Europe Pipe Market, By Product (Metal, Plastic and Concrete Pipe), Pipe Size (Upto ½ Inches, ½ to 1 Inches, 1 to 2 Inches, 2-5 Inches, 5-10 Inches, 10-20 Inches and above 20 Inches), Application (Building, Infrastructure, Industrial and Agriculture), Distribution Channel (Direct Selling and Retail Selling) - Industry Trends and Forecast to 2030.

Europe Pipe Market Analysis and Size

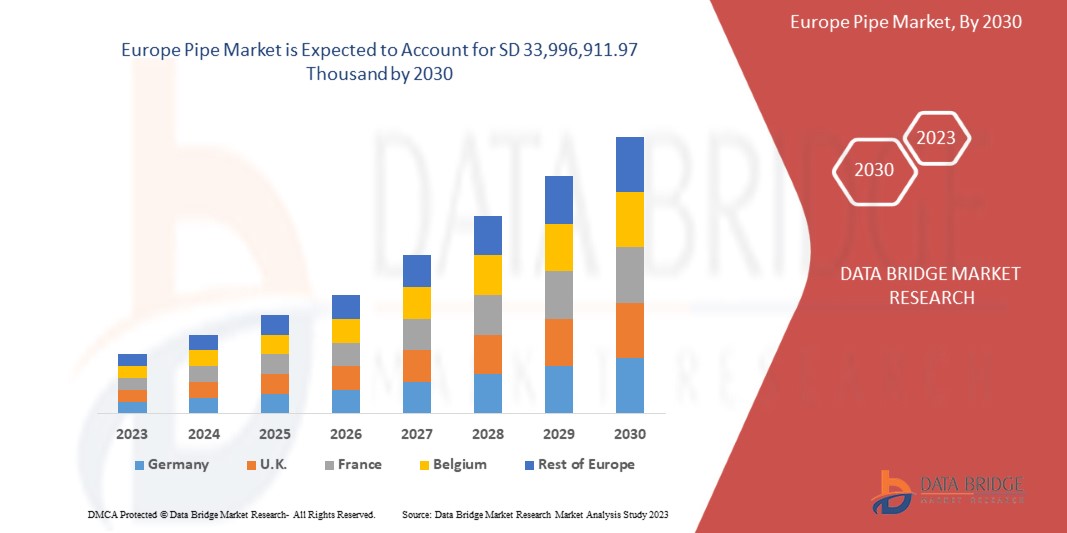

The Europe pipe market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.0% in the forecast period of 2023 to 2030 and is expected to reach USD 33,996,911.97 thousand by 2030. The major factor driving the growth of the pipe market is the positive outlook towards the building and construction sector and the rising usage of pipes in gas and oil transportation.

The Europe pipe market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Product (Metal, Plastic and Concrete Pipe), Pipe Size (Upto ½ Inches, ½ to 1 Inches, 1 to 2 Inches, 2-5 Inches, 5-10 Inches, 10-20 Inches and above 20 Inches), Application (Building, Infrastructure, Industrial and Agriculture), Distribution Channel (Direct Selling and Retail Selling)

|

|

Countries Covered

|

Germany, U.K., France, Italy, Russia, Spain, Turkey, Belgium, Poland, Netherlands, Sweden, Portugal, Austria, Switzerland, Denmark, Norway, Ireland, Finland, and Rest of Europe

|

|

Market Players Covered

|

SEKISUI CHEMICAL CO., LTD., NAN YA PLASTICS CORPORATION, Orbia, Aliaxis Group SA, AGRU, Pipelife Austria GmbH & Co KG, Saudi Arabian Amiantit Co., supreme, LUNA PLAST as, Tubiplast Italy S.r.l., and Heim-Weh-GmbH, among others

|

Market Definition

A pipe is a hollow tube-shaped structure composed of varying materials such as metals, steel, aluminum, plastics, concrete, and others. These are used to provide a covering to the streaming water or liquid substances. Pipes are used for both domestic and commercial purposes. Pipes are available in different diameter sizes and are used by various end-user verticals such as oil and gas, pharmaceutical, chemicals and petrochemicals, water and wastewater, residential, commercial, HVAC, automotive, food processing, and others. Pipes allow easy transportation of liquid substances, and their protective layer allows contamination-free streamlining of these liquid substances.

Europe Pipe Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Positive Outlook Toward Building and Construction Sector

The construction sector is pivotal in the European economy, contributing approximately 9% of the European Union's GDP. One of the significant factors driving this industry growth and shaping the dynamics of the market is the rising spending on building and construction activities. These expenditures profoundly impact the demand and utilization of pipes, particularly in freshwater supply and sewage management applications.

Pipes made up of polyvinyl chloride ensure the safe and efficient transport of clean drinking water. Likewise, durable PVC pipes are widely used when wastewater is transported to treatment plants. Moreover, new installation techniques are emerging, and the expectations of engineering, gas, and water companies are rising. Manufacturing companies have offered innovative materials with exceptional properties to meet these evolving needs. These materials, characterized by low sagging during extrusion and stress-cracking resistance, cater to the changing demands of the construction and infrastructure sectors.

Moreover, the HVAC (Heating, Ventilation, and Air Conditioning) systems and integral components of buildings also rely on piping. These systems transport hot and cold water, oil, or natural gas to regulate temperature and maintain indoor comfort. Different types of HVAC piping, crafted from various materials, play a crucial role in ensuring the efficient functioning of these systems. Thus, the growth and transformation in the construction sector directly impact the demand for HVAC piping materials, contributing to the overall market dynamics in Europe.

- Rising Usage of Pipes in Gas and Oil Transportation

The European gas and oil transportation market is undergoing significant changes, with a particular focus on the rising usage of pipes. In 2022, the European Union experienced a substantial increase in liquefied natural gas imports, reaching over 130 billion cubic meters, which marked a substantial 60% rise from the previous year's 80 billion cubic meters. Europe's ability to receive and utilize this additional LNG supply depends on expanding regasification capacity and the demand from other importers. While oil can be transported through alternative means such as tankers, natural gas predominantly relies on pipelines, accounting for 85% of its transportation.

The European gas and oil transportation market is in flux, with a growing emphasis on the increasing usage of pipelines. The surge in LNG imports and the need for a secure energy supply and climate change mitigation have catalyzed infrastructure projects and legislative efforts in Europe. Addressing technical challenges, promoting an integrated gas market, and balancing supply diversification are essential for the region's energy security and sustainability. Europe continues to evolve its energy landscape, and the role of pipelines in gas and oil transportation is expected to drive market growth.

Opportunities

- Upsurge in Demand for Lightweight Plastic Pipe

The rising inclination towards plastic pipes has helped the plastic pipe segment to witness high demand. Plastic pipes have characteristics that others lack as these pipes give plumbers an option that is easier to install and prevents some of the plumbing problems common with metal pipes. Unlike metal, plastic doesn't conduct heat well, so it is better to maintain the temperature of the water it carries. PVC pipes stay dry even with no insulation. That is really helpful with condensate drains for air conditioners, boilers, and other appliances.

Plastic pipes outperform their other counterparts when it comes to corrosion resistance. Plastic plumbing system pipe does not easily corrode by exposure to water and common household chemicals. Plastic formulas can be adjusted to meet the demands of various residential plumbing needs.

Plastic pipes can easily be adjusted or connected with metal pipes without the risk of damaging chemical reactions. The added advantages that plastic pipes provide are that they are light and easy to handle. Plumbing jobs with these pipes nearly always cost less than those with metal pipes.

The characteristic of plastic, such as corrosion resistance, flexibility, and ease of change, has increased the acceptance of plastic pipes, eventually making them the preferred pipe by the end-users in the market. Furthermore, the adaptability of plastic pipes in various manufacturing sectors, such as the mining industry, is expected to drive market growth.

- Shift of Manufacturers Towards Environmentally Friendly Pipes

The market has witnessed a significant shift in manufacturing practices towards more environmentally friendly pipes in recent years. This transition is driven by the growing awareness and emphasis on sustainability within the construction industry. Manufacturers recognize the importance of reducing their carbon footprint and energy consumption during production while addressing the need for durable, eco-friendly materials. One of the primary materials used in pipe manufacturing, Polyvinyl Chloride (PVC), has long been recognized for its recyclability. PVC pipes can be readily reprocessed, with scrap generated during manufacture routinely reground and reintroduced into manufacturing. Moreover, the industry has started recycling post-consumer waste, collecting used pipes from the waste stream and repurposing into new pipe products. This helps reduce landfill waste and contributes to a more sustainable life cycle for PVC pipes.

Restraints/ Challenges

- Increasing Environmental Concerns on Disposable Pipes

Growing environmental concerns regarding disposable pipes can significantly restrain the market. Disposable pipes often end up in landfills or as litter, contributing to pollution and waste issues. With increasing sustainability awareness, consumers and regulators are pushing for eco-friendly alternatives, which could reduce the demand for disposable pipes. Manufacturers and suppliers may face stricter regulations and consumer preferences for reusable or recyclable options, impacting market growth.

Due to these concerns, the government or regulatory body has to make certain decisions to control the production of environmentally damaging plastic pipes. The production of pipes uses large amounts of energy, produces waste gas, liquid, or solid byproducts, and can be unpleasant for the people working there.

The non-decomposing properties of plastic pipes are a big environmental issue and may restrict market growth. With people becoming more aware of the effects of disposable pipes impact on the environment, the demand for disposable pipes decreases even though it is cost-friendly.

Furthermore, disposable pipe manufacturing and processing involve various risks, increasing environmental concerns. Disposable pipes create pollution and have a bad impact on landfills. The cost of decomposing the pipes is higher and, in some materials, not possible, which restricts the manufacturers or people from looking into this matter. Non-decomposable pipes take years to decompose and pollute the environment, which is expected to restrict the growth of the market.

- Pipe Leakage Issue

Pipe leakage is a major issue faced by users in different instances when it comes to pipes. Pipes are majorly used for applications such as water distribution, sewage, and transportation of various natural gases. Leakages in the pipe cause high investments to the end-users, leading to high maintenance. On the other hand, water leakage causes a major problem, leading to water wastage, thus increasing environmental and economic issues.

In many water distribution systems, much water is lost while in transit from treatment plants to consumers. According to an inquiry made in 1991 by the International Water Supply Association (IWSA), the amount of lost or "Unaccounted for Water" (UFW) is typically in the range of 20–30% of production.

Much water is lost in transit from treatment plants to consumers in many water distribution systems. The amount of loss in terms of water is typically in the range of 20–30% of production. The leakages are on the lesser side in regions where the water transportation systems are new compared to the regions that rely on the same traditional system.

Recent Developments

- In December 2022, Aliaxis Group S.A. bolstered its presence in the European industrial pipe market by acquiring Lareter, a leading Italian company specializing in pressure piping. This strategic move enhances Aliaxis' position in Europe, particularly in Italy, France, and Germany, enabling them to offer a wider range of advanced solutions for industrial applications, starting with water treatment.

- In May 2022, Pipelife Austria Gmbh & CO KG will hold a groundbreaking ceremony in Leonding, Austria. With a spacious 1,230 m² building set for completion in just nine months, the new branch promises expanded storage capacity and a top-tier logistics service. This forward-looking approach reflects Pipelife's vision to provide holistic water and wastewater solutions, positioning it as a leader in the evolving European pipe market.

- In November 2021, AGRU unveiled the brand name "AGRUCHEM" to emphasize the exceptional chemical resistance of their ethylene chlorotrifluoroethylene, polyvinylidene fluoride, and polypropylene products. Despite this change, customers can expect the same high-quality products, installation instructions, approvals, and packaging. AGRUCHEM unifies its global marketing strategy, reinforcing AGRU's reputation for excellence in industrial piping. This development underscores their commitment to delivering top-tier plastic piping solutions across Europe and maintaining their unwavering standards of quality and service.

- In October 2021, Vinidex, part of the Aliaxis group launched a sustainable stormwater drainage pipe system. It’s an environmentally sustainable solution that includes uncompromised performance, flexibility to respond to movements in soil, that is resistance to cracking, easy to install, well-suited for aggressive soils, and complete with a full range of fittings and accessories. This product launch will help the company tap the untapped markets.

- In March 2021, Netafim, the global leader of precision irrigation solutions and agricultural projects and part of the Orbia community of companies, announced that it has signed a definitive agreement to acquire Dutch turn-key greenhouse project provider Gakon Horticultural Projects. Netafim has been active for several decades in the greenhouse market and is now expanding its offering in the production and supply of top-tier greenhouse projects and services to meet increasing global demand for sustainable, secure and locally-grown fresh produce.

Europe Pipe Market Scope

The Europe pipe market is categorized based on product, pipe size, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Metal

- Plastic

- Concrete Pipe

On the basis of product, the market is segmented into metal, plastic and concrete pipe.

Pipe Size

- 2-5 Inches

- 1 to 2 Inches

- ½ to 1 Inches

- Upto ½ Inches

- 5-10 Inches

- 10-20 Inches

- Above 20 Inches

On the basis of pipe size, the market is segmented into upto ½ inches, ½ to 1 inches, 1 to 2 inches, 2-5 inches, 5-10 inches, 10-20 inches and above 20 inches.

Application

- Building

- Infrastructure

- Industrial

- Agriculture

On the basis of application, the market is segmented into building, infrastructure, industrial and agriculture.

Distribution Channel

- Direct Selling

- Retail Selling

On the basis of distribution channel, the market is segmented into direct selling and retail selling.

Europe Pipe Market Regional Analysis/Insights

The Europe pipe market is segmented on the basis of product, pipe size, application and distribution channel.

The countries in the Europe pipe market are Germany, U.K., France, Italy, Russia, Spain, Turkey, Belgium, Poland, Netherlands, Sweden, Portugal, Austria, Switzerland, Denmark, Norway, Ireland, Finland, and Rest of Europe.

Germany is expected to dominate the Europe pipe market in terms of market share and market revenue due to the growing renovations and remodeling activities in this region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Pipe Market Share Analysis

The Europe pipe market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe Pipe Market.

Some of the prominent participants operating in the Europe pipe market are SEKISUI CHEMICAL CO., LTD., NAN YA PLASTICS CORPORATION, Orbia, Aliaxis Group SA, AGRU, Pipelife Austria GmbH & Co KG, Saudi Arabian Amiantit Co., supreme, LUNA PLAST as, Tubiplast Italy S.r.l., and Heim-Weh-GmbH, among others.

SKU-