Europe Phytonutrients Market Analysis and Insights

Increasing demand for phytonutrients in the food and beverage industries will accelerate the market demand. The rising focus on pharmaceutical industries to reduce cancer, diabetes, and heart disease will also enhance the Europe phytonutrients market's growth. Additionally, the need for phytonutrients in the feed and cosmetics industry is expected to drive the market. The increase in demand for ayurvedic products is expected to act as an opportunity for the market.

The standard quality determination technique of phytonutrients is expected to restrain the growth of the Europe phytonutrients market. Additionally, the phytonutrient supplements are insufficient in regulating products that involve marketing and promotion, which are the other factors that can restrain the development of the Europe phytonutrients market. The manufacturers of the phytonutrients focus on the R&D work on the extraction process of phytonutrients that may challenge the market's competitors.

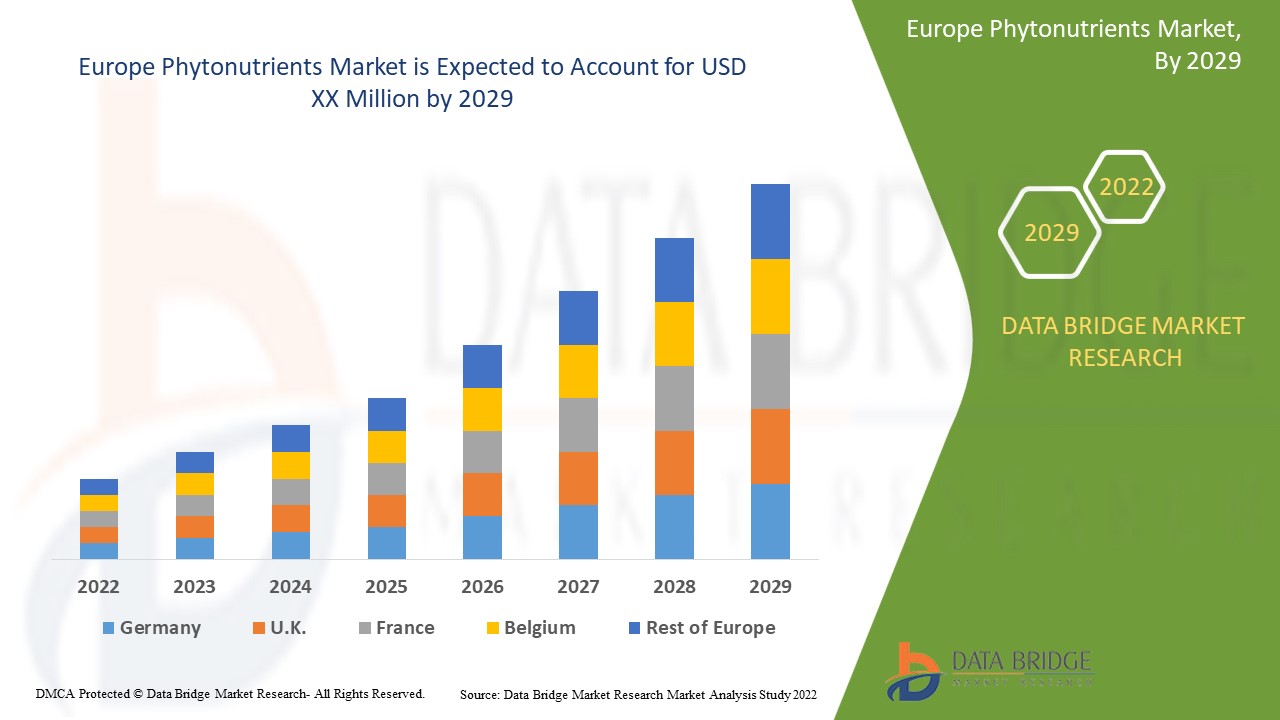

Data Bridge Market Research analyses that the Europe phytonutrients market will grow at a CAGR of 6.7% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, and Marine Plant Extracts), Form (Liquid and Dry), Category (Organic and Conventional), Nature (Blended and Pure), Application (Food Products, Beverages, Nutraceuticals and Dietary Supplements, Cosmetics And Personal Care, Animal Feed, Pharmaceuticals, and Others), |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey and Rest of Europe |

|

Market Players Covered |

Merck KGaA, DSM, ADM, BASF SE, Cargill Incorporated, Cyanotech Corporation, Sabinsa, Ashland, IFF Nutrition & Biosciences, AOM, ConnOils LLC, Lycored, NutriScience Innovations, LLC, Prinova Group LLC., Lycored, DÖHLER GMBH, GUSTAV PARMENTIER GHMB, Elementa, MANUS AKTTEVA BIOPHARMA LLP, DYNADIS, Matrix Fine Sciences Pvt. Ltd, Elementa, Vitae Caps S.A., ExcelVite, Aayuritz Phytonutrients Pvt.Ltd., BTSA, Kothari Phytochemicals International, Hindustan Herbals, Brlb International, Bio-India, Biologicals (BIB) Corporation, and others |

Market Definition

Phytonutrients, also called phytochemicals, are chemicals produced by plants. Plants use phytonutrients to stay healthy. For example, some phytonutrients protect plants from insect attacks, while others protect against radiation from UV rays. Phytonutrients can also provide significant benefits for humans who eat plant foods. Phytonutrient-rich foods include colorful fruits and vegetables, legumes, nuts, tea, whole grains, and many spices. More than 25,000 phytonutrients are found in plant foods. Among the benefits of phytonutrients are antioxidants and anti-inflammatory activities. Phytonutrients may also enhance immunity and intercellular communication. It also repairs DNA damage from exposure to toxins, detoxifies carcinogens, and alters estrogen metabolism.

Europe Phytonutrients Market Dynamics

Drivers

- Increasing demand for food & beverage products

Rising demand for food and beverages due to the increasing Europe population is expected to drive the demand for phytonutrients in the industry. Further, the growing demand for natural ingredients-based food and beverages products because of rising concern about the quality and nutritional value of the products is expected to drive the demand for phytonutrients in the food and beverages industry.

- Increasing demand for animal feed

In the animal feed industry, phytonutrients are used as antioxidants in animal feed to enhance animal growth and protect animals from oxidative damage caused by free radicals. Phytonutrients help to improve innate immunity in animals, especially poultry. The development of phytonutrients in animal feed is attributed to factors such as growing demand for meat worldwide, growing poultry meat consumption, and others expected to drive the demand for animal feed. In turn, the need for phytonutrients will likely increase in the animal feed industry over the forecast period.

Opportunity

-

Growing demand for natural food products

Growing consumer awareness of the benefits of natural or organic products is expected to increase the demand for natural skincare and cosmetic products. As well as rising environmental concerns are likely to increase product demand in the upcoming years. Additionally, increased demand for phytochemicals in skincare and cosmetic products help to combat skin aging, such as Curcumin, resveratrol, epicatechin, ellagic acid, and apigenin. Thus, the increase in demand for natural skincare and cosmetic products is expected to act as an opportunity for the Europe phytonutrients market.

Restraint/Challenge

- Availability of substitutes

Phytonutrients are healthy for the human body. However, extra consumption of some phytonutrients may have side effects. Phytochemicals that are toxic to humans are known as phytotoxins. Some phytochemicals have antinutrient properties that interfere with the absorption of nutrients. And some phytonutrients, such as polyphenols and flavonoids, are pro-oxidants in high ingested amounts.

Thus, the side effects caused by over-consumption of phytonutrients are expected to challenge the demand of the Europe phytonutrients market.

This Europe phytonutrients market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Europe phytonutrients market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Post COVID-19 Impact on Europe Phytonutrients Market

COVID-19 pandemic has resulted in lockdown in most countries to restrict the spread of the virus, which has highly affected every type of industry. The global phytonutrient market growth has created extreme uncertainty due to the outbreak of COVID-19. Maintaining food movement along the food chain is an essential function for the food and beverages industry. Most companies regained operation after the government guidelines, which positively impacted the growth of the Europe phytonutrients market in years to come.

Europe Phytonutrients Market Scope

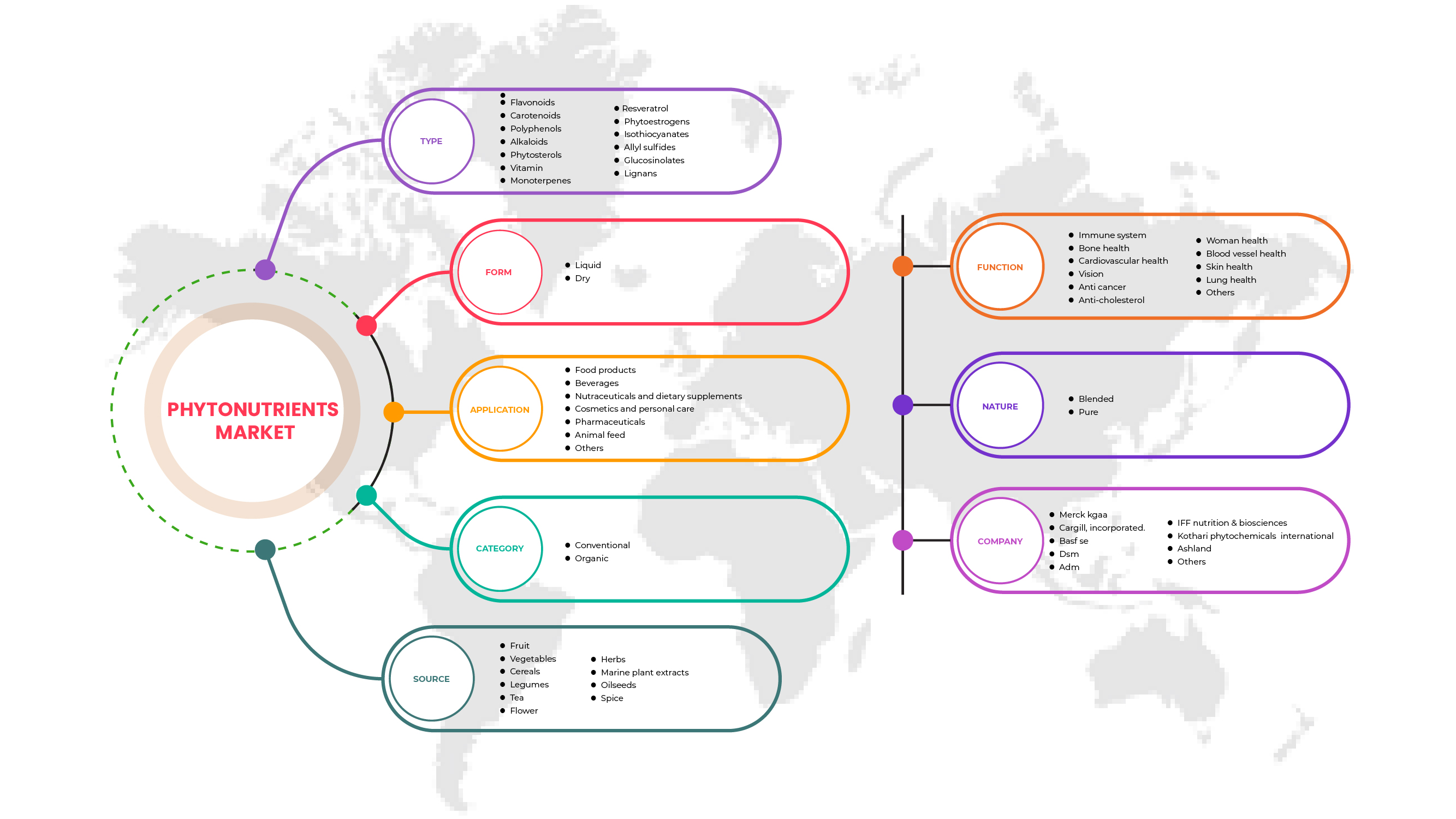

Europe phytonutrients market is segmented into type, source, nature, category, form, function, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Flavonoids

- Carotenoids

- Polyphenols

- Alkaloids

- Phytosterols

- Vitamins

- Monoterpenes

- Resveratrol

- Phytoestrogens

- Isothiocyanates

- Allyl Sulfides

- Glucosinolates

- Lignans

- Betalains

- Others

On the basis of type, the phytonutrients market is segmented into flavonoids, carotenoids, polyphenols, alkaloids, phytosterols, vitamins, monoterpenes, resveratrol, phytoestrogens, isothiocyanates, allyl sulfides, glucosinolates, lignans, betalains, and others.

Form

- Dry

- Liquid

On the basis of form, the phytonutrients market is segmented into dry and liquid.

Category

- Organic

- Conventional

On the basis of category, the phytonutrients market is segmented into organic and conventional.

Nature

- Blended

- Pure

On the basis of nature, the phytonutrients market is segmented into blended and pure.

Function

- Immune System

- Vision

- Skin health

- Bone health

- Cardiovascular health

- Anti-cancer

- Lung health

- Blood vessel health

- Woman health

- Anti-cholesterol

- Others

On the basis of function, the phytonutrients market is segmented into the immune system, vision, skin health, bone health, cardiovascular health, anti-cancer, lung health, blood vessel health, woman health, anti-cholesterol, and others.

Source

- Spice

- Herb

- Flower

- Tea

- Fruit

- Vegetables

- Cereals

- Legumes

- Oilseeds

- Marine plant extract

On the basis of source, the phytonutrients market is segmented into spice, herb, flower, tea, fruit, vegetables, cereals, legumes, oilseeds, and marine plant extracts.

Application

- Food products

- Beverages

- Nutraceuticals & Dietary Supplements

- Cosmetics and Personal Care

- Animal Feed

- Pharmaceuticals

- Others

On the basis of application, the phytonutrients market is segmented into food products, beverages, nutraceuticals and dietary supplements, cosmetics and personal care, animal feed, pharmaceuticals, and others.

Europe Phytonutrients Market Regional Analysis/Insights

Europe phytonutrients market is analyzed, and market size insights and trends are provided based on type, source, nature, category, form, function, and application, as referenced above.

The countries covered in the Europe market report are Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey and Rest of Europe.

Germany dominates the Europe phytonutrients market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. The growth in the region is expected to increase the use of phytonutrients in cosmetic products and dietary supplements.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that affect the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the significant pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Phytonutrients Market Share Analysis

The Europe phytonutrients market competitive landscape provides details of the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the Europe phytonutrients market.

Some of the major players operating in the market are MERCK KGAA DSM, ADM, BASF SE, Cargill, Incorporated, Cyanotech Corporation, Sabinsa, Ashland, IFF Nutrition & Biosciences, AOM, ConnOils LLC, Lycored, NutriScience Innovations, LLC, Prinova Group LLC., DÖHLER GMBH, GUSTAV PARMENTIER GHMB, Elementa, MANUS AKTTEVA BIOPHARMA LLP, DYNADIS, Matrix Fine Sciences Pvt. Ltd, Elementa, Vitae Caps S.A., ExcelVite, Aayuritz Phytonutrients Pvt.Ltd., BTSA, Kothari Phytochemicals International, Hindustan Herbals, Brlb International, Bio-India, Biologicals (BIB) Corporation, and others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and critical trend analysis are the major success factors in the market report. The fundamental research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe Vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PHYTONUTRIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGIES

4.1.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.1.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.1.3 A VAST NETWORK OF DISTRIBUTION

4.1.4 STRATEGIC DECISIONS BY KEY PLAYERS

4.2 PATENT ANALYSIS OF EUROPE PHYTONUTRIENTS MARKET

4.2.1 DBMR ANALYSIS

4.2.2 YEARWISE ANALYSIS

4.3 EXTRACTION PROCESS

4.4 CERTIFICATION

4.5 TECHNOLOGICAL CHALLENGES

4.6 LIST OF SUBSTITUTES

4.7 HEALTH CLAIMS OF PHYTONUTRIENTS

4.8 NUTRITIONAL FACTS OF PHYTONUTRIENTS

4.8.1 RECOMMENDED INTAKE OF PHYTONUTRIENTS

4.9 RAW MATERIAL PRICING ANALYSIS

4.9.1 DEMAND FACTOR IN PRICING

4.9.2 GEOGRAPHICAL PRICING

4.9.3 DEMAND FACTOR IN PRICING

4.1 CONSUMPTION ANALYSIS FOR PHYTONUTRIENT INTAKES IN EUROPEAN COUNTRIES

4.11 IMPORT-EXPORT ANALYSIS

4.12 EUROPE PHYTONUTRIENTS MARKET: SUPPLY CHAIN ANALYSIS

4.13 VALUE CHAIN ANALYSIS: EUROPE PHYTONUTRIENTS MARKET

4.14 IMPORT-EXPORT ANALYSIS

5 EUROPE PHYTONUTRIENTS MARKET: REGULATIONS

5.1 EU REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FOOD & BEVERAGE PRODUCTS

6.1.2 INCREASING DEMAND FOR ANIMAL FEED

6.1.3 INCREASING DEMAND FOR NUTRACEUTICAL PRODUCTS

6.1.4 NUMEROUS HEALTH BENEFITS ASSOCIATED WITH PHYTONUTRIENTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES

6.2.2 QUALITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR NATURAL FOOD PRODUCTS

6.3.2 INCREASING DEMAND FOR CAROTENOIDS IN VARIOUS END-USE INDUSTRIES

6.3.3 GROWING DEMAND FOR NATURAL SKINCARE AND COSMETIC PRODUCTS

6.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF PHYTONUTRIENTS

7 EUROPE PHYTONUTRIENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLAVONOIDS

7.3 CAROTENOIDS

7.4 POLYPHENOLS

7.5 ALKALOIDS

7.6 PHYTOSTEROLS

7.7 VITAMIN

7.8 MONOTERPENES

7.9 RESVERATROL

7.1 PHYTOESTROGENS

7.11 ISOTHIOCYANATES

7.12 ALLYL SULFIDES

7.13 GLUCOSINOLATES

7.14 LIGNANS

7.15 BETALAINS

7.16 OTHERS

8 EUROPE PHYTONUTRIENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 VEGETABLES

8.3 CEREALS

8.4 FRUIT

8.5 LEGUMES

8.6 TEA

8.7 FLOWER

8.8 HERBS

8.9 MARINE PLANT EXTRACTS

8.1 OILSEEDS

8.11 SPICE

9 EUROPE PHYTONUTRIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 EUROPE PHYTONUTRIENTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 EUROPE PHYTONUTRIENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 BLENDED

11.3 PURE

12 EUROPE PHYTONUTRIENTS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 IMMUNE SYSTEM

12.3 BONE HEALTH

12.4 CARDIOVASCULAR HEALTH

12.5 VISION

12.6 ANTI-CANCER

12.7 ANTI-CHOLESTEROL

12.8 WOMEN HEALTH

12.9 BLOOD VESSEL HEALTH

12.1 SKIN HEALTH

12.11 LUNG HEALTH

12.12 OTHERS

13 EUROPE PHYTONUTRIENTS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD PRODUCTS

13.3 BEVERAGES

13.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

13.5 COSMETICS AND PERSONAL CARE

13.6 PHARMACEUTICALS

13.7 ANIMAL FEED

13.8 OTHERS

14 EUROPE PHYTONUTRIENTS MARKET, BY REGION

14.1 OVERVIEW

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 ITALY

14.1.4 FRANCE

14.1.5 SPAIN

14.1.6 NETHERLANDS

14.1.7 SWITZERLAND

14.1.8 BELGIUM

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 DENMARK

14.1.12 SWEDEN

14.1.13 POLAND

14.1.14 REST OF EUROPE

15 EUROPE PHYTONUTRIENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MERCK KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 BASF SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 IFF NUTRITION & BIOSCIENCES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KOTHARI PHYTOCHEMICALS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 ASHLAND

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 AAYURITZ PHYTONUTRIENTS PVT.LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 AOM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BIO-INDIA BIOLOGICALS (BIB) CORPORATION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BRLB INTERNATIONAL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 BTSA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 CONNOILS LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CYANOTECH CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUS ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 DÖHLER GMBH

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 DYNADIS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ELEMENTA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 EXCELVITE

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 GUSTAV PARMENTIER GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 HINDUSTAN HERBALS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 LYCORED

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 MATRIX LIFE SCIENCE PVT. LTD

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MANUS AKTTEVA BIOPHARMA LLP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 NUTRISCIENCE INNOVATIONS, LLC

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 PRINOVA GROUP LLC.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SABINSA

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 VITAE CAPS S.A.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 LIST OF SUBSTITUTE

TABLE 2 POTENTIAL BENEFITS OF PHYTONUTRIENT COMPOUNDS.

TABLE 3 EUROPEAN UNION FRUITS PRICES: (2021)

TABLE 4 EUROPEAN UNION VEGETABLES PRICES: (2021)

TABLE 5 EUROPE FRUITS AND VEGETABLE PRODUCTION, (MILLION TONS), 2018

TABLE 6 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 7 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 8 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 9 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 10 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 11 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 12 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 13 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 14 LIST OF SOME PHYTONUTRIENTS USED IN NUTRACEUTICAL PRODUCTS

TABLE 15 FLAVONOIDS AND SOURCES

List of Figure

FIGURE 1 EUROPE PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 2 EUROPE PHYTONUTRIENTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHYTONUTRIENTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHYTONUTRIENTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHYTONUTRIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHYTONUTRIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHYTONUTRIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE PHYTONUTRIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE PHYTONUTRIENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 EUROPE PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHYTONUTRIENTS IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS LEAD TO THE GROWTH OF THE EUROPE PHYTONUTRIENTS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHYTONUTRIENTS MARKET IN 2022 & 2029

FIGURE 13 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 14 VALUE CHAIN OF PHYTONUTRIENTS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PHYTONUTRIENTS MARKET

FIGURE 16 EUROPE PHYTONUTRIENTS MARKET, BY TYPE, 2021

FIGURE 17 EUROPE PHYTONUTRIENTS MARKET, BY SOURCE, 2021

FIGURE 18 EUROPE PHYTONUTRIENTS MARKET, BY FORM, 2021

FIGURE 19 EUROPE PHYTONUTRIENTS MARKET, BY CATEGORY, 2021

FIGURE 20 EUROPE PHYTONUTRIENTS MARKET, BY NATURE, 2021

FIGURE 21 EUROPE PHYTONUTRIENTS MARKET, BY FUNCTION, 2021

FIGURE 22 EUROPE PHYTONUTRIENTS MARKET, BY APPLICATION, 2021

FIGURE 23 EUROPE PHYTONUTRIENTS MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE PHYTONUTRIENTS MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE PHYTONUTRIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE PHYTONUTRIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE PHYTONUTRIENTS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE PHYTONUTRIENTS MARKET: COMPANY SHARE 2021 (%)

Europe Phytonutrients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Phytonutrients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Phytonutrients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.