Europe Surgical Power Tools Market

Market Size in USD Million

CAGR :

%

USD

537.04 Million

USD

757.89 Million

2025

2033

USD

537.04 Million

USD

757.89 Million

2025

2033

| 2026 –2033 | |

| USD 537.04 Million | |

| USD 757.89 Million | |

|

|

|

|

Europe Surgical Power Tools Market Size

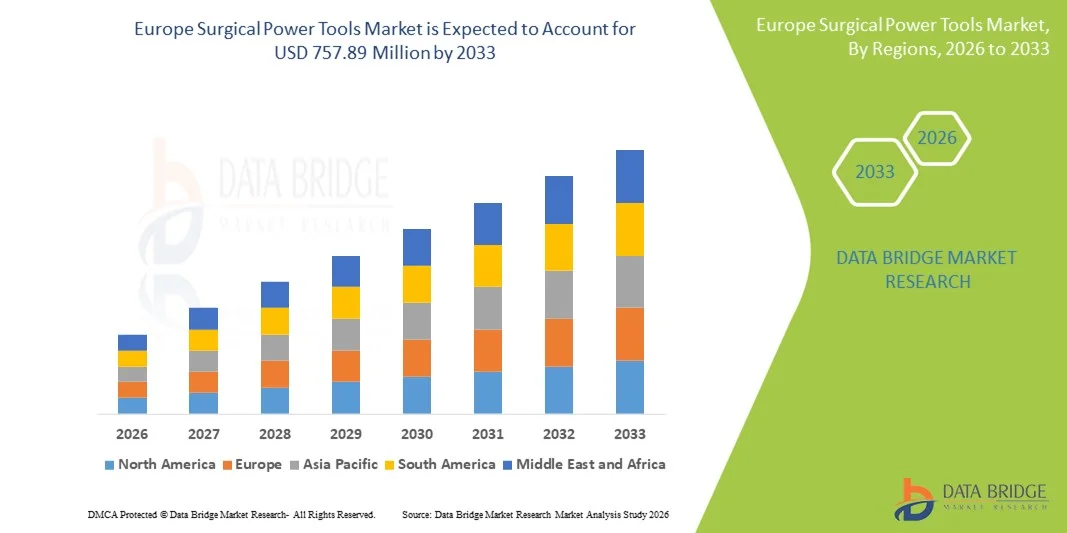

- The Europe surgical power tools market size was valued at USD 537.04 million in 2025 and is expected to reach USD 757.89 million by 2033, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by the increasing volume of surgical procedures rising prevalence of musculoskeletal disorders, and growing adoption of technologically advanced, battery‑powered, and ergonomic surgical tools across hospitals and ambulatory surgical centers

- Furthermore, continuous innovation in surgical power tools including electric and battery‑driven instruments with better portability, precision, and integration with modern surgical workflows along with supportive healthcare infrastructure and regulatory frameworks in major European countries is driving higher demand for reliable, efficient, and user‑friendly surgical solutions, thereby significantly boosting market growth

Europe Surgical Power Tools Market Analysis

- Surgical power tools, including electric, pneumatic, and battery-driven instruments, are increasingly essential in modern operating rooms for orthopedic, neurosurgery, and general surgical procedures due to their enhanced precision, speed, and ability to reduce surgeon fatigue while improving patient outcomes

- The escalating demand for surgical power tools is primarily fueled by the rising volume of surgical procedures, increasing prevalence of musculoskeletal disorders, and growing adoption of advanced, ergonomic, and technologically integrated instruments across hospitals and surgical centers

- Germany dominated the Europe surgical power tools market with the largest revenue share of 28.5% in 2025, characterized by a robust healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key industry players, with orthopedic and neurosurgical procedures driving substantial demand for both new installations and tool upgrades

- Poland is expected to be the fastest-growing country in the market during the forecast period, due to rising healthcare investments, increasing hospital capacities, and greater access to modern surgical technologies

- Orthopedic Surgery segment dominated the Europe surgical power tools market with a market share of 47.5% in 2025, driven by their critical role in joint replacement and trauma surgeries, combined with continuous innovations improving precision, portability, and surgical efficiency

Report Scope and Europe Surgical Power Tools Market Segmentation

|

Attributes |

Europe Surgical Power Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Surgical Power Tools Market Trends

Advanced Precision and Ergonomic Innovations

- A significant and accelerating trend in the Europe surgical power tools market is the development of advanced precision instruments with ergonomic designs that reduce surgeon fatigue and improve procedural accuracy. This trend is shaping expectations for high-performance, user-friendly surgical tools

- For instance, Stryker’s CORE Surgical Power System combines lightweight design with enhanced torque control, enabling surgeons to perform complex procedures with reduced effort and improved precision. Similarly, DePuy Synthes’ Power Tools feature modular components that can be adapted for various orthopedic and trauma surgeries

- Integration of smart features, such as real-time torque monitoring, battery status alerts, and adaptive speed control, is enhancing operational efficiency in operating rooms. For instance, some Medtronic surgical drills include sensors that automatically adjust speed based on bone density, reducing the risk of procedural errors

- The growing adoption of cordless and battery-driven surgical power tools facilitates mobility and flexibility in the OR, allowing hospitals to streamline workflow and reduce setup time while maintaining high levels of sterilization and safety

- Companies are also focusing on wireless connectivity features, allowing power tools to sync with hospital IT systems for performance monitoring and predictive maintenance

- This trend towards precision, ergonomics, and smart integration is fundamentally reshaping surgeon expectations for surgical instruments. Consequently, companies such as Zimmer Biomet are developing next-generation surgical power tools with enhanced torque feedback, modular attachments, and improved user interface

- The demand for surgical power tools that offer advanced ergonomics, precision, and intelligent features is growing rapidly across orthopedic, neurosurgery, and general surgery segments, as hospitals increasingly prioritize efficiency, patient safety, and surgical outcomes

Europe Surgical Power Tools Market Dynamics

Driver

Rising Surgical Procedures and Technological Adoption

- The increasing volume of surgical procedures, particularly orthopedic and neurosurgical interventions, coupled with rapid adoption of technologically advanced instruments, is a significant driver for heightened demand for surgical power tools

- For instance, in March 2025, Stryker launched its updated CORE 2 Surgical Drill System in European hospitals, integrating real-time torque monitoring and ergonomic enhancements to improve surgical outcomes. Such innovations by key companies are expected to drive market growth during the forecast period

- As healthcare facilities focus on improving surgical efficiency and patient outcomes, surgical power tools provide high precision, reduced operation time, and adaptability across multiple procedures, offering a compelling upgrade over manual instruments

- Furthermore, government initiatives promoting modernization of surgical infrastructure and investments in hospital expansion are increasing the adoption of power-assisted surgical instruments across Europe

- The convenience of cordless and modular tools, along with seamless integration into surgical workflows, are key factors propelling the adoption of surgical power tools in hospitals and ambulatory surgical centers. The trend towards minimally invasive surgeries and advanced surgical techniques further contributes to market growth

- Increasing partnerships between surgical tool manufacturers and healthcare providers for training programs is driving adoption, as surgeons gain familiarity with advanced tools and recognize their benefits for patient outcomes

- Rising investment in research and development for innovative surgical technologies, including AI-assisted guidance systems and bone-sensing drills, is further accelerating market demand across Europe

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high initial cost of advanced surgical power tools and ongoing maintenance expenses pose a significant challenge to broader market penetration, particularly for small hospitals or clinics with limited budgets

- For instance, reports of budget constraints in regional hospitals have delayed the adoption of premium surgical drills and systems, causing some institutions to continue using traditional manual instruments

- Ensuring compliance with stringent European medical device regulations and obtaining CE markings for new products is critical and can delay product launches, impacting timely market entry. Companies such as DePuy Synthes and Zimmer Biomet invest heavily in regulatory approvals to address these challenges

- While prices are gradually decreasing due to technological advancements and competitive offerings, the perceived premium for high-end surgical power tools can still hinder adoption in cost-sensitive markets or smaller hospitals

- Inconsistent reimbursement policies for surgical tools and procedures across European countries can also limit procurement by hospitals, reducing market penetration in certain regions

- Supply chain disruptions, such as delays in high-precision components or batteries, can affect the availability of surgical power tools, impacting hospitals’ ability to adopt new instruments promptly

- Overcoming these challenges through modular, cost-efficient tool designs, streamlined regulatory approvals, and hospital financing options will be vital for sustained market growth in Europe

- Increased focus on leasing and rental models for surgical power tools is emerging as a solution to reduce upfront costs and encourage adoption among budget-constrained hospitals and clinics

Europe Surgical Power Tools Market Scope

The market is segmented on the basis of product, technology, device type, application, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into handpieces, disposables, and accessories. The handpiece segment dominated the market with the largest revenue share in 2025, driven by its critical role in powering surgical instruments across orthopedic, neurology, and dental procedures. Handpieces offer high precision, torque control, and speed regulation, enabling surgeons to perform complex surgeries efficiently. Hospitals and ambulatory surgical centers prefer durable and ergonomic handpieces that reduce fatigue during long procedures. Their modular design allows compatibility with multiple drills, saws, and reamers, enhancing utility across departments. Integration of smart features such as real-time torque monitoring and battery status alerts is further boosting adoption. Overall, handpieces remain essential for institutions seeking reliability, versatility, and surgical efficiency.

The disposables and accessories segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing use of single-use drill bits, saw blades, and sterilizable attachments to maintain hygiene and reduce infection risk. Their affordability, easy replacement, and compatibility with advanced handpieces enhance demand. Hospitals are increasingly adopting these items for minimally invasive procedures and specialized surgeries. The growing regulatory focus on sterilization and patient safety also drives adoption. Additionally, disposables support modular handpiece systems, providing flexibility and operational efficiency. Their use is rising steadily in both public and private healthcare settings.

- By Technology

On the basis of technology, the market is segmented into electric-operated power tools, battery-driven power tools, pneumatic power tools, and others. The electric-operated power tools segment dominated the market in 2025 due to their consistent performance, high torque output, and ability to support long-duration procedures. These tools are preferred in orthopedic and neurosurgery departments, where precision and reliability are critical. Their modularity allows use with multiple attachments, expanding functionality across surgeries. Advanced features such as integrated torque sensors and digital monitoring improve surgical accuracy. Hospitals favor electric tools for high-load tasks without interruptions. Overall, these factors make electric-operated power tools a primary choice for European healthcare facilities.

The battery-driven power tools segment is expected to witness the fastest growth from 2026 to 2033, owing to increasing demand for cordless mobility, reduced OR cabling, and flexibility across multiple surgical suites. Battery-powered tools enable portability, faster sterilization, and easy setup. Lithium-ion technology improvements enhance runtime and power output for complex orthopedic and neurosurgical procedures. Adoption in ambulatory surgical centers and smaller hospitals accelerates growth. Battery tools are particularly attractive for minimally invasive and outpatient procedures. Their compact design and improved ergonomics further support rapid uptake.

- By Device Type

On the basis of device type, the market is segmented into large bone power tools, small bone power tools, medium bone power tools, and others. The large bone power tools segment dominated the market in 2025 due to their indispensable role in orthopedic surgeries, including joint replacement, trauma repair, and spinal fixation. They provide high torque, durability, and precision for dense bone structures. Hospitals prioritize large bone tools for critical surgical procedures requiring reliability and consistent performance. Digital integration and torque-monitoring systems further improve surgical outcomes. Continuous R&D enhances ergonomics and reduces vibration for surgeon comfort. Their dominance is reinforced by high-volume orthopedic procedures across Europe.

The small bone power tools segment is expected to witness the fastest growth from 2026 to 2033, driven by minimally invasive surgeries, ENT procedures, and pediatric orthopedic interventions. Small bone tools offer lightweight, precise, and maneuverable designs for delicate procedures. Adoption in neurosurgery, dental surgery, and other specialized applications is rising steadily. Battery-powered designs and AI-assisted torque control further enhance usability. Increasing surgical procedure volumes in emerging European countries support growth. Technological innovations make these tools more reliable and efficient, boosting adoption.

- By Application

On the basis of application, the market is segmented into orthopedic surgery, ENT surgery, neurology surgery, dental surgery, cardiothoracic surgery, and others. The orthopedic surgery segment dominated the market in 2025 with a market share of 47.5%, driven by high volumes of joint replacement, trauma repair, and spinal surgeries across Europe. Orthopedic power tools are critical for precision cutting, drilling, and reaming of bones. Hospitals and ASCs rely heavily on these tools to improve efficiency, reduce operation time, and enhance patient outcomes. Integration with modular handpieces, disposables, and torque-sensing technology has improved effectiveness. The prevalence of musculoskeletal disorders and increasing surgical procedures reinforce dominance. Continuous innovations in ergonomic designs and smart feedback systems also drive adoption.

The dental surgery segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for implantology, restorative procedures, and minimally invasive treatments. Advanced small bone and battery-driven tools allow precise surgeries with reduced patient discomfort. Private clinics and dental tourism in Europe contribute to growth. Adoption of digital dentistry technologies, such as CAD/CAM and 3D-guided implants, accelerates tool usage. Lightweight and ergonomic designs make procedures more efficient. Growing awareness of oral healthcare further supports market expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASC), clinics, and others. The hospitals segment dominated the market in 2025 due to well-equipped surgical theaters, higher procedure volumes, and the ability to invest in advanced tools. Hospitals drive adoption through multi-specialty surgeries, including orthopedic, neurology, and cardiothoracic procedures. They focus on reducing surgical time, enhancing precision, and improving patient outcomes. Integration with hospital IT systems for tool monitoring and predictive maintenance reinforces preference. Hospitals also benefit from dedicated manufacturer support and service contracts. Their large-scale procurement ensures a dominant revenue share.

The ambulatory surgical centers (ASC) segment is expected to witness the fastest growth from 2026 to 2033 due to rising outpatient procedures, cost efficiency, and flexible surgical schedules. ASCs increasingly adopt battery-driven, modular, and compact tools for efficient operations. Minimally invasive surgeries and same-day procedures are driving adoption. ASCs benefit from portable, lightweight, and easy-to-sterilize instruments. Smaller investments and flexible financing options accelerate uptake. Growing demand for outpatient care and specialized procedures supports segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and third-party distribution. The direct tenders segment dominated the market in 2025, as large hospitals and government institutions prefer purchasing directly from manufacturers to ensure authenticity, warranty, and service support. Direct procurement allows customization according to surgical suite requirements. Manufacturers maintain dedicated sales teams for large tenders, reinforcing dominance. Large-scale contracts also provide predictable revenue for suppliers. Hospitals prioritize direct procurement for critical surgeries requiring precision tools. Long-term service agreements with manufacturers further enhance adoption.

The third-party distribution segment is expected to witness the fastest growth from 2026 to 2033, driven by small hospitals, clinics, and ASCs seeking cost-effective access to surgical tools. Distributors provide multiple brands, flexible financing, and easier procurement. Expansion of distribution networks in emerging European countries supports adoption. Third-party channels enable faster delivery, maintenance services, and availability of consumables. Clinics and ASCs benefit from bundled offerings and promotional schemes. Growing market penetration and awareness in tier-2 and tier-3 cities accelerate growth.

Europe Surgical Power Tools Market Regional Analysis

- Germany dominated the Europe surgical power tools market with the largest revenue share of 28.5% in 2025, characterized by a robust healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key industry players, with orthopedic and neurosurgical procedures driving substantial demand for both new installations and tool upgrades

- Hospitals and surgical centers in Germany highly value precision, durability, and ergonomic design in surgical power tools, as well as advanced features such as torque monitoring, modular handpieces, and battery-driven mobility, which improve surgical efficiency and patient outcomes

- The widespread adoption is further supported by continuous R&D investment, strong regulatory frameworks, and well-established hospital networks, enabling the integration of technologically advanced tools into both public and private healthcare facilities

The Germany Surgical Power Tools Market Insight

The Germany surgical power tools market captured the largest revenue share of 28.5% in 2025, driven by a robust healthcare infrastructure, high adoption of advanced surgical technologies, and a strong presence of key industry players. Hospitals and surgical centers prioritize precision, torque-controlled handpieces, and modular power tools that enhance efficiency across orthopedic, neurology, and cardiothoracic procedures. The country’s emphasis on research, innovation, and high-quality surgical outcomes further accelerates demand. Integration of battery-driven, cordless, and AI-assisted tools is becoming increasingly common, improving procedural accuracy and reducing surgeon fatigue. Germany also benefits from well-established regulatory frameworks, facilitating the adoption of technologically advanced devices.

France Surgical Power Tools Market Insight

The France surgical power tools market is projected to grow at a substantial CAGR during the forecast period, primarily driven by increasing surgical volumes, government initiatives to modernize healthcare infrastructure, and rising demand for precision instruments. French hospitals focus on orthopedic and neurosurgical procedures, leveraging electric and battery-powered tools for improved patient outcomes. Modular and ergonomic designs allow tools to be used across multiple specialties, reducing operational costs. The demand for minimally invasive surgeries and integration of digital monitoring systems in surgical theaters further supports market growth. Continuous innovations and training programs for surgeons enhance adoption of next-generation surgical power tools.

U.K. Surgical Power Tools Market Insight

The U.K. surgical power tools market is anticipated to grow at a noteworthy CAGR, fueled by the rising trend of hospital modernization, minimally invasive procedures, and a focus on patient safety. Hospitals and ambulatory surgical centers increasingly prefer high-precision, cordless, and ergonomic instruments for orthopedic, dental, and neurosurgical applications. Concerns regarding surgical efficiency and reducing operation time drive adoption of advanced modular systems. The U.K.’s well-developed healthcare infrastructure, combined with a focus on digital integration and maintenance support, further stimulates market growth. Partnerships between manufacturers and hospitals for training and demonstration programs are also promoting uptake.

Poland Surgical Power Tools Market Insight

The Poland surgical power tools market is expected to witness the fastest growth during the forecast period, driven by rising healthcare investments, expanding hospital capacities, and growing adoption of modern surgical technologies. Small and medium hospitals, as well as ambulatory surgical centers, are increasingly procuring battery-operated, portable, and modular tools to enhance surgical efficiency. Growing demand for orthopedic, dental, and minimally invasive procedures fuels market expansion. Implementation of European Union healthcare modernization initiatives and access to affordable, high-quality surgical power tools further supports growth. Poland is emerging as a key market for technologically advanced yet cost-effective surgical solutions.

Europe Surgical Power Tools Market Share

The Europe Surgical Power Tools industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- CONMED Corporation (U.S.)

- B. Braun SE (Germany)

- De Soutter Medical (U.K.)

- Adeor Medical AG (Switzerland)

- AYGUN CO., INC. (Turkey)

- NSK Ltd. (Japan)

- MicroAire Surgical Instruments, LLC (U.S.)

- Arthrex, Inc. (U.S.)

- Smith & Nephew (U.K.)

- Karl Storz SE & Co. KG (Germany)

- MatOrtho Limited (U.K.)

- GPC Medical Ltd. (U.K.)

- ACF Medical (Turkey)

- Shanghai Bojin Medical Instrument Co., Ltd (China)

- OsteoMed (U.S.)

- Brasseler USA (U.S.)

- KLS Martin Group (Germany)

What are the Recent Developments in Europe Surgical Power Tools Market?

- In October 2025, a major global medical device company acquired a precision orthopedic power tools specialist, expanding its surgical power tool lineup and reinforcing its position in trauma and joint replacement markets. The acquisition is expected to bolster innovation in ergonomic and high-performance instruments widely used in European surgical suites

- In June 2025, Arthrex launched its Synergy Power™ System, a versatile battery-powered surgical instrument platform designed for a wide range of orthopedic procedures, including sports, arthroplasty, trauma, and distal extremities. The system includes two ergonomic handpieces a dual trigger rotary drill and a sagittal saw offering precision, flexibility, and ease of use for surgeons across different orthopedic surgical settings. This launch reflects the ongoing shift toward battery-powered, modular surgical power tools with improved workflow efficiency and comfort for clinicians

- In February 2025, a European healthcare devices firm completed the acquisition of an orthopedic power tool accessories company, strengthening its portfolio of consumables and drill/reamer components used in orthopedic procedures. This acquisition is aimed at enhancing the range of surgical power tools and supporting broader product offerings for trauma and joint replacement applications across European hospitals

- In November 2024, Medtronic acquired Fortimedix Surgical, a Netherlands-based surgical and endoscopy technology firm, to expand its portfolio in minimally invasive and surgical tool technologies. This strategic move enhances Medtronic’s capabilities in advanced surgical instruments that complement powered tool systems used across Europe’s surgical centers

- In March 2023, Stryker announced the launch of its CD NXT power tool system, featuring real-time depth measurement technology that allows surgeons to perform fast, accurate, and consistent drilling with digital feedback, reducing reliance on manual depth gauges. The innovation streamlines surgical steps and enhances precision in orthopedic and other bone procedures, representing a significant advancement in powered surgical drills used in Europe and globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.