Europe Molecular Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

11.60 Billion

USD

17.80 Billion

2025

2033

USD

11.60 Billion

USD

17.80 Billion

2025

2033

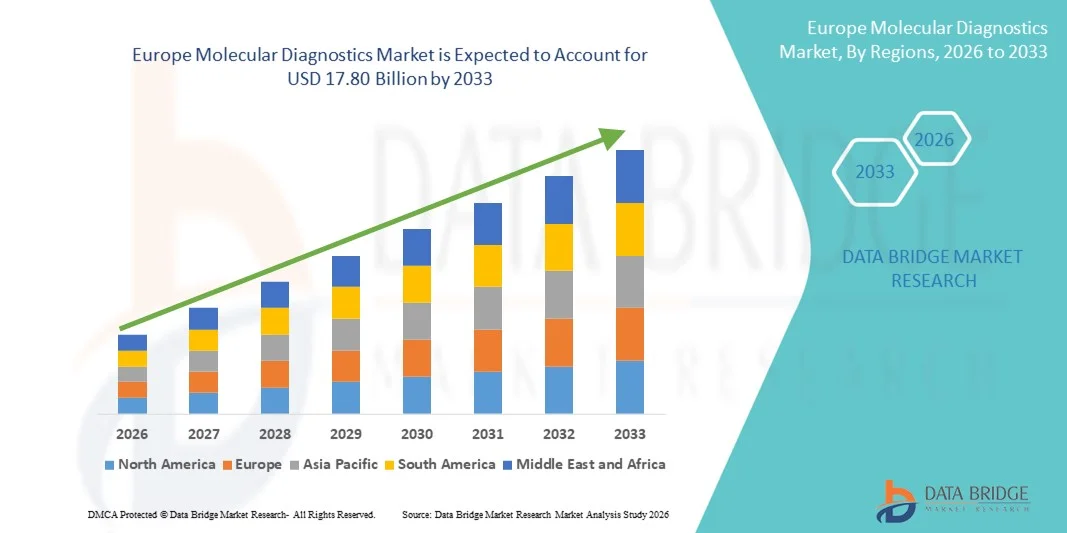

| 2026 –2033 | |

| USD 11.60 Billion | |

| USD 17.80 Billion | |

|

|

|

|

Europe Molecular Diagnostics Market Size

- The Europe molecular diagnostics market size was valued at USD 11.60 billion in 2025 and is expected to reach USD 17.80 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by rapid technological advancements in molecular diagnostic techniques, including PCR, next-generation sequencing (NGS), and point-of-care testing, which are significantly enhancing the accuracy, speed, and scalability of disease detection across clinical and research settings

- Furthermore, rising demand for early and precise diagnosis of infectious diseases, cancer, and genetic disorders—along with increasing adoption of personalized medicine and expanding healthcare infrastructure—is positioning molecular diagnostics as a critical component of modern healthcare, thereby substantially accelerating the growth of the Molecular Diagnostics Market

Europe Molecular Diagnostics Market Analysis

- Molecular diagnostics, which enable the detection and analysis of biological markers in the genome and proteome, play a critical role in modern healthcare by supporting early disease detection, precise diagnosis, and personalized treatment approaches across infectious diseases, oncology, and genetic testing

- The rising demand for accurate and rapid diagnostic solutions is primarily driven by the increasing prevalence of chronic and infectious diseases, growing adoption of precision medicine, technological advancements in PCR and next-generation sequencing (NGS), and expanding use of point-of-care molecular tests

- The U.K. dominated the molecular diagnostics market with the largest revenue share of approximately 39.4% in 2025, supported by advanced healthcare infrastructure, strong government initiatives for early disease detection, high adoption of next-generation diagnostic technologies, and the presence of leading diagnostic companies

- Germany is expected to be the fastest-growing country in the molecular diagnostics market during the forecast period, registering a CAGR of around 13.5%, driven by increasing investments in healthcare diagnostics, expanding laboratory facilities, rising awareness of precision medicine, and supportive regulatory frameworks for molecular testing

- The Reagents & Kits segment dominated the molecular diagnostics market with the largest revenue share of approximately 58.4% in 2025, driven by their recurring consumption nature and indispensable role in routine molecular testing workflows

Report Scope and Molecular Diagnostics Market Segmentation

|

Attributes |

Molecular Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Molecular Diagnostics Market Trends

Advancements in Automation and High-Throughput Molecular Testing

- A significant and accelerating trend in the Europe molecular diagnostics market is the increasing adoption of automated and high-throughput diagnostic platforms to improve testing efficiency, accuracy, and turnaround time

- Laboratories across Europe are rapidly transitioning toward automated molecular workflows to handle rising test volumes for infectious diseases, oncology, and genetic disorders

- For instance, several European diagnostic laboratories have expanded the use of fully automated PCR and sample-to-result systems to support large-scale screening and decentralized testing, enabling faster clinical decision-making and improved patient outcomes

- Automation in molecular diagnostics enables reduced manual intervention, minimized human error, and enhanced reproducibility of results, which is particularly critical for applications such as cancer diagnostics, prenatal testing, and pathogen detection

- The integration of molecular diagnostic platforms with laboratory information management systems (LIMS) is further streamlining data handling, result reporting, and workflow optimization across hospital and reference laboratories

- This trend toward scalable, efficient, and standardized molecular testing solutions is reshaping diagnostic practices across Europe, encouraging manufacturers to develop compact, high-throughput instruments suitable for both centralized laboratories and near-patient testing environments

- The growing demand for rapid, reliable, and cost-effective molecular assays is driving continuous innovation in reagents, instruments, and consumables, reinforcing the role of molecular diagnostics in modern healthcare systems

Europe Molecular Diagnostics Market Dynamics

Driver

Rising Burden of Infectious and Chronic Diseases

- The increasing prevalence of infectious diseases, cancer, and genetic disorders across Europe is a major driver fueling demand for molecular diagnostics, as these technologies offer high sensitivity and specificity for early and accurate disease detection

- For instance, the sustained need for molecular testing for respiratory infections, oncology biomarkers, and antimicrobial resistance surveillance has significantly increased test volumes across European healthcare systems

- Molecular diagnostics play a critical role in personalized medicine by enabling targeted therapy selection, disease monitoring, and treatment response assessment, particularly in oncology and rare genetic conditions

- In addition, growing government initiatives to strengthen disease surveillance programs and improve diagnostic preparedness are accelerating the adoption of advanced molecular testing solutions

- The expansion of hospital laboratories, reference labs, and diagnostic networks across Europe, combined with rising healthcare expenditure, continues to propel market growth

Restraint/Challenge

High Costs and Regulatory Complexity

- The high cost of molecular diagnostic instruments, reagents, and consumables remains a key challenge, particularly for smaller laboratories and healthcare facilities with limited budgets

- For instance, advanced PCR and next-generation sequencing platforms require significant upfront investment, along with ongoing costs related to reagents, maintenance, and skilled personnel

- In addition, stringent regulatory requirements and lengthy approval processes under European regulatory frameworks can delay product launches and increase compliance costs for manufacturers

- The need for specialized infrastructure and trained professionals further limits adoption in resource-constrained settings

- Overcoming these challenges through cost-effective assay development, simplified workflows, workforce training, and regulatory harmonization will be essential to ensure sustained growth of the molecular diagnostics market in Europe

Europe Molecular Diagnostics Market Scope

The molecular diagnostics market is segmented on the basis of product, technology, and application.

- By Product

On the basis of product, the Molecular Diagnostics market is segmented into Reagents & Kits, Instruments, and Services & Software. The Reagents & Kits segment dominated the molecular diagnostics market with the largest revenue share of approximately 58.4% in 2025, driven by their recurring consumption nature and indispensable role in routine molecular testing workflows. Reagents and kits are required for every diagnostic test, including PCR, sequencing, and hybridization assays, ensuring consistent demand across laboratories, hospitals, and research institutions. The rising prevalence of infectious diseases, cancer, and genetic disorders has significantly increased test volumes, directly supporting reagent sales. In addition, continuous innovation in assay sensitivity, multiplexing capabilities, and faster turnaround times has strengthened adoption. Regulatory approvals for companion diagnostics and disease-specific kits further support market leadership. Expansion of molecular testing in emerging economies also contributes to sustained reagent demand. Together, these factors firmly position reagents and kits as the dominant revenue contributor.

The Services & Software segment is expected to witness the fastest CAGR of around 13.9% from 2026 to 2033, fueled by the growing complexity of molecular data and the increasing need for advanced analytics. Laboratories are increasingly outsourcing data interpretation, bioinformatics, and cloud-based data management solutions to improve efficiency and accuracy. The rapid adoption of next-generation sequencing has further intensified demand for specialized software platforms capable of handling large genomic datasets. Additionally, the shift toward personalized medicine and companion diagnostics requires integrated digital solutions for clinical decision-making. Rising adoption of laboratory automation and AI-enabled analytics also supports growth. As laboratories focus on scalability and compliance, services and software are emerging as a high-growth segment.

- By Technology

On the basis of technology, the Molecular Diagnostics market is segmented into Mass Spectrometry (MS), Capillary Electrophoresis, Next-Generation Sequencing (NGS), Chips and Microarray, PCR-Based Methods, Cytogenetics, In Situ Hybridization (ISH/FISH), Molecular Imaging, and Others. The PCR-based methods segment accounted for the largest market revenue share of approximately 41.6% in 2025, owing to its widespread clinical acceptance, high sensitivity, and rapid turnaround time. PCR remains the gold standard for infectious disease detection, oncology testing, and genetic screening. Its extensive use during the COVID-19 pandemic further strengthened laboratory infrastructure and long-term adoption. PCR platforms are cost-effective, scalable, and compatible with both centralized and decentralized testing environments. Continuous advancements such as real-time PCR and digital PCR have expanded clinical applications. Strong regulatory validation and clinician familiarity further support dominance.

The Next-Generation Sequencing (NGS) segment is projected to grow at the fastest CAGR of nearly 14.7% from 2026 to 2033, driven by expanding applications in oncology, rare disease diagnosis, and precision medicine. Declining sequencing costs and improved throughput have increased accessibility across clinical laboratories. NGS enables comprehensive genomic profiling, making it essential for companion diagnostics and targeted therapies. Increasing adoption of liquid biopsy and population-scale genomic studies further accelerates demand. Technological improvements in bioinformatics and automation are reducing complexity barriers. As personalized healthcare expands, NGS is expected to experience robust growth.

- By Application

On the basis of application, the Molecular Diagnostics market is segmented into Oncology, Pharmacogenomics, Microbiology, Prenatal Testing, Tissue Typing, Blood Screening, Cardiovascular Diseases, Neurological Diseases, Infectious Diseases, and Others. The Infectious Diseases segment dominated the market with a revenue share of approximately 33.8% in 2025, supported by the high global burden of viral and bacterial infections. Molecular diagnostics enable rapid, accurate detection of pathogens, which is critical for effective disease management and outbreak control. Increased awareness of early diagnosis, rising hospital admissions, and improved testing access have strengthened adoption. Government initiatives supporting infectious disease surveillance also play a major role. The integration of molecular tests into routine clinical workflows further reinforces segment leadership. Continued investments in public health infrastructure sustain long-term demand.

The Oncology segment is anticipated to register the fastest CAGR of about 15.2% from 2026 to 2033, driven by the growing adoption of precision oncology and companion diagnostics. Molecular diagnostics play a vital role in identifying genetic mutations, predicting treatment response, and monitoring disease progression. Rising cancer incidence globally and increased use of targeted therapies significantly support growth. Advances in NGS and liquid biopsy technologies further expand oncology testing applications. Strong pharmaceutical-diagnostic collaborations and regulatory approvals also accelerate market expansion. Oncology is expected to remain the key growth engine for molecular diagnostics.

Europe Molecular Diagnostics Market Regional Analysis

- The Europe molecular diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising demand for early and accurate disease detection, strong government initiatives promoting preventive healthcare, and increasing adoption of next-generation diagnostic technologies

- The region’s advanced healthcare infrastructure, coupled with high investment in research and development, supports the development and commercialization of innovative molecular diagnostic assays

- Growth is also fueled by an expanding network of laboratories, hospitals, and clinical research centers that are increasingly integrating molecular diagnostics into routine healthcare practices

U.K. Molecular Diagnostics Market Insight

The U.K. molecular diagnostics market dominated the Molecular Diagnostics market with the largest revenue share of approximately 39.4% in 2025, supported by advanced healthcare infrastructure, strong government initiatives for early disease detection, high adoption of next-generation diagnostic technologies, and the presence of leading diagnostic companies. The country’s focus on precision medicine, oncology diagnostics, and public health screening programs is driving adoption across hospitals, clinical laboratories, and research institutions. Additionally, collaboration between biotechnology firms, diagnostic manufacturers, and academic institutions continues to accelerate innovation and market growth in the U.K.

Germany Molecular Diagnostics Market Insight

Germany molecular diagnostics market is expected to be the fastest-growing country in the Molecular Diagnostics market during the forecast period, registering a CAGR of around 13.5%. Growth is driven by increasing investments in healthcare diagnostics, expansion of molecular testing laboratories, rising awareness of precision medicine, and supportive regulatory frameworks for molecular testing. Germany’s well-established healthcare ecosystem, strong focus on technological innovation, and initiatives to improve accessibility of advanced diagnostics are fostering rapid adoption of molecular diagnostic platforms across clinical and research settings.

Europe Molecular Diagnostics Market Share

The Molecular Diagnostics industry is primarily led by well-established companies, including:

- Roche Diagnostics (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific (U.S.)

- QIAGEN (Netherlands)

- Bio-Rad Laboratories (U.S.)

- Danaher Corporation (U.S.)

- Siemens Healthineers (Germany)

- Becton, Dickinson and Company (BD) (U.S.)

- Hologic, Inc. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Illumina, Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Qiagen N.V. (Netherlands)

- BioMérieux S.A. (France)

- Cepheid (U.S.)

- Genomic Health, Inc. (U.S.)

- Guardant Health, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Grail, Inc. (U.S.)

Latest Developments in Europe Molecular Diagnostics Market

- In July 2024, Abbott announced improvements to its COVID‑19 molecular diagnostic tests, confirming that its antigen and PCR assays consistently detect new variants including KP.2, KP.3, and KP.1.1, supporting ongoing demand for robust pathogen detection methods in molecular diagnostics labs worldwide. The company also launched the interpretable droplet digital PCR (I2ddPCR) assay in January 2025, which combines advanced AI‑based image processing for high‑accuracy digital PCR testing of low‑abundance targets, enhancing diagnostic sensitivity for research and clinical applications

- In February 2024, Metropolis Healthcare Limited inaugurated an advanced molecular diagnostics center in Dehradun, India, with the capacity to process 200–250 samples per day and offering a broad range of molecular testing services, including PCR and genetic assays, expanding regional access to high‑quality molecular diagnostics. This launch reflects growing investment in molecular testing infrastructure in emerging markets

- In April 2025, Roche Diagnostics introduced its “cobas omni Utility Channel” in Europe, a high‑throughput molecular testing platform designed to consolidate multiple assays on a single system, enabling laboratories to streamline workflows and improve testing efficiency across a range of clinical applications. This product launch supports expanded use of automated molecular testing in centralized labs

- In February 2025, Abbott received U.S. FDA clearance for its “Alinity m Respiratory Panel 2” assay, a multiplex molecular test capable of detecting COVID‑19, influenza A/B, and RSV, reinforcing the role of combined pathogen panels in clinical molecular diagnostics and improving rapid respiratory disease detection in healthcare settings

- In March 2025, Illumina, Inc. launched the “NovaSeq X Series” next‑generation sequencing platform, designed to significantly increase sequencing throughput and reduce costs, empowering genomic profiling for research and precision medicine applications in molecular diagnostics labs globally

- In April 2025, Seegene presented its automated PCR testing system “CURECA” at the European Society of Clinical Microbiology and Infectious Diseases (ESCMID) conference in Vienna, Austria, aimed at automating pre‑processing and downstream PCR steps to enhance laboratory productivity and diagnostic accuracy

- In June 2025, Gencurix entered into a development and commercialization agreement with QIAGEN to jointly advance digital PCR‑based oncology diagnostic products, reflecting a trend toward collaborative innovation in high‑precision cancer molecular diagnostics

- In June 2025, Gene Solutions and Shenzhen USK Bioscience formed a strategic partnership to establish a state‑of‑the‑art next‑generation sequencing laboratory in southern China, facilitating local access to advanced oncology molecular diagnostics and strengthening regional genomic testing infrastructure

- In April 2025, Vgenomics and Meril Genomics announced a partnership to expand access to genomic services including non‑invasive prenatal testing (NIPT) and targeted NGS for infectious disease and rare disease diagnosis, illustrating cross‑industry collaboration to broaden molecular testing applications

- In February 2025, Agilus Diagnostics and Lucence entered a collaboration to integrate advanced molecular testing technologies focused on cancer detection, therapeutic selection, and disease monitoring, highlighting continued efforts to enhance diagnostic capabilities through strategic partnerships

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.