Europe Molecular Diagnostic Controls Market

Market Size in USD Billion

CAGR :

%

USD

87.99 Billion

USD

167.75 Billion

2025

2033

USD

87.99 Billion

USD

167.75 Billion

2025

2033

| 2026 –2033 | |

| USD 87.99 Billion | |

| USD 167.75 Billion | |

|

|

|

|

Europe Molecular Diagnostic Controls Market Size

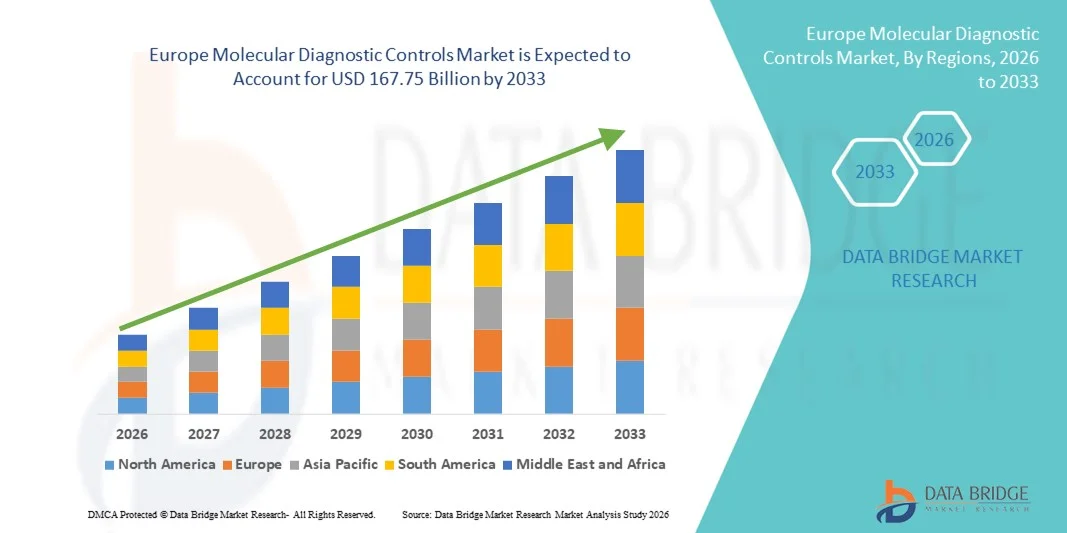

- The Europe molecular diagnostic controls market size was valued at USD 87.99 billion in 2025 and is expected to reach USD 167.75 billion by 2033, at a CAGR of 8.40% during the forecast period

- The market growth is primarily driven by the increasing adoption of molecular diagnostic technologies and continuous advancements in assay standardization, quality assurance, and laboratory automation, leading to greater accuracy and reliability in diagnostic testing across clinical and research settings

- Furthermore, rising demand for precise, reproducible, and regulatory-compliant diagnostic results is encouraging laboratories and diagnostic manufacturers to increasingly adopt molecular diagnostic controls as essential tools for test validation and quality monitoring. These converging factors are accelerating the uptake of Molecular Diagnostic Controls solutions, thereby significantly boosting overall market growth

Europe Molecular Diagnostic Controls Market Analysis

- Molecular diagnostic controls, which are used to ensure the accuracy, reliability, and consistency of molecular diagnostic assays, have become critical components of modern clinical diagnostics and laboratory workflows across hospitals, reference laboratories, and research institutions due to their role in quality assurance and regulatory compliance

- The growing demand for molecular diagnostic controls is primarily driven by the rapid adoption of molecular diagnostic testing, increasing prevalence of infectious and genetic diseases, and the rising need for standardized and validated diagnostic results to support clinical decision-making

- The U.K. dominated the molecular diagnostic controls market with the largest revenue share of 38.6% in 2025, supported by a well-established healthcare infrastructure, strong government initiatives promoting diagnostic quality standards, and high adoption of advanced molecular testing across public and private laboratories

- Germany is expected to be the fastest-growing country in the molecular diagnostic controls market during the forecast period, driven by increasing investments in diagnostic research, expanding molecular testing capabilities, and growing demand for precision medicine and early disease detection

- The Independent Controls segment dominated the largest market revenue share of 58.6% in 2025, driven by their broad compatibility across multiple molecular diagnostic platforms and instruments

Report Scope and Molecular Diagnostic Controls Market Segmentation

|

Attributes |

Molecular Diagnostic Controls Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Molecular Diagnostic Controls Market Trends

Advancement in Quality Assurance and Standardization of Diagnostic Testing

- A significant and accelerating trend in the molecular diagnostic controls market is the growing emphasis on stringent quality assurance, assay standardization, and regulatory compliance across clinical and research laboratories. Molecular diagnostic controls are increasingly being adopted to ensure accuracy, reproducibility, and reliability of test results in high-throughput molecular testing environments

- For instance, companies such as Bio-Rad Laboratories and Thermo Fisher Scientific have expanded their portfolios of molecular diagnostic controls designed for PCR, qPCR, and next-generation sequencing (NGS) assays, supporting laboratories in maintaining consistent performance across different platforms and instruments

- The rising complexity of molecular assays, particularly in oncology, infectious diseases, and genetic testing, has increased the need for well-characterized positive, negative, and internal controls to validate assay performance and minimize false positives or negatives

- Furthermore, the increasing adoption of companion diagnostics and personalized medicine has amplified demand for highly specific molecular controls that can verify assay sensitivity, specificity, and limit of detection across diverse patient samples

- Regulatory agencies and accreditation bodies are also reinforcing quality standards for molecular testing, encouraging laboratories to integrate robust diagnostic controls into routine workflows. This has led manufacturers to develop multi-analyte and third-party independent controls compatible with multiple assay platforms

- The trend toward standardized, high-quality molecular diagnostic controls is reshaping laboratory best practices, supporting consistent clinical decision-making and enhancing confidence in molecular test outcomes across healthcare systems

Europe Molecular Diagnostic Controls Market Dynamics

Driver

Rising Demand for Accurate Molecular Testing Driven by Disease Burden and Advanced Diagnostics

- The increasing global burden of infectious diseases, cancer, and genetic disorders, combined with the rapid expansion of molecular diagnostics, is a key driver fueling demand for molecular diagnostic controls

- For instance, during the expansion of molecular testing capabilities for oncology and infectious disease screening, laboratories increasingly relied on validated molecular controls to ensure assay accuracy and regulatory compliance across large testing volumes

- As molecular diagnostics become central to early disease detection, treatment selection, and patient monitoring, the need for reliable controls to validate test performance has intensified. Molecular diagnostic controls help laboratories detect assay drift, reagent degradation, and operator errors, thereby safeguarding result integrity

- In addition, the growing adoption of advanced technologies such as real-time PCR, digital PCR, and NGS in clinical laboratories is driving demand for sophisticated controls capable of supporting complex workflows

- The expansion of molecular testing into decentralized settings, including hospital laboratories and reference labs, further boosts demand for ready-to-use, standardized diagnostic controls that simplify quality management and reduce operational variability

Restraint/Challenge

High Cost, Limited Customization, and Technical Complexity

- The relatively high cost of molecular diagnostic controls, particularly multi-analyte and platform-specific controls, presents a notable challenge for widespread adoption, especially in small laboratories and resource-constrained healthcare settings

- Some laboratories face difficulties in accessing controls that precisely match their specific assays, instruments, or emerging biomarkers, leading to limited customization options and potential compatibility issues

- In addition, the technical complexity involved in selecting, validating, and integrating appropriate molecular diagnostic controls into existing workflows can act as a barrier, particularly for laboratories with limited technical expertise or infrastructure

- Stability, storage requirements, and lot-to-lot consistency of controls also remain concerns, as variations can impact long-term assay performance and increase quality management costs

- While manufacturers are actively working to improve control stability and expand assay coverage, overcoming cost pressures, improving customization, and simplifying implementation will be critical for broader market penetration and sustained growth of the Molecular Diagnostic Controls market

Europe Molecular Diagnostic Controls Market Scope

The market is segmented on the basis of product, analyte type, application, end user, and distribution channel.

- By Product

On the basis of product, the Molecular Diagnostic Controls market is segmented into Independent Controls and Instrument Specific Controls. The Independent Controls segment dominated the largest market revenue share of 58.6% in 2025, driven by their broad compatibility across multiple molecular diagnostic platforms and instruments. Independent controls are widely preferred by clinical laboratories and reference labs as they offer flexibility in validating assays from different manufacturers. These controls help laboratories reduce dependency on instrument-specific consumables, lowering operational costs. They are extensively used for quality assurance, proficiency testing, and routine assay validation. Growing adoption of laboratory-developed tests (LDTs) further supports demand. Independent controls enable standardized performance monitoring across platforms, improving diagnostic accuracy. Regulatory emphasis on quality control in molecular diagnostics reinforces their use. Their availability for a wide range of analytes enhances market penetration. Strong demand from high-throughput labs contributes to dominance. Increasing testing volumes for infectious diseases and oncology also support growth. Their cost-effectiveness and operational efficiency strengthen adoption globally. North America and Europe account for significant usage due to mature laboratory infrastructure.

The Instrument Specific Controls segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, driven by increasing adoption of fully automated molecular diagnostic systems. These controls are specifically designed to match instrument workflows, ensuring optimal assay performance and regulatory compliance. Growing preference for closed-system platforms in hospitals and diagnostic centers supports rapid adoption. Instrument-specific controls reduce variability and enhance reproducibility of test results. Rising demand for point-of-care and rapid molecular testing further accelerates growth. Manufacturers increasingly bundle controls with diagnostic instruments, boosting market uptake. Technological advancements in PCR and NGS platforms support expansion. Regulatory approvals favor standardized instrument-linked controls. Increased installation of automated diagnostic analyzers globally fuels demand. Emerging markets are rapidly adopting integrated diagnostic systems. Instrument-specific controls ensure streamlined laboratory operations. These factors collectively drive the segment’s high CAGR.

- By Analyte Type

On the basis of analyte type, the market is segmented into Single Analyte Controls and Multi Analyte Controls. The Single Analyte Controls segment held the largest market revenue share of 55.2% in 2025, owing to their high specificity and widespread use in targeted diagnostic testing. Single analyte controls are extensively used for validating individual molecular assays, particularly in infectious disease and genetic testing. Laboratories prefer these controls for precise monitoring of assay sensitivity and accuracy. They are essential in confirming test performance for regulated diagnostic procedures. Growing demand for pathogen-specific testing supports adoption. These controls are commonly used in routine clinical workflows and proficiency testing programs. Their simplicity and ease of interpretation enhance reliability. Regulatory compliance requirements further support demand. High usage in PCR-based diagnostics strengthens dominance. Single analyte controls are cost-effective for focused testing needs. Strong adoption in clinical laboratories sustains market leadership. Developed regions contribute significantly to market share.

The Multi Analyte Controls segment is anticipated to grow at the fastest CAGR of 13.4% from 2026 to 2033, driven by increasing demand for multiplex molecular diagnostics. Multi analyte controls allow simultaneous validation of multiple targets, improving testing efficiency. Growing adoption of syndromic panels and multiplex PCR assays accelerates growth. These controls reduce time, cost, and reagent consumption per test. Rising use in oncology and infectious disease panels supports expansion. Technological advancements in molecular assay design favor multiplex testing. Clinical laboratories seek workflow optimization, boosting adoption. Increasing prevalence of complex diseases requiring multi-marker analysis drives demand. Expansion of high-throughput diagnostic platforms further supports growth. Multi analyte controls enhance quality assurance across multiple targets. Emerging healthcare systems increasingly adopt multiplex diagnostics. These factors contribute to the segment’s rapid growth trajectory.

- By Application

On the basis of application, the Molecular Diagnostic Controls market is segmented into Infectious Disease, Oncology, Genetic Testing, and Others. The Infectious Disease segment dominated the largest market revenue share of 46.8% in 2025, driven by high global testing volumes and continuous monitoring requirements. Molecular diagnostic controls are critical for ensuring accuracy in detecting viral, bacterial, and fungal pathogens. The COVID-19 pandemic significantly increased awareness and infrastructure for infectious disease testing. Ongoing surveillance of respiratory, sexually transmitted, and hospital-acquired infections sustains demand. Regulatory mandates require rigorous quality control for infectious disease diagnostics. High adoption of PCR and rapid molecular tests supports segment dominance. Public health programs and screening initiatives further drive usage. Laboratories rely on controls for assay validation and lot-to-lot consistency. Growing antimicrobial resistance monitoring supports sustained demand. Strong funding for infectious disease diagnostics reinforces adoption. North America and Asia-Pacific lead in testing volumes. This segment remains the cornerstone of molecular diagnostic controls usage.

The Oncology segment is expected to register the fastest CAGR of 14.2% from 2026 to 2033, driven by the rapid expansion of molecular oncology and precision medicine. Increasing use of companion diagnostics and biomarker-based testing supports demand for high-quality controls. Molecular controls ensure accuracy in detecting cancer-related genetic mutations. Rising cancer prevalence globally accelerates testing volumes. Adoption of next-generation sequencing (NGS) in oncology boosts control usage. Personalized treatment approaches require stringent quality validation. Pharmaceutical and diagnostic companies increasingly collaborate on oncology diagnostics. Regulatory emphasis on validated oncology assays supports growth. Growing investment in cancer research further accelerates adoption. Academic and clinical research institutions drive demand. Emerging markets are expanding oncology diagnostic infrastructure. These factors result in strong projected CAGR.

- By End User

On the basis of end user, the market is segmented into Clinical Laboratories, Hospitals, IVD Manufacturers & Contract Research Organizations, Academic & Research Institutes, and Others. The Clinical Laboratories segment accounted for the largest market revenue share of 49.5% in 2025, driven by high diagnostic testing volumes and routine quality control requirements. Clinical labs conduct large-scale molecular testing for infectious diseases, genetic disorders, and oncology. These laboratories rely heavily on diagnostic controls to ensure test accuracy and regulatory compliance. Expansion of centralized diagnostic labs supports sustained demand. Adoption of high-throughput automated platforms boosts control usage. Government and private lab networks contribute to dominance. Increasing outsourcing of diagnostic services reinforces market share. Stringent accreditation requirements further drive adoption. Clinical labs use controls for daily validation and proficiency testing. High sample volumes ensure continuous demand. Advanced laboratory infrastructure in developed regions supports growth. This segment remains the primary consumer of molecular diagnostic controls.

The IVD Manufacturers & Contract Research Organizations segment is projected to grow at the fastest CAGR of 12.7% from 2026 to 2033, driven by increasing assay development and clinical trial activities. These organizations use molecular controls extensively during test development, validation, and regulatory submissions. Growth in companion diagnostics and personalized medicine accelerates demand. Rising partnerships between pharma and diagnostics firms support expansion. CROs require standardized controls for multi-site trials. Increasing regulatory scrutiny drives quality assurance needs. Expansion of diagnostic R&D pipelines supports sustained growth. Global outsourcing trends further boost CRO adoption. Emerging biotech companies contribute to rising demand. Increased funding for diagnostic innovation supports this segment. Rapid technological advancements enhance testing complexity. These factors contribute to strong CAGR growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Retail Sales and Direct Tender. The Direct Tender segment dominated the largest market revenue share of 57.1% in 2025, driven by bulk procurement by hospitals, government laboratories, and large diagnostic networks. Direct tender agreements ensure consistent supply, cost advantages, and long-term contracts. Public healthcare systems prefer direct procurement for standardized quality control materials. Large laboratories benefit from volume discounts and technical support. Direct tender channels support regulatory compliance and traceability. National screening programs drive large-scale purchasing. Strong adoption in public health laboratories reinforces dominance. Direct procurement ensures reliable supply chains. Diagnostic infrastructure expansion supports growth. Institutional buyers prefer tender-based procurement models. Developed and emerging markets both utilize this channel extensively. This segment remains dominant due to cost-efficiency and reliability.

The Retail Sales segment is expected to witness the fastest CAGR of 10.9% from 2026 to 2033, driven by increasing demand from small laboratories and research institutions. Retail channels offer flexibility and faster access to molecular diagnostic controls. Growth of private diagnostic centers supports retail adoption. E-commerce platforms enhance accessibility and product availability. Smaller labs prefer retail purchasing for lower-volume needs. Expansion of academic research activities boosts demand. Retail sales support rapid replenishment cycles. Technological advancements increase product variety in retail channels. Emerging markets show growing reliance on retail distributors. Improved logistics and cold-chain infrastructure support growth. Rising demand for specialty and customized controls accelerates adoption. These factors contribute to strong retail CAGR growth.

Europe Molecular Diagnostic Controls Market Regional Analysis

- The Europe molecular diagnostic controls market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory requirements for diagnostic accuracy, increasing emphasis on quality assurance in clinical laboratories, and the rising adoption of molecular diagnostic testing across healthcare systems

- Growing prevalence of infectious diseases, cancer, and genetic disorders, along with expanding screening and early detection programs, is fueling demand for reliable molecular diagnostic controls. European laboratories are increasingly integrating standardized controls to ensure test reproducibility, regulatory compliance, and consistency across diverse molecular platforms

- The region is witnessing steady growth across hospital laboratories, reference laboratories, and research institutions, with molecular diagnostic controls being incorporated into both routine diagnostics and advanced molecular testing workflows

U.K. Molecular Diagnostic Controls Market Insight

The U.K. molecular diagnostic controls market dominated Europe with the largest revenue share of 38.6% in 2025, supported by a well-established healthcare infrastructure and strong government initiatives promoting high diagnostic quality standards. The widespread adoption of advanced molecular testing techniques across public and private laboratories, particularly for oncology, infectious diseases, and genetic screening, has significantly driven demand for molecular diagnostic controls. In addition, the U.K.’s robust regulatory framework and focus on standardized laboratory practices encourage the consistent use of validated controls to ensure accuracy and reliability of test results. Continued investments in laboratory modernization and expanding molecular diagnostic capabilities are expected to further support market growth during the forecast period.

Germany Molecular Diagnostic Controls Market Insight

The Germany molecular diagnostic controls market t is expected to expand at the fastest CAGR during the forecast period, driven by increasing investments in diagnostic research, expanding molecular testing capabilities, and a strong focus on precision medicine and early disease detection. Germany’s advanced healthcare infrastructure and emphasis on technological innovation support the adoption of sophisticated molecular diagnostic assays, thereby increasing the need for high-quality diagnostic controls. The growing use of molecular diagnostics in oncology, personalized medicine, and infectious disease monitoring is further accelerating demand. Additionally, Germany’s commitment to research and development, coupled with rising participation in clinical studies, is reinforcing the adoption of molecular diagnostic controls across clinical and research laboratories.

Europe Molecular Diagnostic Controls Market Share

The Molecular Diagnostic Controls industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Bio-Rad Laboratories (U.S.)

- Roche Diagnostics (Switzerland)

- Abbott (U.S.)

- Danaher Corporation (U.S.)

- Siemens Healthineers (Germany)

- QIAGEN (Germany)

- Merck KGaA (Germany)

- LGC Group (U.K.)

- Seracare Life Sciences (U.S.)

- Randox Laboratories (U.K.)

- ZeptoMetrix (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Becton, Dickinson and Company (U.S.)

- SeraCare (a QIAGEN Company) (U.S.)

- Microbiologics (U.S.)

- Ampliqon (Denmark)

- HyTest (Finland)

- Roche Molecular Diagnostics (U.S.)

Latest Developments in Europe Molecular Diagnostic Controls Market

- In June 2021, Molbio Diagnostics Pvt. Ltd. announced the launch of a new manufacturing facility in Goa for its Truenat Real-Time PCR molecular diagnostic platform, increasing production capacity and supporting expanded supply of molecular controls and assays across India and global markets

- In February 2022, ZeptoMetrix (Antylia Scientific) launched the SARS-CoV-2 Omicron Control, a molecular quality control designed to aid laboratories in accurately testing for variants of the SARS-CoV-2 virus, addressing challenges related to mutation detection in molecular assays

- In November 2024, Microbiologics completed the acquisition of SensID, a reference materials and quality controls manufacturer, expanding its molecular diagnostics control portfolio — particularly in oncology and precision medicine applications

- In June 2025, ZeptoMetrix announced the launch of the NATtrol Influenza A H5N1 Quantitative Stock, a molecular quality control product designed to simulate authentic clinical specimens while allowing labs to validate full assay workflows, including extraction and amplification steps, without handling live virus material

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.