Europe Polyalkylene Glycol (PAG) Base Oil Market Analysis and Size

PAG oil or polyalkylene glycol is completely synthetic hygroscopic oil intended specifically for air conditioning compressors in automobiles. They are widely used as compressor oil. Water-soluble PAG oil and water insoluble PAG oil are two of the common products of the PAG. Other than compressor oil, they are also widely used in applications such as worn gear lubricant, anhydrous fire resistant hydraulic fluid, metal working fluid, and others.

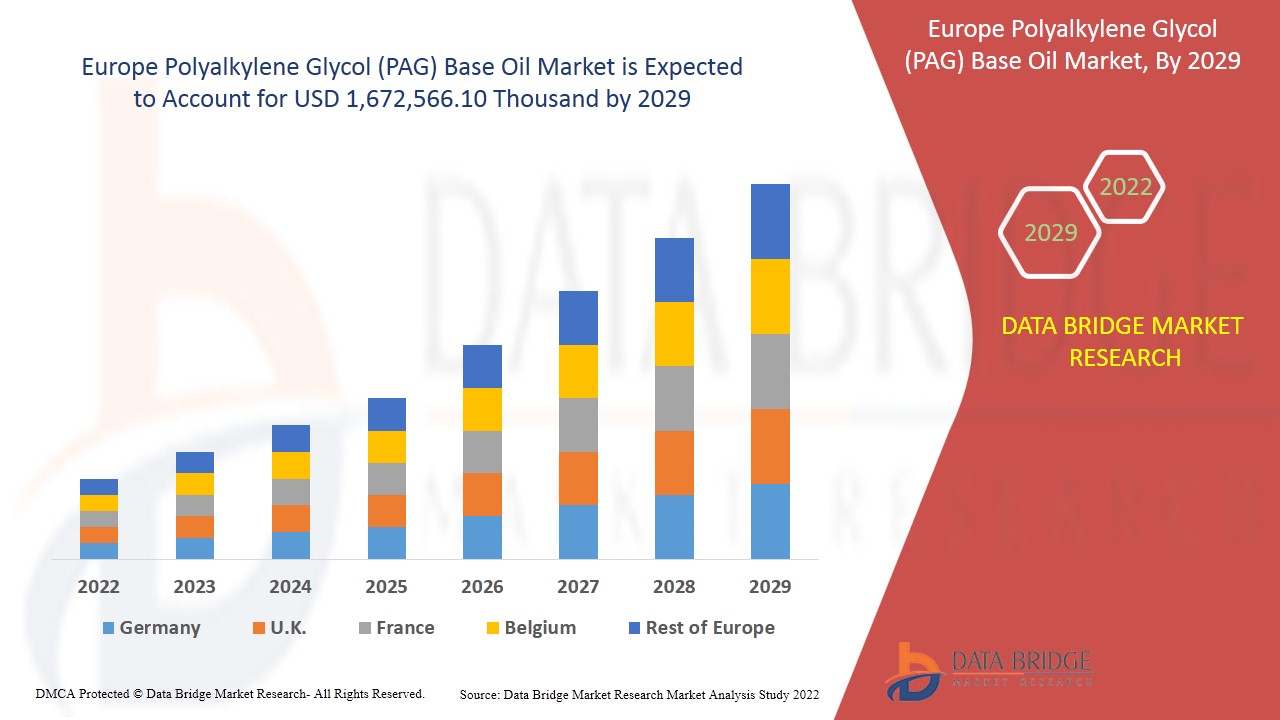

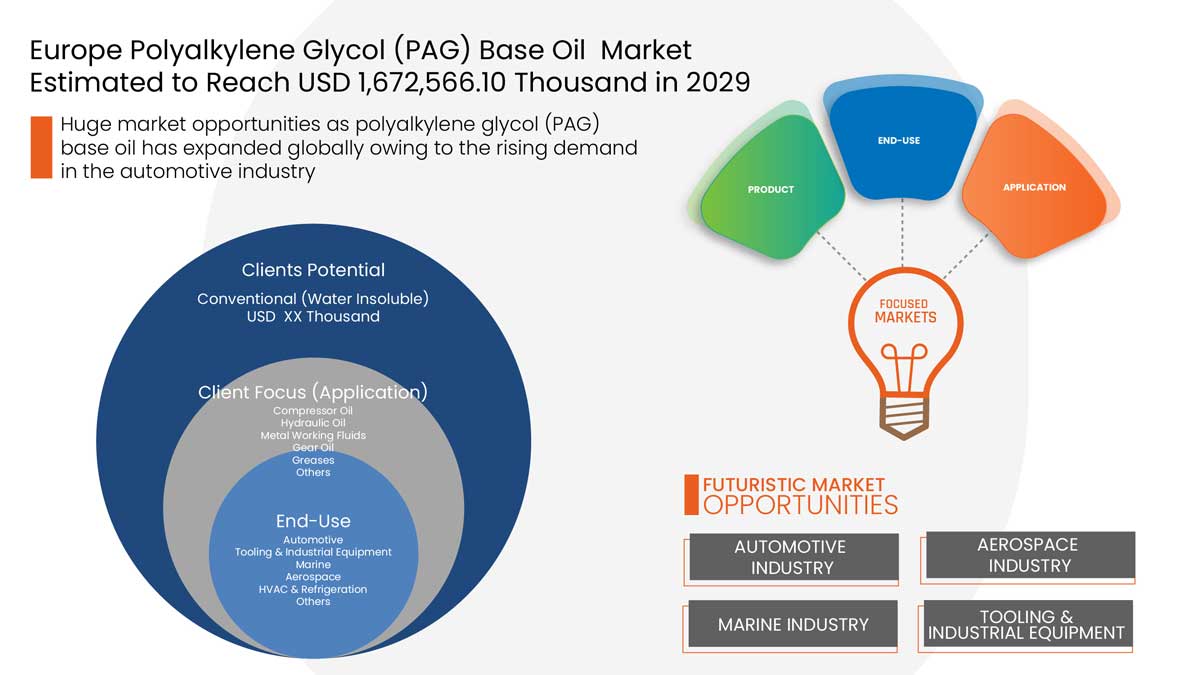

The PAG oils have high viscosity index, good water solubility, shear stability, and less volatility under high temperatures. Later, polyalkylene glycol (PAG) base oils began to see extensive use as textile lubricants and as quenchants in metal heat treating. Data Bridge Market Research analyses that the Europe polyalkylene glycol (PAG) base oil market is expected to reach USD 1,672,566.10 thousand by the year 2029, at a CAGR of 3.2% during the forecast period. "Conventional (water insoluble)" accounts for the most prominent product segment in the respective market, owing to the demand for PAGs in the automotive industry. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Product (Conventional (Water Insoluble), and Water-Soluble), Application (Hydraulic Oil, Gear Oil, Compressor Oil, Metal Working Fluids, Greases, and Others), End-Use (Automotive, Aerospace, Marine, Tooling & Industrial Equipment, HVAC & Refrigeration, and Others) |

|

Country Covered |

Germany, U.K., France, Netherlands, Italy, Spain, Belgium, Russia, Turkey, Switzerland and the Rest of Europe |

|

Market Players Covered |

TotalEnergies, Phillips 66 Company, Exxon Mobil Corporation, Royal Dutch Shell plc, Denso Corporation, BASF SE, Eni Oil Products, Chevron Corporation, FUCHS, Croda International Plc, FUCHS, Hornett Bros & Co Ltd., PETRONAS Lubricants International, LIQUI MOLY GmbH, Morris Lubricants, Ultrachem Inc., Idemitsu Kosan Co., Ltd., among others |

Market Definition

Polyalkylene glycol (PAG) base oils are classified by their weight percent composition of oxypropylene versus oxyethylene units in the polymer chain. Polyalkylene glycol (PAG) base oils with 100 weight percent oxypropylene groups are water insoluble; whereas those with 50 to 75 weight percent oxyethylene are water soluble at ambient temperatures. Polyalkylene glycol (PAG) base oils have long been used as industrial lubricants, and recent work has led to the development of polyalkylene glycol (PAG) lubricants for use in equipment in the food processing industry. These products are known as food-grade approved lubricants.

COVID-19 had a Minimal Impact on Europe Polyalkylene Glycol (PAG) Base Oil Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the Europe polyalkylene glycol (PAG) base oil market. The operations and supply chain of polyalkylene glycol (PAG) base oil, with multiple manufacturing facilities, were still operating in the region. The service providers continued offering polyalkylene glycol (PAG) base oil following sanitation and safety measures in the post-COVID scenario.

The Market Dynamics of the Europe Polyalkylene Glycol (PAG) Base Oil Market Include:

- Significant Demand for PAG in the Automotive Industry

The Europe polyalkylene glycol (PAG) base oil market is likely to flourish in the future on account of increasing growth in the automobile industry. Extensive and increasing use of vehicles and the need for high-performance lubricants from the automotive industry are expected to boost the growth of the Europe polyalkylene glycol (PAG) base oil market.

- Rising Technological Advancements and Modernization in Production Techniques

Recent and fast-evolving changes and advancements in equipment technology have resulted in more demanding lubricant conditions and requirements, which are beyond the capabilities of mineral oil-based lubricants. More technological advancements are being considered in producing polyalkylene glycol (PAG) based engine oils as a step forward for significant fuel consumption reduction. This is expected to drive the growth of the Europe polyalkylene glycol (PAG) base oil market.

- Considerable Increase in Construction Activities and Infrastructural Development Across the Globe

PAG base oils are being used in the infrastructure and construction of those buildings or places where fire resistance or environmental acceptability is required. Increasing consumer spending power accompanied by government initiatives towards boosting the public infrastructure is likely to drive the construction industry in the future, which will further help the PAG-based oil market growth.

- Growing Use in Food-Grade Products

The use of lubricants in food production and processing is widely common. Over time, the regulations and requirements for lubricants in food machinery and industry have evolved to include various product technology. Thus, the growing use of PAG oils in food-grade products is expected to propel the Europe polyalkylene glycol (PAG) base oil market in the forecast period.

- Increasing Use of Bio-Degradable PAG Oils

Biodegradable oils have increased in popularity in recent years, but these oils can also have up to 50% of a petroleum oil base. The increase in biodegradable polyalkylene glycol base oil and the approval of its biodegradability by EPA is expected to act as an opportunity for the Europe polyalkylene glycol (PAG) base oil market.

- Growing Research and Development Activities

Polyalkylene glycol oils are one of the first synthetic lubricants developed and commercialized. Polyalkylene glycol (PAG) oils are classified by their weight percent composition of oxypropylene versus oxyethylene units in the polymer chain. Increased research and development activities have created novel applications for polyalkylene glycol (PAG) base oil, which is expected to provide growth opportunities for the market.

Restraints/Challenges faced by the Europe Polyalkylene Glycol (PAG) Base Oil Market

- Rise in Cost of Synthetic Fibers

Textile fiber production is one industry that benefits from using polyalkylene glycol (PAG) oils. These oils do not stain or discolor fibers and are easily removed during the scouring process. PAG oils are the lubricant of choice for many high-speed, high-temperature fiber processes requiring shear stability. In addition, they are often used as lubricants in textile manufacturing equipment as extreme pressure gear oils. Thus, the increasing price of synthetic fiber affects the textile industry and the Europe polyalkylene glycol (PAG) oil base market as they are interconnected.

- High Cost Compared to Conventional Mineral Oils

Base oils comprise 30-40% of the total cost of the finished lubricants. Therefore, it becomes very important for the manufacturers to choose the right base oil type for their finished products. The high price of polyalkylene glycol-based lubricants is the primary challenging factor for the market. This affects the price of synthetic base oils, including PAGs, and forces manufacturers to set the price higher than other conventional mineral oils, which may challenge the market growth tremendously.

The countries covered in the report are Germany, U.K., France, Netherlands, Italy, Spain, Belgium, Russia, Turkey, Switzerland, and the Rest of Europe.

Germany is expected to dominate the market due to the rising technological advancements and modernization in production techniques in the region. More technological advancements are being considered in producing polyalkylene glycol (PAG) based engine oils as a step forward for significant fuel consumption reduction. This is expected to drive the growth of the Europe polyalkylene glycol (PAG) base oil market.

This Europe polyalkylene glycol (PAG) base oil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the rodenticides market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In December 2021, Shell New Energies US LLC, a subsidiary of Royal Dutch Shell plc (Shell), has acquired Savion LLC (Savion), a large utility-scale solar and energy storage developer in the United States. This acquisition will bring goodwill to the company

- In July 2021, DENSO CORPORATION launched its new online media website, "The COREs." This development will help Denso Corporation attract and serve more customers through its online channel.

Europe Polyalkylene Glycol (PAG) Base Oil Market Scope

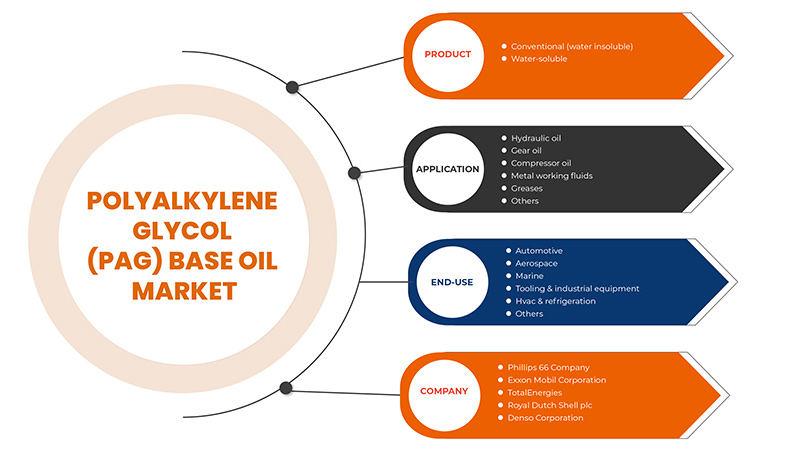

Europe polyalkylene glycol (PAG) base oil market is segmented on the basis of product, application, and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Conventional (Water Insoluble)

- Water-Soluble

On the basis of product, the Europe polyalkylene glycol (PAG) base oil market is segmented into conventional (water insoluble) and water-soluble. The conventional (water soluble) segment is expected to dominate the market as they have a very high viscosity index and low and high-temperature abilities, which helps boost its demand in the forecast year.

Application

- Hydraulic Oil

- Gear Oil

- Compressor Oil

- Metal Working Fluids

- Greases

- Others

On the basis of application, the Europe polyalkylene glycol (PAG) base oil market is segmented into hydraulic oil, gear oil, compressor oil, metal working fluids, greases, and others. The compressor oil segment is expected to dominate the market as it reduces the wear and tear on rotating parts and prevents metal from rubbing against metal, which helps boost its demand in the forecast year.

End-Use

- Automotive

- Aerospace

- Marine

- Tooling & Industrial Equipment

- HVAC & Refrigeration

- Others

On the basis of end-use, the Europe polyalkylene glycol (PAG) base oil market is segmented into automotive, aerospace, marine, tooling & industrial equipment, HVAC & refrigeration, and others. The automotive segment is expected to dominate the market as PAG oil helps control friction and wear in the automotive engine, which helps to boost its demand in the forecast year.

Competitive Landscape and Europe Polyalkylene Glycol (PAG) Base Oil Market Share Analysis

The Europe polyalkylene glycol (PAG) base oil market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the Europe polyalkylene glycol (PAG) base oil market.

Some of the major players operating in the Europe polyalkylene glycol (PAG) base oil market are TotalEnergies, Phillips 66 Company, Exxon Mobil Corporation, Royal Dutch Shell plc, Denso Corporation, BASF SE, Eni Oil Products, Chevron Corporation, FUCHS, Croda International Plc, FUCHS, Hornett Bros & Co Ltd., PETRONAS Lubricants International, LIQUI MOLY GmbH, Morris Lubricants, Ultrachem Inc., Idemitsu Kosan Co., Ltd., among others.

Research Methodology: Europe Polyalkylene Glycol (PAG) Base Oil Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry.

The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Expert Analysis, Import/Export Analysis, Pricing Analysis, Production Consumption Analysis, Climate Chain Scenario, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe versus Regional and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DATA TRIANGULATION

2.7 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DROC ANALYSIS

2.8 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

2.9 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY RESEARCH ANALYSIS

2.1 PRODUCT LIFE LINE CURVE

2.11 MULTIVARIATE MODELING

2.12 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.13 DBMR MARKET POSITION GRID

2.14 MARKET END USE COVERAGE GRID

2.15 DBMR MARKET CHALLENGE MATRIX

2.16 DBMR VENDOR SHARE ANALYSIS

2.17 IMPORT-EXPORT DATA

2.18 SECONDARY SOURCES

2.19 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND FOR PAG IN AUTOMOTIVE INDUSTRY

5.1.2 RISING TECHNOLOGICAL ADVANCEMENTS AND MODERNIZATION IN PRODUCTION TECHNIQUES

5.1.3 CONSIDERABLE INCREASE IN CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS GLOBE

5.1.4 GROWING USE IN FOOD-GRADE PRODUCTS

5.2 RESTRAINTS

5.2.1 RISE IN COST OF SYNTHETIC FIBERS

5.2.2 VOLATILITY IN CRUDE OIL PRICES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIO-DEGRADABLE PAG OILS

5.3.2 GROWING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 PRESENCE OF SUBSTITUTES IN MARKET

5.4.2 HIGH COST COMPARED TO CONVENTIONAL MINERAL OILS

6 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 CONVENTIONAL (WATER INSOLUBLE)

6.3 WATER SOLUBLE

7 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 COMPRESSOR OIL

7.3 HYDRAULIC OIL

7.4 METAL WORKING FLUIDS

7.5 GEAR OIL

7.6 GREASES

7.7 OTHERS

8 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 TOOLING & INDUSTRIAL EQUIPMENT

8.4 MARINE

8.5 AEROSPACE

8.6 HVAC & REFRIGERATION

8.7 OTHERS

9 EUROPE

9.1 GERMANY

9.2 U.K.

9.3 FRANCE

9.4 NETHERLANDS

9.5 ITALY

9.6 SPAIN

9.7 BELGIUM

9.8 RUSSIA

9.9 TURKEY

9.1 SWITZERLAND

9.11 REST OF EUROPE

10 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

10.2 MERGER & ACQUISITION

10.3 EXPANSIONS

10.4 NEW PRODUCT DEVELOPMENT

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 TOTALENERGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 PHILLIPS 66 COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATES

12.3 EXXON MOBIL CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

12.4 ROYAL DUTCH SHELL PLC

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 ENI OIL PRODUCTS

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATES

12.6 BASF SE

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 CHEVRON CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 CRODA INTERNATIONAL PLC

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATES

12.9 DENSO CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATES

12.1 FUCHS

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATES

12.11 HORNETT BROS & CO LTD.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 IDEMITSU KOSAN CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 LIQUI MOLY GMBH

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATES

12.14 MORRIS LUBRICANTS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATES

12.15 PETRONAS LUBRICANTS INTERNATIONAL

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATES

12.16 ULTRACHEM INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 3 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 5 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2022-2029 (USD THOUSAND)

TABLE 8 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2022-2029 (THOUSAND KILOTONNES)

TABLE 9 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 10 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 11 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 12 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 13 GERMANY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 14 GERMANY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 15 GERMANY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 16 GERMANY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 17 U.K. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 18 U.K. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 19 U.K. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 20 U.K. POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 21 FRANCE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 22 FRANCE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 23 FRANCE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 24 FRANCE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 25 NETHERLANDS POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 26 NETHERLANDS POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 27 NETHERLANDS POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 28 NETHERLANDS POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 29 ITALY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 30 ITALY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 31 ITALY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 32 ITALY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 33 SPAIN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 34 SPAIN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 35 SPAIN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 36 SPAIN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 37 BELGIUM POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 38 BELGIUM POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 39 BELGIUM POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 40 BELGIUM POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 41 RUSSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 42 RUSSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 43 RUSSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 44 RUSSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 45 TURKEY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 46 TURKEY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 47 TURKEY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 48 TURKEY POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 49 SWITZERLAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 50 SWITZERLAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

TABLE 51 SWITZERLAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 52 SWITZERLAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2022-2029 (USD THOUSAND)

TABLE 53 REST OF EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (USD THOUSAND)

TABLE 54 REST OF EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2022-2029 (THOUSAND KILOTONNES)

List of Figure

FIGURE 1 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 2 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 3 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 4 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: PRODUCT LIFE LINE CURVE

FIGURE 5 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MULTIVARIATE MODELLING

FIGURE 6 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MARKET END USE COVERAGE GRID

FIGURE 9 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 12 SIGNIFICANT DEMAND FOR PAGS IN AUTOMOTIVE INDUSTRY IS DRIVING THE EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CONVENTIONAL (WATER INSOLUBLE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

FIGURE 15 VOLATILE CRUDE OIL PRICES

FIGURE 16 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2021

FIGURE 17 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2021

FIGURE 18 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2021

FIGURE 19 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SNAPSHOT (2021)

FIGURE 20 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021)

FIGURE 21 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY PRODUCT (2022-2029)

FIGURE 24 EUROPE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY SHARE 2021 (%)

Europe Pag Base Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Pag Base Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Pag Base Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.