Europe Polyhydroxyalkanoates (PHA) Market Analysis and Insights

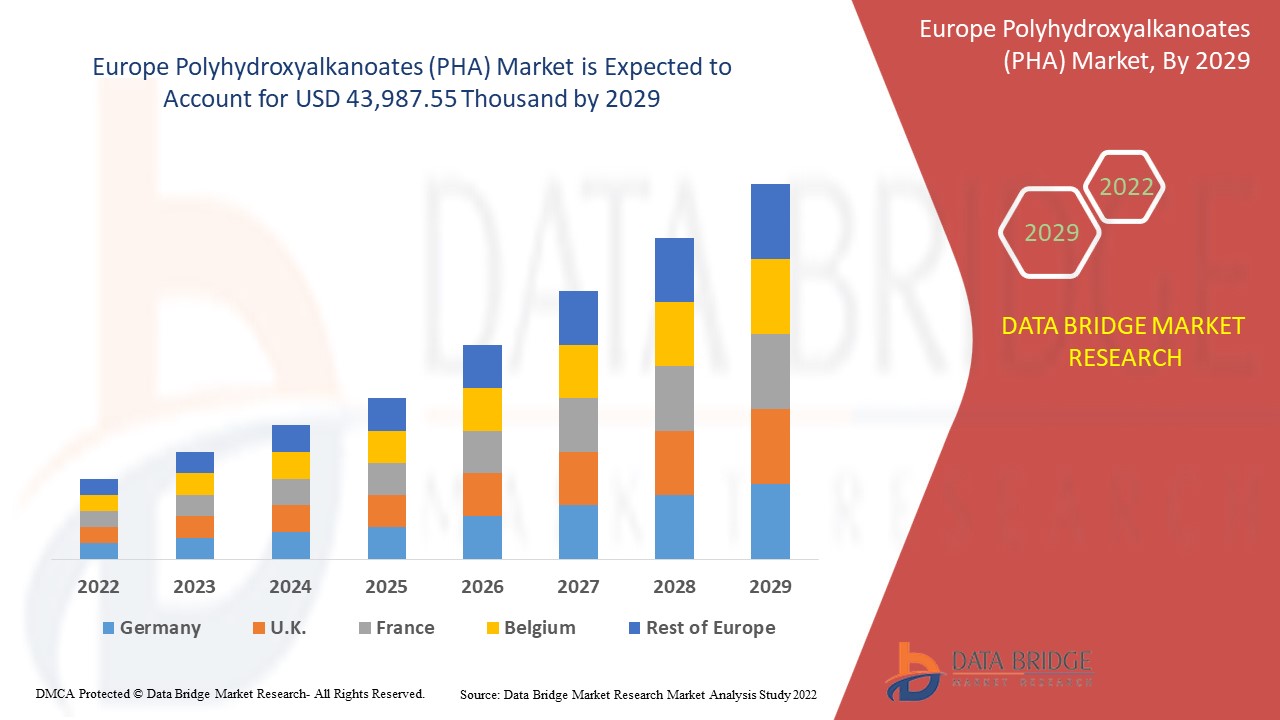

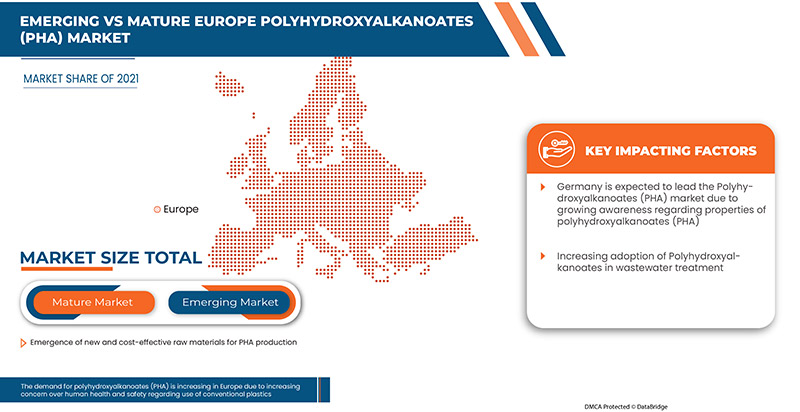

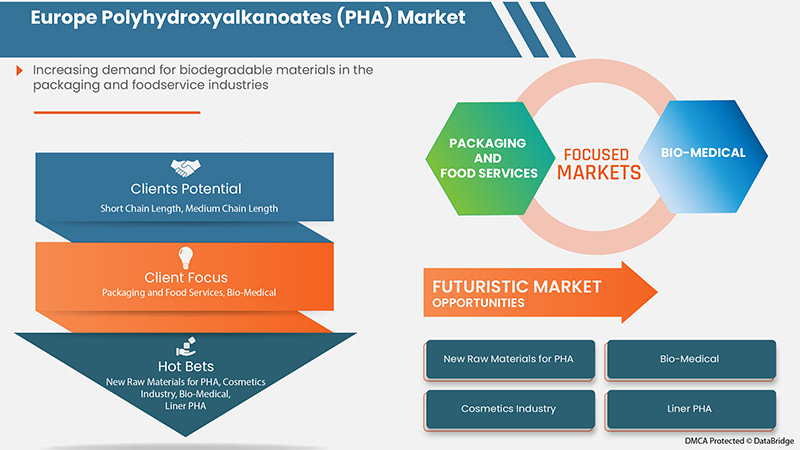

Europe polyhydroxyalkanoates (PHA) market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.3% in the forecast period of 2022 to 2029 and is expected to reach USD 43,987.55 thousand by 2029. The major factor driving the growth of the Polyhydroxyalkanoates (PHA) market is the increasing demand for biodegradable materials in the packaging and food service industries, the emergence of new and cost-effective raw materials for PHA production, and increasing concerns for human health and safety.

Polyhydroxyalkanoates (PHA) are gaining prominence and attention in various applications, including food packaging and biomedical applications, because of their excellent biodegradability, biocompatibility, and thermal properties. Since PHAs are non-toxic, inert, and hydrophobic, these attributes make PHA ideal for human use and do not threaten human health and safety.

Europe polyhydroxyalkanoates (PHA) market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Short Chain Length and Medium Chain Length), Form (Co-Polymerized PHA and Linear PHA), Application (Packaging and Food Services, Bio-Medical, Agriculture, Wastewater Treatment, Cosmetics, 3D Printing and Chemical Addictive) |

|

Countries Covered |

U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, Rest of Europe |

|

Market Players Covered |

BASF SE, PolyFerm Canada, Full Cycle Bioplastics, CJ CHEILJEDANG CORP., BIO-ON, Bluepha Co, Ltd, TERRAVERDAE BIOWORKS INC., RWDC Industries, NEWLIGHT TECHNOLOGIES, INC. TianAn Biologic Materials Co, Ltd., Danimer Scientific, YIELD10 BIOSCIENCE, INC. |

Market Definition

Polyhydroxyalkanoates (PHA) are biodegradable polymers that are manufactured by the microbial fermentation of glucose or sugar. In other words, polyhydroxyalkanoates (PHA) are produced by numerous microorganisms, including through the bacterial fermentation of lipids. Owing to their biodegradable properties, polyhydroxyalkanoates (PHA) are used for a wide range of industrial applications. Polyhydroxyalkanoates (PHA) serve as a source of energy and a carbon store when produced using bacteria.

Europe Polyhydroxyalkanoates (PHA) Market Dynamics

Drivers

- Increasing demand for biodegradable materials in the packaging and foodservice industries

The Polyhydroxyalkanoates (PHA) market growth factors include the increasing demand for biodegradable materials in the packaging and food service industries, as these materials will mitigate environmental pollution and support sustainability initiatives. Moreover, factors such as increasing demand for food packaging and increasing demand for biodegradable plastics in various forms of packaging are expected to drive the demand for polyhydroxyalkanoates (PHA) shortly.

- Emergence of new and cost-effective raw materials for PHA production

The demand for polyhydroxyalkanoates (PHA) is mainly driven by the abundance of sugar sources found in sugarcane, beet, molasses, and bagasse which can be easily consumed and converted by bacteria to produce PHA. In addition, the manufacturing of biodegradable plastics can benefit from raw materials derived from non-food items or waste residues worldwide. This is owing to the rising Europe demand for cereals, including maize, wheat, barley, and other grains for food, animal feed, and biofuels. Additionally, non-food raw resources such as organic waste, biomass, and dead plants are predicted to improve waste management.

- Increasing concerns for human health and safety

Manufacturers in the polyhydroxyalkanoate market blend PHAs with other polymers to provide valuable human-use options. Moreover, thermal decomposition methods such as pyrolysis are being used for chemically decomposing PHA into other substances, including monomers or oligomers, by the presence of heat and leaving no harm to the environment.

Opportunities

- Increasing investments in research & development activities for PHA applications

Polyhydroxyalkanoates (PHA) are a diverse group of biodegradable polyesters that can be synthesized through biological and non-biological routes. Polyhydroxyalkanoates (PHA) are compounds that belong to the class of polyesters made from renewable resources such as corn starch or sugar cane bagasse. With the growing acceptance of PHA in various industries and segments, companies are investing heavily to explore new applications for PHAs, including biomedical products, paints & coatings, and textiles, which is expected to offer lucrative opportunities for the growth of the Europe polyhydroxyalkanoates (PHA) market.

- Stringent government regulations regarding the use of plastic products

The strict governmental law against single-use plastic and increasing concerns over human health and safety are expected to offer opportunities for growth in the Europe; polyhydroxyalkanoates (PHA) market. The need for environment-friendly products is driving innovation in the bioplastics industry. The packaging and food services industry demands single-use plastics and sustainable packaging. This increases the need for bioplastics. Moreover, there are many PHA manufacturers across the globe with a huge domestic market in their regions.

Restraints/Challenges

- Higher price of PHA as compared to conventional polymers

The considerably higher cost of PHA than other polymers is also one of the major restrictions on industry expansion. Biodegradable plastics, such as PHA, have a production cost of 20 percent to 80 percent greater than conventional plastics. These bio-based materials and technologies are still in the early stages of development and have not yet reached the same level of commercialization as their petrochemical counterparts.

- Performance issues of PHA related to its properties

PHAs applications are limited due to poor mechanical properties, high production cost, and limited functionalities. However, chemical modifications and blends with natural biopolymers or other biodegradable polymers are used to improve the properties of PHAs, but this remains a hindrance to market growth. PHA has a very narrow thermal processing window. The low hydrothermal stability of PHB causes difficulties during processing with conventional polymer processing equipment such as extruders, injection molding machines, and 3-D printing equipment. Thermal degradation of PHB leads to quick and substantial decreases in molecular weight, color changes from white/yellow to brown, and the loss of final rheological and mechanical properties.

- Slow advancement in manufacturing technologies for PHA production

Economic threats hamper the broad market penetration of PHAs: production of these materials is still significantly more expensive if compared to the well-established, large-scale manufacturing of petrol-based plastics. In particular, the allocation of feedstocks needed for PHA production drastically contributes to these polyesters' still high production price. The major limitations in producing PHAs are special growth conditions required, substrate composition, cultures condition, fermentation processes (batch, fed-batch, repeated batch, or fed-batch, and continuous modes), and high recovery cost. In addition, the production of PHA generates a large amount of biomass waste.

Recent Development

- In January 2021, Danimer Scientific opened its new facility at 605 Rolling Hills Lane, Winchester, KY 40391, which is the world's first commercial production facility for PHA. With the help of this new facility, the company doubled its production capacity in the year 2021.

Europe Polyhydroxyalkanoates (PHA) Market Scope

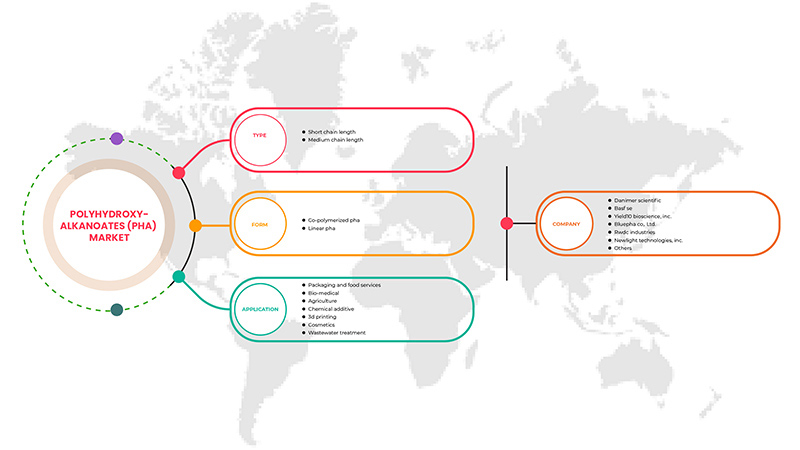

The Europe polyhydroxyalkanoates (PHA) market is categorized based on type, form, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Short Chain Length

- Medium Chain Length

Based on type, the Europe polyhydroxyalkanoates (PHA) market is classified into two segments short chain length and medium chain length.

Form

- Co-Polymerized PHA

- Linear PHA

Based on form, the Europe polyhydroxyalkanoates (PHA) market is classified into two segments co-polymerized PHA and linear PHA.

Application

- Packaging and Food Services

- Bio-Medical

- Agriculture

- Chemical Additive

- 3D Printing

- Cosmetics

- Wastewater Treatment

Based on the application, the Europe polyhydroxyalkanoates (PHA) market is classified into seven segments packaging and food services, bio-medical, agriculture, chemical additive, 3d printing, cosmetics, and wastewater treatment.

Europe Polyhydroxyalkanoates (PHA) Market Regional Analysis/Insights

The Europe polyhydroxyalkanoates (PHA) market is segmented on the basis of type, form, and application.

The countries in the Europe polyhydroxyalkanoates (PHA) market are the U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, and the rest of Europe. Germany is dominating the Europe polyhydroxyalkanoates (PHA) market in terms of market share and market revenue because of the growing consumer inclination toward eco-friendly plastic products.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country data.

Competitive Landscape and Europe Polyhydroxyalkanoates (PHA) Market Share Analysis

Europe polyhydroxyalkanoates (PHA) market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Europe Polyhydroxyalkanoates (PHA) market.

Some of the prominent participants operating in the Europe polyhydroxyalkanoates (PHA) market are BASF SE, PolyFerm Canada, Full Cycle Bioplastics, CJ CHEILJEDANG CORP., BIO-ON, Bluepha Co, Ltd, TERRAVERDAE BIOWORKS INC., RWDC Industries, NEWLIGHT TECHNOLOGIES, INC. TianAn Biologic Materials Co, Ltd., Danimer Scientific, YIELD10 BIOSCIENCE, INC.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Europe Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 BMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 POLYHYDROXYALKANOATES (PHA) PLANT CAPITAL /INSTALLATION COST

4.3 PRODUCTION COST ANALYSIS

4.4 PRODUCT VALUE CHAIN & MARGIN ANALYSIS

4.5 CONSUMER BUYING BEHAVIOUR

4.6 FACTORS AFFECTING BUYING DECISION

4.7 IMPORT EXPORT SCENARIO

4.8 IMPACT OF ECONOMIC SLOWDOWN

4.8.1 OVERVIEW

4.8.2 IMPACT ON PRICE

4.8.3 IMPACT ON SUPPLY CHAIN

4.8.4 IMPACT ON SHIPMENT

4.8.5 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.8.6 CONCLUSION

4.9 PRICING ANALYSIS

4.1 PRODUCT ADOPTION CRITERIA

4.10.1 OVERVIEW

4.10.2 PRODUCT AWARENESS

4.10.3 PRODUCT INTEREST

4.10.4 PRODUCT EVALUATION

4.10.5 PRODUCT TRIAL

4.10.6 PRODUCT ADOPTION

4.10.7 CONCLUSION

4.11 RAW MATERIAL SOURCING ANALYSIS

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR BIODEGRADABLE MATERIALS IN THE PACKAGING AND FOODSERVICE INDUSTRIES

6.1.2 EMERGENCE OF NEW AND COST-EFFECTIVE RAW MATERIALS FOR PHA PRODUCTION

6.1.3 INCREASING CONCERNS FOR HUMAN HEALTH AND SAFETY

6.2 RESTRAINTS

6.2.1 HIGHER PRICE OF PHA AS COMPARED TO CONVENTIONAL POLYMERS

6.2.2 PERFORMANCE ISSUES OF PHA RELATED TO ITS PROPERTIES

6.3 OPPORTUNITIES

6.3.1 INCREASING INVESTMENTS IN RESEARCH & DEVELOPMENT ACTIVITIES FOR PHA APPLICATIONS

6.3.2 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF PLASTIC PRODUCTS

6.4 CHALLENGE

6.4.1 SLOW ADVANCEMENT IN MANUFACTURING TECHNOLOGIES FOR PHA PRODUCTION

7 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE

7.1 OVERVIEW

7.2 SHORT CHAIN LENGTH

7.3 MEDIUM CHAIN LENGTH

8 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM

8.1 OVERVIEW

8.2 CO-POLYMERIZED PHA

8.3 LINEAR PHA

9 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND FOOD SERVICES

9.3 BIO-MEDICAL

9.4 AGRICULTURE

9.5 CHEMICAL ADDITIVE

9.6 3D PRINTING

9.7 COSMETICS

9.8 WASTEWATER TREATMENT

10 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 AWARD

11.3 NEW PRODUCTION FACILITY

11.4 EVENT

11.5 FUNDING

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 DANIMER SCIENTIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SWOT

13.1.5 PRODUCT PORTFOLIO

13.1.6 RECENT UPDATE

13.2 BASF SE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SWOT

13.2.5 PRODUCT PORTFOLIO

13.2.6 RECENT UPDATE

13.3 YIELD10 BIOSCIENCE, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SWOT

13.3.5 PRODUCT PORTFOLIO

13.3.6 RECENT UPDATES

13.4 BLUEPHA CO., LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 SWOT

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATES

13.5 RWDC INDUSTRIES

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 SWOT

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 BIO-ON

13.6.1 COMPANY SNAPSHOT

13.6.2 SWOT

13.6.3 PRODUCTION CAPACITY

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT UPDATE

13.7 CHEILJEDANG CORP.

13.7.1 COMPANY SNAPSHOT

13.7.2 SWOT

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 FULL CYCLE BIOPLASTICS

13.8.1 COMPANY SNAPSHOT

13.8.2 SWOT

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 NEWLIGHT TECHNOLOGIES, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 SWOT

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 POLYFERM CANADA

13.10.1 COMPANY SNAPSHOT

13.10.2 SWOT

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 TERRAVERDAE BIOWORKS INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 SWOT

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 TIANAN BIOLOGIC MATERIALS CO, LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 SWOT

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 6 EUROPE SHORT CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE SHORT CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 EUROPE MEDIUM CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE MEDIUM CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (TONS)

TABLE 10 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE CO-POLYMERIZED PHA IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE LINEAR PHA IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE PACKAGING AND FOOD SERVICES IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE BIO-MEDICAL IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE AGRICULTURE IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE CHEMICAL ADDITIVE IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE 3D PRINTING IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE COSMETICS IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE WASTEWATER TREATMENT IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 24 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 26 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 28 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 30 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 U.K. POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 U.K. POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 34 U.K. POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 U.K. POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 38 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 ITALY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 ITALY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 42 ITALY POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 ITALY POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 46 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 47 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 50 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 51 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 SWITZERLAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 SWITZERLAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 54 SWITZERLAND POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 55 SWITZERLAND POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 TURKEY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 TURKEY POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 58 TURKEY POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 TURKEY POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 BELGIUM POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 BELGIUM POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 62 BELGIUM POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 BELGIUM POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 NETHERLANDS POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NETHERLANDS POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 66 NETHERLANDS POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 NETHERLANDS POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 LUXEMBURG POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 LUXEMBURG POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 70 LUXEMBURG POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 LUXEMBURG POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

List of Figure

FIGURE 1 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET

FIGURE 2 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR BIODEGRADABLE MATERIALS IN THE PACKAGING AND FOODSERVICE INDUSTRIES IS EXPECTED TO DRIVE EUROPE POLYHYDROXYALKANOATES (PHA) MARKET IN THE FORECAST PERIOD

FIGURE 15 SHORT CHAIN LENGTH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYHYDROXYALKANOATES (PHA) MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR EUROPE POLYHYDROXYALKANOATES (PHA) MARKET (USD/KG)

FIGURE 18 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE EUROPE POLYHYDROXYALKANOATES (PHA) MARKET

FIGURE 20 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY TYPE, 2021

FIGURE 21 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY FORM, 2021

FIGURE 22 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY APPLICATION, 2021

FIGURE 23 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: BY TYPE (2022-2029)

FIGURE 28 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY SHARE 2021 (%)

Europe Polyhydroxyalkanoate Pha Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Polyhydroxyalkanoate Pha Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Polyhydroxyalkanoate Pha Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.