Europe Personal Fall Protection Market

Market Size in USD Billion

CAGR :

%

USD

1,763.86 Billion

USD

2,726.96 Billion

2022

2030

USD

1,763.86 Billion

USD

2,726.96 Billion

2022

2030

| 2023 –2030 | |

| USD 1,763.86 Billion | |

| USD 2,726.96 Billion | |

|

|

|

Europe Personal Fall Protection Market Analysis and Size

the growing demand for fall protection equipment in different industries such as mining, construction, and others, coupled with increased safety awareness in the industrial areas, are the key factors driving the personal fall protection market. However, poor quality and loose ends of fall-related equipment increase the risk of accidents and may hamper the growth of the personal fall protection market. In addition, the adoption of new and advanced technologies to manufacture personal fall protection products is expected to create huge opportunities for the personal fall protection market.

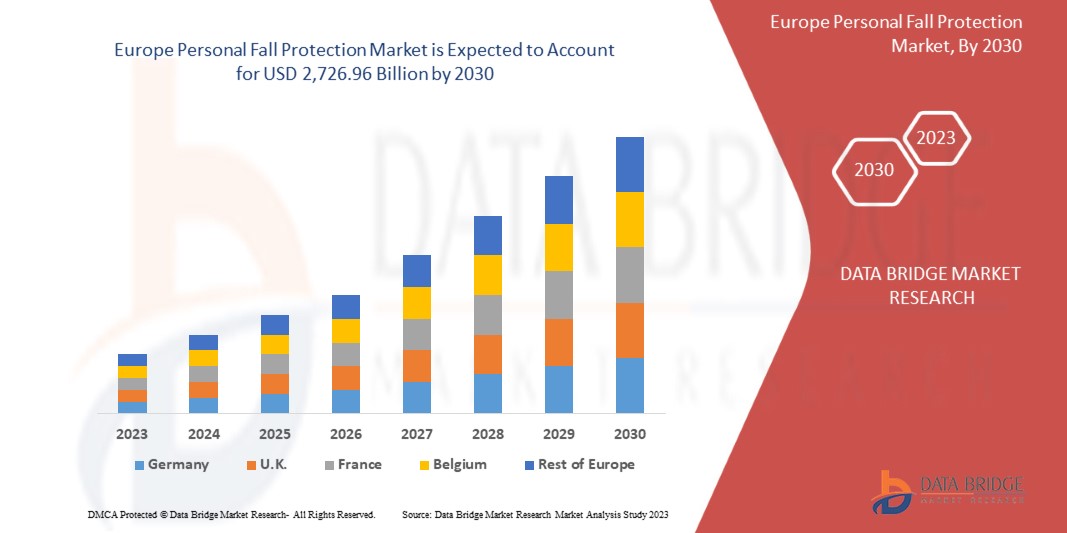

Data Bridge Market Research analyzes that the personal fall protection market, which was USD 1,763.86 billion in 2022, is likely to reach USD 2,726.96 billion by 2030 and is expected to undergo a CAGR of 5.56% during the forecast period of 2023 to 2030. “Products” dominates the type segment of the personal fall protection market due to an increase in awareness for safety in working places and its uses in many upcoming construction and industrial projects.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Products, Services), Industry (Construction, General Industry, Oil & Gas, Energy & Utilities, Mining, Telecommunication, Agriculture, Transportation, Marine and Shipbuilding, Others) |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe |

|

Market Players Covered |

Honeywell International Inc. (U.S.), Carl Stahl Hebetechnik GmbH (Germany), 3M (U.S.), Bergman & Beving AB (Sweden), ABS Safety GmbH (Germany), Adolf Wurth GmbH & Co. KG (Germany), SafetyLink Pty Ltd. (Australia), Guardian Fall (U.S.), Eurosafe Solutions (U.K.), Petzl (France), SKYLOTECH (Germany), WernerCo. (U.S.), MSA (U.S.), Kee Safety, Inc. (U.S.), Fallprotec S.A. (France) |

|

Market Opportunities |

|

Market Definition

Personal fall protection refers to a system of safety measures and equipment designed to prevent or mitigate the risk of individuals falling from elevated surfaces, such as rooftops, construction sites, or industrial structures. It encompasses a range of devices and gear, including harnesses, lanyards, anchors, and lifelines, which are used to secure and protect workers or individuals working at heights. The primary goal of personal fall protection is to ensure the safety of workers and prevent injuries by minimizing the potential for falls, and it is a crucial component of workplace and construction site safety protocols.

Europe Personal Fall Protection Market Dynamics

Drivers

- European regulations and safety standards

European authorities have established comprehensive safety standards and regulations that mandate the use of fall protection equipment in various industries. These regulations are aimed at safeguarding the well-being of workers and reducing workplace accidents. The enforcement of such regulations compels businesses and organizations to invest in personal fall protection systems and gear, contributing to the sustained demand for these products. In addition, the strict adherence to safety standards underscores the region's commitment to creating a safer working environment, fostering a culture of safety awareness and compliance among employers and employees alike. As a result, personal fall protection is not just a choice but a legal requirement, driving its adoption and market growth.

- Heightened awareness of worker safety

Workers, employers, and safety authorities have become increasingly cognizant of the risks associated with working at heights. High-profile incidents and a growing emphasis on workplace safety have underscored the critical need for fall protection measures. This increased awareness has led to a proactive approach in adopting and using fall protection gear in various industries, thereby driving the demand for these products. Moreover, the promotion of safety culture through training and education programs has contributed to a heightened sense of responsibility among employers and workers to invest in and utilize fall protection solutions, further fueling the market's growth.

Opportunity

- Offering tailored and adaptable fall protection solutions to various industries

Various industries and work environments have distinct safety requirements and site-specific challenges. Providing tailored fall protection solutions allows manufacturers to address these unique needs. By offering personalized designs and configurations, companies can enhance user comfort and safety, leading to higher customer satisfaction and loyalty. Customization also extends to adapting products to specific regulations and industry standards, making it easier for businesses to comply with safety mandates. This approach not only creates innovation but also opens up new revenue streams for manufacturers who can meet the diverse demands of different sectors and applications.

Restraint/Challenge

- Adhering to complex and evolving safety regulations and standards

Compliance challenges represent a notable restraint in the European personal fall protection market. The regulatory landscape for fall protection is complex and constantly evolving, requiring manufacturers and end-users to keep pace with a multitude of safety standards and requirements. Ensuring that products meet these stringent regulations and obtain necessary certifications can be a time-consuming and costly process. Furthermore, varying regulations across different European countries may lead to inconsistencies in compliance efforts. It creates challenges for manufacturers in terms of product design, testing, and documentation, while end-users may find it burdensome to select, implement, and maintain fall protection solutions that meet the ever-evolving legal requirements, potentially impeding market growth.

This personal fall protection market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the personal fall protection market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In January 2021, Guardian Fall announced its new product called new cable lanyard, which is compatible with leading edges with the lightweight durability of fixed length up to 12 feet of fall protection during working at height. This new product launch helped the company in expanding its product portfolio

- In March 2019, SKYLOTECH launched a new solution named “Claw Line”, a steel cable fall arrest system to protect fall on ladders. This new product launch helped the company in enhancing its product portfolio

Europe Personal Fall Protection Market Scope

The personal fall protection market is segmented on the basis of type, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Products

- Services

Industry

- Construction

- General Industry

- Oil & Gas

- Energy & Utilities

- Mining

- Telecommunication

- Agriculture

- Transportation

- Marine and Shipbuilding

- Others

Europe Personal Fall Protection Market Regional Analysis/Insights

The personal fall protection market is analysed and market size insights and trends are provided by type, and industry are referenced above.

The countries covered in the personal fall protection market report are Germany, U.K., Italy, France, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and the rest of Europe.

Germany is expected to dominate the market due to rising awareness of customers towards worker safety coupled with various government initiatives towards workers' safety. Italy is expected to grow with the highest CAGR due to the increasing awareness of worker safety and the importance of personal fall protection.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Personal Fall Protection Market Share Analysis

The personal fall protection market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the personal fall protection market.

Some of the major players operating in the personal fall protection market are:

- Honeywell International Inc. (U.S.)

- Carl Stahl Hebetechnik GmbH (Germany)

- 3M (U.S.)

- Bergman & Beving AB (Sweden)

- ABS Safety GmbH (Germany)

- Adolf Wurth GmbH & Co. KG (Germany)

- SafetyLink Pty Ltd. (Australia)

- Guardian Fall (U.S.)

- Eurosafe Solutions (U.K.)

- Petzl (France)

- SKYLOTECH (Germany)

- WernerCo. (U.S.)

- MSA (U.S.)

- Kee Safety, Inc. (U.S.)

- Fallprotec S.A. (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE PERSONAL FALL PROTECTION MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- TYPE LIFELINE CURVE

- DBMR MARKET POSITION GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- EUROPE PERSONAL FALL PROTECTION MARKET- INDUSTRY INSIGHTS

- Market Overview

- drivers

- grow IN demand for personal fall protection equipment in construction and mining project

- IncreasE IN safety awareness in the industrial area

- Stringent government regulations for mandatING THE use of personal fall protection equipment

- RisE IN incidence of fall-related injuries and accidents

- IncreaSE IN number of launches for personal fall protected equipment

- Restraints

- Poor quality and loose ends of fall-related equipment increases the risk of accident

- decrease rate of tourism and sportS industry due to pandemic

- OPPORTUNITIES

- increaSE IN adoption of smart technologies for manufacturing of fall protection equipment

- introduction of iot and asset tracking features in fall protection equipment

- Challenges

- high competition among the market players

- high cost associated with the products

- personal fall protection equipment can lead to limited productivity FOR workers

- IMPACT OF COVID-19 ON THE EUROPE PERSONAL FALL PROTECTION MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE EUROPE PERSONAL FALL PROTECTION MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST EUROPE PERSONAL FALL PROTECTION MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- europe personal fall protection market, by type

- overview

- PRODUCTs

- SOFT GOODS

- ROPES

- BODY BELTS

- HARNESS

- FULL BODY HARNESS

- CHEST HARNESS

- LANYARD

- ROPE LANYARD

- SHOCK-ABSORBING LANYARD

- WIRE ROPE LANYARD

- HARD GOODS

- ROPE GRABS

- FALL ARRESTER

- MANUAL FALL ARRESTER

- ANCHORS

- KARABINER

- CONNECTORS

- RETRACTABLE BLOCKS

- INSTALLED SYSTEMS

- VERTICAL SYSTEM

- PORTABLE LADDER

- STEP LADDER

- EXTENSION

- ORCHARD

- TRESTLE

- OTHERS

- SUPPORT SCAFFOLD

- OTHERS

- HORIZONTAL SYSTEM

- LIFELINE SYSTEM

- GUARDRAIL SYSTEM

- SERVICES

- INSPECTION AND MAINTENANCE

- ASSEMBLY AND DEASSEMBLY

- TRAINING

- europe personal fall protection market, by Industry

- overview

- Construction

- BY INDUSTRY

- BRIDGE DECKING

- FLOOR OPENINGS

- REROOFING

- FIXED SCAFFOLDS

- LEADING EDGE WORK

- BY TYPE

- PRODUCTS

- SERVICES

- General industry

- PRODUCTS

- SERVICES

- energy & UTILITIES

- PRODUCTS

- SERVICES

- Oil & Gas

- PRODUCTS

- SERVICES

- Mining

- PRODUCTS

- SERVICES

- Telecommunication

- PRODUCTS

- SERVICES

- Agriculture

- PRODUCTS

- SERVICES

- Marine & Shipbuilding

- PRODUCTS

- SERVICES

- TRANSPORTATION

- PRODUCTS

- SERVICES

- others

- PRODUCTS

- SERVICES

- Europe personal fall protection market, BY COUNTRY

- Germany

- France

- Italy

- U.K.

- Turkey

- russia

- Spain

- Netherlands

- Switzerland

- Belgium

- Rest of Europe

- COMPANY landscape

- company share analysis: Europe

- Swot analysis

- Company profile

- 3M

- COMPANY SNAPSHOT

- REVENUE analysis

- product Portfolio

- Recent Development

- adolf wurth gmbh & co. kg

- company snapshot

- revenue analysis

- product portfolio

- Recent Development

- honeywell international iNc

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- Recent Development

- WERNER CO.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- skylotec

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ABS SAFETY GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- bergman & beving ab

- company snapshot

- revenue analysis

- PRODUCT PORTFOLIO

- Recent Development

- CARL STAHL HEBETECHNIK GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- eurosafe solutions

- company snapshot

- PRODUCT PORTFOLIO

- Recent Development

- Fallprotec s.a.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- guardian fall

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KEE SAFETY, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- Recent Development

- MSA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- petzl

- company snapshot

- PRODUCT PORTFOLIO

- Recent Development

- safetylink pty ltd

- company snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

List of Table

TABLE 1 Europe Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 2 Europe products in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 3 Europe soft goods in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 4 Europe harness in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 5 Europe lanyard in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 6 Europe HARD goods in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 7 Europe rope grabs in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 8 Europe installed systems in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 9 Europe vertical system in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 10 Europe Portable Ladder in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 11 Europe horizontal system in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 12 Europe Services in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 13 Europe Personal fall protection Market, By Industry, 2019-2028 (USD Million)

TABLE 14 Europe construction in Personal fall protection Market, By Industry, 2019-2028 (USD Million)

TABLE 15 Europe construction in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 16 Europe General industry in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 17 Europe Energy & Utilities in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 18 Europe Oil & Gas in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 19 Europe Mining in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 20 Europe Telecommunication in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 21 Europe Agriculture in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 22 Europe Marine & Shipbuilding in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 23 Europe Transportation in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 24 Europe Others in Personal fall protection Market, By type, 2019-2028 (USD Million)

TABLE 25 Europe personal fall protection market, By COUNTRY, 2019-2028 (USD million)

TABLE 26 Germany personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 27 Germany products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 28 Germany soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 29 Germany harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 30 Germany lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 31 Germany hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 32 Germany rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 33 Germany installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 34 Germany vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 35 Germany portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 36 Germany horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 37 Germany Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 38 Germany personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 39 Germany construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 40 Germany construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 41 Germany general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 42 Germany energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 43 Germany oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 44 Germany mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 45 Germany telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 46 Germany agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 47 Germany marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 48 Germany transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 49 Germany others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 50 France personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 51 France products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 52 France soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 53 France harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 54 France lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 55 France hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 56 France rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 57 France installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 58 France vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 59 France portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 60 France horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 61 France Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 62 France personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 63 France construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 64 France construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 65 France general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 66 France energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 67 France oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 68 France mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 69 France telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 70 France agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 71 France marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 72 France transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 73 France others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 74 Italy personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 75 Italy products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 76 Italy soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 77 Italy harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 78 Italy lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 79 Italy hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 80 Italy rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 81 Italy installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 82 Italy vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 83 Italy portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 84 Italy horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 85 Italy Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 86 Italy personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 87 Italy construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 88 Italy construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 89 Italy general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 90 Italy energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 91 Italy oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 92 Italy mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 93 Italy telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 94 Italy agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 95 Italy marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 96 Italy transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 97 Italy others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 98 U.K. personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 99 U.K. products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 100 U.K. soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 101 U.K. harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 102 U.K. lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 103 U.K. hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 104 U.K. rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 105 U.K. installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 106 U.K. vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 107 U.K. portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 108 U.K. horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 109 U.K. Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 110 U.K. personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 111 U.K. construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 112 U.K. construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 113 U.K. general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 114 U.K. energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 115 U.K. oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 116 U.K. mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 117 U.K. telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 118 U.K. agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 119 U.K. marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 120 U.K. transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 121 U.K. others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 122 TURKEY personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 123 TURKEY products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 124 TURKEY soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 125 TURKEY harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 126 TURKEY lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 127 TURKEY hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 128 TURKEY rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 129 TURKEY installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 130 TURKEY vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 131 TURKEY portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 132 TURKEY horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 133 TURKEY Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 134 TURKEY personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 135 TURKEY construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 136 TURKEY construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 137 TURKEY general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 138 TURKEY energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 139 TURKEY oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 140 TURKEY mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 141 TURKEY telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 142 TURKEY agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 143 TURKEY marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 144 TURKEY transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 145 TURKEY others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 146 RUSSIA personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 147 RUSSIA products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 148 RUSSIA soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 149 RUSSIA harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 150 RUSSIA lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 151 RUSSIA hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 152 RUSSIA rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 153 RUSSIA installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 154 RUSSIA vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 155 RUSSIA portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 156 RUSSIA horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 157 RUSSIA Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 158 RUSSIA personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 159 RUSSIA construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 160 RUSSIA construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 161 RUSSIA general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 162 RUSSIA energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 163 RUSSIA oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 164 RUSSIA mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 165 RUSSIA telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 166 RUSSIA agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 167 RUSSIA marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 168 RUSSIA transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 169 RUSSIA others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 170 SPAIN personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 171 SPAIN products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 172 SPAIN soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 173 SPAIN harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 174 SPAIN lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 175 SPAIN hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 176 SPAIN rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 177 SPAIN installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 178 SPAIN vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 179 SPAIN portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 180 SPAIN horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 181 SPAIN Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 182 SPAIN personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 183 SPAIN construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 184 SPAIN construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 185 SPAIN general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 186 SPAIN energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 187 SPAIN oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 188 SPAIN mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 189 SPAIN telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 190 SPAIN agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 191 SPAIN marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 192 SPAIN transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 193 SPAIN others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 194 NETHERLANDS personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 195 NETHERLANDS products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 196 NETHERLANDS soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 197 NETHERLANDS harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 198 NETHERLANDS lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 199 NETHERLANDS hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 200 NETHERLANDS rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 201 NETHERLANDS installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 202 NETHERLANDS vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 203 NETHERLANDS portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 204 NETHERLANDS horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 205 NETHERLANDS Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 206 NETHERLANDS personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 207 NETHERLANDS construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 208 NETHERLANDS construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 209 NETHERLANDS general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 210 NETHERLANDS energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 211 NETHERLANDS oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 212 NETHERLANDS mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 213 NETHERLANDS telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 214 NETHERLANDS agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 215 NETHERLANDS marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 216 NETHERLANDS transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 217 NETHERLANDS others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 218 SWITZERLAND personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 219 SWITZERLAND products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 220 SWITZERLAND soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 221 SWITZERLAND harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 222 SWITZERLAND lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 223 SWITZERLAND hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 224 SWITZERLAND rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 225 SWITZERLAND installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 226 SWITZERLAND vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 227 SWITZERLAND portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 228 SWITZERLAND horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 229 SWITZERLAND Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 230 SWITZERLAND personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 231 SWITZERLAND construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 232 SWITZERLAND construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 233 SWITZERLAND general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 234 SWITZERLAND energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 235 SWITZERLAND oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 236 SWITZERLAND mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 237 SWITZERLAND telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 238 SWITZERLAND agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 239 SWITZERLAND marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 240 SWITZERLAND transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 241 SWITZERLAND others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 242 BELGIUM personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 243 BELGIUM products in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 244 BELGIUM soft goods in fall protection market, By type, 2019-2028 (USD million)

TABLE 245 BELGIUM harness in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 246 BELGIUM lanyard in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 247 BELGIUM hard goods in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 248 BELGIUM rope grabs in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 249 BELGIUM installed systems in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 250 BELGIUM vertical system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 251 BELGIUM portable ladder in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 252 BELGIUM horizontal system in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 253 BELGIUM Services in personal fall protection market, By type, 2019-2028 (USD million)

TABLE 254 BELGIUM personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 255 BELGIUM construction in personal fall protection market, By industry, 2019-2028 (USD million)

TABLE 256 BELGIUM construction in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 257 BELGIUM general industry in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 258 BELGIUM energy and utilities in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 259 BELGIUM oil & gas in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 260 BELGIUM mining in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 261 BELGIUM telecommunication in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 262 BELGIUM agriculture in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 263 BELGIUM marine & Shipbuilding in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 264 BELGIUM transportation in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 265 BELGIUM others in personal fall protection market, By Type, 2019-2028 (USD million)

TABLE 266 REST OF EUROPE personal fall protection market, By Type, 2019-2028 (USD million)

List of Figure

FIGURE 1 EUROPE PERSONAL FALL PROTECTION MARKET: segmentation

FIGURE 2 EUROPE PERSONAL FALL PROTECTION MARKET: data triangulation

FIGURE 3 EUROPE PERSONAL FALL PROTECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PERSONAL FALL PROTECTION MARKET: regional VS COUNTRY MARKET analysiS

FIGURE 5 EUROPE PERSONAL FALL PROTECTION MARKET: company research analysis

FIGURE 6 EUROPE PERSONAL FALL PROTECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE PERSONAL FALL PROTECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE PERSONAL FALL PROTECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PERSONAL FALL PROTECTION MARKET: SEGMENTATION

FIGURE 10 increasing safety awareness in the industrial areas is driving the Europe personal fall protection market in the forecast period of 2021 to 2028

FIGURE 11 product segment is expected to account for the largest share of the EUROPE PERSONAL FALL PROTECTION MARKET in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGEs OF THE EUROPE PERSONAL FALL PROTECTION MARKET

FIGURE 13 Europe Personal fall protection Market, By type, 2020

FIGURE 14 Europe Personal fall protection Market, By Industry, 2020

FIGURE 15 Europe personal fall protection market: SNAPSHOT (2020)

FIGURE 16 Europe personal fall protection market: BY COUNTRY (2020)

FIGURE 17 Europe personal fall protection market: BY COUNTRY (2021 & 2028)

FIGURE 18 Europe personal fall protection market: BY COUNTRY (2020 & 2028)

FIGURE 19 Europe personal fall protection market: BY TYPE (2021 & 2028)

FIGURE 20 EUROPE PERSONAL FALL PROTECTION MARKET: company share 2020 (%)

Europe Personal Fall Protection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Personal Fall Protection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Personal Fall Protection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.