Europe Skin Packaging For Fresh Meat Market

Market Size in USD Million

CAGR :

%

USD

216.04 Million

USD

300.25 Million

2025

2033

USD

216.04 Million

USD

300.25 Million

2025

2033

| 2026 –2033 | |

| USD 216.04 Million | |

| USD 300.25 Million | |

|

|

|

|

What is the Europe Skin Packaging for Fresh Meat Market Size and Growth Rate?

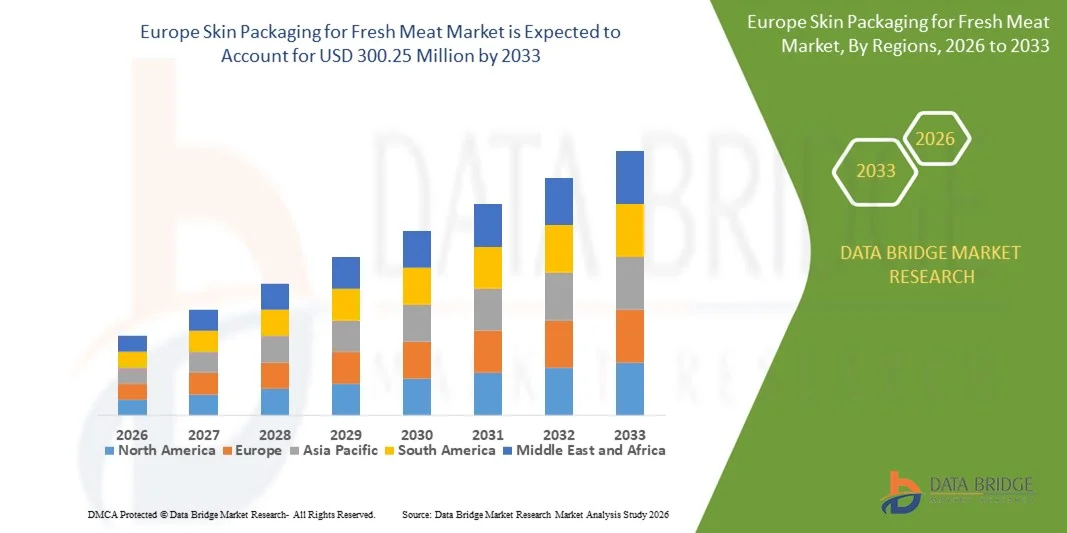

- The Europe skin packaging for fresh meat market size was valued at USD 216.04 million in 2025 and is expected to reach USD 300.25 million by 2033, at a CAGR of 4.20% during the forecast period

- The recent trend indicates increasing demand for skin packaging for fresh meat as investments in public and private food industries continue to increase. The factors driving the growth of the market are increasing health awareness among the general population and continuous technological advancements in skin packaging

What are the Major Takeaways of Skin Packaging for Fresh Meat Market?

- With rapid growth of globalization and increase in mandates for food and beverages by various countries and regions, the skin packaging for fresh meat market will witness an increased trajectory in the coming years

- Advancements & new trends in skin packaging technologies and increasing consumption fresh meat with premium packaging will further drive the market growth

- Germany dominated the europe skin packaging for fresh meat market with the largest revenue share of 32.8% in 2024, driven by strong demand for high-quality fresh meat packaging, advanced food processing infrastructure, and widespread adoption of vacuum skin packaging by major retailers and meat processors

- The France skin packaging for fresh meat market is witnessing steady growth at a CAGR of 8.7%, supported by rising consumption of fresh and premium meat products, expanding modern retail formats, and increasing focus on food waste reductions

- The Non-carded Thermoformable Skin Packaging segment dominated the market with an estimated 41.6% share in 2025, driven by its superior product visibility, tight film conformity, and ability to extend shelf life without additional backing materials

Report Scope and Skin Packaging for Fresh Meat Market Segmentation

|

Attributes |

Skin Packaging for Fresh Meat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Skin Packaging for Fresh Meat Market?

Growing Adoption of High-Barrier, Sustainable, and Shelf-Life-Enhancing Skin Packaging Solutions

- The skin packaging for fresh meat market is witnessing a strong shift toward high-barrier, vacuum-based, and application-specific skin films designed to extend shelf life and preserve meat freshness

- Manufacturers are increasingly focusing on multi-layer, oxygen-resistant, and clarity-enhanced films that improve product visibility while preventing oxidation, moisture loss, and microbial growth

- Rising emphasis on recyclable, downgauged, and bio-based skin packaging materials is driving innovation in response to tightening sustainability regulations and retailer commitments

- For instance, companies such as Amcor, Sealed Air, Berry Global, Winpak, and Klöckner Pentaplast are investing in recyclable skin films and mono-material packaging solutions for fresh meat

- Growing demand for extended shelf life, reduced food waste, and premium meat presentation is accelerating the adoption of advanced skin packaging formats

- As retail and foodservice standards continue to evolve, skin packaging is becoming critical for enhancing product protection, visual appeal, and supply-chain efficiency

What are the Key Drivers of Skin Packaging for Fresh Meat Market?

- Rising consumption of fresh, chilled, and value-added meat products across retail and foodservice channels is a major growth driver

- For instance, during 2024–2025, leading meat processors and retailers expanded the use of skin packaging to improve shelf stability and reduce spoilage losses

- Increasing focus on food safety, hygiene, and extended distribution cycles across global meat supply chains is accelerating skin packaging adoption

- Advancements in film extrusion, sealing technologies, and high-clarity materials are improving pack integrity while maintaining product aesthetics

- Growing preference for convenient, leak-proof, and tamper-evident packaging formats among consumers is supporting market expansion

- Supported by sustainability initiatives, food-waste reduction goals, and premiumization trends, the skin packaging for fresh meat market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Skin Packaging for Fresh Meat Market?

- High material costs and specialized equipment requirements associated with advanced skin packaging films limit adoption among small and mid-scale meat processors

- For instance, during 2024–2025, fluctuating resin prices and rising energy costs increased packaging production expenses

- Compatibility issues between skin films, trays, and sealing machinery can create operational challenges for processors

- Stringent food safety regulations, material compliance standards, and recyclability requirements increase development and certification timelines

- Limited recycling infrastructure for multi-layer plastic films poses sustainability and regulatory challenges

- To overcome these barriers, manufacturers are focusing on mono-material designs, downgauging strategies, and cost-efficient film innovations, supporting future market penetration

How is the Skin Packaging for Fresh Meat Market Segmented?

The market is segmented on the basis of type, material, heat seal coating, air fill, function, nature, and end use.

- By Type

On the basis of type, the skin packaging for fresh meat market is segmented into Carded Thermoformable Skin Packaging, Non-carded Thermoformable Skin Packaging, and Skin Packaging. The Non-carded Thermoformable Skin Packaging segment dominated the market with an estimated 41.6% share in 2025, driven by its superior product visibility, tight film conformity, and ability to extend shelf life without additional backing materials. This format is widely adopted by large meat processors and retailers due to lower material usage, enhanced vacuum performance, and compatibility with automated packaging lines.

The Carded Thermoformable Skin Packaging segment is expected to register the fastest CAGR from 2026 to 2033, supported by rising demand for premium meat presentation, branding space, and value-added retail packs. Increased adoption in specialty meats and export-oriented packaging is further accelerating growth.

- By Material

Based on material, the market is segmented into Plastic, Paper and Paperboard, and Others. The Plastic segment held the largest market share of 68.9% in 2025, owing to its excellent barrier properties, flexibility, seal integrity, and suitability for vacuum skin applications. Plastic materials such as PET, PE, and multilayer films are widely used to prevent oxygen ingress, moisture loss, and contamination, ensuring longer shelf life for fresh meat products.

The Paper and Paperboard segment is projected to grow at the fastest CAGR during 2026–2033, driven by increasing sustainability initiatives, retailer commitments to reduce plastic usage, and advancements in coated and barrier-treated paper solutions. Innovations in recyclable and fiber-based skin packaging are expected to support long-term adoption.

- By Heat Seal Coating

On the basis of heat seal coating, the skin packaging for fresh meat market is segmented into Water-Based, Solvent-Based, and Others. The Water-Based heat seal coating segment dominated the market with a 45.3% revenue share in 2025, driven by its low VOC emissions, food safety compliance, and compatibility with sustainable packaging initiatives. Water-based coatings offer reliable sealing performance while supporting recyclability and regulatory requirements.

The Solvent-Based segment is anticipated to witness the fastest growth rate from 2026 to 2033, owing to its superior adhesion strength and performance in high-speed packaging operations. Despite environmental concerns, continued use in demanding applications and improvements in emission control technologies are supporting segment growth.

- By Air-Fill

Based on air-fill, the market is segmented into Vacuum Fill and Non-Vacuum Fill. The Vacuum Fill segment accounted for the largest share of 72.4% in 2025, as vacuum skin packaging significantly enhances shelf life, reduces microbial growth, and maintains meat texture and color. This format is extensively used in fresh meat retailing, export packaging, and centralized processing facilities.

The Non-Vacuum Fill segment is expected to grow at the fastest CAGR during the forecast period, supported by its lower equipment costs and suitability for short shelf-life and local distribution applications. Small processors and regional meat suppliers are increasingly adopting non-vacuum solutions for cost efficiency.

- By Function

By function, the market is segmented into Preserve & Protect, Fit for Purpose, Regulatory Labelling, Presentation, and Others. The Preserve & Protect segment dominated the market with a 39.8% share in 2025, driven by the critical need to extend shelf life, reduce spoilage, and maintain food safety standards. Skin packaging effectively minimizes oxygen exposure and moisture loss, making it essential for fresh meat preservation.

The Presentation segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer preference for visually appealing, premium meat packaging. Retailers increasingly use skin packaging to enhance product differentiation and brand perception.

- By Nature

On the basis of nature, the skin packaging for fresh meat market is segmented into Microwavable and Non-Microwavable packaging. The Non-Microwavable segment held the dominant share of 63.7% in 2025, as most fresh meat products are intended for conventional cooking methods. This segment benefits from lower material complexity and broad regulatory acceptance.

The Microwavable segment is expected to witness the fastest growth during 2026–2033, driven by increasing demand for convenience foods, ready-to-cook meat products, and urban lifestyles. Advancements in heat-resistant films and consumer-friendly packaging designs are supporting adoption.

- By End Use

Based on end use, the market is segmented into Meat, Poultry, and Seafood. The Meat segment dominated the market with a 44.5% revenue share in 2025, driven by high global consumption of beef, pork, and lamb, along with extensive use of skin packaging in retail and export channels.

The Seafood segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by the need for extended freshness, leak-proof packaging, and premium presentation. Rising seafood exports and cold-chain expansion are further accelerating growth.

Which Region Holds the Largest Share of the Skin Packaging for Fresh Meat Market?

- Germany dominated the europe skin packaging for fresh meat market with the largest revenue share of 32.8% in 2024, driven by strong demand for high-quality fresh meat packaging, advanced food processing infrastructure, and widespread adoption of vacuum skin packaging by major retailers and meat processors

- The country’s well-established meat processing industry, strict food safety regulations, and high penetration of premium and private-label meat products are accelerating demand for high-barrier, shelf-life-extending skin packaging solutions

- Leading packaging players such as MULTIVAC, Klöckner Pentaplast, Winpak, and Schur Flexibles are actively investing in recyclable films, mono-material solutions, and high-clarity skin packaging formats, positioning Germany as a manufacturing and innovation hub for Europe’s skin packaging for fresh meat market

France Skin Packaging for Fresh Meat Market Insight

The France skin packaging for fresh meat market is witnessing steady growth at a CAGR of 8.7%, supported by rising consumption of fresh and premium meat products, expanding modern retail formats, and increasing focus on food waste reduction. French meat processors are increasingly adopting vacuum skin packaging to extend shelf life, improve hygiene, and enhance product presentation. Strong regulatory emphasis on sustainable packaging, along with retailer-led initiatives to reduce plastic waste and improve recyclability, is driving the adoption of downgauged and recyclable skin packaging materials. Investments in cold-chain logistics and fresh food supply modernization are further strengthening France’s position in the European market.

U.K. Skin Packaging for Fresh Meat Market Insight

The U.K. skin packaging for fresh meat market is expanding steadily, driven by growing demand for convenience-ready fresh meat, increasing private-label penetration, and strong retailer focus on extended shelf life and reduced spoilage. Adoption of vacuum and high-clarity skin packaging formats is rising across beef, poultry, and seafood categories. Retailers and processors are prioritizing recyclable and mono-material skin packaging to meet sustainability commitments and evolving regulatory requirements. Continued investments in automated packaging lines and premium meat presentation are positioning the U.K. as a key growth contributor to Europe’s Skin Packaging for Fresh Meat market.

Which are the Top Companies in Skin Packaging for Fresh Meat Market?

The skin packaging for fresh meat industry is primarily led by well-established companies, including:

- Dow, Inc. (U.S.)

- Windmöller & Hölscher (Germany)

- Sealed Air Corporation (U.S.)

- Klöckner Pentaplast (Luxembourg)

- Berry Global Inc. (U.S.)

- Amcor plc (Switzerland)

- Graphic Packaging International, LLC (U.S.)

- FLEXOPACK S.A. (Greece)

- WINPAK LTD. (Canada)

- Schur Flexibles Holding GesmbH (Austria)

- Mannok Pack (U.K.)

- G. Mondini spa (Italy)

- CLONDALKIN GROUP (Netherlands)

- PLASTOPIL (Israel)

- MULTIVAC (Germany)

- ULMA Packaging (Spain)

- JASA Packaging Solutions (Netherlands)

- Sealpac International bv (Netherlands)

- KM Packaging Services Ltd (U.K.)

- Bliston Packaging BV (Netherlands)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Skin Packaging For Fresh Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Skin Packaging For Fresh Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Skin Packaging For Fresh Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.