Europe Transparent Conductive Films Market

Market Size in USD Billion

CAGR :

%

USD

4.54 Billion

USD

9.66 Billion

2025

2033

USD

4.54 Billion

USD

9.66 Billion

2025

2033

| 2026 –2033 | |

| USD 4.54 Billion | |

| USD 9.66 Billion | |

|

|

|

|

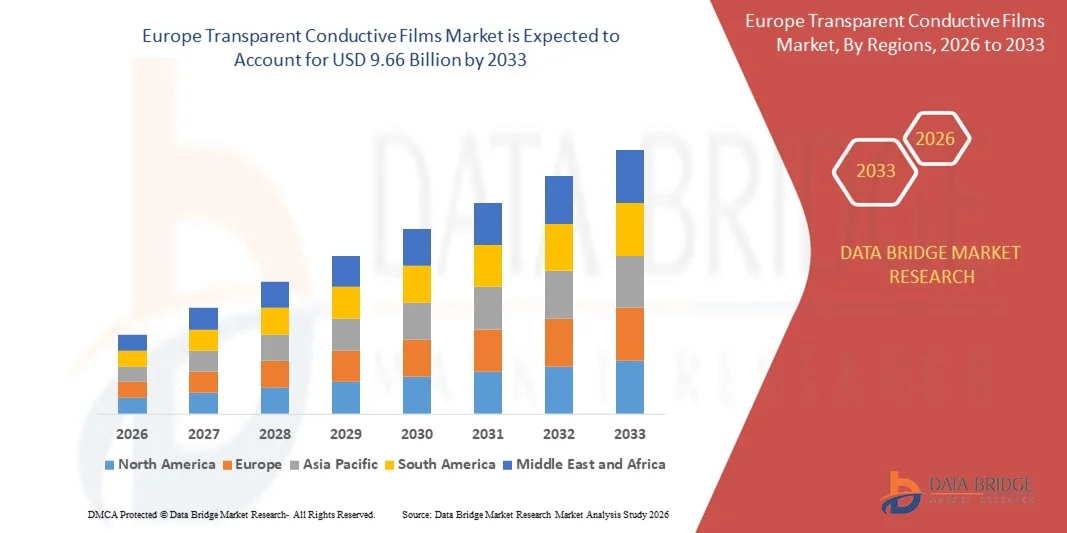

What is the Europe Transparent Conductive Films Market Size and Growth Rate?

- The Europe transparent conductive films market size was valued at USD 4.54 billion in 2025 and is expected to reach USD 9.66 billion by 2033, at a CAGR of 9.9% during the forecast period

- The transparent conductive films market growth is significantly driven by the increasing demand for advanced display technologies and touchscreens across various applications including smartphones, tablets, notebooks, PCs, TV displays, OLED lighting, and flexible displays

- The increasing demand for high-performance, low-resistance, and high-transparency films across the growing consumer electronics, automotive (especially in displays), and renewable energy sectors is a significant driver. Rising adoption in wearable devices, industrial touchscreens, and smart windows applications, where the unique properties of transparent conductive films are highly valued, is further fueling market expansion

What are the Major Takeaways of Transparent Conductive Films Market?

- Transparent conductive films are thin, optically transparent layers that possess electrical conductivity. Typically composed of materials such as indium tin oxide (ITO), they allow the passage of light while facilitating the conduction of electric current. These films find applications in touchscreens, solar cells, flexible electronics, and other technologies requiring both transparency and conductivity

- The expanding adoption of transparent conductive films is primarily attributable to the growing demand for these films in various optoelectronic devices, the increasing production of touch-enabled devices requiring transparent electrodes, and the continuous advancements in display technologies demanding materials with high transparency and conductivity for enhanced performance and energy efficiency in diverse consumer and industrial applications

- Germany dominated the Europe transparent conductive films market with the largest revenue share of 33.4% in 2024, driven by strong demand from the automotive electronics, industrial automation, and advanced display manufacturing sectors

- The France transparent conductive films market is witnessing steady growth at a CAGR of 7.36%, supported by rising investments in consumer electronics, renewable energy systems, and smart infrastructure projects

- Indium tin oxide segment dominates the market with a market share of 42.81% in 2024 due to its well-established presence and proven reliability across a wide array of applications. Its maturity in manufacturing processes, excellent electrical conductivity, and high optical transparency have made it the go-to material for numerous devices, despite the limitations of indium availability and cost

Report Scope and Transparent Conductive Films Market Segmentation

|

Attributes |

Transparent Conductive Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Transparent Conductive Films Market?

Increasing Demand in Consumer Electronics

- A significant and accelerating trend in the transparent conductive films market is the increasing integration of these films within consumer electronics. This growing adoption is fueled by the need for high-performance displays and touch interfaces that can enhance the user experience, improve device aesthetics, and enable innovative functionalities in smartphones, tablets, laptops, wearables, and other electronic gadgets

- For instance, major companies at the forefront of consumer electronics, such as Apple, Samsung, and LG, widely incorporate transparent conductive films in the touchscreens and displays of their smartphones, tablets, and laptops for responsive touch functionality and clear visual output. Leading material manufacturers such as Nitto Denko, Oike & Co., Ltd., and Teijin Limited provide a wide range of transparent conductive films specifically designed for the demanding performance and aesthetic requirements of consumer electronics

- This heightened integration of transparent conductive films in consumer electronics enables more intuitive user interaction with devices, improves the clarity and vibrancy of displays, and contributes to sleek and modern designs by allowing for thinner and lighter devices. Compared to traditional interface methods, touchscreens based on transparent conductive films offer the advantage of direct manipulation, multi-touch capabilities, and seamless integration with the display, thus leading to enhanced usability and a more engaging user experience

- The growing emphasis on advanced features, high-resolution displays, foldable devices, and the continuous drive for innovative user interfaces in consumer electronics are further fueling the importance of transparent conductive films as critical components in modern electronic devices. The trend towards larger screen sizes in smartphones and the increasing adoption of tablets and wearable devices are also boosting the demand for high-quality transparent conductive films

- Organizations are increasingly acknowledging the benefits of using transparent conductive films for their excellent optical clarity, good electrical conductivity, and versatility in application, making them ideal for integration into the complex and sophisticated designs of modern consumer electronics where display quality and touch responsiveness are paramount. This trend towards advanced and feature-rich electronic devices is driving substantial advancements and investments in the transparent conductive films market

- The demand for high-quality and reliable transparent conductive films is growing rapidly as the increasing deployment of touch-based interfaces and advanced display technologies encourages businesses to adopt material solutions such as transparent conductive films that can ensure seamless and dependable operation, ultimately boosting the functionality and user satisfaction of consumer electronic products

What are the Key Drivers of Transparent Conductive Films Market?

- A significant and growing driver for the transparent conductive films market is the increasing consumer preference for high-quality, glare-free screens, leading to a rapid expansion in the demand for anti-reflective coatings in displays. This trend necessitates the use of transparent conductive films as a crucial component in these advanced displays to enable touch functionality and maintain visual clarity while minimizing reflections

- For instance, major players in the consumer electronics sector, such as Apple and Samsung, incorporate anti-reflective coatings on the screens of their smartphones, tablets, and laptops, which utilize transparent conductive films for touch input. Leading manufacturers of display materials, including Corning and AGC Inc., offer specialized glass substrates with integrated anti-reflective coatings that are compatible with transparent conductive films provided by companies such as Nitto Denko and Gunze

- As consumers increasingly demand optimal viewing experiences with reduced glare in various lighting conditions, the demand for transparent conductive films that can be effectively combined with anti-reflective coatings rises. Transparent conductive films are essential for the functionality of touchscreens and advanced displays where anti-reflective properties enhance visibility and user comfort, making them a preferred choice for meeting consumer expectations for high-quality visual performance

- Companies in the display manufacturing and consumer electronics sectors are increasingly recognizing the advantages of combining anti-reflective coatings with transparent conductive films to deliver superior screen quality and user satisfaction. This trend towards high-performance displays with reduced glare across various devices is driving substantial opportunities and growth in the transparent conductive films market

- The demand for advanced display technologies with excellent visibility and minimal reflections is growing rapidly in the consumer electronics market, encouraging manufacturers to integrate transparent conductive films with anti-reflective coatings into their products for enhanced user experience and visual clarity. This integration ultimately boosts the value and appeal of devices utilizing these combined technologies

Which Factor is Challenging the Growth of the Transparent Conductive Films Market?

- A notable challenge for the transparent conductive films market arises from the inherently high production costs associated with manufacturing these specialized materials. The utilization of rare and often expensive raw materials, such as indium tin oxide (ITO), coupled with complex and energy-intensive manufacturing processes, contributes significantly to the overall cost of production, potentially hindering widespread adoption and affordability for certain applications

- For instance, while leading manufacturers such as Nitto Denko and Teijin Limited strive to optimize their production processes, the fundamental cost of indium, a key component in widely used ITO films, remains a significant factor. The high cost can be a particular concern for companies in price-sensitive consumer electronics segments, potentially limiting the integration of transparent conductive films in lower-end devices or driving the search for cost-effective alternatives

- Addressing this challenge requires ongoing research and development efforts focused on exploring alternative materials such as silver nanowires, carbon nanotubes, and conductive polymers, which have the potential for lower production costs. While advancements are being made by companies such as Cambrios Technologies and C3Nano in these alternative materials, ITO remains a dominant material, and its inherent cost can still pose a barrier to entry or expansion in certain market segments

- Despite their advantages in terms of performance and optical clarity for many applications, the high production costs of transparent conductive films can be a concern for industries seeking large-scale deployment across diverse product lines. This cost factor might lead some manufacturers to explore alternative, potentially less efficient or less versatile, conductive materials or to limit the implementation of advanced display or touch technologies in their more budget-conscious offerings

- Overcoming these limitations involves continuous innovation in material science and manufacturing techniques to either reduce the cost of existing materials such as ITO or to develop and scale the production of affordable and high-performing alternative transparent conductive materials. Understanding the cost-benefit trade-offs and the specific requirements of different applications is vital for effectively utilizing transparent conductive films within their optimal economic parameters and encouraging broader market penetration

How is the Transparent Conductive Films Market Segmented?

The market is segmented on the basis of material and application.

- By Material

On the basis of material, the market is segmented into indium tin oxide on glass, indium tin oxide on pet, silver nanowires, metal mesh, graphene, carbon nanotubes, conductive polymers, pedot, and others. The indium tin oxide on glass segment dominates the largest market revenue share of 42.81% in 2024, driven by its well-established presence and proven reliability across a wide array of applications. Its maturity in manufacturing processes, excellent electrical conductivity, and high optical transparency have made it the go-to material for numerous devices, despite the limitations of indium availability and cost.

The carbon nanotubes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for flexible and transparent electronics. Advancements in CNT synthesis and processing are leading to more efficient and cost-effective conductive films. Their superior flexibility, high conductivity, and potential for lower production costs compared to ITO make them an attractive alternative for next-generation displays and devices.

- By Application

On the basis of application, the market is segmented into smartphones, DSSCS, tablets, notebooks, PCs, TV displays, OLED lighting, OPV, wearable devices, and others. The TV displays segment dominates the largest market revenue share in 2024, driven by the increasing demand for larger, high-resolution displays in households worldwide. The established manufacturing infrastructure for large ITO-based screens and the consumer preference for high-quality visual experiences in televisions contribute to this dominance.

The smartphones segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the continuous proliferation of smartphones and the increasing demand for constant connectivity and advanced features. The rapid adoption of 5G networks and advancements in display technologies, including flexible and foldable screens, are pushing the need for innovative and efficient transparent conductive films in smartphone manufacturing.

Which Region Holds the Largest Share of the Transparent Conductive Films Market?

- Germany dominated the Europe transparent conductive films market with the largest revenue share of 33.4% in 2024, driven by strong demand from the automotive electronics, industrial automation, and advanced display manufacturing sectors

- The country’s leadership in automotive electrification, Industry 4.0 adoption, and smart manufacturing is accelerating the use of transparent conductive films in touch panels, sensors, displays, and photovoltaic applications

- Germany’s robust materials science ecosystem, strong presence of automotive OEMs, and close collaboration between electronics manufacturers and research institutes are supporting high-volume production and innovation in ITO, metal mesh, and conductive polymer films, positioning the country as a key manufacturing and technology hub for Europe’s Transparent Conductive Films market

France Transparent Conductive Films Market Insight

The France transparent conductive films market is witnessing steady growth at a CAGR of 7.36%, supported by rising investments in consumer electronics, renewable energy systems, and smart infrastructure projects. Increasing adoption of transparent conductive films in touch-enabled devices, smart windows, and photovoltaic modules is driving demand. French manufacturers are focusing on alternative materials such as silver nanowires and conductive polymers to reduce dependence on indium-based solutions. Strong government support for clean energy deployment, electronics innovation, and advanced materials research is reinforcing France’s role in strengthening Europe’s transparent conductive films supply chain.

U.K. Transparent Conductive Films Market Insight

The U.K. transparent conductive films market is expanding steadily, driven by growing demand for flexible electronics, wearable devices, and advanced sensor technologies. Adoption of transparent conductive films in OLED displays, medical devices, and automotive interfaces is increasing, supported by strong R&D capabilities and innovation-led manufacturing. Government-backed funding for advanced materials research, electronics miniaturization, and sustainable technology development is encouraging commercialization of next-generation transparent conductive films. Collaboration between universities, start-ups, and global electronics firms is positioning the U.K. as an innovation-focused contributor to Europe’s Transparent Conductive Films market.

Which are the Top Companies in Transparent Conductive Films Market?

The Transparent Conductive Films industry is primarily led by well-established companies, including:

- Dow, Inc. (U.S.)

- Windmöller & Hölscher (Germany)

- Sealed Air Corporation (U.S.)

- Klöckner Pentaplast (Luxembourg)

- Berry Global Inc. (U.S.)

- Amcor plc (Switzerland)

- Graphic Packaging International, LLC (U.S.)

- FLEXOPACK S.A. (Greece)

- WINPAK LTD. (Canada)

- Schur Flexibles Holding GesmbH (Austria)

- Mannok Pack (U.K.)

- G. Mondini spa (Italy)

- CLONDALKIN GROUP (Netherlands)

- PLASTOPIL (Israel)

- MULTIVAC (Germany)

- ULMA Packaging (Spain)

- JASA Packaging Solutions (Netherlands)

- Sealpac International bv (Netherlands)

- KM Packaging Services Ltd (U.K.)

- Bliston Packaging BV (Netherlands)

What are the Recent Developments in Global Center Stack Display Market?

- In July 2021, TEIJIN LIMITED commenced commercial operations for manufacturing carbon fiber products, including prepreg, in Vietnam. This expansion has significantly increased the company's production capacity for composite intermediate materials. The strategic move bolsters TEIJIN LIMITED's growth trajectory, allowing for greater output and meeting the rising demand for advanced carbon fiber composites in various industries

- In May 2021, Toyobo Co., Ltd. became a first-close investor in the JMTC Chemical and Materials Investment Limited Partnership, an investment fund supporting start-ups developing new materials. This strategic partnership contributed to increased company output and subsequently boosted profits. Toyobo Co., Ltd.'s collaboration with the investment fund aligns with its commitment to fostering innovation in material development

- In March 2021, NITTO DENKO CORPORATION fortified its oligonucleotide therapeutic manufacturing business in Japan, making substantial investments. This strategic move resulted in a noteworthy expansion of the manufacturing capacity for oligonucleotide therapeutics, positioning NITTO DENKO CORPORATION to meet the growing demand for advanced therapeutic solutions and reinforcing its presence in the biopharmaceutical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Transparent Conductive Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Transparent Conductive Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Transparent Conductive Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.