Europe Small Molecule Sterile Injectable Drugs Market

Market Size in USD Billion

CAGR :

%

USD

49.44 Billion

USD

83.68 Billion

2025

2033

USD

49.44 Billion

USD

83.68 Billion

2025

2033

| 2026 –2033 | |

| USD 49.44 Billion | |

| USD 83.68 Billion | |

|

|

|

|

Europe Small Molecule Sterile Injectable Drugs Market Size

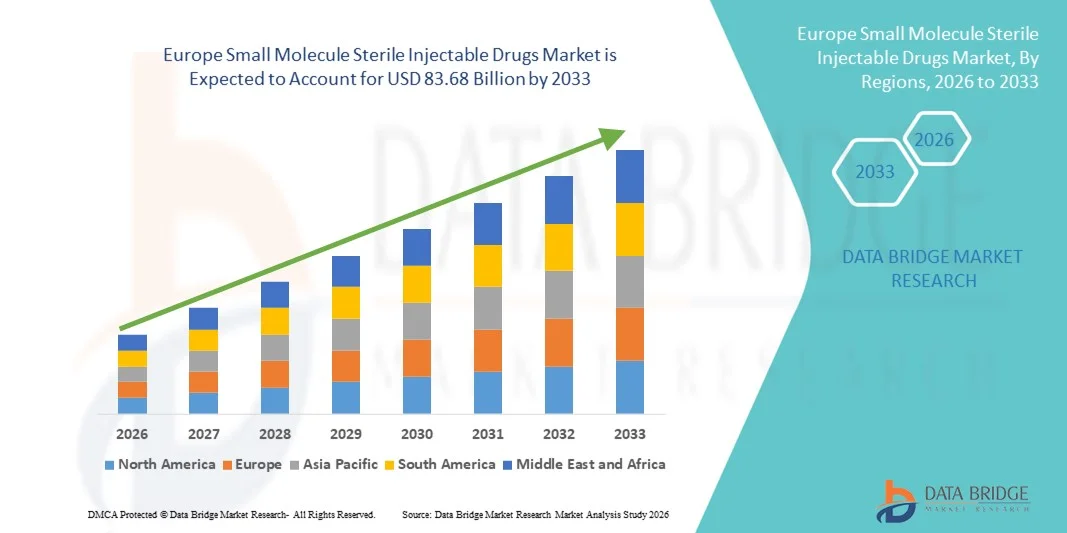

- The Europe small molecule sterile injectable drugs market size was valued at USD 49.44 billion in 2025 and is expected to reach USD 83.68 billion by 2033, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic and infectious diseases strong pharmaceutical manufacturing bases in key countries and stringent regulatory standards that ensure high quality sterile injectables across Europe

- Furthermore, rising healthcare expenditure, expansion of hospital and specialty clinic services, and ongoing investments in aseptic processing technologies are driving adoption of small molecule sterile injectable drugs in both hospital and outpatient settings. These converging factors are boosting demand for ready‑to‑administer sterile injectables and accelerating the region’s market growth

Europe Small Molecule Sterile Injectable Drugs Market Analysis

- Small molecule sterile injectable drugs, providing high-purity, ready-to-administer therapeutic solutions, are increasingly critical components in modern healthcare systems across hospitals, clinics, and outpatient care settings due to their efficacy, safety, and ease of administration

- The escalating demand for these drugs is primarily fueled by the rising prevalence of chronic and infectious diseases, stringent regulatory requirements for sterile formulations, and increasing adoption of advanced aseptic manufacturing technologies

- Germany dominated the Europe small molecule sterile injectable drugs market with the largest revenue share of 28.7% in 2025, characterized by its well-established pharmaceutical manufacturing infrastructure, strong regulatory frameworks, and high healthcare expenditure, with major contributions from vial filling and syringe filling products used across infectious disease and cardiovascular therapies

- Poland is expected to be the fastest-growing country in the market during the forecast period due to improving healthcare infrastructure, increasing hospital capacity, and growing adoption of cartridge filling and other advanced delivery formats for metabolic and neurological applications

- Vial filling segment dominated the market with a market share of 43.2% in 2025, driven by its widespread adoption for infectious diseases and cardiovascular therapies, established compatibility with hospital administration systems, and ability to maintain high sterility and dosage accuracy

Report Scope and Europe Small Molecule Sterile Injectable Drugs Market Segmentation

|

Attributes |

Europe Small Molecule Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Small Molecule Sterile Injectable Drugs Market Trends

Shift Towards Prefilled and Ready-to-Administer Formats

- A significant and accelerating trend in the Europe small molecule sterile injectable drugs market is the growing adoption of prefilled syringes, cartridges, and ready-to-administer formulations, improving dosing accuracy and reducing preparation time in hospitals and clinics

- For instance, B. Braun’s prefilled syringes and cartridges streamline administration workflows, minimizing preparation errors and enhancing patient safety in outpatient and inpatient settings

- Prefilled and ready-to-administer injectables reduce medication errors, lower contamination risks, and improve nurse and caregiver efficiency, while supporting rapid response in emergency and intensive care scenarios

- The seamless integration of these advanced delivery formats with hospital pharmacy automation systems facilitates centralized drug management and efficient inventory control, enabling clinicians to focus on patient care

- This trend towards more convenient, safe, and automated injectable solutions is reshaping hospital procurement priorities and influencing pharmaceutical manufacturing strategies

- The demand for prefilled and ready-to-administer sterile injectables is growing rapidly across both developed and emerging European healthcare markets, as providers increasingly prioritize safety, efficiency, and workflow optimization

- Rising patient preference for minimally invasive and self-administered injectables in homecare settings is further driving the adoption of innovative delivery formats across Europe

Europe Small Molecule Sterile Injectable Drugs Market Dynamics

Driver

Increasing Prevalence of Chronic and Infectious Diseases

- The rising prevalence of chronic diseases such as cardiovascular, metabolic, and autoimmune disorders, along with infectious diseases, is a significant driver for the heightened demand for small molecule sterile injectables

- For instance, Pfizer’s injectable cardiovascular therapies and anti-infective vials have seen increased utilization in hospitals across Germany and France, reflecting growing disease burden and treatment requirements

- As healthcare providers seek safe and effective delivery methods for critical therapies, sterile injectables offer precise dosing, reduced contamination risk, and better patient outcomes compared to traditional oral formulations

- Furthermore, government and hospital initiatives to improve treatment accessibility and ensure consistent drug quality are increasing procurement of sterile injectables, making them an essential component of modern healthcare delivery

- The convenience of ready-to-administer formats, combined with regulatory approval for critical disease applications, is propelling the adoption of sterile injectables across hospitals, specialty clinics, and homecare settings

- Increased focus on hospital preparedness and pandemic readiness has accelerated demand for injectable anti-infectives, vaccines, and emergency therapeutics in Europe

- Collaborations between pharmaceutical companies and healthcare providers to expand supply chains for sterile injectables are enhancing product availability and supporting market growth

Restraint/Challenge

Regulatory Compliance and Cold Chain Management Hurdles

- Stringent regulatory requirements for sterile injectable production, including aseptic processing, GMP compliance, and batch testing, pose a significant challenge to new market entrants and smaller manufacturers

- For instance, recent inspections by the European Medicines Agency (EMA) highlighted deficiencies in aseptic processing controls, causing production delays for certain cardiovascular and metabolic injectables

- Maintaining cold chain integrity and ensuring product stability during transportation and storage are critical, as deviations can lead to reduced potency, contamination, or product recalls

- In addition, the high costs of sterile manufacturing facilities and validated processes can limit scalability and slow adoption in emerging European markets, despite growing demand

- Overcoming these challenges through investment in state-of-the-art manufacturing technologies, robust quality assurance, and cold chain infrastructure is vital for sustained growth and market competitiveness

- Limited availability of skilled personnel trained in aseptic techniques and injectable production can hinder production efficiency and quality assurance in some European countries

- Evolving regulatory updates across different European countries require continuous compliance adaptation, increasing operational complexity and cost for manufacturers

Europe Small Molecule Sterile Injectable Drugs Market Scope

The market is segmented on the basis of product, application, end-users, and distribution channels.

- By Product

On the basis of product, the market is segmented into vial filling, syringe filling, cartridge filling, and others. The vial filling segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its widespread adoption in hospitals and specialty clinics. Vials are highly versatile, allowing multiple doses per container, which reduces packaging costs and improves inventory management. Healthcare providers prefer vials for their compatibility with automated filling lines and established aseptic processing systems. The segment also benefits from strong regulatory familiarity, ensuring compliance with stringent European pharmacopeia standards. In addition, vials are widely used for infectious disease and cardiovascular therapies, which represent a significant portion of sterile injectable demand. Their long-standing presence in clinical practice and ease of storage further reinforce their dominance.

The syringe filling segment is expected to witness the fastest growth with a CAGR of 11.8% from 2026 to 2033, fueled by increasing demand for ready-to-administer solutions in hospitals and home care. Prefilled syringes reduce preparation errors, improve patient safety, and enhance workflow efficiency for healthcare professionals. Their growing use in metabolic, neurological, and autoimmune treatments is boosting adoption across Europe. Syringes are particularly favored in outpatient and homecare settings due to ease of administration and reduced risk of contamination. Technological advancements in automated syringe filling are also enabling higher production capacities, supporting faster market growth.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, metabolic diseases, neurology, dermatology, urology, autoimmune diseases, respiratory disorders, and others. The infectious diseases segment dominated the market in 2025 with a share of 38.6%, driven by high prevalence of bacterial and viral infections across Europe. Hospitals and clinics rely heavily on sterile injectables for rapid treatment of critical infections. This segment benefits from government programs to improve vaccination and anti-infective availability. Injectable anti-infectives offer precise dosing and ensure treatment efficacy, reducing mortality in hospitalized patients. Strong R&D pipelines and manufacturing capabilities in Germany, France, and Italy also support the supply of sterile anti-infectives. Moreover, the segment’s stability in cold chain storage and long shelf-life make it a preferred choice for healthcare providers.

The cardiovascular diseases segment is expected to witness the fastest growth from 2026 to 2033, driven by rising prevalence of heart failure, thrombosis, and hypertension in aging European populations. Injectable cardiovascular drugs, particularly prefilled syringes and vials, are increasingly used in hospital critical care and outpatient settings. Advancements in formulation, such as long-acting injectables, are improving patient adherence and therapeutic outcomes. The growing focus on emergency and intensive care treatments further accelerates segment growth. Countries with high healthcare expenditure, such as Germany and the U.K., are early adopters of these advanced injectables.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home care settings, and others. The hospital segment dominated the market with the largest share of 45.3% in 2025, due to high patient volume and the requirement for critical care and emergency treatments. Hospitals benefit from economies of scale in purchasing sterile injectables and rely on vial and syringe formats for multiple therapeutic applications. Established hospital pharmacy systems facilitate inventory control, ensuring continuous availability of injectables. Regulatory compliance and quality assurance protocols are easier to maintain in hospital environments. In addition, hospitals drive demand for both high-volume production and ready-to-administer injectables, strengthening this segment’s dominance. European hospitals, especially in Germany, France, and Italy, remain key consumers of sterile injectables.

The home care settings segment is expected to witness the fastest growth over the forecast period, fueled by increasing adoption of self-administered injectable therapies for chronic and metabolic diseases. Prefilled syringes and cartridges allow patients to safely administer treatments outside hospitals. Aging populations and the push for decentralized healthcare delivery are supporting homecare expansion. Telemedicine and home health services further facilitate adoption of sterile injectables in residential settings. Convenience, reduced hospitalization costs, and improved patient compliance are driving growth in this segment. Countries such as Poland, Spain, and the Nordics are leading this trend in Europe.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The direct tender segment dominated the market with a share of 50.1% in 2025, driven by bulk procurement by hospitals and government healthcare programs. Direct tendering ensures lower costs, consistent supply, and regulatory compliance for sterile injectable drugs. This channel is particularly strong for critical care and high-demand anti-infective and cardiovascular injectables. Contracts via tenders also support long-term supplier relationships and facilitate large-scale distribution across European healthcare systems. The segment’s dominance is reinforced by strong participation from key pharmaceutical manufacturers. Countries with centralized healthcare systems, such as Germany and France, heavily utilize this channel.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising e-commerce adoption and demand for home-delivered injectable therapies. Online channels provide convenient access to prefilled syringes and specialty injectables for homecare patients. Integration with telemedicine and digital prescription services is expanding the reach of online pharmacies. Enhanced logistics and cold chain capabilities are enabling safe delivery of sensitive injectable products. Younger and tech-savvy patients are increasingly preferring online pharmacies for chronic and metabolic therapies. Countries such as the U.K., Germany, and the Nordics are early adopters of this distribution channel

Europe Small Molecule Sterile Injectable Drugs Market Regional Analysis

- Germany dominated the Europe small molecule sterile injectable drugs market with the largest revenue share of 28.7% in 2025, characterized by its well-established pharmaceutical manufacturing infrastructure, strong regulatory frameworks, and high healthcare expenditure, with major contributions from vial filling and syringe filling products used across infectious disease and cardiovascular therapies

- Hospitals and specialty clinics in Germany highly value the availability of high-quality sterile injectables for critical care, infectious diseases, and cardiovascular therapies, along with ready-to-administer formats that improve workflow efficiency and patient safety

- This widespread adoption is further supported by advanced hospital systems, government support for healthcare access, and a strong presence of leading domestic and multinational pharmaceutical manufacturers, establishing Germany as the primary hub for sterile injectable production and consumption in Europe

The Germany Small Molecule Sterile Injectable Drugs Market Insight

The Germany market dominated Europe with the largest revenue share in 2025, fueled by a well-established pharmaceutical manufacturing base, high healthcare expenditure, and strong regulatory oversight. Hospitals and specialty clinics highly value the availability of high-quality sterile injectables for infectious diseases, cardiovascular therapies, and metabolic treatments. The adoption of prefilled syringes and automated vial filling systems enhances workflow efficiency and reduces medication errors. Germany’s emphasis on innovation, advanced manufacturing capabilities, and adherence to European Pharmacopeia standards promotes widespread use of sterile injectables. Furthermore, government healthcare programs and strong R&D pipelines for critical therapies support continued market expansion.

U.K. Small Molecule Sterile Injectable Drugs Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing prevalence of chronic diseases and the rising adoption of homecare injectable therapies. Healthcare providers are emphasizing ready-to-administer formats to improve patient compliance and reduce hospital workloads. The U.K.’s robust healthcare infrastructure and centralized procurement practices support efficient distribution of sterile injectables. Concerns about patient safety, accurate dosing, and aseptic processing are encouraging healthcare facilities to adopt advanced injectable solutions. Moreover, the growing number of outpatient clinics and specialty centers is expected to boost demand across multiple therapeutic areas.

France Small Molecule Sterile Injectable Drugs Market Insight

The France market is witnessing steady growth due to increasing hospital admissions for infectious diseases, cardiovascular conditions, and metabolic disorders. Prefilled syringes and vial-based injectables are increasingly preferred to enhance dosing accuracy and reduce preparation time for healthcare professionals. France’s strong regulatory framework ensures high quality and safety standards for all sterile injectables. The market is further supported by investments in hospital automation, centralized pharmacy management systems, and cold chain infrastructure. Growing patient awareness and government programs promoting access to essential therapies also contribute to market expansion.

Poland Small Molecule Sterile Injectable Drugs Market Insight

The Poland market is expected to witness the fastest growth during the forecast period, driven by expanding hospital infrastructure, rising healthcare expenditure, and increasing access to advanced injectable therapies. Prefilled syringes and cartridge formats are rapidly being adopted for metabolic, cardiovascular, and infectious disease treatments, improving patient safety and adherence. Homecare services and outpatient clinics are contributing to rising demand, as patients prefer convenient and ready-to-administer solutions. Government initiatives to improve access to essential medicines and investments in cold chain logistics are supporting market growth. The growing focus on modernizing healthcare delivery and expanding specialty clinics is accelerating adoption of sterile injectables. Moreover, increasing awareness among healthcare professionals about aseptic handling and safe administration practices is boosting market penetration in Poland.

Europe Small Molecule Sterile Injectable Drugs Market Share

The Europe Small Molecule Sterile Injectable Drugs industry is primarily led by well-established companies, including:

- Recipharm AB (Sweden)

- Vetter Pharma‑Fertigung GmbH & Co. KG (Germany)

- Cenexi (France)

- Siegfried Holding AG (Switzerland)

- Unither Pharmaceuticals (France)

- Famar Group (Greece)

- Aenova Group (Germany)

- Baxter (U.S.)

- Lonza Group AG (Switzerland)

- Rentschler Biopharma SE (Germany)

- Delpharm (France)

- CordenPharma GmbH (Germany)

- NextPharma Technologies GmbH (Germany)

- BAG Health Care GmbH (Germany)

- Lyocontract GmbH (Germany)

- Simtra BioPharma Solutions (Germany)

- PCI Pharma Services (U.S.)

- Fresenius Kabi AG (Germany)

- Pfizer (U.S.)

What are the Recent Developments in Europe Small Molecule Sterile Injectable Drugs Market?

- In October 2025, Polpharma Biologics launched Europe’s first ranibizumab biosimilar in a pre‑filled syringe format to improve ophthalmic care delivery. The company announced that Ranivisio® PFS, a biosimilar to Lucentis® presented in a pre‑filled syringe, is now commercially available in France, offering precise dosing and easier administration for neovascular age‑related macular degeneration and related conditions, representing a notable innovation in sterile injectable drug presentations

- In June 2025, Simtra BioPharma Solutions completed construction of a new sterile injectable manufacturing facility. The expansion added 1,800 m² of production space, increasing total manufacturing area to nearly 12,000 m², introducing prefilled syringe technology and additional freeze dryers. This facility strengthens the company’s sterile fill/finish capacity for vials and syringes to meet growing demand for complex injectable therapeutics

- In February 2025, Recipharm launched a fully operational modular sterile filling system. Recipharm installed a new GMP‑compliant modular aseptic filling line at its Wasserburg facility that supports multiple product types, including syringes and vials. The system improves flexibility, reduces product loss, and broadens sterile processing capacity for clinical and commercial needs

- In February 2025, Sovereign Pharma secured EU approval for multiple sterile injectable products. The company received European Union regulatory approval for a range of aseptic and terminally sterilised formats including vials, ampoules, cartridges, and pre‑filled syringes reinforcing its ability to supply sterile injectables across EU markets

- In February 2023, Switzerland‑based CARBOGEN AMCIS opened a new sterile injectable drug manufacturing facility in France, expanding automated production lines for liquid and freeze‑dried sterile injectables. The new 9,500 m² facility includes two fully automated lines capable of producing highly potent compounds and advanced injectable therapies, boosting Europe’s fill‑finish capacity amid tight global aseptic manufacturing supply

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.