Europe Treasury Software Market

Market Size in USD Million

CAGR :

%

USD

939.66 Million

USD

1,181.12 Million

2024

2032

USD

939.66 Million

USD

1,181.12 Million

2024

2032

| 2025 –2032 | |

| USD 939.66 Million | |

| USD 1,181.12 Million | |

|

|

|

|

Treasury Software Market Size

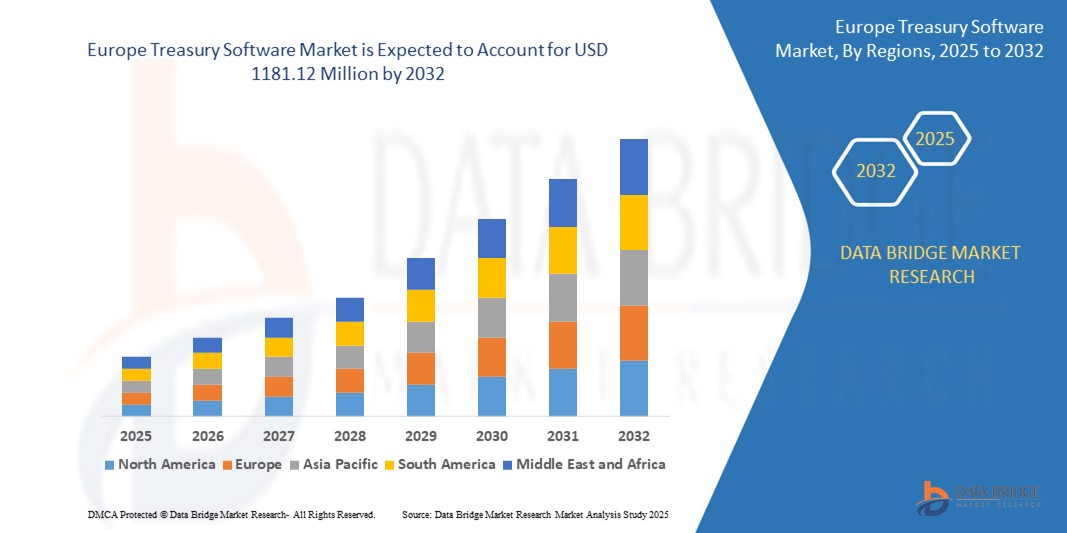

- The Europe treasury software market size was valued at USD 939.66 million in 2024 and is expected to reach USD 1181.12 million by 2032, at a CAGR of 2.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of cloud-based financial systems and the accelerating digital transformation of corporate finance functions, leading to greater automation, real-time cash visibility, and streamlined treasury operations across organizations of all sizes

- Furthermore, rising demand for secure, scalable, and integrated solutions for liquidity management, financial risk mitigation, and regulatory compliance is establishing treasury software as a critical component in modern enterprise financial infrastructure. These converging factors are significantly boosting the adoption of treasury software solutions, thereby driving the market forward

Treasury Software Market Analysis

- Treasury software refers to a suite of applications designed to automate, manage, and optimize a company’s financial operations, including cash flow, investments, debt, and risk. These systems help streamline processes such as bank reconciliation, cash forecasting, and regulatory reporting while providing real-time financial insights

- The rising demand for treasury software is primarily driven by the growing complexity of global finance, increased emphasis on compliance and data security, and the need for centralized financial control across distributed business environments

- Germany dominated the treasury software market in 2024, due to strong demand from its advanced banking and manufacturing sectors, along with early digital adoption across large enterprises and public institutions

- U.K. is expected to be the fastest growing region in the treasury software market during the forecast period due to increasing adoption of cloud-based solutions, a dynamic fintech environment, and growing demand for real-time visibility into liquidity and cash positions among multinational firms

- On premise segment dominated the market with a market share of 54.1% in 2024, due to the high demand among large financial institutions and government bodies for greater control over data, enhanced security, and customization capabilities. These organizations often operate within strict regulatory environments that require localized data storage and system configurations tailored to complex internal workflows, making on-premise deployment the preferred choice

Report Scope and Treasury Software Market Segmentation

|

Attributes |

Treasury Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Treasury Software Market Trends

Growing Digital Transformation

- The treasury software market is expanding swiftly as organizations pursue end-to-end digital transformation to streamline financial processes, improve transparency, and support real-time decision-making across increasingly complex corporate and banking environments

- For instance, FIS and Kyriba have reported a surge in adoption of cloud-based treasury management platforms that automate cash positioning, liquidity forecasting, and intercompany netting, highlighting the market’s pivot toward modern, digitally native solutions

- Integration of advanced technologies—such as artificial intelligence, machine learning, and robotic process automation—enhances the ability of treasury software to provide predictive analytics, fraud detection, and workflow optimization

- Mobile and remote work trends are driving demand for treasury platforms accessible across devices, supporting flexible work models, faster approvals, and collaboration among distributed finance teams

- Open banking and API ecosystems are facilitating seamless connectivity between treasury systems and banks, ERP, and payment platforms, reducing manual workflows and improving data integration

- Regulations and compliance requirements are accelerating the adoption of digital treasury tools that enable automated reporting, audit trails, and risk controls, particularly for multinational entities operating in diverse jurisdictions

Treasury Software Market Dynamics

Driver

Increasing Emphasis on Cash Management

- A heightened focus on cash visibility, forecasting accuracy, and working capital optimization is fueling adoption of treasury software as organizations seek to mitigate financial risks, manage liquidity, and ensure business continuity in volatile markets

- For instance, SAP and Oracle have expanded their treasury management offerings to help global enterprises centralize cash positions, implement in-house banking, and automate reconciliation across multi-currency and multi-bank structures

- Treasury software allows for real-time aggregation of global cash balances, speedy deployment of idle funds, and improved investment management, supporting strategic treasury roles within organizations

- The rise of e-commerce, cross-border trade, and supply chain complexity is making robust cash management tools essential for timely payments, collections, and financial control

- Enhanced treasury visibility supports regulatory compliance, financial reporting accuracy, and stakeholder confidence, driving ongoing investment in digital cash management solutions

Restraint/Challenge

Implementation Challenges of Treasury Software

- Organizations face significant hurdles when implementing treasury software, particularly around system integration, data migration, and alignment with existing processes or legacy infrastructure

- For instance, case studies from TIS and Reval highlight challenges including lengthy deployment timelines, high customization needs, and resistance to change among finance teams unfamiliar with new digital workflows

- Integration with ERP, bank systems, and external partners can be complex, often requiring custom interfaces or middleware that increases project cost and risk

- Data quality issues—stemming from inconsistent or fragmented financial records—can hinder the automation and analytics capabilities promised by advanced treasury platforms

- Ongoing user training, change management, and the need for continuous upgrades or cybersecurity vigilance can stretch resources, impacting adoption rates especially among mid-sized and resource-constrained organizations

Treasury Software Market Scope

The market is segmented on the basis of operating system, application, deployment mode, organization size, and vertical.

- By Operating System

On the basis of operating system, the Europe treasury software market is segmented into Windows, Linux, iOS, Android, and MAC. The Windows segment dominated the largest market revenue share in 2024 due to its widespread use across enterprise environments and compatibility with most treasury software solutions. Financial institutions and corporate treasuries continue to prefer Windows-based platforms for their stability, long-standing support ecosystem, and integration capabilities with enterprise resource planning (ERP) systems.

The Linux segment is projected to experience the fastest growth rate from 2025 to 2032, driven by rising demand for open-source flexibility, lower operating costs, and enhanced security features. European financial organizations are increasingly adopting Linux-based systems to meet regulatory compliance and cybersecurity standards while gaining more control over software customization and deployment.

- By Application

On the basis of application, the market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others. The liquidity and cash management segment held the largest share in 2024, owing to heightened emphasis on real-time cash visibility and accurate forecasting among corporates and banks. As macroeconomic uncertainties persist across Europe, organizations are prioritizing liquidity optimization to ensure operational resilience.

The financial risk management segment is expected to record the highest CAGR over the forecast period, driven by the evolving financial risk landscape, including currency volatility, interest rate fluctuations, and regulatory pressures. Treasury teams across industries are increasingly turning to risk management tools that offer scenario modeling, stress testing, and automated compliance features to mitigate financial exposure.

- By Deployment Mode

On the basis of deployment mode, the Europe treasury software market is categorized into on-premise and cloud. The on-premise segment led the market with a revenue share of 54.1% in 2024, driven by the high demand among large financial institutions and government bodies for greater control over data, enhanced security, and customization capabilities. These organizations often operate within strict regulatory environments that require localized data storage and system configurations tailored to complex internal workflows, making on-premise deployment the preferred choice.

The cloud segment is anticipated to grow at the fastest rate from 2025 to 2032, propelled by the increasing need for scalability, reduced upfront costs, and faster implementation cycles. Cloud-based treasury solutions are gaining momentum among mid-sized enterprises and multinational corporations seeking real-time global access, remote collaboration, and seamless updates without heavy IT infrastructure investments.

- By Organization Size

On the basis of organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment captured the largest revenue share in 2024, due to their complex treasury operations, multi-country presence, and significant need for centralized financial oversight. These organizations typically invest in advanced treasury systems with modules for multi-currency management, regulatory compliance, and automation of high-volume transactions.

The SME segment is expected to register the fastest growth through 2032, as more small and mid-sized firms recognize the value of digital treasury tools in improving financial accuracy and operational efficiency. Growing cloud adoption and the availability of cost-effective, modular solutions tailored for SMEs are fueling this segment’s rapid expansion.

- By Vertical

On the basis of vertical, the Europe treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others. The BFSI segment accounted for the largest market share in 2024, driven by its critical reliance on treasury systems for liquidity management, regulatory reporting, and risk mitigation. European banks and financial institutions are at the forefront of deploying sophisticated treasury technologies to navigate complex financial environments and ensure compliance with evolving EU regulations.

The healthcare segment is poised to witness the fastest CAGR from 2025 to 2032, driven by increasing financial complexity within hospital groups, pharmaceutical companies, and private clinics. Treasury software adoption in the healthcare sector is being propelled by the need to manage cash flows efficiently, control expenditures, and comply with health-sector financial governance norms across different European jurisdictions.

Teasury Software Market Regional Analysis

- Germany dominated the treasury software market with the largest revenue share in 2024, driven by strong demand from its advanced banking and manufacturing sectors, along with early digital adoption across large enterprises and public institutions

- The country’s leadership is supported by a well-established financial ecosystem, stringent regulatory compliance requirements, and widespread integration of ERP and treasury management systems across corporations

- Germany’s position is further reinforced by ongoing investments in financial automation, growing use of AI in cash flow forecasting, and alignment with EU regulations supporting digital finance and cybersecurity resilience

U.K. Treasury Software Market Insight

The U.K. treasury software market is projected to register the fastest CAGR in the Europe treasury software market during the forecast period of 2025 to 2032, driven by increasing adoption of cloud-based solutions, a dynamic fintech environment, and growing demand for real-time visibility into liquidity and cash positions among multinational firms. The country’s progressive open banking regulations, combined with government support for digital finance innovation, are accelerating uptake among both large financial institutions and tech-driven SMEs. Treasury departments are also investing in scalable platforms that support cross-border operations, regulatory compliance, and integration with decentralized finance tools.

France Treasury Software Market Insight

France is expected to grow steadily during the forecast period of 2025 to 2032. Growth is supported by rising awareness of financial automation among mid-sized companies, increased focus on managing regulatory risk, and the digitization of public sector finance operations. National digital transformation strategies, such as France Relance and broader EU funding initiatives, are encouraging adoption of treasury software across a range of verticals including healthcare, energy, and public administration. The country’s strong commitment to financial governance, data protection, and localized software solutions is further reshaping its treasury technology landscape.

Treasury Software Market Share

The treasury software industry is primarily led by well-established companies, including:

- Finastra (U.K.)

- ZenTreasury Ltd (Finland)

- Emphasys Software (U.S.)

- SS&C Technologies, Inc. (U.S.)

- CAPIX (Australia)

- Adenza (Switzerland)

- Coupa Software Inc. (U.S.)

- datalog finance (France)

- FIS (U.S.)

- Treasury Software Corp. (U.S.)

- MUREX S.A.S (France)

- EdgeVerve Systems Limited (India)

- Financial Sciences Corp. (U.S.)

- Broadridge Financial Solutions, Inc. (U.S.)

- CashAnalytics (Ireland)

- Oracle (U.S.)

- Fiserv, Inc. (U.S.)

- ION (Ireland)

- SAP (Germany)

- Salmon Software Ltd. (U.S.)

- ABM CLOUD (Ukraine)

Latest Developments in Europe Treasury Software Market

- In September 2022, TIS and Delega entered a collaboration, offering customers advanced automated multi-bank signatory rights management. This strategic partnership allows users of both platforms to seamlessly access NextGen electronic bank account management (eBAM), thereby eliminating manual processes associated with signatory management across multiple banking relationships. By integrating Delega’s specialized signatory rights automation with TIS’s global payments and cashflow platform, corporate finance teams benefit from increased transparency, centralized control, and faster onboarding of signatories—enhancing compliance and reducing operational risk in treasury functions

- In March 2022, ZenTreasury collaborated with MCA to provide Redington Gulf with Lease Accounting Software for IFRS-16 compliance. This partnership resulted in a streamlined, unified software solution that simplifies the complex task of managing lease data across multiple departments and systems. Rather than relying on manual imports or disconnected tools, users gain centralized visibility and real-time updates through a single interface. The solution reduces audit risks, improves accuracy in lease liability calculations, and helps organizations meet the stringent disclosure and reporting requirements set by IFRS-16 standards

- In July 2020, Oracle acquired DataFox, strengthening its capabilities in AI-driven data enrichment and analytics. This acquisition enabled Oracle to enhance its treasury and financial software portfolio with advanced business intelligence features that provide dynamic company insights, predictive analytics, and real-time market signals. For treasury operations, this means improved decision-making through enriched data sources that inform counterparty risk analysis, investment forecasting, and supplier evaluation. The integration of DataFox's capabilities supports Oracle’s broader mission of embedding artificial intelligence across its cloud applications

- In July 2020, FIS launched a cloud-based treasury management solution, marking a strategic shift toward cloud-native financial operations. The solution was designed to address the growing demand for flexible, scalable, and secure treasury tools accessible from anywhere. By leveraging cloud infrastructure, FIS enables real-time liquidity monitoring, automated bank reconciliation, and centralized cash visibility for corporations. This move significantly reduces the total cost of ownership and IT burden for clients while improving collaboration across geographically dispersed finance teams

- In September 2020, Intuit formed a strategic collaboration with Visa, aimed at integrating Visa’s payment infrastructure within Intuit’s ecosystem of financial tools, including QuickBooks. This partnership allows small and medium-sized businesses to access seamless, secure, and automated payment capabilities—streamlining invoice payments, payroll disbursements, and cash flow tracking. By embedding Visa’s real-time payment capabilities, Intuit enhanced user experience and promoted faster, safer transactions, supporting business continuity and financial agility for its customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.