW,

- 2.4 μW- 3.5 μW

- More Than 3.5 μW

On the basis of retention power mode, the ultra-low-power microcontroller market is segmented into 1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and more than 3.5 μW.

Application

- General Test & Measurement

- Sensing

- Flow Measurement

- Others

On the basis of application, the ultra-low-power microcontroller market is segmented into general test & measurement, sensing, flow measurement and others.

End-User

- Healthcare

- Industrial

- Manufacturing

- It & Telecom

- Military & Defense

- Aerospace

- Media & Entertainment

- Automotive

- Servers & Data Centers

- Consumer Electronics

- Others

On the basis of end-user, the ultra-low-power microcontroller market is segmented into healthcare, industrial, manufacturing, IT & telecom, military & defense, aerospace, media & entertainment, automotive, servers & data centers, consumer electronics and others.

Ultra-Low-Power Microcontroller Market Regional Analysis/Insights

The ultra-low-power microcontroller market is analyzed and market size insights and trends are provided by country, peripheral type, type, component, packaging type, network connectivity, RAM capacity, retention power mode, application, and end-user as referenced above.

The countries covered in the Europe ultra-low-power microcontroller market report are the U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Luxemburg, and rest of Europe.

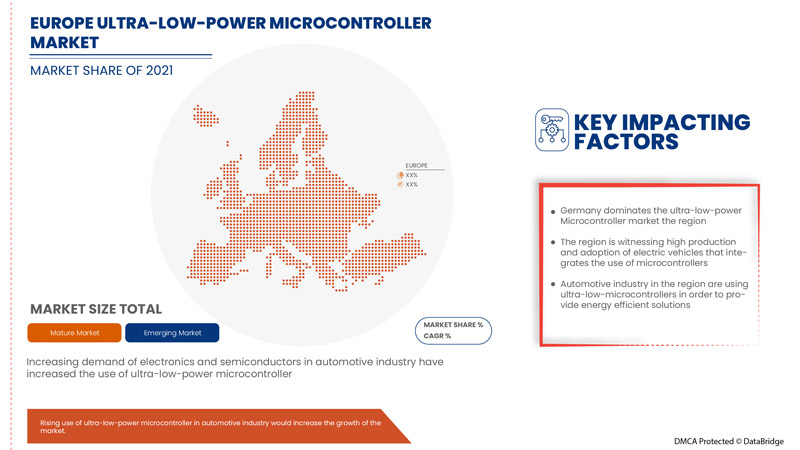

Germany dominates the ultra-low-power microcontroller market as the region has witnessed high growth in renewable energy and electric vehicles, increasing the demand for ultra-low-power microcontrollers. The region's automotive sector is rapidly adopting electric vehicles, and for that, more low-power microcontrollers are being used.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ultra-Low-Power Microcontroller Market Share Analysis

The ultra-low-power microcontroller market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultra-low-power microcontroller market.

Some of the major players operating in the ultra-low-power microcontroller market are Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, e-peas, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electronics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 PERIPHERAL TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS

5.1.2 GROWING POPULARITY OF LOW-BATTERY-POWERED IOT DEVICES

5.1.3 INCREASING DEMAND FOR LOW POWER CONSUMING MCU IN SMART DEVICES

5.1.4 RISING DEMAND FOR MICROCONTROLLERS IN EDGE AI

5.1.5 INCREASING DEMAND FOR SMART HOME AND BUILDING MANAGEMENT APPLICATIONS

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES IN ULTRA-LOW-POWER MICROCONTROLLER

5.2.1 HUGE CARBON FOOTPRINT ISSUES IN SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF POWER ELECTRONICS IN AUTOMOTIVE TECHNOLOGIES

5.3.2 SURGE IN GOVERNMENT INVESTMENTS TO SUPPORT IOT GROWTH ACROSS THE GLOBE

5.3.3 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LOWER ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE

6.1 OVERVIEW

6.2 ANALOG DEVICES

6.3 DIGITAL DEVICES

7 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE

7.1 OVERVIEW

7.2 GENERAL PURPOSE SENSING AND MEASUREMENT MCUS

7.3 CAPACITIVE TOUCH SENSING MCUS

7.4 ULTRASONIC SENSING MCUS

8 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 PROCESSORS

8.2.2 MEMORY

8.2.3 POWER SUPPLY UNIT

8.2.4 SENSORS

8.2.5 CONTROLLER

8.2.6 OTHERS

8.3 SOFTWARE

8.4 SERVICES

8.4.1 IMPLEMENTATION & INTEGRATION

8.4.2 TRAINING & CONSULTING

8.4.3 SUPPORT & MAINTENANCE

9 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 32 BIT PACKAGING

9.3 16 BIT PACKAGING

9.4 8 BIT PACKAGING

10 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.3 WIRED

11 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY

11.1 OVERVIEW

11.2 MORE THAN 512 KB

11.3 96 KB-512 KB

11.4 LESS THAN 96 KB

12 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE

12.1 OVERVIEW

12.2 2.4 ΜW- 3.5 ΜW

12.3 1.6 ΜW- 2.4 ΜW

12.4 MORE THAN 3.5 ΜW

13 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 GENERAL TEST AND MEASUREMENT

13.3 SENSING

13.4 FLOW MEASUREMENT

13.5 OTHERS

14 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER

14.1 OVERVIEW

14.2 CONSUMERS ELECTRONICS

14.2.1 SMARTPHONES

14.2.2 DESKTOP

14.2.3 TABLETS

14.2.4 LAPTOPS

14.2.5 SMART WATCHES

14.3 AUTOMOTIVE

14.3.1 INFOTAINMENT

14.3.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

14.4 HEALTHCARE

14.4.1 PORTABLE MEDICAL DEVICES

14.4.2 WEARABLE MEDICAL PATCHES

14.5 MEDIA & ENTERTAINMENT

14.6 INDUSTRIAL

14.6.1 BUILDING AUTOMATION

14.6.2 ROBOTICS

14.6.3 MACHINE VISION

14.6.4 AUTOMATED GUIDED VEHICLES

14.6.5 HUMAN–MACHINE INTERFACE (HMI)

14.7 IT & TELECOM

14.8 MANUFACTURING

14.9 SERVERS AND DATA CENTERS

14.1 MILITARY & DEFENSE

14.11 AEROSPACE

14.11.1 AVIONICS AND DEFENSE SYSTEMS

14.11.2 UNMANNED AERIAL VEHICLES

14.12 OTHERS

15 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 U.K.

15.1.3 FRANCE

15.1.4 ITALY

15.1.5 SPAIN

15.1.6 RUSSIA

15.1.7 NETHERLANDS

15.1.8 SWITZERLAND

15.1.9 TURKEY

15.1.10 BELGIUM

15.1.11 REST OF EUROPE

16 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEXAS INSTRUMENTS INCORPORATED

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STMICROELECTRONICS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ANALOG DEVICES, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 INFINEON TECHNOLOGIES AG

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MICROCHIP TECHNOLOGY INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 RENESAS ELECTRONICS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 NXP SEMICONDUCTORS

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMBIQ MICRO, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BROADCOM

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EM MICROELECTRONIC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 E-PEAS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 HOLTEK SEMICONDUCTOR INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 LAPIS SEMICONDUCTOR CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 NUVOTON TECHNOLOGY CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PROFICHIP USA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SEIKO EPSON CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SILICON LABORATORIES

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZILOG, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 3 EUROPE ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 5 EUROPE DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 9 EUROPE GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 EUROPE CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 EUROPE ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 17 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 19 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 EUROPE SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 23 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 25 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 27 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 29 EUROPE 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 31 EUROPE 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 33 EUROPE 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 35 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 37 EUROPE WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 39 EUROPE WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 41 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 43 EUROPE MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 45 EUROPE 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 47 EUROPE LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 49 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 51 EUROPE 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 53 EUROPE 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 EUROPE 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 55 EUROPE MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 57 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 59 EUROPE GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 61 EUROPE SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 63 EUROPE FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 65 EUROPE OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 67 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 69 EUROPE CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 EUROPE CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 71 EUROPE CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 73 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 75 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 77 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 79 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 81 EUROPE MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 EUROPE MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 83 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 85 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 EUROPE IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 EUROPE IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 89 EUROPE MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 90 EUROPE MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 91 EUROPE SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 EUROPE SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 93 EUROPE MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 94 EUROPE MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 95 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 97 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 99 EUROPE OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 100 EUROPE OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 101 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 103 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 104 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 105 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 107 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 109 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 EUROPE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EUROPE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 113 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 114 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 115 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 116 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 117 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 118 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 119 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 120 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 121 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 123 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 125 EUROPE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 EUROPE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 EUROPE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 129 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 EUROPE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 131 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 EUROPE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 133 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 EUROPE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 135 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 137 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 139 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 140 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 141 GERMANY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 GERMANY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 143 GERMANY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 GERMANY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 145 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 146 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 147 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 148 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 149 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 150 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 151 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 152 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 153 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 155 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 GERMANY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 157 GERMANY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 GERMANY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 GERMANY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 GERMANY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 161 GERMANY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 GERMANY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 163 GERMANY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 GERMANY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 165 GERMANY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 GERMANY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 167 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 169 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 171 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 172 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 173 U.K. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.K. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 175 U.K. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 U.K. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 177 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 179 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 180 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 181 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 183 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 184 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 185 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 187 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 188 U.K. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 189 U.K. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.K. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 U.K. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 U.K. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 193 U.K. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.K. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 195 U.K. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.K. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 197 U.K. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 U.K. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 199 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 201 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 203 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 204 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 205 FRANCE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 FRANCE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 207 FRANCE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 FRANCE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 209 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 210 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 211 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 212 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 213 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 214 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 215 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 216 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 217 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 219 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 220 FRANCE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 221 FRANCE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 FRANCE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 FRANCE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 FRANCE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 225 FRANCE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 FRANCE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 227 FRANCE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 FRANCE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 229 FRANCE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 FRANCE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 231 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 232 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 233 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 235 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 236 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 237 ITALY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 ITALY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 239 ITALY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 ITALY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 241 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 242 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 243 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 244 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 245 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 246 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 247 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 248 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 249 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 251 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 252 ITALY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 253 ITALY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 ITALY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 ITALY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 ITALY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 257 ITALY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 ITALY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 259 ITALY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 ITALY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 261 ITALY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 ITALY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 263 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 264 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 265 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 267 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 268 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 269 SPAIN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 SPAIN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 271 SPAIN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 SPAIN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 273 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 274 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 275 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 276 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 277 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 278 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 279 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 280 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 281 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 283 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 284 SPAIN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 285 SPAIN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 SPAIN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 287 SPAIN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 SPAIN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 289 SPAIN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 SPAIN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 291 SPAIN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 SPAIN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 293 SPAIN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 SPAIN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 295 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 296 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 297 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 299 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 300 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 301 RUSSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 RUSSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 303 RUSSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 RUSSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 305 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 306 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 307 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 308 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 309 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 310 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 311 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 312 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 313 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 315 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 316 RUSSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 317 RUSSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 318 RUSSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 319 RUSSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 320 RUSSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 321 RUSSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 322 RUSSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 323 RUSSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 RUSSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 325 RUSSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 326 RUSSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 327 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 328 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 329 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 330 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 331 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 332 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 333 NETHERLANDS HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 334 NETHERLANDS HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 335 NETHERLANDS SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 336 NETHERLANDS SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 337 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 338 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 339 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 340 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 341 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 342 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 343 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 344 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 345 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 346 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 347 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 348 NETHERLANDS ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 349 NETHERLANDS CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 350 NETHERLANDS CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 351 NETHERLANDS AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 352 NETHERLANDS AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 353 NETHERLANDS HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 354 NETHERLANDS HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 355 NETHERLANDS INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 356 NETHERLANDS INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 357 NETHERLANDS AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 358 NETHERLANDS AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 359 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 360 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 361 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 363 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 364 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 365 SWITZERLAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 366 SWITZERLAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 367 SWITZERLAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 368 SWITZERLAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 369 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 370 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 371 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 372 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 373 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 374 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 375 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 376 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 377 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 378 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 379 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 380 SWITZERLAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 381 SWITZERLAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 382 SWITZERLAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 383 SWITZERLAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 384 SWITZERLAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 385 SWITZERLAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 386 SWITZERLAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 387 SWITZERLAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 388 SWITZERLAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 389 SWITZERLAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 390 SWITZERLAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 391 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 392 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 393 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 394 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 395 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 396 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 397 TURKEY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 398 TURKEY HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 399 TURKEY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 400 TURKEY SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 401 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 403 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 404 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 405 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 406 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 407 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 408 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 409 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 410 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 411 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 412 TURKEY ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 413 TURKEY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 414 TURKEY CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 415 TURKEY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 416 TURKEY AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 417 TURKEY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 418 TURKEY HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 419 TURKEY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 420 TURKEY INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 421 TURKEY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 422 TURKEY AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 423 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 424 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 425 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 426 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 427 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 428 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 429 BELGIUM HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 430 BELGIUM HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 431 BELGIUM SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 432 BELGIUM SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 433 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 434 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 435 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 436 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 437 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 438 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 439 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 440 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 441 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 442 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 443 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 444 BELGIUM ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 445 BELGIUM CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 446 BELGIUM CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 447 BELGIUM AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 448 BELGIUM AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 449 BELGIUM HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 450 BELGIUM HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 451 BELGIUM INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 452 BELGIUM INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 453 BELGIUM AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 454 BELGIUM AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 455 REST OF EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 456 REST OF EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

List of Figure

FIGURE 1 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: CHALLENGE MATRIX

FIGURE 11 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS IS EXPECTED TO DRIVE THE EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 ANALOG DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET IN FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET

FIGURE 16 SHARE OF ELECTRICITY FLOW THROUGH POWER ELECTRONICS IN THE U.S. (2005–2030) (IN %)

FIGURE 17 NUMBER OF WEARABLE DEVICES IN U.S. FROM 2014 TO 2019 (IN MILLIONS)

FIGURE 18 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2021

FIGURE 19 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2021

FIGURE 20 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2021

FIGURE 21 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2021

FIGURE 23 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2021

FIGURE 24 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2021

FIGURE 25 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2021

FIGURE 26 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2021

FIGURE 27 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: SNAPSHOT (2021)

FIGURE 28 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021)

FIGURE 29 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY PERIPHERAL TYPE (2022-2029)

FIGURE 32 EUROPE ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

Europe Ultra Low Power Microcontroller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Ultra Low Power Microcontroller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Ultra Low Power Microcontroller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.