Europe Magnet Wire Market

Market Size in USD Billion

CAGR :

%

USD

10.27 Billion

USD

17.77 Billion

2025

2033

USD

10.27 Billion

USD

17.77 Billion

2025

2033

| 2026 –2033 | |

| USD 10.27 Billion | |

| USD 17.77 Billion | |

|

|

|

|

Europe Magnet Wire Market Size

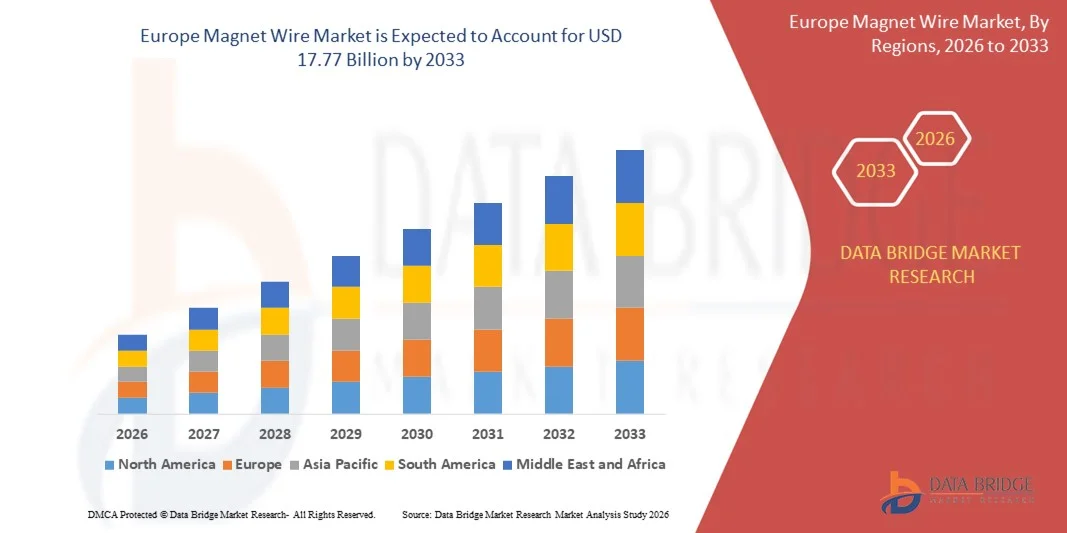

- The Europe magnet wire market size was valued at USD 10.27 billion in 2025 and is expected to reach USD 17.77 billion by 2033, at a CAGR of 7.1% during the forecast period

- The market growth is largely driven by the rising electrification across industries, particularly the rapid expansion of electric vehicles, renewable energy systems, and industrial automation, which significantly increases the demand for motors, transformers, and generators requiring high-quality magnet wire

- Furthermore, growing emphasis on energy efficiency, lightweight designs, and improved thermal performance in electrical equipment is encouraging manufacturers to adopt advanced magnet wire materials and insulation technologies. These combined factors are accelerating the consumption of magnet wire across automotive, energy, and industrial sectors, thereby supporting sustained market growth

Europe Magnet Wire Market Analysis

- Magnet wire is an insulated electrical conductor primarily used in winding motors, transformers, inductors, and other electromagnetic equipment, where efficient electrical conductivity and thermal stability are critical for performance and reliability

- The increasing demand for magnet wire is mainly fueled by the global shift toward electrification, rising production of electric motors and transformers, and continuous advancements in insulation materials to meet higher voltage, temperature, and efficiency requirements across end-use industries

- Germany dominated the magnet wire market in 2025, due to strong demand from the automotive, industrial motor, and electrical equipment manufacturing sectors, supported by the country’s leadership in electric vehicle production and industrial automation

- U.K. is expected to be the fastest growing region in the magnet wire market during the forecast period due to rising investments in electric mobility, renewable energy infrastructure, and advanced electrical equipment manufacturing

- Copper segment dominated the market with a market share of 72.63% in 2025, due to its superior electrical conductivity, thermal stability, and long-standing preference in electrical and electronics applications. Copper magnet wire is widely used in motors, transformers, and coils due to its ability to handle high current densities while minimizing energy loss. Its compatibility with various insulation types and ease of manufacturing further strengthen its dominance in the market

Report Scope and Magnet Wire Market Segmentation

|

Attributes |

Magnet Wire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Magnet Wire Market Trends

Rising Adoption of Magnet Wire in Electric Vehicles and High-Efficiency Motors

- A major trend in the magnet wire market is the rising adoption of advanced magnet wire solutions in electric vehicles and high-efficiency motors, driven by the global transition toward electrification and energy optimization across transportation and industrial sectors. Magnet wire plays a critical role in motor windings, transformers, and generators, making it a foundational component for improving power density, thermal resistance, and overall electrical efficiency

- For instance, companies such as Superior Essex and Sumitomo Electric Industries supply high-performance magnet wire used extensively in electric vehicle traction motors and industrial motor systems. Their products support higher temperature endurance and reduced energy losses, which are essential for improving motor efficiency and extending component lifespan

- The expansion of electric vehicle production is increasing demand for magnet wire with enhanced insulation materials that can withstand higher voltages and compact motor designs. This trend is reinforcing innovation in enamel coatings and conductor materials to support lightweight and high-output motor architectures

- Industrial automation and manufacturing facilities are adopting high-efficiency motors to reduce operational energy consumption and comply with tightening efficiency standards. Magnet wire optimized for low resistance and improved thermal management is becoming increasingly important for these applications

- The renewable energy sector is also contributing to this trend as wind turbines and power generation equipment rely heavily on magnet wire for generators and transformers. The need for reliable electrical performance under continuous load conditions is strengthening the role of high-quality magnet wire solutions

- Overall, the growing focus on electrification, energy efficiency, and sustainable power systems is accelerating the adoption of advanced magnet wire across multiple end-use industries. This trend is positioning magnet wire as a critical enabler of efficient motor performance and long-term energy savings

Europe Magnet Wire Market Dynamics

Driver

Growing Demand for Energy-Efficient Electrical Equipment Across Industries

- The growing demand for energy-efficient electrical equipment across industrial, automotive, and power sectors is a key driver of the magnet wire market, as manufacturers seek to minimize energy losses and improve system performance. Magnet wire is essential for enhancing electrical conductivity and thermal efficiency in motors, transformers, and generators used across these industries

- For instance, Siemens and ABB utilize high-grade magnet wire in their energy-efficient motors and power equipment to meet global efficiency regulations and reduce operational power consumption. The use of advanced magnet wire supports higher efficiency ratings and improved reliability in demanding industrial environments

- Rising electricity costs and stricter energy efficiency standards are pushing industries to upgrade existing electrical infrastructure with more efficient equipment. This is increasing demand for magnet wire designed to deliver consistent electrical performance with reduced heat generation

- The automotive industry is accelerating the adoption of energy-efficient motors for electric and hybrid vehicles, further boosting the need for high-quality magnet wire. These applications require materials that support compact designs while maintaining high power output and durability

- As industries continue to prioritize energy efficiency to lower costs and meet sustainability goals, the reliance on advanced magnet wire solutions is expected to remain strong. This sustained demand is reinforcing the driver and supporting steady growth in the magnet wire market

Restraint/Challenge

Volatility in Copper and Aluminum Raw Material Prices

- The magnet wire market faces a significant challenge due to volatility in copper and aluminum raw material prices, as these metals account for a substantial portion of production costs. Fluctuating commodity prices directly impact manufacturing expenses and create uncertainty in pricing strategies for magnet wire producers

- For instance, companies such as Nexans and Prysmian Group are highly exposed to changes in copper and aluminum prices due to their extensive use of these materials in wire and cable manufacturing. Sudden price increases can compress profit margins and complicate long-term supply agreements with customers

- Global supply chain disruptions, geopolitical tensions, and changes in mining output contribute to frequent price fluctuations of copper and aluminum. These factors make it difficult for manufacturers to forecast costs accurately and maintain stable pricing

- The challenge is further intensified by rising demand for copper and aluminum from electric vehicles, renewable energy projects, and infrastructure development. Increased competition for these raw materials places additional pressure on availability and cost stability

- Manufacturers must balance cost management with the need to maintain high electrical performance and product quality, which limits the ability to substitute materials easily. This ongoing volatility continues to act as a restraint on market growth and influences strategic sourcing and pricing decisions within the magnet wire industry

Europe Magnet Wire Market Scope

The market is segmented on the basis of type, product type, material, shape, application, distribution channel, and end-user.

- By Type

On the basis of type, the magnet wire market is segmented into copper, aluminum, and others. The copper segment dominated the largest market revenue share of 72.63% in 2025, driven by its superior electrical conductivity, thermal stability, and long-standing preference in electrical and electronics applications. Copper magnet wire is widely used in motors, transformers, and coils due to its ability to handle high current densities while minimizing energy loss. Its compatibility with various insulation types and ease of manufacturing further strengthen its dominance in the market.

The aluminum segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its lightweight nature and cost-effectiveness compared to copper. For instance, companies such as Southwire have increasingly adopted aluminum magnet wire in large-scale transformers and automotive motors to reduce overall weight and material costs. The growing focus on energy-efficient and lightweight applications in electric vehicles and industrial motors is expected to drive this segment’s adoption.

- By Product Type

On the basis of product type, the magnet wire market is segmented into enamelled wire and covered conductor wire. The enamelled wire segment held the largest market revenue share in 2025 due to its high insulation performance, durability under high temperatures, and suitability for high-frequency and high-voltage applications. Enamelled wires are widely used in motors, generators, and transformers, ensuring reliable performance across industrial and consumer electronics applications.

The covered conductor wire segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand in compact motor and appliance designs requiring additional mechanical protection. For instance, companies such as Superior Essex have integrated covered conductor wire in home appliance motors to enhance safety and longevity. The additional insulation layer provides resistance to abrasion, moisture, and chemical exposure, making it increasingly preferred in specialized applications.

- By Material

On the basis of material, the magnet wire market is segmented into Polyamide-Imide (PAI), Polyimides (PI), Polyetherimide (PEI), Polyether Ether Ketone (PEEK), and others. The Polyimides (PI) segment dominated the largest market revenue share in 2025 due to its excellent thermal stability, chemical resistance, and mechanical strength. PI-based magnet wires are extensively used in high-performance motors, aerospace components, and industrial transformers where high-temperature endurance is critical.

The Polyamide-Imide (PAI) segment is projected to witness the fastest growth from 2026 to 2033, driven by its superior heat resistance and enhanced electrical insulation properties. For instance, MWS Wire Industries has increasingly adopted PAI magnet wire in industrial motor windings to ensure performance under extreme operational conditions. Its capability to maintain insulation integrity at elevated temperatures makes it suitable for electric vehicles and high-efficiency transformers.

- By Shape

On the basis of shape, the magnet wire market is segmented into round magnet wire, round bondable magnet wire, rectangle magnet wire, and square magnet wire. The round magnet wire segment held the largest market revenue share in 2025 due to its ease of manufacturing, versatility across motor and transformer applications, and compatibility with automated winding machines. Round wires offer uniform current distribution and reliable performance, which is crucial for both industrial and consumer applications.

The rectangle magnet wire segment is expected to witness the fastest growth from 2026 to 2033, fueled by its higher packing efficiency and optimized space utilization in compact motor and transformer designs. For instance, companies such as Sumitomo Electric have increasingly employed rectangular wires in EV motors to improve power density and thermal management. Its geometric advantage allows for reduced winding space, making it ideal for miniaturized and high-efficiency electrical equipment.

- By Application

On the basis of application, the magnet wire market is segmented into motors, home appliances, transformers, and others. The motor segment dominated the largest market revenue share in 2025, driven by the increasing adoption of motors across industrial, automotive, and consumer applications. Magnet wire is a critical component in motor windings, ensuring efficiency, thermal stability, and durability under continuous operation.

The transformer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for energy-efficient and high-capacity transformers. For instance, ABB has been increasingly using high-grade magnet wire in transformer windings to enhance energy efficiency and reduce thermal losses. The surge in renewable energy installations and smart grid infrastructure further supports the growth of this segment.

- By Distribution Channel

On the basis of distribution channel, the magnet wire market is segmented into e-commerce, supermarkets/hypermarkets, specialty stores, B2B/third-party distributors, and others. The B2B/third-party distributors segment held the largest market revenue share in 2025 due to established supply networks, bulk order capabilities, and strong relationships with industrial and commercial clients. These channels facilitate consistent availability and support customized solutions for large-scale projects.

The e-commerce segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing digitalization of industrial procurement and smaller-scale commercial purchases. For instance, RS Components has leveraged its e-commerce platform to provide instant access to magnet wire products for OEMs and small-scale manufacturers. Online platforms provide convenience, quick delivery, and easy comparison, accelerating the adoption of magnet wire through digital channels.

- By End-User

On the basis of end-user, the magnet wire market is segmented into electrical & electronics, industrial, transportation, energy, automotive, residential, infrastructure, and others. The electrical & electronics segment dominated the largest market revenue share in 2025, driven by high consumption in motors, transformers, and electronic devices. The sector benefits from the growing demand for energy-efficient appliances, consumer electronics, and smart home devices requiring reliable magnet wire performance.

The automotive segment is projected to witness the fastest growth from 2026 to 2033, fueled by rising electric vehicle production and advanced automotive motor applications. For instance, Tesla has integrated high-performance magnet wire in EV traction motors and battery cooling systems to enhance efficiency and reduce energy loss. The global shift toward electrification and hybrid mobility solutions continues to boost demand for specialized magnet wire in the automotive sector.

Europe Magnet Wire Market Regional Analysis

- Germany dominated the magnet wire market with the largest revenue share in 2025, driven by strong demand from the automotive, industrial motor, and electrical equipment manufacturing sectors, supported by the country’s leadership in electric vehicle production and industrial automation

- The country’s well-established automotive OEM base, high concentration of motor and transformer manufacturers, and early adoption of energy-efficient motor standards sustain consistent demand for copper and aluminum magnet wire across multiple applications

- Increasing focus on electrification, industrial efficiency, and renewable energy integration, supported by manufacturers such as Elektrisola Group and LEONI AG, reinforces Germany’s leading position. Continuous investment in EV drivetrains, high-efficiency motors, and export-oriented electrical equipment production ensures Germany’s dominance in the Europe magnet wire market

U.K. Magnet Wire Market Insight

The U.K. is projected to register the fastest CAGR in the Europe magnet wire market from 2026 to 2033, supported by rising investments in electric mobility, renewable energy infrastructure, and advanced electrical equipment manufacturing. For instance, companies such as Bekaert and TE Connectivity operate facilities and supply magnet wire-based components for motors, transformers, and power systems, supporting wider adoption. Increasing deployment of electric buses, expansion of offshore wind projects, and modernization of power distribution networks are accelerating magnet wire demand. Growing focus on decarbonization targets, grid upgrades, and localized manufacturing positions the U.K. as the fastest-growing market in the region.

France Magnet Wire Market Insight

France is expected to witness steady growth during 2026–2033, driven by consistent demand from the automotive, power generation, and industrial machinery sectors, along with strong emphasis on energy efficiency and electrification. The country’s established automotive manufacturing base and expanding renewable energy projects support stable consumption of magnet wire for motors, generators, and transformers. Increasing integration of electric drivetrains, adherence to stringent efficiency regulations, and continued investment in industrial modernization strengthen market penetration. Stable growth in electrical equipment production, supportive energy policies, and ongoing innovation in motor technologies reinforce France’s steady growth within the Europe magnet wire market.

Europe Magnet Wire Market Share

The magnet wire industry is primarily led by well-established companies, including:

- Superior Essex Inc. (U.S.)

- ZTT (China)

- IRCE S.p.A. (Italy)

- Citychamp Dartong Co. (China)

- Sumitomo Electric Industries, Ltd. (Japan)

- MWS Wire Industries, Inc. (U.S.)

- Taihan Cable & Solution Co., Ltd. (South Korea)

- Condumex, Inc. (Mexico)

- Fujikura Ltd. (Japan)

- Reco Zrt. (Hungary)

- LS Cable & System Ltd. (South Korea)

- Tongling Jingda Special Magnet Wire Co., Ltd. (China)

- ELEKTRISOLA Dr. Gerd Schildbach GmbH & Co. KG (Germany)

- Sam Dong Co., Ltd. (South Korea)

- Tre Tau Engineering s.r.l. (Italy)

- Henan Huayang Electrical Technology Group Co., Ltd. (China)

- SWCC Corporation (Saudi Arabia)

- Dahrén Group (Sweden)

- Proterial, Ltd. (Japan)

- Xinzhu Cable Group (China)

- REA (Italy)

- Phelps Dodge Philippines (Philippines)

- Ederfil Becker (France)

- Essex Solutions Inc. (U.S.)

Latest Developments in Europe Magnet Wire Market

- In December 2025, Tretau announced plans to establish its first manufacturing facility outside Europe in Fort Wayne, Indiana, U.S., marking a strategic expansion into the North American magnet wire market. This move is expected to significantly shorten supply chains and improve delivery timelines for local OEMs operating in electric vehicles, renewable energy, and advanced manufacturing sectors. By localizing production, Tretau aims to strengthen customer relationships, reduce logistics costs, and capitalize on the rising demand for high-efficiency magnet wire driven by electrification trends

- In December 2025, LS Cable & System evaluated the production of rectangular magnet wire and copper materials in the U.S. to support increasing demand from the automotive sector. Rectangular magnet wire is gaining importance due to its higher space utilization and efficiency in EV motors, making this evaluation strategically aligned with next-generation vehicle requirements. Local production would enhance supply stability for key customers such as GM and Hyundai Motor, while reinforcing LS Cable & System’s competitiveness in the rapidly expanding U.S. EV ecosystem

- In July 2023, Superior Essex announced capacity optimization initiatives across its global magnet wire manufacturing footprint to address growing demand from electric vehicles, renewable energy systems, and industrial motors. These initiatives focused on improving throughput, enhancing product consistency, and supporting the production of advanced insulation magnet wires. The development enabled the company to better serve high-growth applications while maintaining cost efficiency and reinforcing its leadership in premium magnet wire solutions

- In 2021, Essex Furukawa implemented Sight Machine Inc.’s manufacturing productivity platform across its plants in the U.S., China, and Germany to improve operational transparency and performance. The platform enabled real-time monitoring of production processes, helping the company achieve measurable improvements in sustainability, energy efficiency, and product quality. This digital transformation strengthened Essex Furukawa’s manufacturing resilience and positioned it to meet increasing global demand with improved consistency and reduced operational risk

- In 2021, LS Cable & System intensified its focus on expanding its presence in the global electric vehicle components market by prioritizing high-voltage, lightweight, and aluminum magnet wires. This strategic direction aligned with the automotive industry’s shift toward electrification and weight reduction to improve vehicle efficiency. Its exclusive magnet wire supply arrangement with Hyundai Motor further solidified its role as a key supplier, supporting long-term demand growth in EV motor and powertrain applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Magnet Wire Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Magnet Wire Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Magnet Wire Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.