Market Analysis and Size

The process of automating the configuration, operation, deployment, testing, and management of virtual and physical devices in a network is referred to as network automation. The availability of the network service will increase as everyday functions and network testing, as well as repetitive procedures, are handled and controlled automatically. Any network can benefit from network automation. Enterprises, service providers, and data centres can use software and hardware-based solutions to automate their networks, lowering operational costs, reducing human error, and increasing productivity.

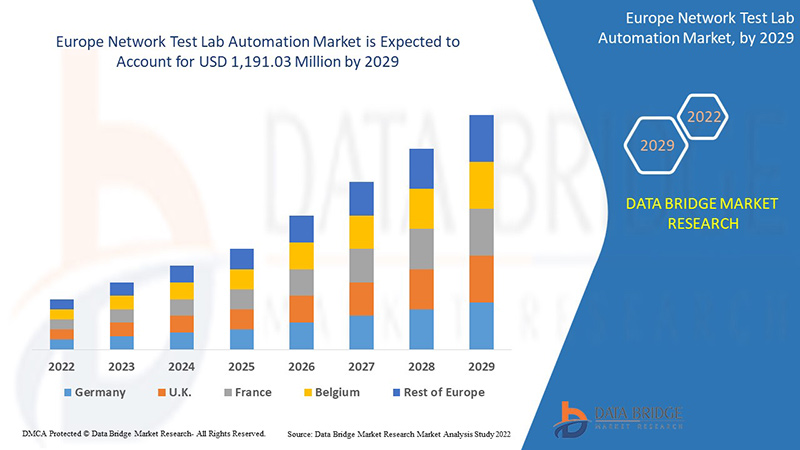

Data Bridge Market Research analyses that the Europe network test lab automation market is expected to reach the value of USD 1,191.03 million by 2029. The network test lab automation market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Component (Hardware, Software, Services), Network Type (Physical Network, Virtual Network, Hybrid Network), Testing Type (Functional Testing, Regression Testing, Performance Testing), Deployment Mode (Cloud, On-Premise, Hybrid), End-User (Enterprise Vertical, Service Provider), Organization Size (Large Enterprise, Small & Medium Enterprise), Automation Type (Modular Automation, Total Lab Automation) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Fiber Smart Networks, Cisco, Sedona Systems, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Segron Automation S.R.O., Phoenix Datacom Limited, HCL Technologies. |

Market Definition

As industries and enterprises accelerate their digital transformation initiatives, new product and technology cycles are getting shorter. To ensure success of new technology introduction in existing operational environments, it is critical to have the right resources to extensively test and validate the device, product or solution for real world reliability, performance and interoperability. Since testing on simulated environments introduces significant future risks, most enterprises make considerable investments in building lab infrastructure and expertise or get it tested by network test lab automation service providers. As these new technologies and products from industries and enterprises are more complex than before and enterprises face a skills gap in networking, testing, monitoring and automation; the service providers do the testing on behalf of enterprises. The services provider may use testing type such as functional, performance or regression for the proposed product and take help of various tools in test. The arrival of Artificial Intelligence and its integration with IOTs and 5G will rise the rate of digital products in all industries and has to be tested before launch. This will make the Europe network test lab automation market bloom in the future.

Network Test Lab Automation Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in demand for automation and solution for seamless customer experience

Nowadays, research and pathology laboratories have undergone significant evolution in the last two decades. In the labs, there is a growing demand for technologically advanced automated instruments and laboratory systems. Several innovations, including lab automation, are being driven by the desire to improve diagnoses, medication discovery, and research.

With lab automation, different lab scientists and professionals are able to achieve next-gen speed, consistency, and precision in research and report generation. Furthermore, lab automation advancements have resulted in the standardization of processes that help in reducing the number of errors. Therefore, the increasing evaluation of real-time results with the help of automated techniques and the growing cases of diagnosis has resulted in a significant demand for advanced software and cutting-edge automated systems.

- Penetration of cloud based storage options for various lab applications

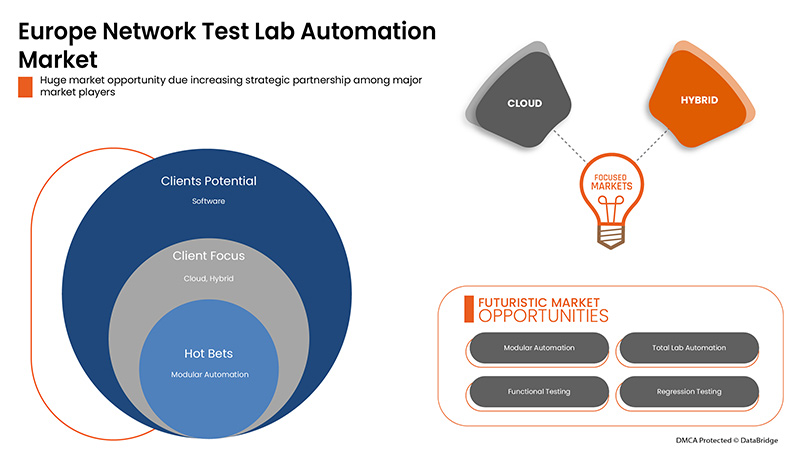

Over the last few decades, it is reported that 90% of businesses have chosen the cloud-based solutions over traditional computing and data storage methods for benefits like better insights, easier collaboration, and reduced costs for the organizations. However, increased cloud usage means that businesses also need to manage their cloud infrastructure more efficiently in order to manage operational efficiency and reduced complexity. Cloud automation refers to the use of software and processes to automate the provisioning and management of cloud computing workloads and services such as virtual network creation, virtual machine deployment, load balancing, and performance monitoring. Using cloud automation, IT administrators can reduce or eliminate manual processes to lower administrative overhead and speed up the delivery of resources.

Opportunities

- Growing need of network automation & testing for digital transformation

Digital transformation is the process of using digital technologies to transform existing traditional and non-digital business processes and services, or creating new ones, to meet the evolving market and customer expectations. Thus it is completely altering the way businesses are managed and operated, and how value is delivered to customers. Digital transformation is important as it allows organizations to adapt to ever-changing industries and continually improve its operations accordingly. Every digital transformation initiative will have its own specific goals. The main purpose of any digital transformation is to improve the current processes. But, the digital transformation of organizations, it requires extensive planning, proper resource management, testing & development of products and software with huge capital investment. If not done, it can take a long time to implement the software and business model which result leads in a loss of capital and time for an organisation. According to a Bain & Company study, only 8% of global companies have been able to achieve their targeted business outcomes from their investments in digital technology. This makes the integration of network automation and testing very essential for the successful digital transformation.

Restraints/Challenges

- Rise in complexity of lab automation systems and thereby increasing the risk of downtime

Network lab automation processes have been implemented across the globe to benefit from decreasing the necessity for human staff and to perform repetitive tasks by implementing automated machine processes instead. But the higher the complexity of the system, the greater the risk that a system failure would generate serious consequences on laboratory functioning. Many critical system failures, especially involving the assembly lines, would require restoring manual procedures for managing samples (i.e. manual sorting, centrifugation). Although in most labs, it is found that resources are a limiting factor for development and testing. A traditional way to manage the labs and coordinate schedules is to use patch panels and change connections manually. However, this approach is not scalable and is inefficient in many cases.

- Lack of skilled workforce and experienced expertise

Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and Automation are new technologies which have the potential to transform the network testing industry over the next decade. These technological trends have become even more important with the COVID-19 pandemic changing the tech-driven landscape. With the global pandemic changing workforce dynamics, the reliance on cutting-edge software, web, and mobile applications has grown substantially. To support this ever-growing demand, businesses turned to technology to increase the need to release fully functional, feature-rich, and flawless products and software to their end-users. As a result, in came test automation brought the promise of extensive test coverage, scientific test accuracy, streamlined testing operations, lower cost, and increased resource efficiency. This resulted in the need for a large skilled workforce for the industry to meet the rising demand. A skilled worker is any worker who has special skills, training, or knowledge that they can then apply to their work. The skills required for the network testing industry may include proficiency in various programming languages, mastery of leading automation testing tools (codeless ones too), should have experience in manual testing and knowledge of test management tools with an understanding of business requirements. This requirement narrowed down the number of skilled labour for the industry additionally the demand for this role is increasing as less qualified labour is in the industry.

Post COVID-19 Impact on Network Test Lab Automation Market

COVID-19 created a positive impact on the network test lab automation market due to rapid adoption of remote working and cloud infrastructure.

The COVID-19 pandemic has impacted the network test lab automation market to an extent in positive manner. Increasing adoption and utilization of artificial intelligence and machine learning in enterprises has helped the market to grow during and after the pandemic. Also, the growth has been high after the market has opened after COVID-19, and it is expected that there would be considerable growth in the sector owing to higher demand of industry 4.0 and automation technology.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the network test lab automation. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for use of automation technology has led to the market's growth

Recent Development

- In April 2022, Keysight Technologies, Inc. announced that its automated field-to-lab device test platform solutions have been selected by Xiaomi. Xiaomi chose Keysight's test tools to verify 5G device performance under a variety of network signaling and radio channel circumstances. To develop advanced 5G test solutions, Keysight effectively combined lab and field-based test capabilities. This collaboration will enhance the client portfolio and the presence of the company.

- In January 2022, Spirent acquires octoScope to expand WiFi testing capabilities. octoScope’s test solutions comprise automated Wi-Fi and 5G testing in emulated real-world-like environments, including the latest WiFi 6 and WiFi 6E technologies. This acquisition will help in wireless network test solutions company to expand WiFi testing capabilities also enhance the services and also brand reorganization across the globe.

Europe Network Test Lab Automation Market Scope

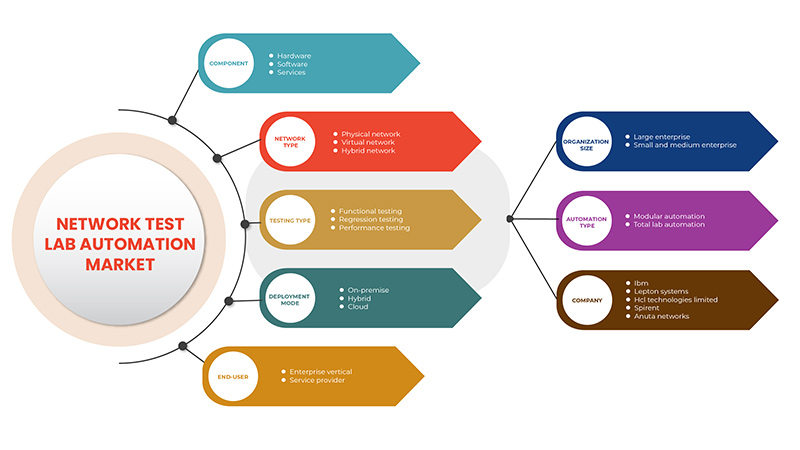

The network test lab automation market is segmented on the basis of component, network type, testing type, deployment mode, end-user, organization size, automation type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

On the basis of component, the Europe network test lab automation market is segmented into hardware, software, services.

Network Type

- Physical Network

- Virtual Network

- Hybrid Network

On the basis of network type, the Europe network test lab automation market has been segmented into physical network, virtual network, hybrid network.

Testing Type

- Functional Testing

- Regression Testing

- Performance Testing

On the basis of testing type, the Europe network test lab automation market has been segmented into functional testing, regression testing, performance testing.

Deployment Mode

- Cloud

- Hybrid

- On-Premise

On the basis of deployment mode, the Europe network test lab automation market is segmented into cloud, hybrid, on-premise.

End-User

- Enterprise Vertical

- Service Provider

On the basis of end-user, the Europe network test lab automation market has been segmented into enterprise vertical, service provider.

Organization Size

- Large Enterprise

- Small & Medium Enterprise

On the basis of organization size, the Europe network test lab automation market is segmented into large enterprise, small & medium enterprise.

Automation Type

- Modular Automation

- Total Lab Automation

On the basis of automation type, the Europe network test lab automation market is segmented into modular automation, total lab automation.

Network Test Lab Automation Market Regional Analysis/Insights

The network test lab automation market is analysed and market size insights and trends are provided by country, component, network type, testing type, deployment mode, end-user, organization size and automation type as referenced above.

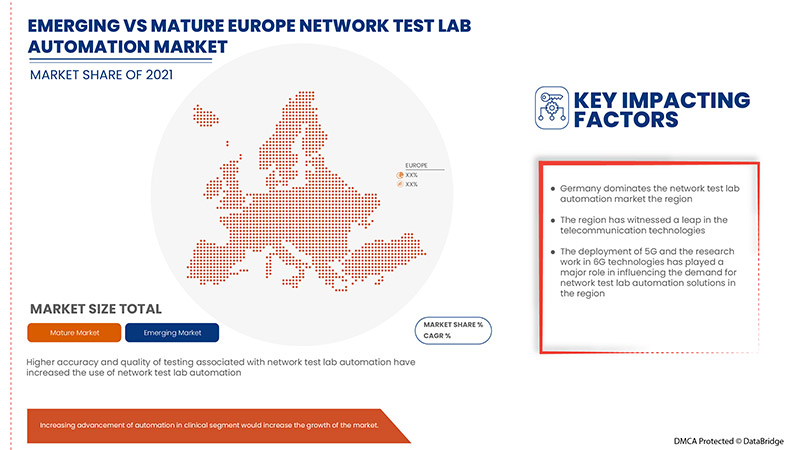

The countries covered in the network test lab automation market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe. Germany dominates in Europe region due to rapid deployment of 5G and the research work in 6G technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Network test lab automation Market Share Analysis

The network test lab automation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to network test lab automation market.

Some of the major players operating in the network test lab automation market are: Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Fiber Smart Networks, Cisco, Sedona Systems, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Segron Automation S.R.O., Phoenix Datacom Limited, HCL Technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NETWORK TEST LAB AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL TRENDS

4.2 CASE STUDIES

4.2.1 AUTOMATION OF API TESTING FOR NETWORK APPLICATION

4.2.2 CIRCUIT SWITCHED CORE NETWORK AUTOMATION

4.3 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

5.1.2 INTEGRATION OF LAB AUTOMATION SYSTEM ACROSS THE REGION

5.1.3 PENETRATION OF CLOUD BASED STORAGE OPTIONS FOR VARIOUS LAB APPLICATIONS

5.1.4 HIGHER ACCURACY AND QUALITY OF TESTING ASSOCIATED WITH NETWORK TEST LAB AUTOMATION

5.2 RESTRAINTS

5.2.1 HIGHER COST FOR IMPLEMENTATION OF LAB AUTOMATION SYSTEMS

5.2.2 RISE IN COMPLEXITY OF LAB AUTOMATION SYSTEMS AND THEREBY INCREASING THE RISK OF DOWNTIME

5.3 OPPORTUNITIES

5.3.1 GROWING NEED OF NETWORK AUTOMATION & TESTING FOR DIGITAL TRANSFORMATION

5.3.2 INCREASING ADVANCEMENT OF AUTOMATION IN MEDICAL SEGMENT

5.3.3 ADVENT OF ARTIFICIAL INTELLIGENCE IN NETWORK AUTOMATION AND TESTING

5.3.4 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LACK OF END USER FRIENDLY TOOLS IN TEST LAB AUTOMATION

5.4.2 LACK OF SKILLED WORKFORCE AND EXPERIENCED EXPERTISE

6 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 TEST AS A SERVICE

6.2.2 NETWORK AUTOMATION TOOLS

6.2.3 TEST LAB AS A SERVICE (LAAS)

6.2.4 INTENT-BASED NETWORKING

6.3 HARDWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICE

6.4.1.1 DEPLOYMENT AND INTEGRATION SERVICES

6.4.1.2 TRAINING AND SUPPORT SERVICES

6.4.1.3 ADVISORY AND CONSULTING SERVICE

6.4.2 MANAGED SERVICE

7 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE

7.1 OVERVIEW

7.2 VIRTUAL NETWORK

7.3 HYBRID NETWORK

7.4 PHYSICAL NETWORK

8 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 FUNCTIONAL TESTING

8.3 REGRESSION TESTING

8.4 PERFORMANCE TESTING

9 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

9.4 HYBRID

10 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY END-USER

10.1 OVERVIEW

10.2 ENTERPRISE VERTICAL

10.2.1 INFORMATION TECHNOLOGY

10.2.2 BANKING, FINANCIAL SERVICE AND INSURANCE

10.2.3 MANUFACTURING

10.2.4 HEALTHCARE

10.2.5 EDUCATION

10.2.6 ENERGY AND UTILITIES

10.2.7 OTHERS

10.3 SERVICE PROVIDER

11 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE

11.1 OVERVIEW

11.2 MODULAR AUTOMATION

11.3 TOTAL LAB AUTOMATION

12 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE

12.1 OVERVIEW

12.2 LARGE ENTERPRISE

12.3 SMALL AND MEDIUM ENTERPRISE

13 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 SWITZERLAND

13.1.9 BELGIUM

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 EUROPE NETWORK TEST LAB AUTOMATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KEYSIGHT TECHNOLOGIES

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SOLUTION PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IBM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SPIRENT COMMUNICATIONS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CISCO SYSTEMS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HCL TECHNOLOGIES LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTIONS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACCUVER

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ANUTA NETWORKS PVT. LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 APPVIEWX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BELL INTEGRATOR

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CALIENT TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DANAHER

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 BRAND PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FIBER MOUNTAIN

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FIBER SMART NETWORKS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GREAT SOFTWARE LABORATORY

16.14.1 COMPANY SNAPHSOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 JUNIPER NETWORKS, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 KENTIK

16.16.1 COMPANY SNAPSHOT

16.16.2 SOLUTION PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LEPTON SYSTEMS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 NETBRAIN TECHNOLOGIES, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NETSCOUT

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PHOENIX DATACOM LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 SOLUTION PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PLURIBUS NETWORKS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 POLATIS, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 QUALISYSTEMS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SEGRON AUTOMATION S.R.O

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VERSA NETWORKS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPRO LIMITED

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 ZPE SYSTEMS, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 SOLUTION PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 EUROPE SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 3 EUROPE SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 6 EUROPE SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE VIRTUAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE HYBRID NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PHYSICAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE FUNCTIONAL TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE REGRESSION TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PERFORMANCE TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CLOUD IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ON-PREMISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE HYBRID IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SERVICE PROVIDER IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE MODULAR AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE TOTAL LAB AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE LARGE ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE SMALL AND MEDIUM ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 EUROPE ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 42 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 GERMANY SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 GERMANY ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 U.K. SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 60 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 61 U.K. ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 U.K. NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 FRANCE SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 FRANCE ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 75 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 76 ITALY SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 ITALY SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 80 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 81 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 82 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 83 ITALY ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 85 ITALY NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 86 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 SPAIN SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SPAIN SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SPAIN PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 91 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 92 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 94 SPAIN ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 SPAIN NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 104 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 RUSSIA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 130 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 131 BELGIUM SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 137 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 141 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 142 TURKEY SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 TURKEY SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 TURKEY PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 146 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 147 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 148 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 149 TURKEY ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 151 TURKEY NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 152 REST OF EUROPE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 EUROPE NETWORK TEST LAB AUTOMATION MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE NETWORK TEST LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NETWORK TEST LAB AUTOMATION MARKET:REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE NETWORK TEST LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NETWORK TEST LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NETWORK TEST LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NETWORK TEST LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE NETWORK TEST LAB AUTOMATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 EUROPE NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 INTEGRATION OF LAB AUTOMATION ACROSS THE REGION MAGNET IS EXPECTED TO BE KEY DRIVERS THE MARKET FOR EUROPE NETWORK TEST LAB AUTOMATION MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE NETWORK TEST LAB AUTOMATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF EUROPE NETWORK TEST LAB AUTOMATION MARKET

FIGURE 14 TYPE OF CLOUD COMPUTING SERVICE, BY SERVICE MODEL, 2021 (EUROPE)

FIGURE 15 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT, 2021

FIGURE 16 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY NETWORK TYPE, 2021

FIGURE 17 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY TESTING TYPE, 2021

FIGURE 18 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY END-USER, 2021

FIGURE 20 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 EUROPE NETWORK TEST LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT (2022-2029)

FIGURE 27 EUROPE NETWORK TEST LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.