Market Analysis and Insights: Europe Middle Office Outsourcing Market

Market Analysis and Insights: Europe Middle Office Outsourcing Market

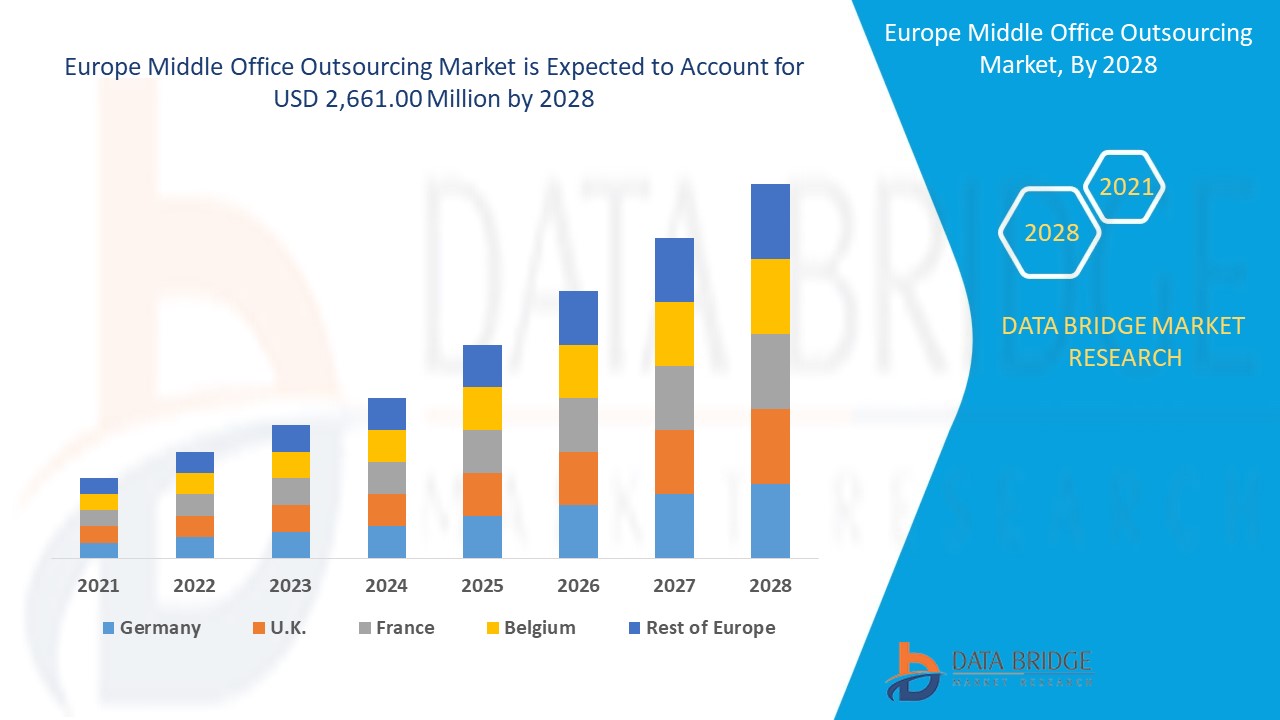

The middle office outsourcing market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.2% in the forecast period of 2021 to 2028 and expected to reach USD 2,661.00 million by 2028. Rise in need to improve efficiency and productivity is expected to drive the growth of the market.

The middle office is the department in a financial services organization, investment bank, or hedge fund that lies in between the front and back office. It typically manages risk and calculates profits and losses. Middle office outsourcing refers to carrying out these middle office non-core functions with the help of a third party. Middle office outsourcing carries out a package of traditional middle-office functions, such as trade processing, reconciliations, corporate actions and investment accounting, with new data aggregation, storage and analytics services. Middle-office operations were outsourced for competitive advantage.

Some of the factors which are driving the market are increasing adoption of new technologies such as AI, machine learning and others in outsourcing and improved focus towards reducing the cost of conducting business. Delay in outsourcing process is restraining the middle office outsourcing market growth. Emergence of big data analytics and increasing digitization and automation of business processes are some of the factors which are opening lucrative opportunity for the market. Legal concerns and data privacy issues is acting as a major challenge for the market growth.

This middle office outsourcing market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Europe Middle Office Outsourcing Market Scope and Market Size

Europe Middle Office Outsourcing Market Scope and Market Size

Europe middle office outsourcing market is segmented on the basis of offering, deployment model, and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of offering, the Europe middle office outsourcing market has been segmented into foreign exchange and trade management, portfolio management, investment operations, liquidity management, asset class servicing and others. In 2021, foreign exchange and trade management is expected to dominate the market mainly due to factors such as increasing need for outsourcing services for foreign exchange and trade management activities, need to reduce costs, and managing remote working of asset management operations in an efficient way.

- On the basis of deployment model, the Euope middle office outsourcing market has been segmented into cloud and on premises. In 2021, on-premises is expected to dominate the market, this is mainly attributed to huge presence asset management companies who prefers on premise deployment model to manage data.

- On the basis of end user, the Europe middle office outsourcing market has been segmented into investment banking and management firms, asset management companies, stock exchanges, broker- dealers, banks and others. In 2021, investment banking and management firms is expected to dominate the market owing to increasing demand for outsourcing of investment operations due to huge presence of investment banking and management firms.

Middle Office Outsourcing Market Country Level Analysis

Middle office outsourcing market is analysed and market size information is provided by country, offering, deployment model, and end user as referenced above.

The countries covered in Europe middle office outsourcing market report are, U.K., Germany, France, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and Rest of Europe

U.K. dominates the middle office outsourcing market owing to factors such as focus on increasing potential for outsourcing services and strong presence of investment operations in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Expanding Demand for Middle Office Outsourcing Business

Middle office outsourcing market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in middle office outsourcing and changes in regulatory scenarios with their support for the middle office outsourcing market. The data is available for historic period 2019.

Competitive Landscape and Middle Office Outsourcing Market Share Analysis

Middle office outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to middle office outsourcing market.

The major players covered in the report are Accenture, BNP Paribas, GBST, JPMorgan Chase & Co., SS&C Technologies, Inc., Royal Bank of Canada, State Street Corporation, Citigroup Inc., THE BANK OF NEW YORK MELLON CORPORATION, CACEIS, Apex Group Ltd., Northern Trust Corporation, Societe Generale, Linedata, Empaxis Data Management, Inc., Indus Valley Partners., BROWN BROTHERS HARRIMAN, and Genpact among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of middle office outsourcing market.

For instance,

- In February 2021, BROWN BROTHERS HARRIMAN announced launch of new look middle-office platform named as ‘BBH Investment Operations, powered by Infomediary’. This newly launched platform aims to transform the way asset manager clients utilizes data for front-, middle- and back-office processes. This will help the company to enhance their offerings in the market.

- In November 2020, Apex Group Ltd. announced the launch of CFO & COO Solutions via their subsidiary Throgmorton. This newly launched CFO & COO Solutions will provide a comprehensive offering to help outsource functions and alleviate the associated cost pressures on asset managers. This will help the company to enhance their offerings and to grow in the market.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for middle office outsourcing through expanded range of size.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF EUROPE MIDDLE OFFICE OUTSOURCING MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- offering timeline curve

- MARKET end user COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- risE IN adoption of middle office outsourcing solutions

- Introduction of various data analytics services

- RISE IN adoption of new technologies such as AI, Machine learning

- RisE IN need to improve efficiency and productivity

- Improved focus towards reducing cost of conducting business

- Restraints

- Unexpected operational and integration costs

- Delay in outsourcing process

- opportunities

- IncreasE IN emphasis on research and development activities

- Emergence of big data analytics

- Accelerated growth in the financial sector

- RisE IN adoption of cloud technology

- IncreasE IN digitization and Automation of Business Processes

- challenges

- Legal concerns and data privacy issues

- Lack of domain knowledge and technical expertise

- IMPACT OF COVID-19 ON THE EUROPE MIDDLE OFFICE OUTSOURCING MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND AND SUPPLY CHAIN

- CONCLUSION

- Europe Middle office outsourcing MARKET, BY offering

- overview

- foreign exchange and trade management

- portfolio management

- portfolio management

- pre-trade compliance

- order management

- investment operations

- reconciliation

- investment record-keeping

- cash administration

- derivatives processing

- hedge solutions

- collateral management services

- DATA MANAGEMENT, DATA CAPTURE, ONBOARDING

- VALUATION AND CALCULATION

- DAILY CALL ADMINISTRATION

- COLLATERAL SERVICING

- EMIR reporting

- LIQUIDITY MANAGEMENT

- ASSET CLASS SERVICING

- others

- Europe MIDDLE OFFICE OUTSOURCING MARKET, BY deployment model

- overview

- cloud

- on-premise

- Europe MIDDLE OFFICE OUTSOURCING MARKET, BY end user

- overview

- investment banking and management firms

- asset management companies

- stock exchanges

- broker- dealers

- banks

- others

- Europe MIDDLE OFFICE OUTSOURCING market, by REGION

- EUROPE

- U.K.

- GERMANY

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- TURKEY

- BELGIUM

- NETHERLANDS

- SWITZERLAND

- rest of EUROPE

- Europe MIDDLE OFFICE OUTSOURCING Market: COMPANY landscape

- Company share analysis: Europe

- swot analysis

- company profile

- JPMorgan Chase & Co.

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- solution PORTFOLIO

- recent DEVELOPMENT

- Citigroup, Inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- Service PORTFOLIO

- recent DEVELOPMENT

- State Street Corporation

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- solution PORTFOLIO

- recent DEVELOPMENTS

- Accenture

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- service PORTFOLIO

- recent DEVELOPMENTS

- THE BANK OF NEW YORK MELLON CORPORATION

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- solution PORTFOLIO

- recent DEVELOPMENTS

- Adepa Europe Services S.A.

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENT

- Apex Group Ltd.

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENTs

- BNP Paribas

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENT

- BROWN BROTHERS HARRIMAN

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENT

- CACEIS

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENTS

- Empaxis Data Management, Inc.

- COMPANY snapshot

- solution PORTFOLIO

- recent DEVELOPMENT

- GBST

- COMPANY snapshot

- solution PORTFOLIO

- recent DEVELOPMENT

- Genpact

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- HedgeGuard

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENT

- Indus Valley Partners

- COMPANY snapshot

- service PORTFOLIO

- recent DEVELOPMENT

- Linedata

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENTS

- Northern Trust Corporation

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENTS

- Royal Bank of Canada

- COMPANY snapshot

- REVENUE ANALYSIS

- product & Service PORTFOLIO

- recent DEVELOPMENT

- Societe Generale

- COMPANY snapshot

- REVENUE ANALYSIS

- solution PORTFOLIO

- recent DEVELOPMENTS

- SS&C Technologies, Inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- solution & Service PORTFOLIO

- recent DEVELOPMENTS

- questionnaire

- related reports

List of Table

TABLE 1 Europe Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 2 Europe foreign exchange and trade management in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 3 Europe portfolio management in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 4 Europe Portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD MILLION)

TABLE 5 Europe Investment operations in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 6 Europe Investment operations in Middle office outsourcing Market, By type, 2019-2028 (USD MILLION)

TABLE 7 Europe Collateral management services in Middle office outsourcing Market, By type, 2019-2028 (USD MILLION)

TABLE 8 Europe Liquidity management in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 9 Europe Asset class servicing in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 10 Europe Others in Middle office outsourcing market, By region, 2019-2028 (USD Million)

TABLE 11 Europe Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 12 Europe cloud in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 13 Europe on-premise in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 14 Europe Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 15 Europe investment banking and management firms in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 16 Europe asset management companies in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 17 Europe stock exchanges in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 18 Europe broker- dealers in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 19 Europe banks in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 20 Europe others in Middle office outsourcing Market, By Region, 2019-2028 (USD MILLION)

TABLE 21 EUROPE Middle office outsourcing Market, By Country, 2019-2028 (USD Million)

TABLE 22 EUROPE Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 23 EUROPE investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 24 EUROPE collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 25 EUROPE portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 26 EUROPE Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 27 EUROPE Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 28 U.K. Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 29 U.K. investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 30 U.K. collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 31 U.K. portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 32 U.K. Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 33 U.K. Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 34 GERMANY Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 35 GERMANY investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 36 GERMANY collateral management services in investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 37 GERMANY portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 38 GERMANY Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 39 GERMANY Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 40 FRANCE Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 41 FRANCE investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 42 FRANCE collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 43 FRANCE portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 44 FRANCE Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 45 FRANCE Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 46 ITALY Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 47 ITALY investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 48 ITALY collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 49 ITALY portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 50 ITALY Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 51 ITALY Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 52 SPAIN Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 53 SPAIN investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 54 SPAIN collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 55 SPAIN portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 56 SPAIN Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 57 SPAIN Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 58 RUSSIA Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 59 RUSSIA investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 60 RUSSIA collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 61 RUSSIA portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 62 RUSSIA Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 63 RUSSIA Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 64 TURKEY Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 65 TURKEY investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 66 TURKEY collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 67 TURKEY portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 68 TURKEY Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 69 TURKEY Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 70 BELGIUM Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 71 BELGIUM investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 72 BELGIUM collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 73 BELGIUM portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 74 BELGIUM Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 75 BELGIUM Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 76 NETHERLANDS Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 77 NETHERLANDS investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 78 NETHERLANDS collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 79 NETHERLANDS portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 80 NETHERLANDS Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 81 NETHERLANDS Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 82 SWITZERLAND Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

TABLE 83 SWITZERLAND investment operations in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 84 SWITZERLAND collateral management services in Middle office outsourcing Market, By Type, 2019-2028 (USD Million)

TABLE 85 SWITZERLAND portfolio management in Middle office outsourcing Market, By type, 2019-2028 (USD Million)

TABLE 86 SWITZERLAND Middle office outsourcing Market, By deployment model, 2019-2028 (USD Million)

TABLE 87 SWITZERLAND Middle office outsourcing Market, By end user, 2019-2028 (USD Million)

TABLE 88 rest of EUROPE Middle office outsourcing Market, By offering, 2019-2028 (USD Million)

List of Figure

FIGURE 1 EUROPE Middle office outsourcing MARKET: segmentation

FIGURE 2 Europe Middle office outsourcing market: data triangulation

FIGURE 3 Europe Middle office outsourcing market: DROC ANALYSIS

FIGURE 4 Europe Middle office outsourcing market: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe Middle office outsourcing market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe Middle office outsourcing market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe Middle office outsourcing market: DBMR MARKET POSITION GRID

FIGURE 8 Europe Middle office outsourcing market: vendor share analysis

FIGURE 9 Europe MIDDLE OFFICE OUTSOURCING market: MARKET end user COVERAGE GRID

FIGURE 10 Europe Middle office outsourcing market: SEGMENTATION

FIGURE 11 Rising adoption of middle office outsourcing solutions is EXPECTED TO DRIVE EUROPE MIDDLE OFFICE OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 foreign exchange and trade management segment is expected to account for the largest share of Europe Middle office outsourcing market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF Europe Middle Office Outsourcing Market

FIGURE 14 Europe Middle office outsourcing MARKET, BY offering, 2020

FIGURE 15 Europe Middle office outsourcing MARKET: BY deployment model, 2020

FIGURE 16 Europe Middle office outsourcing MARKET: BY end User, 2020

FIGURE 17 EUROPE Middle office outsourcing Market: SNAPSHOT (2020)

FIGURE 18 EUROPE Middle office outsourcing Market: by Country (2020)

FIGURE 19 EUROPE Middle office outsourcing Market: by Country (2021 & 2028)

FIGURE 20 EUROPE Middle office outsourcing Market: by Country (2020 & 2028)

FIGURE 21 EUROPE Middle office outsourcing Market: by offering (2021-2028)

FIGURE 22 EUROPE MIDDLE OFFICE OUTSOURCING market: COMPANY SHARE 2020 (%)

Europe Middle Office Outsourcing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Middle Office Outsourcing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Middle Office Outsourcing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.