Market Analysis and Insights

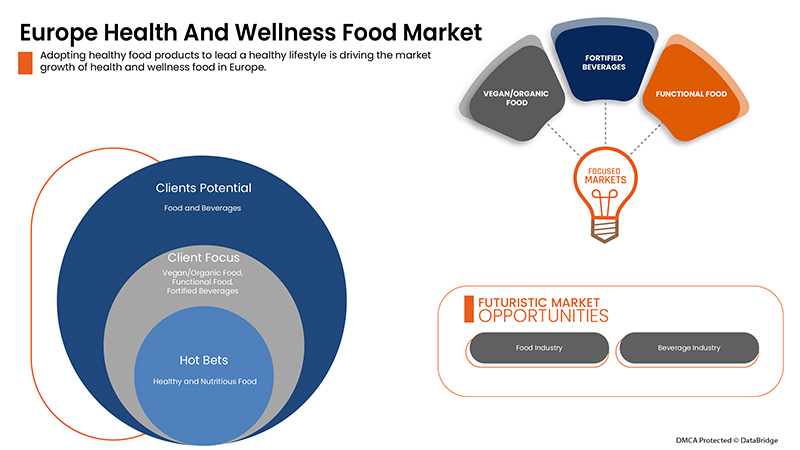

The global health and wellness food market is growing faster than the packaged food industry, owing to shifting customer tastes toward a more natural and functional offering to adopt a more holistic approach to a balanced diet. The growing number of individuals altering their eating habits and embracing a balanced nutritional diet and active lifestyle is a major element driving the growth of the health and wellness food industry. People worldwide are realizing the value of a healthy diet, exercise, and regular physical activity, which is critical for the market's growth. However, high prices of health and wellness foods and high maintenance costs may hamper the market's growth.

The rising consumption of organic food made from natural ingredients over inorganic products will open up new chances for the global health and wellness food market. In contrast, high competition among market players may challenge the market's growth.

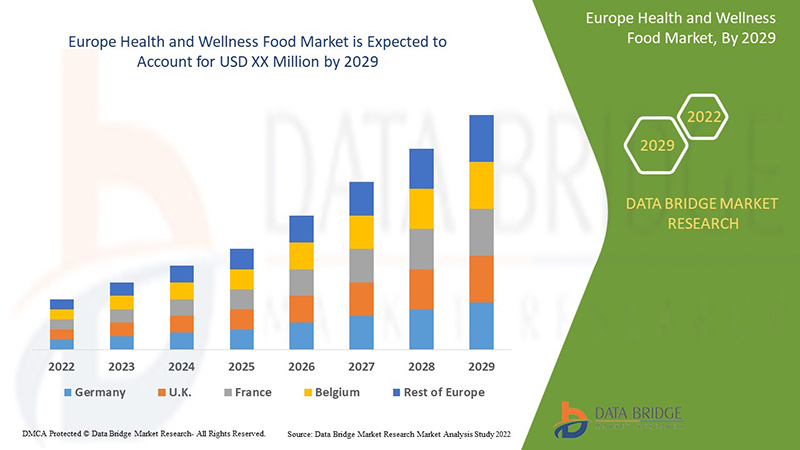

Data Bridge Market Research analyses that the Europe health and wellness food market will grow at a CAGR of 9.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

By Type (Functional Food, Fortified and Healthy Bakery Products, Healthy Snacks, BFY Foods, Beverages, Chocolates and Others), Calorie Content (No-Calorie, Low Calories and Reduced-Calorie), Nature (Non-GMO and GMO), Fat Content (No Fat, Low Fat and Reduced-Fat), Category (Conventional and Organic), Free From Category (Gluten-Free, Dairy-Free, Soy-Free, Nut-Free, Lactose-Free, Artificial Flavor-Free, Artificial Color-Free and Others) and Distribution Channel (Store-Based Retailers and Non-Store Retailers) |

|

Regions Covered |

Spain, Italy, France, Germany, U.K, Switzerland, Netherlands, Belgium, Russia, Turkey and rest of Europe |

|

Market Players Covered |

Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Yoplait USA, Inc., Chobani, LLC., SO DELICIOUS DAIRY FREE, The Simply Good Foods Company, Mondelez International, Kellogg Co., The Quaker Oats Company, Yakult Honsha Co., Ltd., LIBERTÉ |

Market Definition

Food, Health, and Wellness are all interconnected. The food we consume and where it comes from impact our health and fitness. Wellness stems from the balanced food we incorporate into our daily lives. Health is not just eating better foods but also lowering tension and stress and exercising regularly. Food, Health, and Well-Being foods can help reduce the risk or treatment of disease and improve physical or mental performance by including a functional element or a modification in processing.

Europe Health and Wellness Food Market Dynamics

Drivers

- Growing expenditure on healthy food products

Consumer disposable income increased, and households had more money to either save or spend on food, which naturally led to a growth in consumption of healthy food products, creating demand for the global health and wellness food market. Thus, increasing the disposable income of consumers enables them to buy more nutritional beverages to live a healthy life, boosting the market growth. Furthermore, increasing expenditure on healthy and nutritional food has driven the demand for food products that help people maintain their health.

Thus, it can be seen that due to the increase in disposable income, consumers spend more money on healthy products such as nutritional beverages to stay healthy, which is expected to drive the growth of the Europe health and wellness food market.

- Growing demand for clean label food

Clean label food products contain ingredients that are most natural and less processed. Consumers are opting for healthy and hygienic food options to live a healthier lifestyle, thus increasing the demand for health & wellness food products. Consumers are becoming more inclined toward clean, labelled food free from preservatives or additives to continue a particular lifestyle. Also, the awareness regarding promoting a sustainable environment by using clean label products is boosting the market's growth. The rising demand for clean label food enables health & wellness manufacturers to introduce more products, which adds to the market's growth.

Therefore, the increasing number of manufacturers gaining clean label safety products to offer high-quality products to the consumers and fulfill their growing need for clean label & healthy food is expected to propel the market growth of the Europe health and wellness food market.

Opportunities

-

Change in eating habits and lifestyle of millennials

The millennials' changing eating habits are more inclined towards conscious indulgence, which means that while they want to indulge in eating out and eating right, they want to be mindful of what they eat and select their places after thorough consideration. Millennials are willing to pay for fresh, healthy food. They love food and flavors from multiple cultures and engage in distribution channels like meal services and smoothie deliveries. Thus, the changing eating habits of millennials create an opportunity for the Europe health and wellness food market.

Thus, these changing eating preferences create an opportunity for the nutritional food and beverages market, and manufacturers are trying to fulfill the demands of millennials. This is projected to create ample opportunities for the growth of the Europe health and wellness food product market.

Restraints/Challenges

- Lack of awareness among people and skepticism towards healthy food & beverages

The limited or lack of awareness about the health benefits and nutritional value of nutritional food & beverages creates skepticism about the products. Consumers are hesitant about consuming nutritional beverages due to increased contamination and adulteration in food & beverages. Thus, this ultimately creates skepticism among the consumers, who think twice before buying the food or beverage to avoid the side effects. This is the key challenging factor for the market growth. Lack of understanding about nutritional labeling on food & beverages creates confusion among consumers. The nutritional labels can be misleading, and in some cases, these are false claims, creating hesitation among consumers to choose proper healthy food & beverages.

However, manufacturers are trying to add more value to the nutritional and healthy beverages and clearly label the products' nutritional value.

Thus, the increasing skepticism and lack of awareness about the nutritional content and health benefits of health and wellness products among some consumers may hamper the market's growth.

Post-COVID-19 Impact on Europe Health and Wellness Food Market

The COVID-19 pandemic has affected the global health and wellness food market significantly. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially decreasing the demand for food products. However, post covid, the demand for health and wellness food products has increased significantly owing to increased awareness about the side effects of unhealthy food and the urge to stay fit and healthy. Consumers are trying to have the most nutritious products such as plant-based, vegan, and nutritional food and beverages to avoid medical conditions.

Thus, the trend of having healthy eating patterns has significantly affected the market, which is leading the market towards rapid growth in the coming years.

Recent Developments

- In May 2022, Oreo is launching a new range of gluten-free Oreos in the United States, Oreo Zero in China, Lacta Intense in Brazil, and Caramilk, a chocolate product, in Australia. These products result from new formulations for health-conscious consumers as health and well-being continue to be a focus of innovation for the company

Europe Health and Wellness Food Market Scope

Europe health and wellness food market are segmented on type, calorie content, nature, fat content, category, free from the category, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Functional Food

- Fortified and Healthy Bakery Products

- Healthy Snacks

- BFY Foods

- Beverages

- Chocolates

- Others

By type, the Europe health and wellness food market is segmented into functional food, fortified and healthy, bakery products, healthy snacks, BFY foods, beverages, chocolates, and others.

Calorie Content

- No calorie

- Low calories

- Reduced calorie

By calorie content, the Europe health and wellness food market is segmented into no calorie, low calories, and reduced calorie.

Nature

- Non-GMO

- GMO

By nature, the Europe health and wellness food market is segmented into non-GMO and GMO.

Fat Content

- No fat

- Low fat,

- Reduced-fat

By fat content, the Europe health and wellness food market is segmented into no fat, low fat, and reduced fat.

Category

- Conventional

- Organic

By category, the Europe health and wellness food market is segmented into conventional and organic

Free From Category

- Gluten-Free

- Dairy-Free

- Soy-Free

- Nut-Free

- Lactose-Free

- Artificial Flavor Free

- Artificial Color Free

- Others

By free from category, the Europe health and wellness food market is segmented into gluten free, dairy free, soy free, nut free, lactose free, artificial flavor free, artificial color free and others.

Distribution Channel

- Store-based retailers

- Non-store retailers

By distribution channel, the Europe health and wellness food market is segmented into store based retailers and non-store retailers.

Europe Health and Wellness Food Market Regional Analysis/Insights

Europe health and wellness food market are analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the Europe health and wellness food market report are the Spain, Italy, France, Germany, U.K, Switzerland, Netherlands, Belgium, Russia, Turkey and rest of Europe.

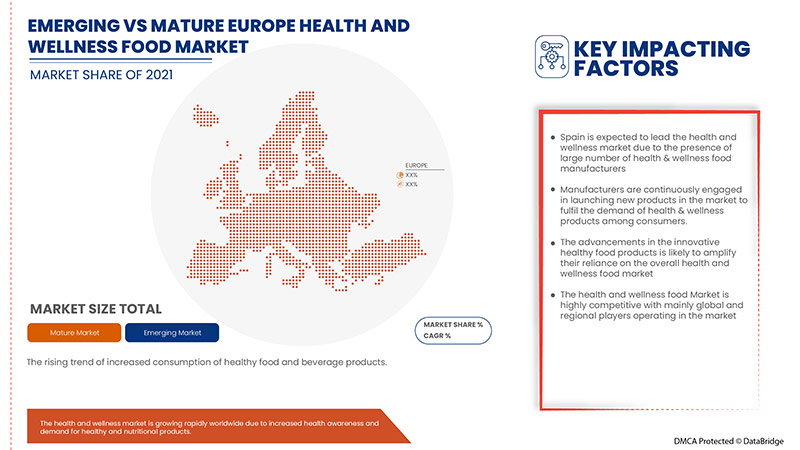

Spain is expected to dominate the Europe health and wellness food market regarding market share and revenue. It is estimated to maintain its dominance during the forecast period due to the rising trend of increased consumption of healthy food and beverage and growing consumer demand for functional food.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Global brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Health and Wellness Food Market Share Analysis

The Europe Health and Wellness Food Market competitive landscape details the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on Europe health and wellness food market.

Some of the major players operating in the Europe Health and Wellness Food Market are Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Yoplait USA, Inc., Chobani, LLC., SO DELICIOUS DAIRY FREE, The Simply Good Foods Company, Mondelez International, Kellogg Co., The Quaker Oats Company, Yakult Honsha Co., Ltd., LIBERTÉ among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE EUROPE HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 EUROPE

14.1.1 SPAIN

14.1.2 ITALY

14.1.3 FRANCE

14.1.4 GERMANY

14.1.5 U.K.

14.1.6 SWITZERLAND

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

List of Figure

FIGURE 1 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH AND WELLNESS FOOD MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 EUROPE GMO CROP REVENUE (2018)

FIGURE 19 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 EUROPE HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

Europe Health And Wellness Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Health And Wellness Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Health And Wellness Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.