Market Analysis and Size

Forklift trucks have been deployed for lifting and transferring heavy materials, such as crates, container goods, and other such components, over a short distance. These heavy-duty electric lift trucks are ideal for warehousing operations, recycling operations and dockyards to perform numerous functions.

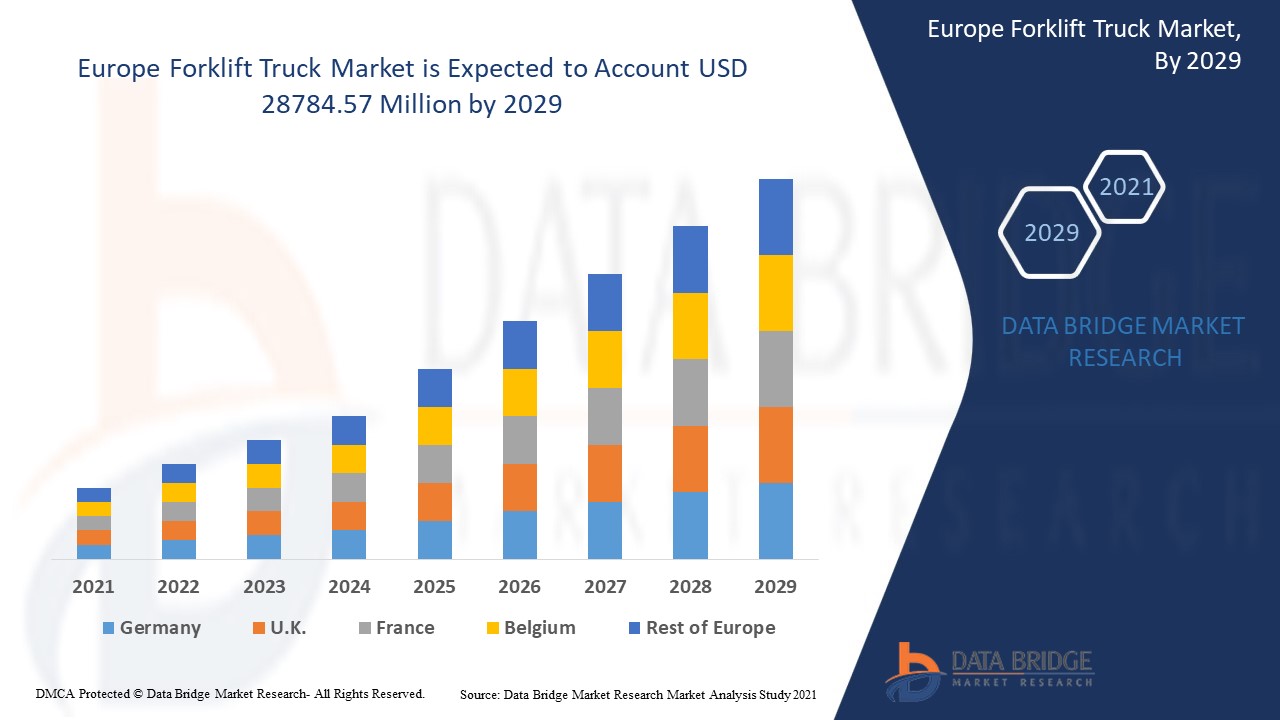

They assist in moving packed goods around the storage area, and loading and unloading goods from vehicles. Europe Forklift Truck Market was valued at USD 37169.66 million in 2021 and is expected to reach USD 28784.57 million by 2029, registering a CAGR of 6.60% during the forecast period of 2022-2029. Class III: Electric Motor Pedestrian Trucks accounts for the largest application segment in the respective market owing to the high demand in warehouses and distribution centers. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

A forklift truck refers to an industrial machine that incorporates two horizontal prongs for loading and transporting goods and materials. The machine is usually operated by a trained machinist. This truck is powered by electric batteries or combustion engines.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Warehouse and Counterbalance), Class (Class I: Electric Motor Rider Trucks, Class II: Electric Motor Narrow Aisle Trucks, Class III: Electric Motor Pedestrian Trucks, Class IV: Internal Combustion Engine Trucks; Class V: Internal Combustion Engine Trucks, Class VI: Electric And Internal Combustion Engine Tractors, and Class VII: Rough Terrain Forklift Trucks), Fuel Type (Diesel, Gasoline and LPG/CNG, and Electric/Hybrid), Engine Type (Internal Combustion (IC) Engine Power and Electric Power), Lifting Capacity (< 5 ton, 5 ton - 10 ton, 11 ton - 36 ton, and > 36 ton), End-Use Industry (Retail and Wholesale, Transportation and Logistics, Automotive and Electrical Engineering, Food Industry, and Other Industries) |

|

Countries Covered |

Germany, France, Russia, U.K., Italy, Spain, Netherlands, Belgium, Switzerland, Turkey and Rest of Europe |

|

Market Players Covered |

Jungheinrich AG (Germany), Hyster-Yale Group, Inc (US), KION GROUP AG (Germany), Lift Technologies, Inc (US), Crown Equipment Corporation (US), Toyota Industries Corporation (Japan), Mitsubishi Logisnext Co., Ltd (Japan), and Godrej & Boyce Manufacturing (India), among other |

|

Market Opportunities |

|

Europe Forklift Truck Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Expansion of Construction Industry

The rise in the construction industry along with the swift industrialization is one of the major factors driving the growth of forklift truck market. These trucks are popular for being powerful, user-friendly, economical, and easy to maintain. They are usually utilized in several industrial tasks owing to their unique features.

- Increase in Warehouses

The surge in number of warehouse developments in the advancing countries accelerate the market growth. The rise in need from the manufacturing industry has a positive impact on the growth of the market.

- Concerns regarding Safety

The increase in the adoption of forklift truck market to enhance productivity, and reduce injuries and disasters further influence the market. Also, an inclination for IC-engine forklift trucks in developing regions assist in the expansion of the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the forklift truck market.

Opportunities

Furthermore, increase in demand for battery-operated forklifts extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, surge in investments will further expand the market.

Restraints/Challenges

On the other hand, increase in third party logistics (3PL) services and high cost of battery operated and fuel cell forklift are expected to obstruct market growth. Also, stringent safety and emission regulations are projected to challenge the forklift truck market in the forecast period of 2022-2029.

This forklift truck market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on forklift truck market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on Europe Forklift Truck Market

The COVID-19 had a negative impact on forklift truck market owing to the strict lockdowns and social distancing to contain the spread of the virus. The economic uncertainty, partial shutdown of the business and low consumer confidence impacted demand for forklift truck market. The supply chain got hampered during the pandemic along with delay logistics activities. However, the automotive forklift truck market is expected to regain its pace during the post pandemic scenario due to the easing on the restrictions.

Recent Developments

- In April 2019, KION GROUP AG engaged in providing industrial trucks, supply chain solutions, services and ware house technology launched five new Linde and Baoli forklift trucks in Europemarket. This product launch has helped the company to strengthen its presence in North America.

- In June 2020, Hyster-Yale Materials Handling, Inc, had acquired Zhejiang Maximal Forklift Co., Ltd. Hyster had acquired 75 percent of the outstanding shares.This acquisition has helped the company to strengthen its product portfolio in material handling equipment.

Europe Forklift Truck Market Scope and Market Size

The forklift truck market is segmented on the basis of product type, power source, fuel type, tonnage, class and industry. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Counterbalance

- Warehouse

On the basis of product type, the market is segmented into counterbalance and warehouse. Counterbalance accounted the largest market share due to the rising e-commerce sector which has inadvertently increased the warehouse activities due to which it increases the demand for counter balance in the e-commerce sector.

Power Source

- Internal Combustion Forklift Truck

- Electric Forklift Truck

On the basis of power source, the market is segmented into internal combustion forklift truck and electric forklift truck. The internal combustion forklift accounted the largest market share as these forklift are widely usage in the harsh environment has this forklift have high capacity for loading material from one place to another.

Class

- Class V (IC Engine Forklift Trucks, Pneumatic Tire)

- Class IV (IC Engine Forklift Trucks, Solid/Cushion Tires)

- Class I (Electric Motor Rider Forklift Trucks)

- Class III (Electric Hand Forklift Trucks)

- Class II (Electric Motor Narrow Aisle Forklift Truck)

- Class VI (Electric and IC Engine Tractors)

- Class VII (Rough Terrain Forklift Truck)

On the basis class, the market is segmented into class V (IC engine forklift trucks, pneumatic tire), class IV (IC engine forklift trucks, solid/cushion tires), class I (electric motor rider forklift trucks), class III (electric hand forklift trucks), class II (electric motor narrow aisle forklift truck), class VI (electric and IC engine tractors) and class VII (rough terrain forklift truck). Class V (IC engine forklift trucks, pneumatic tire) attributes largest market share this forklift has been widely used for outdoor application.

Tonnage

- Below 5 Ton

- 5 To 10 Ton

- 11 To 36 Ton

- 36 Ton And Above

On the basis of tonnage, the market is segmented in to below 5 ton, 5 to 10 ton, 11 to 36 ton and 36 ton and above. Below 5 ton accounted for the largest market share due to the growing utilization of forklift in the indoor application.

Fuel Type

On the basis of fuel type, the market is segmented into electric, LPG/CNG, diesel and gasoline. Electric forklift accounted largest market share as these forklift has zero emission due to which it is widely used for indoor application.

Industry

- Construction

- Freight and Logistic

- Food Industry

- Retail

- Chemical

- Paper and Wood

- Other

On the basis of industry, forklift truck market is segmented into construction, freight and logistic, food industry, retail, chemical, paper and wood, and other. Construction accounted for the largest market share due to the rising population has further increases the demand for shelters which result in increasing construction activities among countries.

Europe Forklift Truck Market Regional Analysis/Insights

The forklift truck market is analyzed and market size insights and trends are provided by country, product type, power source, fuel type, tonnage, class and industry.

The countries covered in the Europe forklift truck market report are the Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, and Rest of Europe in Europe.

Germany dominates the Europe forklift truck market due to the technological advancements and presence of key players within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Forklift Truck Market

The forklift truck market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to forklift truck market.

Some of the major players operating in the forklift truck market are

- Jungheinrich AG (Germany)

- Hyster-Yale Group, Inc (US)

- KION GROUP AG (Germany)

- Lift Technologies, Inc (US)

- Crown Equipment Corporation (US)

- Toyota Industries Corporation (Japan)

- Mitsubishi Logisnext Co., Ltd (Japan)

- Godrej & Boyce Manufacturing (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FORKLIFT TRUCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR E-COMMERCE INDUSTRY

5.1.2 INCREASING INVESTMENTS IN THE INFRASTRUCTURE INDUSTRY

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN FORKLIFT TRUCKS

5.1.4 INCREASING DEMAND FOR ELECTRIC-POWERED FORKLIFT TRUCKS

5.2 RESTRAINTS

5.2.1 INCREASE IN THIRD PARTY LOGISTICS (3PL) SERVICES

5.2.2 INCREASING SAFETY ISSUES RELATED TO FORKLIFT TRUCKS

5.2.3 HIGH COST OF BATTERY OPERATED AND FUEL CELL FORKLIFT

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF HYDROGEN FUEL CELL FORKLIFT

5.3.2 DEVELOPMENT OF AUTONOMOUS FORKLIFTS TRUCKS

5.3.3 INCREASING DEMAND FOR BATTERY-OPERATED FORKLIFTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED WORKFORCE

5.4.2 INCREASING SAFETY AND EMISSION REGULATIONS

6 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 COUNTERBALANCE

6.3 WAREHOUSE

7 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE

7.1 OVERVIEW

7.2 INTERNAL COMBUSTION FORKLIFT TRUCK

7.3 ELECTRIC FORKLIFT TRUCK

8 EUROPE FORKLIFT TRUCK MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS V (IC ENGINE FORKLIFT TRUCKS, PNEUMATIC TIRE)

8.3 CLASS IV (IC ENGINE FORKLIFT TRUCKS, SOLID/CUSHION TIRES)

8.4 CLASS I (ELECTRIC MOTOR RIDER FORKLIFT TRUCKS)

8.5 CLASS III (ELECTRIC HAND FORKLIFT TRUCKS)

8.6 CLASS II (ELECTRIC MOTOR NARROW AISLE FORKLIFT TRUCK)

8.7 CLASS VI (ELECTRIC AND IC ENGINE TRACTORS)

8.8 CLASS VII (ROUGH TERRAIN FORKLIFT TRUCK)

9 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE

9.1 OVERVIEW

9.2 ELECTRIC

9.3 LPG/CNG

9.4 DIESEL

9.5 GASOLINE

10 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE

10.1 OVERVIEW

10.2 BELOW 5 TON

10.3 5 TON TO 10 TON

10.4 TO 36 TON

10.5 TON AND ABOVE

11 EUROPE FORKLIFT TRUCK MARKET, BY END-USER

11.1 OVERVIEW

11.2 CONSTRUCTION

11.2.1 COUNTERBALANCE

11.2.2 WAREHOUSE

11.3 FREIGHT AND LOGISTIC

11.3.1 COUNTERBALANCE

11.3.2 WAREHOUSE

11.4 FOOD INDUSTRY

11.4.1 COUNTERBALANCE

11.4.2 WAREHOUSE

11.5 RETAIL

11.5.1 COUNTERBALANCE

11.5.2 WAREHOUSE

11.6 CHEMICAL

11.6.1 COUNTERBALANCE

11.6.2 WAREHOUSE

11.7 PAPER & WOOD

11.7.1 COUNTERBALANCE

11.7.2 WAREHOUSE

11.8 OTHERS

12 EUROPE FORKLIFT TRUCK MARKET, BY GEOGRAPHY

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K

12.1.3 FRANCE

12.1.4 SPAIN

12.1.5 ITALY

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 SWITZERLAND

12.1.9 TURKEY

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE FORKLIFT TRUCK MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 EUROPE FORKLIFT TRUCK MARKET: SWOT ANALYSIS

14.1 EUROPE FORKLIFT TRUCK MARKET: DATA BRIDGE MARKET RESEARCH ANALYSIS

15 COMPANY PROFILES

15.1 TOYOTA INDUSTRIES CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 KION GROUP AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 BRAND PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JUNGHEINRICH AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 MITSUBISHI LOGISNEXT CO.,LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 CROWN EQUIPMENT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ANHUI HELI CO., LTD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CLARK

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COMBILIFT MATERIAL HANDLING SOLUTIONS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DOOSAN INDUSTRIAL VEHICLE AMERICA CORP.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 EP EQUIPMENT, CO.,LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GODREJ MATERIAL HANDLING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HANGCHA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HUBTEX MASCHINENBAU GMBH & CO. KG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HYSTER-YALE GROUP, INC. (A SUBSIDIARY OF HYSTER-YALE MATERIALS HANDLING, INC.)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 KOMATSU LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 KONECRANES

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 LIFT TECHNOLOGIES, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LONKING MACHINERY CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MANITOU GROUP

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 PALLETRANS FORKLIFTS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 2 EUROPE COUNTERBALANCE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 EUROPE WAREHOUSE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 5 EUROPE INTERNAL COMBUSTION FORKLIFT TRUCK IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE ELECTRIC FORKLIFT TRUCK IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 EUROPE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 8 EUROPE CLASS V (IC ENGINE FORKLIFT TRUCKS, PNEUMATIC TIRE) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE CLASS IV (IC ENGINE FORKLIFT TRUCKS, SOLID/CUSHION TIRES) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE CLASS I (ELECTRIC MOTOR RIDER FORKLIFT TRUCKS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 EUROPE CLASS III (ELECTRIC HAND FORKLIFT TRUCKS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE CLASS II (ELECTRIC MOTOR NARROW AISLE FORKLIFT TRUCK) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 EUROPE CLASS VI (ELECTRIC AND IC ENGINE TRACTORS) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE CLASS VII (ROUGH TERRAIN FORKLIFT TRUCK) IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 16 EUROPE ELECTRIC IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 EUROPE LPG/CNG IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 EUROPE DIESEL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE GASOLINE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 21 EUROPE BELOW 5 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE 5 TON TO 10 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE 11 TO 36 TON IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 EUROPE 36 TON AND ABOVE IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 26 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 28 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 30 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 32 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 34 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 36 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 EUROPE OTHERS IN FORKLIFT TRUCK MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 EUROPE FORKLIFT TRUCK MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 40 EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 41 EUROPE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 42 EUROPE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 43 EUROPE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 44 EUROPE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 45 EUROPE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 46 EUROPE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 EUROPE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 48 EUROPE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 EUROPE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 50 EUROPE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 EUROPE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 GERMANY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 GERMANY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 54 GERMANY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 55 GERMANY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 56 GERMANY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 57 GERMANY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 58 GERMANY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 GERMANY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 60 GERMANY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 GERMANY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 62 GERMANY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 GERMANY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 64 U.K FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 65 U.K FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 66 U.K FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 67 U.K FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 68 U.K FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 69 U.K FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 70 U.K CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 71 U.K FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 72 U.K FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 73 U.K RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 U.K CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 75 U.K PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 76 FRANCE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 FRANCE FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 78 FRANCE FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 79 FRANCE FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 80 FRANCE FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 81 FRANCE FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 82 FRANCE CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 FRANCE FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 FRANCE FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 FRANCE RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 FRANCE CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 87 FRANCE PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 88 SPAIN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 89 SPAIN FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 90 SPAIN FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 91 SPAIN FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 92 SPAIN FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 93 SPAIN FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 94 SPAIN CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 SPAIN FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 96 SPAIN FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 97 SPAIN RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 SPAIN CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 SPAIN PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 ITALY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 ITALY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 102 ITALY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 103 ITALY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 104 ITALY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 105 ITALY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 106 ITALY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 ITALY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 108 ITALY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 109 ITALY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 110 ITALY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 111 ITALY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 112 RUSSIA FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 113 RUSSIA FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 114 RUSSIA FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 115 RUSSIA FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 116 RUSSIA FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 117 RUSSIA FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 118 RUSSIA CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 RUSSIA FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 RUSSIA FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 RUSSIA RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 RUSSIA CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 RUSSIA PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 NETHERLANDS FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 NETHERLANDS FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 126 NETHERLANDS FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 127 NETHERLANDS FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 128 NETHERLANDS FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 129 NETHERLANDS FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 130 NETHERLANDS CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 131 NETHERLANDS FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 132 NETHERLANDS FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 133 NETHERLANDS RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 134 NETHERLANDS CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 135 NETHERLANDS PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 136 SWITZERLAND FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 SWITZERLAND FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 138 SWITZERLAND FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 139 SWITZERLAND FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 140 SWITZERLAND FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 141 SWITZERLAND FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 142 SWITZERLAND CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 SWITZERLAND FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 SWITZERLAND FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 SWITZERLAND RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 SWITZERLAND CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 SWITZERLAND PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 TURKEY FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 149 TURKEY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 150 TURKEY FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 151 TURKEY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 152 TURKEY FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 153 TURKEY FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 154 TURKEY CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 155 TURKEY FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 156 TURKEY FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 157 TURKEY RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 158 TURKEY CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 159 TURKEY PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 160 BELGIUM FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 161 BELGIUM FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2018-2027 (USD MILLION)

TABLE 162 BELGIUM FORKLIFT TRUCK MARKET, BY CLASS, 2018-2027 (USD MILLION)

TABLE 163 BELGIUM FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 164 BELGIUM FORKLIFT TRUCK MARKET, BY TONNAGE, 2018-2027 (USD MILLION)

TABLE 165 BELGIUM FORKLIFT TRUCK MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 166 BELGIUM CONSTRUCTION IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 167 BELGIUM FREIGHT & LOGISTIC IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 168 BELGIUM FOOD INDUSTRY IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 169 BELGIUM RETAIL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 170 BELGIUM CHEMICAL IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 171 BELGIUM PAPER & WOOD IN FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 172 REST OF EUROPE FORKLIFT TRUCK MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 EUROPE FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 2 EUROPE FORKLIFT TRUCK MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FORKLIFT TRUCK MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FORKLIFT TRUCK MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE FORKLIFT TRUCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FORKLIFT TRUCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FORKLIFT TRUCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FORKLIFT TRUCK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR E-COMMERCE INDUSTRY IS EXPECTED TO DRIVE EUROPE FORKLIFT TRUCK MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 COUNTERBALANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FORKLIFT TRUCK MARKET IN 2020 & 2027

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE EUROPE FORKLIFT TRUCK MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF EUROPE FORKLIFT TRUCK MARKET

FIGURE 14 EUROPE FORKLIFT TRUCK MARKET: BY PRODUCT TYPE, 2019

FIGURE 15 EUROPE FORKLIFT TRUCK MARKET: BY POWER SOURCE, 2019

FIGURE 16 EUROPE FORKLIFT TRUCK MARKET: BY CLASS, 2019

FIGURE 17 EUROPE FORKLIFT TRUCK MARKET: BY FUEL TYPE, 2019

FIGURE 18 EUROPE FORKLIFT TRUCK MARKET: BY TONNAGE, 2019

FIGURE 19 EUROPE FORKLIFT TRUCK MARKET: BY END-USER, 2019

FIGURE 20 EUROPE FORKLIFT TRUCK MARKET: SNAPSHOT (2019)

FIGURE 21 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2019)

FIGURE 22 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 EUROPE FORKLIFT TRUCK MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 EUROPE FORKLIFT TRUCK MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 25 EUROPE FORKLIFT TRUCK MARKET: COMPANY SHARE 2019(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.