Europe Molecular Point of Care Testing (using NAAT) Market, By Product (Instruments and Consumables & Reagents), Indication (Respiratory Infections Testing, Sexually Transmitted Infection (STI) Testing, Gastrointestinal Tract Infections Testing, and Others), End User (Laboratories, Hospitals, Clinics, Ambulatory Centers, Homecare, Assisted Living Facilities, and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) – Industry Trends and Forecast to 2028.

Europe Molecular Point of Care Testing (using NAAT) Market Analysis and Insights

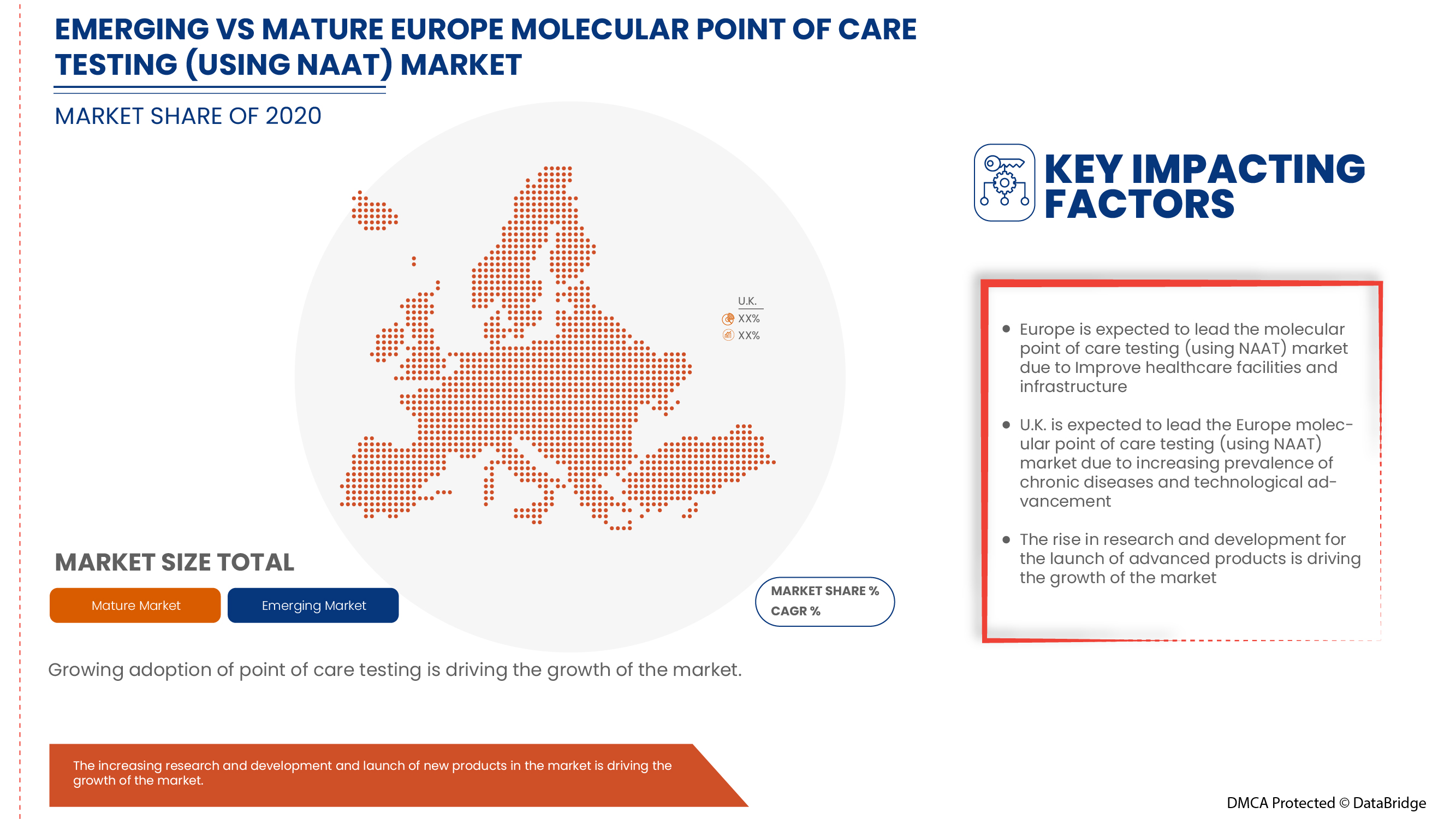

Europe molecular point of care testing (using NAAT) market is expected to gain market growth due to improving healthcare facilities and infrastructures and the adoption of end-of-care testing at the hospital, laboratories, and clinics, which can drive the development of the market. The other factors anticipated to propel the growth of the molecular point of care testing (using NAAT) market include the rising prevalence of infectious diseases.

The other factors, such as the lack of skilled professionals and the high cost of customized molecular point of care testing (using NAAT), hamper the growth of the Europe molecular point of care testing (using NAAT) market. On the other hand, the increased healthcare expenditure and emerging countries with developed hospitals act as an opportunity to grow the Europe molecular point of care testing (using NAAT) market.

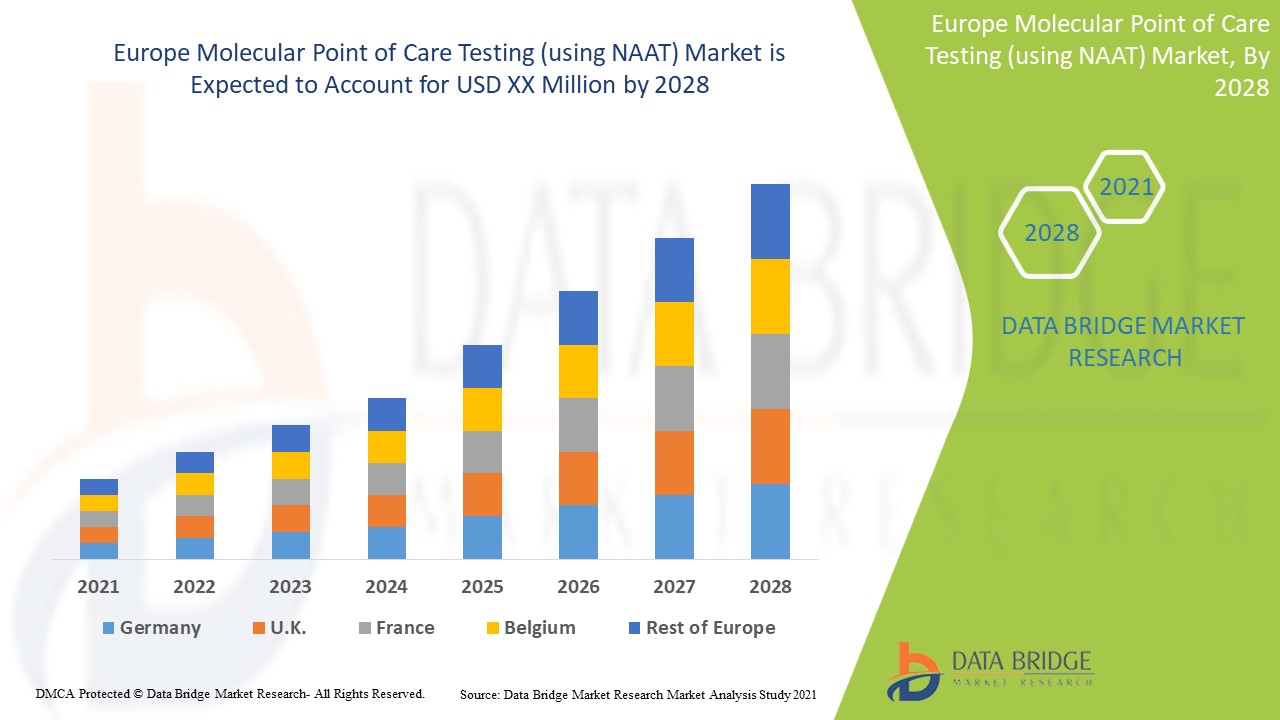

Data Bridge Market Research analyzes that the Europe molecular point of care testing (using NAAT) market will grow at a CAGR of 10.8% from 2021 to 2028.

|

Report Metric

|

Details

|

|

Forecast Period

|

2021 to 2028

|

|

Base Year

|

2020

|

|

Historic Years

|

2019

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Product (Instruments and Consumables & Reagents), Indication (Respiratory Infections Testing, Sexually Transmitted Infection (STI) Testing, Gastrointestinal Tract Infections Testing, and Others), End User (Laboratories, Hospitals, Clinics, Ambulatory Centers, Homecare, Assisted Living Facilities, and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy)

|

|

Countries Covered

|

U.K., Germany, France, Italy, Spain and the Rest of Europe

|

|

Market Players Covered

|

SD Biosensor, Inc., Abbott, F.Hoffmann-La Roche Ltd., Danaher, Thermo Fisher Scientific Inc, binx Health, Inc., Lucira, Meridian Bioscience, Quantumdx Group Ltd., BD, Biomérieux Sa, Qiagen, Quidel Corporation, Bio-Rad Laboratories, Inc., Sekisui Diagnostic, Randox Laboratories Ltd., GenMark Diagnostics, Seegene Inc. Grifols S.A., Wondfo, Oxford Nanopore Diagnostic, and PerkinElmer Inc.

|

Market Definition of Europe Molecular Point of Care Testing (using NAAT) Market

POCT is characterized as testing which can be done close to the patient where a medical decision can be made immediately, including the results and monitoring. POCT devices now entering clinical use are based on nucleic acid amplification technologies (NAAT), defined here as second-generation devices. These platforms generally have improved sensitivity, typically 60 to 90%, compared to first-generation POCTs, and require portable instrumentation with a footprint of approximately 30cm x 30cm. These instruments are essentially used in molecularly detecting various disorders such as HIV, HPV, and respiratory disease through NAAT technology. NAAT is Nucleic Acid Amplification Techniques that allow the identification of pathogenic organisms by detecting their DNA or RNA.

In the worldwide pandemic, attempt to synergize the sensitivity of NAATs and the ease of use of POCT assays, miniaturized NAAT-based POCT devices and assays were devised for faster screening and diagnosis of COVID-19, which also propelled the growth of the market.

Europe Molecular Point of Care Testing (using NAAT) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- INCREASE PREVALENCE OF CHRONIC DISEASES

It is a common fact that health degeneration starts with an increase in age. As the rate of chronic disease grows with time, the factors associated with the disease rates also increase. The high number of obese/ overweight population also has increased the prevalence of chronic diseases in various regions across the globe. The rise in the number of chronic diseases similar to HPV, STI, and T.B., among more, has led to people opting for NAAT-based point-of-care and products for testing. Therefore, this will drive the Europe molecular point of care testing (using NAAT) market in the coming years.

- IMPROVEMENT IN DIAGNOSIS-SEEKING RATE

With the increase in the successful diagnosis of chronic diseases, including cancer, anemia, type 2 diabetes, and others, the improved health care professionals provide regular training sessions for the professionals for conducting tests in account for the improvement of diagnosis rate in the region. With the increase in the burden of diseases, the diagnosis rate is also increasing. With the advancements in the diagnosis, the rate is also growing for people going through the diagnosis.

- RISE IN PREFERENCE FOR HOMECARE TESTING

Home healthcare preferences make clinical information available at the right place and time. It will also help in reducing error and increasing safety with ensured quality. They also help elders in the case of a medical emergency. Many strategic changes have been made in health care to address point-of-care testing benefits. As per the World Health Organization (WHO), the number of people aged 65 and above is expected to rise from an estimated 524 million in 2010 to approximately 1.5 billion in 2050, with developed countries accounting for the majority of the increase.

Opportunities

- STRATEGIC INITIATIVES TAKEN BY MARKET PLAYERS

An increase in the burden of chronic and non-chronic disease globally coupled with the rise in the geriatric population in Africa and Asia has created more demand for the development of new kits and solutions for molecular point-of-care testing with better efficacy and less time consumption. To provide diagnosis and screening in this region, the players in the market undergo partnership and agreement with each other to provide quality care through kits and instruments to the Europe population.

- RisE Healthcare Expenditure

Increasing healthcare expenditure and infrastructure can help patients take hassle-free advanced treatment to receive better diagnoses, procedures, and treatment for fast recovery. Point-of-care testing devices are beneficial for detecting various diseases and supporting treatment plans using POC software and solutions. Healthcare spending comprises out-of-pocket payments (people paying for their care), government expenditure, and sources including health insurance and activities by non-governmental organizations.

Restraints/Challenges

- HIGH COST OF PRODUCTS

The point-of-care testing products require a substantial considerable cost for the development process. As the concept needs to be locked down, the materials must be sourced, and it is essential to consider lead times. Additionally, the process is time-consuming as the device design needs sufficient time to fully mature before bringing to the market for use.

- LACK OF ALIGNMENT WITH TEST RESULTS OBTAINED FROM LABORATORIES

When compared with the results of laboratory testing standards, the NAAT testing results differ. Laboratory testing is more advanced, follows the process, protocol, and science for laboratory testing, and fully integrates with the technology necessary to analyze, validate, and document effects accurately. However, POCT/NAAT is undoubtedly associated with a lack of precise results. Molecular POCT cannot complete the standardization, and other critical criteria cannot achieve the standardization and different essential standards. It is a significant challenge for the Europe molecular point of care testing market. The PoC tests might sometimes provide erroneous results and suffers test results variability.

Post COVID-19 Impact on Europe Molecular Point of Care Testing (using NAAT) Market

COVID-19 significantly impacted the molecular point of care testing (using NAAT) market. COVID-19 has positively affected the price and demand of molecular point-of-care testing (using NAAT) products at a higher level because of progressive online sales and technological advancement. The COVID-19 pandemic outbreak positively impacted the market's growth owing to the increased requirement for molecular point of care testing (using NAAT), especially in various hospitals. The current priority in most hospitals is given to COVID-19 treatments as the surge of COVID-19 cases is still persistent, which also increases the usage of molecular point of care testing (using NAAT). Moreover, many international governments and healthcare organizations have supported the supply of these products due to their high priority in crucial cases.

Recent Developments

- In November 2021, F.Hoffmann-La Roche Ltd announced that Roche ranked as one of the top three most sustainable healthcare companies in the Dow Jones Sustainability Indices for the thirteenth year. This increased the business doing capacity and business expansion in the forecast period

- In October 2021, Thermo Fisher Scientific Corporation received FDA approval for the TaqMan COVId-19 test SARS-COV molecular Assay. This increased the product portfolio of the company and contributed to the company revenue in the forecast period

Europe Molecular Point of Care Testing (using NAAT) Market Scope

The Europe molecular point of care testing (using NAAT) market is categorized into five notable segments based on the product, indication, end user, mode of testing, and distribution channel. The growth amongst these segments will help to analyze market growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Instruments

- Consumables and Reagents

Based on product, the Europe molecular point of care testing (using NAAT) market is segmented into instruments, consumables and reagents.

Indication

- Sexually Transmitted Infection (STI) Testing

- Respiratory Infection Testing

- Gastrointestinal Tract Infection Testing

- Others

Based on indication, the Europe molecular point of care testing (using NAAT) market is segmented into sexually transmitted infection (STI), respiratory, gastrointestinal tract, and others.

End User

- Laboratories

- Hospitals

- Clinics

- Ambulatory Centers

- Home Care

- Assisted Living Facilities

- Others

Based on End User, the Europe molecular point of care testing (using NAAT) market is segmented into laboratories, hospitals, clinics, ambulatory centers, home care, assisted living facilities, and others.

Mode of Testing

- Prescription-Based Testing

- OTC Testing

Based on testing mode, the Europe molecular point of care testing (using NAAT) market is segmented into prescription-based and OTC testing.

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Based on the Distribution channel, the Europe molecular point of care testing (using NAAT) market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

Europe Molecular Point of Care Testing (using NAAT) Market Regional Analysis/Insights

The market of the Europe molecular point of care testing (using NAAT) is analyzed, and market size insights and trends are provided based on product, indication, end user, mode of testing, and distribution channel.

Europe molecular point of care testing (using NAAT) market report covers the U.K., Germany, France, Italy, Spain and the rest of Europe.

U.K. dominates the Europe molecular point of care testing (using NAAT) market in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the rising prevalence of infectious and chronic diseases and the increasing technological advancements in the healthcare sector.

Competitive Landscape and Europe Molecular Point of Care Testing (using NAAT) Market Share Analysis

Europe molecular point of care testing (using NAAT) market competitive landscape provides details about the competitor. Components included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, regulatory guidelines, brand analysis, product approvals, product payload, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus on the Europe molecular point of care testing (using NAAT) market.

Some of the major players operating in the Europe molecular point of care testing (using NAAT) market are S.D. Biosensor, Inc., Abbott, F.Hoffmann-La Roche Ltd., Danaher, Thermo Fisher Scientific Inc, binx Health, Inc., Lucira, Meridian Bioscience, Quantumdx Group Ltd., BD, Biomérieux Sa, Qiagen, Quidel Corporation, Bio-Rad Laboratories, Inc., Sekisui Diagnostic, Randox Laboratories Ltd., GenMark Diagnostics, Seegene Inc. Grifols S.A., Wondfo, Oxford Nanopore Diagnostic, and PerkinElmer Inc. among others.

SKU-