Europe Needle Biopsy Market

Market Size in USD Million

CAGR :

%

USD

283.34 Million

USD

461.93 Million

2025

2033

USD

283.34 Million

USD

461.93 Million

2025

2033

| 2026 –2033 | |

| USD 283.34 Million | |

| USD 461.93 Million | |

|

|

|

|

Europe Needle Biopsy Market Size

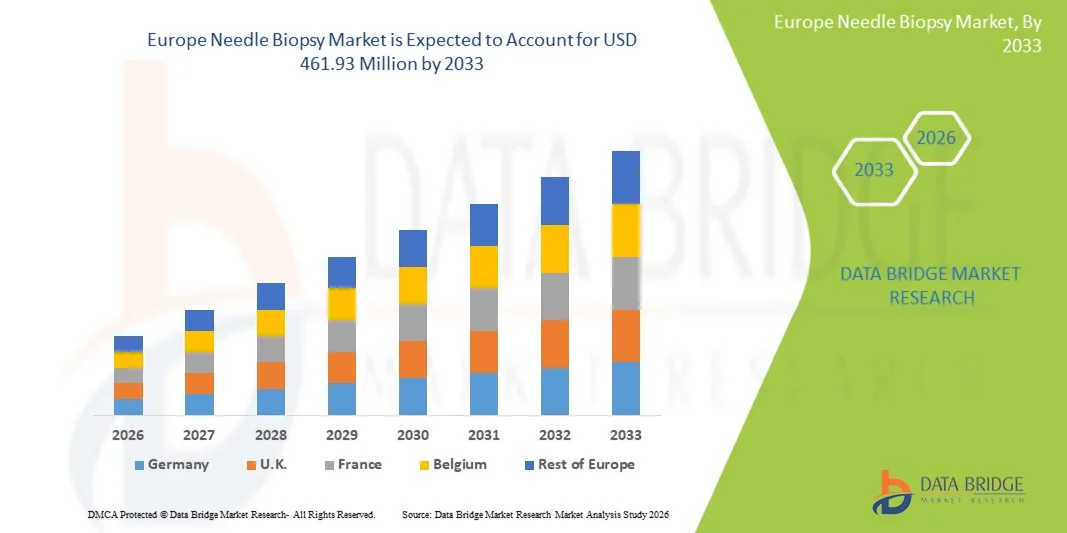

- The Europe needle biopsy market size was valued at USD 283.34 million in 2025 and is expected to reach USD 461.93 million by 2033, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer and other chronic diseases in the region, coupled with increasing awareness and adoption of minimally invasive diagnostic procedures

- Furthermore, advancements in imaging technologies, such as ultrasound, CT, and MRI-guided biopsy systems, along with the growing demand for precise and early disease detection, are positioning needle biopsy as a preferred diagnostic tool in hospitals and diagnostic centers. These factors are collectively driving the adoption of needle biopsy solutions, thereby significantly boosting the industry's growth

Europe Needle Biopsy Market Analysis

- Needle biopsy, involving the minimally invasive extraction of tissue samples for diagnostic evaluation, is becoming an essential tool in modern oncology and pathology workflows across hospitals, diagnostic centers, and specialty clinics in Europe due to its accuracy, safety, and reduced recovery time compared with surgical biopsy procedures

- The increasing demand for needle biopsy is primarily driven by the rising prevalence of cancer and chronic diseases, growing awareness of early diagnosis, and a preference for minimally invasive diagnostic solutions that reduce patient discomfort and procedural risks

- Germany dominated the Europe needle biopsy market with the largest revenue share of 38.1% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced imaging-guided biopsy techniques, and the presence of key market players focusing on innovative and precise biopsy systems

- Poland is expected to be the fastest-growing country in the Europe needle biopsy market during the forecast period due to increasing healthcare investments, expanding diagnostic centers, and rising awareness of minimally invasive procedures

- Core needle biopsy segment dominated the Europe needle biopsy market with a market share of 45.8% in 2025, driven by its accuracy, reliability in cancer detection, and suitability for a wide range of tissue types

Report Scope and Europe Needle Biopsy Market Segmentation

|

Attributes |

Europe Needle Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Needle Biopsy Market Trends

“Advancements in Imaging-Guided and AI-Assisted Biopsy Systems”

- A significant and accelerating trend in the Europe needle biopsy market is the integration of advanced imaging modalities such as ultrasound, CT, and MRI with AI-assisted guidance systems, improving the precision and accuracy of tissue sampling

- For instance, the Visumax Biopsy System combines high-resolution imaging with AI algorithms to assist radiologists in targeting lesions with minimal invasiveness, reducing sampling errors and repeat procedures

- AI-enabled biopsy systems can learn from historical patient data to suggest optimal needle paths, predict tissue characteristics, and provide real-time feedback to operators, enhancing procedural efficiency and diagnostic reliability

- The seamless integration of needle biopsy devices with hospital PACS and digital pathology platforms enables centralized management of diagnostic workflows, including real-time image analysis, biopsy reporting, and record-keeping, streamlining the overall diagnostic process

- This trend towards intelligent, precise, and integrated biopsy systems is fundamentally improving diagnostic confidence and patient outcomes. Consequently, companies such as Becton Dickinson are developing AI-assisted biopsy devices capable of automated lesion detection and real-time procedural guidance

- The demand for needle biopsy solutions featuring AI-driven imaging support is growing rapidly across hospitals and diagnostic centers, as clinicians increasingly prioritize diagnostic accuracy and workflow efficiency

- Collaboration between biopsy device manufacturers and software providers to offer integrated AI analytics platforms is increasing, supporting faster diagnosis and better treatment planning

Europe Needle Biopsy Market Dynamics

Driver

“Rising Prevalence of Cancer and Chronic Diseases”

- The increasing incidence of cancer and other chronic conditions across European populations, combined with a growing emphasis on early diagnosis, is a major driver of the demand for needle biopsy procedures

- For instance, in March 2025, Hologic, Inc. introduced an advanced core needle biopsy system designed for minimally invasive breast and prostate sampling, emphasizing precision and patient comfort

- Clinicians are favoring needle biopsy due to its minimally invasive nature, lower complication rates, and faster recovery compared with surgical biopsies, making it a preferred diagnostic option in modern healthcare settings

- Furthermore, the increasing awareness of early detection programs and national cancer screening initiatives is boosting adoption of needle biopsy in hospitals and diagnostic centers

- The ease of integrating needle biopsy procedures into existing imaging workflows, combined with higher patient acceptance, is propelling market growth in both public and private healthcare institutions

- Growing investments in hospital infrastructure and diagnostic centers across Europe are facilitating wider access to needle biopsy procedures

- Rising collaborations between device manufacturers and healthcare providers to develop customized biopsy solutions for specific cancer types are further driving market demand

Restraint/Challenge

“High Procedure Costs and Regulatory Barriers”

- The relatively high cost of advanced needle biopsy systems and disposables can limit adoption, particularly in smaller clinics or in cost-sensitive countries, posing a challenge to broader market penetration

- For instance, reports of elevated pricing for AI-assisted biopsy systems have made some hospitals hesitant to invest in next-generation devices despite their clinical advantages

- Strict regulatory requirements for medical device approvals, including CE marking and compliance with EU MDR, can delay market entry for new biopsy technologies, impacting adoption timelines

- In addition, the need for skilled personnel to operate sophisticated imaging-guided and AI-assisted biopsy systems can act as a barrier for facilities lacking trained staff, particularly in less urbanized areas

- Overcoming these challenges through cost optimization, streamlined regulatory approvals, and clinician training programs will be crucial for sustained growth in the Europe needle biopsy market

- Limited reimbursement policies in some European countries for advanced biopsy procedures may hinder adoption among private healthcare providers

- Concerns about patient discomfort and procedural risks in certain high-risk cases can restrict the use of needle biopsy, especially in smaller or older patient populations

Europe Needle Biopsy Market Scope

The market is segmented on the basis of needle type, ergonomics, procedure, sample site, utility, application, end user, and distribution channel.

- By Needle Type

On the basis of needle type, the Europe needle biopsy market is segmented into trephine biopsy needles, klima sternal needle, salah needle aspiration needle, jamshidi needle, and others. The core needle segment dominated the market with the largest revenue share in 2025, driven by its high accuracy, reliability in cancer detection, and suitability for multiple tissue types. Hospitals and diagnostic centers prefer core needles for routine oncology diagnostics due to minimal complications and consistent sample quality. Their compatibility with image-guided procedures enhances diagnostic confidence and procedural safety. Increasing use in breast, prostate, liver, and thyroid biopsies further strengthens their dominance. Widespread clinician training and established clinical protocols also support continued adoption.

The Jamshidi needle segment is anticipated to witness the fastest growth during the forecast period, fueled by its specialized use in bone marrow and orthopedic biopsies. Its design allows precise penetration with minimal patient discomfort, ensuring higher sample integrity. Rising prevalence of hematologic malignancies and orthopedic diagnostic procedures is driving demand. Academic and research institutions are increasingly using Jamshidi needles for experimental studies. Technological improvements enhancing usability and safety are accelerating adoption. Growing awareness among clinicians about minimally invasive alternatives also contributes to market growth.

- By Ergonomics

On the basis of ergonomics, the market is segmented into sharp, blunt, quincke, chiba, franseen, and others. The Franseen needle segment dominated the market in 2025 due to its unique three-pronged tip, which allows superior tissue acquisition and higher diagnostic yield. Clinicians prefer Franseen needles for both fine-needle aspiration and core needle biopsy procedures. Its design minimizes procedural complications and preserves sample integrity. Widespread usage in liver, pancreatic, breast, and thyroid biopsies further strengthens its dominance. Integration with imaging-guided systems enhances precision and procedural success. Established familiarity among clinicians ensures strong continued adoption in hospitals and diagnostic centers.

The Chiba needle segment is expected to witness the fastest growth from 2026 to 2033 due to its fine gauge and versatility in minimally invasive procedures. It is increasingly used for small lesion targeting under imaging guidance. Rising demand for patient-friendly, low-risk techniques in outpatient and ambulatory care settings is fueling growth. Its design reduces bleeding and procedural discomfort, which appeals to both clinicians and patients. Adoption in emerging European healthcare markets, supported by training programs, further accelerates expansion. Integration with AI-assisted planning tools also contributes to faster adoption.

- By Procedure

On the basis of procedure, the market is segmented into fine-needle aspiration biopsy, core needle biopsy, vacuum-assisted biopsy, and image-guided biopsy. The core needle biopsy segment dominated in 2025 with a market share of 45.8% due to its high accuracy, reproducibility, and suitability for multiple tissue types. It is widely adopted for breast, prostate, liver, and thyroid cancer diagnostics. Integration with ultrasound, CT, and MRI guidance enhances procedural precision. Clinicians value its ability to provide sufficient tissue for histopathology and molecular testing. Established clinical protocols and training support its widespread adoption. High patient acceptance due to minimal invasiveness reinforces its dominant position.

The image-guided biopsy segment is expected to witness the fastest growth during the forecast period due to increasing adoption of advanced imaging modalities for precise lesion targeting. Rising cancer prevalence and demand for minimally invasive procedures are major drivers. Hospitals and diagnostic centers are investing in imaging-guided systems to improve diagnostic accuracy. Awareness among clinicians and patients about reduced procedural risks fuels growth. Integration with AI-assisted planning and lesion detection tools further enhances appeal. Outpatient and ambulatory surgical centers are increasingly adopting image-guided procedures.

- By Sample Site

On the basis of sample site, the market is segmented into muscles, bones, and other organs. The other organs segment dominated in 2025 due to the high volume of biopsies performed in liver, pancreas, kidney, and thyroid tissues. These procedures are essential for early diagnosis of cancers and chronic diseases. Hospitals prefer advanced needle types and imaging guidance for organ biopsies to ensure precision. The high success rates and reduced complication risks contribute to dominance. Clinical guidelines and government screening programs promoting organ biopsies support market growth. Growing patient preference for minimally invasive procedures further reinforces adoption.

The bone segment is anticipated to witness the fastest growth during the forecast period due to rising incidence of hematologic malignancies and orthopedic conditions requiring bone marrow or skeletal tissue evaluation. Specialized needles such as Jamshidi and Klima sternal are increasingly used. Research and academic centers also drive demand through experimental studies. Technological advancements improving precision, usability, and patient comfort accelerate adoption. Rising awareness about minimally invasive techniques further supports growth. Hospitals and diagnostic centers are expanding their bone biopsy services to meet demand.

- By Utility

On the basis of utility, the market is segmented into disposable and reusable needles. The disposable segment dominated in 2025 due to infection control protocols, ease of use, and reduced risk of cross-contamination. Hospitals and diagnostic centers prefer single-use needles to comply with stringent hygiene standards. Rising awareness of patient safety and regulatory guidelines support its dominance. Outpatient and ambulatory procedures favor disposable needles due to convenience. Availability in multiple sizes and needle types enhances adoption. Strong manufacturer support for training and supply ensures consistent market growth.

The reusable segment is expected to witness the fastest growth during the forecast period due to cost-effectiveness in high-volume hospitals and research centers. Technological improvements enable easier sterilization and enhance durability. Reusable needles are preferred for specialized or complex procedures requiring precision. Long-term clinical data demonstrating reliability further supports adoption. Emerging European healthcare markets favor reusable solutions due to budget constraints. Integration with imaging-guided systems also improves procedural efficiency.

- By Application

On the basis of application, the market is segmented into tumor, infection, inflammation, and others. The tumor segment dominated in 2025 due to the rising prevalence of cancers and the increasing use of minimally invasive biopsy techniques for early diagnosis. Hospitals and diagnostic centers prefer needle biopsy for tumor detection due to high accuracy and lower procedural risks. Integration with imaging guidance and AI-assisted tools enhances diagnostic confidence. Clinical guidelines and screening programs promoting early tumor detection further support dominance. Patient preference for less invasive procedures reinforces growth.

The infection segment is anticipated to witness the fastest growth during the forecast period due to increasing use of needle biopsy in diagnosing localized infections, abscesses, and inflammatory conditions. Rising awareness among clinicians about minimally invasive procedures supports adoption. Outpatient and ambulatory care settings drive growth due to patient convenience. Advanced needle designs improving sample quality for microbiological testing accelerate adoption. Integration with laboratory information systems enhances workflow efficiency. Academic and research institutions increasingly use needle biopsy for infection-related studies.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centers, biopsy labs, ambulatory surgical centers, academic and research organizations, and others. The hospital segment dominated in 2025 due to the high volume of oncology and chronic disease diagnostics performed in hospital settings. Availability of advanced imaging equipment, trained personnel, and adherence to clinical protocols support dominance. Hospitals invest in AI-assisted biopsy systems to improve diagnostic accuracy. Integration with electronic medical records and pathology workflows strengthens adoption. Rising patient preference for minimally invasive procedures reinforces market growth. Hospitals remain key drivers due to high procedure volumes and repeat demand.

The academic and research organization segment is expected to witness the fastest growth during the forecast period due to increasing use of needle biopsy in clinical trials, translational research, and experimental studies. Specialized and image-guided needles are increasingly adopted for research objectives. Collaborations with device manufacturers for customized solutions drive growth. Rising funding from government and private institutions supports adoption. Integration with laboratory and pathology research workflows improves efficiency. Academic centers also contribute to training future clinicians, further accelerating market adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated in 2025 due to bulk procurement by hospitals and large diagnostic networks, ensuring cost efficiency and reliable supply. Hospitals prefer tender-based procurement for long-term contracts and service support. Availability of after-sales services and training from manufacturers strengthens dominance. Long-term supply agreements and regulatory compliance requirements also support the segment. Bulk purchasing ensures consistent inventory and reduces operational risks. Hospitals and large diagnostic chains continue to prefer direct tender for major equipment and disposable needles.

The retail sales segment is anticipated to witness the fastest growth during the forecast period due to increasing demand from smaller diagnostic centers, outpatient clinics, and academic institutions. Ease of ordering through online portals and distributors accelerates adoption. Growing awareness of the benefits of needle biopsy among smaller healthcare providers fuels demand. Retail channels provide flexibility in procuring specialized or disposable needles. Manufacturers are increasingly partnering with distributors to expand reach. Rising adoption in emerging European markets also drives segment growth.

Europe Needle Biopsy Market Regional Analysis

- Germany dominated the Europe needle biopsy market with the largest revenue share of 38.1% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced imaging-guided biopsy techniques, and the presence of key market players focusing on innovative and precise biopsy systems

- Hospitals and diagnostic centers in the region prioritize minimally invasive procedures such as needle biopsy for early cancer detection, chronic disease diagnosis, and research applications, contributing to widespread adoption

- This dominance is further supported by high healthcare expenditure, strong government initiatives for cancer screening programs, and the growing preference for image-guided and AI-assisted biopsy procedures

The Germany Needle Biopsy Market Insight

The Germany needle biopsy market captured the largest revenue share in Europe in 2025, driven by high cancer prevalence, advanced healthcare infrastructure, and growing adoption of minimally invasive procedures. Hospitals and diagnostic centers increasingly prefer core needle, fine-needle, and image-guided biopsy systems due to their accuracy, safety, and reproducibility. Integration with AI-assisted imaging and digital pathology platforms improves workflow efficiency and diagnostic confidence. Government initiatives and national screening programs promoting early cancer detection further drive adoption. The country’s emphasis on innovation and research supports the development of next-generation biopsy devices. Patient preference for less invasive procedures reinforces market growth across hospitals and specialized centers.

France Needle Biopsy Market Insight

The France needle biopsy market is witnessing steady growth due to rising cancer prevalence, early detection programs, and growing adoption of minimally invasive diagnostic procedures. Hospitals and diagnostic centers prefer core needle and fine-needle biopsy techniques for accurate tissue sampling and reduced complication risks. Integration with imaging modalities such as ultrasound and CT enhances procedural safety and accuracy. Government policies and reimbursement programs support widespread adoption in both public and private healthcare sectors. Research institutions contribute to market expansion through clinical trials and development of innovative biopsy technologies. Increasing patient preference for less invasive procedures, especially in oncology, drives further adoption.

U.K. Needle Biopsy Market Insight

The U.K. needle biopsy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national cancer screening programs and increased patient preference for minimally invasive procedures. Hospitals and diagnostic centers favor imaging-guided core and fine-needle biopsies for reliable diagnosis and improved workflow efficiency. Integration with AI-assisted planning and digital pathology systems enhances diagnostic accuracy. Supportive healthcare policies, reimbursement frameworks, and skilled personnel availability further encourage adoption. Research organizations are contributing to technological development and clinical studies. Awareness campaigns promoting early disease detection reinforce market growth across public and private healthcare facilities.

Poland Needle Biopsy Market Insight

The Poland needle biopsy market is the fastest growing in Europe, driven by increasing awareness of minimally invasive diagnostic procedures and rising cancer prevalence. Hospitals and diagnostic centers are rapidly adopting core, fine-needle, and image-guided biopsy systems due to their accuracy, safety, and efficiency. Government initiatives and national early detection programs are supporting adoption across public and private healthcare sectors. Integration with AI-assisted imaging platforms and digital pathology systems enhances workflow, precision, and reporting. Research institutions and academic centers are contributing to the development and validation of innovative biopsy technologies. Patient preference for less invasive, outpatient-friendly procedures is further accelerating market growth.

Europe Needle Biopsy Market Share

The Europe Needle Biopsy industry is primarily led by well-established companies, including:

- BD (U.S.)

- Boston Scientific Corporation (U.S.)

- Argon Medical Devices (U.S.)

- Hologic, Inc. (U.S.)

- Cook (U.S.)

- Medtronic (Ireland.)

- B. Braun SE (Germany)

- FUJIFILM Holdings Corporation (Japan)

- Danaher (U.S.)

- CONMED Corporation (U.S.)

- Leica Biosystems (Germany)

- Stryker (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Olympus Corporation (Japan)

- INRAD, Inc. (U.S.)

- SOMATEX Medical Technologies GmbH (Germany)

- Zamar Care (Europe)

- MDL SRL. (Italy)

- UROMED (Switzerland)

- BIOPSYBELL S.R.L. (Italy)

What are the Recent Developments in Europe Needle Biopsy Market?

- In October 2025, Olympus Corporation announced the launch of the SecureFlex Single‑Use Fine Needle Biopsy Device, which will be commercially available in Europe and Japan in Autumn 2025, emphasising disposability and ease of use

- In October 2025, a new European clinical launch (or market introduction) of the Olympus SecureFlex device marked a shift toward single‑use fine needle biopsy devices in Europe, responding to hygiene and workflow demands in diagnostic centres.

- In March 2025, the ISUOG (International Society of Ultrasound in Obstetrics & Gynecology) together with ESGO published a consensus statement on ultrasound‑guided biopsy in gynecological oncology. The document helps standardize biopsy procedures across Europe, supporting safer, high-quality minimally invasive diagnostics

- In November 2024, Mammotome introduced the AutoCore™ Single Insertion Core Biopsy System, the first automated spring‑loaded core needle device, streamlining ultrasound‑guided breast biopsies with one‑button operation and automatic sample handling

- In August 2022, Mammotome launched the Mammotome Revolve™ EX Dual Vacuum‑Assisted Breast Biopsy System, the first vacuum‑assisted device explicitly designed for benign lesion excision. It offers a faster sampling rate (one tissue sample every 5 seconds), an expanded collection cup (up to 75 samples), ergonomic handpiece design, and a sterile EZ-Sleeve to reduce turnover time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.