Europe Intercom Devices Market Analysis and Size

Intercoms are electronic communications systems that consist of fixed microphone/speaker units that connect to a central control device. There are two basic types of products: hard-wired and wireless. Hard-wired intercoms are connected by cables and are installed in buildings, apartments, offices, and manufacturing facilities. Wireless intercoms rely upon radio frequency (RF) transmission and are used in television stations, broadcast control vehicles, power plants, and communications facilities.

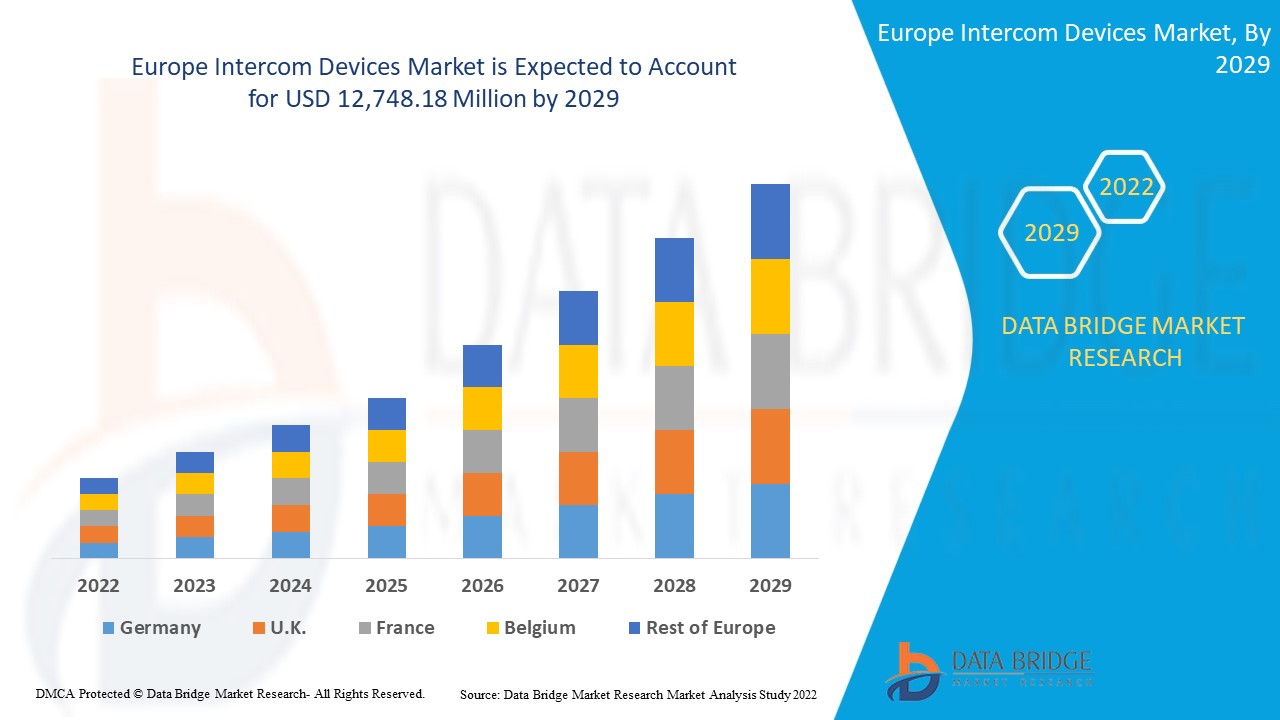

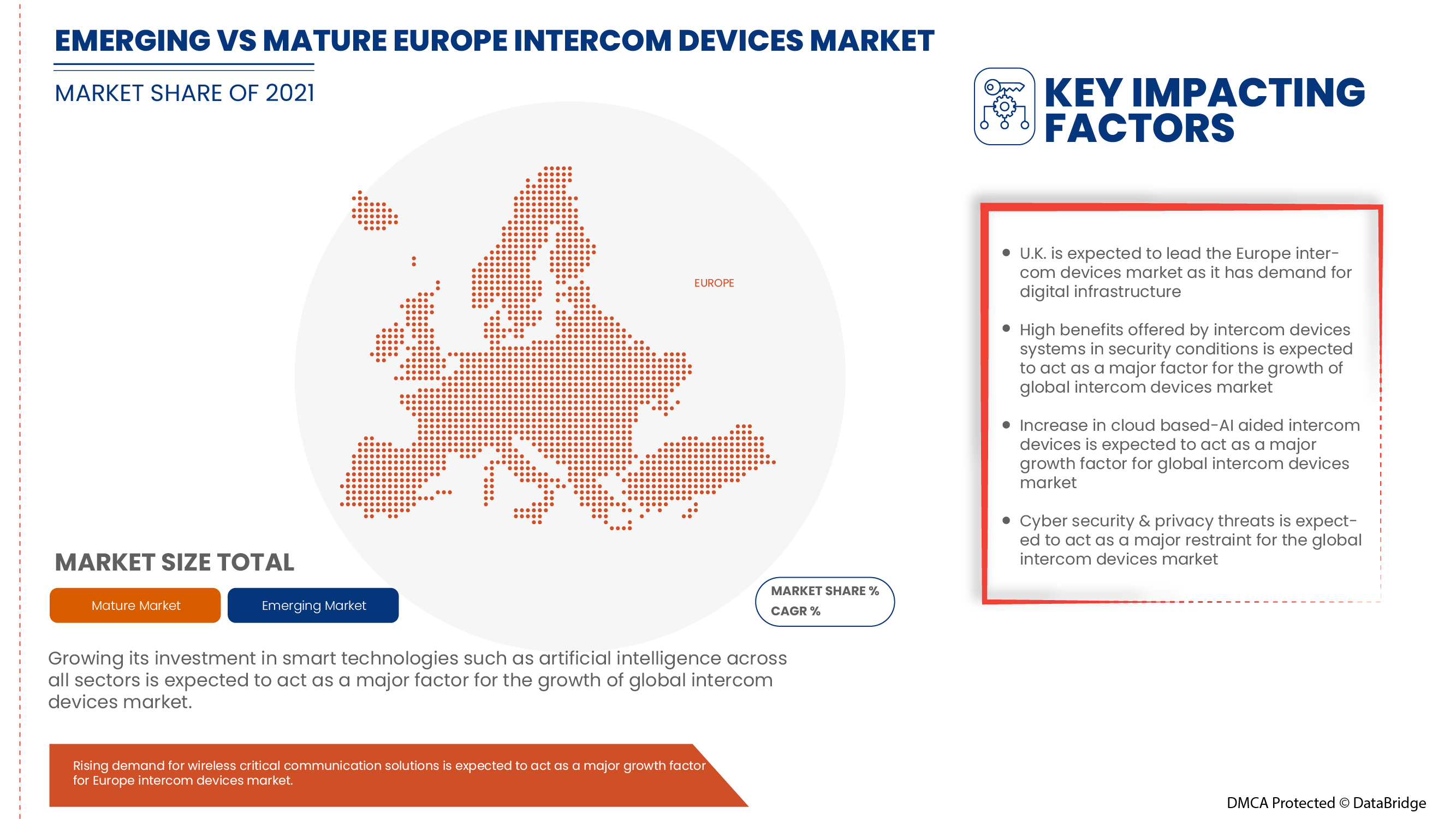

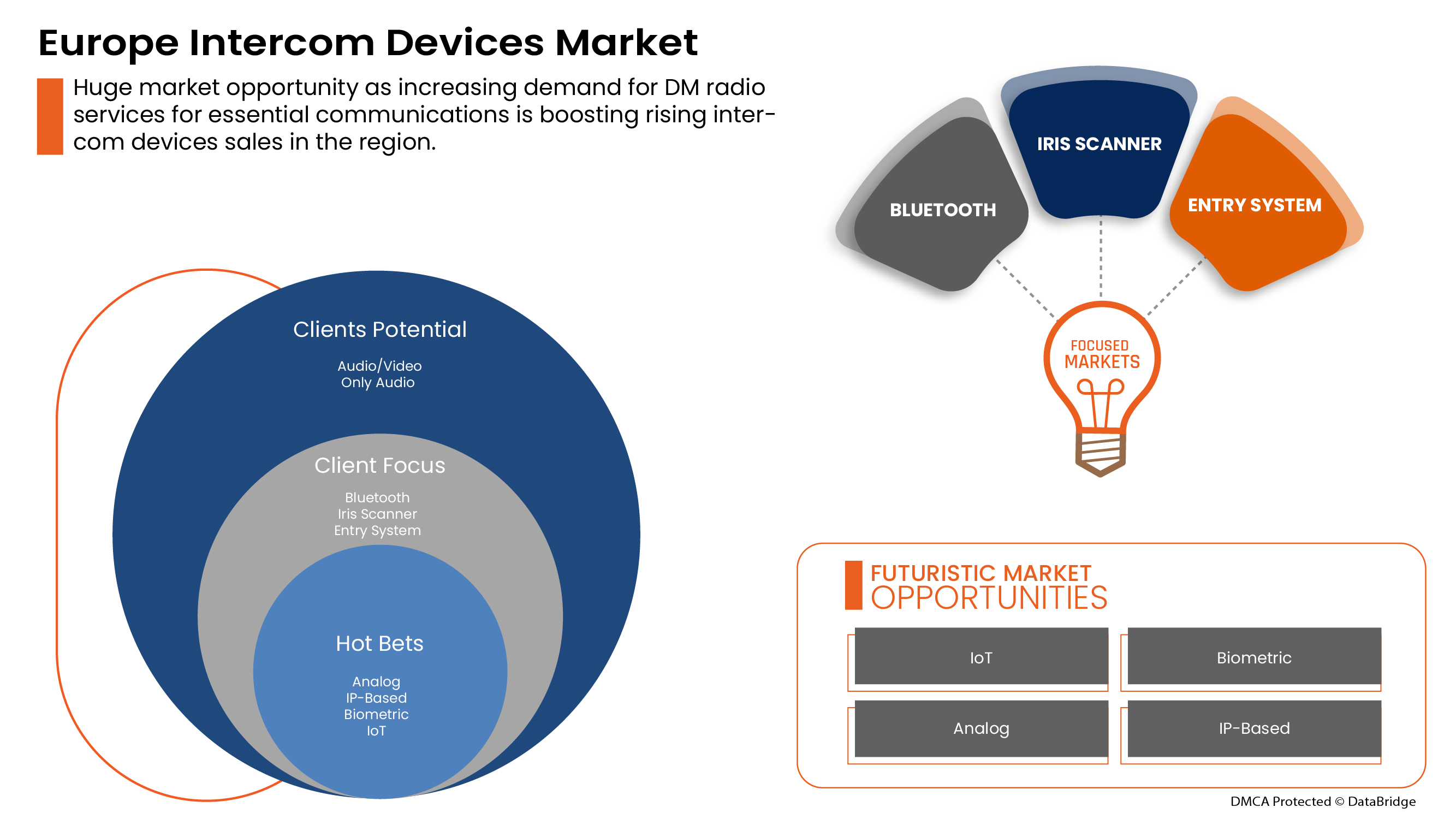

Data Bridge Market Research analyses that the Europe intercom devices market is expected to reach the value of USD 12,748.18 million by 2029, at a CAGR of 11.9% during the forecast period. "Audio/Video" accounts for the most prominent communication segment as this type of communication is in demand and is the best option for increasing security. The Europe intercom devices market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Device Type (Door Entry Systems, Handheld Devices, and Video Baby Monitors), Access Control (Fingerprint Readers, Password Access, Proximity Cards, and Wireless Access), Technology (Analog and IP-Based), End-use (Automotive, Commercial, Government, Residential, and Others), Communication Type (Audio/Video and Only Audio) |

|

Countries Covered |

Germany, France, Italy, U.K., Turkey, Switzerland, Spain, Russia, Netherlands, Belgium, Rest of Europe |

|

Market Players Covered |

Comelit Group S.p.A., Fujian Aurine Technology Co.,Ltd., Xiamen Leelen Technology Co., Ltd., Aiphone Corporation, Panasonic Holdings Corporation, Honeywell International Inc., Commend International GmbH. (A brand of TKH group), Legrand Group, FERMAX INTERNATIONAL, S.A.U., Zhuhai Taichuan Cloud Technology Co., LTD., 2N TELEKOMUNIKACE a.s (A brand of Axis Communications Inc.), Competition Electronic(zhuhai) co., ltd., Jiale Group, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., TCS TürControlSysteme AG, COMMAX, Siedle, Akuvox (Xiamen) Networks Co., Ltd., DoorKing, TOA Corporation, Barix.com, URMET S.p.A., Bird Home Automation GmbH, among others |

Market Definition

An intercom system is an advanced type of door entry system with a camera for managing access to a building. Like other types of intercom systems, a video door intercom with a camera also supports communication between visitors and occupants. Rather than relying on just voice, occupants can view live or recorded images from a door entry reader equipped with a camera to verify a visitor's identity before granting access.

Intercom technology supports many other advanced features to strengthen access control security and improve convenience for occupants and visitors. Features such as remote unlocking, cloud-based management, integration with building management systems, artificial intelligence, and facial recognition technologies are giving businesses and property managers greater efficiency and flexibility in managing property access.

Europe Intercom Devices Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Advent of advanced security audiovisual systems

There has been a progressive shift in the IoT ecosphere. This ecosphere is served by various standard electronic parts that are hardware integrated with various software. Utilizing custom audio visual services in the IoT era is necessary for driving audiovisual IoT technology. Since IoT-enabled devices can connect with the advanced broader network, they are achieving extensive functionality. IoT-enabled video intercom devices such as door locks and interactive displays with guidelines are widely adopted in various sectors such as automotive, commercial, government, residential, and others.

- Increase in robbery and thief cases across the globe

Robbery is the act of stealing, especially by brute force or through threats of violence. Robbers can rob a person or a place, such as a house or business. Due to increasing cases of robbery, intercom usage is increasing in various institutions such as schools and hospitals among others.

Restraint/ Challenge

- Rise in cyber security & threats weakening intercom solutions

Cybercrime/hacking and cyber security issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security are weaknesses that hackers exploit to perform unauthorized actions within a system. According to Purple Sec LLC, in 2018, mobile malware variants for mobile have increased by 54%, out of which 98% of mobile malware target Android devices. 25% of businesses are estimated to have been victims of crypto-jacking, including the security industry.

Opportunities

- Growing government initiatives toward the development of smart cities

The initiatives taken by the government in smart cities and communities are done by two governance bodies that are a high-level group advising the European Commission (EC) made up of senior representatives from industries, cities, and civil society, as well as the smart cities stakeholder platform. The platform focuses on identifying the solutions and needs of various developers. The smart cities stakeholder platform is essentially about promoting innovations. It aims to accelerate the development and market deployment of energy efficiency and low carbon technology applications in the urban environment.

- Increased check on deter burglars, baby monitoring, and ensuring the safety of the property

Burglar's activities are increasing daily in various countries such as the U.K. Most criminals try to avoid risky situations, and these people prefer easy targets with a low-risk reward ratio. Intercom devices are being used to ensure and increase the safety of properties in different cities. Hard-wired intercoms are connected by cables and installed in buildings, apartments, and manufacturing facilities.

Post COVID-19 Impact on Europe Intercom Devices market

COVID-19 created a major impact on the Europe intercom devices market as almost every country opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The government took some strict actions, such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more, to prevent the spread of COVID-19. The only business which was dealing in this pandemic situation were the essential services that were allowed to open and run the processes.

The growth of the intercom devices market is rising due to the advanced security audio visual systems post-COVID. Also, the opening of lockdown is boosting the intercom industry, which is raising the demand for intercom devices in the market. However, factors such as the rise in cyber security & threats weakening intercom solutions are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the Intercom devices. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade have led to the market's growth.

Recent Development

- In July 2021, Hangzhou Hikvision Digital Technology Co., Ltd unveiled its All-in-One Indoor Station tablet gadget, which combines security solutions in homes and offices. With this product, the company has managed to make a footprint in a cloud-based device management application for users across the world.

- In May 2018, Panasonic Holdings Corporation launched a video intercom systems range solutions. Features such as wireless and interactive cutting-edge technologies were used in the VL-VM series of the analog video intercom system. This has helped the company further improve its product portfolio and offer innovative solutions for the consumer

Europe Intercom Devices Market Scope

The Europe intercom devices market is segmented on the basis of communication type, device type, access control, technology, and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The Europe intercom devices market is segmented on the basis of communication type, device type, access control, technology, and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Communication Type

- Audio/video

- Only audio

On the basis of communication type, the Europe intercom devices market is segmented into audio/video and only audio.

By Device Type

- Door entry systems

- Handheld devices

- Video baby monitors

On the basis of device type, the Europe intercom devices market has been segmented into door entry systems, handheld devices, and video baby monitors.

By Access Control

- Fingerprint readers

- Password access

- Proximity cards

- Wireless access

On the basis of access control, the Europe intercom devices market has been segmented into fingerprint readers, password access, proximity cards, and wireless access.

By Technology

- Analog

- IP-Based

On the basis of technology, the Europe intercom devices market has been segmented into analog and IP-Based.

By End-Use

- Automotive

- Commercial

- Government

- Residential

- Others

On the basis of end-use, the Europe intercom devices market has been segmented into automotive, commercial, government, residential, and others.

Europe Intercom Devices Market Regional Analysis/Insights

The Europe intercom devices market is analyzed, and market size insights and trends are provided by country, communication type, device type, access control, technology, and end use as referenced above.

The countries covered in the Europe intercom devices market report are Germany, France, Italy, U.K., Turkey, Switzerland, Spain, Russia, Netherlands, Belgium, and the rest of Europe.

In 2022, Germany is expected to dominate the Europe Intercom devices market due to increased development of cloud-based intercom devices designed to improve security and contribute new levels of operational intelligence for governments, enterprises, transport, and communities.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country data.

Competitive Landscape and Europe Intercom Devices Market Share Analysis

The Europe intercom devices market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Europe intercom devices market.

Some of the major players operating in the Europe intercom devices market are Comelit Group S.p.A., Fujian Aurine Technology Co.,Ltd., Xiamen Leelen Technology Co., Ltd., Aiphone Corporation, Panasonic Holdings Corporation, Honeywell International Inc., Commend International GmbH. (A brand of TKH group), Legrand Group, FERMAX INTERNATIONAL, S.A.U., Zhuhai Taichuan Cloud Technology Co., LTD., 2N TELEKOMUNIKACE a.s (A brand of Axis Communications Inc.), Competition Electronic(zhuhai) co., ltd., Jiale Group, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., TCS TürControlSysteme AG, COMMAX, Siedle, Akuvox (Xiamen) Networks Co., Ltd., DoorKing, TOA Corporation, Barix.com, URMET S.p.A., Bird Home Automation GmbH, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMMUNICATION TYPE TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AUDIO AND AUDIO/VIDEO INTERNAL UNIT

4.2 U.S. COMPETITORS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIOVISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY & THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECK ON DETER BURGLARS, BABY MONITORING AND ENSURING SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS AUDIO/VIDEO INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR AUDIO/VIDEO INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE AUDIO/VIDEO INTERCOM DEVICES

6 EUROPE INTERCOM DEVICE MARKET, BY COMMUNICATION TYPE

6.1 OVERVIEW

6.2 AUDIO/VIDEO

6.3 ONLY AUDIO

7 EUROPE INTERCOM DEVICE MARKET, BY DEVICE TYPE

7.1 OVERVIEW

7.2 DOOR ENTRY SYSTEMS

7.3 HANDHELD DEVICES

7.4 VIDEO BABY MONITORS

8 EUROPE INTERCOM DEVICE MARKET, BY ACCESS CONTROL

8.1 OVERVIEW

8.2 FINGERPRINT READERS

8.3 PROXIMITY CARDS

8.4 PASSWORD ACCESS

8.5 WIRELESS ACCESS

9 EUROPE INTERCOM DEVICE MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ANALOG

9.3 IP-BASED

10 EUROPE INTERCOM DEVICE MARKET, BY END-USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

10.4 GOVERNMENT

10.5 AUTOMOTIVE

10.6 OTHERS

11 EUROPE INTERCOM DEVICES MARKET, BY REGION

11.1 EUROPE

11.1.1 U.K.

11.1.2 GERMANY

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 TURKEY

11.1.10 BELGIUM

11.1.11 REST OF EUROPE

12 EUROPE INTERCOM DEVICES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 PANASONIC HOLDINGS CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCTS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAMSUNG ELECTRONICS CO., LTD. ELECTRONICS CO., LTD.

14.3.1 COMPANY PROFILE

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LEGRAND GROUP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCTS PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HONEYWELL INTERNATIONAL INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DAHUA TECHNOLOGY CO., LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCTS PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AIPHONE CORPORATION.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 SIEDLE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMMAX.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCTS PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 2N TELEKOMUNIKACE A.S

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCTS PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 AKUVOX (XIAMEN) NETWORKS CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 ALPHA COMMUNICATIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 BARIX.COM

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 BIRD HOME AUTOMATION GMBH.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCTS PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 BUTTERFLYMX, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT & SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 COMELIT GROUP S.P.A.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 COMMEND INTERNATIONAL GMBH.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCTS PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 COMPETITION ELECTRONIC (ZHUHAI) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCTS PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 DOORKING

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 FERMAX ELECTRÓNICA, S.A.U.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCTS PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 FUJIAN AURINE TECHNOLOGY CO., LTD.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCTS PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 JIALE GROUP

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 SWIFTLANE.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCTS PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TCS TÜRCONTROLSYSTEME AG

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCTS PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 TOA CORPORATION.

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 URMET S.P.A.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCTS PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 WRT INTELLIGENT TECHNOLOGY COMPANY LIMITED

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT & SOLUTION PORTFOLIO

14.27.3 RECENT DEVELOPMENT

14.28 XIAMEN LEELEN TECHNOLOGY CO., LTD.

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCTS PORTFOLIO

14.28.3 RECENT DEVELOPMENTS

14.29 ZHUHAI TAICHUAN CLOUD TECHNOLOGY CO., LTD.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT & SOLUTION PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 ZICOM

14.30.1 COMPANY SNAPSHOT

14.30.2 PRODUCT PORTFOLIO

14.30.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 LIST OF U.S. COMPETITORS

TABLE 2 EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE VIDEO BABY MONITORS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 10 EUROPE FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE WIRELESS ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE IP-BASED IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE RESIDENTIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE AUTOMOTIVE IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE INTERCOM DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 27 EUROPE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 EUROPE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 29 U.K. INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.K. INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.K. INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 32 U.K. INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 U.K. INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 37 GERMANY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 GERMANY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 FRANCE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 40 FRANCE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 41 FRANCE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 42 FRANCE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 FRANCE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 44 ITALY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 45 ITALY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 ITALY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 47 ITALY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 ITALY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 49 SPAIN INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 50 SPAIN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 51 SPAIN INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 52 SPAIN INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 SPAIN INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 54 RUSSIA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 55 RUSSIA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 56 RUSSIA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 57 RUSSIA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION))

TABLE 58 RUSSIA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 NETHERLANDS INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 NETHERLANDS INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NETHERLANDS INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 62 NETHERLANDS INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 NETHERLANDS INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 68 SWITZERLAND INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 TURKEY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 70 TURKEY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 71 TURKEY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 72 TURKEY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 TURKEY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 79 REST OF EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE INTERCOM DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE INTERCOM DEVICES MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 EUROPE INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES IS EXPECTED TO DRIVE THE EUROPE INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AUDIO/VIDEO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE INTERCOM DEVICES MARKET IN 2022 & 2029

FIGURE 13 ADVANTAGES OFFERED BY VIDEO SYSTEM OVER AUDIO ONLY SYSTEMS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE INTERCOM DEVICES MARKET

FIGURE 15 VIDEO SYSTEMS

FIGURE 16 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 17 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 18 IMPACT OF CYBER SECURITY THREAT

FIGURE 19 EUROPE INTERCOM DEVICE MARKET: BY COMMUNICATION TYPE, 2021

FIGURE 20 EUROPE INTERCOM DEVICE MARKET: BY DEVICE TYPE, 2021

FIGURE 21 EUROPE INTERCOM DEVICE MARKET: BY ACCESS CONTROL, 2021

FIGURE 22 EUROPE INTERCOM DEVICE MARKET: BY TECHNOLOGY, 2021

FIGURE 23 EUROPE INTERCOM DEVICE MARKET: BY END-USE, 2021

FIGURE 24 EUROPE INTERCOM DEVICES MARKET: SNAPSHOT (2021)

FIGURE 25 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2021)

FIGURE 26 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE (2022-2029)

FIGURE 29 EUROPE INTERCOM DEVICES MARKET: COMPANY SHARE 2021 (%)

Europe Intercom Devices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Intercom Devices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Intercom Devices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.