Europe Modular Construction Market Analysis and Insights

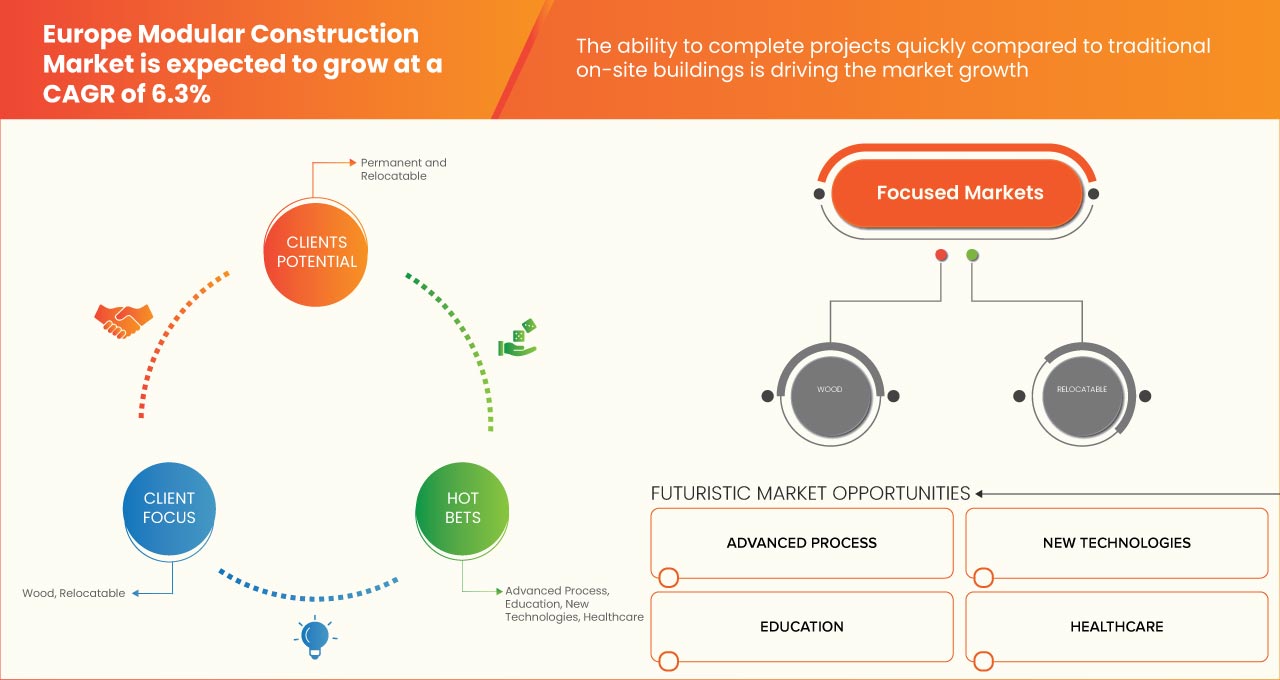

Europe modular construction market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 6.3% in the forecast period of 2023 to 2030 and is expected to reach USD 28,431,693.42 thousand by 2030. The major factor driving the growth of the Europe modular construction market is the ease of disassembling helps to deconstruct into parts and can be reconstructed or redistributed to incorporate into various other projects.

Molecular buildings designed for disassembly would be easier to remove in a more controlled way, causing less environmental harm than building constructed and demolished using traditional construction methods. Modular projects are designed in such a way as to maximize sustainability or to meet a project requirement for future relocation.

The Europe modular construction market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Permanent and Relocatable), Material (Wood, Steel, Concrete, and Others), End-User (Residential, Hospitality, Healthcare, Education, Retail and Commercial, Relocatable Buildings, Permanent Modular, Office, and Others) |

|

Countries Covered |

U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxembourg, and rest of Europe |

|

Market Players Covered |

LAING O’ROURKE, Skanska, Modulaire Group, KLEUSBERG, Bechtel Corporation, Fluor Corporation, Wernick Group, KOMA MODULAR, and Elements Europe among others |

Market Definition

Modular construction is a process in which a building is constructed off-site. The building is constructed under controlled conditions using the same design and materials to the same codes and standards as usually built facilities but in around half the time. Buildings are manufactured in "modules" that when put together on site, and specifications of the most sophisticated site-built facility reflect identical design intent without compromise.

Europe Modular Construction Market Dynamics

DRIVERS

- Ability to Complete Projects Quickly Compared to Traditional On-Site Buildings

Construction off-site is transforming the construction process for schools, commercial buildings, hospitals, and other construction industries, ensuring better construction quality management and quicker delivery times. Modular construction has been utilized for a long time in the construction of residential and many other commercial product types due to the quick delivery times for the assigned project. Modular buildings are constructed off-site in modules and brought to the site in flat-packed panels, ready to build.

- Increase in Per Capita Income and Easy Availability of Finances and Loans

Growing urbanization and industrialization has led to the growth of the economies. The advantages of using modular and off-site construction as compared with the traditional construction methods are numerous due to its efficiency in delivery, shorter schedules, lower cost, higher quality, and better safety. Modular construction provides a solution to this shortage by enabling more automation. New technologies such as Artificial Intelligence (AI) can help to increase off-site prefabrication—modular construction cuts cost by 20% to 30%.

OPPORTUNITIES

- Rise in Investments and Growing Demand for New Housing, Commercial, and Industrial Structures

The industrialists shifted in preference towards maximizing modular design constructed to create affordable housing. In addition, the real estate sector is among the most globally recognized sectors. It comprises four sub-sectors - housing, retail, hospitality, and commercial. The growth of this sector is well complemented by the growth in the corporate environment, the demand for office space, and urban and semi-urban accommodation. Therefore, the real estate sector has witnessed high growth in recent times with a rise in demand for office and residential spaces.

- Renewed Focus on Upgrading Healthcare Infrastructure

Modular construction provides clean and noise-free construction, one factor that the healthcare industry is shifting its preference to modular construction for facility space expansion. Most of the buildings are done off-site because the modules are constructed in a manufacturing facility, so there will be less noise at the medical facility, and the patients will face no disturbance. More than ever, owners of hospitals and other healthcare facilities are turning to modular construction for their expansion needs.

RESTRAINTS/CHALLENGES

- Shortage of Skilled Labor in the Modular Construction Industry

The major challenge faced by the Europe modular construction market is the lack of skilled labor in the industry, which hampers the market growth to a larger extent. An unskilled labor force negatively impacts project performance. The focus should be made on improving and enhancing labor skills as it is highly demanding in the construction sector. Performance in any industry is very important in achieving measures to ensure sustainability and competitiveness.

- Fluctuating Transportation Costs for Prefabricated Modules

Modular-constructed buildings are fast becoming the construction method choice across the world. People worldwide shifted to modular construction due to cost-effectiveness, efficient construction, and safety associated with the workers. The transportation of prefabricated modular building sections requires lots of space. Also, the restriction on manufacturing and transportation can limit the size of modular units used for construction, which impacts the desirable room sizes. Changing transportation costs for prefabricated modules can significantly restrain market growth.

Recent Development

- In February 2021, according to Forbes, traditionally constructed houses can take up to four to six months to build, whereas modular-constructed houses take between six and ten weeks

Europe Modular Construction Market Scope

Europe modular construction market is segmented into three notable segments based on type, material, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Permanent

- Relocatable

Based on type, the market is segmented into permanent and relocatable.

Material

- Wood

- Steel

- Concrete

- Others

Based on material, the market is segmented into wood, steel, concrete, and others.

End-User

- Residential

- Hospitality

- Healthcare

- Education

- Retail And Commercial

- Office

- Others

Based on end-user, the market is segmented into residential, hospitality, healthcare, education, retail and commercial, office, and others.

Europe Modular Construction Market Regional Analysis/Insights

Europe modular construction market is segmented into three notable segments based on type, material, and end-user.

The countries in the Europe modular construction market are the U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxembourg, and the rest of Europe. The U.K. is dominating the market in terms of market share and market revenue due to the growing characteristics of modular construction in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Modular Construction Market Share Analysis

The Europe modular construction market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the Europe modular construction market are LAING O’ROURKE, Skanska, Modulaire Group, KLEUSBERG, Bechtel Corporation, Fluor Corporation, Wernick Group, KOMA MODULAR, and Elements Europe among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MODULAR CONSTRUCTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ABILITY TO COMPLETE PROJECTS QUICKLY COMPARED TO TRADITIONAL ON-SITE BUILDINGS

5.1.2 GROWING EMPHASIS ON SUSTAINABILITY, QUALITY, AND WORKERS' SAFETY

5.1.3 EASE OF DISASSEMBLING, REFURBISHMENT, AND RELOCATION OF MODULAR CONSTRUCTIONS

5.1.4 INCREASE IN PER CAPITA INCOME AND EASY AVAILABILITY OF FINANCES AND LOANS

5.2 RESTRAINTS

5.2.1 LACK OF RELIABILITY ON MODULAR CONSTRUCTION IN EARTHQUAKE-PRONE REGIONS

5.2.2 FLUCTUATING TRANSPORTATION COSTS FOR PREFABRICATED MODULES

5.3 OPPORTUNITIES

5.3.1 RISE IN INVESTMENTS AND GROWING DEMAND FOR NEW HOUSING, COMMERCIAL, AND INDUSTRIAL STRUCTURES

5.3.2 INCREASED SUPPORT FROM GOVERNMENT RULES AND POLICIES

5.3.3 RENEWED FOCUS ON UPGRADING HEALTHCARE INFRASTRUCTURE

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING MODULAR CONSTRUCTION

5.4.2 SHORTAGE OF SKILLED LABOR IN THE MODULAR CONSTRUCTION INDUSTRY

6 EUROPE MODULAR CONSTRUCTION MARKET, BY TYPE

6.1 OVERVIEW

6.2 PERMANENT

6.3 RELOCATABLE

7 EUROPE MODULAR CONSTRUCTION MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 WOOD

7.3 STEEL

7.4 CONCRETE

7.5 OTHERS

8 EUROPE MODULAR CONSTRUCTION MARKET, BY END-USER

8.1 OVERVIEW

8.2 RESIDENTIAL

8.3 HOSPITALITY

8.4 HEALTHCARE

8.5 EDUCATION

8.6 RETAIL AND COMMERCIAL

8.6.1 RETAIL AND COMMERCIAL, BY END-USER

8.6.1.1 RELOCATABLE BUILDING

8.6.1.2 PERMANENT MODULAR

8.7 OFFICE

8.8 OTHERS

9 EUROPE MODULAR CONSTRUCTION MARKET

9.1 EUROPE

9.1.1 U.K.

9.1.2 GERMANY

9.1.3 FRANCE

9.1.4 ITALY

9.1.5 SPAIN

9.1.6 RUSSIA

9.1.7 SWITZERLAND

9.1.8 TURKEY

9.1.9 BELGIUM

9.1.10 NETHERLANDS

9.1.11 LUXEMBOURG

9.1.12 REST OF EUROPE

10 EUROPE MODULAR CONSTRUCTION MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

10.2 CONTRACT

10.3 DIVESTMENT

10.4 ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 SKANSKA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 LAING O’ ROURKE

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT UPDATE

12.3 MODULAIRE GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT UPDATE

12.4 BECHTEL CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT UPDATE

12.5 KLEUSBERG

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT UPDATES

12.6 ELEMENTS EUROPE

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 FLUOR CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 KOMA MODULAR

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 WERNICK GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PREFABRICATED BUILDINGS, WHETHER OR NOT COMPLETE OR ALREADY ASSEMBLED; HS CODE – 9406 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PREFABRICATED BUILDINGS, WHETHER OR NOT COMPLETE OR ALREADY ASSEMBLED; HS CODE – 9406 (USD THOUSAND)

TABLE 3 EUROPE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 5 EUROPE MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 10 U.K. MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 U.K. MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 12 U.K. MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 13 U.K. MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 14 U.K. RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 15 GERMANY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 GERMANY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 17 GERMANY MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 GERMANY MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 GERMANY RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 20 FRANCE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 FRANCE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 22 FRANCE MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 23 FRANCE MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 24 FRANCE RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 25 ITALY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 ITALY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 27 ITALY MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 28 ITALY MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 29 ITALY RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 30 SPAIN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SPAIN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 32 SPAIN MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 33 SPAIN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 34 SPAIN RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 35 RUSSIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 RUSSIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 37 RUSSIA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 RUSSIA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 39 RUSSIA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 40 SWITZERLAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 SWITZERLAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 42 SWITZERLAND MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 SWITZERLAND MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 44 SWITZERLAND RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 45 TURKEY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 TURKEY MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 47 TURKEY MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 48 TURKEY MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 49 TURKEY RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 50 BELGIUM MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 BELGIUM MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 52 BELGIUM MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 53 BELGIUM MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 54 BELGIUM RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 55 NETHERLANDS MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NETHERLANDS MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 57 NETHERLANDS MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 58 NETHERLANDS MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 59 NETHERLANDS RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 60 LUXEMBOURG MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 LUXEMBOURG MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 62 LUXEMBOURG MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 63 LUXEMBOURG MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 LUXEMBOURG RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 65 REST OF EUROPE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 REST OF EUROPE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

List of Figure

FIGURE 1 EUROPE MODULAR CONSTRUCTION MARKET

FIGURE 2 EUROPE MODULAR CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MODULAR CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MODULAR CONSTRUCTION MARKET: EUROPE MARKET ANALYSIS

FIGURE 5 EUROPE MODULAR CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MODULAR CONSTRUCTION MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE MODULAR CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE MODULAR CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE MODULAR CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE MODULAR CONSTRUCTION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE MODULAR CONSTRUCTION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE MODULAR CONSTRUCTION MARKET: SEGMENTATION

FIGURE 13 GROWING EMPHASIS ON SUSTAINABILITY, QUALITY, AND WORKER SAFETY IS EXPECTED TO DRIVE EUROPE MODULAR CONSTRUCTION MARKET IN THE FORECAST PERIOD

FIGURE 14 PERMANENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MODULAR CONSTRUCTION MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE MODULAR CONSTRUCTION MARKET

FIGURE 16 EUROPE MODULAR CONSTRUCTION MARKET: BY TYPE, 2022

FIGURE 17 EUROPE MODULAR CONSTRUCTION MARKET: BY MATERIAL, 2022

FIGURE 18 EUROPE MODULAR CONSTRUCTION MARKET: BY END-USER, 2022

FIGURE 19 EUROPE MODULAR CONSTRUCTION MARKET: SNAPSHOT (2022)

FIGURE 20 EUROPE MODULAR CONSTRUCTION MARKET: BY COUNTRY (2022)

FIGURE 21 EUROPE MODULAR CONSTRUCTION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 EUROPE MODULAR CONSTRUCTION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 EUROPE MODULAR CONSTRUCTION MARKET: BY TYPE (2023 - 2030)

FIGURE 24 EUROPE MODULAR CONSTRUCTION MARKET: COMPANY SHARE 2022 (%)

Europe Modular Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Modular Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Modular Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.