Market Analysis and Insights: Europe Processed Meat Market

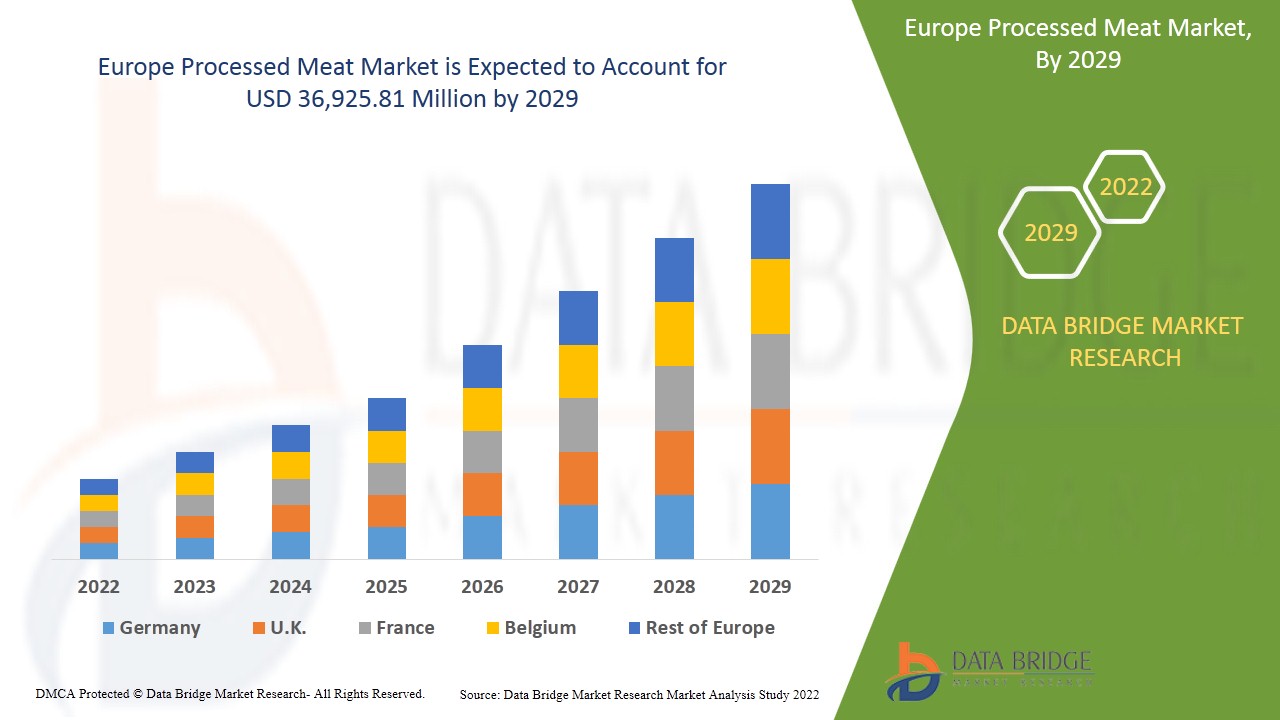

Europe processed meat market is expected to grow in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.9% in the forecast period of 2022 to 2029 and is expected to reach USD 36,925.81 million by 2029. Increased demand for processed meat in the food and pharmaceutical industries may drive growth in the Europe processed meat market.

Processed meat can be defined as meat supplemented with several additives and preservatives such as acidifiers, minerals, salts, and various other seasoning and flavoring agents. The meat is primarily processed to enhance its quality, prevent degeneration, and add flavors to its original composition. It can be red meat or white meat from swine, poultry, cattle, or sea animal meat.

Meat such as beef, pork, turkey, chicken, and lamb are commonly used to produce processed meat. Various processed meat products include pepperoni, jerky, hot dogs, and sausages. Certain preservatives are added to the meat to prevent bacteria and other organisms from spoiling.

Major factors that are expected to boost the growth of the Europe processed meat market in the forecast period are the increase in disposable income. Moreover, the decrease in the time taken to cook meat at home because of the hectic lifestyle is estimated further to supplement the growth of the Europe processed meat market.

- On the other hand, the rise in the incidences of obesity because of the high consumption of processed meat-based products is projected to impede the growth of the Europe processed meat market in the timeline period. In addition, growing fast food and restaurant chains can further provide potential opportunities for the growth of the Europe processed meat market in the coming years. However, the stringent government regulations might further challenge the growth of the Europe processed meat market.

The Europe processed meat market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Europe processed meat market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Europe Processed Meat Market Scope and Market Size

Europe processed meat market is segmented into eight notable segments based on type, product type, category, nature, packaging type, packaging material, end-user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of processing type, the Europe processed meat market is segmented into fresh processed meat, frozen meat, chilled meat, canned meat, dried/semi dried meat, fermented meat, and others. In 2022, the fresh processed meat segment is expected to dominate the market due to rising consumer preference for fresh processed meat due to its maintained nutrient content.

- On the basis of product type, the Europe processed meat market is segmented into beef, pork, goat, lamb, chicken, turkey, duck, and fish. In 2022, the chicken segment is expected to dominate the market due to the increasing import and export of poultry meat.

- On the basis of category, the Europe processed meat market is segmented into cured and uncured. In 2022, the cured segment is expected to dominate the market due to the availability of cured meat with different flavors.

- On the basis of nature, the Europe processed meat market is segmented into organic and conventional. In 2022, the conventional segment is expected to dominate the market due to the availability of conventional meat and better taste coupled with more affordability than organic meat.

- On the basis of packaging type, the Europe processed meat market is segmented into trays, pouches, boxes, cannisters, and others. In 2022, the pouches segment is expected to dominate the market due to its easy to carry and reseal nature, making them more versatile than single-use bags and other types of packages.

- On the basis of packaging material, the Europe processed meat market is segmented into plastic, glass, paper/cardboard, metal, and others. In 2022, the plastic segment is expected to dominate the market due to its properties such as durability and others.

- On the basis of end-user, the processed meat market is segmented into household and food service sector. In 2022, the food service sector segment is expected to dominate the processed meat market due to the rapid expansion of the food sector in various developed and developing economies.

- On the basis of distribution channel, the Europe processed meat market is segmented into store based retailers and non-store based retailers. In 2022, the store based retailers segment is expected to dominate the market due to the availability of trained company representatives in supermarkets and hypermarkets.

Europe Processed Meat Market Country Level Analysis

Europe processed meat market is segmented into eight notable segments based on type, product type, category, nature, packaging type, packaging material, end-user, and distribution channel.

The countries covered in the Europe processed meat market report are the Germany, France, U.K., Italy, Spain, Austria, Russia, Turkey, Belgium, Denmark, Netherlands, Sweden, Poland, Switzerland and Rest of Europe.

The processing type segment in the Europe region is expected to grow with the highest growth rate in the forecast period of 2022 to 2029 because of growth in investments and collaborations in the meat processing business. Germany is expected to lead the growth of the European market, and the product type segment is expected to dominate in this country due to the growing urbanization and increased adoption of a healthy lifestyle.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Processed Meat is Boosting the Market Growth of Europe Processed Meat Market

Europe processed meat market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Europe Processed Meat Market Share Analysis

The Europe processed meat market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the Europe processed meat market.

Some of the major players operating in the Europe processed meat market are Cargill, Incorporated,

JBS Foods, Tyson Foods, Inc., Smithfield Foods, Inc., Hormel Foods Corporation, Groupe Bigard, NH Foods Ltd., Louis Dreyfus Company, Tönnies Group, Gausepohl Fleisch Deutschland GmbH, HKScan, Gruppo Veronesi, TERRENA, Müller Gruppe, OSI Group, Charoen Pokphand Foods PCL., Sanderson Farms, Incorporated., Westfleisch SCE mbH, Marfrig, Vion Food Group, Danish Crown A.M.B.A, The Kraft Heinz Company, among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product launches are also initiated by companies worldwide, which accelerates the Europe processed meat market.

For instance,

- In November 2021, JBS Foods announced to bring cultivated meat to the market till 2024. The company is launching this product with BioTech Foods. This will help the company to attract more customer base and to widen its product portfolio

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player enhance the company's footprints in the Europe processed meat market, which also benefits the organization’s profit growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

List of Table

FIGURE 1 EUROPE PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 2 EUROPE PROCESSED MEAT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PROCESSED MEAT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PROCESSED MEAT MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE PROCESSED MEAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PROCESSED MEAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PROCESSED MEAT MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE PROCESSED MEAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE EUROPE PROCESSED MEAT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS IS DRIVING THE GROWTH OF EUROPE PROCESSED MEAT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PROCESSED MEAT MARKET IN 2022 & 2029

FIGURE 13 EUROPE PROCESSED MEAT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PROCESSED MEAT MARKET

FIGURE 15 EUROPE PROCESSED MEAT MARKET, BY TYPE (2021)

FIGURE 16 EUROPE PROCESSED MEAT MARKET, BY PRODUCT TYPE (2021)

FIGURE 17 EUROPE PROCESSED MEAT MARKET, BY PACKAGING TYPE (2021)

FIGURE 18 EUROPE PROCESSED MEAT MARKET, BY END-USER (2021)

FIGURE 19 EUROPE PROCESSED MEAT MARKET, BY CATEGORY

FIGURE 20 EUROPE PROCESSED MEAT MARKET, BY NATURE (2021)

FIGURE 21 EUROPE PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL (2021)

FIGURE 22 EUROPE SNAPSHOT, 2021

FIGURE 23 EUROPE SUMMARY, 2021

FIGURE 24 EUROPE SUMMARY, 2022 & 2029

FIGURE 25 EUROPE SUMMARY, 2021 & 2029

FIGURE 26 EUROPE SUMMARY BY PRODUCT, 2022 - 2029

FIGURE 27 EUROPE PROCESSED MEAT MARKET: COMPANY SHARE 2021 (VOLUME %)

List of Figure

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PROCESSED MEAT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS (VOLUME %)

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 EUROPE PROCESSED MEAT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.2.1 GROWING UTILIZATION OF NEW TECHNOLOGIES IN MEAT PROCESSING

4.2.2 GROWING COLLABORATIONS AND PARTNERSHIPS

4.2.3 CONSUMER OPTING FOR HEALTHEIR MEAT PRODUCTS WITH DECREASED FAT LEVEL, CHOLESTEROL,

5 EUROPE PROCESSED MEAT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS

6.1.2 PREFERENCE FOR ANIMAL-BASED PROTEINS OVER PLANT-BASED PROTEINS

6.1.3 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.4 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

6.2 RESTRAINTS

6.2.1 HIGH INVESTMENT COST IN POULTRY BUSINESS

6.2.2 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 GROWING FAST FOOD AND RESTAURANT CHAINS

6.3.2 INCREASING AUTOMATION IN MEAT PROCESSING INDUSTRY

6.3.3 GROWING PREFERENCE FOR ORGANIC MEAT

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT REGULATIONS

6.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7 COVID-19 IMPACT ON EUROPE PROCESSED MEAT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST EUROPE PROCESSED MEAT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 EUROPE PROCESSED MEAT MARKET, BY TYPE

8.1 FRESH PROCESSED MEAT

8.2 FROZEN MEAT

8.3 CHILLED MEAT

8.4 CANNED MEAT

8.5 DRIED/SEMI DRIED MEAT

8.6 FERMENTED MEAT

9 EUROPE PROCESSED MEAT MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW:

9.2 BEEF

9.3 PORK

9.4 GOAT

9.5 LAMB

9.6 CHICKEN

9.7 TURKEY

9.8 DUCK

9.9 FISH

10 EUROPE PROCESSED MEAT MARKET, BY PACKAGING TYPE

10.1 TRAYS

10.2 POUCHES

10.3 BOXES

10.4 CANNISTERS

10.5 OTHERS

11 EUROPE PROCESSED MEAT MARKET, BY END USER:

11.1 OVERVIEW:

11.2 HOUSEHOLD

11.3 FOOD SERVICE SECTOR

12 EUROPE PROCESSED MEAT MARKET, BY CATEGORY:

12.1 OVERVIEW:

12.2 CURED

12.3 UNCURED

13 EUROPE PROCESSED MEAT MARKET, BY NATURE:

13.1 OVERVIEW:

13.2 ORGANIC

13.3 CONVENTIONAL

14 EUROPE PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL

14.1 STORE BASED RETAILER

14.2 NON-STORE BASED RETAILER

15 EUROPE PROCESSED MEAT MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 U.K

15.1.3 FRANCE

15.1.4 ITALY

15.1.5 SPAIN

15.1.6 SWITZERLAND

15.1.7 NETHERLANDS

15.1.8 AUSTRIA

15.1.9 RUSSIA

15.1.10 BELGIUM

15.1.11 DENMARK

15.1.12 SWEDEN

15.1.13 POLAND

15.1.14 TURKEY

15.1.15 REST OF EUROPE

16 EUROPE PROCESSED MEAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 JBS FOODS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUS ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TYSON FOODS, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VION FOOD GROUP

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CARGILL, INCORPORATED

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 DANISH CROWN A.M.B.A

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CHAROEN POKPHAND FOODS PUBLIC CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 SMITHFIELD FOODS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 TÖNNIES GROUP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HORMEL FOODS CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUS ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 NATIONAL BEEF PACKING COMPANY L.L.C.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GAUSEPOHL FLEISCH DEUTSCHLAND GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GROUPE BIGARD

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GRUPPO VERONESI

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUS ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 HKSCAN

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUS ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KOCH FOODS.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LOUIS DREYFUS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARFRIG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MÜLLER GRUPPE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 NH FOODS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUS ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 OSI GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 PERDUE FARMS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SANDERSON FARMS, INCORPORATED.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TERRENA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THE KRAFT HEINZ COMPANY

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 WESTFLEISCH SCE MBH

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

LIST OF TABLES

TABLE 1 ALLERGIES CAUSED BY DIFFERENT PLANT-BASED PROTEINS

Europe Processed Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Processed Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Processed Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.