Europe Encapsulated Calcium Propionate Market

Market Size in USD Million

CAGR :

%

USD

102.90 Million

USD

174.18 Million

2024

2032

USD

102.90 Million

USD

174.18 Million

2024

2032

| 2025 –2032 | |

| USD 102.90 Million | |

| USD 174.18 Million | |

|

|

|

|

Europe Encapsulated Calcium Propionate Market Size

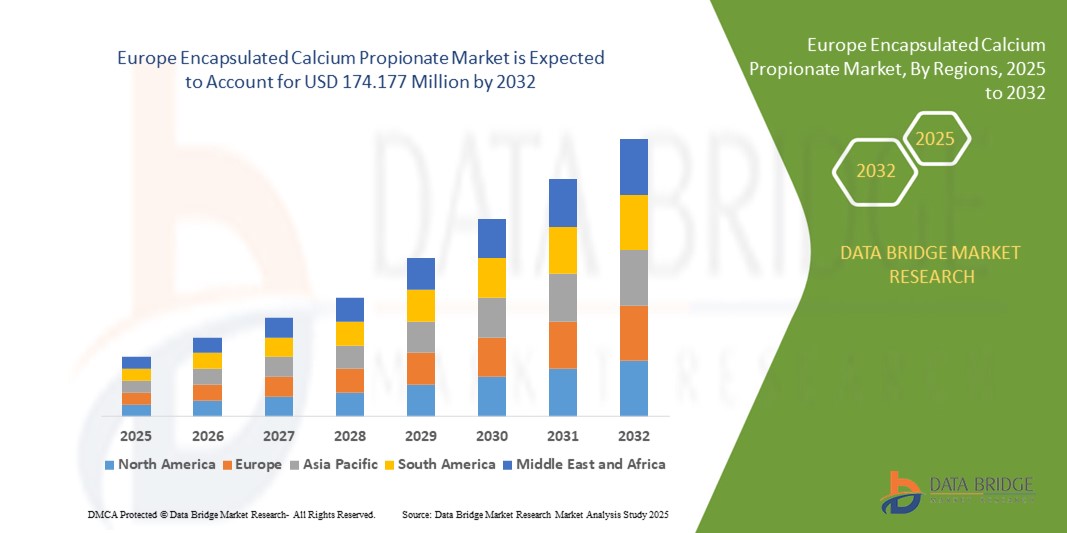

- The Europe encapsulated calcium propionate market size was valued at USD 102.90 million in 2024 and is expected to reach USD 174.177 million by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by the rising demand for extended shelf-life bakery and confectionery products, driven by increasing consumer preference for preservative solutions with controlled release properties

- Growing focus on reducing food waste and maintaining product freshness across supply chains is further accelerating the adoption of Europe encapsulated calcium propionate among food manufacturers

Europe Encapsulated Calcium Propionate Market Analysis

- The market is witnessing steady growth as food manufacturers seek safer and more effective ways to control microbial spoilage without compromising product quality

- Increasing health awareness and stringent food safety regulations are encouraging the use of encapsulated preservatives that ensure controlled release and minimal chemical interaction with food components

- U.K. is projected to dominate the in Europe Encapsulated Calcium Propionate market from 2025 to 2032, driven by its advanced food processing infrastructure, high regulatory standards for food safety, and strong demand for clean-label preservatives

- Germany is expected to witness the highest compound annual growth rate (CAGR) in the Europe encapsulated calcium propionate market due to rapid technological advancements in food preservation, increasing consumer preference for high-quality packaged foods, and rising investments in innovative encapsulation solutions

- The food grade segment held the largest market revenue share in 2024, driven by the rising demand for packaged bakery and dairy products requiring longer shelf life and improved safety standards. Increasing regulatory emphasis on food quality and consumer preference for safe, clean-label preservatives further support the dominance of this segment

Report Scope and Europe Encapsulated Calcium Propionate Market Segmentation

|

Attributes |

Europe Encapsulated Calcium Propionate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Encapsulated Calcium Propionate Market Trends

Rising Adoption Of Encapsulation Technology In Food Preservation

• The increasing use of encapsulation techniques in food preservation is transforming the calcium propionate market by enabling controlled release and improving the stability of preservatives. This ensures extended shelf life for bakery and dairy products while maintaining flavor and texture quality. The technology also reduces direct chemical interaction with food ingredients, enhancing product safety and consumer acceptance. As a result, more manufacturers are integrating encapsulated solutions into large-scale production lines to meet growing quality demands

• The demand for clean-label and minimally processed food products is driving innovation in encapsulation technologies. Manufacturers are adopting microencapsulation to reduce direct chemical interaction with food ingredients, aligning with consumer preferences for natural and safe food additives. This trend is supported by rising health consciousness, as consumers increasingly seek preservative solutions with fewer synthetic components while maintaining food freshness. Investments in research and development are boosting the creation of eco-friendly encapsulation materials to meet regulatory and sustainability standards

• Encapsulation also helps in masking the odor and taste of calcium propionate, making it more suitable for a wider range of food applications. This is encouraging its adoption among bakery chains, dairy processors, and packaged food manufacturers seeking improved product quality. Furthermore, encapsulation enables controlled ingredient release, preserving flavor profiles during storage and transportation. Its role in enhancing consumer satisfaction is becoming central to product differentiation strategies in the competitive food industry

• For instance, in 2023, several bakery producers in Europe introduced encapsulated calcium propionate formulations that maintained product freshness for longer durations, reducing food wastage and production costs. These initiatives also helped manufacturers comply with strict food safety regulations while optimizing inventory management systems. The ability to extend product shelf life contributed to lowering logistic expenses and improving profit margins for food companies

• While encapsulation technology is expanding the application scope, continuous research, cost optimization, and advanced delivery systems are essential to achieve maximum commercial benefits. Collaboration between food scientists, packaging innovators, and ingredient suppliers is key to unlocking its full potential. In addition, training programs for manufacturers can accelerate adoption and standardization across both developed and emerging markets

Europe Encapsulated Calcium Propionate Market Dynamics

Driver

Growing Demand For Extended Shelf-Life And Food Safety

• Rising concerns over food spoilage and microbial contamination are prompting food manufacturers to adopt preservatives that ensure both safety and quality. Europe encapsulated calcium propionate offers targeted release, reducing overuse while maintaining efficacy. It provides a safer and cleaner solution that aligns with consumer preferences for minimally processed food products. Food brands are increasingly highlighting encapsulation on product labels as a mark of quality and innovation

• The growth of the bakery industry, coupled with changing dietary habits and expanding urban populations, is significantly driving the demand for encapsulated preservatives that enhance product shelf life without compromising taste. Busy lifestyles and higher demand for convenience foods are increasing the need for products with longer storage stability. Encapsulation technology ensures freshness without relying on excessive chemical treatments, appealing to health-conscious buyers

• Government initiatives promoting food safety and stringent regulations on microbial contamination are pushing food processors toward safer and more effective preservation methods. Regulatory compliance is becoming a major factor influencing procurement decisions in food manufacturing plants. Encapsulation provides a solution that meets both international quality standards and evolving consumer expectations for transparency in ingredients

• For instance, in 2022, regulatory authorities across Europe introduced stricter guidelines promoting the use of encapsulated preservatives in processed foods to enhance freshness and reduce direct chemical exposure. This initiative accelerated adoption among European bakery chains, dairy manufacturers, and packaged food producers aiming to comply with clean-label requirements and extend product shelf life, while supporting the region’s broader sustainability and food safety goals

• While food safety concerns are accelerating demand, ensuring affordability and large-scale availability remains a focus area for industry stakeholders. Scaling up production and improving distribution networks will be crucial to reaching small and medium-sized enterprises. Partnerships between technology providers and food companies can help reduce costs and expand market penetration

Restraint/Challenge

High Production Costs And Limited Awareness In Emerging Markets

• The production of Europe encapsulated calcium propionate involves advanced processing technologies, driving up manufacturing costs compared to conventional preservatives. This price difference often limits adoption in cost-sensitive regions. Smaller bakeries and dairy units struggle to justify the investment, especially when profit margins are tight. Subsidies or collaborative financing models may be required to bridge the affordability gap

• In many developing markets, food processors lack awareness regarding the benefits of encapsulated preservatives, continuing to rely on traditional chemical additives that are cheaper but less effective. Limited marketing and education efforts slow down technology acceptance despite its proven advantages. Awareness campaigns through trade associations and government agencies can play a vital role in shifting perceptions

• Limited R&D infrastructure in emerging economies further slows the adoption of encapsulation technologies, as local manufacturers face barriers in scaling up advanced preservation methods. The absence of skilled professionals and technical expertise hinders innovation and quality control in production facilities. Joint ventures with food tech companies can help transfer knowledge and build local capabilities

• For instance, in 2023, small-scale bakeries across Europe reported hesitation in adopting encapsulated preservatives due to increased production costs and limited technical expertise. This dependency on conventional preservation methods continues to limit shelf-life optimization and market competitiveness, highlighting the need for government-backed initiatives and industry collaborations to showcase the long-term economic and quality advantages of encapsulated solutions

• To overcome these challenges, industry players need to focus on cost optimization, training programs, and awareness campaigns to drive adoption in high-growth potential markets. Introducing modular encapsulation units and low-cost delivery systems can make the technology more accessible. Regional partnerships can also facilitate shared resources and knowledge exchange to support small-scale manufacturers

Europe Encapsulated Calcium Propionate Market Scope

The market is segmented on the basis of grade, form, and application.

- By Grade

On the basis of grade, the Europe encapsulated calcium propionate market is segmented into food grade and feed grade. The food grade segment held the largest market revenue share in 2024, driven by the rising demand for packaged bakery and dairy products requiring longer shelf life and improved safety standards. Increasing regulatory emphasis on food quality and consumer preference for safe, clean-label preservatives further support the dominance of this segment.

The feed grade segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing need to prevent microbial spoilage in animal feed and maintain nutritional quality. The rising livestock population and awareness regarding animal health management are accelerating adoption in this category.

- By Form

On the basis of form, the encapsulated calcium propionate market is segmented into powder and granular. The powder segment accounted for the largest revenue share in 2024, as it offers ease of mixing, uniform distribution in food products, and cost-effectiveness in large-scale production. Powdered Europe Encapsulated Calcium Propionate is widely used by bakery manufacturers due to its superior solubility and consistent preservation performance.

The granular segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its advantages in controlled release, improved handling properties, and reduced dust formation. This form is gaining traction in specialized food processing applications where precise dosage and safety are critical.

- By Application

On the basis of on application, the Europe encapsulated calcium propionate market is segmented into food & beverages and feed. The food & beverages segment held the dominant revenue share in 2024, driven by the rising consumption of baked goods, dairy products, and ready-to-eat meals where extended shelf life and freshness are essential. Increasing urbanization and demand for convenience foods are further contributing to segment growth.

The feed segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising livestock production and the need to prevent feed spoilage in storage and transportation. Europe Encapsulated Calcium Propionate helps maintain feed quality, reducing economic losses for farmers and ensuring animal health standards.

Europe Encapsulated Calcium Propionate Market Regional Analysis

- U.K. Europe encapsulated calcium propionate market is projected to dominate the regional market from 2025 to 2032, driven by its advanced food processing infrastructure, high regulatory standards for food safety, and strong demand for clean-label preservatives

- The presence of leading bakery and confectionery manufacturers, coupled with rising investments in innovative encapsulation technologies, positions the U.K. as a key contributor to Europe’s market share

Germany Encapsulated Calcium Propionate Market Insight

The Germany encapsulated calcium propionate market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rapid technological advancements in food preservation and growing consumer demand for high-quality, long-shelf-life bakery and dairy products. Germany’s emphasis on research-driven innovations and sustainable food additives further accelerates the adoption of encapsulated calcium propionate across the food processing industry.

Europe Encapsulated Calcium Propionate Market Share

The Europe encapsulated calcium propionate industry is primarily led by well-established companies, including:

- Ingrizo NV (Belgium)

- Glanbia plc (Ireland)

- TasteTech (U.K.)

- Glanbia plc (Ireland)

- ADDCON GmbH (Germany)

- AB Mauri (U.K.)

- Perstorp (Sweden)

- TasteTech (U.K.)

Latest Developments in Europe Encapsulated Calcium Propionate Market

- In August 2022, Balchem Corporation announced its acquisition of Cardinal Associates Inc., operating as "Bergstrom Nutrition,". The acquisition of Bergstrom Nutrition by Balchem Corporation brings several strategic advantages. The expanded product range provides new growth opportunities, strengthens market presence, and complements Balchem's expertise in science-backed mineral products, contributing to overall business development and success

- In June 2022, Balchem Corporation successfully concluded its acquisition of Kappa Bioscience AS, a prominent science-driven manufacturer headquartered in Oslo, Norway, specializing in vitamin K2 for the human nutrition industry. This acquisition enhances the company's product offerings, broadens its capabilities, and opens up new avenues for growth. The acquisition aligns with Balchem's commitment to innovation and market leadership, providing a valuable asset to meet evolving consumer demands in the nutrition sector and contributing to overall business expansion and success

- In September 2022, Ingrizo NV announced that Korys decided to invest in Ingrizo to allow it to continue with its growth path and with the development of its present and future product portfolios. The participation of Korys had a positive effect since both parties had a strong ambition to significantly expand the turnover

- In November 2023, at IBA Munich, a renowned trade fair for bakery and pastry sectors, Llopartec showcased its expertise in personalized food solutions, positioning itself as a leader in the international market. The event, a hub of intercommunication and innovation, hosted 1,073 exhibitors from 46 countries and drew a record attendance of 57,000 visitors from 150 nations. Llopartec, with its stand, presented new products and innovations primarily targeting the bakery, pastry, and microencapsulation sectors. This exhibition helped the company to showcase its product portfolio and innovation and in expansion of their market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Encapsulated Calcium Propionate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Encapsulated Calcium Propionate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Encapsulated Calcium Propionate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.