Europe Olive Oil Market Analysis and Insights

Olive oil is oil that is extracted from the olives and consists of healthy fatty acids like oleic acid along with palmitic acid and linoleic acid. Olive oil is cooking oil that offers great nutritional value. Owing to its popularity across the globe, a wide categorical range of olive oils is available in the market. Its nutritional composition includes vitamins D ingredient and K, monosaturated fats, and high levels of antioxidants. Apart from just using it as edible cooking oil, olive oils are also used in a wide range of applications. For instance, olive oil has moisturizing and exfoliating properties, which makes it perfect for skin care and personal care applications.

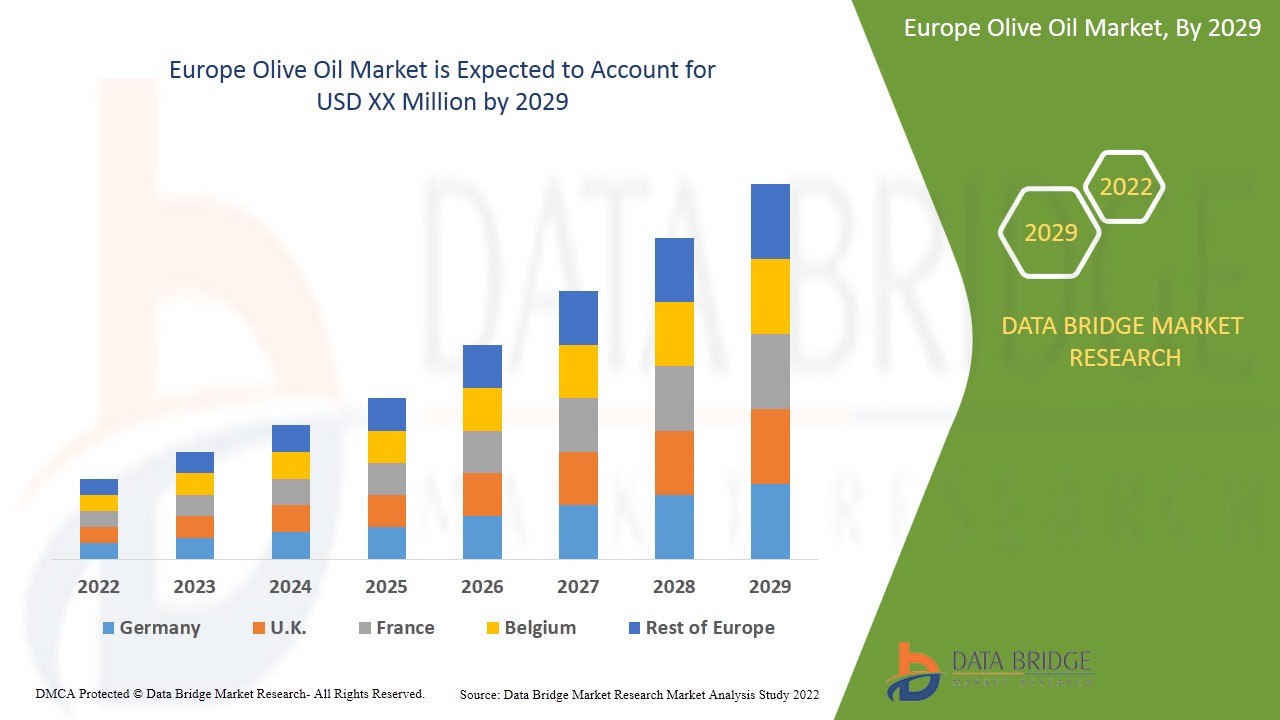

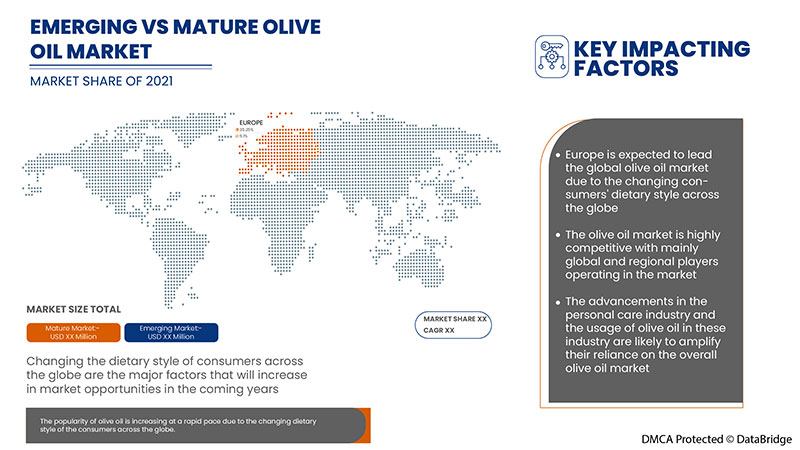

Increasing use of olive oil coupled with the growing application of olive oil in personal/skincare products has surged its demand. Data Bridge Market Research analyses that the Europe olive oil market will grow at a CAGR of 5.1% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

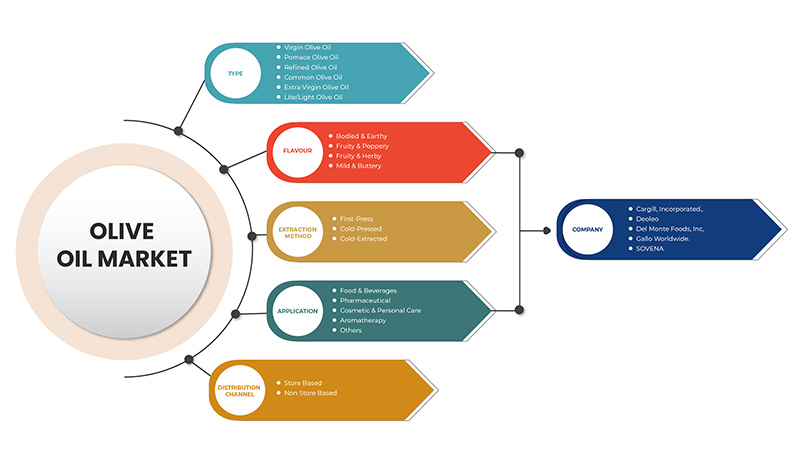

Segments Covered |

By Type (Virgin Olive Oil, Pomace Olive Oil, Refined Olive Oil, Common Olive Oil, Extra Virgin Olive Oil, And Lite/Light Olive Oil), Flavor (Full-Bodied & Earthy, Fruity & Peppery, Fruity & Herby, And Mild & Buttery), Extraction Method (First-Press, Cold-Pressed And Cold-Extracted), Application (Food And Beverages, Pharmaceutical, Cosmetic and Personal Care, Aromatherapy, And Others), Distribution Channel (Store Based and Non-Store Based) |

|

Countries Covered |

Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Poland, Belgium, Denmark, Italy, and the Rest of Europe |

|

Market Players Covered |

Cargill, Incorporated, Deoleo, Del Monte Foods, Inc, Gallo Worldwide, BORGES INTERNATIONAL GROUP, S.L.U., Avenida Rafael Ybarra, SOVENA, Aceites Sandúa, ΜΙΝΕRVΑ, among others. |

Europe Olive Oil Market Dynamics

Drivers

- Growing Use of Olive Oil in Personal Care Products

Olive oil has antioxidants and anti-inflammatory properties, beneficial for skincare. Olive oil removes dead skin cells and other impurities and cleanses, hydrates, and nourishes the hair when used on the skin.

- Increasing Use of Olive Oil in Household and Foodservice Sector

The increase in olive oil demand for cooking in households is due to growing awareness regarding the good health benefits of olive oil. It has the highest content of monounsaturated fats and contains antioxidants such as vitamins A, D, E, K, and beta-carotene, which helps in reducing bad cholesterol and preventing heart disease.

Opportunities

- Rising Prevalence of Obesity and Other Health Problems Due to Using of Conventional Fatty Oils

Awareness about excessive consumption of fat is increasing with increasing obesity. Obesity is associated with a higher incidence of several diseases, including diabetes, cardiovascular disease, and cancer.

Restraints/Challenges

Fluctuations in Prices of Olive Oil

The price of olive oil depends on many factors. One of the factors is commodity brokers worldwide who buy and sell bulk quantities of their olive oils daily. Depending on the availability of olives, the price will rise or fall.

Thus, fluctuations in the olive oil prices are expected to restrain the olive oil market in the forecast period.

This Europe olive oil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on Europe olive oil market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Olive Oil Market

The COVID-19 has affected the market to some extent. Due to lockdown, the manufacturing process was halted as well as the demand from the end-users also decreased, which has affected the market. Post-COVID, the demand for olive oil is increased due to changes in purchasing patterns of consumers and increasing the demand for olive oil among various end-users such as food & beverages, fine fragrance, personal care, and others.

Recent Development

- In July 2020, Aceites Sandúa launched two new premium category extra virgin olive oils, Capricho by Sandúa Ecológico Arbequina and Cosecha Seleccionada Sandúa Premium. This has helped the company to widen its product portfolio

Europe Olive Oil Market Scope

Europe olive oil market is segmented into type, flavor, extraction method, application, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Extra Virgin Olive Oil

- Virgin Olive Oil

- Common Olive Oil

- Refined Olive Oil

- Lite/Light Olive Oil

- Pomace Olive Oil

Based on type, the Europe olive oil market is segmented into virgin olive oil, pomace olive oil, refined olive oil, common olive oil, extra virgin olive oil, and lite/light olive oil.

Flavor

- Fruity & Herby

- Fruity & Peppery

- Mild & Buttery

- Full-Bodied & Earthy

Based on flavor, the Europe olive oil market is segmented into full-bodied & earthy, fruity & peppery, fruity & herby, and mild & buttery.

Extraction Method

- Cold-Extracted

- Cold-Pressed

- First-Press

Based on the extraction method, the Europe olive oil market is segmented into first-press, cold-pressed, and cold-extracted.

Application

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceutical

- Aromatherapy

- Others

Based on application, the Europe olive oil market is segmented into food and beverages, pharmaceutical, cosmetic and personal care, aromatherapy, and others.

Distribution Channel

- Store based

- Non store based

Based on the distribution channel, the Europe olive oil market is segmented into store based and non-store based.

Europe Olive Oil Market Regional Analysis/Insights

Europe olive oil market is analysed, and market size insights and trends are provided by country, type, flavor, extraction method, application, and distribution channel.

The countries covered in the Europe olive oil market report are Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Poland, Belgium, Denmark, Italy, and the Rest of Europe.

Germany is expected to dominate the Europe olive oil market due to the growing production and consumption of olive oil in the region. France is expected to dominate the Europe olive oil market due to the growing food and beverage industry in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Olive Oil Market Share Analysis

The Europe olive oil market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Europe olive oil market.

Some of the Major Players Operating in the Olive Oil Market Are:

- Cargill, Incorporated

- Deoleo

- Del Monte Foods, Inc

- Gallo Worldwide

- BORGES INTERNATIONAL GROUP, S.L.U.

- Avenida Rafael Ybarra

- SOVENA

- Aceites Sandúa

- ΜΙΝΕRVΑ

- EU Olive Oil Ltd

- Artajo oil

- SALOV GROUP

- Domenico Manca S.p.a.

- Les huiles d'olive Lahmar

- JAENCOOP GROUP

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE OLIVE OIL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT & EXPORT ANALYSIS OF EUROPE OLIVE OIL MARKET

4.1.1 IMPORT-EXPORT ANALYSIS

4.2 LIST OF SUBSTITUTES:

4.3 EUROPE OLIVE OIL MARKET: MARKETING STRATEGIES

4.3.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.3.2 PROMOTION OF THEIR PRODUCTS BY RELAUNCHING

4.3.3 A VAST NETWORK OF DISTRIBUTION

4.3.4 INNOVATIVE PACKAGING

4.4 RAW MATERIAL PRICING ANALYSIS

4.4.1 GEOGRAPHICAL PRICING

4.4.2 DEMAND FACTOR IN PRICING

4.4.3 DEMAND FACTOR IN PRICING

4.5 EUROPE OLIVE OIL PRODUCTION AND CONSUMPTION

5 EUROPE OLIVE OIL MARKET: REGULATIONS

5.1 FSSAI REGULATIONS

5.2 EU REGULATIONS

5.3 REGULATIONS BY DEPARTMENT FOR ENVIRONMENT, FOOD & RURAL AFFAIRS AND ANIMAL AND PLANT HEALTH AGENCY

6 BRAND COMPETITIVE ANALYSIS

7 COMPARATIVE ANALYSIS

7.1 SIMILARITIES BETWEEN OLIVE AND VEGETABLE OIL

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 CHANGING DIETARY STYLE OF CONSUMERS ACROSS GLOBE

8.1.2 RISING AWARENESS ABOUT HEALTH BENEFITS OF OLIVE OIL

8.1.3 INCREASE IN USE OF OLIVE OIL IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS

8.1.4 INCREASING USE OF OLIVE OIL IN HOUSEHOLD AND FOODSERVICE SECTOR

8.2 RESTRAINTS

8.2.1 FLUCTUATIONS IN PRICES OF OLIVE OIL

8.2.2 AVAILABILITY OF SUBSTITUTE PRODUCTS AT LOW COST

8.3 OPPORTUNITIES

8.3.1 INCREASING DEMAND FOR AROMATHERAPY

8.3.2 RISING PREVALENCE OF OBESITY AND OTHER HEALTH PROBLEMS DUE TO USE OF CONVENTIONAL FATTY OILS

8.3.3 GROWING FAST FOODS AND RESTAURANT CHAINS

8.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

8.4 CHALLENGES

8.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

8.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF OLIVE OIL

9 EUROPE OLIVE OIL MARKET, BY TYPE

9.1 OVERVIEW

9.2 EXTRA VIRGIN OLIVE OIL

9.3 VIRGIN OLIVE OIL

9.4 COMMON OLIVE OIL

9.5 REFINED OLIVE OIL

9.6 LITE/LIGHT OLIVE OIL

9.7 POMACE OLIVE OIL

10 EUROPE OLIVE OIL MARKET, BY FLAVOUR

10.1 OVERVIEW

10.2 FRUITY & HERBY

10.3 FRUITY & PEPPERY

10.4 MILD & BUTTERY

10.5 FULL-BODIED & EARTHY

11 EUROPE OLIVE OIL MARKET, BY EXTRACTION METHOD

11.1 OVERVIEW

11.2 COLD-EXTRACTED

11.3 COLD-PRESSED

11.4 FIRST-PRESS

12 EUROPE OLIVE OIL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 COOKING

12.2.2 BAKING

12.2.2.1 BREADS

12.2.2.2 CAKES & PASTRIES

12.2.2.3 BROWNIE

12.2.2.4 BISCOTTI

12.2.2.5 OTHER DESSERTS

12.3 COSMETICS & PERSONAL CARE

12.4 PHARMACEUTICALS

12.5 AROMATHERAPY

12.6 OTHERS

13 EUROPE OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED

13.2.1 SUPER MARKETS/HYPER MARKETS

13.2.2 SPECIALTY STORES

13.2.3 GROCERY STORES

13.2.4 CONVENIENCE STORES

13.3 NON STORE BASED

13.3.1 ONLINE

13.3.2 WHOLESALERS/SUPPLIERS

14 EUROPE OLIVE OIL MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 NETHERLANDS

14.1.7 BELGIUM

14.1.8 SWITZERLAND

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 POLAND

14.1.12 DENMARK

14.1.13 REST OF EUROPE

15 COMPANY LANDSCAPE: EUROPE OLIVE OIL MARKET

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.1.6 SWOT ANALYSIS

17.2 DEL MONTE FOODS, INC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.2.6 SWOT ANALYSIS

17.3 SOVENA

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.3.5 SWOT ANALYSIS

17.4 DEOLEO

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.4.6 SWOT ANALYSIS

17.5 BORGES INTERNATIONAL GROUP, S.L.U.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.5.5 SWOT ANALYSIS

17.6 SALOV GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ACEITES SANDÚA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ARTAJO OIL

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 AVENIDA RAFAEL YBARRA

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 DOMENICO MANCA S.P.A.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EU OLIVE OIL LTD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GALLO WORLDWIDE

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GOURMET FOODS INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 GRAMPIANS OLIVE CO.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 JAENCOOP GROUP

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LES HUILES D'OLIVE LAHMAR

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 ΜΙΝΕRVΑ

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SUN GROVE FOODS INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TUCAN OLIVE OIL COMPANY LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 VICTORIAN OLIVE GROVES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 1509 OLIVE OIL AND ITS FRACTIONS OBTAINED FROM THE FRUIT OF THE OLIVE TREE (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 1509 OLIVE OIL AND ITS FRACTIONS OBTAINED FROM THE FRUIT OF THE OLIVE TREES (USD THOUSAND)

TABLE 3 EUROPE (SPAIN) AVERAGE MONTHLY PRICE FOR EXTRA VIRGIN OLIVE OIL (2019/20)

TABLE 4 EUROPE (ITALY) AVERAGE MONTHLY PRICE FOR EXTRA VIRGIN OLIVE OIL (2019/20)

TABLE 5 CHINA AVERAGE PRICE FOR OLIVE OIL (2019/20)

TABLE 6 EUROPE OLIVE OIL PRODUCTION (2016-2022)

TABLE 7 EUROPE OLIVE OIL PRODUCTION (2016-2022)

TABLE 8 U.S CANADA, MEXICO OLIVE OIL PRODUCTION (2016-2020)

TABLE 9 AUSTRALIA OLIVE OIL PRODUCTION (2016-2020)

TABLE 10 EUROPE OLIVE OIL CONSUMPTION (2016-2020)

TABLE 11 EUROPE OLIVE OIL CONSUMPTION (2016-2020)

TABLE 12 NORTH AMERICA (U.S, CANADA, MEXICO) OLIVE OIL CONSUMPTION (2016-2020)

TABLE 13 CHINA OLIVE OIL CONSUMPTION (2016-2020)

TABLE 14 COMPARISON OF OLIVE OIL WITH VEGETABLE OIL

TABLE 15 THE FOLLOWING TABLE SHOWCASES THE FLUCTUATIONS IN THE PRICE OF OLIVE OIL IN CHINA OVER THE YEARS (2016-2019)

TABLE 16 THE FOLLOWING TABLE SHOWS THE SIMILAR CALORIES AND FAT CONTENT BY DIFFERENT OILS AND THE AVERAGE PRICES IN THE YEAR 2021:

TABLE 17 EUROPE OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE EXTRA VIRGIN OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE VIRGIN OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE COMMON OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE REFINED OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LITE/LIGHT OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE POMACE OLIVE OIL IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FRUITY & HERBY IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FRUITY & PEPPERLY IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE MILD & BUTTERLY IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE FULL-BODIED & EARTHY IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 30 EUROPE COLD EXTRACTED IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE COLD PRESSED IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE FIRST-PRESS IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE FOOD & BEVERAGES IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE COSMETICS & PERSONAL CARE IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE PHARMACEUTICALS IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE AROMATHERAPY IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE OTHERS IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 EUROPE STORE BASED IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 EUROPE NON STORE BASED IN OLIVE OIL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 EUROPE OLIVE OIL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 EUROPE OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 49 EUROPE OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 50 EUROPE OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 EUROPE NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 GERMANY OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 58 GERMANY OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 59 GERMANY OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 GERMANY FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 GERMANY BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 GERMANY OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 GERMANY STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 GERMANY NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 U.K. OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.K. OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 67 U.K. OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 68 U.K. OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.K. FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.K. BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.K. OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 U.K. STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 U.K. NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 FRANCE OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 76 FRANCE OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 77 FRANCE OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 FRANCE FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 FRANCE BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 FRANCE OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 FRANCE STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 FRANCE NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 ITALY OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ITALY OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 85 ITALY OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 86 ITALY OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 ITALY FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 ITALY BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 ITALY OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 ITALY STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 91 ITALY NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 92 SPAIN OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 94 SPAIN OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 95 SPAIN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SPAIN FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SPAIN BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SPAIN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 99 SPAIN STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 SPAIN NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 NETHERLANDS OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 NETHERLANDS OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 103 NETHERLANDS OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 104 NETHERLANDS OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 NETHERLANDS FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 NETHERLANDS BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 NETHERLANDS OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 NETHERLANDS STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 BELGIUM OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 BELGIUM OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 112 BELGIUM OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 113 BELGIUM OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 BELGIUM FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 BELGIUM BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 BELGIUM OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 117 BELGIUM STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 BELGIUM NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 131 RUSSIA OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 RUSSIA FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 TURKEY OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 TURKEY OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 139 TURKEY OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 140 TURKEY OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 TURKEY FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 TURKEY BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 TURKEY OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 TURKEY STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 145 TURKEY NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 POLAND OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 POLAND OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 148 POLAND OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 149 POLAND OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 POLAND FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 POLAND BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 POLAND OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 POLAND STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 POLAND NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 155 DENMARK OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 DENMARK OLIVE OIL MARKET, BY FLAVOUR, 2020-2029 (USD MILLION)

TABLE 157 DENMARK OLIVE OIL MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 158 DENMARK OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 DENMARK FOOD & BEVERAGES IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 DENMARK BAKING IN OLIVE OIL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 DENMARK OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 DENMARK STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 DENMARK NON STORE BASED IN OLIVE OIL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 REST OF EUROPE OLIVE OIL MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE OLIVE OIL MARKET: SEGMENTATION

FIGURE 2 EUROPE OLIVE OIL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE OLIVE OIL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE OLIVE OIL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE OLIVE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE OLIVE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE OLIVE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE OLIVE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE OLIVE OIL MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE EUROPE OLIVE OIL MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF OLIVE OIL IN PERSONAL/SKINCARE PRODUCTS, PHARMACEUTICALS AND RAISING AWARENESS ABOUT THE HEALTH BENEFITS MAY LEAD TO THE MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE OLIVE OIL MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE OLIVE OIL MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN CONSUMPTION OF OLIVE OIL FROM 2016 TO 2020

FIGURE 15 EUROPE OLIVE OIL MARKET: BY TYPE, 2021

FIGURE 16 EUROPE OLIVE OIL MARKET: BY FLAVOUR, 2021

FIGURE 17 EUROPE OLIVE OIL MARKET, BY EXTRACTION METHOD, 2021

FIGURE 18 EUROPE OLIVE OIL MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE OLIVE OIL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 EUROPE OLIVE OIL MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE OLIVE OIL MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE OLIVE OIL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE OLIVE OIL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE OLIVE OIL MARKET: BY TYPE (2022 & 2029)

FIGURE 25 EUROPE OLIVE OIL MARKET: COMPANY SHARE 2021 (%)

Europe Olive Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Olive Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Olive Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.