Europe G-CSF/ PEG-G-CSF Market Analysis and Insights

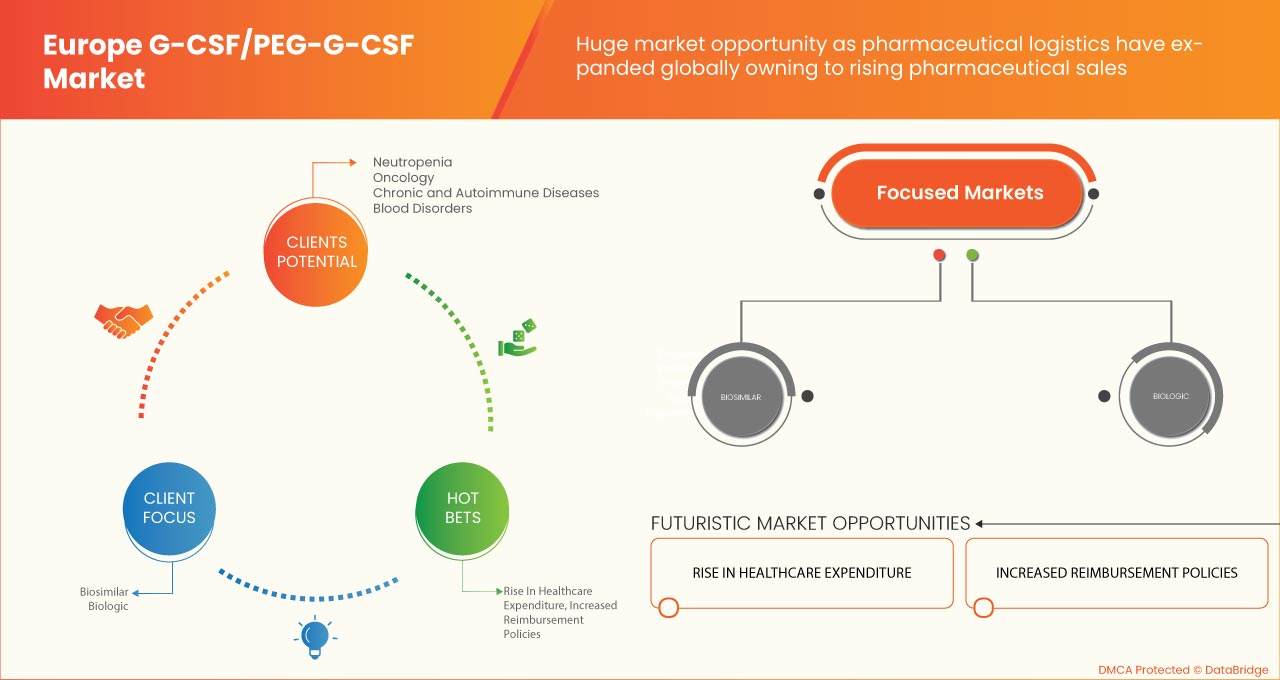

The increase in cancer prevention in developed countries and governments have introduced conscious initiatives to educate early treatment, promoting the Europe sales market of biosimilar G-CSF. Grafeel, Colstim, Neukine and Filcad, which are approved biosimilars and are also cost-effective and readily available in developing countries, will lead to significant market growth. China and India are the countries where the number of cancer patients is increasing, which is likely to boost the Europe market. Thus, the use of biosimilars helps in reducing the healthcare costs of patients compared to the use of original biologics, which increases the demand in the Europe G-CSF Biosimilars sales market. Due to the complex biological manufacturing processes of individual biosimilars, the costs of biosimilars are not as low as generics. Growing prevelance of autoimmune and rare chronic diseases is expected to drive the segmental market’s growth.

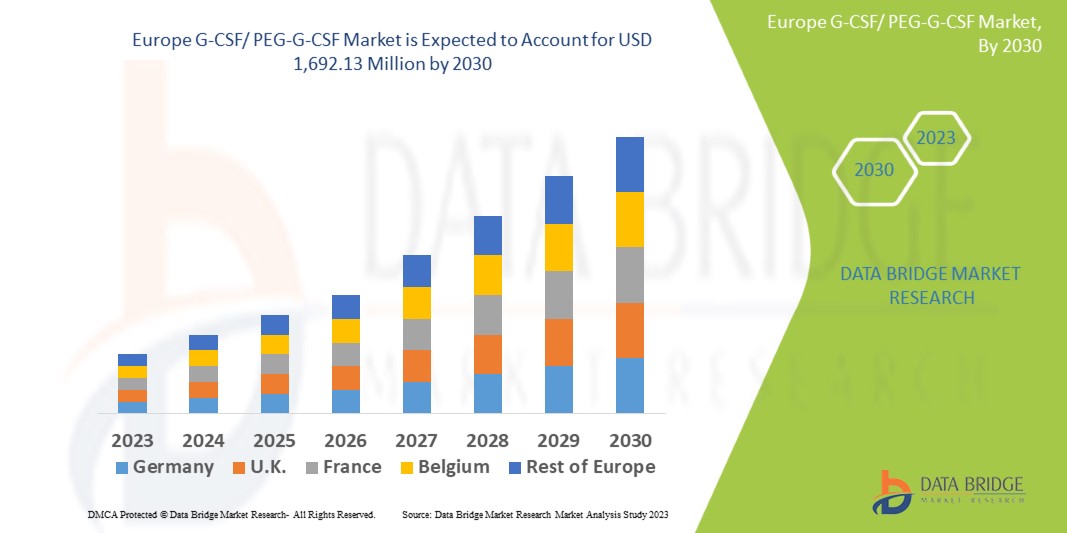

Data Bridge Market Research analyzes that the Europe G-CSF/ PEG-G-CSF market is expected to reach the value of USD 1,692.13 million by 2030, at a CAGR of 5.1% during the forecast period. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

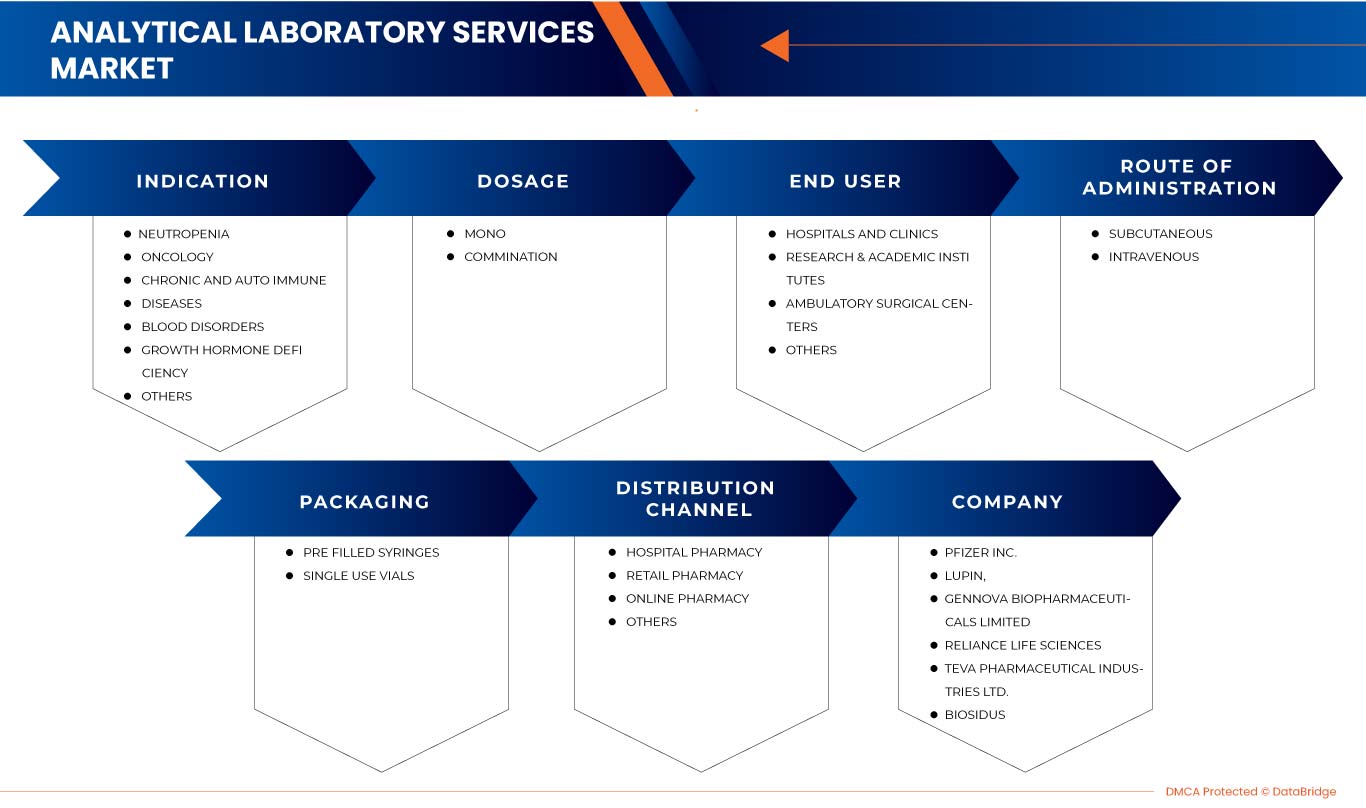

Segments Covered |

By Indication (Neutropenia, Oncology, Chronic and Autoimmune Disease, Blood Disorders, Growth Harmony Deficiency and Others), Dosage (Mono and Combination), Route Of Administration (Intravenous, Subcuetaneous), Packaging (Single Use Vials and Pre Filled Syringes), End User (Hospitals and Clinics, Research and Academic Institutes, Ambulatory Surgical Centers and Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy and Others) |

|

Countries Covered |

Germany, U.K., France, Italy, Russia, Netherlands, Spain, Sweden, Poland, Belgium, Switzerland, Denmark, Norway, Finland, Turkey, Rest of Europe |

|

Market Players Covered |

USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., among others. |

Europe G-CSF/ PEG-G-CSF Market Definition

Granulocyte colony-stimulating factor (G-CSF) is a medication used to treat neutropenia. This is a disease in which the number of white blood cells is lower than average and is caused by some forms of chemotherapy. The main types of G-CSF are lenograstim (Granocyte), filgrastim (Neupogen, zarzio, nivestim, accofil), long-acting (pegylated) filgrastim (pegfilgrastim, neulasta, pelmeg, ziextenco), and lipegfilgrastim (lonquex). Lenograstim is a glycosylated recombinant therapeutic agent that is chemically similar or identical to naturally occurring human granulocyte colony-stimulating factor (G-CSF). Various products include tablets and capsules and treat cancer, blood disorders, growth hormone deficiency, and chronic and autoimmune diseases.

Europe G-CSF/ PEG-G-CSF Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing incidences of blood cancers and cancer diseases

Cancer is a general term for many diseases that can affect any part of the body. Other terms used for cancer are malignant tumors and neoplasm. One of the characteristics of cancer is the rapid formation of abnormal cells that grow beyond normal limits and can invade neighboring parts of the body and spread to other organs; the latter process is called metastasis. Extensive metastases are the leading cause of cancer death.

Filgrastim is a granulocyte colony-stimulating factor (GCSF) that helps increase the number of neutrophils in the blood. Filgrastim and pegfilgrastim are highly used to increase white blood cells after cancer chemotherapy or radiation therapy.

Thus, the increasing number of cases of blood cancer and cancer diseases is driving the Europe G-CSF / PEG-G-CSF market in the coming years.

- Increasing cases of febrile neutropenia

Febrile neutropenia refers to fever during significant neutropenia. If a patient is neutropenic, their risk of infection may be higher than usual, and the severity of a particular infection may also be higher. Febrile neutropenia is the most common life-threatening complication of cancer treatment; its treatment is often an oncological emergency.

Febrile neutropenia is neutropenia accompanied by fever. Neutropenia refers to a decrease in the concentration of neutrophils in the blood. Neutrophils are a type of white blood cell that help fight infections as part of the immune system. The Infectious Diseases Society of America defines neutropenia as an absolute neutrophil count (ANC) of less than 1500 cells/mm3. The risk of infection and neutropenic fever increases dramatically with severe neutropenia, defined as an absolute neutrophil count (ANC) of less than 500 cells/mm3. Fever is defined as a single oral temperature greater than or equal to 101° Fahrenheit (38.3° Celsius) or a persistent temperature greater than or equal to 100.4° Fahrenheit (38.0° Celsius) or greater for one hour or longer.

The latest guidelines from three international cancer organizations, the European Organization for Research and Treatment of Cancer, the American Society of Clinical Oncology, and the US National Cancer Network, agree that filgrastim or pegfilgrastim should be given prophylactically in febrile neutropenia with chemotherapy. > or = 20% or if the risk is 10-20% and the patient has other risk factors for febrile neutropenia.

Thus, the increasing cases of febrile neutropenia are further driving the Europe G-CSF / PEG-G-CSF market in the coming years.

Restraint

- Stringent Governmental Regulations

Pharmaceutical companies developing biosimilars such as filgrastim face a major challenge in the approval process for their products. Each country has a different approval process for all drugs, treatments, vaccines, and medical devices. However, these approval procedures are difficult to follow. This is due to the various regulations and evidence required to prove the effectiveness and safety of the product.

European Medicines Agency regulatory requirements ensure the same high quality, safety, and efficacy standards for biosimilars as for originator biologicals. They also include a rigorous comparability exercise with the reference product but are not universally accepted by regulatory bodies outside the European Union (EU). It should be noted that 'similar biologics' approved in India, 'biogenerics' approved in Iran, 'medicamento biológico similares' approved in Argentina, and non-originator biologicals approved in South Africa might not have been authorized if they had been subjected to the strict regulatory processes required for approval of biosimilars in the EU.

Due to this strict regulation by the government that has to be followed for the production and manufacturing of G-CSF / PEG-G-CSF by the various regulatory body, which impedes the market growth of the Europe G-CSF / PEG-G-CSF market.

Opportunity

- The use of biosimilars helps reduce healthcare costs for patients

Biosimilars have the potential to fundamentally change healthcare by providing more affordable, equally effective treatments for patients and providing more treatment options for physicians. Developing biosimilars requires rigorous analysis to demonstrate their equivalence to the reference product and ensure no clinically meaningful differences in their safety, efficacy, and purity. As a result, health systems can channel long-term savings into overall improvements in patient care. To help create a thriving biosimilar market and ensure patient access, policymakers can take steps to reduce or eliminate the cost of biosimilars and encourage physicians to prescribe biosimilars compared to Europe.

Biosimilars have the potential to expand treatment options and increase health equity. At the same time, they can save money for individual patients and health systems. Through legislative and advocacy efforts and future initiatives, access to these effective medicines can expand and fundamentally change the health services for patients who need them.

Thus, the use of biosimilars helps reduce healthcare costs for patients. This factor creates opportunities for market growth.

Challenge

- Multiple side effects of G-CSF

Granulocyte colony-stimulating factor (G-CSF) is a drug used to treat neutropenia, a disorder in which certain forms of chemotherapy cause a lower-than-average number of white blood cells. G-CSF is a type of growth factor that makes the bone marrow produce more white blood cells to reduce the risk of infection after some types of cancer treatment. But there are multiple side effects of G-CSF, such as bone or muscle pain, Bruising, bleeding gums or nosebleeds, diarrhea, high temperature (fever), breathlessness and looking pale, sore mouth, throat, gut and back passage, and, among others. These side effects can be seen in more than 10 in 100 people (more than 10%).

According to a study performed by NCBI, most normal donors receiving G-CSF experience side effects, but these are mild to moderate in degree. Ninety percent of donors experienced some side effects of G-CSF. The most frequent effects noted were bone pain (83%), headache (39%), body aches (23%), fatigue (14%), and nausea and vomiting (12%), which is expected to act as a challenge for market growth.

Thus, the increasing side effects of G-CSF are challenging market growth.

Post-COVID-19 Impact on Europe G-CSF/ PEG-G-CSF Market

The COVID-19 pandemic has had a somewhat positive impact on the G-CSF/ PEG-G-CSF market. The pandemic has imposed new norms and regulations, such as social distancing and lockdowns, to prevent the spread of the virus. As a result, people all over the world were forced to stay at home, which led to new trends such as work at home. This stay at home has led decrease in diagnosis and prognosis of diseases. The increased focus on self-care, exercise and health has helped fitness apps and platforms gain significant traction in the wake of the pandemic.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the transplant diagnostics market.

Recent Developments

- In July 2018, Accord Healthcare, a subsidiary of Intas Pharmaceuticals Ltd., launched a pegfilgrastim biosimilar across Europe after being given Green Light for Pelgraz® (pegfilgrastim) by CHMP (Committee for Medicinal Products for Human Use). This product launched helped the company to expand their business across Europe.

- In March 2022, Kashiv Biosciences announced the approval of its Biologics License Application (BLA) for filgrastim-ayow, a biosimilar referencing Neupogen by U.S. Food and Drug Administration (FDA). The product is marketed under the proprietary name RELEUKO.

Europe G-CSF/ PEG-G-CSF Market Scope

Europe G-CSF/ PEG-G-CSF market is segmented into indication, dosage, route of administration, packaging, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

EUROPE G-CSF / PEG-G-CSF MARKET, BY INDICATION

- NEUTROPENIA

- CHEMOTHERAPY INDUCED FEBRILE NEUTROPENIA (MYELOSUPPRESSIVE CHEMOTHERAPY TREATMENT)

- SEVERE CHRONIC NEUTROPENIA

- RADIOTHERAPY INDUCED NEUTROPENIA

- NEUTROPENIA IN HIV PATIENTS

- CLOZAPINE INDUCED NEUTROPENIA

- NEUTROPENIA IN HEPATITIS C PATIENTS

- CONGENITAL NEUTROPENIA

- ONCOLOGY

- ACUTE MYELOID LEUKEMIA RECEIVING CONSOLIDATION CHEMOTHERAPY

- OTHERS

- CHRONIC AND AUTOIMMUNE DISEASES

- BLOOD DISORDERS

- GROWTH HORMONE DEFICIENCY

- OTHERS

On the basis of indication the Europe G-CSF/PEG-G-CSF is further segmented into neutropenia, oncology, chronic and autoimmune diseases, blood disorders, growth hormone deficiency and others.

EUROPE G-CSF / PEG-G-CSF MARKET, BY DOSAGE

- MONO

- COMBINATION

On the basis of dosage the Europe G-CSF/PEG-G-CSF is further segmented into mono and combination.

EUROPE G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION

- INTRAVENOUS

- SUBCUTANEOUS

On the basis of route of administration the Europe G-CSF/PEG-G-CSF is further segmented into intravenous and subcutaneous.

EUROPE G-CSF / PEG-G-CSF MARKET, BY PACKAGING

- SINGLE USE VIALS

- PRE FILLED SYRINGES

On the basis of packaging the Europe G-CSF/PEG-G-CSF is further segmented into single use vials and pre filled syringes.

EUROPE G-CSF / PEG-G-CSF MARKET, BY END USER

- HOSPITALS & CLINICS

- RESEARCH & ACADEMIC INSTITUTES

- AMBULATORY SURGICAL CENTERS

- OTHERS

On the basis of end user the Europe G-CSF/PEG-G-CSF is further segmented into hospitals and clinics, research & academic institutes, ambulatory surgical centers and others.

EUROPE G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL

- HOSPITAL PHARMACY

- ONLINE PHARMACY

- RETAIL PHARMACY

- OTHERS

On the basis of distribution channel the Europe G-CSF/PEG-G-CSF is further segmented into hospital pharmacy, online pharmacy, retail pharmacy and others.

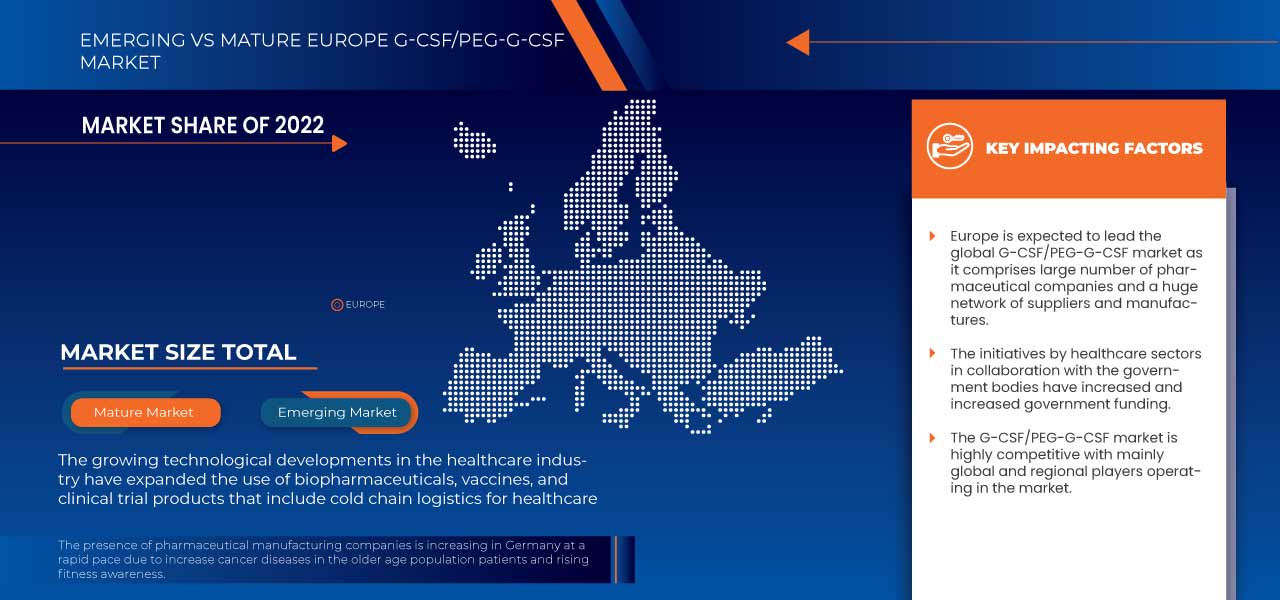

Europe G-CSF/ PEG-G-CSF Market Regional Analysis/Insights

The Europe G-CSF/ PEG-G-CSF market is analyzed and market size information is provided based on country, indication, dosage, route of administration, packaging, end user, and distribution channel.

The Europe G-CSF/ PEG-G-CSF market comprises od the countries Germany, U.K., France, Italy, Russia, Netherlands, Spain, Sweden, Poland, Belgium, Switzerland, Denmark, Norway, Finland, Turkey, Rest of Europe.

Germany is expected to grow due to its latest advanced technology and inventions in the G-CSF/ PEG-G-CSF.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe G-CSF/ PEG-G-CSF Market Share Analysis

Europe G-CSF/ PEG-G-CSF market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Europe G-CSF/ PEG-G-CSF market.

Some major companies which are dealing in the market are USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE G-CSF / PEG-G-CSF MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 EUROPE G-CSF/PEG-G-CSF MARKET: MERGERS AND ACQUISITION

4.4 EUROPE G-CSF / PEG-G-CSF MARKET

4.5 STRATEGIES TO THE ENTER THE MARKET

4.5.1 JOINT VENTURE (PARTNERSHIPS):

4.5.2 ACQUISITION:

4.5.3 LINE EXPANSION VIA COLLABORATION:

4.5.4 PRODUCT APPROVAL:

4.5.5 PRODUCT LAUNCH:

4.5.6 GEOGRAPHIC EXPANSION:

4.5.7 COST LEADERSHIP:

4.5.8 PRODUCT DEVELOPMENT:

4.6 EUROPE G-CSF / PEG-G-CSF MARKET, INDUSTRY INSIGHTS

4.6.1 PATENT ANALYSIS

4.6.2 DRUG TREATMENT RATE BY MATURED MARKETS

4.6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.6.4 THERAPEUTIC ASSESSMENT

4.6.5 KEY PRICING STRATEGIES

4.6.6 KEY PATIENT ENROLLMENT STRATEGIES

4.6.7 CONCLUSION

4.7 PIPELINE ANALYSIS FOR EUROPE G-CSF / PEG-G-CSF MARKET

5 EPIDEMIOLOGY

6 EUROPE G-CSF / PEG-G-CSF MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING INCIDENCES OF BLOOD CANCERS AND CANCER DISEASES

7.1.2 RISING INCIDENCES OF AUTOIMMUNE DISORDERS

7.1.3 INCREASING CASES OF FEBRILE NEUTROPENIA

7.1.4 INCREASING AWARENESS ABOUT FILGRASTIM AND PEGFILGRASTIM

7.2 RESTRAIN

7.2.1 STRINGENT GOVERNMENTAL REGULATIONS

7.2.2 AVAILABILITY OF ALTERNATIVES FOR THE CHEMOTHERAPY

7.3 OPPORTUNITIES

7.3.1 THE USE OF BIOSIMILARS HELPS REDUCE HEALTHCARE COSTS FOR PATIENTS

7.3.2 COST-EFFECTIVENESS AND PATENT EXPIRY OF BIOLOGICAL PRODUCTS

7.4 CHALLENGES

7.4.1 THE HIGH COST ASSOCIATED WITH BRANDED BIOLOGICS AND IMPROVED CHEMOTHERAPY

7.4.2 THE MULTIPLE SIDE EFFECTS OF G-CSF

8 EUROPE G-CSF/ PEG-G-CSF MARKET, BY INDICATION

8.1 OVERVIEW

8.2 NEUTROPENIA

8.2.1 CHEMOTHERAPY INDUCED FEBRILE NEUTROPENIA (MYELOSUPPRESSIVE CHEMOTHERAPY TREATMENT)

8.2.2 SEVERE CHRONIC NEUTROPENIA

8.2.3 RADIOTHERAPY INDUCED NEUTROPENIA

8.2.4 NEUTROPENIA IN HIV PATIENTS

8.2.5 CLOZAPINE INDUCED NEUTROPENIA

8.2.6 NEUTROPENIA IN HEPATITIS C PATIENTS

8.2.7 CONGENITAL NEUTROPENIA

8.3 ONCOLOGY

8.3.1 ACUTE MYELOID LEUKEMIA RECEIVING CONSOLIDATION CHEMOTHERAPY

8.3.2 OTHERS

8.4 CHRONIC AND AUTO IMMUNE DISEASES

8.5 BLOOD DISORDERS

8.6 GROWTH HORMONE DEFICIENCY

8.7 OTHERS

9 EUROPE G-CSF/ PEG-G-CSF MARKET, BY DOSAGE

9.1 OVERVIEW

9.2 MONO

9.3 COMBINATION

10 EUROPE G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION

10.1 OVERVIEW

10.2 SUBCUTANEOUS

10.3 INTRAVENOUS

11 EUROPE G-CSF/ PEG-G-CSF MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 PRE FILLED SYRINGES

11.3 SINGLE USE VIALS

12 EUROPE G-CSF/ PEG-G-CSF MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND CLINICS

12.3 RESEARCH & ACADEMIC INSTITUTES

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 EUROPE G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 HOSPITALS PHARMACY

13.3 RETAIL PHARMACY

13.4 ONLINE PHARMACY

13.5 OTHERS

14 EUROPE G-CSF/PEG-G-CSF MARKET, BY REGION

14.1 EUROPE

14.1.1 RUSSIA

14.1.2 TURKEY

15 EUROPE G-CSF / PEG-G-CSF MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PFIZER INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 VIATRIS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AMGEN INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 STADA ARZENEIMITTEL AG

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TEVA PHARMACEUTICAL INDUSTRIES LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ACCORD HEALTHCARE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AMNEAL PHARMACEUTICALS LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APOTEX INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BIOCON

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 BIO SIDUS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CADILA PHARMACEUTICALS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 COHERUS BIOSCIENCES

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 DR. REDDY’S LABORATORIES LTD

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 FRESENIUS KABI AG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 GENNOVA BIOPHARMACEUTICALS LIMITED

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 HANGZHOU JIUYUAN GENE ENGINEERING CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 INTAS PHARMACEUTICALS LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 KASHIV BIOSCIENCES, LLC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KYOWA KIRIN CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 LUPIN

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENT

17.22 MUNDIPHARMA INTERNATIONAL.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NAPP PHARMACEUTICALS LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 RELIANCE LIFE SCIENCES

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 SANDOZ INTERNATIONAL GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 SPECTRUM PHARMACEUTICALS, INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 USV PRIVATE LIMITED

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BELOW ARE THE RULES AND REGULATIONS TO GET APPROVAL FOR USE IN THE MARKET:

TABLE 2 EUROPE G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 5 EUROPE ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 7 EUROPE CHRONIC AND AUTO IMMUNE DISEASES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE BLOOD DISORDERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE GROWTH HORMONE DEFICIENCY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE G-CSF/ PEG-G-CSF MARKET, BY DOSAGE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MONO IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE COMBINATION IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE SUBCUTANEOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE INTRAVENOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE G-CSF/ PEG-G-CSF MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PRE FILLED SYRINGES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE SINGLE USE VIALS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE G-CSF/ PEG-G-CSF MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 EUROPE HOSPITALS AND CLINICS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE RESEARCH & ACADEMIC INSTITUTES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE AMBULATORY SURGICAL CENTERS IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 26 EUROPE HOSPITALS PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE RETAIL PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ONLINE PHARMACY IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE G-CSF / PEG-G-CSF MARKET, 2020-2030 (USD MILLION)

TABLE 31 EUROPE G-CSF / PEG-G-CSF MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

TABLE 32 EUROPE G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 33 EUROPE NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 34 EUROPE ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 35 EUROPE G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 36 EUROPE G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 37 EUROPE G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 38 EUROPE G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 39 EUROPE G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 40 RUSSIA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 41 RUSSIA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 42 RUSSIA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 43 RUSSIA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 44 RUSSIA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 45 RUSSIA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 46 RUSSIA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 47 RUSSIA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 48 RUSSIA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 49 RUSSIA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 50 RUSSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 51 RUSSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 52 RUSSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 53 RUSSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 54 RUSSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 55 RUSSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 56 RUSSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 57 RUSSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 58 RUSSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 59 RUSSIA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 60 RUSSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 61 RUSSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 62 RUSSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 63 RUSSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 64 RUSSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 65 RUSSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 66 RUSSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 67 RUSSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 68 RUSSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 69 TURKEY G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 70 TURKEY NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 71 TURKEY ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 72 TURKEY G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 73 TURKEY MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 74 TURKEY G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 75 TURKEY SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 76 TURKEY INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 77 TURKEY G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 78 TURKEY PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 79 TURKEY SINGLE USE VIALS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 80 TURKEY G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 81 TURKEY HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 82 TURKEY HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 83 TURKEY HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 84 TURKEY RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 85 TURKEY RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 86 TURKEY RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 87 TURKEY AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 88 TURKEY AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 89 TURKEY AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 90 TURKEY G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 91 TURKEY HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 92 TURKEY HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 93 TURKEY HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 94 TURKEY RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 95 TURKEY RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 96 TURKEY RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 97 TURKEY ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 98 TURKEY ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 99 TURKEY ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

List of Figure

FIGURE 1 EUROPE G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 2 EUROPE G-CSF / PEG-G-CSF MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE G-CSF / PEG-G-CSF MARKET: DROC ANALYSIS

FIGURE 4 EUROPE G-CSF / PEG-G-CSF MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE G-CSF / PEG-G-CSF MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE G-CSF / PEG-G-CSF MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE G-CSF / PEG-G-CSF MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE G-CSF / PEG-G-CSF MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE G-CSF / PEG-G-CSF MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN CANCER PROPHYLAXIS IN DEVELOPED COUNTRIES AND INITIATIVES TAKEN BY GOVERNMENTS ARE TO DRIVE THE EUROPE G-CSF / PEG-G-CSF MARKET FROM 2023 TO 2030

FIGURE 12 NEUTROPENIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE G-CSF / PEG-G-CSF MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE G-CSF / PEG-G-CSF MARKET

FIGURE 14 EUROPE G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2022

FIGURE 15 EUROPE G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2021-2030 (USD MILLION)

FIGURE 16 EUROPE G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, CAGR (2022-2029)

FIGURE 17 EUROPE G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, LIFELINE CURVE

FIGURE 18 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2022

FIGURE 19 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2021-2030 (USD MILLION)

FIGURE 20 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, CAGR (2023-2030)

FIGURE 21 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, LIFELINE CURVE

FIGURE 22 EUROPE G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 23 EUROPE G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

FIGURE 24 EUROPE G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 25 EUROPE G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 EUROPE G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2022

FIGURE 27 EUROPE G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2021-2030 (USD MILLION)

FIGURE 28 EUROPE G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, CAGR (2023-2030)

FIGURE 29 EUROPE G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 30 EUROPE G-CSF/ PEG-G-CSF MARKET: BY END USER, 2022

FIGURE 31 EUROPE G-CSF/ PEG-G-CSF MARKET: BY END USER, 2021-2030 (USD MILLION)

FIGURE 32 EUROPE G-CSF/ PEG-G-CSF MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 EUROPE G-CSF/ PEG-G-CSF MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

FIGURE 36 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 EUROPE G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE G-CSF/PEG-G-CSF MARKET: SNAPSHOT (2022)

FIGURE 39 EUROPE G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022)

FIGURE 40 EUROPE G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 EUROPE G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 EUROPE G-CSF/PEG-G-CSF MARKET: BY INDICATION (2023-2030)

FIGURE 43 EUROPE G-CSF / PEG-G-CSF MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.