Europe Rehabilitation Therapy Services Market

Market Size in USD Billion

CAGR :

%

USD

94.41 Billion

USD

260.00 Billion

2025

2033

USD

94.41 Billion

USD

260.00 Billion

2025

2033

| 2026 –2033 | |

| USD 94.41 Billion | |

| USD 260.00 Billion | |

|

|

|

|

Europe Rehabilitation Therapy Services Market Size

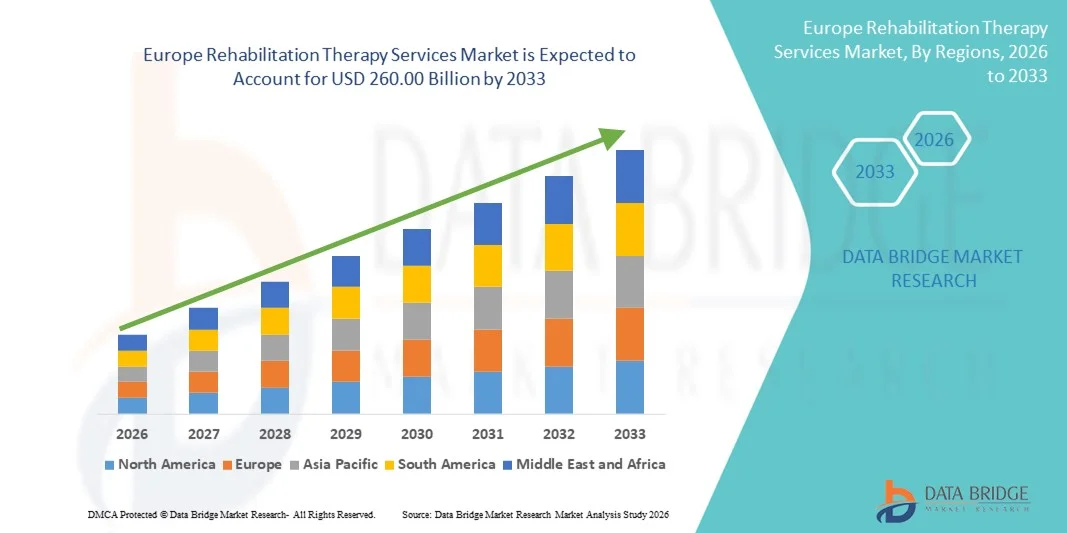

- The Europe rehabilitation therapy services market size was valued at USD 94.41 billion in 2025 and is expected to reach USD 260.00 billion by 2033, at a CAGR of 13.5% during the forecast period

- The market growth is largely driven by the rising prevalence of chronic diseases, neurological disorders, and musculoskeletal conditions, along with a rapidly aging population across European countries, increasing the demand for long-term and post-acute rehabilitation services

- Furthermore, growing awareness of early rehabilitation, expansion of outpatient and home-based therapy models, and advancements in therapy techniques and digital rehabilitation solutions are positioning rehabilitation therapy services as a critical component of Europe’s healthcare continuum, thereby significantly boosting overall market growth

Europe Rehabilitation Therapy Services Market Analysis

- Rehabilitation therapy services, including rehabilitation therapy services, speech therapy, occupational therapy, respiratory therapy, and cognitive behavioral therapy, are integral components of Europe’s healthcare ecosystem, supporting recovery, mobility restoration, and long-term functional improvement across inpatient and outpatient care settings

- The increasing demand for rehabilitation therapy services in Europe is primarily driven by the aging population, rising prevalence of orthopedic, neurological, and cardiopulmonary conditions, and growing awareness of early and continuous rehabilitation interventions

- Germany dominated the Europe rehabilitation therapy services market with a revenue share of 28.4% in 2025, supported by advanced healthcare infrastructure, strong statutory health insurance coverage, high rehabilitation service utilization, and a large elderly population requiring long-term and post-acute care

- The United Kingdom is expected to be the fastest growing country driven by expanding outpatient rehabilitation programs, rising investments in community-based care, and increased focus on early intervention and recovery-oriented healthcare models

- Outpatient rehabilitation services dominated the Europe rehabilitation therapy services market with a market share of 61.2% in 2025, driven by cost efficiency, reduced hospital stays, and increasing adoption across hospitals, private practices, and specialized rehabilitation centers

Report Scope and Europe Rehabilitation Therapy Services Market Segmentation

|

Attributes |

Europe Rehabilitation Therapy Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Rehabilitation Therapy Services Market Trends

Expansion of Digital and Home-Based Rehabilitation Models

- A significant and accelerating trend in the Europe rehabilitation therapy services market is the growing adoption of digital rehabilitation platforms and home-based therapy models, supported by telehealth technologies and remote patient monitoring to improve accessibility and continuity of care

- For instance, several healthcare providers across Germany, the U.K., and France have integrated virtual physiotherapy and digitally guided rehabilitation programs to support post-acute recovery and chronic condition management outside traditional clinical settings

- Digital rehabilitation solutions enable features such as remote progress tracking, personalized therapy plans, and real-time therapist feedback, allowing patients to maintain adherence while reducing the need for frequent in-person visits. For instance, virtual rehabilitation platforms increasingly use motion-tracking and app-based guidance to improve therapy outcomes

- The integration of digital rehabilitation tools with broader healthcare IT systems facilitates centralized patient data management and coordinated care between hospitals, outpatient centers, and home health providers, creating a more efficient rehabilitation ecosystem

- This trend toward more flexible, patient-centric, and technology-enabled rehabilitation services is reshaping expectations for therapy delivery across Europe, encouraging providers to expand hybrid care models combining in-person and remote services

- Increasing adoption of data-driven outcome measurement tools is emerging as a key trend, enabling providers to demonstrate clinical effectiveness and align rehabilitation services with value-based healthcare models

- Growing collaboration between hospitals and private rehabilitation centers is enhancing service continuity and capacity, allowing patients to transition more efficiently from inpatient to outpatient and home-based care

Europe Rehabilitation Therapy Services Market Dynamics

Driver

Rising Burden of Chronic Diseases and Aging Population

- The increasing prevalence of chronic conditions, orthopedic disorders, and neurological diseases, combined with Europe’s rapidly aging population, is a major driver fueling demand for rehabilitation therapy services

- For instance, in 2025, multiple European national health systems expanded post-acute rehabilitation coverage to address growing recovery needs following orthopedic surgeries and stroke-related hospitalizations

- As life expectancy rises, a larger proportion of the population requires long-term rehabilitation to maintain mobility, independence, and quality of life, making rehabilitation services a core component of healthcare delivery

- Furthermore, increased awareness among clinicians and patients regarding the benefits of early rehabilitation intervention is driving higher referral rates for structured therapy programs

- The shift toward value-based healthcare and reduced hospital stays further supports rehabilitation service growth, as providers emphasize effective recovery and functional outcomes beyond acute care

- Rising incidence of sports-related injuries and work-related musculoskeletal disorders is additionally driving demand for specialized rehabilitation therapy services across Europe

- Government initiatives focused on reducing long-term disability and healthcare costs are further encouraging investments in rehabilitation infrastructure and service expansion

Restraint/Challenge

Workforce Shortages and Reimbursement Limitations

- Shortages of skilled rehabilitation professionals, including physiotherapists, occupational therapists, and speech therapists, present a significant challenge to service capacity expansion across several European countries

- For instance, rural and semi-urban regions in Eastern and Southern Europe continue to face limited access to specialized rehabilitation professionals, constraining service availability

- Variability in reimbursement policies and funding levels across national healthcare systems can restrict patient access to certain rehabilitation services, particularly advanced or long-term therapy programs

- Administrative complexity and cost pressures on hospitals and outpatient providers further limit investment in new rehabilitation infrastructure and digital therapy solutions

- Addressing these challenges through workforce training initiatives, policy harmonization, and improved reimbursement frameworks will be essential to sustain long-term growth in the Europe rehabilitation therapy services market

- Uneven digital readiness among providers and patients can slow the adoption of tele-rehabilitation solutions, particularly among older populations

- High operational costs associated with maintaining multidisciplinary rehabilitation teams can limit scalability for smaller private practices and rehabilitation centers

Europe Rehabilitation Therapy Services Market Scope

The market is segmented on the basis of service, age group, service type, application, service category, model, end user, and service channel.

- By Service

On the basis of service, the Europe rehabilitation therapy services market is segmented into rehabilitation therapy services, speech therapy, occupational therapy, respiratory therapy, cognitive behavioral therapy, and others. The rehabilitation therapy services segment dominated the market with the largest revenue share of 42.5% in 2025, driven by its broad applicability across multiple conditions such as orthopedic, neurological, and cardiological rehabilitation. This segment benefits from high patient awareness, insurance coverage, and strong hospital and outpatient adoption, making it the primary choice for post-acute and chronic care therapy. Providers often offer comprehensive packages combining physical therapy, exercise regimens, and functional mobility training, which further enhances its market share. The large elderly population in Germany, France, and the U.K. also heavily contributes to the dominance of this segment. Government initiatives promoting rehabilitation for reducing long-term disability reinforce its market leadership.

The occupational therapy segment is anticipated to witness the fastest growth rate of 20.3% from 2026 to 2033, fueled by increasing workplace-related musculoskeletal disorders and rising demand for pediatric and adult functional independence programs. Occupational therapy’s focus on enabling daily living activities and enhancing quality of life has expanded its adoption across hospitals, rehabilitation centers, and home health services. Technological integration, including virtual therapy tools, adaptive devices, and personalized care plans, supports faster growth. The rising prevalence of neurological disorders and post-stroke rehabilitation needs further accelerates segment growth.

- By Age Group

On the basis of age group, the market is segmented into elderly, pediatrics, and adults. The elderly segment dominated the market with a revenue share of 46.1% in 2025, driven by high incidence of chronic diseases, orthopedic conditions, and post-acute rehabilitation needs. Aging populations in Germany, Italy, and France require long-term care and structured rehabilitation programs to maintain mobility, independence, and quality of life. Elderly patients often require multidisciplinary therapy services, including physiotherapy, occupational therapy, and cognitive rehabilitation, increasing service utilization. Awareness campaigns and government-supported rehabilitation programs further strengthen this segment’s market share. Hospitals and outpatient centers have designed specialized elderly programs to improve adherence and outcomes, reinforcing dominance. The integration of home-based therapy and digital rehabilitation solutions has also increased accessibility for elderly patients, supporting consistent service uptake.

The pediatrics segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by growing awareness of early intervention programs for children with developmental, neurological, or musculoskeletal conditions. Pediatric rehabilitation focuses on improving mobility, functional skills, and social participation, with increasing adoption in schools, hospitals, and home-based care. Technological advancements, such as interactive digital therapy tools and gamified exercises, make pediatric rehabilitation more effective and engaging. Rising incidence of congenital disorders and pediatric neurological conditions further boosts segment growth.

- By Service Type

On the basis of service type, the market is segmented into outpatient rehabilitation services and inpatient rehabilitation services. The outpatient rehabilitation services segment dominated the market with a share of 61.2% in 2025, supported by cost-effectiveness, shorter recovery cycles, and higher accessibility for patients. Outpatient programs are increasingly preferred for post-surgical care, stroke rehabilitation, and musculoskeletal therapy, allowing patients to continue treatment without prolonged hospital stays. Hospitals, private practices, and rehabilitation centers offer flexible schedules and personalized therapy plans to enhance adherence and functional recovery. Government policies promoting outpatient care and insurance coverage for ambulatory therapy further strengthen this segment. Integration with digital health platforms for remote monitoring and tele-rehabilitation also contributes to market dominance.

The inpatient rehabilitation services segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, driven by the growing need for intensive therapy for severe orthopedic, neurological, and cardiopulmonary conditions. Inpatient programs provide round-the-clock care, multidisciplinary support, and advanced therapy modalities. Rising hospital infrastructure development in Central and Eastern Europe and higher post-acute care demand in Germany and France support segment growth.

- By Application

On the basis of application, the market is segmented into orthopedic, neurological, cardiological, pulmonary rehabilitation, palliative care, sports-related injuries, integumentary, pelvic care, and others. The orthopedic rehabilitation therapy services segment dominated the market with a revenue share of 38.6% in 2025, driven by the high prevalence of musculoskeletal disorders, joint replacements, and post-surgical recovery requirements. Orthopedic therapy is widely adopted in hospitals, outpatient centers, and home health programs due to its structured exercise regimens, mobility enhancement, and pain management. Government programs supporting post-surgical rehabilitation and insurance coverage reinforce dominance. Increasing sports participation and work-related injuries further contribute to orthopedic rehabilitation demand. The availability of advanced equipment and digital exercise guidance enhances therapy outcomes.

The neurological rehabilitation therapy services segment is expected to witness the fastest CAGR of 21.1% from 2026 to 2033, fueled by the rising incidence of stroke, Parkinson’s disease, multiple sclerosis, and other neurological disorders across Europe. Neurorehabilitation combines physiotherapy, occupational therapy, cognitive training, and speech therapy, making it highly multidisciplinary. Technological innovations such as robotics, AI-assisted therapy, and virtual reality applications accelerate patient recovery. Expanding outpatient neurorehabilitation centers and tele-rehabilitation services further support segment growth.

- By Service Category

On the basis of service category, the market is segmented into hospital services, physician services, industrial services, and employer services. The hospital services segment dominated the market with a revenue share of 44.7% in 2025, driven by the high availability of multidisciplinary rehabilitation teams, advanced therapy equipment, and structured inpatient and outpatient programs. Hospitals serve as primary referral centers for post-surgical, orthopedic, neurological, and cardiopulmonary rehabilitation, ensuring comprehensive care under supervision. Public and private hospital investments in rehabilitation infrastructure and coverage under national healthcare systems strengthen this segment. Hospitals also lead in integrating digital rehabilitation platforms and tele-rehabilitation programs for continuity of care. The presence of highly skilled therapists and specialized rehabilitation units contributes to dominance.

The employer services segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by rising demand for workplace injury rehabilitation, ergonomics programs, and employee wellness initiatives. Employers are increasingly collaborating with rehabilitation providers to reduce absenteeism, improve functional recovery, and enhance productivity. Industrialized nations in Europe, such as Germany, France, and the U.K., offer tax incentives and occupational health programs, supporting segment growth. The rise in work-related musculoskeletal disorders further drives adoption of employer-led rehabilitation services.

- By Model

On the basis of model, the market is segmented into manual and conventional. The conventional segment dominated the market with a revenue share of 55.3% in 2025, as traditional hands-on therapy approaches such as physiotherapy exercises, manual therapy, and guided rehabilitation programs remain the standard across European hospitals and rehabilitation centers. Conventional models are trusted for their clinical effectiveness, real-time therapist intervention, and suitability for severe orthopedic or neurological cases. Many insurers and healthcare systems also cover conventional therapy models extensively, further strengthening adoption. Conventional therapy remains foundational even in hybrid programs that incorporate digital or tele-rehabilitation elements. Continuous clinical research supporting evidence-based protocols reinforces this segment’s dominance.

The manual segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by personalized hands-on techniques, including massage, joint mobilization, and manual lymphatic therapy, which complement digital and conventional approaches. Increasing adoption of manual therapy in outpatient centers, home health, and sports rehabilitation programs supports growth. The focus on individualized care plans and integration with patient-specific recovery goals accelerates segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, skilled nursing facilities, home health, private practices, sports and fitness facility centers, rehabilitation centers, and others. The hospitals segment dominated the market with a revenue share of 48.2% in 2025, owing to the availability of specialized multidisciplinary rehabilitation teams, inpatient and outpatient facilities, and high patient referral rates for orthopedic, neurological, and cardiopulmonary conditions. Hospitals provide structured rehabilitation pathways, supported by advanced medical equipment, digital tracking tools, and integration with home-based or tele-rehabilitation programs. National healthcare reimbursement policies in Germany, France, and the U.K. also favor hospital-based rehabilitation, driving adoption. Hospitals are central to research and clinical trials, reinforcing service credibility and market dominance.

The home health segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, fueled by rising elderly populations, post-acute care requirements, and growing demand for home-based rehabilitation therapy. Patients increasingly prefer therapy at home for convenience, reduced travel, and personalized care, supported by telehealth and remote monitoring solutions. Home health services reduce hospital congestion and healthcare costs while ensuring continuity of care. Integration with mobile apps, wearable devices, and remote physiotherapy platforms further accelerates adoption.

- By Service Channel

On the basis of service channel, the market is segmented into direct channel and online channel. The direct channel segment dominated the market with a revenue share of 69.1% in 2025, as traditional, in-person rehabilitation sessions remain the primary mode of therapy delivery in hospitals, clinics, and outpatient centers. Direct channels allow therapists to monitor patient progress, adjust therapy intensity, and deliver hands-on interventions effectively. Hospitals, private practices, and rehabilitation centers prefer direct engagement for complex orthopedic, neurological, and cardiopulmonary cases. Insurance coverage and reimbursement policies also favor direct therapy delivery, reinforcing dominance. Patient trust, safety, and clinical oversight are key factors maintaining preference for direct channels.

The online channel segment is expected to witness the fastest CAGR of 24.7% from 2026 to 2033, driven by the rising adoption of tele-rehabilitation, virtual therapy platforms, and mobile app-based exercise programs. Online channels enable patients to access therapy remotely, track progress digitally, and maintain adherence to prescribed exercise regimens. Elderly and mobility-impaired populations benefit from remote therapy options, while healthcare providers expand digital programs to meet demand. Advancements in motion-tracking, wearable devices, and AI-enabled therapy guidance further accelerate growth in online service delivery.

Europe Rehabilitation Therapy Services Market Regional Analysis

- Germany dominated the Europe rehabilitation therapy services market with a revenue share of 28.4% in 2025, supported by advanced healthcare infrastructure, strong statutory health insurance coverage, high rehabilitation service utilization, and a large elderly population requiring long-term and post-acute care

- Patients and providers in Germany highly value structured therapy programs, multidisciplinary care teams, and access to both inpatient and outpatient rehabilitation services, which enhance recovery outcomes and functional independence

- This widespread adoption is further supported by government initiatives promoting post-acute care, increasing elderly population requiring long-term rehabilitation, and strong public and private healthcare spending, establishing Germany as a key hub for rehabilitation services in Europe

The U.K. Europe Rehabilitation Therapy Services Market Insight

The U.K. rehabilitation therapy services market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for outpatient and home-based rehabilitation programs and growing awareness of early intervention therapies. Rising incidences of orthopedic, neurological, and cardiopulmonary conditions, coupled with post-surgical recovery needs, are boosting service adoption. The U.K.’s well-developed healthcare infrastructure, strong private practice network, and emphasis on patient-centered care are encouraging investment in rehabilitation services. Integration of digital therapy platforms and tele-rehabilitation solutions is further supporting market growth. Additionally, government support, insurance coverage, and initiatives for reducing long-term disability are reinforcing adoption across both residential and clinical settings.

Germany Europe Rehabilitation Therapy Services Market Insight

The Germany rehabilitation therapy services market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of rehabilitation benefits, a large elderly population, and a strong public healthcare system. Germany’s advanced medical infrastructure, emphasis on innovation, and widespread availability of multidisciplinary therapy teams promote adoption across hospitals, outpatient centers, and rehabilitation facilities. The country’s focus on post-acute care and value-based healthcare encourages structured rehabilitation programs for orthopedic, neurological, and cardiopulmonary conditions. Integration of digital therapy solutions and home-based rehabilitation models is becoming increasingly prevalent. German patients and providers highly value personalized, efficient, and evidence-based rehabilitation services, reinforcing the market’s growth trajectory.

France Europe Rehabilitation Therapy Services Market Insight

The France rehabilitation therapy services market is projected to grow steadily, driven by increasing demand for outpatient and home-based rehabilitation, particularly among the aging population. Chronic conditions, orthopedic surgeries, and neurological disorders are major factors influencing therapy adoption. France’s strong healthcare infrastructure, favorable reimbursement policies, and government initiatives supporting functional recovery and long-term care contribute to market expansion. Hospitals and private rehabilitation centers are integrating multidisciplinary approaches, including physical, occupational, and speech therapy. Growing awareness among patients about early intervention and continuity of care is further boosting demand. Digital rehabilitation tools and tele-rehabilitation programs are being increasingly deployed to enhance patient engagement and therapy outcomes.

Italy Europe Rehabilitation Therapy Services Market Insight

The Italy rehabilitation therapy services market is expected to witness robust growth, fueled by rising cases of musculoskeletal disorders, orthopedic surgeries, and neurological conditions. Aging demographics and increased life expectancy are driving demand for long-term rehabilitation programs. Italian healthcare providers are expanding outpatient and home-based therapy services, supported by government policies promoting functional recovery and reduced hospital stays. Rehabilitation centers are increasingly adopting multidisciplinary approaches, combining physical, occupational, and cognitive therapy. Patient awareness of rehabilitation benefits, alongside reimbursement coverage, is encouraging higher utilization. The integration of digital platforms and tele-rehabilitation solutions is enhancing accessibility and continuity of care, supporting market expansion across residential and clinical settings.

Europe Rehabilitation Therapy Services Market Share

The Europe Rehabilitation Therapy Services industry is primarily led by well-established companies, including:

- MEDIAN Kliniken (Germany)

- Nuffield Health (U.K.)

- Circle Health Group (U.K.)

- Bupa (U.K.)

- Spire Healthcare Group plc (U.K.)

- Priory Group (U.K.)

- Rehab Group (Ireland)

- Ascot Rehabilitation Therapy (U.K.)

- Sword Health (Portugal)

- Balance Rehab Clinic (Switzerland)

- Paracelsus Recovery (Switzerland)

- The Royal Buckinghamshire Hospital (U.K.)

- Intercontinental Care (Europe)

- Rehaklinik Zihlschlacht (Switzerland)

- Sant Joan de Déu Barcelona Children’s Hospital (Spain)

- Physio Plus Tech (France)

- OMT Global (Europe)

- Rehab Alternatives (Europe)

- Prospira PainCare (Europe)

- Full Range Rehabilitation Services (Europe)

What are the Recent Developments in Europe Rehabilitation Therapy Services Market?

- In November 2025, the first NHS National Rehabilitation Centre in the U.K. was announced, marking a transformative infrastructure development aimed at delivering intensive, early rehabilitation treatments and advanced robotic support for recovery after serious illness or injury, emphasizing state‑of‑the‑art care and multidisciplinary services

- In February 2025, Romatem Europe opened its first rehabilitation clinic in Germany (Neuss), offering comprehensive physical therapy, neurological and orthopedic rehabilitation services with modern technologies, expanding service availability in Western Europe

- In January 2025, the REHAB Karlsruhe 2025 trade fair was held in Germany, bringing together almost 400 exhibitors from 16 countries to showcase the latest innovations, digital aids, assistive technologies, and therapy solutions in rehabilitation, mobility, and care, with special focus on stroke support and prosthetic mobility underscoring the region’s push toward cutting‑edge rehabilitation technologies and inclusive care dialogue

- In March 2024, the EU and UNDP launched the “School of the Physical Therapist of the Future” programme, aimed at training and upskilling rehabilitation professionals to meet growing service demand, particularly in regions facing workforce shortages

- In June 2023, the EU funded the €6 million PREPARE project to advance personalised rehabilitation care, targeting improved quality of life for people with chronic non‑communicable diseases and strengthening rehabilitation therapy approaches across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.