Europe Flow Cytometry Market

Market Size in USD Billion

CAGR :

%

USD

1.49 Billion

USD

3.27 Billion

2024

2032

USD

1.49 Billion

USD

3.27 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 3.27 Billion | |

|

|

|

|

Europe Flow Cytometry Market Analysis

Flow cytometry is a technique for detecting and quantifying the physical and chemical properties of a population of cells or particles. A sample containing cells or particles is suspended in a fluid and injected into the flow cytometer equipment in this process. Flow cytometry is a well-established technology for identifying cells in a solution that is most typically used to assess peripheral blood, bone marrow, and other bodily fluids. Immune cells are identified and quantified using flow cytometry, which is also used to describe hematological malignancies. The evaluation of cells through this technique has a key role in diagnosing many chronic diseases. It analyzes biological activities inside cells, apoptosis, necrosis, cell cycle, cell membrane, cell proliferation, and measurement of DNA per cell.

The major diagnostic applications include benign hematologic process, cancer, AIDS, immune deficiency, benign hematologic, and these diseases' detection using fluorescence. In this process, cells are dyed with fluorophores to detect the light emitted to produce the intensity by labeling specific proteins (immunophenotyping) for diagnosing leukemia and lymphomas.

Europe Flow Cytometry Market Size

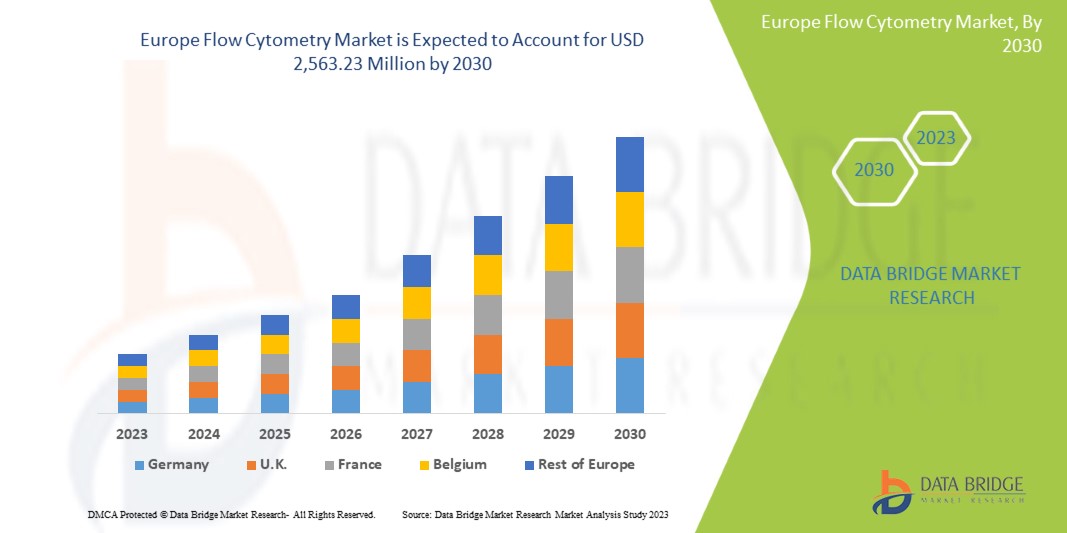

Europe flow cytometry market size was valued at USD 1.49 billion in 2024 and is projected to reach USD 3.27 billion by 2032, with a CAGR of 10.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Europe Flow Cytometry Market Trends

“Increasing Adoption of Multi-Parameter Analysis Capabilities”

One significant trend in the Europe flow cytometry market is the increasing adoption of multi-parameter analysis capabilities, driven by advancements in technology that allow for the simultaneous measurement of numerous cellular markers. This trend is largely fueled by the rising demand for detailed cellular characterization in areas such as cancer research, immunology, and personalized medicine, where complex cellular interactions need to be understood. Innovations in laser systems, detectors, and software are making it possible to analyze more parameters with greater sensitivity and resolution, enabling researchers and clinicians to gain deeper insights into biological processes and improve diagnostic accuracy. This shift towards more sophisticated flow cytometry systems is transforming research methodologies and expanding the applicability of flow cytometry across various fields.

Report Scope and Europe Flow Cytometry Market Segmentation

|

Attributes |

Europe Flow Cytometry Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada , Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium, Austria, Ireland, Norway, Poland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Peru, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

BD (U.S.), Agilent Technologies, Inc.(U.S.), Thermo Fisher Scientific Inc.(U.S.), Bio-Rad Laboratories, Inc.(U.S.), Sartorius AG (Germany), Bennubio Inc. (U.S.), Enzo Biochem Inc. (U.S.), Apogee Flow Systems Ltd. (U.K.), Beckman Coulter, Inc. (U.S.), Coherent Corp. (U.S.), Cell Signaling Technology, Inc. (U.S.), Cytek Biosciences (U.S.), and Biomérieux. (France), Cytonome/ST LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Flow Cytometry Market Definition

The Europe flow cytometry market refers to the industry that encompasses the development, production, and distribution of flow cytometry equipment, reagents, software, and services used for analyzing and sorting cells and other particles suspended in a fluid stream. Flow cytometry is a powerful technique that allows for the simultaneous measurement of multiple physical and chemical characteristics of individual cells, such as size, complexity, and protein expression. This technology is widely employed in various applications, including immunology, oncology, microbiology, and drug development, making it an essential tool in both clinical diagnostics and research settings.

Europe Flow Cytometry Market Dynamics

Drivers

- Rising Prevalence of Chronic Diseases

Flow cytometry is a technique for detecting and quantifying the physical and chemical properties of a population of cells or particles. A sample containing cells or particles is suspended in a fluid and injected into the flow cytometer equipment in this process. Flow cytometry is a well-established technology for identifying cells in a solution that is most typically used to assess peripheral blood, bone marrow, and other bodily fluids. Immune cells are identified and quantified using flow cytometry, which is also used to describe hematological malignancies. The evaluation of cells through this technique has a key role in diagnosing many chronic diseases. It analyzes biological activities inside cells, apoptosis, necrosis, cell cycle, cell membrane, cell proliferation, and measurement of DNA per cell.

The major diagnostic applications include benign hematologic process, cancer, AIDS, immune deficiency, benign hematologic, and these diseases' detection using fluorescence. In this process, cells are dyed with fluorophores to detect the light emitted to produce the intensity by labeling specific proteins (immunophenotyping) for diagnosing leukemia and lymphomas.

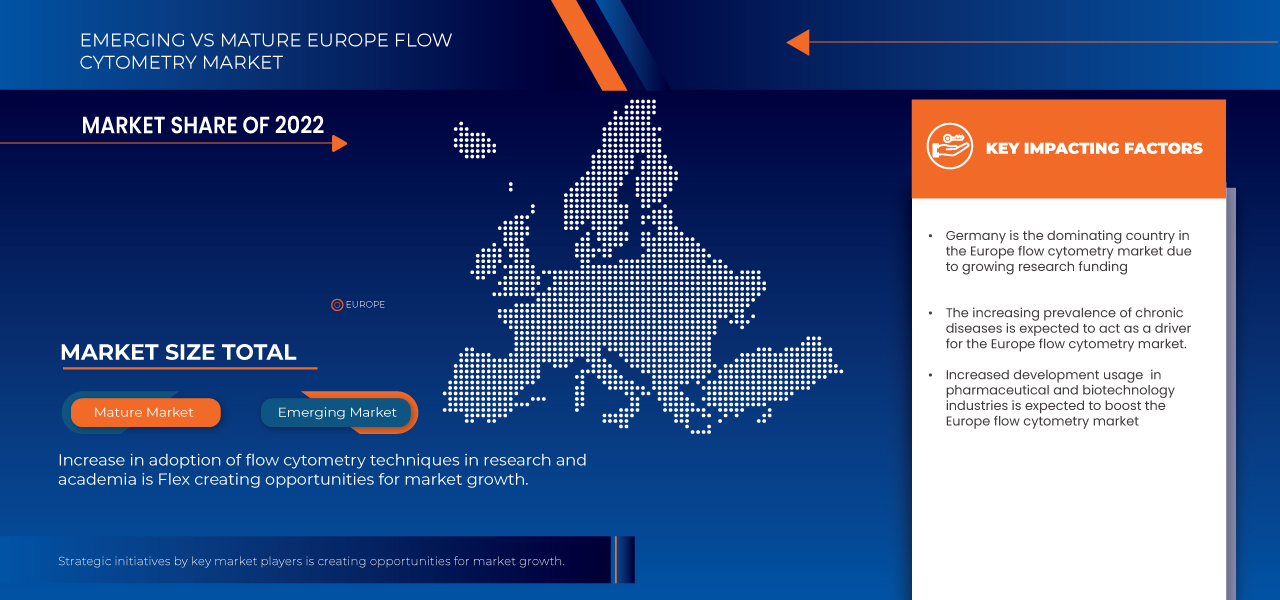

The increasing prevalence of chronic diseases has created a growing demand for flow cytometric techniques that can help researchers and clinicians better understand the underlying mechanisms of these diseases and develop more effective treatments.

- Increasing Application of Cytometry Instruments

Flow cytometry is a powerful analytical tool used to analyze and quantify single cells or particles in a heterogeneous mixture. It uses lasers and optics to detect and measure cells or particles such as size, shape and fluorescence intensity. This technique involves labeling cells or particles with fluorescent dyes or antibodies that bind to specific cell surface markers or intracellular molecules. The labeled cells or particles are then passed through a flow cytometer, which detects and measures the fluorescence emitted by each cell or particle. Flow cytometry is widely used in many research fields, including immunology, microbiology, stem cell research, cancer research, drug discovery and development, and clinical diagnostics. The technique is constantly evolving with new applications and hardware and software improvements, making it an important tool in the study of biological systems.

For instance,

- In July 2023, according to the article published by NCBI, the increasing application of flow cytometry in diverse fields, including immunophenotyping, viability assays, cell cycle analysis, and rare cell identification, drives the Europe flow cytometry market. Its ability to analyze individual cells at a single-cell level and sort specific populations for advanced research fuels demand. This versatility accelerates growth in both academic and clinical research, propelling market expansion.

- In June 2020, according to the article published by the Wiley online library, flow cytometry can be used to identify and characterize different subsets of immune cells in patients with autoimmune diseases such as Systemic Lupus Erythematosus (SLE). The study concluded that flow cytometry could provide valuable insights into the pathogenesis of these diseases and help develop more targeted therapies. This accelerates growth in both academic and clinical research, propelling market expansion.

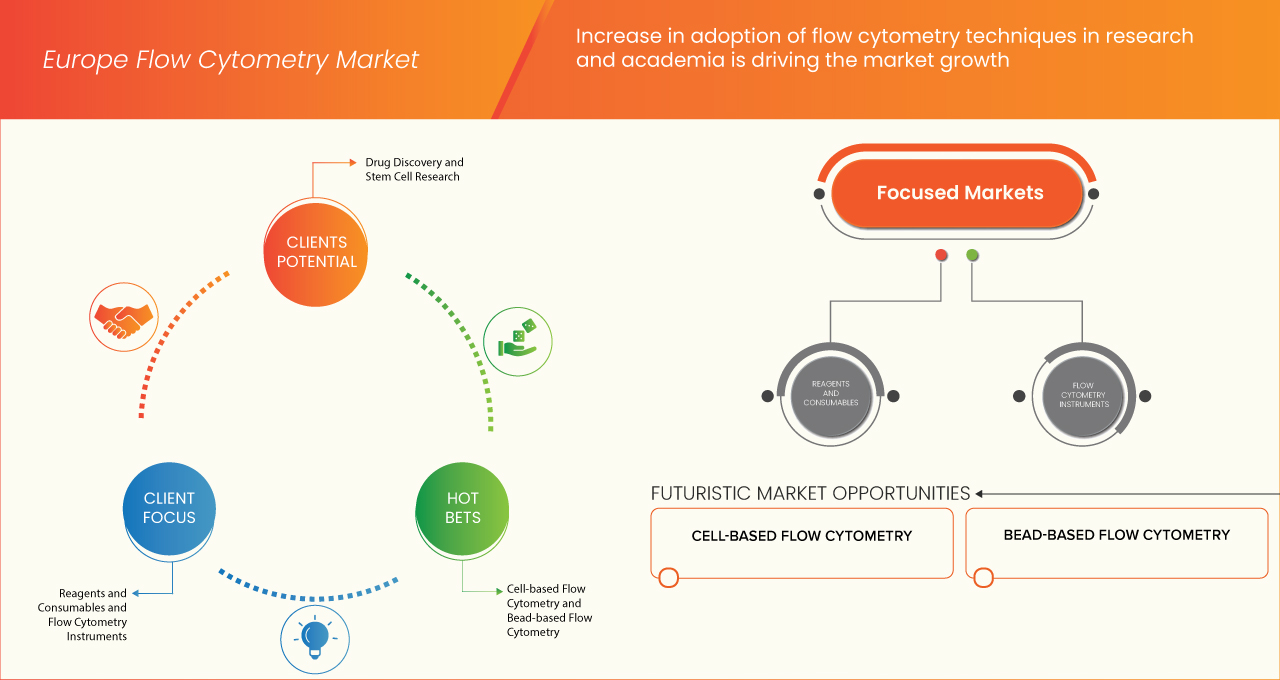

Growing Use of Flow Cytometry in Drug Discovery

- The expanding research activities are projected to drive the growth of flow cytometry. It has emerged as the major key to exploring drug discovery and development processes. Due to its outstanding ability to analyze heterogeneous populations of cells, flow cytometry presents an appealing promise for drug discovery and development paths. It delivers higher-resolution insights into the multiparameter functional and biological information of a single cell. Moreover, continuing progress in flow cytometry approaches such as high-throughput multifactorial analysis, cell sorting improvements, and quick event detection and resolution ensures increased efficiency in finding and characterizing novel bioactive medicines.

- For instance;-

- In March 2024, according to the article published by NCBI, the increasing use of flow cytometry in drug discovery, particularly for biomarker modulation in early clinical trials, drives the Europe flow cytometry market. Its ability to provide valuable insights into molecule progression and reverse translation of patient data accelerates discoveries in therapeutic development. This growing application in drug discovery propels the demand for advanced flow cytometry technologies in the healthcare and pharmaceutical sectors.

- In November 2021, according to the article published by News Medical Life Sciences, the increased use of flow cytometry in drug discovery, from target identification to lead development, is driving the Europe market. It enables the analysis of various biomolecular structures, including cell membranes, proteins, DNA, and mRNA, allowing for precise targeting in drug development. This broad applicability in understanding complex biological processes accelerates the demand for flow cytometry technologies in pharmaceutical research.

Opportunities

- Increase In Adoption of Flow Cytometry Techniques in Research and Academia

Flow cytometry is a sophisticated technique for measuring individual cells and other particles in suspension at a rate of thousands of cells per second. Flow cytometry has been extended to environmental investigations, extracellular vesicle analysis, and the capacity to use upwards of 30 different parameters for more extensive analysis. It is most typically used in the setting of immunology. Flow cytometers provide exceptional capabilities, high-quality data, and an easy-to-use platform that saves time for researchers while collecting and evaluating data.

The rise in chronic diseases and infectious diseases prevalence and incidence has opened wide opportunities for enormous research and development for novel diagnostic and therapeutic applications.

For instances,

In February 2021, according to a study published in PLOS ONE, researchers used flow cytometry to analyze the immune response of patients with COVID-19. The study found that flow cytometry was a reliable and effective tool for characterizing the immune response to the virus, which could help guide treatment strategies

In April 2021, according to a study published in Frontiers in Immunology, researchers used flow cytometry to study the immune response to HIV infection. The study found that flow cytometry was an effective tool for characterizing the immune response to the virus, which could lead to the development of new treatments and vaccines

- Rising Development of Pharmaceutical and Biotechnology Industries

Flow cytometry instruments have become an integral part of drug discovery and development in the pharmaceutical and biotechnology industries. The development of new flow cytometry equipment has helped researchers analyze and sort cells faster, more accurately and more efficiently, which has helped speed up the drug development timeline. For instance, Beckman Coulter, a leading manufacturer of flow cytometry equipment, has developed the CytoFLEX LX flow cytometer with rapid detection, enhanced sensitivity and a small footprint. CytoFLEX LX is designed to help researchers analyze rare cell populations faster and more efficiently.

Overall, the development of new flow cytometry devices is helping pharmaceutical and biotechnology companies accelerate drug development timelines by enabling faster and more accurate analysis of complex cell populations. With the rising geriatric population and chronic disease cases, the growth of biotechnology and pharmaceutical firms is also expanding. Across the globe, research and development activities are escalating due to public health expenditure with economic performance.

For instance,

- In October 2024, Ardena announced a substantial expansion of its Bioanalytical in the Netherlands. Moreover, it focused on expanding its capabilities in immunochemistry, flow cytometry, and qPCR platforms, increasing its LC-MS/MS capacity, and adding new Hamilton automated systems to enhance efficiency and address evolving bioanalytical challenges

- In April 2021, according to data provided by the CBO (Congressional Budget Office), the pharmaceutical sector spent USD 83 Billion on research and development. These costs were incurred for a number of operations, including the discovery and testing of novel medications, the development of incremental advancements such as product expansions, and clinical testing for safety monitoring and marketing

Restraints/Challenges

- High Cost of Flow Cytometry Instruments

The substantial initial investment required for flow cytometry instruments, coupled with the ongoing costs of reagents, dyes, and maintenance, creates financial barriers, particularly for smaller laboratories or those in resource-constrained environments. Additionally, the technical complexity of flow cytometry demands skilled personnel for operation, with specialized training required to properly utilize the technology. This limits its accessibility in regions where expertise is lacking, reducing its adoption rate. Moreover, flow cytometry systems require regular maintenance, calibration, and troubleshooting, which increases operational costs and can result in downtime, further impacting laboratory efficiency. Stringent regulatory requirements for approval of these medical devices also create delays in market entry and additional compliance costs. These factors collectively hinder the widespread adoption of flow cytometry, especially in emerging markets where financial constraints, lack of trained professionals, and slow regulatory processes act as significant barriers to growth, ultimately restraining the market’s potential expansion.

For Instance

- In January 2024, according to the article published by Excedr, the high cost of flow cytometry instruments, ranging from USDUSD100,000 to USDUSD1.5 million, acts as a significant restraint for the Europe market. These expenses limit access to smaller labs and institutions, making it challenging for them to adopt advanced technology. As a result, the high initial investment and maintenance costs hinder widespread use and slow market growth, especially in resource-limited settings.

- In November 2023, according to the article published by NCBI, the high cost of flow cytometry instruments, ranging from USD50,000 to USD750,000 or more, acts as a significant restraint on the Europe market. This substantial financial investment required for advanced features and specifications limits accessibility, especially for smaller research labs and institutions with constrained budgets. Consequently, the high cost slows adoption and hampers market growth, particularly in resource-limited settings.

The initial investment in instruments and the ongoing expenses for reagents and maintenance create financial challenges for smaller labs and those in resource-limited areas. The technology’s complexity also requires trained personnel, limiting its use in regions lacking expertise. Additionally, the need for regular maintenance and calibration increases operational costs and causes potential downtime. Strict regulatory requirements further delay product approval and market entry. These factors limit the adoption of flow cytometry, especially in emerging markets, restraining the overall growth of the market.

- Limitations of Flow Cytometry

Flow cytometry has inherent limitations, such as its inability to analyze formalin-fixed tissues, which restricts its use in certain research and clinical applications. The method is designed for fresh or frozen samples, and formalin fixation can alter cell structure and marker expression, rendering them unsuitable for analysis. Additionally, flow cytometry struggles to fully capture complex cellular interactions or multi-layered signaling pathways. These restrictions limit the scope of its use in various fields and act as a restraint on the Europe flow cytometry market by narrowing its applicability, particularly in clinical and pathology settings.

For instance-

- In June 2021, according to the article published by LearnHaem, Flow cytometry requires fresh samples to be processed immediately after collection, as improper storage or prolonged storage leads to natural apoptosis, which diminishes the accuracy of results. Additionally, flow cytometry cannot be used on formalin-fixed tissues, limiting its application in certain clinical and research environments. These constraints act as a restraint on the Europe flow cytometry market by reducing its versatility and applicability in some areas.

- In March 2020, according to the article published by NCBI, Flow cytometry faced limitations due to optical blur caused by high cell movement, which affects image clarity. Additionally, the detection of rare and atypical objects, such as Circulating Tumor Cells (CTCs), poses a challenge despite their prognostic importance. These issues limit the ability to accurately capture and analyze critical biomarkers, restraining the growth and application of flow cytometry in certain diagnostic and research areas.

Flow cytometry faces limitations, such as its inability to analyze formalin-fixed tissues, which are commonly used in pathology and clinical diagnostics. The process requires fresh or frozen samples, and the chemical fixation process alters cell markers, rendering them incompatible with flow cytometric analysis. Furthermore, the technique struggles to fully capture intricate cellular interactions or complex signaling pathways. These limitations restrict the technology’s broader application, acting as a restraint on the Europe flow cytometry market by reducing its versatility in clinical and research settings.

Europe Flow Cytometry Market Scope

The market is segmented on the basis of product, application, technology, distribution channel, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Reagents And Consumables

- Dye

- Antibodies

- Beads

- Others

- Flow Cytometry Instruments

- Cell Analyzers

- By Type

- Imaging Flow Cytometers

- Non-Imaging Flow Cytometers

- By Range

- High-Range Cell Analyzers

- Mid-Range Cell Analyzers

- Low-Range Cell Analyzers

- By Modality

- Benchtop

- Standalone

- By Type

- Cell Sorters

- By Modality

- Benchtop

- Standalone

- By Range

- High-Range Cell Analyzers

- Mid-Range Cell Analyzers

- Low-Range Cell Analyzers

- By Modality

- Cell Analyzers

- Accessories

- Filters

- Detectors

- Others

- Services

- Software

Technology

- Cell-Based Flow Cytometry

- Flow Cytometry Instruments

- Reagnets & Consumables

- Accessories

- Bead-Based Flow Cytometry

- Flow Cytometry Instruments

- Reagnets & Consumables

- Accessories

Application

- Research Applications

- Cell Cycle Analysis

- Cell Sorting/Screening

- Cell Transfection/Viability

- Pharmaceutical And Biotechnology

- Drug Discovery

- Stem Cell Research

- In Vitro Toxicity Testing

- Immunology

- Apoptosis

- Cell Counting

- Others

- Clinical Applications

- Hematology

- Cancer

- Immunodeficiency Diseases

- Organ Transplantation

- Other Clinical Application

- Industrial Applications

End User

- Pharmaceuticals And Biotechnology Companies

- Academic & Research Institutes

- Hospitals

- Clinical Testing Laboratories

- Cro

- Blood Bank

- Cmo & Cdmo

- Forensic Laboratoreis

- Others

Distribution Channel

- Retail Sales

- Offline

- Online

- Direct Tenders

Europe Flow Cytometry Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, application, technology, distribution channel, and end user as referenced above.

The countries covered in the market are U.S., Canada , Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium, Austria, Ireland, Norway, Poland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Peru, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, and Rest of Middle East & Africa.

Germany is dominating and the fastest-growing country in the flow cytometry market due to its strong pharmaceutical and biotechnology industries, significant investment in research and development, and leading academic institutions. The country’s focus on advancing healthcare technologies, along with government support for scientific innovation, drives the widespread adoption and growth of flow cytometry in research, diagnostics, and clinical applications.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Europe Flow Cytometry Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Europe Flow Cytometry Market Leaders Operating in the Market Are:

- BD (U.S.)

- Agilent Technologies, Inc.(U.S.)

- Thermo Fisher Scientific Inc.(U.S.)

- Bio-Rad Laboratories, Inc.(U.S.)

- Sartorius AG (Germany)

- Bennubio Inc. (U.S.)

- Enzo Biochem Inc. (U.S.)

- Apogee Flow Systems Ltd. (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Coherent Corp. (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Cytek Biosciences (U.S.)

- Biomérieux. (France)

- Cytonome/ST LLC (U.S.)

Latest Developments Europe Flow Cytometry Market

- In July 2024, Agilent Technologies has announced the acquisition of Canadian drug services firm BioVectra for USD 925 million. This move expands Agilent's capabilities in gene editing, specifically in manufacturing oligonucleotides and peptides, enhancing its role in RNA-based therapies and gene editing technologies like CRISPR-Cas

- In June 2024, Thermo Fisher celebrated the ribbon-cutting of a 72,500-square-foot expansion at its Middleton campus, which will serve as a laboratory for pharmaceutical testing. The project will create 350 jobs over the next two years, with state tax credits supporting the initiative

- In November 2024, Sartorius Stedim Biotech has opened a new Center for Bioprocess Innovation in Marlborough, Massachusetts, aimed at advancing the development of next-generation therapeutics. The 63,000-square-foot facility will provide process optimization, training, and GMP suites for clinical production starting in 2025

- In March 2024, Beckman Coulter Life Sciences has launched the CytoFLEX nano Flow Cytometer, a breakthrough in nanoparticle analysis that enables detection as small as 40 nm. This system enhances sensitivity, offering up to 50% more data for research into extracellular vesicles and lower-abundance targets

- In March 2024, Beckman Coulter Life Sciences has received FDA 510(k) clearance to distribute its DxFLEX Clinical Flow Cytometer in the U.S. This simplifies high-complexity testing with enhanced sensitivity and automated compensation, making multicolor flow cytometry more accessible and efficient for labs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF CHRONIC DISEASES

5.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

5.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

5.1.4 GROWING RESEARCH FUNDING

5.2 RESTRAINTS

5.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

5.2.2 LIMITATIONS OF FLOW CYTOMETRY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

5.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

5.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

5.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

6 EUROPE FLOW CYTOMETRY MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 REAGENTS AND CONSUMABLES

6.2.1 DYE

6.2.2 ANTIBODIES

6.2.3 BEADS

6.2.4 OTHERS

6.3 FLOW CYTOMETRY INSTRUMENTS

6.3.1 CELL ANALYZERS

6.3.1.1 CELL ANALYZERS, BY TYPE

6.3.1.1.1 IMAGING FLOW CYTOMETERS

6.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

6.3.1.2 CELL ANALYZERS, BY RANGE

6.3.1.2.1 HIGH-RANGE CELL ANALYZERS

6.3.1.2.2 MID-RANGE CELL ANALYZERS

6.3.1.2.3 LOW-RANGE CELL ANALYZERS

6.3.1.3 CELL ANALYZERS, BY MODALITY

6.3.1.3.1 BENCHTOP

6.3.1.3.2 STANDALONE

6.3.2 CELL SORTERS

6.3.2.1 BENCHTOP

6.3.2.2 STANDALONE

6.3.3 CELL SORTERS

6.3.3.1 HIGH-RANGE CELL ANALYZERS

6.3.3.2 MID-RANGE CELL ANALYZERS

6.3.3.3 LOW-RANGE CELL ANALYZERS

6.4 ACCESSORIES

6.4.1 FILTERS

6.4.2 DETECTORS

6.4.3 OTHERS

6.5 SERVICES

6.6 SOFTWARE

7 EUROPE FLOW CYTOMETRY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 CELL-BASED FLOW CYTOMETRY

7.2.1 FLOW CYTOMETRY INSTRUMENTS

7.2.2 REAGENTS & CONSUMABLES

7.2.3 ACCESSORIES

7.3 BEAD-BASED FLOW CYTOMETRY

7.3.1 FLOW CYTOMETRY INSTRUMENTS

7.3.2 REAGENTS & CONSUMABLES

7.3.3 ACCESSORIES

8 EUROPE FLOW CYTOMETRY MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 RESEARCH APPLICATIONS

8.2.1 CELL CYCLE ANALYSIS

8.2.2 CELL SORTING/SCREENING

8.2.3 CELL TRANSFECTION/VIABILITY

8.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

8.2.4.1 DRUG DISCOVERY

8.2.4.2 STEM CELL RESEARCH

8.2.4.3 IN VITRO TOXICITY TESTING

8.2.5 IMMUNOLOGY

8.2.6 APOPTOSIS

8.2.7 CELL COUNTING

8.2.8 OTHERS

8.3 CLINICAL APPLICATIONS

8.3.1 HAEMATOLOGY

8.3.2 CANCER

8.3.3 IMMUNODEFICIENCY DISEASES

8.3.4 ORGAN TRANSPLANTATION

8.3.5 OTHER CLINICAL APPLICATION

8.4 INDUSTRIAL APPLICATIONS

9 EUROPE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.2.1 OFFLINE

9.2.2 ONLINE

9.3 DIRECT TENDERS

10 EUROPE FLOW CYTOMETRY MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

10.3 ACADEMIC & RESEARCH INSTITUTES

10.4 HOSPITALS

10.5 CLINICAL TESTING LABORATORIES

10.6 CRO

10.7 BLOOD BANK

10.8 CMO & CDMO

10.9 FORENSIC LABORATORIES

10.1 OTHERS

11 EUROPE FLOW CYTOMETRY MARKET BY COUNTRIES-

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 TURKEY

11.1.10 BELGIUM

11.1.11 AUSTRIA

11.1.12 IRELAND

11.1.13 NORWAY

11.1.14 POLAND

11.1.15 REST OF EUROPE

12 EUROPE FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AGILENT TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 THERMO FISHER SCIENTIFIC INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 BIO-RAD LABORATORIES, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 SARTORIUS AG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 APOGEE FLOW SYSTEMS LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BIOMÉRIEUX

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BIOLEGEND, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COHERENT CORP.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 CYTOBUOY

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 CELL SIGNALING TECHNOLOGY, INC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 CYTEK BIOSCIENCES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 DIASORIN S.P.A.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 ELABSCIENCE BIONOVATION INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ENZO BIOCHEM, INC

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 MILTENYI BIOTEC AND/OR ITS AFFILIATES

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MERCK KGAA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 NANOCELLECT BIOMEDICAL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 NEOGENOMICS LABORATORIES

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SONY BIOTECHNOLOGY INC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENT

14.22 TAKARA BIO INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 UNION BIOMETRICA, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 EUROPE FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 EUROPE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 3 EUROPE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 4 EUROPE FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 5 EUROPE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 EUROPE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 7 EUROPE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 8 EUROPE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 9 EUROPE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 10 EUROPE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 EUROPE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 EUROPE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 13 EUROPE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 EUROPE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 15 EUROPE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 16 EUROPE FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 17 EUROPE CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 18 EUROPE BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 19 EUROPE FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 20 EUROPE RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 21 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 22 EUROPE CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 23 EUROPE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 24 EUROPE RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 25 EUROPE FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 26 EUROPE FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 27 GERMANY FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 GERMANY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 29 GERMANY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 30 GERMANY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 31 GERMANY FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 32 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 34 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 35 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 36 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 37 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 38 GERMANY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 39 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 40 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 41 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 42 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 43 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 44 GERMANY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 45 GERMANY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 46 GERMANY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 47 GERMANY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 48 GERMANY FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 49 GERMANY CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 50 GERMANY BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 51 GERMANY FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 52 GERMANY RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 GERMANY PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 54 GERMANY CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 55 GERMANY FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 56 GERMANY FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 GERMANY RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 58 FRANCE FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 59 FRANCE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 60 FRANCE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 61 FRANCE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 62 FRANCE FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 65 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 66 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 67 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 68 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 69 FRANCE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 70 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 71 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 72 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 73 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 74 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 75 FRANCE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 76 FRANCE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 77 FRANCE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 78 FRANCE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 79 FRANCE FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 80 FRANCE CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 81 FRANCE BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 82 FRANCE FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 83 FRANCE RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 84 FRANCE PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 85 FRANCE CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 FRANCE FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 87 FRANCE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 88 FRANCE RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 U.K. FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 90 U.K. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 91 U.K. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 92 U.K. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 93 U.K. FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 94 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 96 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 97 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 98 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 99 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 100 U.K. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 101 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 102 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 103 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 104 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 105 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 106 U.K. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 107 U.K. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 108 U.K. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 109 U.K. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 110 U.K. FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 111 U.K. CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 112 U.K. BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 113 U.K. FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 U.K. RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 115 U.K. PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 116 U.K. CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 117 U.K. FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 118 U.K. FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 119 U.K. RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 120 ITALY FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 121 ITALY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 122 ITALY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 123 ITALY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 124 ITALY FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 125 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 127 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 128 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 129 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 130 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 131 ITALY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 132 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 133 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 134 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 135 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 136 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 137 ITALY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 138 ITALY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 ITALY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 140 ITALY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 141 ITALY FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 142 ITALY CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 143 ITALY BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 144 ITALY FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 145 ITALY RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 146 ITALY PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 147 ITALY CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 ITALY FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 149 ITALY FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 150 ITALY RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 151 SPAIN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 152 SPAIN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 153 SPAIN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 154 SPAIN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 155 SPAIN FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 156 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 158 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 159 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 160 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 161 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 162 SPAIN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 163 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 164 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 165 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 166 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 167 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 168 SPAIN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 169 SPAIN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 170 SPAIN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 171 SPAIN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 172 SPAIN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 173 SPAIN CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 174 SPAIN BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 175 SPAIN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 176 SPAIN RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 177 SPAIN PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 178 SPAIN CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 SPAIN FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 180 SPAIN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 181 SPAIN RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 182 RUSSIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 183 RUSSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 184 RUSSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 185 RUSSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 186 RUSSIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 187 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 189 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 190 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 191 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 192 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 193 RUSSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 194 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 195 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 196 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 197 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 198 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 199 RUSSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 200 RUSSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 201 RUSSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 202 RUSSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 203 RUSSIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 204 RUSSIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 205 RUSSIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 206 RUSSIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 207 RUSSIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 208 RUSSIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 209 RUSSIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 210 RUSSIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 211 RUSSIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 212 RUSSIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 213 NETHERLANDS FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 214 NETHERLANDS REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 215 NETHERLANDS REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 216 NETHERLANDS REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 217 NETHERLANDS FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 218 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 220 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 221 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 222 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 223 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 224 NETHERLANDS CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 225 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 226 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 227 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 228 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 229 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 230 NETHERLANDS CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 231 NETHERLANDS ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 232 NETHERLANDS ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 233 NETHERLANDS ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 234 NETHERLANDS FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 235 NETHERLANDS CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 236 NETHERLANDS BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 237 NETHERLANDS FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 NETHERLANDS RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 NETHERLANDS PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 240 NETHERLANDS CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 241 NETHERLANDS FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 242 NETHERLANDS FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 243 NETHERLANDS RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 244 SWITZERLAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 245 SWITZERLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 246 SWITZERLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 247 SWITZERLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 248 SWITZERLAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 249 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 251 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 252 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 253 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 254 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 255 SWITZERLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 256 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 257 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 258 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 259 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 260 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 261 SWITZERLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 262 SWITZERLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 263 SWITZERLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 264 SWITZERLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 265 SWITZERLAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 266 SWITZERLAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 267 SWITZERLAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 268 SWITZERLAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 269 SWITZERLAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 270 SWITZERLAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 271 SWITZERLAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 272 SWITZERLAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 273 SWITZERLAND FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 274 SWITZERLAND RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 275 TURKEY FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 276 TURKEY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 277 TURKEY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 278 TURKEY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 279 TURKEY FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 280 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 282 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 283 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 284 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 285 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 286 TURKEY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 287 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 288 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 289 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 290 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 291 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 292 TURKEY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 293 TURKEY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 294 TURKEY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 295 TURKEY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 296 TURKEY FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 297 TURKEY CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 298 TURKEY BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 299 TURKEY FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 300 TURKEY RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 301 TURKEY PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 302 TURKEY CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 303 TURKEY FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 304 TURKEY FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 305 TURKEY RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 306 BELGIUM FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 307 BELGIUM REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 308 BELGIUM REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 309 BELGIUM REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 310 BELGIUM FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 311 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 313 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 314 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 315 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 316 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 317 BELGIUM CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 318 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 319 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 320 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 321 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 322 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 323 BELGIUM CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 324 BELGIUM ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 325 BELGIUM ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 326 BELGIUM ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 327 BELGIUM FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 328 BELGIUM CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 329 BELGIUM BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 330 BELGIUM FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 BELGIUM RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 332 BELGIUM PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 333 BELGIUM CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 334 BELGIUM FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 335 BELGIUM FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 336 BELGIUM RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 337 AUSTRIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 338 AUSTRIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 339 AUSTRIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 340 AUSTRIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 341 AUSTRIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 342 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 343 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 344 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 345 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 346 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 347 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 348 AUSTRIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 349 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 350 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 351 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 352 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 353 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 354 AUSTRIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 355 AUSTRIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 356 AUSTRIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 357 AUSTRIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 358 AUSTRIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 359 AUSTRIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 360 AUSTRIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 361 AUSTRIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 362 AUSTRIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 363 AUSTRIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 364 AUSTRIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 365 AUSTRIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 366 AUSTRIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 367 AUSTRIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 368 IRELAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 369 IRELAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 370 IRELAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 371 IRELAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 372 IRELAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 373 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 375 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 376 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 377 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 378 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 379 IRELAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 380 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 381 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 382 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 383 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 384 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 385 IRELAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 386 IRELAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 387 IRELAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 388 IRELAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 389 IRELAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 390 IRELAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 391 IRELAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 392 IRELAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 393 IRELAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 394 IRELAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 395 IRELAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 396 IRELAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 397 IRELAND FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 398 IRELAND RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 399 NORWAY FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 400 NORWAY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 401 NORWAY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 402 NORWAY REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 403 NORWAY FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 404 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 406 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 407 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 408 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 409 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 410 NORWAY CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 411 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 412 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 413 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 414 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 415 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 416 NORWAY CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 417 NORWAY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 418 NORWAY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 419 NORWAY ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 420 NORWAY FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 421 NORWAY CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 422 NORWAY BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 423 NORWAY FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 424 NORWAY RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 425 NORWAY PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 426 NORWAY CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 427 NORWAY FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 428 NORWAY FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 429 NORWAY RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 430 POLAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 431 POLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 432 POLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 433 POLAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 434 POLAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 435 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 436 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 437 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 438 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 439 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 440 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 441 POLAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 442 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 443 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 444 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 445 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 446 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 447 POLAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 448 POLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 449 POLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 450 POLAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 451 POLAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 452 POLAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 453 POLAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 454 POLAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 455 POLAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 456 POLAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 457 POLAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 458 POLAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)