Europe Mass Notification Systems Market

Market Size in USD Billion

CAGR :

%

USD

3.05 Billion

USD

11.40 Billion

2025

2033

USD

3.05 Billion

USD

11.40 Billion

2025

2033

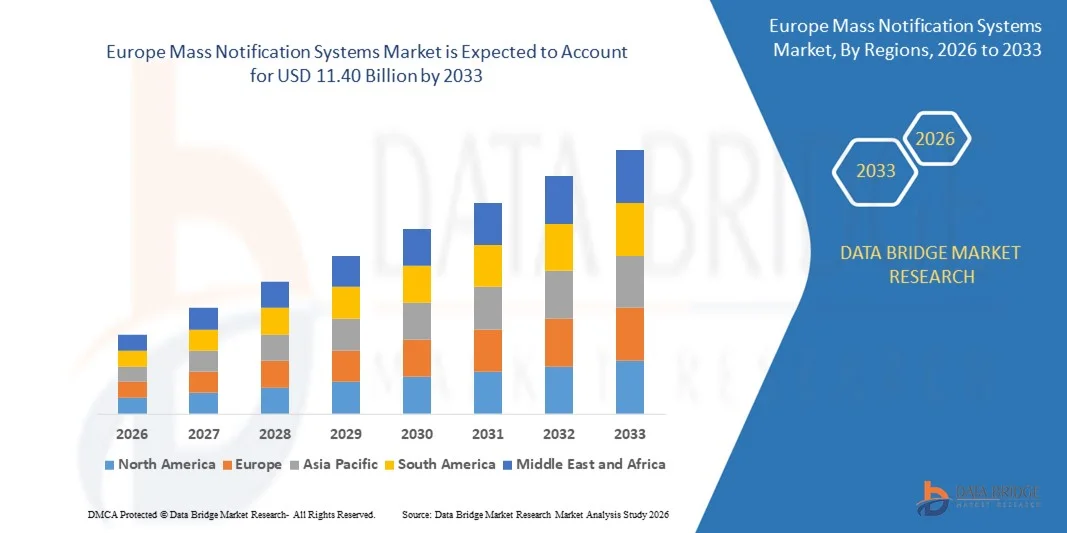

| 2026 –2033 | |

| USD 3.05 Billion | |

| USD 11.40 Billion | |

|

|

|

|

Europe Mass Notification Systems Market Size

- The Europe mass notification systems market size was valued at USD 3.05 billion in 2025 and is expected to reach USD 11.40 billion by 2033, at a CAGR of 17.9% during the forecast period

- The market growth is largely driven by the rising need for rapid, reliable, and multi-channel emergency communication across public and private organizations, as increasing incidents related to natural disasters, security threats, and workplace emergencies are elevating preparedness requirements

- Furthermore, growing regulatory emphasis on public safety compliance and the expanding adoption of cloud-based and mobile communication technologies are encouraging organizations to invest in advanced mass notification systems. These combined factors are accelerating system deployment across enterprises and government bodies, thereby significantly supporting overall market expansion

Europe Mass Notification Systems Market Analysis

- Mass notification systems are communication platforms designed to quickly disseminate critical alerts and instructions to large groups through channels such as SMS, voice calls, emails, mobile apps, and desktop notifications, ensuring timely awareness during emergencies

- The increasing demand for mass notification systems is primarily supported by heightened focus on organizational resilience, growing integration with security and incident management solutions, and the need for real-time situational awareness to minimize risk and improve emergency response outcomes

- Germany dominated the mass notification systems market in 2025, due to strong regulatory emphasis on workplace safety, emergency preparedness, and public warning systems across industrial and public sectors

- U.K. is expected to be the fastest growing country in the mass notification systems market during the forecast period due to rising focus on public safety, business continuity, and regulatory compliance across enterprises and public institutions

- Software segment dominated the market with a market share of around 65% in 2025, due to the demand for centralized alert platforms that can integrate across devices and communication channels. Organizations are increasingly adopting robust software platforms that offer real-time alerts, multi-channel messaging, and scalability to meet the needs of diverse operations and emergency protocols

Report Scope and Mass Notification Systems Market Segmentation

|

Attributes |

Mass Notification Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Mass Notification Systems Market Trends

Growing Integration of Cloud-Based and Mobile-Enabled Mass Notification Platforms

- A major trend in the mass notification systems market is the increasing integration of cloud-based architectures and mobile-enabled platforms, driven by the need for faster, scalable, and location-independent emergency communication. This integration is enhancing the ability of organizations to deliver real-time alerts across multiple channels while ensuring system flexibility and reliability during critical events

- For instance, Everbridge has expanded its cloud-based mass notification capabilities to support multi-channel communication across SMS, voice, email, and mobile applications, enabling enterprises and public institutions to improve crisis response speed and coordination. Such platforms strengthen communication reach and support centralized management of alerts across geographically dispersed users

- The adoption of mobile-enabled mass notification systems is rising as smartphones become the primary communication device for employees, students, and citizens. This is improving message delivery effectiveness and ensuring higher response rates during emergencies

- Organizations with distributed workforces are increasingly relying on cloud-hosted notification platforms to maintain business continuity and employee safety. This is positioning cloud deployment as a preferred approach for scalable and resilient emergency communication

- The integration of mass notification systems with other digital safety and security platforms is gaining traction as organizations seek unified incident response frameworks. This trend is reinforcing the role of cloud and mobile technologies in building connected and responsive safety ecosystems

- The growing reliance on digital infrastructure for emergency preparedness is strengthening this trend, as cloud-based and mobile-enabled mass notification platforms support rapid deployment, real-time updates, and continuous system availability across diverse environments

Europe Mass Notification Systems Market Dynamics

Driver

Rising Focus on Real-Time Emergency Communication and Public Safety Compliance

- The increasing emphasis on real-time emergency communication is a key driver for the mass notification systems market, as organizations prioritize timely information dissemination to minimize risk and protect lives. Heightened awareness of workplace safety, public security, and disaster preparedness is encouraging broader adoption of these systems

- For instance, Toronto Zoo selected Everbridge’s mass notification system to rapidly communicate critical alerts to staff and visitors, improving on-site safety management during emergencies. This adoption reflects how public venues are strengthening compliance with safety regulations through reliable notification platforms

- Government agencies and enterprises are investing in mass notification solutions to meet regulatory requirements related to emergency preparedness and public warning obligations. These systems support standardized communication protocols and ensure consistent alert delivery

- The growing frequency of natural disasters, security incidents, and operational disruptions is increasing the need for coordinated and immediate communication. This is reinforcing the importance of mass notification systems as essential components of organizational resilience strategies

- The rising expectation for transparent, fast, and accurate emergency communication is solidifying real-time notification capabilities as a critical driver shaping long-term market expansion

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The mass notification systems market faces challenges related to high implementation costs and the complexity of integrating new platforms with existing IT and communication infrastructure. These factors can slow adoption, particularly among cost-sensitive organizations

- For instance, large-scale deployments by enterprises integrating mass notification systems with legacy telephony, security, and building management systems often require significant upfront investment and technical customization. This increases deployment timelines and overall project costs

- Complex system integration demands skilled IT resources and ongoing maintenance, adding to operational expenses for organizations. These requirements can limit adoption among small and medium organizations

- Ensuring interoperability across multiple communication channels and third-party platforms further increases system complexity. Organizations must invest in testing and configuration to maintain reliable alert delivery

- These integration and cost-related challenges remain key constraints that influence adoption rates, despite the growing need for effective mass notification solutions across public and private sectors

Europe Mass Notification Systems Market Scope

The market is segmented on the basis of offering, solution, deployment model, organization size, application, and end user.

- By Offering

On the basis of offering, the mass notification systems market is segmented into hardware, software, and service. The software segment dominated the market with the largest revenue share of around 65% in 2025, driven by the demand for centralized alert platforms that can integrate across devices and communication channels. Organizations are increasingly adopting robust software platforms that offer real-time alerts, multi-channel messaging, and scalability to meet the needs of diverse operations and emergency protocols.

The service segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by the growing demand for managed and professional services. These services include system integration, maintenance, and support, which are critical for ensuring uninterrupted operation and compliance with industry-specific safety requirements.

- By Solution

On the basis of solution, the mass notification systems market is segmented into in-building solutions, distributed recipient solutions, and wide-area solutions. The distributed recipient solutions segment held the largest revenue share in 2025, driven by the need to reach users through multiple channels such as SMS, email, phone calls, and mobile apps. These solutions enable organizations to deliver rapid alerts across geographies and are widely adopted for both internal and public communication.

The wide-area solutions segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in city-wide alerting systems and government initiatives for public safety and disaster response. These systems are essential for outdoor warning sirens and geolocation-based alerts.

- By Deployment Model

On the basis of deployment model, the mass notification systems market is segmented into on-premises and cloud. The cloud segment held the largest revenue share in 2025, attributed to its flexibility, scalability, and lower upfront costs. Cloud-based solutions enable rapid deployment and are particularly suited for organizations with distributed operations or limited IT infrastructure.

The on-premises segment is expected to witness the fastest growth rate from 2026 to 2033, due to its relevance for institutions with strict data control, security compliance, or offline operations. Government and defense organizations often prefer on-premise deployments to maintain full control over sensitive data.

- By Organization Size

On the basis of organization size, the mass notification systems market is segmented into large organizations and small and medium organizations. The large organizations segment accounted for the largest revenue share in 2025, driven by the scale and complexity of communication needs across diverse facilities and departments. These organizations prioritize rapid alerting, compliance, and business continuity, often investing in comprehensive notification infrastructure.

The small and medium organization segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by growing awareness of the benefits of mass notification systems in risk mitigation. Cloud-based, cost-effective solutions make adoption feasible for smaller firms with limited budgets.

- By Application

On the basis of application, the mass notification systems market is segmented into Integrated Public Alert and Warning System (IPAWS), interoperable emergency communication, and business continuity and disaster recovery. The business continuity and disaster recovery segment dominated the market in 2025, driven by increased incidents of cyberattacks, natural disasters, and operational disruptions. Enterprises across industries are adopting MNS to ensure real-time information delivery and minimize downtime.

The Integrated Public Alert and Warning System (IPAWS) segment is expected to witness the fastest growth rate from 2026 to 2033, particularly in countries with advanced emergency response frameworks. IPAWS supports nationwide alerts, improving coordination among public agencies and communities.

- By End User

On the basis of end user, the mass notification systems market is segmented into commercial, industrial, healthcare, energy and utilities, IT and telecommunication, education, transport and logistics, hospitality, government, defense, retail, and others. The government segment held the largest market revenue share in 2025, driven by national mandates for emergency preparedness and public alert systems. Governments are deploying advanced mass notification systems for crisis communication, evacuation alerts, and weather warnings.

The healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the critical need for real-time coordination in hospitals, clinics, and care facilities. MNS platforms help manage staff alerts, patient notifications, and compliance with health and safety standards.

Europe Mass Notification Systems Market Regional Analysis

- Germany dominated the mass notification systems market with the largest revenue share in 2025, driven by strong regulatory emphasis on workplace safety, emergency preparedness, and public warning systems across industrial and public sectors

- The country’s advanced industrial base, widespread adoption of digital communication infrastructure, and high penetration of enterprise safety and security platforms continue to support consistent demand for mass notification systems across manufacturing, transportation, and government applications

- Increasing investments in smart infrastructure, critical event management, and integrated safety platforms, supported by technology providers such as Siemens and Bosch Building Technologies, reinforce Germany’s leading position. Continuous upgrades of public alert systems and enterprise communication frameworks ensure Germany’s dominance in the Europe mass notification systems market

U.K. Mass Notification Systems Market Insight

The U.K. is projected to register the fastest CAGR in the Europe mass notification systems market from 2026 to 2033, supported by rising focus on public safety, business continuity, and regulatory compliance across enterprises and public institutions. For instance, organizations across education, healthcare, and local government increasingly deploy platforms from providers such as Everbridge to support multi-channel emergency communication. Expanding adoption of cloud-based notification solutions, strong digital transformation initiatives, and increasing emphasis on crisis response readiness are accelerating market expansion. Growing investment in resilient communication infrastructure positions the U.K. as the fastest-growing market in the region.

France Mass Notification Systems Market Insight

France is expected to witness steady growth during 2026–2033, driven by consistent demand from government agencies, transportation authorities, and large enterprises focused on emergency communication and operational resilience. The country’s strong public safety framework and emphasis on coordinated crisis management support stable adoption of mass notification systems. Increasing integration of notification platforms with security, mobility, and public alert infrastructures strengthens market penetration. Stable investments in digital safety solutions, adherence to regulatory standards, and ongoing modernization of communication systems reinforce France’s steady growth within the Europe mass notification systems market.

Europe Mass Notification Systems Market Share

The mass notification systems industry is primarily led by well-established companies, including:

- Johnson Controls (U.S.)

- BearCom Group, Inc. (U.S.)

- Omnilert (U.S.)

- American Signal Corporation (U.S.)

- Everbridge (U.S.)

- Siemens (Germany)

- Anthology Inc. (U.S.)

- 3S Incorporated (U.S.)

- Singlewire Software, LLC. (U.S.)

- xMatters. (U.S.)

- Alertus Technologies LLC. (U.S.)

- On Time Telecom, Inc. (U.S.)

- Mircom Group of Companies. (Canada)

- Transputec Ltd. (U.K.)

- Alert Cascade (U.K.)

- Alert Media, Inc. (U.S.)

- CriticalArc (Australia)

- Aurea, Inc. (U.S.)

- BlackBerry Limited. (Canada)

- Mitel Networks Corp. (Canada)

Latest Developments in Europe Mass Notification Systems Market

- In June 2024, Toronto Zoo adopted Everbridge’s mass notification system to strengthen safety measures for both staff and visitors, reflecting the growing reliance on multi-channel emergency communication platforms across public venues. The deployment enables rapid dissemination of critical alerts through SMS, email, desktop notifications, and voice calls, improving response coordination during emergencies. This adoption highlights how ease of deployment and scalable communication capabilities are driving wider penetration of mass notification systems within large, high-footfall facilities, reinforcing market demand for cloud-based and rapidly deployable solutions

- In March 2024, Motorola Solutions enhanced its Rave Alert mass notification platform by expanding real-time alerting, analytics, and mobile integration capabilities for enterprises and public sector users. The upgrade improves situational awareness and accelerates decision-making during emergencies by unifying alerts, incident data, and user responses within a single ecosystem. This development strengthens Motorola Solutions’ competitive positioning while underscoring the market shift toward integrated, intelligent notification platforms that support faster and more coordinated emergency responses

- In September 2023, Everbridge Inc. launched Everbridge 360 at the Global Security Exchange (GSX) 2023 conference, introducing a unified critical event management and public warning platform. By consolidating risk intelligence, communications, collaboration, and coordination into one interface, the platform reduces response time and operational complexity during crises. This launch significantly advances the mass notification systems market by addressing enterprise demand for end-to-end resilience solutions that streamline emergency workflows and improve organizational preparedness

- In 2022, Evolv Technology enhanced its Evolv Express system through integration with Milestone video management system and the Titan HST mass notification platform, enabling synchronized threat detection and real-time alerts. The integration allows security teams to trigger immediate notifications based on weapons detection data at venue entry points, improving incident response accuracy and speed. This innovation supports the market’s transition toward connected and intelligence-driven mass notification ecosystems, particularly in high-risk and high-attendance environments

- In 2022, Acoustic Technology, Inc. introduced a new line of mass notification systems that combined its established capabilities with upgraded features focused on real-time communication efficiency and system reliability. The product launch enhanced emergency alert delivery and operational performance, supporting more dependable communication during critical events. This development reinforces the company’s innovation-driven strategy while contributing to overall market growth by improving the effectiveness and trustworthiness of mass notification infrastructure across public safety applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.