Europe Skin Packaging for Fresh Meat Market, By Type (Carded Thermoformable Skin Packaging, Non-carded Thermoformable Skin Packaging), Material (Plastic, Paper and Paperboard, Others), Heat Seal Coating (Water-Based, Solvent-Based, Others), Air-Fill (Vacuum Fill, Non-Vacuum Fill), Function (Preserve & Protect, Fit For Purpose, Regulatory Labelling, Presentation, Others), Nature (Microwavable, Non-Microwavable), End Use (Meat, Poultry, Seafood), Country (Germany, France, Russia, Spain, U.K., Italy, Turkey, Poland, Netherlands, Denmark, Belgium, Sweden, Switzerland, Rest Of Europe) Industry Trends and Forecast To 2028.

Market Analysis and Insights: Europe Skin Packaging for Fresh Meat Market

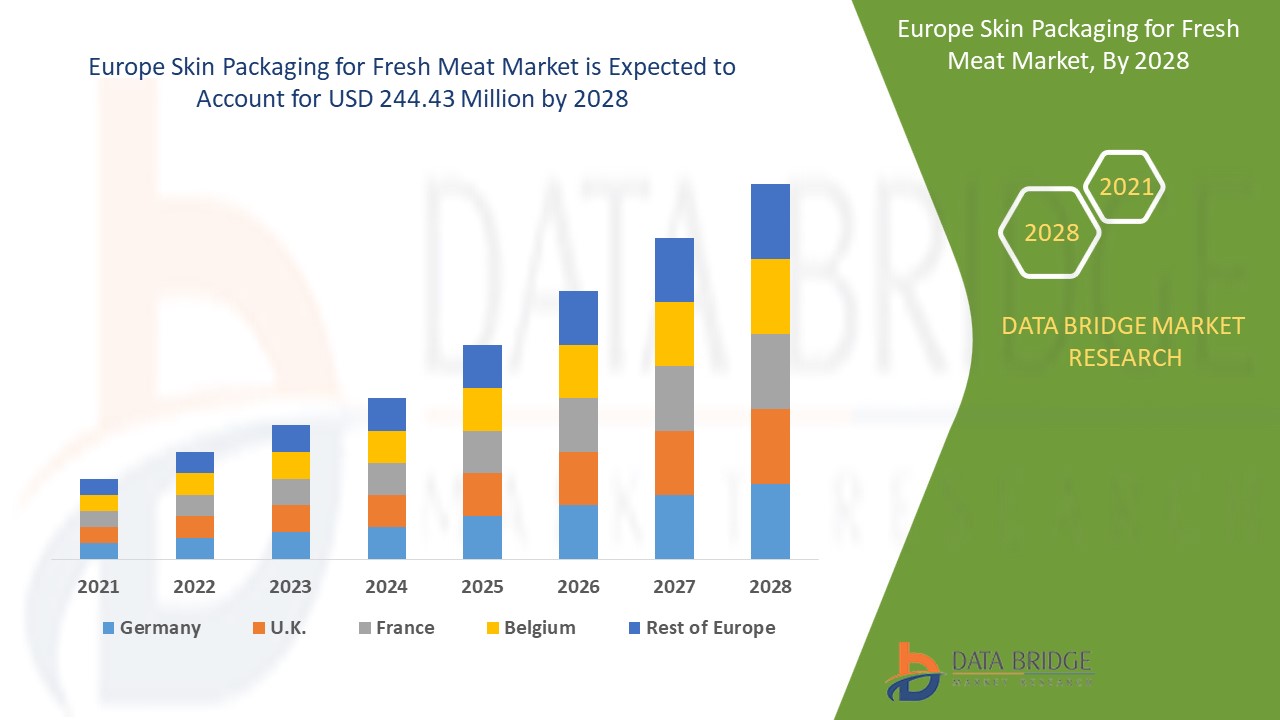

Europe skin packaging for fresh meat market is expected to gain significant growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.2% in the forecast period of 2021 to 2028 and is expected to reach USD 244.43 million by 2028. Advancements & new trends in skin packaging technologies and increasing consumption fresh meat with premium packaging will drive the market. Recent innovations and new product launches create new opportunities for the market. However, availability of alternatives in the market is a major challenge for the market.

Skin packaging, a relatively new technique derived from vacuum packaging, is developed with the aim of retailing and import & exports of small portions of fresh meat, minced meat, or meat preparations. This skin packaging helps the fresh meat to maintain the quality, extends its shelf life and protects the fresh meat from contamination. Thus, the skin packaging is advantageous in terms of maintenance of meat quality and for prolonging shelf-life and improving the stability of the products. There are different types of skin packaging, such as carded and non-carded, which have different remedial factors and different techniques of production, thus, variety of skin packaging is growing the market rapidly.

The recent trend indicates increasing demand for skin packaging for fresh meat as investments in public and private food industries continue to increase. The factors driving the growth of the market are increasing health awareness among the general population and continuous technological advancements in skin packaging. With rapid growth of globalization and increase in mandates for food and beverages by various countries and regions, the skin packaging for fresh meat market will witness an increased trajectory in the coming years. Advancements & new trends in skin packaging technologies and increasing consumption fresh meat with premium packaging will further drive the market growth.

However, the high cost of packaging in the global skin packaging for fresh meat and availability of alternatives in market will restrict the market growth.

Europe skin packaging for fresh meat market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Europe skin packaging for fresh meat market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Skin Packaging for Fresh Meat Market Scope and Market Size

Europe skin packaging for fresh meat market is segmented into seven segments based on type, material, heat seal coating, air fill, function, nature, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the skin packaging for fresh meat market is segmented into carded thermoformable skin packaging and non-carded thermoformable skin packaging. In 2021, the non-carded thermoformable skin packaging segment is expected to dominate the market due to the high production & easy availability of non-carded thermoformable skin packaging.

- On the basis of material, the skin packaging for fresh meat market is segmented into plastic, paper and paperboard, and others. In 2021, the plastic segment is expected to dominate the market due to the extended shelf life and affordable pricing of plastics packaging which attracts the customers.

- On the basis of heat seal coating, the skin packaging for fresh meat market is segmented into water-based, solvent-based and others. In 2021, the water-based segment is expected to dominate the market due to the high demand of water based heat seal coating owing to its benefits such as moisture control and to maintain the quality of the products.

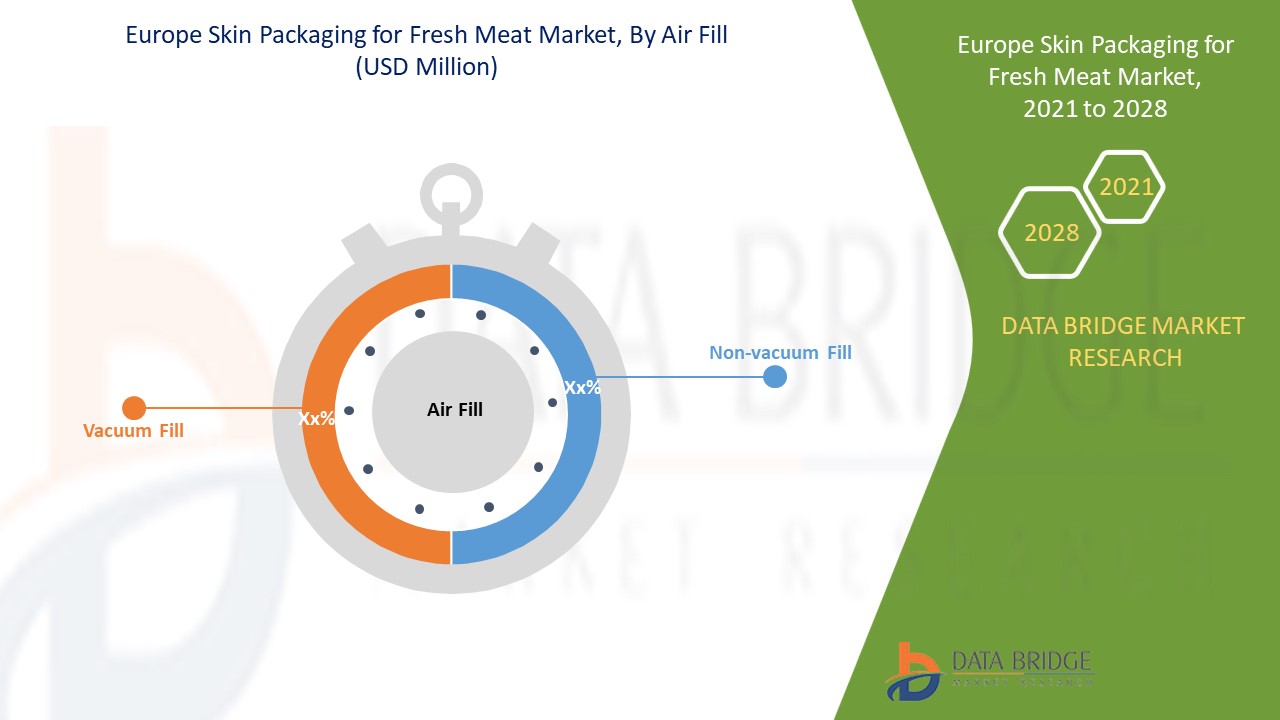

- On the basis of air fill, the skin packaging for fresh meat market is segmented into vacuum fill and non-vacuum fill. In 2021, the vacuum fill segment is expected to dominate the market due to the benefits of vacuum fill such as sealed barrier from external elements and shelf life extension.

- On the basis of function, the skin packaging for fresh meat market is segmented into preserve & protect, fit for purpose, regulatory labelling, presentation and others. In 2021, the preserve & protect segment is expected to dominate the market to maintain the product quality & safety of the fresh meat.

- On the basis of nature, the skin packaging for fresh meat market is segmented into microwavable and non-microwavable. In 2021, the microwavable segment is expected to dominate the market due to high demand of microwavable skin packaging as it is easiest method to prepare the food in their busy lifestyles.

- On the basis of end use, the skin packaging for fresh meat market is segmented into meat, poultry and seafood. In 2021, the meat segment is expected to dominate the market due to the high production & consumption fresh meat owing to its health benefits.

Skin Packaging for Fresh Meat Market Country Level Analysis

Europe skin packaging for fresh meat market is analyzed and market size information is provided by the country, type, material, heat seal coating, air fill, function, nature, and end use as referenced above.

The countries covered in the Europe skin packaging for fresh meat market report are Germany, France, Russia, Spain, U.K., Italy, Turkey, Poland, Netherlands, Denmark, Belgium, Sweden, Switzerland, and Rest of Europe.

Non-carded thermoformable skin packaging segment in Germany is expected to grow with the highest growth rate in the forecast period of 2021 to 2028 because of consumption and production of fresh meat. Non-carded thermoformable skin packaging segment in France is growing rapidly due to growing import and export of fresh meat in France. Russia is growing rapidly in the Europe market and non-carded thermoformable skin packaging segment is dominating in this country owing to increasing research and development for the Skin Packaging for Fresh Meat.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Skin Packaging for Fresh Meat, Boosting the Growth of Skin Packaging for Fresh Meat Market

Europe skin packaging for fresh meat market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2010 to 2019.

Competitive Landscape and Skin Packaging for Fresh Meat Market Share Analysis

Europe skin packaging for fresh meat market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to Skin Packaging for Fresh Meat market.

Major companies which are dealing in the Europe skin packaging for fresh meat market are Dow, Windmöller & Hölscher, Sealed Air, Klöckner Pentaplast, Berry Global Inc., Amcor plc, Graphic Packaging Interna, tional, LLC, FLEXOPACK S.A., WINPAK LTD., Schur Flexibles Holding GesmbH, Mannok Pack, G. Mondini spa, CLONDALKIN GROUP, PLASTOPIL, MULTIVAC, ULMA Packaging, JASA Packaging Solutions, Sealpac International bv, KM Packaging Services Ltd, NPP, Bliston Packaging BV, and Enterpack among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Various contracts and agreements are also initiated by the companies’ worldwide, which are also accelerating the growth of the skin packaging for fresh meat market.

For instance,

- In February 2019, JASA Packaging Solutions launches Bag-2-Paper for 100% recyclable packaging. They use no heat to seal the packages, increasing energy efficiency and reducing manufacturing costs. This launch will have increased the customer base of the company

- In April 2019, Amcor Plc launched new recyclable packaging to reduce a pack's carbon footprint by up to 64%. This product launch helped the company to increase the product portfolio and increase their sales

SKU-