Market Analysis and Size

In the past years, especially during the outbreak of the pandemic millions of people throughout the world chose MOOCs for leaning. They utilized MOOCs for various goals such as changing careers, supplemental learning, corporate eLearning and training, career development, and college preparations, among others.

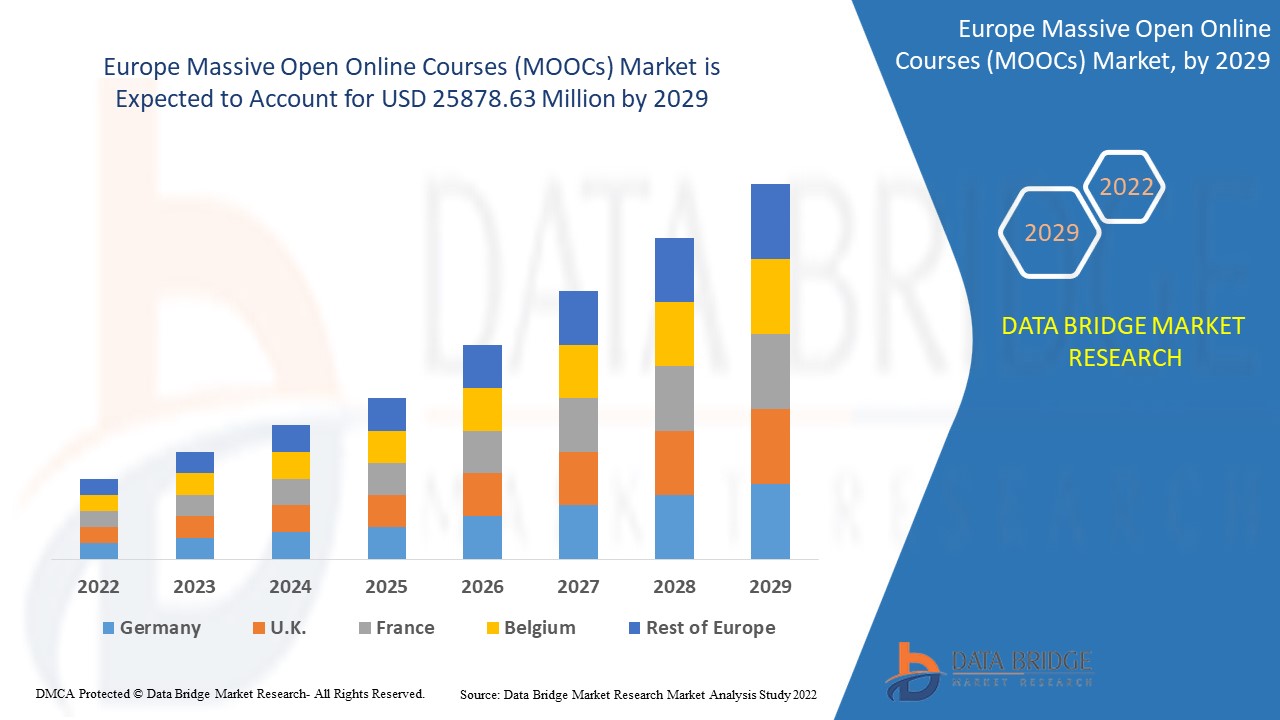

Europe Massive Open Online Courses (MOOCs) Market was valued at USD 497.15 million in 2021 and is expected to reach USD 25878.63 million by 2029, registering a CAGR of 37.70% during the forecast period of 2022-2029. Services account for the largest component segment in the respective market owing to the increased adoption. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

Massive open online courses (MOOCs) is defined as the online courses that has an open education platform and can reach an unlimited amount of participants. MOOC contains the videos of traditional forms of lectures with the entire course materials and promotes community interactions between the professionals and the learners. Massive open online courses (MOOCs) are the ultimate arrange in distance education, as these offer open educational assets to the students all around the world.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Platform, Services), Student Served (Post Graduate, Corporate, Under Graduate, High School and Junior High School), Subjects (Business Management, Computer Science and Programming, Science, Sociology and Philosophy, Humanities, Education and Training, Healthcare and Medicine, Arts and Design, Mathematics, Foreign Language Learning and Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Udacity, Inc. (US), Federica Web Learning (Italy), edX Inc. (US), Coursera Inc (US), Udemy, Inc. (US), Pluralsight LLC (US), Alison (Ireland), FutureLearn (UK), XuetangX (China), Skillshare, Inc. (US), OpenupEd (UK), Kadenze, Inc. (US), and 360training (US), among others |

|

Market Opportunities |

|

Europe Massive Open Online Courses (MOOCs) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Digital Advancements In Online Courses

The surge in the advancements in online courses over the time acts as one of the major factors driving the massive open online courses (MOOCs) market. Also, rise in demand for massive open online courses (MOOCs) owing to the advantages such as availability in different languages, special attention to every student, lesser cost, and availability of demo classes, among others.

- Advent of Various Tools

The rise in the advent of various tools such as Zoom and Microsoft Teams to help classmates connect with each other and their tutors accelerate the market growth. During the outbreak of COVID-19, digital learning was highly adopted to stay in touch with each other through online medium.

- Shift to Digital Learning

The rise in the shift towards digital learning to acquire personalizing education further influence the market. The continuous developments helping students to set both the pace and path of their learning assist in the expansion of the market further.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the massive open online courses (MOOCs) market.

Opportunities

Furthermore, various initiatives and programs launched in the U.S to strengthen MOOC systems extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Mobility and ease of use will further expand the market.

Restraints/Challenges

On the other hand, low completion rate, and inefficiency in tracking and validating the progress are expected to obstruct market growth. Also, lack of personalized guidance and mentorship is projected to challenge the massive open online courses (MOOCs) market in the forecast period of 2022-2029.

This massive open online courses (MOOCs) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on massive open online courses (MOOCs) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Europe Massive Open Online Courses (MOOCs) Market

COVID-19 had a positive impact on the massive open online courses (MOOCs) market due to the rise in number of industry verticals massive open online courses (MOOCs) during the outbreak of COVID-19. An increase in number of people deploying MOOCs was witnessed for various purposes such as digital learning, changing careers, supplemental learning, corporate eLearning and training, career development, and college preparations, among others. The broadcast and media technology market is expected to witness high growth in the post-pandemic scenario owing to the rise in usage of various media platforms among consumers.

Recent Developments

- In May 2020, edX Inc. launched a worldwide activity to assist colleges confronting the challenge of actualizing compelling online instructing and learning. The company is offering access to ability and substance for complimentary, edX is making a difference, colleges are making plans for the up and coming semester when a vast majority of campuses are likely to be closed or mostly closed. This launch will help the company to strengthen its brand in the MOOCs market.

- In March 2020, Udacity, Inc. entered into a partnership with Nutanix (NASDAQ: NTNX), which is engaged in cloud computing. Through this partnership, the company offers a modern Hybrid Cloud Nanodegree Program. This program will upgrade learning openings within the developing cloud innovations showcase that are basic for organizations to uplevel their IT foundation. This partnership helps the company to increase its courses category for cloud computing.

Europe Massive Open Online Courses (MOOCs) Market Scope and Market Size

The massive open online courses (MOOCs) market is segmented on the basis of component, student served and subjects. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Platform

- Services

Student Served

- Post Graduate

- Corporate

- Under Graduate

- High School

- Junior High School

Subjects

- Business Management

- Computer Science and Programming

- Science

- Sociology and Philosophy

- Humanities

- Education and Training

- Healthcare and Medicine

- Arts and Design

- Mathematics

- Foreign Language Learning

- Others

Europe Massive Open Online Courses (MOOCs) Market Regional Analysis/Insights

The massive open online courses (MOOCs) market is analysed and market size insights and trends are provided by country, component, student served and subjects as referred above.

The countries covered in the massive open online courses (MOOCs) market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Spain Accounted Largest Market Share is Due to Growing Internet Penetration across the Developing Countries has Increase Trend for the MOOC Market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Massive Open Online Courses (MOOCs) Market

The massive open online courses (MOOCs) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to massive open online courses (MOOCs) market.

Some of the major players operating in massive open online courses (MOOCs) market are

- Udacity, Inc. (US)

- Federica Web Learning (Italy)

- edX Inc. (US)

- Coursera Inc (US)

- Udemy, Inc. (US)

- Pluralsight LLC (US)

- Alison (Ireland)

- FutureLearn (UK)

- XuetangX (China)

- Skillshare, Inc. (US)

- OpenupEd (UK)

- Kadenze, Inc. (US)

- 360training (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT(COMPONENT) TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 COVID-19 IMPACT ON EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) IN INFORMATION & COMMUNICATION TECHNOLOGY INDUSTRY

5.1 AFTERMATH OF THE NETWORK INDUSTRY AND GOVERNMENT ROLE

5.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.2.1 COURSE LAUNCHES

5.2.2 PARTNERSHIPS

5.3 IMPACT ON DEMAND & SUPPLY CHAIN

5.4 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 NEED FOR SCALABLE OPEN EDUCATION

6.1.2 NECESSITY FOR COST-EFFECTIVE EDUCATION PLATFORMS

6.1.3 INCREASING REQUIREMENT FOR EUROPE TRAINING

6.1.4 INCREASING ADOPTION OF DIGITAL LEARNING

6.1.5 EXTENSIVE GOVERNMENT INITIATIVES FOR GROWTH OF MOOC

6.2 RESTRAINTS

6.2.1 LOW COMPLETION RATE

6.2.2 LOW MOTIVATION AND ENGAGEMENT TO ADOPT MOOC SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN DEMAND FOR GAMIFICATION IN MOOCS

6.3.2 RISING NEED FOR TECHNOLOGY SUBJECTS

6.3.3 GROWING DEMAND FOR MOOC IN ASIA-PACIFIC REGION

6.3.4 MOBILITY AND EASE OF USE OF MOOCS

6.4 CHALLENGES

6.4.1 LACK OF PERSONALIZED GUIDANCE AND MENTORSHIP

6.4.2 INEFFICIENCY IN TRACKING AND VALIDATING THE PROGRESS

6.4.3 LACK OF TECHNICAL SUPPORT POST IMPLEMENTATION OF MOOCS

7 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS)MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.2.1 XMOOC

7.2.2 CMOOC

7.3 SERVICES

7.3.1 TRAINING & CONSULTING

7.3.2 IMPLEMENTATION

7.3.3 SUPPORT & MAINTENANCE

8 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY STUDENT SERVED

8.1 OVERVIEW

8.1.1 POST GRADUATE

8.1.2 CORPORATE

8.1.3 UNDERGRADUATE

8.1.4 HIGH SCHOOL

8.1.5 JUNIOR HIGH SCHOOL

9 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY SUBJECTS

9.1 OVERVIEW

9.1.1 BUSINESS MANAGEMENT

9.1.2 COMPUTER SCIENCE & PROGRAMMING

9.1.3 SCIENCE

9.1.4 SOCIOLOGY & PHILOSOPHY

9.1.5 HUMANITIES

9.1.6 EDUCATION & TRAINING

9.1.7 HEALTHCARE & MEDICINE

9.1.8 ARTS & DESIGN

9.1.9 MATHEMATICS

9.1.10 FOREIGN LANGUAGE LEARNING

9.1.11 OTHERS

10 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY GEOGRAPHY

10.1 EUROPE

10.1.1 SPAIN

10.1.2 U.K

10.1.3 FRANCE

10.1.4 GERMANY

10.1.5 RUSSIA

10.1.6 NETHERLANDS

10.1.7 ITALY

10.1.8 SWITZERLAND

10.1.9 BELGIUM

10.1.10 TURKEY

10.1.11 REST OF EUROPE

11 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 COURSERA INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 COURSE PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 EDX INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 COURSE PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 UDACITY, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.3.3 PROGRAM PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 FUTURELEARN (A SUBSIDIARY OF SEEK)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 SWAYAM

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.5.3 PROGRAM PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ALISON

13.6.1 COMPANY SNAPSHOT

13.6.2 COURSE PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 D2L CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PROGRAM PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 EWANT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 FEDERICA WEB LEARNING

13.9.1 COMPANY SNAPSHOT

13.9.2 MOOC PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 IVERSITY LEARNING SOLUTIONS GMBH

13.10.1 COMPANY SNAPSHOT

13.10.2 COURSE PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 KADENZE, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 COURSE PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MIRÍADAX

13.12.1 COMPANY SNAPSHOT

13.12.2 COURSE PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 NOVOED, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 SOLUTION PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 OPENUPED

13.14.1 COMPANY SNAPSHOT

13.14.2 COURSE PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PLURALSIGHT LLC.(A SUBSIDIARY OF PLURALSIGHT)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 SIMPLILEARN SOLUTIONS

13.16.1 COMPANY SNAPSHOT

13.16.2 COURSE PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SKILLSHARE, INC

13.17.1 COMPANY SNAPSHOT

13.17.2 PROGRAM PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 UDEMY, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 COURSE PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 XUETANGX

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.20TRAINING

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 2 EUROPE PLATFROM IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 EUROPE PLATFROM IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 4 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 5 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 6 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 7 EUROPE POST GRADUATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 8 EUROPE CORPORATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 9 EUROPE UNDERGRADUATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 10 EUROPE HIGHSCHOOL IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 11 EUROPE JUNIOR HIGHSCHOOL IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 12 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY SUBJECTS, 2018-2027 (USD MILLION)

TABLE 13 EUROPE BUSINESS MANAGEMENT IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 14 EUROPE COMPUTER SCIENCE & PROGRAMMING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 15 EUROPE SCIENCE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 16 EUROPE SOCIOLOGY & PHILOSOPHY IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 17 EUROPE HUMANITIES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 18 EUROPE EDUCATION & TRAINING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 19 EUROPE HEALTHCARE & MEDICINE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 20 EUROPE ARTS & DESIGN IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 21 EUROPE MATHEMATICS IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 22 EUROPE FOREIGN LANGUAGE LEARNING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 23 EUROPE OTHERS IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 24 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 26 EUROPE PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 27 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 29 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 30 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 SPAIN PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 32 SPAIN SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 33 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 34 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 35 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 36 U.K PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 U.K SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 39 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 40 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 41 FRANCE PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 FRANCE SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 44 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 45 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 GERMANY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 GERMANY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 49 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 50 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 RUSSIA PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 RUSSIA SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 54 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 55 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 56 NETHERLANDS PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 NETHERLANDS SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 59 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 60 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 61 ITALY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 ITALY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 64 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 65 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 SWITZERLAND PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 67 SWITZERLAND SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 69 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 70 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 BELGIUM PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 BELGIUM SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 74 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 75 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 76 TURKEY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 TURKEY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 79 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 80 REST OF EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: SEGMENTATION

FIGURE 2 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: EUROPE VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: SEGMENTATION

FIGURE 10 NECESSITY FOR COST-EFFECTIVE EDUCATION PLATFORMS WILL BOOST THE EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 11 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET

FIGURE 13 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY COMPONENT, 2019

FIGURE 14 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY STUDENT SERVED, 2019

FIGURE 15 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY SUBJECTS, 2019

FIGURE 16 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: SNAPSHOT (2019)

FIGURE 17 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2019)

FIGURE 18 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2020 & 2027)

FIGURE 19 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2019 & 2027)

FIGURE 20 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COMPONENT(2020-2027)

FIGURE 21 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: COMPANY SHARE 2019(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.