Europe Laboratory Hoods And Enclosure Market

Market Size in USD Million

CAGR :

%

USD

168.86 Million

USD

265.70 Million

2025

2033

USD

168.86 Million

USD

265.70 Million

2025

2033

| 2026 –2033 | |

| USD 168.86 Million | |

| USD 265.70 Million | |

|

|

|

|

Europe Laboratory Hoods and Enclosure Market Size

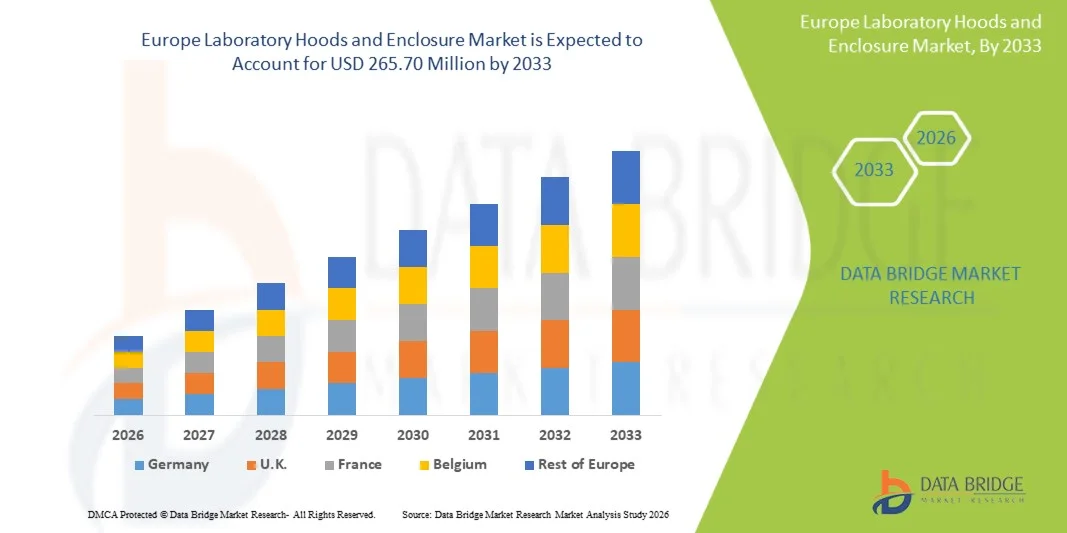

- The Europe Laboratory Hoods and Enclosure Market size was valued at USD 168.86 Million in 2025 and is expected to reach USD 265.70 Million by 2033, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing need for safety, contamination control, and compliance with regulatory standards in laboratories, research facilities, and pharmaceutical manufacturing units, leading to greater adoption of laboratory hoods and enclosures to ensure safe handling of chemicals, biological samples, and hazardous substances

- Furthermore, rising investments in life sciences research, biotechnology, and pharmaceutical industries, coupled with growing awareness of workplace safety and good laboratory practices (GLP), are establishing laboratory hoods and enclosures as essential equipment in modern laboratories. These converging factors are accelerating the uptake of Laboratory Hoods and Enclosure solutions, thereby significantly boosting the industry’s growth

Europe Laboratory Hoods and Enclosure Market Analysis

- Laboratory hoods and enclosures, designed to provide safe and controlled environments for handling hazardous chemicals, biological samples, and sensitive materials, are increasingly vital components in research laboratories, pharmaceutical production units, and clinical testing facilities due to their ability to prevent contamination and ensure compliance with safety regulations

- The escalating demand for laboratory hoods and enclosures is primarily fueled by growing investments in life sciences, biotechnology, and pharmaceutical research, rising awareness of laboratory safety standards, and increasing focus on regulatory compliance. These converging factors are accelerating the uptake of Laboratory Hoods and Enclosure solutions, thereby significantly boosting the industry’s growth

- The U.K. dominated the Europe Laboratory Hoods and Enclosure Market with the largest revenue share of 36.9% in 2025, supported by strong government and private investments in research infrastructure, expansion of specialty and tertiary laboratories, increasing adoption of advanced safety equipment, and initiatives to strengthen life sciences and healthcare research capabilities

- Germany is expected to be the fastest-growing region in the Europe Laboratory Hoods and Enclosure Market, registering a CAGR of 11.2% during the forecast period, driven by rapid development of private and public research laboratories, growing pharmaceutical and biotechnology sectors, rising adoption of advanced laboratory safety equipment, and government programs promoting innovation in clinical research and industrial R&D

- The Benchtop segment dominated with 57.3% revenue share in 2025, fueled by its high adoption in laboratories requiring stationary and stable setups for precision work

Report Scope and Europe Laboratory Hoods and Enclosure Market Segmentation

|

Attributes |

Laboratory Hoods and Enclosure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Laboratory Hoods and Enclosure Market Trends

“Enhanced Safety and Operational Efficiency in Laboratory Settings”

- A major and accelerating trend in the Europe Laboratory Hoods and Enclosure Market is the adoption of high-performance, ergonomic, and energy-efficient laboratory solutions designed to enhance safety, workflow efficiency, and compliance with international standards

- For instance, in leading Saudi Arabian universities, upgraded biosafety cabinets and chemical fume hoods now feature modular designs, adjustable airflow systems, and integrated sensors for real-time monitoring, ensuring both personnel protection and consistent experimental conditions

- Adoption of advanced contamination control mechanisms, such as HEPA and ULPA filtration, is increasing, particularly in pharmaceutical and biotechnology research labs, to minimize cross-contamination and maintain sterile environments

- Ergonomic and space-efficient designs are being prioritized to optimize laboratory layouts, allowing multiple users to operate safely in high-density research setting

- Manufacturers such as Labconco, Thermo Fisher Scientific, and Esco are expanding their offerings in the region with modular hoods, flexible configurations, and smart airflow controls that enhance laboratory efficiency while meeting stringent safety standards

- Demand is also rising for hoods capable of handling diverse chemical, biological, and molecular research applications, supporting the region’s growing emphasis on biotechnology, genomics, and clinical research

Europe Laboratory Hoods and Enclosure Market Dynamics

Driver

“Expansion of Research Infrastructure and Stringent Safety Regulations”

- Rapid government investments in healthcare, research, and biotechnology infrastructure are significantly boosting demand for advanced laboratory hoods and enclosures in the region

- For instance, in 2025, multiple hospitals and research institutes in Riyadh upgraded to Class II biosafety cabinets with airflow alarms and UV sterilization, enabling safe handling of hazardous materials

- The rising establishment of private and tertiary laboratories in countries such as Saudi Arabia and Egypt is creating a strong market for high-performance hoods that ensure compliance with international safety standards

- Strict adherence to chemical and biological handling protocols by regulators in the Middle East is compelling research facilities to adopt hoods and enclosures with advanced filtration and containment capabilities

- Increasing collaboration with international research institutions is prompting local labs to meet global laboratory safety standards, further driving adoption

- Growing awareness of laboratory worker safety and risk mitigation is encouraging hospitals, pharmaceutical companies, and universities to replace outdated setups with modern, certified containment systems

Restraint/Challenge

“High Capital Investment and Operational Costs”

- Advanced laboratory hoods and enclosures come with significant upfront costs, which can be prohibitive for smaller laboratories and research institutions

- For instance, installing modular Class II biosafety cabinets with real-time airflow monitoring and HEPA filtration in Abu Dhabi private labs was reported to cost more than three times standard mechanical fume hoods, slowing procurement decisions

- Regular maintenance, calibration, and periodic certification requirements add to ongoing operational expenses, which can strain budgets in developing regions

- Limited availability of trained technicians for installation, calibration, and maintenance in certain countries is another factor restraining adoption

- Energy consumption of high-performance hoods and enclosures can also increase operational costs, particularly in large-scale research facilities

- Addressing these challenges through leasing options, government incentives, modular designs, and regional training programs for technicians is critical to broaden market adoption

Europe Laboratory Hoods and Enclosure Market Scope

The Africa Europe Laboratory Hoods and Enclosure Market is segmented on the basis of product, modularity, material, and end user.

• By Product

On the basis of product, the market is segmented into Ventilated Balance Enclosures (VBEs), Biological Safety Cabinets, Laminar Flow Cabinets, Enclosures, Hoods, and Others. The Biological Safety Cabinets (BSCs) segment dominated the market with 42.5% revenue share in 2025, driven by increasing adoption in pharmaceutical production, academic research, and clinical laboratories across Africa. BSCs ensure operator and environmental safety during handling of biohazardous materials, which makes them essential in virology, microbiology, and cell culture applications. The segment benefits from stringent biosafety regulations in countries like South Africa, Egypt, and Nigeria, prompting laboratories to upgrade or replace outdated units. Hospitals, research centers, and pharmaceutical companies prioritize BSCs due to their reliability and compliance with ISO and WHO standards. Rising investments in vaccine research, infectious disease testing, and biotechnology further drive demand. The COVID-19 pandemic amplified the need for BSCs in diagnostic labs and research institutes. Technological advancements such as HEPA filtration, energy-efficient operation, and ergonomic designs enhance adoption. The segment also benefits from high durability and long service life, making BSCs a preferred choice for high-volume laboratories. Government-funded biosafety initiatives and public-private partnerships boost market penetration. Africa’s growing pharmaceutical and life sciences sectors continue to support consistent revenue growth.

The Ventilated Balance Enclosures (VBEs) segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by their increasing use in analytical laboratories for handling powders, chemicals, and sensitive compounds. VBEs offer controlled airflow, ergonomic design, and integrated weighing stations, making them ideal for high-precision pharmaceutical and research workflows. Rising pharmaceutical manufacturing and quality control testing in Africa fuel segment growth. VBEs are increasingly adopted in universities and research institutes for analytical chemistry and biopharma research. Compact, benchtop VBE models facilitate adoption in labs with limited space. Manufacturers are launching energy-efficient and low-maintenance VBEs to attract new customers. The trend toward automation and digital integration in lab equipment enhances their appeal. Expansion in contract research organizations (CROs) and private laboratories further accelerates adoption. Government programs promoting industrial and research capabilities in life sciences support VBE demand. Enhanced safety and contamination control features drive procurement. The need for compliance with ISO and GLP standards also strengthens market growth.

• By Modularity

On the basis of modularity, the market is segmented into Benchtop and Portable. The Benchtop segment dominated with 57.3% revenue share in 2025, fueled by its high adoption in laboratories requiring stationary and stable setups for precision work. Benchtop models are preferred in pharmaceutical labs, research institutes, and academic centers due to their robustness, reliability, and compatibility with a wide range of laboratory instruments. They allow for integrated workflow setups, including connections with sensors, ventilation systems, and filtration units. The segment benefits from strong adoption in countries like South Africa, Egypt, and Kenya, where laboratory infrastructure is expanding. Regulatory and safety standards mandate stationary setups for handling chemicals and biological materials, increasing benchtop adoption. Continuous improvements in ergonomic design and energy efficiency further support revenue growth. Benchtop units provide long service life and are often selected for high-throughput laboratories. The COVID-19 pandemic highlighted their importance in diagnostic and research labs. Expansion of pharmaceutical R&D in Africa continues to reinforce the segment. Technological upgrades, including automated airflow and monitoring systems, enhance their adoption.

The Portable segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by rising demand for flexible and mobile lab setups in smaller research institutes, field laboratories, and emerging healthcare facilities. Portable units enable on-site testing, rapid deployment, and use in mobile laboratories for environmental, clinical, and industrial applications. Lightweight materials such as PVC and aluminum improve portability without compromising safety. Portable models are increasingly adopted for field research, sample collection, and point-of-care testing in remote areas. Manufacturers are integrating digital airflow monitoring and modular designs to enhance usability. Expansion of mobile research and outreach programs in African countries further boosts growth. The demand for temporary laboratory setups during epidemics, environmental testing, and pharmaceutical field studies drives adoption. Easy maintenance and energy efficiency make portable units attractive for low-resource labs. The trend toward decentralization of research and testing enhances the growth potential.

• By Material

On the basis of material, the market is segmented into PVC, Stainless Steel, and Others. The Stainless Steel segment dominated with 49.6% revenue share in 2025, owing to its durability, chemical resistance, and ease of sterilization. Stainless steel laboratory hoods and enclosures are preferred for biosafety cabinets, chemical fume hoods, and pharmaceutical research due to their long service life and compliance with biosafety and ISO standards. Hospitals, research centers, and academic laboratories invest in stainless steel units for high-throughput testing and handling of hazardous materials. The COVID-19 pandemic highlighted the need for reliable, easy-to-clean materials in diagnostic and research labs. Corrosion resistance, low maintenance, and aesthetic appeal further enhance adoption. Expansion of biotechnology and pharmaceutical sectors in South Africa, Nigeria, and Egypt supports stainless steel segment growth. Integration with airflow control systems, HEPA filtration, and ergonomic designs increases product value. Government regulations mandating safety and quality standards drive procurement. Standardized manufacturing practices ensure compliance with international safety certifications. The segment remains critical for high-performance laboratories.

The PVC segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by cost-effectiveness, lightweight construction, and chemical resistance suitable for field labs, educational centers, and smaller research setups. PVC enclosures are increasingly used in portable models and benchtop solutions. Adoption is growing in African regions with budget-sensitive institutions seeking flexible, low-maintenance lab equipment. Easy customization, modularity, and rapid installation make PVC units attractive for emerging labs. Government programs supporting capacity building in research and healthcare labs encourage procurement. PVC units provide resistance to acids and basic reagents, reducing maintenance costs. Lightweight construction allows ease of relocation within labs. Integration with airflow and ventilation systems ensures safety compliance. Low capital expenditure requirements further accelerate adoption.

• By End User

On the basis of end user, the market is segmented into Pharmaceutical Companies, Research Institutes, Academic Centers, and Others. The Pharmaceutical Companies segment dominated with 46.7% revenue share in 2025, driven by increasing R&D activities, quality control testing, and regulatory compliance in drug development and production. Pharmaceutical labs rely heavily on biological safety cabinets, ventilated enclosures, and laminar flow hoods for safe handling of chemicals, sterile preparation, and analytical workflows. Growth is supported by expanding pharmaceutical manufacturing hubs in South Africa, Egypt, and Morocco. Adoption is bolstered by government initiatives promoting biotech and pharmaceutical sectors. Continuous innovation in lab equipment enhances workflow efficiency, safety, and contamination control. Companies invest in energy-efficient, automated systems to reduce operational costs. Regulatory requirements for biosafety and ISO certification strengthen demand. Increased clinical trials, vaccine production, and contract research activities further drive adoption. Integration with automated laboratory instruments increases reliability. Long-term partnerships with manufacturers support sustained growth.

The Academic Centers segment is expected to witness the fastest CAGR of 10.0% from 2026 to 2033, fueled by growing investment in higher education and research infrastructure across Africa. Universities and colleges adopt laboratory hoods and enclosures for teaching, student research, and faculty-driven R&D programs. Portable and benchtop units enable practical laboratory training while maintaining biosafety compliance. Funding from government programs, international collaborations, and grants supports the expansion of laboratory facilities. Adoption of cost-effective PVC models for educational labs accelerates growth. Integration with research programs in biotechnology, molecular biology, and pharmaceuticals drives procurement. The trend toward modular and flexible laboratory setups encourages innovation in lab furniture and enclosure design. Increased focus on STEM education across Africa strengthens demand. Academic centers often seek lightweight, ergonomic, and energy-efficient solutions. Collaborative research initiatives between universities and private labs further boost adoption.

Europe Laboratory Hoods and Enclosure Market Regional Analysis

- The Europe Laboratory Hoods and Enclosure Market is witnessing robust growth, driven by increasing investments in research and healthcare infrastructure across the region

- The market dominated the European market with the largest revenue share of 36.9% in 2025, supported by strong government and private funding for academic research, life sciences, and clinical laboratories. Expansion of specialty and tertiary laboratories, along with initiatives to strengthen healthcare research capabilities, has created a significant demand for advanced laboratory hoods and enclosures

- In London and Cambridge, for instance, academic and clinical research centers have adopted ventilated balance enclosures and modular biosafety cabinets with energy-efficient features to comply with international safety and hygiene standards. Modern laboratory designs emphasizing ergonomics, sustainability, and operational efficiency are further encouraging laboratories to upgrade to advanced hoods and enclosures.

U.K. Europe Laboratory Hoods and Enclosure Market Insight

The U.K. Europe Laboratory Hoods and Enclosure Market dominated Europe in 2025 with the largest revenue share of 36.9%, driven by substantial government and private investments in research infrastructure, healthcare, and life sciences. Expansion of specialty and tertiary laboratories, coupled with increasing adoption of advanced safety equipment, has fueled demand for modern laboratory hoods and enclosures. Leading academic and clinical research centers in London, Oxford, and Cambridge have upgraded to ventilated balance enclosures, biosafety cabinets, and laminar flow hoods equipped with HEPA filtration and real-time airflow monitoring to meet international biosafety standards. The growing emphasis on ergonomics, energy efficiency, and sustainable laboratory operations has encouraged laboratories to adopt modular and customizable enclosure systems, allowing for optimized workflow and reduced operational costs while maintaining high safety and hygiene standards. The increasing number of pharmaceutical, biotechnology, and clinical research initiatives further supports the market’s steady growth in the U.K., ensuring continued demand for advanced laboratory safety solutions.

Germany Europe Laboratory Hoods and Enclosure Market Insight

Germany Europe Laboratory Hoods and Enclosure Market is expected to be the fastest-growing European market for laboratory hoods and enclosures, registering a CAGR of 11.2% during the forecast period. Growth is driven by the rapid development of both private and public research laboratories, expansion of the pharmaceutical and biotechnology sectors, and government programs promoting innovation in clinical research and industrial R&D. Research institutes in Berlin and Munich, for example, are increasingly installing laminar flow cabinets and chemical fume hoods equipped with HEPA filtration, airflow monitoring, and energy-saving systems to support high-precision pharmaceutical and biotechnological research. The focus on energy efficiency, sustainability, and ergonomic design is shaping laboratory investments across Germany, ensuring enhanced operational efficiency while maintaining compliance with stringent safety regulations.

Europe Laboratory Hoods and Enclosure Market Share

The Laboratory Hoods and Enclosure industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Esco Lifesciences Group (Singapore)

- Labconco Corporation (U.S.)

- NuAire, Inc. (U.S.)

- The Baker Company (U.S.)

- Air Science (U.S.)

- Haier Biomedical (China)

- Avantor, Inc. (U.S.)

- BINDER GmbH (Germany)

- Germfree Laboratories, Inc. (U.S.)

- NuAire, Inc. (U.S.)

- Kewaunee Scientific Corporation (U.S.)

- AB Sciex (U.S.)

- Sakura Finetek (Japan)

- Thermo Electron Corporation (U.S.)

- Labgene Scientific Instruments (China)

- Esco Global Pte Ltd. (Singapore)

- HEMCO Corporation (U.S.)

- Flow Sciences, Inc. (U.S.)

- BioAir (Italy)

Latest Developments in Europe Laboratory Hoods and Enclosure Market

- In July 2023, Labconco Corporation introduced the Nexus Horizontal Clean Bench, the first laminar flow hood with onboard intelligence. This advanced clean bench provides an ISO Class 4 clean air environment with a 5‑inch touchscreen interface, data logging capabilities, and constant airflow profile technology, enhancing contamination control, traceability, and usability for non‑hazardous lab workflows

- In August 2023, Esco Lifesciences launched the Labculture G4 Class II Biological Safety Cabinet, featuring improved airflow management, ergonomic workspace, Centurion touchscreen control, and remote data logging. This innovation strengthened laboratory containment performance and operator comfort in biological research and diagnostic applications, reflecting ongoing product upgrades in the biosafety cabinet segment

- In November 2023, Esco Micro Pte. Ltd. announced a new Class II biological safety cabinet at ARABLAB 2023, reinforcing its commitment to biosafety and education. The launch supported global lab safety standards by offering improved containment solutions and showcasing Esco’s role in promoting safe laboratory practices

- In September 2023, Air Science USA LLC’s AS‑AHA‑193 Purair BIO Biological Safety Cabinet was officially listed under NSF/ANSI 49 certified models, reflecting broader industry compliance with stringent safety standards for containment and operator protection in labs

- In April 2023, AZBIL TELSTAR, S.L.U. expanded its service capabilities with a new facility in Lainate, Italy, aimed at strengthening its biological safety cabinet market presence and after‑sales support. The expansion was intended to enhance customer service and technical support across Europe

- In February 2024, Yamato Scientific Co., Ltd. announced development of a new series of laminar flow cabinets designed for low‑noise operation and enhanced visibility, addressing the needs of electronics and medical device industries where particulate control is critical. This launch demonstrated market diversification beyond traditional bioscience sectors

- In March 2024, AirClean Systems, Inc. unveiled updated PCR Workstation Enclosures at the Pittcon Conference & Expo, featuring built‑in UV sterilization, touchscreen controls, and HEPA filtration to support genomic and molecular biology workflows. This development highlighted the increasing importance of contamination‑controlled enclosures in cutting‑edge research environments

- In April 2024, WALDNER Holding GmbH & Co. KG launched its ScienLab modular laboratory fume hood system, engineered for flexible integration in new and existing lab infrastructures with enhanced airflow efficiency and reduced energy use, targeting pharmaceutical and chemical labs. This innovation supported lab configuration flexibility and sustainability goals

- In May 2024, Thermo Fisher Scientific Inc. announced the launch of next‑generation energy‑efficient biological safety cabinets under the Heracell series, designed with advanced HEPA filtration, ergonomic controls, and digital monitoring systems to meet demand in academic and pharmaceutical labs. This represented a major enhancement in safety and sustainability for containment equipment

- In January 2024, Mott Manufacturing Ltd. partnered with a leading North American research institute to supply customized ventilated balance enclosures (VBEs) tailored for high‑precision weighing of hazardous materials, reflecting the growing need for specialized containment solutions in complex research environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.