Europe Herpes Market

Market Size in USD Million

CAGR :

%

USD

381.52 Million

USD

612.68 Million

2025

2033

USD

381.52 Million

USD

612.68 Million

2025

2033

| 2026 –2033 | |

| USD 381.52 Million | |

| USD 612.68 Million | |

|

|

|

|

Europe Herpes Market Size

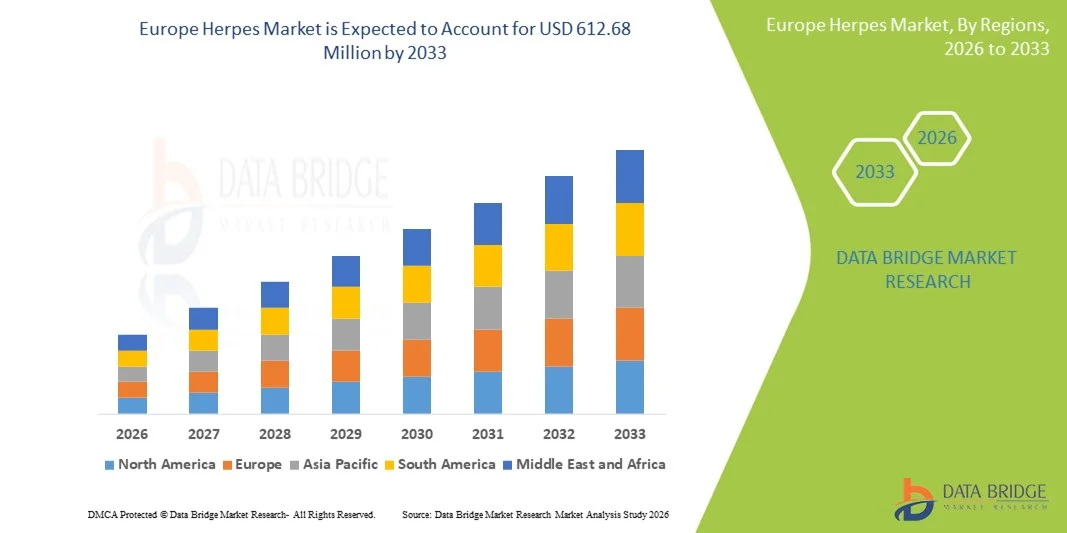

- The Europe herpes market size was valued at USD 381.52 million in 2025 and is expected to reach USD 612.68 million by 2033, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by the rising prevalence of herpes infections across Europe, increasing healthcare spending, and the expansion of effective antiviral drug treatments which are improving patient outcomes and treatment adoption

- Furthermore, growing awareness of sexually transmitted infections (STIs), supportive public health initiatives, and advancements in diagnostic and therapeutic solutions are driving demand for more accessible and integrated herpes care, solidifying the region’s role as a key market for herpes therapeutics

Europe Herpes Market Analysis

- Herpes treatments, including antiviral therapies for HSV-1 and HSV-2 infections, are increasingly vital components of Europe’s healthcare landscape due to their effectiveness in managing symptoms, preventing outbreaks, and reducing transmission risks in both residential and clinical settings

- The escalating demand for herpes treatments is primarily fueled by the rising prevalence of herpes infections, growing awareness of sexually transmitted infections (STIs), and a preference for effective, easily accessible antiviral medications

- Germany dominated the herpes market with the largest revenue share of 28.5% in 2025, driven by well-established healthcare infrastructure, high healthcare spending, and a strong presence of leading pharmaceutical companies offering antiviral therapies, supported by public health campaigns and early adoption of advanced treatment protocols

- Poland is expected to be the fastest-growing country in the herpes market during the forecast period due to increasing healthcare access, rising awareness of STIs, and expansion of antiviral drug availability

- Acyclovir segment dominated the herpes market with a market share of 42.9% in 2025, driven by its long-standing reputation for efficacy, widespread clinical use, and inclusion in treatment guidelines across European countries

Report Scope and Europe Herpes Market Segmentation

|

Attributes |

Europe Herpes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Herpes Market Trends

Advancements in Antiviral Therapies and Digital Health Awareness

- A significant and accelerating trend in the Europe herpes market is the development of more effective antiviral therapies and the integration of digital health tools such as telemedicine platforms, mobile apps for outbreak tracking, and online prescription management. This combination is improving patient adherence, convenience, and overall disease management

- For instance, Valaciclovir Prolonged-Release tablets launched in Germany offer simplified dosing schedules, improving compliance for patients managing recurrent HSV-1 and HSV-2 infections. Similarly, some telehealth platforms in the U.K. allow patients to consult dermatologists and obtain antiviral prescriptions remotely, reducing barriers to care

- Digital health tools and advanced therapies enable features such as personalized outbreak reminders, monitoring treatment effectiveness, and early detection of symptoms, helping reduce complications

- The seamless integration of antiviral therapies with digital monitoring platforms facilitates centralized management of patient health, enabling healthcare providers to track treatment adherence and patient outcomes remotely. Patients can manage medications, record symptoms, and receive guidance through a single interface

- This trend towards more intuitive, patient-centered, and digitally integrated herpes care is reshaping expectations for treatment and disease management. Consequently, pharmaceutical companies such as GlaxoSmithKline are developing patient support programs with digital tools and therapy adherence features

- The demand for herpes treatments combined with digital health support is growing rapidly across both clinical and home care settings, as patients increasingly prioritize convenience, compliance, and integrated healthcare solutions

- The integration of wearable devices for real-time symptom monitoring in countries such as Spain is also gaining traction, allowing healthcare providers and patients to detect early signs of flare-ups and optimize treatment schedules

Europe Herpes Market Dynamics

Driver

Rising Prevalence of Herpes and Growing Awareness

- The increasing prevalence of HSV-1 and HSV-2 infections, coupled with growing awareness of sexually transmitted infections, is a significant driver for the heightened demand for effective herpes treatments

- For instance, in March 2025, Germany’s Ministry of Health launched a national awareness campaign to improve early diagnosis and management of HSV infections, aiming to reduce transmission and complications. Such initiatives by key countries are expected to drive herpes market growth in the forecast period

- As patients and healthcare providers become more aware of infection risks and the need for timely treatment, antiviral therapies offer symptom management, recurrence prevention, and transmission reduction, providing a compelling alternative to untreated infections

- Furthermore, the increasing availability of telemedicine and online pharmacy services is making treatment more accessible, allowing patients to obtain prescriptions and follow up on care conveniently

- The ease of treatment adherence, improved accessibility, and patient support programs are key factors propelling the adoption of herpes therapies across Europe. Initiatives for public awareness, telehealth consultations, and patient education further contribute to market growth

- For instance, public health campaigns in Italy focusing on sexual health education have significantly increased early diagnosis rates and antiviral treatment adoption among young adults

- Rising insurance coverage and reimbursement policies in countries such as the Netherlands are enabling broader access to antiviral medications, further driving market expansion

Restraint/Challenge

Side Effects and Regulatory Hurdles

- Concerns surrounding potential side effects of antiviral therapies, such as nausea, headache, and mild skin reactions, pose a significant challenge to broader market adoption, as patients may discontinue treatment prematurely

- For instance, reports of renal-related side effects in some long-term acyclovir users have made some patients hesitant to adhere to prescribed antiviral regimens

- Addressing these safety concerns through better patient education, dosage optimization, and monitoring protocols is crucial for building trust. Companies such as GlaxoSmithKline and Viatris emphasize safety profiles and provide guidance to physicians to reassure patients. In addition, regulatory compliance and approval requirements for new antiviral formulations can delay market entry, particularly for innovative or combination therapies

- While generic antiviral drugs are widely available and affordable, premium or newly developed therapies often come at a higher cost, which can be a barrier for price-sensitive patients in certain countries

- Overcoming these challenges through enhanced patient support, education on therapy safety, and development of cost-effective antiviral options will be vital for sustained herpes market growth across Europe

- For instance, complex approval processes for combination antiviral therapies in France and Germany can slow the launch of innovative treatments, limiting availability for patients in need

- High treatment discontinuation rates due to mild adverse effects reported in clinical studies also present a challenge, requiring ongoing efforts in patient education and monitoring to maintain therapy adherence

Europe Herpes Market Scope

The market is segmented on the basis of virus type, product, drug type, age, route of administration, distribution channel, and end users.

- By Virus Type

On the basis of virus type, the Europe herpes market is segmented into herpes simplex and herpes zoster. The Herpes Simplex segment dominated the market in 2025, accounting for the largest revenue share due to its higher prevalence in both adult and pediatric populations across Europe. Patients with HSV-1 and HSV-2 infections often require recurrent antiviral therapy, which ensures steady demand. The segment benefits from widespread clinical awareness, routine testing, and early diagnosis programs that improve treatment initiation. Strong research pipelines for targeted therapies and long-term management also support the segment’s dominance. Healthcare providers in countries such as Germany and France prioritize Herpes Simplex management due to its potential for recurrent outbreaks and transmission prevention. Moreover, insurance coverage for antiviral treatments in Western Europe enhances accessibility and uptake for this virus type.

The Herpes Zoster segment is expected to witness the fastest growth over the forecast period, driven by increasing incidence of shingles among aging populations. Vaccination awareness programs in the U.K. and Italy and rising healthcare spending for older adults are key drivers. Herpes Zoster often leads to severe complications such as postherpetic neuralgia, prompting early antiviral intervention. The growing focus on preventive care, immunization campaigns, and patient education contributes to rapid adoption of treatments. In addition, the segment is supported by pharmaceutical innovation in more effective antiviral formulations and combination therapies specifically for shingles management.

- By Product

On the basis of product, the market is segmented into Acyclovir, Docosanol, Valacyclovir, Famciclovir, and Others. The Acyclovir segment dominated the market in 2025 with the largest share of 42.9% due to its long-standing clinical efficacy and widespread use in Europe. Acyclovir is considered a first-line treatment for both HSV-1 and HSV-2 infections and is included in many European treatment guidelines. Its availability in generic form makes it affordable for a broad patient base, further reinforcing dominance. High physician confidence, established dosing regimens, and strong patient adherence contribute to the consistent market share. Hospitals, clinics, and retail pharmacies routinely stock Acyclovir, ensuring stable distribution and accessibility. Market demand is further strengthened by ongoing awareness campaigns and inclusion in public health programs across Western Europe.

The Valacyclovir segment is expected to witness the fastest growth due to its improved pharmacokinetic profile, allowing less frequent dosing and enhanced patient compliance. This product is particularly popular among working adults and travelers due to convenience. Its effectiveness in reducing recurrence frequency and transmission risk drives physician preference. Pharmaceutical companies are actively promoting Valacyclovir through patient education initiatives in Germany, France, and the U.K. Increased adoption in telemedicine platforms for remote prescription management also supports rapid growth. The segment benefits from strong brand recognition and continued clinical evidence supporting superior patient outcomes.

- By Drug Type

On the basis of drug type, the market is segmented into prescription drugs and over-the-counter (OTC) drugs. The Prescription Drug segment dominated the market in 2025, driven by regulatory requirements for antiviral therapies such as Acyclovir, Valacyclovir, and Famciclovir in most European countries. Prescription drugs ensure controlled access, dosage compliance, and proper monitoring of adverse effects. Hospitals, clinics, and specialty pharmacies prefer prescription medications to manage both acute outbreaks and long-term suppression therapy. Clinical guidelines recommend prescription antiviral therapy as first-line treatment, supporting market dominance. The segment is further reinforced by higher insurance reimbursement rates for prescription medications. Patient trust and physician confidence in prescription antivirals also strengthen sustained demand.

The OTC Drug segment is expected to witness the fastest growth over the forecast period due to increasing awareness of mild herpes outbreak management among adults. OTC topical treatments, such as creams and gels, provide accessible options for self-care and symptom relief. Growth is supported by online pharmacies and retail outlets offering convenient access to OTC products. Consumers increasingly seek quick, low-cost interventions for recurring cold sores or minor outbreaks. Educational campaigns highlighting proper use of OTC options and preventive measures are boosting adoption. Countries such as France and Spain show significant expansion in OTC sales through pharmacies and e-commerce platforms.

- By Age

On the basis of age, the market is segmented into adult and pediatrics. The Adult segment dominated the market with the largest revenue share in 2025 due to the higher prevalence of HSV-1 and HSV-2 infections in adults and recurrent outbreaks requiring treatment. Adults also drive demand for chronic suppression therapy, prescription antivirals, and telemedicine-enabled healthcare services. The segment benefits from strong insurance coverage, proactive healthcare monitoring, and patient awareness campaigns. Adults are also more likely to invest in preventive treatments and lifestyle management strategies to minimize outbreaks. Hospitals and clinics prioritize adult care due to higher case volumes and clinical resource allocation. Adult-focused patient support programs further enhance treatment adherence and sustained market demand.

The Pediatrics segment is expected to witness the fastest growth over the forecast period due to increasing early diagnosis and pediatric antiviral treatment adoption. Public health initiatives in Germany and Italy encourage early HSV detection in children to prevent complications. Telemedicine platforms and pediatric specialty clinics facilitate convenient treatment access. The segment benefits from rising parental awareness, preventive counseling, and vaccination programs for Herpes Zoster in adolescents. Growing focus on pediatric-friendly formulations, such as suspensions and topical gels, supports adoption. Improved compliance and safety measures in pediatric treatment also drive market expansion.

- By Route of Administration

On the basis of route of administration, the market is segmented into topical, oral, and parenteral. The Oral segment dominated the market in 2025 with the largest share due to the convenience, efficacy, and preference for systemic treatment of HSV infections. Oral antivirals such as Valacyclovir and Acyclovir tablets enable suppression of recurrent outbreaks and reduction of transmission risk. Hospitals, clinics, and pharmacies prioritize oral formulations due to ease of administration and patient compliance. Oral drugs are widely available, affordable, and included in clinical guidelines, supporting steady demand. Telemedicine platforms also promote oral therapy for home-based management. The segment is reinforced by strong physician preference and robust patient adherence tracking systems.

The Topical segment is expected to witness the fastest growth over the forecast period due to rising consumer preference for localized symptom management and over-the-counter accessibility. Creams, gels, and ointments are used to alleviate discomfort from cold sores and minor lesions. Growth is supported by online pharmacies and retail outlets offering convenient OTC access. Topical treatments appeal to both adults and pediatric populations for mild outbreaks. Educational campaigns on proper topical use are increasing adoption. Innovations in formulation for faster absorption and symptom relief further boost the segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospitals pharmacies, retail pharmacies, drug stores, online pharmacies, and others. The Hospitals Pharmacies segment dominated the market with the largest share in 2025 due to the high volume of prescription antivirals dispensed through hospital networks. Hospitals manage acute and chronic cases, ensuring reliable patient access and adherence monitoring. The segment benefits from clinical oversight, insurance reimbursement, and steady patient footfall. Hospitals often stock first-line antivirals such as Acyclovir, Valacyclovir, and Famciclovir for immediate treatment initiation. Clinical protocols and established pharmacy networks reinforce dominance. Strong physician trust in hospital dispensing also drives market share.

The Online Pharmacies segment is expected to witness the fastest growth over the forecast period due to rising e-commerce penetration and telemedicine adoption across Europe. Patients increasingly order prescription and OTC antivirals online for convenience and home delivery. Online platforms provide access to remote consultations, prescription management, and timely delivery. COVID-19 accelerated adoption of digital healthcare channels, boosting online pharmacy growth. Digital marketing, subscription programs, and mobile apps contribute to segment expansion. Countries such as the U.K., Germany, and France show rapid adoption of online pharmaceutical services.

- By End Users

On the basis of end users, the market is segmented into hospitals, specialty clinics, and others. The Hospitals segment dominated the market with the largest share in 2025 due to high patient volume, availability of prescription medications, and treatment monitoring capabilities. Hospitals serve both acute outbreak management and long-term suppressive therapy, making them key distribution points. They also offer patient counseling, adherence support, and clinical follow-ups. Established hospital networks in Germany, France, and the U.K. strengthen market penetration. Hospital pharmacies maintain consistent stock of antivirals for immediate treatment initiation. Physician trust and regulatory oversight in hospital settings reinforce dominance.

The Specialty Clinics segment is expected to witness the fastest growth over the forecast period due to increasing focus on sexual health and dermatology clinics specializing in HSV management. Clinics offer personalized treatment plans, counseling, and advanced therapies. Rising awareness and early diagnosis campaigns drive patient visits. Telemedicine integration in specialty clinics supports remote follow-up and prescription management. Clinics in countries such as Italy, Spain, and Poland are expanding services to address herpes prevalence. Convenience, targeted care, and focused expertise contribute to segment growth.

Europe Herpes Market Regional Analysis

- Germany dominated the herpes market with the largest revenue share of 28.5% in 2025, driven by well-established healthcare infrastructure, high healthcare spending, and a strong presence of leading pharmaceutical companies offering antiviral therapies, supported by public health campaigns and early adoption of advanced treatment protocols

- Patients and healthcare providers in Germany highly value timely access to antiviral therapies, established treatment protocols, and integrated patient support programs, which help manage recurrent outbreaks and reduce transmission risk

- This widespread adoption is further supported by high healthcare spending, extensive insurance coverage, and the presence of leading pharmaceutical companies, establishing prescription antiviral therapies as the preferred solution for both acute and long-term herpes management in Germany

The Germany Herpes Market Insight

The Germany herpes market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of sexually transmitted infections, advanced healthcare infrastructure, and strong insurance coverage. Germany’s emphasis on innovation in healthcare and preventive treatment supports adoption of antiviral therapies, particularly prescription medications such as Acyclovir and Valacyclovir. Patients and physicians prefer treatments that offer long-term suppression of outbreaks, and telemedicine platforms further enhance access to care. Public health campaigns and digital health tools for symptom tracking are becoming increasingly prevalent, aligning with local patient expectations for timely, effective, and monitored therapy. The integration of antiviral therapies into hospital, clinic, and pharmacy networks ensures broad availability and consistent adherence to treatment protocols.

France Herpes Market Insight

The France herpes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government awareness programs, strong healthcare spending, and increasing patient knowledge about STIs. French patients and healthcare providers value effective antiviral therapies combined with digital health support, such as mobile apps for outbreak monitoring and remote consultation. Prescription antivirals dominate, supported by robust insurance coverage and pharmacy networks. Growing urbanization and increasing access to specialized clinics encourage early diagnosis and preventive treatment. The country’s focus on sexual health education and routine testing programs continues to stimulate market growth.

U.K. Herpes Market Insight

The U.K. herpes market is expected to expand at a considerable CAGR during the forecast period, fueled by rising prevalence of herpes infections, telemedicine adoption, and patient demand for convenient access to antiviral therapies. Home care and outpatient treatment settings are increasingly incorporating prescription antivirals into standard care. The U.K.’s well-established digital health infrastructure, including online pharmacies and remote consultation platforms, is driving adoption. Patients are also motivated by awareness campaigns and STI prevention programs, encouraging early diagnosis and long-term therapy management. Hospital networks, clinics, and pharmacies play a pivotal role in ensuring continuous supply and adherence to antiviral treatment protocols.

Poland Herpes Market Insight

The Poland herpes market is expected to grow at a notable CAGR during the forecast period, driven by increasing awareness of sexually transmitted infections, rising access to healthcare, and expanding adoption of antiviral therapies. Patients in Poland are increasingly seeking effective treatments for both HSV-1 and HSV-2 infections, including prescription antivirals such as Acyclovir and Valacyclovir. Telemedicine platforms and online pharmacies are improving accessibility, particularly in urban areas, while specialty clinics provide targeted care for recurrent outbreaks. Public health campaigns promoting early diagnosis, preventive measures, and adherence to treatment protocols are helping to expand the market. In addition, the availability of affordable antiviral options and government-supported healthcare initiatives encourages broader therapy adoption..

Europe Herpes Market Share

The Europe Herpes industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Merck & Co. Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Sanofi (France)

- Abbott (U.S.)

- Fresenius Kabi AG (Germany)

- Glenmark Pharmaceuticals Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Emcure Pharmaceuticals Ltd. (India)

- Apotex Inc. (Canada)

- Aurobindo Pharma Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Agenus Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Bausch Health (Canada)

What are the Recent Developments in Europe Herpes Market?

- In October 2025, GSK’s Shingrix new prefilled syringe presentation received a positive CHMP opinion, streamlining administration of the recombinant shingles (herpes zoster) vaccine in the European Union and facilitating easier use by healthcare professionals. The approval reflects ongoing efforts to enhance preventive care against shingles and related complications

- In September 2025, researchers in Germany published that they had generated a highly potent nanobody against herpesvirus, capable of neutralizing HSV‑1 infection at an early stage by targeting essential viral fusion proteins. This discovery promises new therapeutic and preventive approaches for severe herpes infections

- In August 2025, researchers presented new findings at the 2025 European Society of Cardiology Congress showing that herpes zoster (shingles) vaccination is associated with a statistically significant lower risk of heart attack and stroke

- In June 2025, the European Commission withdrew the marketing authorisation for Zostavax, the live attenuated herpes zoster vaccine, after it was discontinued for commercial reasons and was no longer marketed in the EU. This shift marked the end of Zostavax availability in favor of more effective vaccines such as Shingrix

- In September 2024, GSK publicly discontinued development of its HSV therapeutic vaccine candidate (GSK3943104) after the Phase 1/2 trial failed to meet primary efficacy endpoints, underlining the difficulty of developing an effective herpes vaccine and impacting the focus of R&D in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.