Europe Offsite Sterilization Services Market

Market Size in USD Million

CAGR :

%

USD

603.88 Million

USD

962.00 Million

2021

2029

USD

603.88 Million

USD

962.00 Million

2021

2029

| 2022 –2029 | |

| USD 603.88 Million | |

| USD 962.00 Million | |

|

|

|

Europe Offsite Sterilisation Service Market Analysis and Insights

One strategy used in certain hospitals to address the issues above is sterilizing medical instruments outside the hospital, sometimes known as outsourcing the sterilization process or offsite sterilization centers. Applying this procedure has been the subject of numerous discussions involving cost savings, improved quality and the efficiency of sterilizing medical equipment.

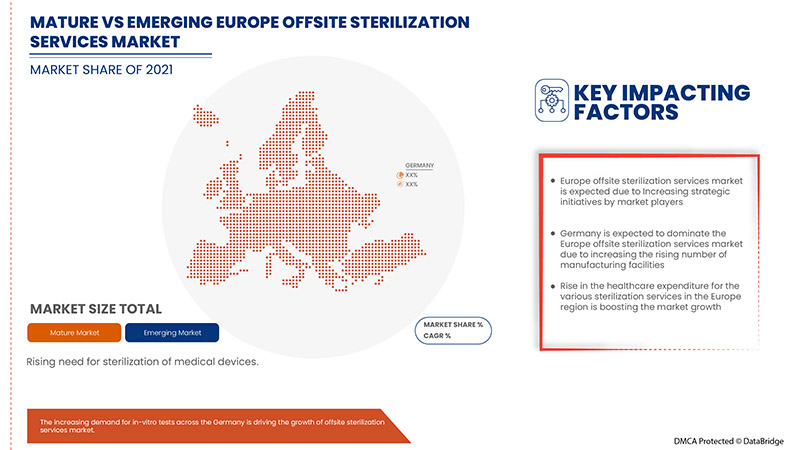

Europe offsite sterilisation service market is expected to grow in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.1% in the forecast period of 2022 to 2029 and is expected to reach USD 962.00 million by 2029 from USD 603.88 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

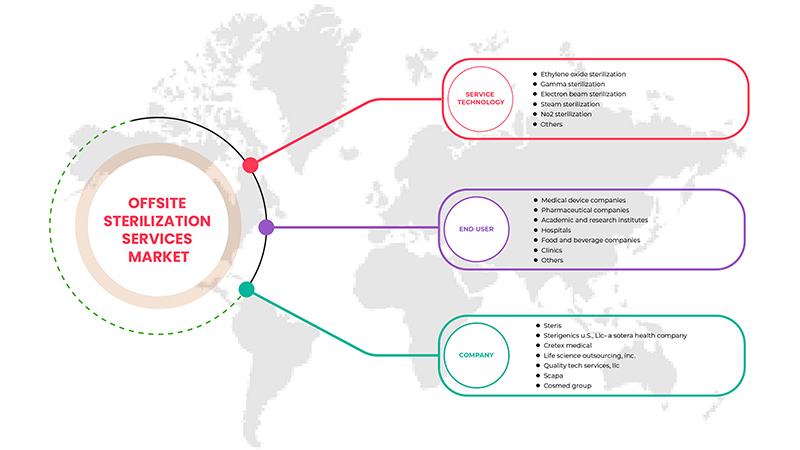

By Service Technology (Ethylene Oxide Sterilisation, Gamma sterilisation, Electron Beam Sterilisation, Steam Sterilisation, NO2 Sterilisation and Others), End User (Hospitals, Clinics, Medical Device Companies, Pharmaceutical Companies, Food & Beverage Companies, Academic & Research Institutes and Others) |

|

Countries Covered |

Germany, France, United Kingdom, Italy, Spain, Netherlands, Russia, Switzerland, Turkey and Rest of Europe |

|

Market Players Covered |

The major companies which are dealing in the market are Sterigenics U.S., LLC (Subsidairy of Sotera Health), STERIS, BGS Beta-Gamma-Service GmbH & Co. KG, Scapa among others |

Market Definition

Sterilization, any physical or chemical process that destroys all life forms, is used primarily to kill microorganisms, spores and viruses. Precisely defined, sterilization is the destruction of all organisms by a suitable chemical agent or by heat, either wet steam under pressure at 120 °C (250 °F) or more for at least 15 minutes or dry heat at 160 to 180 °C (320 to 360 °F) for three hours. In short, sterilization is a process used to remove all kinds of microorganisms like bacteria, viruses, fungi and prions in any area, surface, or medication. They are usually destroyed by using chemicals like glutaraldehyde, chlorine, formaldehyde, etc. They can also be killed by intense radiation or high temperature. They are widely used in food, spacecraft and the medical industry.

Europe Offsite Sterilisation Service Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

- Rise In The Need For Medical Tools And In-Vitro Tests

Testing on human bodily tissue or blood samples is called in vitro diagnostics (IVD). In vitro diagnostics can monitor a person's overall health, diagnose diseases or other disorders and help treat, prevent, or cure illnesses. An extensive range of IVDs is available, from simple self-tests for pregnancy and blood glucose monitors for people with diabetes to complex diagnoses made in clinical laboratories. HIV tests, blood type determination and cancer screening are more examples of IVDs.

Critical items are medical instruments that come into contact with sterile bodily fluids or tissues. When utilized, these objects should be clean to prevent the spread of disease from any microbial contamination. Thus, due to this, the sterilization market is increasing.

- Increased Usage Of E-Beam Sterilization

E-beam irradiation, often known as beta irradiation, is frequently used to sterilize medical equipment and pharmaceutical packaging materials. It works by continuously passing electrons through the items being fixed. The prevalence of such sterilization services is rapidly increasing globally, leading to the demand for E-beam Sterilisation.

Opportunity

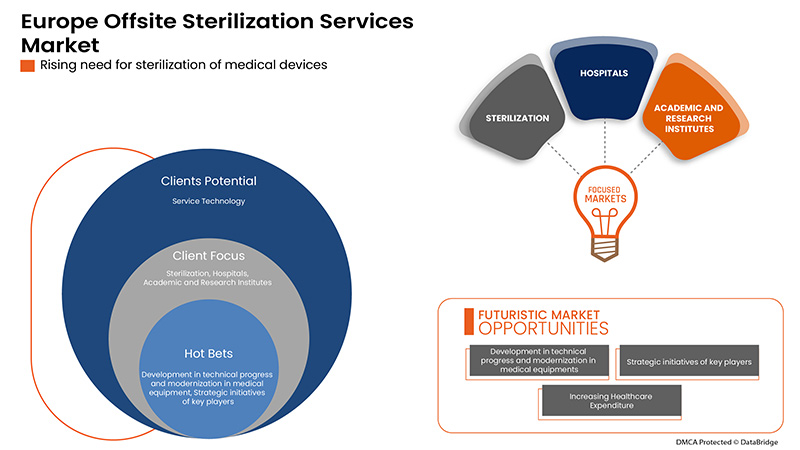

- Rise In Healthcare Expenditure

Healthcare expenditure has increased worldwide as people's disposable incomes in various countries are increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking the initiative to accelerate healthcare expenditure. The rise in healthcare expenditure simultaneously helps healthcare settings to improve their offsite sterilization services over the recent years.

Also, the strategic initiatives key market players take will provide structural integrity and future opportunities for the offsite sterilization services market in the forecast period of 2022-2029.

Restraint/Challenge

- High Cost Of Services

However, the barriers to the local development of sterilization services and the high cost of services in some regions may impede the use of sterilization services hampering the market's growth. Additionally, increased competition in sterilization industries and long lead time for the overseas qualification can be challenging factors for the development of the market

This offsite sterilization service market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on offsite sterilisation service market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Post COVID-19 Impact Offsite Sterilisation Service Market

COVID-19 has positively affected the market. The use of sterilization has increased in those years, such as E-beam sterilization, gamma sterilization and steam sterilization, among others. Hence the use of various sterilization methods has widely grown in the world's population. Therefore, the pandemic has effected positively on this sterilization market.

Recent Development

- In June 2022, According to The Built In article, Beth Israel Deaconess Medical Centre doctors developed AI-enhanced microscopes to scan for harmful bacteria like E. coli and staphylococcus in blood samples at a faster rate than is possible using manual scanning. The scientists used 25,000 images of blood samples to teach the machines how to search for bacteria. The apparatus then learned how to identify and predict harmful bacteria in blood with 95 percent accuracy

Europe Offsite Sterilisation Service Market Scope

Europe offsite sterilisation service market is segmented into service technology and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Service Technology

- Ethylene Oxide Sterilization,

- Gamma sterilization,

- Electron Beam Sterilization,

- Steam Sterilization,

- NO2 Sterilization

- Others

On the basis of service technology, the Europe offsite sterilisation service market is segmented into ethylene oxide sterilisation, gamma sterilisation, electron beam sterilisation, steam sterilisation, no2 sterilisation and others.

End User

- Hospitals

- Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Food & Beverage Companies

- Academic & Research Institutes

- Others

On the basis of end user, the Europe offsite sterilisation service market is segmented into hospitals, clinics, medical device companies, pharmaceutical companies, food & beverage companies, academic & research institutes and others.

Offsite sterilisation service market regional analysis/insights

The offsite sterilisation service market is analysed and market size insights and trends are provided by country, service technology and end user.

The countries included in the region are Germany, France, United Kingdom, Italy, Spain, Netherlands, Russia, Switzerland, Turkey and Rest of Europe.

Germany dominates the offsite sterilisation service market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the escalation in innovation and technologies in the country for sterilization services.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that influence the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology and import-export tariffs, are some of the significant pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and Offsite Sterilisation Service Market Share Analysis

The Offsite Sterilisation Service market competitive landscape provides details by the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth and application dominance. The above data points provided are only related to the companies' focus on Europe offsite sterilisation service market.

Some of the major players operating in the offsite sterilisation service market are Sterigenics U.S., LLC (Subsidiary of Sotera Health), STERIS, BGS Beta-Gamma-Service GmbH & Co. KG, B. Braun Sterilog Ltd (a subsidiary of B. Braun Medical) and Scapa among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and fundamental trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE OFFSITE STERILIZATION SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PARAMETRIC VALIDATION FOR STEAM STERILIZERS

5 EUROPE OFFSITE STERILIZATION SERVICES MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.2 REGULATION IN EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS AND MEDICAL EQUIPMENT

6.1.3 RISING USE OF E-BEAM STERILIZATION

6.2 RESTRAINTS

6.2.1 CONCERNS REGARDING THE SAFETY OF REPROCESSED INSTRUMENTS

6.2.2 STRINGENT GOVERNMENT RULES AND REGULATIONS FOR THE STERILIZATION PROCESS

6.3 OPPORTUNITIES

6.3.1 INCREASING TECHNICAL PROGRESS AND MODERNIZATION IN MEDICAL EQUIPMENT

6.3.2 INCREASED INTEREST IN DEVELOPING ECONOMIES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 INCREASING UNDERSTANDING OF ETHYLENE OXIDE'S NEGATIVE EFFECTS

6.4.2 INCREASE IN THE SOPHISTICATED MEDICAL INSTRUMENT STERILISATION

7 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY

7.1 OVERVIEW

7.2 ETHYLENE OXIDE STERILIZATION, BY APPLICATION

7.2.1 TEMPERATURE SENSITIVE PRODUCTS

7.2.2 PRODUCT WITH INTEGRATED BATTERIES

7.2.3 PRODUCTS WITH INTEGRATED ELECTRONICS

7.2.4 POLYMER BASED PRODUCTS

7.2.5 SINGLE USE MEDICAL DEVICE

7.2.6 IMPLANTS

7.2.7 PHARMACEUTICAL VIALS

7.2.8 DRUG DEVICE COMBINATION PRODUCTS

7.2.9 OTHERS

7.3 GAMMA STERILIZATION, BY APPLICATION

7.3.1 SINGLE USE MEDICAL PRODUCTS

7.3.2 PACKAGED PRODUCTS

7.3.3 FOOD PRODUCTS

7.3.4 PHARMACEUTICAL PRODUCT AND PACKAGING

7.3.5 IMPLANTABLE MEDICAL DEVICES

7.3.5.1 STENTS

7.3.5.2 HEART VALVES

7.3.5.3 OTHERS

7.3.6 RAW MATERIALS

7.3.7 TISSUE BASED DEVICES

7.3.8 OTHERS

7.4 ELECTRON BEAM STERILIZATION, BY STERILIZATION

7.4.1 LOW DENSITY, UNIFORMLY PACKAGED PRODUCTS

7.4.2 SEMICONDUCTOR ENHANCEMENT

7.4.3 CUSTOMIZED DOSE RANGES

7.4.4 BIOLOGICS AND TISSUE

7.4.5 OTHERS

7.5 STEAM STERILIZATION, BY STERILIZATION

7.5.1 METALLIC SURGICAL INSTRUMENTS

7.5.2 FILLED SYRINGES

7.5.3 LIQUID IN OPEN OR CLOSED CONTAINERS

7.5.4 GELS IN OPEN OR CLOSED CONTAINERS

7.5.5 PHARMACEUTICAL VIALS

7.5.6 GLASS BASED PRODUCTS

7.5.7 CERAMIC BASED PRODUCTS

7.5.8 POROUS FABRICS

7.5.9 OTHERS

7.6 NO2 STERILIZATION, BY APPLICATION

7.6.1 PRE-FILLED SYRINGES AND COMBINATION PRODUCTS

7.6.2 MEDICAL DEVICES

7.6.3 ORTHOPEDIC IMPLANTS

7.6.4 OTHERS

7.7 OTHERS

8 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 MEDICAL DEVICE COMPANIES

8.3 PHARMACEUTICAL COMPANIES

8.4 ACADEMIC AND RESEARCH INSTITUTES

8.5 HOSPITALS

8.6 FOOD AND BEVERAGE COMPANIES

8.7 CLINICS

8.8 OTHERS

9 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 FRANCE

9.1.3 UNITED KINGDOM

9.1.4 ITALY

9.1.5 RUSSIA

9.1.6 SPAIN

9.1.7 TURKEY

9.1.8 NETHERLANDS

9.1.9 SWITZERLAND

9.1.10 REST OF EUROPE

10 EUROPE OFFSITE STERILIZATION SERVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 STERIS.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 STERIGENICS U.S., LLC- A SOTERA HEALTH COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ROCHLING SE & CO.KG

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 STERITECH

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 SCAPA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 BGS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 ANDERSEN SCIENTIFIC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 B BRAUN STERILOG LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BLUE LINE STERILIZATION SERVICES LLC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 CLORDISYS SOLUTIONS

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 COSMED GROUP

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 CRETEX MEDICAL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 E-BEAM SERVICES, INC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 EUROPLAZ TECHNOLOGIES LIMITED

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 INFINITY LABORATORIES

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 LIFE SCIENCE OUTSOURCING, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENTS

12.17 MEDISTRI SA

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 MICROTROL STERILISATION SERVICES PVT LTD.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 MIDWEST STERILIZATION CORPORATION

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 PRINCE STERILIZATION SERVICES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 PROTECH DESIGN & MANUFACTURING

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS

12.22 QUALITY TECH SERVICES, LLC

12.22.1 COMPANY SNAPSHOT

12.22.2 PRODUCT PORTFOLIO

12.22.3 RECENT DEVELOPMENTS

12.23 READYSET SURGICAL

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENTS

12.24 SIAM STERI SERVICE.CO., LTD.

12.24.1 COMPANY SNAPSHOT

12.24.2 PRODUCT PORTFOLIO

12.24.3 RECENT DEVELOPMENTS

12.25 STERILE SERVICES SINGAPORE

12.25.1 COMPANY SNAPSHOT

12.25.2 PRODUCT PORTFOLIO

12.25.3 RECENT DEVELOPMENTS

12.26 SURGICAL HOLDINGS

12.26.1 COMPANY SNAPSHOT

12.26.2 PRODUCT PORTFOLIO

12.26.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 EUROPE ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 15 EUROPE MEDICAL DEVICE COMPANIES IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHARMACEUTICAL COMPANIES IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ACADEMIC AND RESEARCH INSTITUTES IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HOSPITALS IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FOOD AND BEVERAGE COMPANIES IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE CLINICS IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE OTHERS IN OFFSITE STERILIZATION SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 GERMANY OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 GERMANY ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 GERMANY GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 GERMANY IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 GERMANY ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 GERMANY STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 GERMANY NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 GERMANY OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 FRANCE OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 40 FRANCE ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 FRANCE GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 FRANCE IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 FRANCE ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 FRANCE STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 FRANCE NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 FRANCE OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 UNITED KINGDOM OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 UNITED KINGDOM ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 UNITED KINGDOM GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 UNITED KINGDOM IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 UNITED KINGDOM ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 UNITED KINGDOM STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 UNITED KINGDOM NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 UNITED KINGDOM OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ITALY OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 ITALY ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 ITALY GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ITALY IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 ITALY ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 ITALY STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 ITALY NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ITALY OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 RUSSIA OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 RUSSIA ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 RUSSIA GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 RUSSIA IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 RUSSIA ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 RUSSIA STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 RUSSIA NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 RUSSIA OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 SPAIN OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 SPAIN ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 SPAIN GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SPAIN IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SPAIN ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SPAIN STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 SPAIN NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 SPAIN OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 TURKEY OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 TURKEY ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 TURKEY GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 TURKEY IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 TURKEY ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 TURKEY STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 TURKEY NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 TURKEY OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 NETHERLANDS OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 NETHERLANDS ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 NETHERLANDS GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 NETHERLANDS IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 NETHERLANDS ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 SWITZERLAND OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 SWITZERLAND ETHYLENE OXIDE STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SWITZERLAND GAMMA STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SWITZERLAND IMPLANTABLE MEDICAL DEVICES IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 SWITZERLAND ELECTRON BEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SWITZERLAND STEAM STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SWITZERLAND NO2 STERILIZATION IN OFFSITE STERILIZATION SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SWITZERLAND OFFSITE STERILIZATION SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 REST OF EUROPE OFFSITE STERILIZATION SERVICES MARKET, BY SERVICE TECHNOLOGY, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE OFFSITE STERILIZATION SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE OFFSITE STERILIZATION SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE OFFSITE STERILIZATION SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE OFFSITE STERILIZATION SERVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE OFFSITE STERILIZATION SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE OFFSITE STERILIZATION SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE OFFSITE STERILIZATION SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE OFFSITE STERILIZATION SERVICES MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 EUROPE OFFSITE STERILIZATION SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE OFFSITE STERILIZATION SERVICES MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF HOSPITAL-ACQUIRED INFECTIONS AND RISING USE OF E-BEAM STERILIZATION ARE EXPECTED TO DRIVE THE EUROPE OFFSITE STERILIZATION SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ETHYLENE OXIDE STERILIZATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE OFFSITE STERILIZATION SERVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE OFFSITE STERILIZATION SERVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE OFFSITE STERILIZATION SERVICES MARKET

FIGURE 15 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY SERVICE TECHNOLOGY, 2021

FIGURE 16 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY SERVICE TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY SERVICE TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY SERVICE TECHNOLOGY, LIFELINE CURVE

FIGURE 19 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY END USER, 2021

FIGURE 20 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 21 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 22 EUROPE OFFSITE STERILIZATION SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 23 EUROPE OFFSITE STERILIZATION SERVICE MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE OFFSITE STERILIZATION SERVICE MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE OFFSITE STERILIZATION SERVICE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE OFFSITE STERILIZATION SERVICE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE OFFSITE STERILIZATION SERVICE MARKET: BY SERVICE TECHNOLOGY (2022-2029)

FIGURE 28 EUROPE OFFSITE STERILIZATION SERVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.