Europe Hydrocolloids Market

Market Size in USD Billion

CAGR :

%

USD

2.75 Billion

USD

4.43 Billion

2024

2032

USD

2.75 Billion

USD

4.43 Billion

2024

2032

| 2025 –2032 | |

| USD 2.75 Billion | |

| USD 4.43 Billion | |

|

|

|

|

Hydrocolloids Market Size

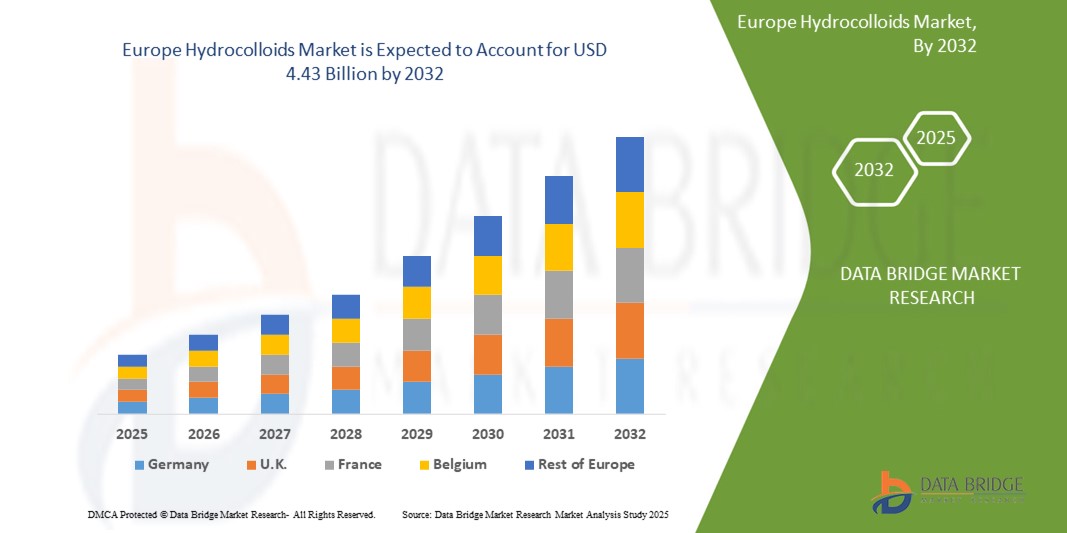

- The Europe hydrocolloids market size was valued at USD 2.75 billion in 2024 and is expected to reach USD 4.43 billion by 2032, growing at a CAGR of 6.10% during the forecast period.

- This growth is attributed to rising demand for natural and clean-label ingredients, increasing utilization in the food and beverage industry for texture enhancement and shelf-life extension, and expanding applications in pharmaceutical and personal care sectors.

Hydrocolloids Market Analysis

- Hydrocolloids are a group of polysaccharides and proteins that form gels or thickening solutions when dispersed in water. These compounds are widely used across industries for their ability to modify the viscosity and texture of products, stabilize emulsions, and act as fat replacers and dietary fiber.

- The market in Europe is experiencing significant growth owing to the increasing adoption of functional foods and growing consumer awareness regarding health and wellness. Regulatory support for natural food additives and clean-label formulations further drives market expansion.

- Germany is expected to dominate the Europe hydrocolloids market with a share of 33.75%, driven by its strong food processing industry, innovation in plant-based products, and rising demand for organic and natural ingredients in packaged foods and beverages.

- France is anticipated to be the fastest-growing market during the forecast period, supported by increasing investment in biotechnology and a robust demand for hydrocolloids in pharmaceuticals and high-end cosmetics, especially in natural and vegan product lines.

- Gelatin is projected to hold the largest share in the hydrocolloids market at 38.62%, due to its extensive application in confectionery, dairy, and nutraceutical sectors. Its functional properties such as gelling, foaming, and emulsifying make it a preferred choice across a range of end-use industries.

Report Scope and Hydrocolloids Market Segmentation

|

Attributes |

Hydrocolloids Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrocolloids Market Trends

“Shift Toward Clean Label and Plant-Based Hydrocolloids”

- A key trend shaping the Europe hydrocolloids market is the growing preference for clean label and plant-based hydrocolloids.

- This trend is being fueled by rising consumer awareness of health and wellness, increased demand for transparency in food ingredients, and a shift toward vegetarian and vegan diets.

- For instance, companies such as CP Kelco and Ingredion Incorporated are expanding their portfolios to include pectin, carrageenan, and other plant-derived hydrocolloids, offering natural solutions for thickening and stabilizing without synthetic additives.

- Food and beverage manufacturers are increasingly reformulating their products using hydrocolloids like agar, xanthan gum, and guar gum to meet clean-label requirements while maintaining texture, shelf stability, and sensory appeal.

- As regulatory bodies and consumers push for greater ingredient transparency and natural formulations, the adoption of plant-based hydrocolloids is expected to accelerate, creating growth opportunities across food, pharmaceutical, and personal care applications.

Hydrocolloids Market Dynamics

Driver

“Rising Demand for Functional Ingredients in Food & Beverage Industry”

- The increasing use of hydrocolloids as functional ingredients in the food & beverage sector is a major driver of market growth in the Europe region.

- Hydrocolloids enhance texture, stability, moisture retention, and shelf life, making them critical for processed foods, dairy products, bakery items, and ready-to-eat meals.

- The growing consumption of convenience foods, coupled with urbanization and changing lifestyles, is driving the need for high-performance stabilizers and thickeners that align with health and wellness trends.

- For instance, companies like Fufeng Group and Ashland Global are introducing customized xanthan gum and gelatin solutions to improve viscosity and mouthfeel in sauces, beverages, and desserts, meeting evolving consumer expectations.

- With the rise in demand for healthier and more sustainable food products, hydrocolloids are becoming essential for delivering improved nutrition profiles, fat replacement, and gluten-free formulations.

- This increasing reliance on hydrocolloids to create high-quality, functional food products is expected to sustain long-term market growth across the region.

Restraint/Challenge

“High Cost of Natural and Specialty Raw Materials”

- The high cost of natural and specialty raw materials presents a significant challenge for the Europe hydrocolloids market, especially as the industry shifts toward clean-label, plant-based, and organic formulations.

- Sourcing raw materials such as seaweed (for carrageenan and alginate), guar seeds, and fruit peels (for pectin) involves complex extraction and purification processes, which substantially increase production costs for manufacturers.

- This challenge is particularly pronounced in price-sensitive sectors like food & beverages and personal care, where manufacturers often operate under tight profit margins and face growing pressure to deliver natural alternatives at competitive pricing.

- For instance, producers of plant-based hydrocolloids such as pectin and agar incur high operational expenses due to seasonal variability in raw material availability, stringent quality control requirements, and labor-intensive processing. These factors collectively drive up unit costs and may limit adoption in cost-conscious markets.

- The rising demand for sustainably sourced, non-GMO, and certified organic hydrocolloids further intensifies cost pressures, potentially slowing the market’s expansion in regions where affordability remains a key purchasing criterion.

Hydrocolloids Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the Europe Hydrocolloids Market is segmented into Gelatin, Pectin, Carrageenan, Xanthan Gum, Agar, and Others. The Gelatin segment dominates the largest market revenue share of 38.6% in 2025, owing to its widespread use in food & beverage, pharmaceutical, and personal care applications. Its excellent gelling, stabilizing, and emulsifying properties make it a preferred choice in confectionery, capsules, and cosmetics.

However, the Pectin segment is expected to grow at the highest CAGR of 7.35% during the forecast period of 2025–2032. This growth is primarily driven by the rising demand for clean-label, plant-based ingredients in jams, jellies, beverages, and dairy products, along with growing consumer preference for natural and vegan thickeners.

- By Application

On the basis of application, the Europe Hydrocolloids Market is segmented into Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, and Others. The Food & Beverage segment held the largest market share of 46.9% in 2025, driven by increasing utilization of hydrocolloids as thickening, gelling, and stabilizing agents in dairy products, bakery items, sauces, and meat alternatives. The demand is further fueled by the trend towards plant-based and clean-label formulations in Europe.

However, the Pharmaceuticals segment is expected to witness the highest CAGR of 6.87% during the forecast period. This is attributed to the expanding use of hydrocolloids in drug delivery systems, tablet binding, wound care, and capsule manufacturing, as the pharmaceutical industry increasingly adopts biocompatible and functional excipients to improve product performance and patient outcomes.

Europe Hydrocolloids Market Insight

The Europe hydrocolloids market is set to expand steadily through 2032, driven by increasing demand for natural thickeners, stabilizers, and gelling agents in food & beverage, pharmaceuticals, and cosmetics. Health-conscious consumer behavior, clean-label preferences, and the rising popularity of plant-based diets are reshaping the hydrocolloid landscape across the region. Regulatory support for sustainable and organic ingredients is encouraging innovation and adoption of bio-based hydrocolloids in various applications.

- Germany Hydrocolloids Market Insight

Germany holds the largest market share in the Europe hydrocolloids market, primarily due to its robust food processing, pharmaceutical, and cosmetics industries. The country has a strong demand for clean-label and functional food additives, especially in dairy, bakery, and meat alternatives. Furthermore, Germany’s well-established pharmaceutical sector is contributing to consistent hydrocolloid usage in drug formulation and capsule production.

- Italy Hydrocolloids Market Insight

Italy is witnessing steady growth in the hydrocolloids market, supported by its rich culinary tradition and a thriving food processing sector. The use of gelling and thickening agents in processed meats, sauces, and desserts is prevalent. Moreover, the country’s expanding pharmaceutical and nutraceutical markets are creating opportunities for gelatin and xanthan gum in capsule production and dietary supplements.

Hydrocolloids Market Share

The Hydrocolloids Market industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Hexion Inc. (U.S.)

- Huntsman International LLC (U.S.)

- Cardolite Corporation (U.S.)

- BASF SE (Germany)

- Arnette Polymers, LLC (U.S.)

- Aditya Birla Chemicals (India)

- Momentive Performance Materials Inc. (U.S.)

- Adeka Corporation (Japan)

- Air Products and Chemicals, Inc. (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Cargill, Incorporated (U.S.)

- Kukdo Chemical Co., Ltd. (South Korea)

- Nagase ChemteX Corporation (Japan)

- Atul Ltd. (India)

Latest Developments in Global Hydrocolloids Market

- In May 2025, Cargill expanded its pectin production facility in Malchin, Germany, to strengthen its supply capabilities for European food manufacturers. This expansion is aimed at meeting the rising demand for natural and label-friendly texturizing agents in jams, fruit-based dairy products, and beverages, aligning with the region's shift toward clean-label and plant-based ingredients.

- In February 2025, Jungbunzlauer introduced a new line of xanthan gum products under the brand “Xanlite” targeted at low-viscosity beverage and personal care applications in the EU market. These new variants are optimized for improved solubility and flow properties, catering to growing consumer demand for functional beverages and lightweight cosmetic formulations.

- In October 2024, Kerry Group inaugurated a new application and development center in Ireland focused on innovation in hydrocolloids and taste modulation. The facility is designed to accelerate customized product development for European clients in the bakery, dairy, and meat alternatives sectors, enhancing the group’s ability to respond swiftly to regional consumer trends.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HYDROCOLLOIDS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE EUROPE HYDROCOLLOIDS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 EUROPE HYDROCOLLOIDS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 EUROPE HYDROCOLLOIDS MARKET, BY TYPE

11.1 OVERVIEW

11.2 STARCH

11.3 GELATIN GUM

11.4 XANTHAN GUM

11.5 CARRAGEENAN

11.6 GUM KARAYA

11.7 GUM TRAGACANTH

11.8 ALGINATES

11.9 PECTIN

11.1 GUAR GUM

11.11 GUM ARABIC

11.12 OTHERS

12 EUROPE HYDROCOLLOIDS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 DRY

12.3.1 DRY, BY TYPE

12.3.1.1. POWDER

12.3.1.2. GRANULAR

12.3.1.3. KIBBLES

12.3.1.4. OTHERS ( IF ANY)

13 EUROPE HYDROCOLLOIDS MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 EUROPE HYDROCOLLOIDS MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 DAIRY PRODUCTS

14.2.1 DAIRY PRODUCTS, BY TYPE

14.2.1.1. CHEESE

14.2.1.2. ICE-CREAM

14.2.1.3. MILK POWDER

14.2.1.4. DAIRY SPREAD

14.2.1.5. YOGURT

14.2.1.6. OTHERS (IF ANY)

14.2.2 DAIRY PRODUCTS, BY HYDROCOLLOIDS TYPE

14.2.2.1. STARCH

14.2.2.2. GELATIN GUM

14.2.2.3. XANTHAN GUM

14.2.2.4. CARRAGEENAN

14.2.2.5. GUM KARAYA

14.2.2.6. GUM TRAGACANTH

14.2.2.7. ALGINATES

14.2.2.8. PECTIN

14.2.2.9. GUAR GUM

14.2.2.10. GUM ARABIC

14.2.2.11. OTHERS

14.3 BAKERY PRODUCTS

14.3.1 BAKERY PRODUCTS, BY TYPE

14.3.1.1. BREADS & ROLLS

14.3.1.2. CAKES & PASTRIES

14.3.1.3. BISCUITS

14.3.1.3.1. PLAIN BISCUITS

14.3.1.3.2. FILLED BISCUITS

14.3.1.4. MUFFINES

14.3.1.5. COOKIES

14.3.1.6. DOUGHNUTS

14.3.1.7. OTHERS

14.3.2 BAKERY PRODUCTS, BY HYDROCOLLOIDS TYPE

14.3.2.1. STARCH

14.3.2.2. GELATIN GUM

14.3.2.3. XANTHAN GUM

14.3.2.4. CARRAGEENAN

14.3.2.5. GUM KARAYA

14.3.2.6. GUM TRAGACANTH

14.3.2.7. ALGINATES

14.3.2.8. PECTIN

14.3.2.9. GUAR GUM

14.3.2.10. GUM ARABIC

14.3.2.11. OTHERS

14.4 CONVENIENCE FOOD

14.4.1 CONVENIENCE FOOD, BY TYPE

14.4.1.1. READY TO EAT PRODUCTS

14.4.1.2. SOUPS & SAUCES

14.4.1.3. SEASONINGS & DRESSINGS

14.4.1.4. NOODLES

14.4.1.5. PASTA

14.4.1.6. PIZZA

14.4.1.7. NUTS, SEEDS, & TRAIL MIXES

14.4.1.8. OTHERS (IF ANY)

14.4.2 CONVENIENCE FOOD, BY HYDROCOLLOIDS TYPE

14.4.2.1. STARCH

14.4.2.2. GELATIN GUM

14.4.2.3. XANTHAN GUM

14.4.2.4. CARRAGEENAN

14.4.2.5. GUM KARAYA

14.4.2.6. GUM TRAGACANTH

14.4.2.7. ALGINATES

14.4.2.8. PECTIN

14.4.2.9. GUAR GUM

14.4.2.10. GUM ARABIC

14.4.2.11. OTHERS

14.5 PROCESSED MEAT PRODUCTS

14.5.1 PROCESSED MEAT PRODUCTS, BY TYPE

14.5.1.1. POULTRY

14.5.1.2. BEEF

14.5.1.3. PORK

14.5.1.4. SEAFOOD

14.5.2 PROCESSED MEAT PRODUCTS, BY HYDROCOLLOIDS TYPE

14.5.2.1. STARCH

14.5.2.2. GELATIN GUM

14.5.2.3. XANTHAN GUM

14.5.2.4. CARRAGEENAN

14.5.2.5. GUM KARAYA

14.5.2.6. GUM TRAGACANTH

14.5.2.7. ALGINATES

14.5.2.8. PECTIN

14.5.2.9. GUAR GUM

14.5.2.10. GUM ARABIC

14.5.2.11. OTHERS

14.6 CONFECTIONERY

14.6.1 CONFECTIONERY, BY TYPE

14.6.1.1. CHOCOLATE

14.6.1.2. HARD & SOFT CANDY

14.6.1.3. TOFFEES

14.6.1.4. CARAMELS & NOUGATS

14.6.1.5. GUMS & JELLY

14.6.1.6. CREAM FEELINGS

14.6.1.7. OTHERS (IF ANY)

14.6.2 CONFECTIONERY PRODUCTS, BY HYDROCOLLOIDS TYPE

14.6.2.1. STARCH

14.6.2.2. GELATIN GUM

14.6.2.3. XANTHAN GUM

14.6.2.4. CARRAGEENAN

14.6.2.5. GUM KARAYA

14.6.2.6. GUM TRAGACANTH

14.6.2.7. ALGINATES

14.6.2.8. PECTIN

14.6.2.9. GUAR GUM

14.6.2.10. GUM ARABIC

14.6.2.11. OTHERS

14.7 BREAKFAST CEREALS

14.7.1 BREAKFAST CEREALS, BY HYDROCOLLOIDS TYPE

14.7.1.1. STARCH

14.7.1.2. GELATIN GUM

14.7.1.3. XANTHAN GUM

14.7.1.4. CARRAGEENAN

14.7.1.5. GUM KARAYA

14.7.1.6. GUM TRAGACANTH

14.7.1.7. ALGINATES

14.7.1.8. PECTIN

14.7.1.9. GUAR GUM

14.7.1.10. GUM ARABIC

14.7.1.11. OTHERS

14.8 PROCESSED FOODS

14.8.1 PROCESSES FOODS, BY HYDROCOLLOIDS TYPE

14.8.1.1. STARCH

14.8.1.2. GELATIN GUM

14.8.1.3. XANTHAN GUM

14.8.1.4. CARRAGEENAN

14.8.1.5. GUM KARAYA

14.8.1.6. GUM TRAGACANTH

14.8.1.7. ALGINATES

14.8.1.8. PECTIN

14.8.1.9. GUAR GUM

14.8.1.10. GUM ARABIC

14.8.1.11. OTHERS

14.9 SPORT NUTRITION

14.9.1 SPORT NUTRITION, BY HYDROCOLLOIDS TYPE

14.9.1.1. STARCH

14.9.1.2. GELATIN GUM

14.9.1.3. XANTHAN GUM

14.9.1.4. CARRAGEENAN

14.9.1.5. GUM KARAYA

14.9.1.6. GUM TRAGACANTH

14.9.1.7. ALGINATES

14.9.1.8. PECTIN

14.9.1.9. GUAR GUM

14.9.1.10. GUM ARABIC

14.9.1.11. OTHERS

14.1 BEVERAGES

14.10.1 BEVERAGES, BY TYPE

14.10.1.1. RTD BEVERAGES

14.10.1.2. FRUIT JUICES

14.10.1.3. DAIRY DRINKS

14.10.1.4. FRUIT-BASED SOFT DRINKS

14.10.1.5. PLANT-BASED MILK

14.10.1.6. OTHERS

14.10.2 BEVERAGES, BY HYDROCOLLOIDS TYPE

14.10.2.1. STARCH

14.10.2.2. GELATIN GUM

14.10.2.3. XANTHAN GUM

14.10.2.4. CARRAGEENAN

14.10.2.5. GUM KARAYA

14.10.2.6. GUM TRAGACANTH

14.10.2.7. ALGINATES

14.10.2.8. PECTIN

14.10.2.9. GUAR GUM

14.10.2.10. GUM ARABIC

14.10.2.11. OTHERS

15 EUROPE HYDROCOLLOIDS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT

15.3 INDIRECT

16 EUROPE HYDROCOLLOIDS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

16.2 MERGERS & ACQUISITIONS

16.3 NEW PRODUCT DEVELOPMENT & APPROVALS

16.4 EXPANSIONS & PARTNERSHIP

16.5 REGULATORY CHANGES

17 EUROPE HYDROCOLLOIDS MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

17.1 EUROPE

17.1.1 GERMANY

17.1.2 U.K.

17.1.3 ITALY

17.1.4 FRANCE

17.1.5 SPAIN

17.1.6 SWITZERLAND

17.1.7 NETHERLANDS

17.1.8 BELGIUM

17.1.9 RUSSIA

17.1.10 DENMARK

17.1.11 SWEDEN

17.1.12 POLAND

17.1.13 TURKEY

17.1.14 REST OF EUROPE

18 SWOT AND DBMR ANALYSIS, EUROPE HYDROCOLLOIDS MARKET

19 EUROPE HYDROCOLLOIDS MARKET, COMPANY PROFILE

19.1 DSM

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHICAL PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 KELCO

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHICAL PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 INGREDION

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHICAL PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 TATE & LYLE

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHICAL PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 NOREVO

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHICAL PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 CARGILL INCORPORATED

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHICAL PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 B. BRAUN MELSUNGEN AG

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHICAL PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 ADM

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHICAL PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 JUNGBUNZLAUER SUISSE AG

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHICAL PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 SMITH & NEPHEW

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHICAL PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 KERRY GROUP

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHICAL PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 CONCLUSION

21 REFERENCE

22 QUESTIONNAIRE

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Hydrocolloids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Hydrocolloids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Hydrocolloids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.