Europe Refrigerant Market

Market Size in USD Billion

CAGR :

%

USD

6.96 Billion

USD

10.12 Billion

2024

2032

USD

6.96 Billion

USD

10.12 Billion

2024

2032

| 2025 –2032 | |

| USD 6.96 Billion | |

| USD 10.12 Billion | |

|

|

|

|

Refrigerant Market Size

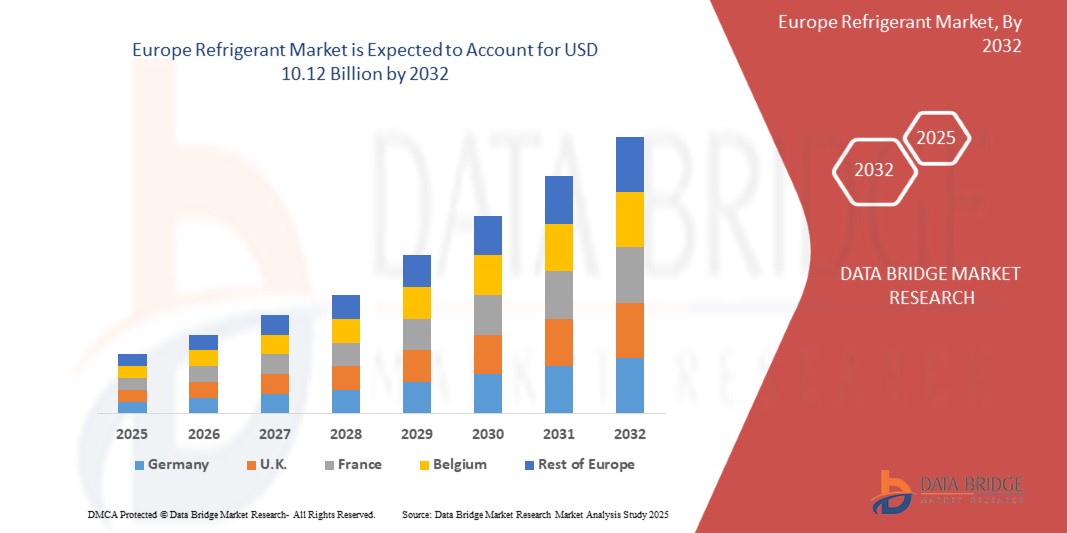

- The Europe Refrigerant Market was valued at USD 6.96 billion in 2024 and is expected to reach USD 10.12 billion by 2032.

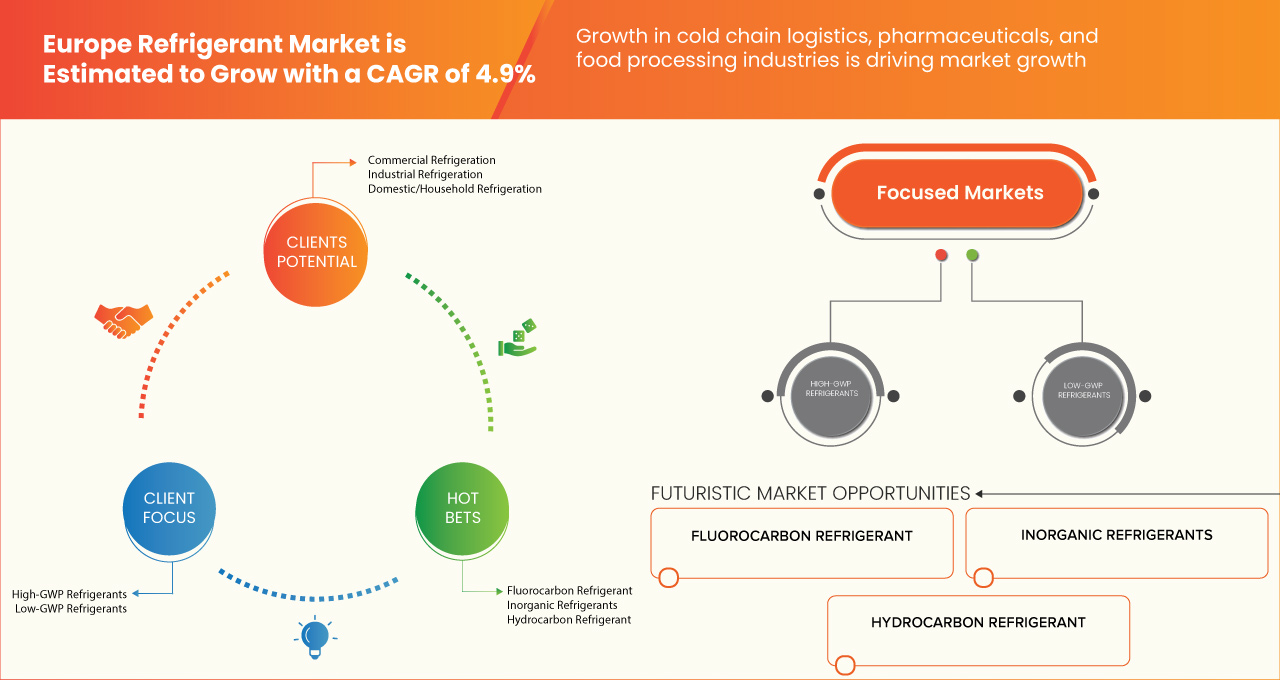

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.9% primarily driven by the increasing demand for energy-efficient and eco-friendly refrigeration solutions

Refrigerant Market Analysis

- increasing demand for cooling systems in residential, commercial, and industrial sectors. Growth is fueled by rising urbanization, climate change, and expanding cold chain logistics

- Stringent environmental regulations on high-GWP refrigerants are pushing the market toward eco-friendly alternatives like hydrofluoroolefins (HFOs) and natural refrigerants

- Germany dominates the Europe refrigerant market due to its strong industrial base, advanced HVAC technology, stringent environmental regulations promoting low-GWP refrigerants, and high demand for energy-efficient cooling solutions across various sectors

- For instance, as per news published by Life Science Networks, temperature-sensitive pharmaceuticals, including vaccines and biologics, require strict temperature control to maintain their efficacy. Advanced packaging solutions, such as insulated containers and phase-change materials, ensure stability during transit, preventing degradation and ensuring the safe delivery of critical medicines.

Report Scope and Refrigerant Market Segmentation

|

Attributes |

Refrigerant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany, U.K., Russia, France, Italy, Spain, Netherlands, Turkey, Belgium, Switzerland, Denmark, Sweden, Finland, Portugal, and Rest of Europe |

|

Key Market Players |

Linde PLC (Ireland), Arkema (France), The Chemours Company (U.S.), Honeywell International Inc. (U.S.), AIR LIQUIDE (France), AGC Chemicals Europe, Ltd. (U.K.), A-Gas International Limited (England), DAIKIN INDUSTRIES, Ltd (Japan), DONGYUE GROUP (China), Entalpia Europe (Poland), Gas Servei (Spain), GTS SPA (Italy), National Refrigerants Ltd (U.K.), Rhodia Chemicals Ltd. UK. (U.K.), SOL Spa (Italy), Tazzetti S.p.A (Italy) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Refrigerant Market Trends

“Europe Shifts to Low-GWP Refrigerants, Driven by Regulations and Sustainability”

- The refrigerant market is driven by increasing demand for cooling systems in residential, commercial, and industrial sectors. Growth is fueled by rising urbanization, climate change, and expanding cold chain logistics.

- Stringent environmental regulations on high-GWP refrigerants are pushing the market toward eco-friendly alternatives like hydrofluoroolefins (HFOs) and natural refrigerants. Asia-Pacific dominates due to rapid industrialization and rising HVAC adoption, while North America and Europe focus on regulatory compliance.

Refrigerant Market Dynamics

Driver

Growth in Cold Chain Logistics, Pharmaceuticals, and Food Processing Industries

The rising demand for refrigeration is driven by the growth of cold chain logistics, pharmaceuticals, and food processing industries. As more people rely on fresh and frozen food, efficient storage and transportation have become essential. Supermarkets, restaurants, and online grocery stores need reliable refrigeration systems to keep food fresh and safe for longer periods.

In the pharmaceutical industry, temperature-sensitive medicines, vaccines, and biologics require proper cooling to maintain their effectiveness. With increasing healthcare needs, more storage and transportation facilities with advanced refrigeration systems are being developed to ensure the safe delivery of these critical products.

Similarly, the food processing industry depends heavily on refrigeration to store raw materials and finished products. Meat, dairy, seafood, and other perishable goods need controlled temperatures to prevent spoilage and maintain quality. As the demand for processed and packaged food grows, the need for efficient cooling solutions also rises.

Overall, the expansion of these industries is fueling the demand for better refrigeration systems. Companies are investing in advanced cooling technologies to meet safety and quality standards. With continuous growth in these sectors, the need for efficient and eco-friendly refrigeration will only increase in the coming years.

For instance,

- As per news published by Life Science Networks, temperature-sensitive pharmaceuticals, including vaccines and biologics, require strict temperature control to maintain their efficacy. Advanced packaging solutions, such as insulated containers and phase-change materials, ensure stability during transit, preventing degradation and ensuring the safe delivery of critical medicines

- According to blog published by World BI Group, temperature-sensitive pharmaceuticals, including vaccines and biologics, require precise temperature control to maintain their efficacy. The cold chain ensures safe storage and transportation, preventing degradation. Advanced refrigeration systems and logistics solutions help maintain stability and product integrity

- A study by Refcold outlined, refrigeration is crucial in the food processing industry for preserving perishable goods like meat, dairy, and seafood. It prevents spoilage, extends shelf life, and maintains quality, ensuring food safety as the demand for processed foods rises

In summary, the growing demand for refrigeration is driven by cold chain logistics, pharmaceuticals, and food processing industries. Increased need for fresh food, temperature-sensitive medicines, and processed goods fuels investment in advanced cooling solutions. As these sectors expand, efficient and eco-friendly refrigeration systems become essential to ensure safety, quality, and sustainability.

Opportunity

Growing Adoption of Natural Refrigerants

More businesses and industries are switching to natural refrigerants because they are better for the environment and help meet strict government regulations. Natural options like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons (like propane) don’t harm the ozone layer or contribute much to global warming, making them a smart alternative to older refrigerants.

Governments are encouraging this shift by phasing out harmful refrigerants and offering incentives for eco-friendly cooling solutions. Companies that adopt natural refrigerants can benefit from lower energy costs and avoid heavy fines for using outdated systems. Many supermarkets, food processing plants, and industrial facilities are upgrading their refrigeration systems to stay ahead of changing regulations.

Even though natural refrigerants require some adjustments, such as new equipment or additional safety measures, they offer long-term savings and efficiency. For example, CO₂-based refrigeration systems are gaining popularity in grocery stores because they work well even in high-temperature climates. Similarly, ammonia is widely used in large cold storage warehouses due to its excellent cooling performance.

With the growing focus on sustainability and stricter environmental laws, businesses that switch to natural refrigerants now will have a competitive advantage, avoiding future costs and contributing to a greener planet.

For instance,

- As per blog published by GEA Group, natural refrigerants like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons provide climate-neutral cooling solutions with minimal Global Warming Potential. Their adoption helps industries comply with environmental regulations while improving energy efficiency and reducing long-term operational costs

- According to Airgas Refrigerants, natural refrigerants like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons offer sustainable cooling solutions with low environmental impact. These alternatives help industries reduce greenhouse gas emissions, comply with regulations, and improve energy efficiency in refrigeration systems

In summary, businesses are shifting to natural refrigerants like ammonia, CO₂, and hydrocarbons due to environmental benefits and strict regulations. Governments offer incentives, while companies gain cost savings and compliance. Despite equipment adjustments, these refrigerants improve efficiency, making them a smart, sustainable choice for long-term success in refrigeration.

Restraint/Challenge

High Initial Investment in Transitioning to New Refrigerants and Equipment

Upgrading to new, eco-friendly refrigerants and modern cooling equipment is a great step, but it comes with a big price tag. Many businesses and homeowners want to make the switch, but the high upfront cost can be a major hurdle.

New refrigerants often require new or modified equipment, since older systems may not be compatible. This means businesses must spend money not just on the refrigerants themselves but also on buying and installing updated cooling units. For industries like food storage, supermarkets, and manufacturing, these costs can be very high.

Even though modern systems are more energy-efficient and save money on electricity in the long run, the initial expense can slow down adoption. Small businesses and households may find it difficult to afford the switch, even though it leads to lower energy bills and reduced maintenance costs over time.

To help with this transition, some governments and organizations are offering financial support, like tax breaks and subsidies. As demand for eco-friendly cooling grows, technology will improve, and prices will eventually come down. While the upfront cost is high, switching to modern refrigeration systems ensures compliance with new regulations, cuts long-term costs, and supports a more sustainable future.

For instance,

- In October 2024 article by Refindustry highlighted that the price of high-GWP refrigerants in Europe has surged by up to 1000%, rising from €3–5/kg in 2014 to €30–45/kg in 2024. Meanwhile, natural alternatives like CO₂ and propane remain stable at €5–15/kg

In summary, transitioning to new refrigerants and equipment requires a high upfront cost, making it challenging for businesses and homeowners. While modern systems offer long-term savings and efficiency, initial expenses slow adoption. Government incentives and technological advancements are helping ease the transition, ensuring compliance, cost reduction, and a sustainable future.

- Complex Retrofitting Requirements for Existing Refrigeration Systems

Upgrading old refrigeration systems to use eco-friendly refrigerants is not as simple as swapping out the gas. Many existing cooling units are designed for high-GWP (Global Warming Potential) refrigerants, meaning they aren’t compatible with natural alternatives like CO₂, ammonia, or hydrocarbons. Retrofitting these systems requires major modifications, including replacing compressors, heat exchangers, and piping. In some cases, businesses must install entirely new refrigeration units, which can cost anywhere from €50,000 to over €1 million, depending on the system size and complexity.

One big challenge is safety. Ammonia, for example, is highly efficient but toxic in case of leaks, requiring advanced detection and ventilation systems. Similarly, hydrocarbons are flammable, meaning businesses must add explosion-proof components to ensure safety. These additional upgrades add to the already high costs of retrofitting.

For supermarkets, cold storage warehouses, and industrial facilities, downtime during retrofitting is another concern. Installing a new system can take weeks, leading to potential revenue losses. Because of these challenges, many businesses delay upgrades, despite government incentives and regulatory pressure.

While retrofitting is expensive and complex, companies that invest in modern, energy-efficient refrigeration will benefit from lower operating costs and compliance with future environmental regulations, avoiding penalties and higher expenses later.

For instance,

- As per news published by Ecacool, Germany’s Federal Ministry for the Environment provides subsidies of up to €150,000 per installation to support retrofitting refrigeration systems with natural refrigerants. This initiative helps businesses reduce energy consumption and comply with environmental regulations

- Aa per study of Entropic, the European standard EN 378 establishes safety requirements for refrigeration systems using natural refrigerants like ammonia (R717) and hydrocarbons (R290). Businesses must implement leak detection, ventilation, and explosion-proof components to ensure safety, increasing retrofitting complexity and costs

In summary, retrofitting old refrigeration systems is costly and complex, requiring equipment upgrades costing €50,000 to over €1 million. Safety concerns, system downtime, and compatibility issues make the process challenging. Despite incentives, many businesses delay retrofits. However, upgrading improves efficiency, lowers costs, and ensures compliance with environmental regulations, avoiding future penalties.

Refrigerant Market Scope

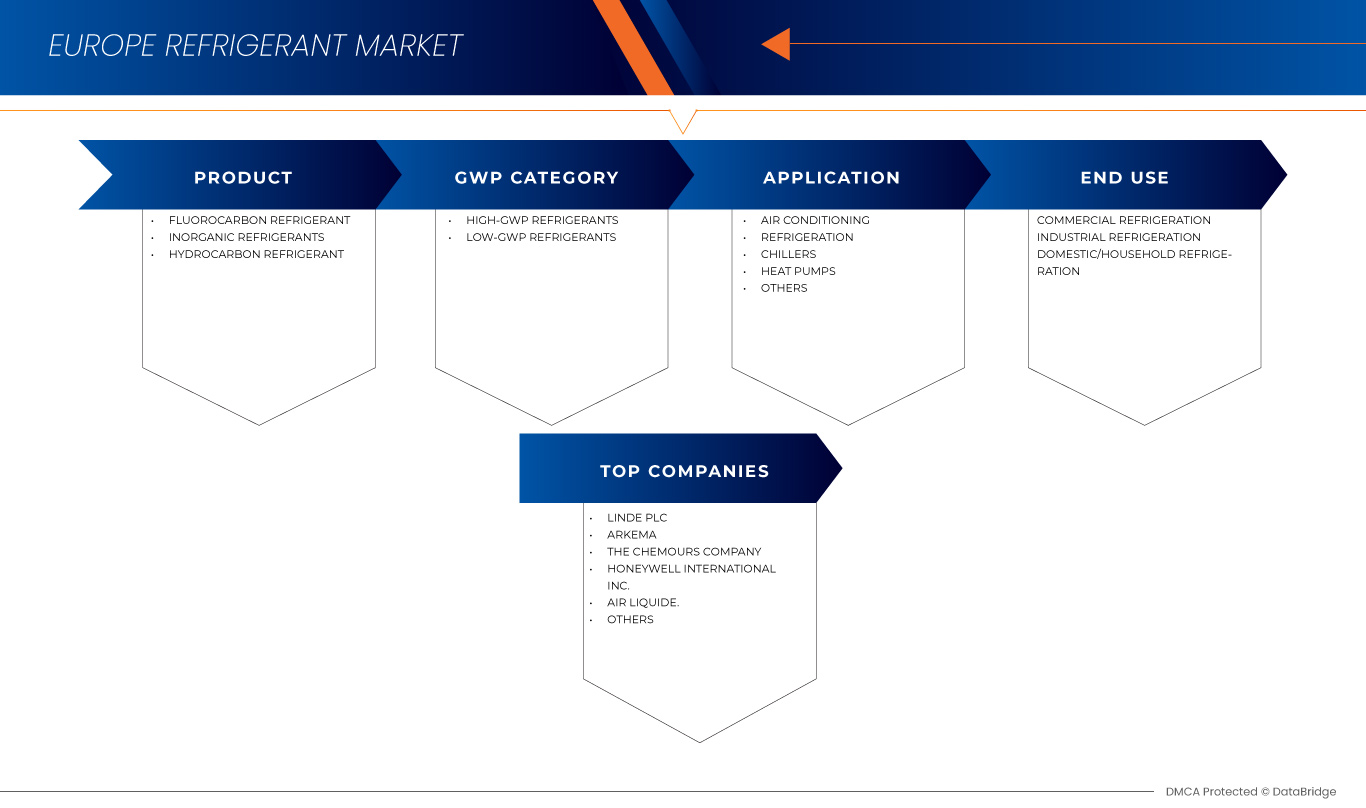

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By GWP Category |

|

|

By Application |

|

|

By End Use

|

|

Refrigerant Market Regional Analysis

Germany is the Dominant Region in the Refrigerant Market”

- Germany is expected to dominate the European refrigerant market due to its strong industrial base, advanced HVAC and automotive sectors, and commitment to sustainable cooling solutions. The country leads in the adoption of low-GWP refrigerants, driven by stringent EU regulations and environmental policies. Germany’s strong R&D investments foster innovations in eco-friendly refrigerants like CO₂, ammonia, and hydrofluoroolefins (HFOs). Additionally, the presence of major refrigerant manufacturers and a well-established cold chain infrastructure further strengthen its market position. With increasing demand for energy-efficient cooling technologies and a focus on climate-friendly alternatives, Germany continues to be the key driver of Europe’s refrigerant market growth.

“Germany is Projected to Register the Highest Growth Rate”

- Germany is expected to have highest CAGR in the European refrigerant market due to its rapid transition toward low-GWP and eco-friendly refrigerants, driven by stringent EU regulations like the F-Gas Regulation. The country’s strong investments in R&D foster innovations in sustainable refrigerants such as CO₂, ammonia, and hydrofluoroolefins (HFOs). Growing demand for energy-efficient HVAC systems, expanding automotive air conditioning applications, and the rise of heat pumps further boost market growth. Additionally, Germany’s well-developed industrial and cold chain infrastructure, along with increasing adoption of advanced cooling technologies, positions it as the fastest-growing refrigerant market in Europe with significant future potential.

Refrigerant Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Linde PLC (Ireland)

- Arkema (France)

- The Chemours Company (U.S.)

- Honeywell International Inc. (U.S.)

- AIR LIQUIDE (France)

- AGC Chemicals Europe, Ltd. (U.K.)

- A-Gas International Limited (U.K.)

- DAIKIN INDUSTRIES, Ltd (Japan)

- DONGYUE GROUP (China)

- Entalpia Europe (Poland)

- Gas Servei (Spain)

- GTS SPA (Italy)

- National Refrigerants Ltd (U.K.)

- Rhodia Chemicals Ltd. UK. (U.K.)

- SOL Spa (Italy)

- Tazzetti S.p.A (Italy)

Latest Developments in Europe Refrigerant Market

- In November 2024, A-Gas participated in MOP 36 and COP29, highlighting its commitment to Lifecycle Refrigerant Management (LRM). The company engaged in panel discussions on recovery, reclamation, and financing of refrigerants, emphasizing investment in carbon markets. A-Gas also hosted a side event on incentivizing private investment in LRM. Their participation showcased their global leadership in sustainable refrigerant solutions

- In December 2021, Air Liquide has secured a long-term helium-3 supply through a partnership with Laurentis Energy Partners, extracting it as a by-product from Canada's Darlington power station. Helium-3's unique properties enable dilution refrigerators to achieve ultra-low temperatures, essential for quantum computing and scientific research. This agreement enhances Air Liquide's capabilities in extreme cryogenics, supporting advancements in quantum technologies

- In August 2021, A-Gas shortlisted for the Green Business of the Year Award at the 2021 Business Leader Awards. The nomination recognizes their commitment to sustainability, ethical leadership, and environmental impact. A-Gas highlighted its efforts in Lifecycle Refrigerant Management (LRM) and achieving a net-zero carbon future

- In July 2021, National Refrigerants Ltd won Honeywell’s Distributor of the Year Award for the third consecutive year. This achievement highlights their strong sales performance, particularly in R1234yf refrigerant for the UK auto aftermarket. Their commitment to customer service and sustainability has played a key role in their success. As a market leader, they continue to drive growth in low-GWP refrigerants

- In July 2020, National Refrigerants Ltd proudly sponsored World Refrigeration Day 2020, an international campaign highlighting the importance of refrigeration, air-conditioning, and heat-pump technology in modern life. The event aimed to raise awareness about the crucial role refrigeration plays in comfort, food preservation, healthcare, and overall societal development. Through their sponsorship, National Refrigerants Ltd reinforced their commitment to promoting sustainability and innovation in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.6.1 PRODUCTION AND CONSUMPTION ANALYSIS OF THE EUROPE REFRIGERANT MARKET

4.6.1.1 PRODUCTION ANALYSIS

4.6.1.1.1 KEY MANUFACTURING COUNTRIES

4.6.1.1.2 TYPES OF REFRIGERANTS PRODUCED

4.6.2 PRODUCTION CONSTRAINTS

4.6.3 CONSUMPTION ANALYSIS

4.6.3.1 END-USE INDUSTRIES

4.6.3.2 MARKET TRENDS

4.6.4 CONCLUSION

4.7 VENDOR SELECTION CRITERIA

4.7.1 VENDOR SELECTION CRITERIA FOR THE EUROPE REFRIGERANT MARKET

4.7.2 REGULATORY COMPLIANCE

4.7.3 PRODUCT QUALITY AND CERTIFICATION

4.7.4 RANGE OF REFRIGERANTS OFFERED

4.7.5 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.7.6 PRICING AND COST-EFFECTIVENESS

4.7.7 SUSTAINABILITY AND ENVIRONMENTAL IMPACT

4.7.8 TECHNICAL SUPPORT AND AFTER-SALES SERVICE

4.7.9 REPUTATION AND CUSTOMER REVIEWS

4.7.10 INNOVATION AND FUTURE-READINESS

4.7.11 SAFETY AND STORAGE FACILITIES

4.7.12 CONCLUSION

4.8 CLIMATE CHANGE SCENARIO

4.8.1 REGULATORY PUSH FOR LOW-GWP REFRIGERANTS

4.8.2 INCREASING DEMAND FOR COOLING SOLUTIONS

4.8.3 RISE OF NATURAL AND LOW-GWP REFRIGERANTS

4.8.4 ADVANCEMENTS IN SUSTAINABLE COOLING TECHNOLOGIES

4.8.5 EMPHASIS ON REFRIGERANT RECOVERY AND RECYCLING

4.8.6 COMPETITIVE LANDSCAPE AND INDUSTRY COLLABORATION

4.9 RAW MATERIAL COVERAGE OF THE EUROPE REFRIGERANT MARKET

4.9.1 INTRODUCTION

4.9.2 KEY RAW MATERIALS IN REFRIGERANT PRODUCTION

4.9.2.1 FLUORINE-BASED COMPOUNDS

4.9.2.2 HYDROCARBONS (METHANE, ETHANE, PROPANE, AND BUTANE)

4.9.2.3 CHLORINE-BASED COMPOUNDS

4.9.2.4 CARBON DIOXIDE (CO₂)

4.9.2.5 AMMONIA (NH₃)

4.9.3 SUPPLY CHAIN AND PRICING DYNAMICS

4.9.4 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 RAW MATERIAL SOURCING AND PRODUCTION

4.10.2 DISTRIBUTION AND LOGISTICS

4.10.3 REFRIGERANT STORAGE AND SAFETY COMPLIANCE

4.10.4 END-USER APPLICATIONS AND MARKET DEMAND

4.10.5 RECOVERY, RECYCLING, AND RECLAMATION

4.10.6 CHALLENGES AND EVOLVING TRENDS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.11.1 TRANSITION TO LOW-GWP AND NATURAL REFRIGERANTS

4.11.2 RISE OF HYDROFLUOROOLEFINS (HFOS) AS NEXT-GENERATION REFRIGERANTS

4.11.3 INTEGRATION OF SMART AND ENERGY-EFFICIENT REFRIGERATION SYSTEMS

4.11.4 ADVANCEMENTS IN REFRIGERANT RECOVERY AND RECYCLING TECHNOLOGIES

4.11.5 DEVELOPMENT OF HYBRID REFRIGERATION SYSTEMS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES

6.1.2 INCREASING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY REFRIGERATION SOLUTIONS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERANT SYSTEMS

6.1.4 STRINGENT ENVIRONMENTAL REGULATIONS PROMOTING LOW-GWP REFRIGERANTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT IN TRANSITIONING TO NEW REFRIGERANTS AND EQUIPMENT

6.2.2 SAFETY CONCERNS RELATED TO FLAMMABLE OR TOXIC REFRIGERANTS

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF NATURAL REFRIGERANTS

6.3.2 GOVERNMENT INCENTIVES FOR GREEN AND ENERGY-EFFICIENT REFRIGERATION TECHNOLOGIES

6.4 CHALLENGES

6.4.1 HIGH COSTS OF R&D IN SUSTAINABLE REFRIGERANT

6.4.2 COMPLEX RETROFITTING REQUIREMENTS FOR EXISTING REFRIGERATION SYSTEMS

7 EUROPE REFRIGERANT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLUOROCARBON REFRIGERANT

7.2.1 FLUOROCARBON REFRIGERANT, BY PRODUCT

7.2.1.1 HYDROFLUOROOLEFINS (HFOS), BY PRODUCT

7.3 INORGANIC REFRIGERANTS

7.3.1 INORGANIC REFRIGERANT, BY PRODUCT

7.4 HYDROCARBON REFRIGERANT

7.4.1 HYDROCARBON REFRIGERANT, BY PRODUCT

8 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY

8.1 OVERVIEW

8.2 HIGH-GWP REFRIGERANTS

8.3 LOW-GWP REFRIGERANTS

9 EUROPE REFRIGERANT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AIR CONDITIONING

9.2.1 AIR CONDITIONING, BY TYPE

9.3 REFRIGERATION

9.4 CHILLERS

9.5 HEAT PUMPS

9.6 OTHERS

10 EUROPE REFRIGERANT MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL REFRIGERATION

10.2.1 COMMERCIAL REFRIGERATION, BY TYPE

10.3 INDUSTRIAL REFRIGERATION

10.3.1 INDUSTRIAL REFRIGERATION, BY TYPE

10.3.1.1 AUTOMOTIVE, BY TYPE

10.4 DOMESTIC/HOUSEHOLD REFRIGERATION

11 EUROPE REFRIGERANT MARKET BY COUNTRY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 RUSSIA

11.1.4 FRANCE

11.1.5 ITALY

11.1.6 SPAIN

11.1.7 NETHERLANDS

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 SWITZERLAND

11.1.11 DENMARK

11.1.12 SWEDEN

11.1.13 FINLAND

11.1.14 PORTUGAL

11.1.15 REST OF EUROPE

12 EUROPE REFRIGERANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LINDE PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ARKEMA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 THE CHEMOURS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT/NEWS

14.4 HONEYWELL INTERNATIONAL INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS/NEWS

14.5 AIR LIQUIDE

14.5.1 COMPANY SNAPSHOT

1.1.4 REVENUE ANALYSIS 185

1.1.4 PRODUCT PORTFOLIO 186

14.5.2 RECENT DEVELOPMENT

14.6 A-GAS INTERNATIONAL LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT NEWS

14.7 AGC CHEMICALS EUROPE, LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 DAIKIN INDUSTRIES, LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 DONGYUE GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

1.1.4 PRODUCT PORTFOLIO 194

14.9.3 RECENT DEVELOPMENT

14.1 ENTALPIA EUROPE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GAS SERVICE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GTS SPA

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATIONAL REFRIGERANTS LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT NEWS

14.14 RHODIA CHEMICALS LTD. UK.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SOL SPA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

1.1.4 PRODUCT PORTFOLIO 207

14.15.3 RECENT DEVELOPMENT

14.16 TAZZETTI S.P.A.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 5 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 6 EUROPE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 19 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 21 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 22 GERMANY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 GERMANY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 GERMANY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 GERMANY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 GERMANY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 27 GERMANY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 28 GERMANY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 GERMANY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 30 GERMANY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GERMANY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 GERMANY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 35 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 36 U.K. FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 37 U.K. HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 U.K. INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 39 U.K. HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 40 U.K. REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 41 U.K. REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 U.K. AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.K. REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 44 U.K. COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.K. INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.K. AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 49 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 50 RUSSIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 51 RUSSIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 52 RUSSIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 53 RUSSIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 RUSSIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 55 RUSSIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 RUSSIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 RUSSIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 58 RUSSIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 RUSSIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 RUSSIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 63 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 64 FRANCE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 FRANCE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 66 FRANCE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 69 FRANCE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 FRANCE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 77 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 78 ITALY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 ITALY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 81 ITALY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 83 ITALY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 ITALY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 ITALY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 86 ITALY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 90 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 91 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 92 SPAIN FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 SPAIN HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 SPAIN INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 SPAIN HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 SPAIN REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 SPAIN REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 SPAIN AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SPAIN REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 SPAIN COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SPAIN INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 104 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 105 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 106 NETHERLANDS FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 108 NETHERLANDS INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 NETHERLANDS HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 119 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 120 TURKEY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 121 TURKEY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 122 TURKEY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 TURKEY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 TURKEY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 125 TURKEY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 TURKEY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 TURKEY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 128 TURKEY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 TURKEY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 TURKEY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 132 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 133 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 134 BELGIUM FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 135 BELGIUM HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 BELGIUM INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 BELGIUM HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 138 BELGIUM REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 139 BELGIUM REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 BELGIUM AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 BELGIUM REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 142 BELGIUM COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 BELGIUM INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 BELGIUM AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 146 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 147 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 148 SWITZERLAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SWITZERLAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SWITZERLAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 161 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 162 DENMARK FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 DENMARK HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 DENMARK INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 165 DENMARK HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 166 DENMARK REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 167 DENMARK REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 DENMARK AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 DENMARK REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 170 DENMARK COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 DENMARK INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 DENMARK AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 175 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 176 SWEDEN FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 177 SWEDEN HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 178 SWEDEN INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 179 SWEDEN HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 180 SWEDEN REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 181 SWEDEN REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 SWEDEN AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SWEDEN REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 184 SWEDEN COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SWEDEN INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SWEDEN AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 188 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 189 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 190 FINLAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 191 FINLAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 192 FINLAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 193 FINLAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 FINLAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 195 FINLAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 196 FINLAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 FINLAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 198 FINLAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 FINLAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 FINLAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 202 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 203 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 204 PORTUGAL FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 205 PORTUGAL HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 206 PORTUGAL INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 207 PORTUGAL HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 208 PORTUGAL REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 209 PORTUGAL REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 PORTUGAL AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 PORTUGAL REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 212 PORTUGAL COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 PORTUGAL INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 PORTUGAL AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 216 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 217 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

List of Figure

FIGURE 1 EUROPE REFRIGERANT MARKET

FIGURE 2 EUROPE REFRIGERANT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRIGERANT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRIGERANT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRIGERANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRIGERANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE REFRIGERANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE REFRIGERANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE REFRIGERANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID: EUROPE REFRIGERANT MARKET

FIGURE 11 EUROPE REFRIGERANT MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE REFRIGERANT MARKET, BY PRODUCT (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES IS EXPECTED TO DRIVE THE EUROPE REFRIGERANT MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE FLUOROCARBON REFRIGERANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRIGERANT MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 EUROPE REFRIGERANT MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/ KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE REFRIGERANT MARKET

FIGURE 24 EUROPE REFRIGERANT MARKET: BY PRODUCT, 2024

FIGURE 25 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY, 2024

FIGURE 26 EUROPE REFRIGERANT MARKET: BY APPLICATION, 2024

FIGURE 27 EUROPE REFRIGERANT MARKET: BY END USE, 2024

FIGURE 28 GLOBAL REFRIGERANT MARKET: SNAPSHOT (2024)

FIGURE 29 EUROPE REFRIGERANT MARKET: COMPANY SHARE 2024 (%)

Europe Refrigerant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Refrigerant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Refrigerant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.