Europe Passive Fire Protection Coating Market Analysis and Size

Passive fire protection coating is a colorless, odorless, and viscous liquid soluble in water at all concentrations. It is a strong acid made by oxidizing sulfur dioxide solutions and used in large quantities as an industrial and laboratory reagent. Passive fire protection coating or passive fire protection coating, also known as oil of vitriol, is a mineral acid composed of sulfur, oxygen, and hydrogen, with molecular formula H2SO4 and melting point is 10 °C, the boiling point is 337 °C.

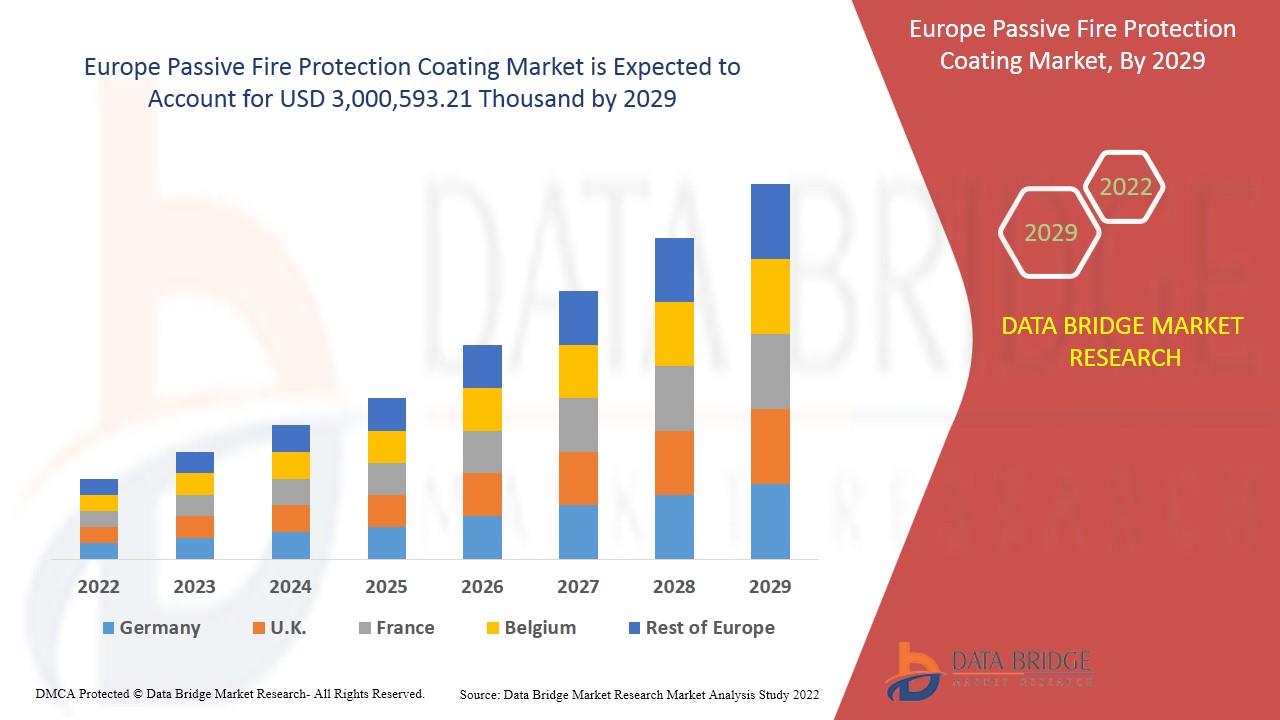

Increasing demand for fertilizers in the agriculture industry and the growing demand for passive fire protection coating across various industries are some of the drivers boosting passive fire protection coating demand in the market. Data Bridge Market Research analyses that the sulfuric market is expected to reach the value of USD 3,000,593.21 thousand by the year 2029, at a CAGR of 4.1% during the forecast period. " elemental sulfur " accounts for the most prominent raw material segment in the respective due to the abundant availability of sulfur across the globe. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand kg, Pricing in USD |

|

Segments Covered |

By Product Type (Cementitious Material, Intumescent Coating, Fireproofing Cladding, Others), Technology (Water-Based Protection Coating, Solvent-Based Protection Coating), Application (Oil & Gas, Construction, Aerospace, Electrical And Electronics, Automotive, Textile, Furniture, Warehousing, Others), End User (Building & Construction, Oil & Gas, Transportation, Others) |

|

Country Covered |

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg and Rest of Europe in Europe |

|

Market Players Covered |

LANXESS (Cologne, Germany ), Brenntag GmbH (a subsidiary of Brenntag SE)( Essen, Germany), Boliden Group (Stockholm, Sweden), Adisseo (Antony, France), Veolia (Paris, France), Univar Solutions Inc (Illinois, U.S.), NORAM Engineering & Construction Ltd.( Vancouver, Canada), Nouryon (Amsterdam, the Netherlands), International Raw Materials LTD (Pennsylvania, U.S.), Eti Bakir (Kastamonu, Turkey), ACIDEKA SA (Vizcaya, Spain), Airedale Chemical Company Limited.( North Yorkshire, U.K.), BASF SE (Ludwigshafen, Germany), Aguachem Ltd (Wrexham, U.K), Feralco AB (Widnes, U.K.), Fluorsid (Milan, Italy), Aurubis AG (Hamburg, Germany), Nyrstar (Budel, The Netherlands), Merck KGaA (Darmstadt, Germany), and Shrieve (Texas, U.S.) |

Market Definition

Passive fire protection coating is a strong acid with hygroscopic characteristics and oxidizing properties. It is used in the fertilizer, chemical, synthetic textile, and pigment industries. Other applications include manufacturing batteries metal pickling, among other industrial manufacturing processes. In market passive fire protection coating is available in different concentration grades such as 98%, 96.5%, 76%, 70% and 38%. A large quantity of passive fire protection coating produces potassium sulfates and fertilizers. Increasing demand for fertilizers in the agriculture industry and the growing demand for passive fire protection coating across various industries are some of the drivers boosting passive fire protection coating demand in the market. With the increasing consumption of passive fire protection coating globally, major players are expanding their production capacities in different countries to strengthen their presence in the market

Regulatory Framework

- The DHHS (1994) and EPA have not classified sulfur trioxide or passive fire protection coating for carcinogenic effects. IARC considers occupational exposure to strong inorganic mists containing passive fire protection coating to be carcinogenic to humans (Group 1) (IARC 1992). ACGIH has classified passive fire protection coating as a suspected human carcinogen (Group A2) (ACGIH 1998).

Passive fire protection coating is on the list of chemicals in “Toxic Chemicals Subject to Section 3 13 of the Emergency Planning and Community Right-to-Know Act”’ (EPA 1998f).

The occupational permissible exposure limit (PEL) for passive fire protection coating is 1 mg/ m3 (OSHA 1998). The NIOSH recommended exposure limit (REL) is also 1 mg/m3 (NIOSH 1997). ACGIH recommends a threshold limit value time-weighted average (TLV-TWA) of 1 mg/m3 and a short-term exposure limit (STEL) of 3 mg/m3 (ACGIH 1998).

COVID-19 had a Minimal Impact on Europe Passive Fire Protection Coatings Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, significant impact was noticed on passive fire protection coating in Europe operations and supply chain, with multiple manufacturing facilities still operating. The service providers continued offering passive fire protection coating following sanitation and safety measures in the post-COVID scenario.

The Market Dynamics of the Europe Passive Fire Protection Coatings Market Include:

- Increasing Demand for Fertilizers in Agricultural Industry

Increasing demand for high-quality fertilizers for crop cultivation boosts the Europe passive fire protection coating market.

- Significant Growth in Chemical Industries

Increasing chemical production in the European region with a chemicals strategy for sustainability is a prominent part of the Green Deal to strengthen the growth of the chemicals industry, making it easier to avoid usage of hazardous chemicals and encourage innovation for the development of safe and sustainable alternatives. Thus, a strategy for sustainability in the chemicals industry can help keep the significant growth in the chemical industry and propel the Europe passive fire protection coating market in the coming years.

- Growing Demand for Passive Fire Protection Coatings Across a Diverse Range of Industries

The demand for passive fire protection coating across a diverse range of industries such as pharmaceutical, textile, paper, and pulp, is expected to grow at an increasing rate and is projected to fuel the Europe passive fire protection coating market.

- Growing Demand for Batteries in Automotive Industry

With increased demand for the recovery of waste printed circuit boards using passive fire protection coating to recover different metals such as gold, silver, iron, and copper is expected to drive the Europe passive fire protection coating market.

- Significant Growth in Healthcare Industry

The increasing advantages of passive fire protection coating batteries in motor vehicles and other machines in electric vehicles are increasing the demand for passive fire protection coating, creating an opportunity for the Europe passive fire protection coating market to tap upon and register higher growth in the future.

- Abundance of Sulfur as a Raw Material

In addition, sulfur nowadays is also produced for industrial use from the petroleum and natural gas industry worldwide. Therefore, an abundance of sulfur reserves around the globe creates an opportunity for the growth of the Europe passive fire protection coating market.

Restraints/Challenges faced by the Europe Passive Fire Protection Coatings Market

- Health Hazards Associated with Passive Fire Protection Coatings

The increasing health hazards associated with the use of passive fire protection coating on the skin, eyes, and other organs is likely to hamper the Europe passive fire protection coating market demand.

- Decline in Sales Resulting from Oversupply of Passive Fire Protection Coatings

The undersupply of passive fire protection coating in the Europe passive fire protection coating market is the biggest problem being faced by key manufacturers operating in the market, which is directly impacting their sales and profit margins as oversupplied with other producers has led to a decrease in the prices. This is acting as the biggest challenge in the Europe passive fire protection coating market growth.

This passive fire protection coating market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the passive fire protection coating market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Development

- In November 2020, Airedale Chemical Company Limited acquired Alutech, which provides a range of metal treatment solutions, including aluminum brighteners and pre-treatment cleaners. This development helps the company increase the demand for passive fire protection coating, which has increased its profits

- In May 2017, BASF SE introduced a new passive fire protection coating catalyst preferred due to its unique geometrical shape. This update helps the company to increase production capacity, which generates revenue in the future

Europe Passive Fire Protection Coatings Market Scope

Europe passive fire protection coatings market is segmented on the basis of product type, by technology, by application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Cementitious Material

- Intumescent Coating

- Fireproofing Cladding

- Others

On the basis of product type, the Europe passive fire protection coatings market is segmented into cementitious material, intumescent coating, fireproofing cladding, and others. The intumescent coating segment is expected to dominate the Europe region, intumescent coating is expected to dominate the market due to wider consumer preference in construction and building industries

Technology

- Water-Based Protection Coating

- Solvent-Based Protection Coating

On the basis of technology, the Europe passive fire protection coatings market is segmented into water-based protection coating and solvent-based protection coating.

Application

- Oil & Gas

- Construction

- Aerospace

- Electrical and Electronics

- Automotive

- Textile

- Furniture

- Warehousing

- Others

On the basis of application, the Europe passive fire protection coatings market is segmented into oil & gas, construction, aerospace, electrical and electronics, automotive, textile, furniture, warehousing and others. In Asia-Pacific, automotive is projected to dominate the market as it reduces potentially vulnerable people that may be at risk on the premises.

End User

- Building & Construction

- Oil & Gas

- Transportation

- Others

On the basis of end user, the Europe passive fire protection coatings market is segmented into building and construction, oil and gas, transportation and others. In Asia-Pacific, building and construction segment is expected to dominate the market because largest construction projects were initiated in the regions.

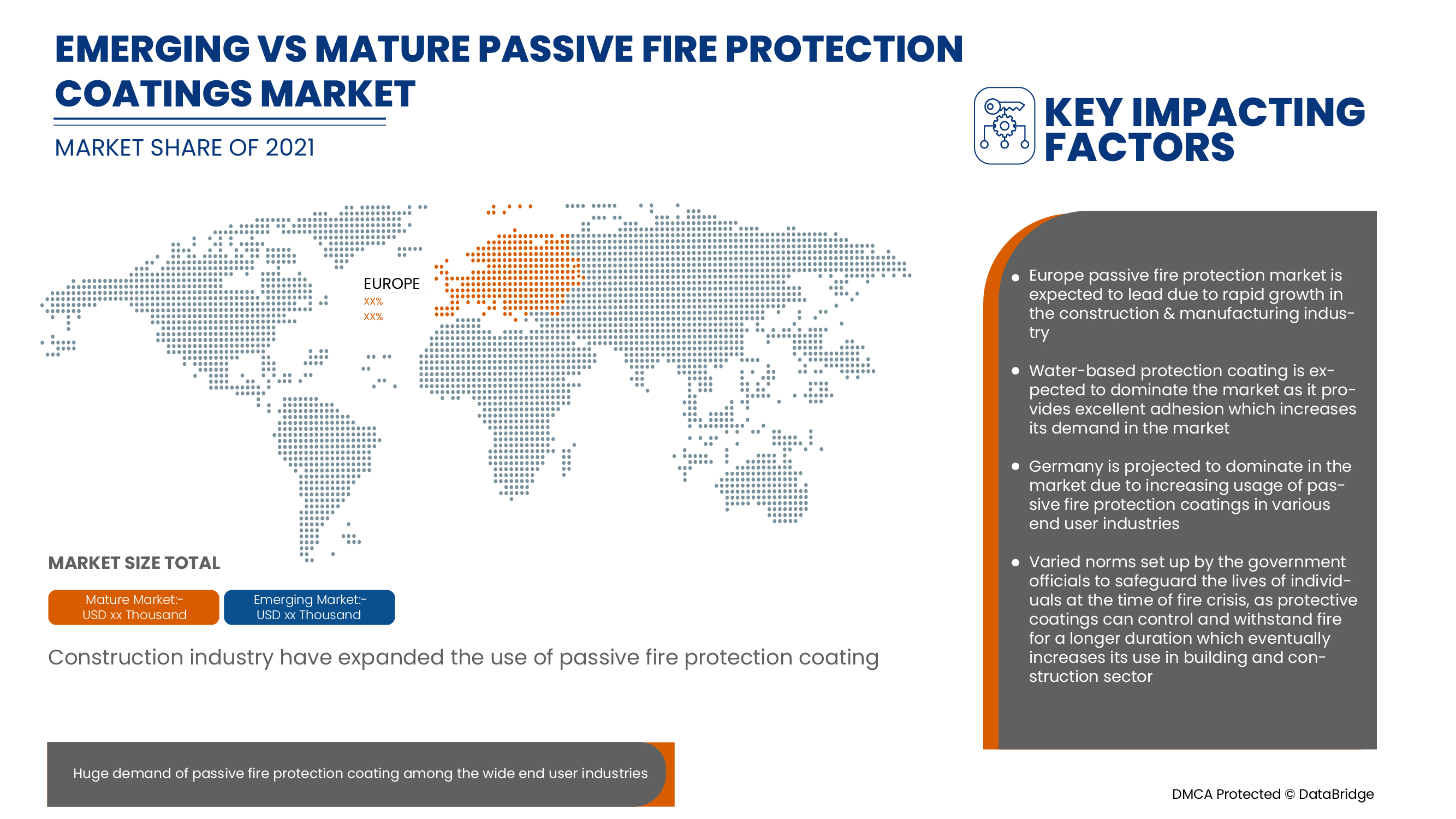

Europe Passive Fire Protection Coatings Regional Analysis/Insights

The passive fire protection coatings market is analyzed and market size insights and trends are provided by country, product type, technology, application and end user as referenced above.

The countries covered in the Europe passive fire protection coating market report are the Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg and Rest of Europe

Germany is expected to dominate the Europe passive fire protection coatings market due to high demand from the construction and building industry. Europe is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for batteries in the automotive industry in the region

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Passive Fire Protection Coatings Market Share Analysis

Europe passive fire protection coating market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Europe passive fire protection coating market.

Some of the major players operating in the passive fire protection coating market are LANXESS, Brenntag GmbH (a subsidiary of Brenntag SE), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA, and Shrieve, among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION PROCESS

4.1.1 INTRODUCTION

4.1.2 FUNCTION

4.1.3 KEYS ELEMENTS

4.1.4 PROCESS

4.2 POTENTIAL COLLABORATION OPPORTUNITIES

4.3 COMPARATIVE ANALYSIS WITH POTENTIAL SUBSTITUTES

4.4 REGIONAL SUMMARY

4.4.1 EUROPE

4.4.2 ASIA-PACIFIC

4.4.3 EUROPE

4.4.4 NORTH AMERICA

4.4.5 MIDDLE-EAST & AFRICA

4.4.6 SOUTH AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSTRUCTION INDUSTRY

5.1.2 ESCALATING APPLICATION SCOPE OF PASSIVE FIRE PROTECTION COATING IN VARIOUS INDUSTRIES

5.1.3 RISING DEMAND FOR WATER-BASED FIRE PROTECTION COATINGS

5.1.4 IMPOSITION OF FAVORABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAPER ALTERNATIVES

5.2.2 VOLATILITY IN THE RAW MATERIAL COSTS

5.3 OPPORTUNITIES

5.3.1 INCREASING INDIVIDUALS DISPOSABLE INCOME

5.3.2 RISING OIL AND GAS EXPLORATION ACTIVITIES

5.3.3 ADVANCEMENT IN THE CONSTRUCTION INDUSTRY TO BRING LUCRATIVE OPPORTUNITIES

5.3.4 RISING USAGES OF FIRE PROTECTION COATINGS IN RENOVATION PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG POTENTIAL END-USERS

5.4.2 HIGH INSTALLATION AND MAINTENANCE COST

6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE

6.1 OVERVIEW

6.2 INTUMESCENT COATING

6.2.1 CELLULOSIC FIRE PROTECTION

6.2.2 HYDROCARBON FIRE PROTECTION

6.3 CEMENTITIOUS MATERIAL

6.3.1 HYDRAULIC CEMENT

6.3.2 SUPPLEMENTARY CEMENTITIOUS MATERIALS (SCMS)

6.4 FIREPROOFING CLADDING

6.5 OTHERS

7 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WATER-BASED PROTECTION COATING

7.3 SOLVENT-BASED PROTECTION COATING

8 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 OIL & GAS

8.4 CONSTRUCTION

8.4.1 HOSPITALS

8.4.2 SKYSCRAPERS

8.4.3 COLLEGES

8.4.4 RESTAURANTS

8.4.5 RESIDENTIAL BUILDINGS

8.4.6 COMMERCIAL BUILDINGS

8.4.7 OFFICES

8.4.8 OTHERS

8.5 AEROSPACE

8.6 ELECTRICAL AND ELECTRONICS

8.7 TEXTILE

8.8 FURNITURE

8.9 WAREHOUSING

8.1 OTHERS

9 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, END USER

9.1 OVERVIEW

9.2 BUILDING & CONSTRUCTION

9.2.1 INTUMESCENT COATING

9.2.2 CEMENTITIOUS MATERIAL

9.2.3 FIREPROOFING CLADDING

9.2.4 OTHERS

9.3 OIL & GAS

9.3.1 INTUMESCENT COATING

9.3.2 CEMENTITIOUS MATERIAL

9.3.3 FIREPROOFING CLADDING

9.3.4 OTHERS

9.4 TRANSPORTATION

9.4.1 INTUMESCENT COATING

9.4.2 CEMENTITIOUS MATERIAL

9.4.3 FIREPROOFING CLADDING

9.4.4 OTHERS

9.5 OTHERS

9.5.1 INTUMESCENT COATING

9.5.2 CEMENTITIOUS MATERIAL

9.5.3 FIREPROOFING CLADDING

9.5.4 OTHERS

10 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 MERGER & ACQUISITION

11.3 RECENT UPDATE

11.4 PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 GCP APPLIED TECHNOLOGIES INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 AKZO NOBEL N.V.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 HILTI

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 ETEX GROUP

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 KANSAI PAINT CO.,LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 JOTUN

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 CARBOLINE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 CONTEGO INTERNATIONAL INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

13.11 EASTMAN CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 ENVIROGRAF PASSIVE FIRE PRODUCTS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 HEMPEL A/S

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATE

13.14 ISOLATEK INTERNATIONAL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 NO BURN, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

13.16 PPG INDUSTRIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATE

13.17 RUDOLF HENSEL GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 SHARPFIBRE LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATE

13.19 SVT GROUP OF COMPANIES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATE

13.2 TEKNOS GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT UPDATE

13.21 VIJAY SYSTEMS ENGINEERS PVT LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 3 POTENTIAL COLLABORATION OPPORTUNITIES

TABLE 4 POTENTIAL SUBSTITUTES

TABLE 5 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 7 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 9 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 12 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 15 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 17 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE WATER-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SOLVENT-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE AEROSPACE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE TEXTILE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE FURNITURE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE WAREHOUSING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (THOUSAND KG)

TABLE 42 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 44 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 56 GERMANY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 GERMANY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 59 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 GERMANY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 62 GERMANY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 GERMANY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 GERMANY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 GERMANY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 U.K PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 U.K PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 68 U.K INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 U.K CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 U.K CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 74 U.K BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 80 FRANCE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 FRANCE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 83 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 FRANCE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 86 FRANCE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 FRANCE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 ITALY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 ITALY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 92 ITALY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 104 SPAIN INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 SPAIN CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 110 SPAIN BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 SPAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 SPAIN TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 SPAIN OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 116 RUSSIA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 RUSSIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 119 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 RUSSIA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 122 RUSSIA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 RUSSIA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 RUSSIA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 RUSSIA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 128 SWITZERLAND INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 SWITZERLAND CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 131 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 SWITZERLAND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 134 SWITZERLAND BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SWITZERLAND OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 SWITZERLAND TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 SWITZERLAND OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 140 TURKEY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 TURKEY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 143 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 TURKEY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 146 TURKEY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 TURKEY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 TURKEY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 TURKEY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 152 BELGIUM INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 BELGIUM CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 155 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 BELGIUM CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 BELGIUM TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 164 NETHERLANDS INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 NETHERLANDS CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 167 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 168 NETHERLANDS CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 170 NETHERLANDS BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 NETHERLANDS OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 NETHERLANDS TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 NETHERLANDS OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 176 LUXEMBURG INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 LUXEMBURG CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 179 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 LUXEMBURG CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 181 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 182 LUXEMBURG BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 LUXEMBURG OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 LUXEMBURG TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 LUXEMBURG OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 REST OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 REST OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

List of Figure

FIGURE 1 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 2 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING CONSTRUCTION INDUSTRY IS DRIVING THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INTUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY, AND CHALLENGES OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET

FIGURE 18 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2021

FIGURE 19 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2021

FIGURE 20 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2021

FIGURE 21 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, END USER, 2021

FIGURE 22 EUROPE PASSIVE FIRE PROTECTION COATING MARKET : SNAPSHOT (2021)

FIGURE 23 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 27 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY SHARE 2021 (%)

Europe Passive Fire Protection Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Passive Fire Protection Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Passive Fire Protection Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.