Europe Magnesium Alloys Market Analysis and Size

The growing use of magnesium alloys in the automotive industry is expected to drive the market growth and the demand for the Europe magnesium alloys market. However, the main obstacles to this market's expansion are price uncertainty for magnesium and problems with weldability and corrosion resistance.

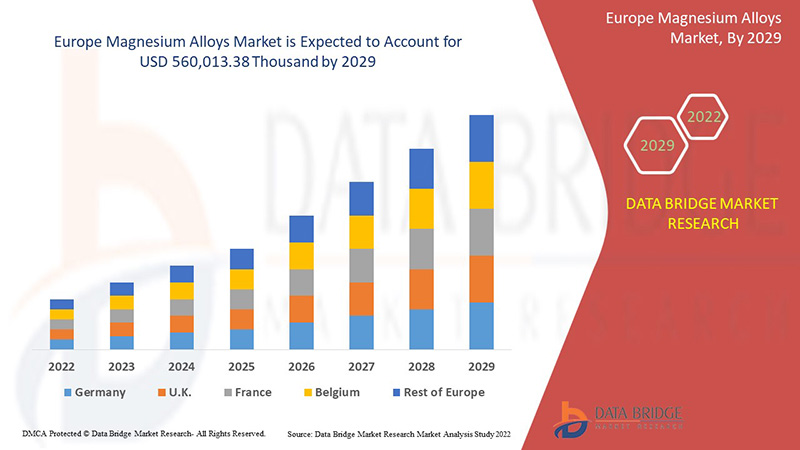

These Europe magnesium alloys are primarily used in the automotive & transportation, gearbox, front end and I.P. beams, steering column and driver's air bag housings, steering wheels, seat frames, and fuel tank covers. Data Bridge Market Research analyses that the Europe magnesium alloys market is expected to reach USD 560,013.38 thousand by 2029, at a CAGR of 4.4% during the forecast period. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Tons |

|

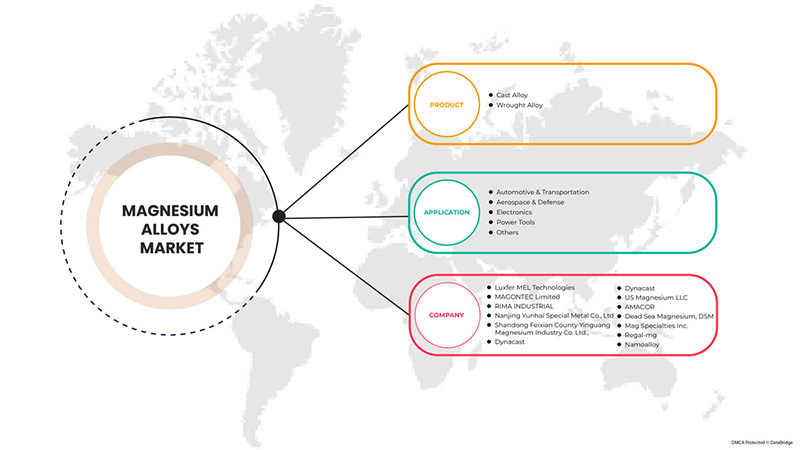

Segments Covered |

By Product (Cast Alloy and Wrought Alloy), Application (Automotive & Transportation, Aerospace & Defense, Electronics, Power Tools, and Others) |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe |

|

Market Players Covered |

Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, U.S. Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd amongst others. |

Market Definition

Magnesium is the lightest structural material with a density of 1.74 g/cm, and alloying magnesium with metal increases the hardness, cast-ability, and strength while having a negligible effect on viscosity. Aluminum is mostly used as an alloying metal with magnesium. Magnesium Alloys have properties such as lightweight, thermal conductivity, strength, durability, corrosion resistance, and high-temperature creep.

COVID-19 had a Minimal Impact on Europe Magnesium Alloys Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. During the COVID-19 outbreak, the magnesium alloys market sustained a significant loss as manufacturing in the automobile and aerospace industries halted. Only the medical supply and life-support sectors were permitted to operate. The supply chain was also disrupted as a result of logistical restrictions. As a result, magnesium alloys market growth was also hampered.

The Market Dynamics of the Europe Magnesium Alloys Market Include:

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers/ Opportunities faced by the Europe Magnesium Alloys Market

- The growth in the use of magnesium alloys in the automotive industry

The growing use of magnesium alloys in the automotive industry is key because that will drive the Europe magnesium alloys market further. The market is driven by the increasing manufacturing of engineering components for weight reduction without compromising vehicles' overall strength and the growing demand for vibration damping capacity. Moreover, magnesium alloys offer strength, light weight, durability, thermal conductivity, high-temperature creep, and corrosion resistance to the vehicle. As a result, the demand for magnesium alloys is expected to grow substantially owing to these characteristics.

- Rise in the popularity of magnesium alloys in artificial human implants and medical devices

The rising popularity of magnesium alloy in artificial human implants and increasing applications of the material in medical devices are likely to propel the industry's growth. Medical device and implant producers mostly use magnesium alloy due to its low density. Magnesium alloys are used in manufacturing portable medical equipment and wheelchairs due to their lightweight properties.

Looking after these advantages, various medical implants and device manufacturers have started using magnesium alloys as an important material in their productions.

- Increase in the applications of the material in aerospace and defense industries

The increasing demand for lightweight components in the Aerospace & Defense sector is a key driver of the Europe magnesium alloys market. Magnesium alloys are used in manufacturing helicopter transmission casings, aircraft engines, gearbox casings, turbine engines, jet engine fan frames, spacecraft, and missiles. Thus, increasing spending on the defense sector and demand for new commercial aircraft are anticipated to remain key growth-driving factors for the Europe magnesium alloys market.

For Instance:

- In 2019, the U.S. government proposed a budget of USD 686 billion for the Department of Defense. The key investments of the budget in aircraft included 77 F-35 Joint Strike Fighters, 10 P-8A Aircraft, and 15 KC-46 Tanker Replacements

- In 2019, as per a study published by Boeing, North America was likely to have 9,130 new airplane deliveries by 2038, the second-highest after Asia-Pacific. Moreover, the preference for fuel-efficient vehicles is projected to boost the usage of such lightweight materials, thereby augmenting the magnesium alloys product demand

- Introduction of New Processes Such As Thixomolding And New Rheocasting

Casting high strength, tensile, and pressure tight components at low cost introduces magnesium alloys into hydraulic and structural applications. Much development work has been undertaken in casting parts at temperatures below the liquids -in the semi-solid state or in a form containing a significant amount of solid. Therefore, all these newly developed processes which offer advantages in the processing of magnesium alloys will provide lucrative opportunities for the growth and development of the Europe magnesium alloys market.

Restraints/Challenges faced by the Europe Magnesium Alloys Market

- Fluctuation in magnesium prices

Fluctuations in magnesium and its alloy prices are expected to limit Europe magnesium alloys market expansion to some extent. In the past, various factors such as coal supply reduction, shutdown, and other policies have made magnesium prices go up. On the supply side, the overall tightening has declined magnesium ingot production.

In the face of violently fluctuating magnesium prices, magnesium alloy companies are actively positioning themselves in the industry through production expansion, equipment upgrading, and high-added value projects.

- Issues associated with corrosion and welding of magnesium alloys

Magnesium alloy usage has been limited due to its poor corrosion resistance and low flexibility. These alloys have about the same corrosion resistance in common environments as mild steel but are less corrosion resistant than aluminum alloys, whether general or galvanic.

In addition, one of the greatest difficulties for the manufacturing engineer is to define which process will produce satisfactory properties of magnesium alloys at the lowest cost by the process of welding. Usually, welding magnesium alloys is not easy as it requires advanced and reliable techniques and strategies, such as tungsten arc inert gas (TIG).

- Various availability of alternative materials for magnesium alloys

Aluminum remains the most inexpensive alloy per cubic inch of all the commonly used alloys in die casting. Thus, the availability of various other alloy types will challenge the sales and growth of the Europe magnesium alloy market.

Europe Magnesium Alloys Market Scope

Europe magnesium alloys market is segmented based on product and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Cast alloy

- Wrought alloy

On the basis of product, the market is segmented into cast alloy and wrought alloy.

Application

- Automotive & transportation

- Aerospace & defense

- Electronics

- Power tools

- Others

On the basis of application, the market is segmented into automotive & transportation, aerospace & defense, electronics, power tools, and others.

Europe Magnesium Alloys Market Regional Analysis/Insights

Europe magnesium alloys market is analyzed, and market size insights and trends are provided by country, deposit type, type, and application, as referenced above.

The countries covered in the Europe magnesium alloys market report are Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe.

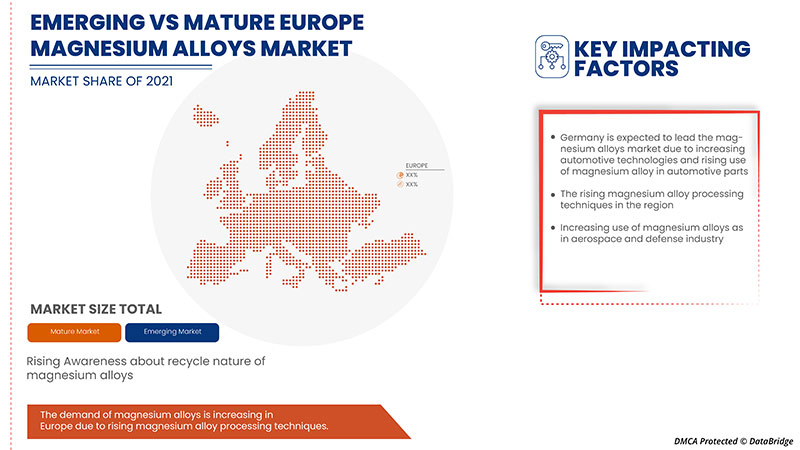

Germany dominates the magnesium alloys market due to the increased use of such lightweight materials, increasing the usage of fuel-efficient vehicles, and increasing product demand in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that influence the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country data.

Competitive Landscape and Europe Magnesium Alloys Share Analysis

Europe magnesium alloys market competitive landscape provides details of a competitor. Components included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points are only related to the companies focus on the Europe magnesium alloys market.

Some of the major players operating in the Europe magnesium alloys market are Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, U.S. Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd amongst others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE MAGNESIUM ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THE THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 REGULATORY COVERAGE

5 PRODUCTION CAPACITY OUTLOOK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY

6.1.2 RISING POPULARITY OF MAGNESIUM ALLOYS IN ARTIFICIAL HUMAN IMPLANTS AND MEDICAL DEVICES

6.1.3 INCREASING APPLICATIONS OF THE MATERIAL IN AEROSPACE AND DEFENSE INDUSTRIES

6.1.4 RISING USES AS A REPLACEMENT OF PLASTICS IN ELECTRONIC APPLICATIONS

6.2 RESTRAINTS

6.2.1 FLUCTUATING MAGNESIUM PRICES

6.2.2 ISSUES ASSOCIATED WITH CORROSION AND WELDING OF MAGNESIUM ALLOYS

6.2.3 ENGINEERING BARRIERS SUCH AS FORMABILITY AT ROOM TEMPERATURE AND DIFFICULTY FORGING

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF NEW PROCESSES SUCH AS THIXOMOLDING AND NEW RHEOCASTING

6.3.2 RECYCLABLE NATURE OF MAGNESIUM ALLOYS

6.3.3 HIGH ABUNDANCE OF MAGNESIUM ELEMENTS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 VARIOUS AVAILABILITY OF ALTERNATIVE MATERIALS FOR MAGNESIUM ALLOYS

6.4.2 PROBLEMS RELATED TO PURITY OF MAGNESIUM ALLOYS

7 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAST ALLOY

7.3 WROUGHT ALLOY

8 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 CAST ALLOY

8.2.2 WROUGHT ALLOY

8.3 AEROSPACE & DEFENSE

8.3.1 CAST ALLOY

8.3.2 WROUGHT ALLOY

8.4 ELECTRONICS

8.4.1 CAST ALLOY

8.4.2 WROUGHT ALLOY

8.5 POWER TOOLS

8.5.1 CAST ALLOY

8.5.2 WROUGHT ALLOY

8.6 OTHERS

8.6.1 CAST ALLOY

8.6.2 WROUGHT ALLOY

9 EUROPE MAGNESIUM ALLOYS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 U.K.

9.1.3 FRANCE

9.1.4 ITALY

9.1.5 SPAIN

9.1.6 RUSSIA

9.1.7 TURKEY

9.1.8 NETHERLANDS

9.1.9 BELGIUM

9.1.10 SWITZERLAND

9.1.11 REST OF EUROPE

10 EUROPE MAGNESIUM ALLOYS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

10.1.1 EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LUXFER MEL TECHNOLOGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 SWOT

12.1.5 RECENT DEVELOPMENT

12.2 MAGNOTEC LIMITED

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY PROFILE

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATES

12.3 RIMA INDUSTRIAL

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT DEVELOPMENTS

12.4 NANJING YUNHAI SPECIAL METAL CO., LTD

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 SWOT

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 SHANDONG FEIXIAN COUNTY YINGUANG MAGNESIUM INDUSTRY CO. LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENT

12.6 AMACOR

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT DEVELOPMENT

12.7 DEAD SEA MAGNESIUM, DSM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT DEVELOPMENTS

12.8 DYNACAST

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 MAG SPECIALITY INC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT DEVELOPMENTS

12.1 NAMOALLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 REGAL-MG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT DEVELOPMENTS

12.12 US MAGNESIUM LLC

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 EUROPE CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 EUROPE WROUGHT ALLOY IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE WROUGHT ALLOY IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 12 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 14 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 16 EUROPE AEROSPACE & DEFENSE IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE AEROSPACE & DEFENSE IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 18 EUROPE AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 20 EUROPE ELECTRONICS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE ELECTRONICS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 EUROPE ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 24 EUROPE POWER TOOLS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE POWER TOOLS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 EUROPE POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 28 EUROPE OTHERS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE OTHERS IN EUROPE MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 EUROPE OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 32 EUROPE MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 34 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 36 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 38 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 40 EUROPE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 42 EUROPE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 44 EUROPE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 46 EUROPE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 GERMANY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 50 GERMANY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 52 GERMANY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 54 GERMANY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 56 GERMANY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 GERMANY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 GERMANY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 GERMANY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 60 GERMANY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 GERMANY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 62 U.K. MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 U.K. MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 64 U.K. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 U.K. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 66 U.K. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 U.K. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 U.K. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 U.K. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 70 U.K. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 72 U.K. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 74 U.K. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 76 FRANCE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 FRANCE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 78 FRANCE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 FRANCE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 80 FRANCE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 81 FRANCE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 FRANCE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 FRANCE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 84 FRANCE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 86 FRANCE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 88 FRANCE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 90 ITALY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 ITALY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 92 ITALY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 94 ITALY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 96 ITALY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 98 ITALY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 100 ITALY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 102 ITALY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 104 SPAIN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 106 SPAIN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 108 SPAIN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 SPAIN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 110 SPAIN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 SPAIN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 112 SPAIN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 SPAIN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 114 SPAIN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 SPAIN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 118 RUSSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 119 RUSSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 120 RUSSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 RUSSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 122 RUSSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 123 RUSSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 124 RUSSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 125 RUSSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 126 RUSSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 RUSSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 128 RUSSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 RUSSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 130 RUSSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 RUSSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 132 TURKEY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 TURKEY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 134 TURKEY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 TURKEY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 136 TURKEY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 TURKEY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 138 TURKEY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 TURKEY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 140 TURKEY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 141 TURKEY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 142 TURKEY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 143 TURKEY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 144 TURKEY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 145 TURKEY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 146 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 147 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 148 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 150 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 151 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 152 NETHERLANDS AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 NETHERLANDS AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 154 NETHERLANDS ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 NETHERLANDS ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 156 NETHERLANDS POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 NETHERLANDS POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 158 NETHERLANDS OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 NETHERLANDS OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 160 BELGIUM MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 162 BELGIUM MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 164 BELGIUM AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 166 BELGIUM AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 168 BELGIUM ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 170 BELGIUM POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 172 BELGIUM OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 174 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 176 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 178 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 180 SWITZERLAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 SWITZERLAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 182 SWITZERLAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 SWITZERLAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 184 SWITZERLAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 185 SWITZERLAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 186 SWITZERLAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 187 SWITZERLAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 188 REST OF EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 189 REST OF EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

List of Figure

FIGURE 1 EUROPE MAGNESIUM ALLOYS MARKET

FIGURE 2 EUROPE MAGNESIUM ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MAGNESIUM ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MAGNESIUM ALLOYS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MAGNESIUM ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MAGNESIUM ALLOYS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE MAGNESIUM ALLOYS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE MAGNESIUM ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE MAGNESIUM ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE MAGNESIUM ALLOYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE MAGNESIUM ALLOYS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE MAGNESIUM ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE MAGNESIUM ALLOYS MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE EUROPE MAGNESIUM ALLOYS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE EUROPE MAGNESIUM ALLOYS MARKET IN THE FORECAST PERIOD

FIGURE 16 CAST ALLOY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MAGNESIUM ALLOY MARKET IN 2022 & 2029

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE MAGNESIUM ALLOYS MARKET

FIGURE 19 EUROPE MAGNESIUM ALLOYS MARKET: BY PRODUCT, 2021

FIGURE 20 EUROPE MAGNESIUM ALLOYS MARKET: BY APPLICATION, 2021

FIGURE 21 EUROPE MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2020)

FIGURE 26 EUROPE MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

Europe Magnesium Alloys Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Magnesium Alloys Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Magnesium Alloys Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.