Europe Primers In Construction Market

Market Size in USD Million

CAGR :

%

USD

3,292.79 Million

USD

6,094.72 Million

2022

2030

USD

3,292.79 Million

USD

6,094.72 Million

2022

2030

| 2023 –2030 | |

| USD 3,292.79 Million | |

| USD 6,094.72 Million | |

|

|

|

Europe Primers in Construction Market Analysis and Size

As metals and wood are structurally dependent on primers for longevity and protection, the exhibited increase in consumption of wood and metal by the European region could be considered as one of the strongest drivers which help in the growth of the primers in construction market. The increase in awareness of health adversities caused by these volatile chemicals and the establishment of standards regarding the use of these chemicals have restricted the growth of the primers in construction market as the majority of primers used to contain these chemicals is an amount above the permitted limit. This increase in construction activities regarding offices and commercial spaces is a golden opportunity for Europe primers in construction market segment as the new constructional activities would boost the demand for primers in these regions.

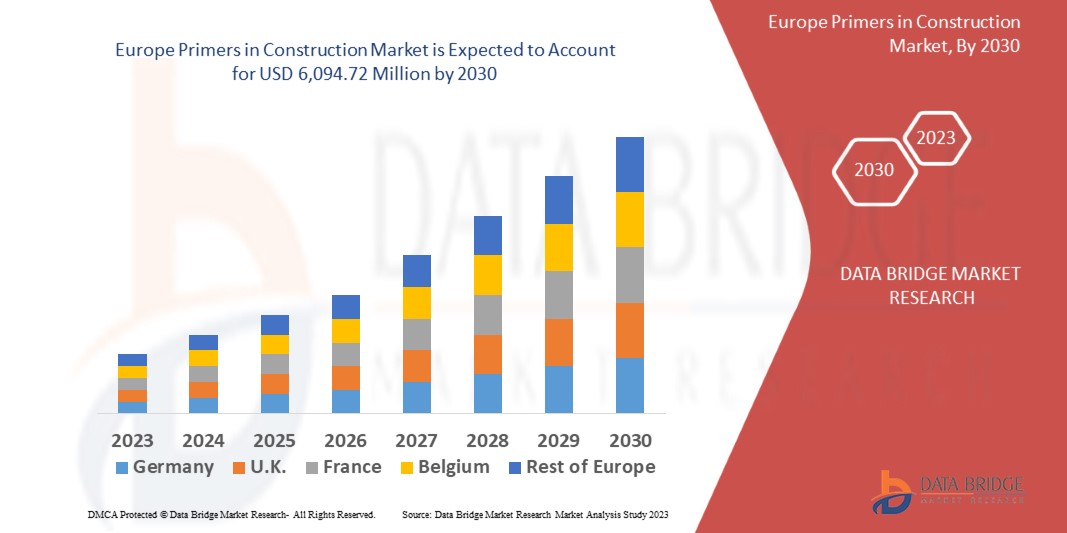

Data Bridge Market Research analyses that the primers in construction market which was USD 3,292.79 million in 2022, would rocket up to USD 6,094.72 million by 2030, and is expected to undergo a CAGR of 8.0% during the forecast period of 2023 to 2030. “New residential construction” segment in the end-use segment dominates the primers in construction market because of the increasing population and rising demand for residential settlements.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, pipeline analysis, pricing analysis, and regulatory framework.

Europe Primers in Construction Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Tons, Pricing in USD |

|

Segments Covered |

By Material (Alkyd, Epoxy, Polyurethane, Acrylic and Others), Surface (Cement, Concrete, Plaster, Metal, Plastic, Wood, Flooring Tiles and Others), Type (Water Based and Solvent Based), End-Use (New Residential Construction, New Non-Residential Construction, New Civil Engineering, Civil Engineering Renovation, Non-Residential Renovation, and Residential Renovation) |

|

Countries Covered |

Germany, France, Italy, U.K., Poland, Romania, and Czech Republic |

|

Market Players Covered |

PPG Industries, Inc. (U.S.), The Sherwin-Williams Company (U.S.), AKZO NOBEL N.V. (Netherlands), RPM International Inc. (U.S.), Axalta Coating Systems, LLC (U.S.), BASF SE (Germany), Jotun (Norway), Kansai Paint Co.,Ltd. (Japan), Henkel AG & Co. kGaA (Germany), Tikkurila (Finland), Hempel A/S (Denmark), and Nippon Paint Holdings Co., Ltd. (Japan) |

|

Market Opportunities |

|

Market Definition

A primer is used as an elementary coating applied on top of materials before the application of paint to ensure a better bond between the surface and the paint. Despite the improved adhesion, the premier could also increase the durability of the paint as well as offer a layer of protection to the surface that is being coated. It is widely used in many industries ranging from construction, automotive, furniture, aerospace and marine transport vehicles.

Primers in construction Market Dynamics

Drivers

- Increasing construction and renovation activities in the region

The European region experiences significant rise in the construction and renovation activities across the residential, commercial, and infrastructure sectors. The need for the use of primers arises in these projects as they are essential for surface preparation, adhesion promotion, and protection against corrosion and weathering.

- Rising infrastructure development projects in Europe

Europe has a lot of ongoing infrastructure development projects, including the construction of roads, bridges, railways, and public facilities. These projects often require primers for surface treatment, corrosion protection, and long-term durability, contributing to the demand for primers in the construction sector in the region.

- Increasing research and development activities for improving the application of primers

Increasing technological advancements and innovations in primer formulations and application methods are also driving the growth of primers construction in Europe. The key manufacturers are investing in research and development activities to introduce innovative primers with improved performance characteristics, such as faster curing, better adhesion, and enhanced chemical resistance. These advancements contribute to the efficiency and effectiveness of construction projects.

Opportunities

- Rise in green and sustainable construction activities

There is a growing demand for environmental friendly and sustainable construction activities in Europe. There is a growing demand for primers that offer low VOC (Volatile Organic Compounds) emissions and are compliant with sustainable building and construction certifications, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), among others.

- Increasing collaboration of manufacturers with architects, specifiers and construction industry professionals

Collaboration and relationship building activities among manufacturers, architects, specifiers, and construction professionals can provide growth opportunities in the market. Primers manufacturers can work closely with these stakeholders to provide technical expertise, product recommendations, and support in the specification process, which can result in increased primer usage in the construction projects.

Restraints/Challenges

- Growing stringent regulations and environmental concerns

The European construction industry is subject to strict regulations by the government related to the usage of chemicals and their environmental impact. There is need for compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and VOC emission limits which can pose challenges for primer manufacturers and end users. There is need to develop formulations that meet regulatory requirements without compromising the performance.

- Lack of awareness and education regarding primers

There is a lack of awareness and understanding among contractors, architects, and construction professionals about the importance and benefits of the use of primers. The limited knowledge about proper surface preparation and the role of primers can lead to their underutilization or incorrect application in construction. There is need for education, training and upskilling programs that are needed to promote the correct use and application of primers in the construction and renovation projects.

This primers in construction market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the primers in construction market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In March 2023, PPG Industries, Inc. introduced PPG ENVIROCRON Primeron powder primer series for high-performance corrosion protection. This product has been designed to provide high corrosion resistance for metal substrates including steel, hot-dip-galvanized steel, metalized steel, and aluminum. The PPG Envirocron Primeron primer powder portfolio has been tested according to the corrosivity categories and approved by the QUALISTEELCOAT international quality label for coated steel. This product launch will strengthen the product portfolio and enhance the share of the company in the market

- In July 2022, Axalta launched Plascoat PPA 742, a single-layer thermoplastic primer solution for metallic substrates in the construction market. Plascoat PPA 742 is easy to apply, even on sharp-edged substrates, making it suitable for various component designs. The primer offers exceptional protection in applications such as urban furniture, construction fencing, metallic structures, and other metal parts

Europe Primers in Construction Market Scope

The primers in construction market are segmented on the basis of the material, surface, type, and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

MATERIAL

- ALKYD

- EPOXY

- POLYURETHANE

- ACRYLIC

- OTHERS

SURFACE

- CEMENT

- CONCRETE

- PLASTER

- METAL

- PLASTIC

- WOOD

- FLOORING TILES

- OTHERS

TYPE

- WATER BASED

- SOLVENT BASED

END-USE

- NEW RESIDENTIAL CONSTRUCTION

- NEW NON-RESIDENTIAL CONSTRUCTION

- NEW CIVIL ENGINEERING

- CIVIL ENGINEERING RENOVATION

- NON-RESIDENTIAL RENOVATION

- RESIDENTIAL RENOVATION

Primers in Construction Market Regional Analysis/Insights

The primers in construction market is analysed and market size insights and trends are provided by country, material, surface, type, and end-use as referenced above.

The countries covered in the primers in construction market report are Germany, France, Italy, the U.K., Poland, Romania, and Czech Republic.

Germany dominates the primers in construction market because of the growing construction and renovation activities in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Growth in construction industry and new technology penetration

The primers in construction market also provides you with detailed market analysis for every country growth in the construction industry, increasing renovation activities and their impact on the primers in construction market. The data is available for historic period 2015-2020.

Competitive Landscape and Primers in construction Market Share Analysis

The primers in construction market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to primers in construction market.

Some of the major players operating in the primers in construction market are:

- PPG Industries, Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- AKZO NOBEL N.V. (Netherlands)

- RPM International Inc. (U.S.)

- Axalta Coating Systems, LLC (U.S.)

- BASF SE (Germany)

- Jotun (Norway)

- Kansai Paint Co.,Ltd. (Japan)

- Henkel AG & Co. kGaA (Germany)

- Tikkurila (Finland)

- Hempel A/S (Denmark)

- Nippon Paint Holdings Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of the Europe primers in construction market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material LIFELINE CURVE

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- DBMR MARKET CHALLENGE MATRIX

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Market Overview

- drivers

- Growing demand fOR primers in new residential construction

- Increasing usage of wood and metals in constructions

- Substantial rise in the economic and living standards

- RestrainTs

- Presence of volatile organic compounds could result in toxicity and health hazards

- Availability of alternatives such as plasters and white cement

- opportunities

- Increasing number of office establishments due to Digitalization and globalization

- Rising demand for more residential buildings and complexes

- Growth in THE tourism industry

- challenge

- Commercialization of VARIOUS Type of paints which don’t require primers

- COVID-19 Impact on Europe Primers in Construction Market

- ANALYSIS ON IMPACT OF COVID-19 ON the Market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE Market

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- PRICE IMPACT

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe primers in construction market, BY material

- overview

- Alkyd

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Epoxy

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Polyurethane

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Acrylic

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Others

- ABSORBENT SUBSTRATE

- NON ABSORBENT SUBSTRATE

- Europe primers in construction market, BY Surface

- overview

- Cement

- Plaster

- Concrete

- Metal

- Wood

- Plastic

- Flooring Tiles

- Others

- Europe primers in construction market, BY type

- overview

- Solvent Based

- Water Based

- Europe primers in construction market, BY End User

- overview

- New Residential Construction

- New Non-Residential Construction

- New Civil Engineering

- Civil Engineering Renovation

- Residential Renovation

- Non-Residential Renovation

- Europe Primers in Construction Market-COUNTRY

- Europe

- GERMANY

- u.k.

- France

- Italy

- Poland

- Romania

- Czech Republic

- Europe Primers in Construction Market: COMPANY landscape

- company share analysis: Europe

- Swot analysis

- COMPANY PROFILE

- AKZO NOBEL N.V.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Axalta Coating Systems, llc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- BASF SE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Hempel A/S

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Jotun

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Kansai Paint Co.,Ltd.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Nippon Paint Holdings Co., Ltd.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- PPG INDUSTRIES, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- RPM International Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- THE SHERWIN-WILLIAMS COMPANY

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- TIKKURILA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- questionnaire

- related reports

List of Table

TABLE 1 IMPORT DATA of Paints and varnishes, incl. enamels and lacquers, based on synthetic or chemically modified natural polymers, dispersed or dissolved in an aqueous medium (excluding those based on acrylic or vinyl polymers); HS code: 320990 (USD thousand)

TABLE 2 export DATA OF PAINTS AND VARNISHES, INCL. ENAMELS AND LACQUERS, BASED ON SYNTHETIC OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (EXCLUDING THOSE BASED ON ACRYLIC OR VINYL POLYMERS); HS CODE: 3209 (USD thousand)

TABLE 3 consumption of steEl in Latin America (Million tonnes)

TABLE 4 Maximum voc content limit values for paints and varnishes (U.K.)

TABLE 5 Maximum voc content limit values inPrimers (U.S.)

TABLE 6 Maximum voc content limit values for paints and varnishes

TABLE 7 Europe primers in construction market, BY material, 2019-2028 (USD Thousand)

TABLE 8 Europe primers in construction market, BY material, 2019-2028 (Tons)

TABLE 9 Europe primers in construction market Alkyd, By material, 2019-2028 (USD Thousand)

TABLE 10 Europe primers in construction300 market, Epoxy By material, 2019-2028 (USD Thousand)

TABLE 11 Europe primers in construction3350 market, Polyurethane By material, 2019-2028 (USD Thousand)

TABLE 12 Europe primers in construction market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 13 Europe primers in construction market, other By material, 2019-2028 (USD Thousand)

TABLE 14 Europe primers in construction market, BY Surface, 2019-2028 (USD Thousand)

TABLE 15 Europe primers in construction market, BY type, 2019-2028 (USD Thousand)

TABLE 16 Europe primers in construction market, BY End User, 2019-2028 (USD Thousand)

TABLE 17 Europe Primers in Construction market, By COUNTRY, 2019-2028 (tone)

TABLE 18 Europe Primers in Construction market, By COUNTRY, 2019-2028 (USD Thousand)

TABLE 19 Europe primers in construction market, By Material, 2019-2028 (Tons)

TABLE 20 Europe primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 21 Europe primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 22 Europe primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 23 Europe primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 24 Europe primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 25 Europe primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 26 Europe primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 27 Europe primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 28 Europe primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 29 Germany primers in construction market, By Material, 2019-2028 (Tons)

TABLE 30 Germany primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 31 Germany primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 32 Germany primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 33 Germany primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 34 Germany primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 35 Germany primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 36 Germany primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 37 Germany primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 38 Germany primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 39 U.k. primers in construction market, By Material, 2019-2028 (Tons)

TABLE 40 U.k. primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 41 U.k. primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 42 U.k. primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 43 U.k. primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 44 U.k. primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 45 U.k. primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 46 U.k. primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 47 U.k. primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 48 U.k. primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 49 France primers in construction market, By Material, 2019-2028 (Tons)

TABLE 50 France primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 51 France primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 52 France primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 53 France primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 54 France primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 55 France primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 56 France primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 57 France primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 58 France primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 59 Italy primers in construction market, By Material, 2019-2028 (Tons)

TABLE 60 Italy primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 61 Italy primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 62 Italy primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 63 Italy primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 64 Italy primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 65 Italy primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 66 Italy primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 67 Italy primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 68 Italy primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 69 Poland primers in construction market, By Material, 2019-2028 (Tons)

TABLE 70 Poland primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 71 Poland primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 72 Poland primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 73 Poland primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 74 Poland primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 75 Poland primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 76 Poland primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 77 Poland primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 78 Poland primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 79 Romania primers in construction market, By Material, 2019-2028 (Tons)

TABLE 80 Romania primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 81 Romania primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 82 Romania primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 83 Romania primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 84 Romania primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 85 Romania primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 86 Romania primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 87 Romania primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 88 Romania primers in construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 89 Czech Republic primers in construction market, By Material, 2019-2028 (Tons)

TABLE 90 Czech Republic primers in construction market, By Material, 2019-2028 (USD Thousand)

TABLE 91 Czech Republic primers in construction market, Alkyd By Material, 2019-2028 (USD Thousand)

TABLE 92 Czech Republic primers in construction market, Epoxy By Material, 2019-2028 (USD Thousand)

TABLE 93 Czech Republic primers in construction market, Polyurethane By MATERIAL, 2019-2028 (USD Thousand)

TABLE 94 Czech Republic primers in construction Market, Acrylic By material, 2019-2028 (USD Thousand)

TABLE 95 Czech Republic primers in construction Market, Others By material, 2019-2028 (USD Thousand)

TABLE 96 Czech Republic primers in construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 97 Czech Republic primers in construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 98 Czech Republic primers in construction Market, By End User, 2019-2028 (USD Thousand)

List of Figure

FIGURE 1 Europe primers in construction market segmentation

FIGURE 2 EUROPE PRIMERS IN CONSTRUCTION MARKET: data triangulation

FIGURE 3 Europe primers in construction market: DROC ANALYSIS

FIGURE 4 Europe primers in construction market: REGIONAL VS. country MARKET ANALYSIS

FIGURE 5 EUROPE PRIMERS IN CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PRIMERS IN CONSTRUCTION MARKET: THE material LIFELINE CURVE

FIGURE 7 EUROPE PRIMERS IN CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 Europe primers in construction market: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PRIMERS IN CONSTRUCTION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 Europe primers in construction market: SEGMENTATION

FIGURE 11 Growing demand of primers in new residential construction IS EXPECTED TO DRIVE THE PRIMERS in construction MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 Alkyd segment is expected to account for the largest share of the Europe primers in construction market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF Europe Primers in Construction Market

FIGURE 14 Private new housing contributed the most to the rise in new work in recent year

FIGURE 15 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 16 STEEL CONSUMPTION PER STEEL-USING SECTOR

FIGURE 17 Mean Equivalized Net Income (Euros) for sweden, iceland and u.k.

FIGURE 18 MEAN EQUIVALIZED NET INCOME (EUROS) FOR ICELAND

FIGURE 19 Private new housing contributed the most to the rise in new work in recent years

FIGURE 20 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 21 Europe primers in construction market: BY material, 2020

FIGURE 22 Europe primers in construction market: BY Surface, 2020

FIGURE 23 Europe primers in construction market: BY type, 2020

FIGURE 24 Europe primers in construction market: BY End User, 2020

FIGURE 25 EUROPE Primers in Construction market: SNAPSHOT (2020)

FIGURE 26 EUROPE Primers in Construction market: BY COUNTRY (2020)

FIGURE 27 EUROPE Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 28 EUROPE Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 29 EUROPE Primers in Construction market: BY material (2019-2028)

FIGURE 30 Europe Primers in Construction Market: company share 2020 (%)

Europe Primers In Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Primers In Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Primers In Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.