Europe Pressure Sensors Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

5.10 Billion

2024

2032

USD

3.10 Billion

USD

5.10 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 5.10 Billion | |

|

|

|

|

Pressure Sensors Market Size

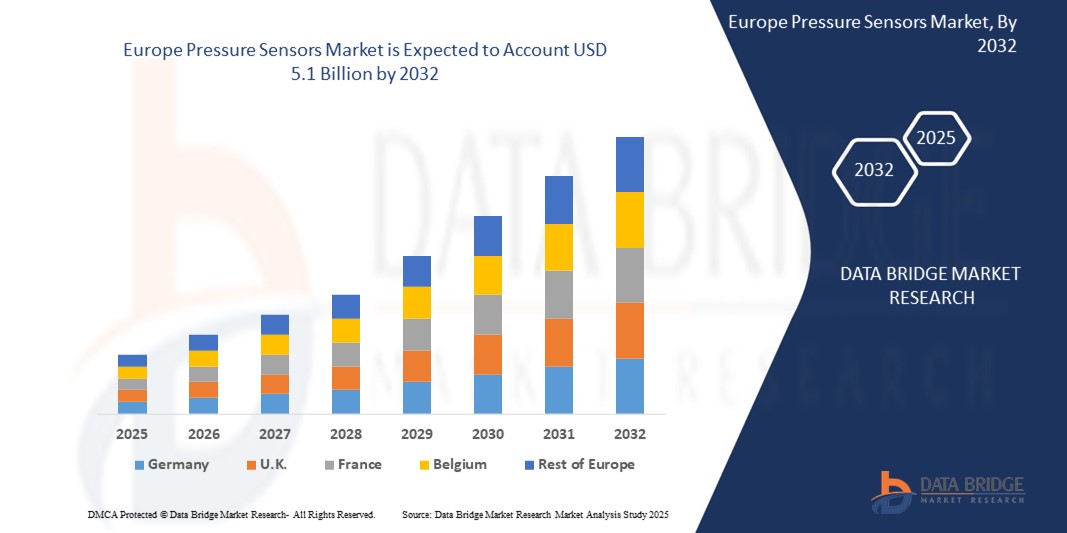

- The Europe Pressure Sensors Market size was valued at USD 3.1 Billion in 2024 and is expected to reach USD 5.1 Billion by 2032, at a CAGR of 7.4% during the forecast period

- The industrial segment is experiencing rapid growth, driven by the adoption of Industry 4.0 technologies and the integration of IoT in manufacturing processes. Pressure sensors play a crucial role in real-time monitoring, predictive maintenance, and process optimization.

Pressure Sensors Market Analysis

- Innovations such as miniaturization, wireless connectivity, and the development of MEMS-based sensors are expanding the applicability of pressure sensors in consumer electronics, healthcare, and environmental monitoring. These advancements enable more compact, efficient, and accurate sensing solutions.

- While the market faces challenges such as pricing pressures and the need for compliance with evolving regulatory standards, opportunities abound in emerging applications like autonomous vehicles, smart cities, and advanced healthcare devices. The continuous evolution of sensor technologies is expected to address these challenges and drive sustained market growth.

- Europe dominates the Pressure Sensors market with the largest revenue share of 46.01% in 2025, due to Increasing adoption of IoT in industrial automation and smart devices.

- Europe is expected to be the fastest growing region in the Pressure Sensors market during the forecast period due driven by the widespread integration of IoT across industrial and consumer applications, stringent safety regulations in automotive manufacturing, and increased use in medical devices.

- Consumer electronics and smart home systems continue to leverage compact, efficient sensors, boosting demand further. However, the market faces restraints such as high implementation costs and limited standardization, which can hamper seamless integration.

Report Scope and Pressure Sensors Market Segmentation

|

Attributes |

Pressure Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pressure Sensors Market Trends

“Powering the Future of Mobility”

- Advancements in Micro-Electro-Mechanical Systems (MEMS) technology have led to the development of miniaturized, cost-effective pressure sensors. These sensors are increasingly integrated into consumer electronics, such as smartphones and wearables, enhancing device functionality and user experience.

- The market is also witnessing a shift towards wireless and IoT-enabled pressure sensors, facilitating real-time data analysis and predictive maintenance across various industries. This trend is particularly evident in applications like smart agriculture, where IoT-enabled pressure sensors monitor soil moisture levels, atmospheric pressure, and irrigation systems.

- The increasing emphasis on energy efficiency and environmental sustainability presents significant opportunities. The expansion of smart cities and infrastructure development is creating new applications for pressure sensors, particularly in monitoring water and gas pipelines, which are essential for effective resource management.

- The Europe pressure sensors market is poised for substantial growth, driven by technological advancements, increased adoption across various industries, and the proliferation of IoT-enabled devices. While challenges exist, the opportunities presented by emerging applications and regional developments position the market for continued expansion in the coming years.

Pressure Sensors Market Dynamics

Driver

“Expanding Applications Across Industrial and Automotive Sectors”

- The increasing integration of pressure sensors into Industry 4.0 systems and smart vehicles is significantly boosting market demand.

- The growing adoption of electric vehicles (EVs) has increased the need for pressure monitoring in battery and thermal management systems.

- For example, in 2024, Bosch expanded its MEMS (micro-electromechanical systems) pressure sensor line to support predictive maintenance and real-time diagnostics in manufacturing and automotive systems.

- In the healthcare sector, miniaturized pressure sensors are used in respiratory monitoring devices, a market that has surged post-pandemic due to heightened demand for remote patient monitoring.

Restraint/Challenge

“Sensor Calibration, Accuracy, and Environmental Limitations”

- Pressure sensors often require regular calibration to maintain accuracy, especially in high-vibration or temperature-variant environments, adding to operational costs.

- Sensor failure or inaccuracy can lead to safety hazards, production downtime, or compromised product quality in critical industries.

- For instance, piezoresistive pressure sensors, while widely used, can suffer from thermal drift and long-term instability in harsh environments like oil & gas or aerospace.

- Additionally, integration with wireless platforms (e.g., IoT systems) introduces latency and cybersecurity challenges, especially in industrial-grade applications.

Pressure Sensors Market Scope

The market is segmented on the sensor type, technology, type, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By sensor type |

|

|

By Technology |

|

|

By Type |

|

|

By Application |

|

|

By End User |

|

Pressure Sensors Market Scope

The market is segmented on the basis sensor type, technology, type, application and end user.

- By sensor type

On the basis of sensor type, the Pressure Sensors market is segmented into Gauge Pressure Sensors, Absolute Pressure Sensors, Differential Pressure Sensors, Vacuum Pressure Sensors and Sealed Pressure Sensors. The Gauge Pressure Sensors segment dominates the largest market revenue share of 25.9% in 2025, the Gauge Pressure Sensors segment is driven by Growth of consumer electronics incorporating pressure sensors (e.g., smartphones, wearables).

The Vacuum Pressure Sensors segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, The Vacuum Pressure Sensors segment is driven by Government regulations on emission control and workplace safety also encourage the integration of pressure sensors in industrial machinery and transportation.

- By Technology

On the basis of Technology, the Pressure Sensors market is segmented into Piezoresistive, Optical, Resonant Solid State, Piezoelectric, Capacitive, Electromagnetic, Others. The Piezoresistive held the largest market revenue share in 2025 of, the passenger vehicle segment is driven Advancements in Micro-Electro-Mechanical Systems (MEMS) technology have led to the development of miniaturized, cost-effective pressure sensors.

The Optical segment is expected to witness the fastest CAGR from 2025 to 2032, the Optical segment is driven by the growing adoption of electric vehicles (EVs) has increased the need for pressure monitoring in battery and thermal management systems.

- By Type

On the basis of type, the Pressure Sensors market is segmented into Wired, Wireless. The Wired held the largest market revenue share in 2025, and it is expected to witness the fastest CAGR from 2025 to 2032. The Pressure Sensors market is primarily driven by Increasing adoption of IoT in industrial automation and smart devices.

- By Application

On the basis of Application, the Pressure Sensors market is segmented into Automotive On-vehicle, Medical Devices, HVAC, Process Controls, Test and Measurement, Others. The Automotive On-vehicle segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. The Pressure Sensors market is driven confluence of technological advancements, regulatory shifts, and industry-specific demands. As automation and digitalization sweep across industrial and consumer landscapes, pressure sensors are becoming critical enablers of innovation and efficiency.

- By End User

On the basis of End User, the Pressure Sensors market is segmented into Automotive, Medical, Industrial, Utility, Aviation, Oil and gas, Marine, Consumer Electronics, Others. The Automotive segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. The Pressure Sensors market is driven surge in Industry 4.0 adoption is significantly boosting demand for pressure sensors, especially in manufacturing and process automation, where real-time data and predictive maintenance are vital.

Pressure Sensors Market Regional Analysis

- Germany dominates the Pressure Sensors market with the largest revenue share of 45.01% in 2024, The Europe Pressure Sensors market is significantly driven by Growth of smart cities and IoT infrastructure requiring embedded pressure sensors.

- Automotive innovation, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), continues to expand the use of pressure sensors in tire pressure monitoring, engine control, and battery management.

Germany Pressure Sensors Market Insight

The Germany Pressure Sensors market captured the largest revenue share of 71.2% within Europe in 2025, driven by healthcare digitization, including remote patient monitoring and wearable technology, is fueling demand for compact and highly sensitive sensors.

U.K Pressure Sensors Market Insight

The U.K Pressure Sensors market is projected to expand at a substantial CAGR throughout the forecast period, The European Pressure Sensors market is propelled by the growing prominence of smart cities and IoT-enabled infrastructure creates vast opportunities for embedded pressure sensors in HVAC systems, water management, and waste monitoring.

Italy Pressure Sensors Market Insight

The Italy Pressure Sensors market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany Pressure Sensors market is significantly driven by as automation and digitalization sweep across industrial and consumer landscapes, pressure sensors are becoming critical enablers of innovation and efficiency.

France Pressure Sensors Market Insight

The France Pressure Sensors market is expected to expand at a considerable CAGR during the forecast period, France Pressure Sensors market is propelled by Growing investments in renewable energy systems—particularly wind and solar—create a need for sensors that monitor pressure within turbines, inverters, and storage systems.

Germany Intelligence Systems Market Insight

The Germany Pressure Sensors market is poised to grow at the fastest CAGR of over 15.1% in 2025, The Europe Pressure Sensors market is experiencing rapid growth, driven by the agricultural sector’s shift toward precision farming and smart irrigation presents new opportunities for rugged, energy-efficient sensors.

Pressure Sensors Market Share

The Pressure Sensors industry is primarily led by well-established companies, including:

- Fuji Electric Co.

- Omron Corporation

- Broadcom

- Panasonic

- Infineon Technologies AG

- Honeywell International Inc.

- Siemens

- Hitachi automotive system Ltd.

- Emerson Electric Co.

- ABB

- NXP Semiconductors

- STMicroelectronics

- Sensata Technologies, Inc.

- Robert Bosch GmbH

- TE Connectivity

- Oxensis, Schneider Electric SE

- Baumer

Latest Developments in Europe Pressure Sensors Market

- In April 2024, Bosch Sensortec introduced the BMP390, a high-performance barometric pressure sensor designed for wearable and IoT applications. This sensor offers improved accuracy and lower power consumption, catering to the growing demand for compact and efficient sensors in consumer electronics.

- In December 2023, Honeywell launched advanced industrial pressure transmitters featuring integrated cybersecurity features and enhanced diagnostic capabilities. These innovations aim to bolster security and reliability in industrial applications.

- In February 2024, NXP expanded its automotive-grade pressure sensor lineup with new devices optimized for electric vehicle battery management systems. This move supports the growing EV market by enhancing battery safety and efficiency.

- In April 2024, TE Connectivity acquired a specialized medical pressure sensor manufacturer to strengthen its position in the healthcare monitoring segment. This acquisition aims to expand TE's offerings in medical-grade sensing solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.