Europe Electric Enclosure Market

Market Size in USD Billion

CAGR :

%

USD

6.20 Billion

USD

10.81 Billion

2024

2032

USD

6.20 Billion

USD

10.81 Billion

2024

2032

| 2025 –2032 | |

| USD 6.20 Billion | |

| USD 10.81 Billion | |

|

|

|

|

Electric Enclosure Market Size

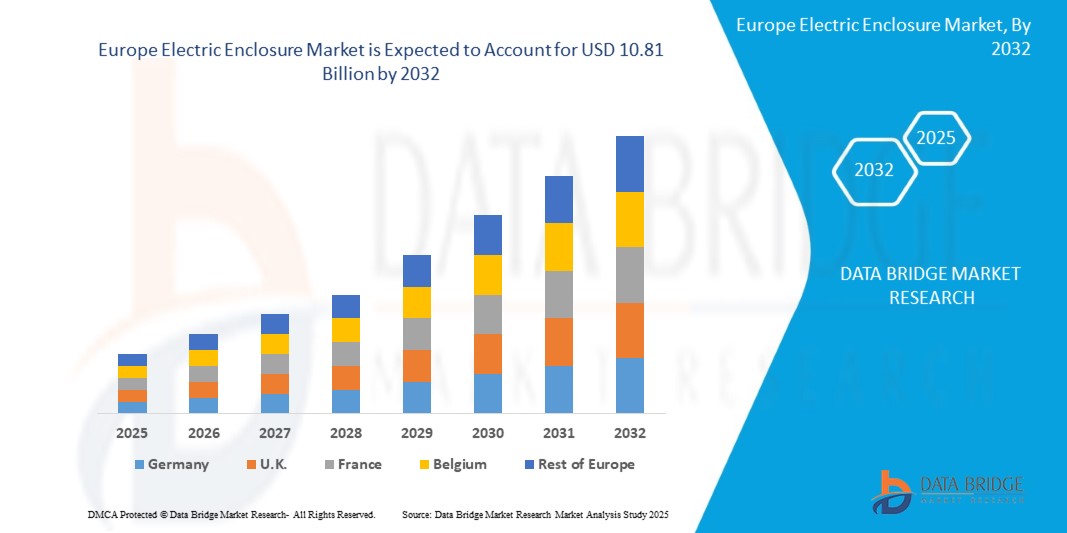

- The Europe Electric Enclosure market size was valued at USD 6.20 billion in 2024 and is expected to reach USD 10.81 billion by 2032, at a CAGR of 7.2% during the forecast period

- This substantial growth is primarily driven by the increasing demand for reliable electrical infrastructure, rapid industrialization, and the expansion of renewable energy projects across Europe. The rising adoption of automation technologies and the need for robust protection of electrical components in harsh environments are further accelerating market expansion.

- The region’s commitment to sustainable energy solutions, supported by significant investments in smart grids, government initiatives promoting energy efficiency, and a strong presence of leading manufacturers, is a key contributor to the market’s upward trajectory. Additionally, the growing integration of electric enclosures in telecommunications, transportation, and smart city projects is driving significant demand across Europe.

Electric Enclosure Market Analysis

- Electric enclosures are protective casings designed to safeguard electrical and electronic components from environmental hazards, ensuring operational reliability and safety. These enclosures, including metallic and non-metallic types, are critical for applications in industrial automation, energy and power systems, telecommunications, transportation infrastructure, and building construction.

- The market is significantly fueled by Europe’s leadership in industrial automation, with the region accounting for over 30% of global automation spending in 2023, led by Germany. The rapid expansion of renewable energy projects, with Europe’s wind and solar installations generating 22% of total electricity in 2023, drives demand for enclosures to protect control systems and power distribution equipment.

- Technological advancements, such as corrosion-resistant materials and modular designs, are enhancing enclosure durability and adaptability, supporting applications in critical infrastructure and smart grids. The European Union’s Green Deal, aiming for carbon neutrality by 2050, is fostering innovation and supporting market growth.

- Germany dominates the market with a commanding 35.4% revenue share in 2024, valued at USD 2.19 billion, driven by its robust industrial base, renewable energy investments, and key players like Rittal and Siemens. The United Kingdom is expected to witness the fastest growth rate, with a projected CAGR of 8.1% from 2025 to 2032, propelled by government initiatives like the Net Zero Strategy and increasing demand in telecommunications and transportation.

- Among product types, the metallic enclosures segment held the largest market share of 62.8% in 2024, valued at USD 3.89 billion, attributed to their widespread use in industrial and energy applications due to durability and high protection levels.

Report Scope and Electric Enclosure Market Segmentation

|

Attributes |

Electric Enclosure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electric Enclosure Market Trends

“Smart Enclosures, Sustainable Materials, Modular Designs, and IoT Integration”

- The adoption of smart enclosures with IoT-enabled monitoring systems is a prominent trend, with over 20% of new enclosures in 2024 incorporating sensors for real-time environmental and operational data, enhancing reliability in industrial and energy applications.

- The use of sustainable and recyclable materials, such as eco-friendly polycarbonates and fiberglass, accounted for 15% of new enclosure deployments in 2024, aligning with the EU’s circular economy and sustainability initiatives.

- Increasing focus on modular enclosure designs, with 25% of new solutions in 2024 offering customizable configurations, is gaining traction in industrial automation and telecommunications for flexible installation and scalability.

- The adoption of corrosion-resistant and IP-rated enclosures is growing, with a 18% increase in demand in 2024, driven by applications in harsh environments like renewable energy and transportation infrastructure.

- Integration of electric enclosures with smart grid and IoT ecosystems, particularly in energy and telecommunications, is expanding, with 22% of new solutions in 2024 designed for real-time data analytics and automation.

- Growing demand for compact and lightweight enclosures in urban infrastructure projects, such as smart cities and transportation, is driving innovation in enclosure design and materials across Europe.

Electric Enclosure Market Dynamics

Driver

“Renewable Energy Expansion, Industrial Automation, Smart Grids, Government Initiatives, and Infrastructure Development”

- The rapid expansion of renewable energy projects, with Europe’s renewable energy capacity reaching 650 GW in 2023, drives significant demand for electric enclosures to protect control systems, inverters, and power distribution equipment in wind, solar, and hydroelectric installations.

- The proliferation of industrial automation, with Europe’s Industry 4.0 investments projected to reach USD 150 billion by 2026, fuels the need for enclosures to safeguard sensitive electrical components in manufacturing and processing facilities.

- The development of smart grid infrastructure, with over 500 smart grid projects active in Europe in 2023, increases demand for enclosures to support advanced metering, distribution automation, and renewable energy integration.

- Government initiatives, such as the EU’s Green Deal and Germany’s Energiewende, provide substantial funding and regulatory support for energy efficiency and sustainable infrastructure, fostering adoption of electric enclosures across industries.

- Advancements in enclosure materials, such as stainless steel and polycarbonate, enhance durability and protection, enabling applications in harsh environments like offshore wind farms and transportation systems.

- The growing demand for reliable telecommunications infrastructure, with 5G subscriptions in Europe projected to reach 600 million by 2027, drives the integration of enclosures in base stations and network equipment.

Restraint/Challenge

“High Material Costs, Supply Chain Disruptions, Regulatory Compliance, Skill Shortages, and Technological Obsolescence”

- The high cost of advanced materials, such as stainless steel and corrosion-resistant alloys, poses a challenge to adoption in cost-sensitive markets, limiting scalability for smaller manufacturers and end-users.

- Supply chain disruptions, including raw material shortages and logistical constraints, have increased production costs by 10-12% since 2023, impacting market growth and delivery timelines.

- Stringent regulatory requirements, such as EU’s RoHS and REACH directives, increase compliance costs and complexity for enclosure manufacturers, particularly for hazardous substance management.

- Skill shortages in advanced manufacturing and enclosure design, with a projected deficit of 200,000 skilled workers in Europe’s electrical industry by 2026, pose challenges to implementation and innovation.

- Rapid technological obsolescence, driven by continuous advancements in enclosure materials and IoT integration, pressures manufacturers to invest heavily in R&D, reducing profitability for smaller players.

- Environmental concerns regarding non-recyclable enclosure materials, coupled with increasing pressure to meet EU sustainability standards, create challenges for manufacturers to develop eco-friendly solutions.

Electric Enclosure Market Scope

The Europe Electric Enclosure Market is segmented on the basis of product type, material, application, mounting type, end-user, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into metallic enclosures and non-metallic enclosures. The metallic enclosures segment dominated with a 62.8% revenue share in 2024, valued at USD 3.89 billion, driven by their durability and use in industrial and energy applications.

The non-metallic enclosures segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2032, fueled by demand for lightweight and corrosion-resistant solutions.

- By MateriaL

On the basis of material, the market is segmented into steel, stainless steel, aluminum, polycarbonate, fiberglass, and others. The stainless steel segment held the largest share of 38.5% in 2024, driven by its corrosion resistance and use in harsh environments.

The polycarbonate segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2032, fueled by its lightweight and eco-friendly properties.

- By Application

On the basis of application, the market is segmented into industrial automation, energy and power, telecommunications, transportation, building and construction, and others. The energy and power segment accounted for the largest revenue share of 40.2% in 2024, driven by renewable energy and smart grid projects.

The telecommunications segment is expected to grow at the fastest CAGR of 8.5% from 2025 to 2032, fueled by 5G infrastructure expansion.

- By Mounting Type

On the basis of mounting type, the market is segmented into wall-mounted, floor-mounted, pole-mounted, and free-standing. The wall-mounted segment held a significant share of 45.6% in 2024, driven by its use in industrial and commercial applications.

The pole-mounted segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2032, fueled by telecommunications and transportation infrastructure.

- By End-User

On the basis of end-user, the market is segmented into manufacturing industries, utilities, commercial facilities, residential buildings, government institutions, and others. The manufacturing industries segment dominated with a 42.3% revenue share in 2024, driven by industrial automation demand.

The utilities segment is expected to grow at the fastest CAGR of 8.2% from 2025 to 2032, fueled by renewable energy and smart grid adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, distributors, and online retail. The direct sales segment held the largest share of 58.7% in 2024, driven by B2B contracts with manufacturers and utilities.

The online retail segment is expected to grow at the fastest CAGR of 8.6% from 2025 to 2032, fueled by e-commerce growth.

Electric Enclosure Market Regional Analysis

Germany Electric Enclosure Market Insights

Germany led the market with a commanding 35.4% revenue share in 2024, valued at USD 2.19 billion, driven by its robust industrial base, leadership in renewable energy, and presence of key players like Rittal and Siemens. The country’s focus on Industry 4.0 and government support through Energiewende solidify its dominance.

United Kingdom Electric Enclosure Market Insights

The United Kingdom is poised to grow at the fastest CAGR of 8.1% from 2025 to 2032, driven by the Net Zero Strategy, smart city initiatives, and 5G infrastructure expansion. The UK accounted for 18.7% of the market in 2024, with strong demand in telecommunications and transportation.

France Electric Enclosure Market Insights

France held a 15.2% market share in 2024, driven by its renewable energy projects and smart grid investments. The adoption of enclosures in industrial automation and transportation, supported by players like Schneider Electric, supports market growth.

Electric Enclosure Market Share

- The Electric Enclosure industry is primarily led by well-established companies, including:

- Rittal GmbH & Co. KG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- Eaton Corporation plc (Ireland)

- Legrand SA (France)

- nVent Electric plc (United Kingdom)

- Eldon Holding AB (Sweden)

- Fibox Oy Ab (Finland)

- Saginaw Control & Engineering (United States)

- B&R Enclosures Pty Ltd. (Australia)

- Adalet (United States)

- Pentair plc (United Kingdom)

- Hammond Manufacturing Co. Ltd. (Canada)

- Spelsberg GmbH + Co. KG (Germany)

- ETA S.p.A. (Italy)

Latest Developments in Europe Electric Enclosure Market

- In September 2023, Legrand introduced a new line of recyclable polycarbonate enclosures, aimed at reducing environmental impact in electrical and building infrastructure. These enclosures are certified for low environmental impact and are fully recyclable, aligning with growing demand for sustainable construction materials. The product line has already gained traction in green building projects across Spain and Italy, contributing to eco-friendly infrastructure development in Europe.

- In November 2023, Rittal unveiled its AX Plastic Enclosure series, designed specifically for compact and lightweight deployments in telecommunications, smart cities, and infrastructure projects. Offering an IP66 protection rating and a 15% improvement in installation efficiency, the new enclosures are ideal for outdoor environments and high-demand utility sectors. The AX series enhances both safety and operational convenience in harsh conditions.

- In February 2024, Schneider Electric released the EcoStruxure Enclosure, an IoT-enabled solution designed for smart grid and critical infrastructure applications. This enclosure supports real-time monitoring, predictive maintenance, and remote management, enabling a 20% reduction in maintenance costs. It has been successfully adopted in over 50 smart energy projects across France and Germany, reinforcing Schneider’s leadership in digital energy management.

- In April 2024, ABB partnered with Siemens to co-develop modular enclosures tailored for offshore wind farm environments. These enclosures boast enhanced corrosion resistance—improved by 25%—making them well-suited for harsh marine conditions. The collaboration aims to support Europe’s renewable energy expansion, particularly in scaling offshore wind infrastructure in the North Sea and surrounding regions.

- In July 2024, nVent Electric introduced the Hoffman Smart Enclosure, an intelligent enclosure system equipped with integrated sensors for environmental and system condition monitoring. This innovation helps reduce downtime by 18% in industrial automation setups, particularly in the UK and Netherlands. The enclosure enables predictive analytics, improving system reliability and reducing the need for manual inspection in critical operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ELECTRIC ENCLOSURE MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE ELECTRIC ENCLOSURE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE ELECTRIC ENCLOSURE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 EUROPE ELECTRIC ENCLOSURE MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 METALLIC

7.2.1 ALUMINUM

7.2.2 STAINLESS STEEL

7.2.3 MILD STEEL

7.2.4 OTHERS

7.3 NON-METALLIC

7.3.1 FIBERGLASS

7.3.2 POLYCARBONATE

7.3.3 PVC

7.3.4 POLYESTER

8 EUROPE ELECTRIC ENCLOSURE MARKET, BY TYPE

8.1 OVERVIEW

8.2 JUNCTION ENCLOSURES

8.3 DISCONNECT ENCLOSURES

8.4 OPERATOR INTERFACE ENCLOSURES

8.5 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

8.6 PUSH BUTTON ENCLOSURES

9 EUROPE ELECTRIC ENCLOSURE MARKET, BY DESIGN

9.1 OVERVIEW

9.2 STANDARD TYPE

9.3 CUSTOM TYPE

10 EUROPE ELECTRIC ENCLOSURE MARKET, BY MOUNTED TYPE

10.1 OVERVIEW

10.2 WALL MOUNTED ENCLOSURE

10.3 FLOOR –MOUNTED/FREE STANDING ENCLOSURE

10.4 UNDERGROUND

11 EUROPE ELECTRIC ENCLOSURE MARKET, BY FORM FACTOR

11.1 OVERVIEW

11.2 SMALL ENCLOSURE

11.2.1 TERMINAL/JUNCTION BOXES

11.2.2 ELECTRICAL BOX ENCLOSURES

11.2.3 BUS ENCLOSURES

11.3 COMPACT ENCLOSURE

11.3.1 SLOPPED ROOF ENCLOSURES

11.3.2 MINING ENCLOSURES

11.3.3 HYGENIC DESIGN ENCLOSURES

11.3.4 SINGLE-STANDING ENCLOSURES

11.4 FREE-SIZE ENCLOSURE

11.4.1 SYSTEM ENCLOSURES

11.4.2 OPERATOR CONSOLES

11.4.3 BAYING SYSTEMS

12 EUROPE ELECTRIC ENCLOSURE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 DUST TIGHT

12.3 HAZARDOUS ENVIROMENT

12.4 DRIP-TIGHT

12.5 FLAME/EXPLOSION

12.6 OTHERS

13 EUROPE ELECTRIC ENCLOSURE MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 POWER GENERATION & DISTRIBUTION

13.2.1 JUNCTION ENCLOSURES

13.2.2 DISCONNECT ENCLOSURES

13.2.3 OPERATOR INTERFACE ENCLOSURES

13.2.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.2.5 PUSH BUTTON ENCLOSURES

13.3 OIL & GAS

13.3.1 JUNCTION ENCLOSURES

13.3.2 DISCONNECT ENCLOSURES

13.3.3 OPERATOR INTERFACE ENCLOSURES

13.3.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.3.5 PUSH BUTTON ENCLOSURES

13.4 METALS & MINING

13.4.1 JUNCTION ENCLOSURES

13.4.2 DISCONNECT ENCLOSURES

13.4.3 OPERATOR INTERFACE ENCLOSURES

13.4.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.4.5 PUSH BUTTON ENCLOSURES

13.5 MEDICAL

13.5.1 JUNCTION ENCLOSURES

13.5.2 DISCONNECT ENCLOSURES

13.5.3 OPERATOR INTERFACE ENCLOSURES

13.5.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.5.5 PUSH BUTTON ENCLOSURES

13.6 PULP & PAPER

13.6.1 JUNCTION ENCLOSURES

13.6.2 DISCONNECT ENCLOSURES

13.6.3 OPERATOR INTERFACE ENCLOSURES

13.6.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.6.5 PUSH BUTTON ENCLOSURES

13.7 FOOD & BEVERAGES

13.7.1 JUNCTION ENCLOSURES

13.7.2 DISCONNECT ENCLOSURES

13.7.3 OPERATOR INTERFACE ENCLOSURES

13.7.4 ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.7.5 PUSH BUTTON ENCLOSURES

13.8 TRANSPORTATION

13.8.1 BY ENCLOSURES TYPE

13.8.1.1. JUNCTION ENCLOSURES

13.8.1.2. DISCONNECT ENCLOSURES

13.8.1.3. OPERATOR INTERFACE ENCLOSURES

13.8.1.4. ENVIROMENT AND CLIMATE CONTROL ENCLOSURES

13.8.1.5. PUSH BUTTON ENCLOSURE

13.8.2 BY TYPE

13.8.2.1. ROADWAYS

13.8.2.2. RAILWAYS

13.8.2.3. AIRWAYS

13.9 OTHERS

14 EUROPE ELECTRIC ENCLOSURE MARKET, BY REGION

14.1 EUROPE ELECTRIC ENCLOSURE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 EUROPE

14.1.1.1. GERMANY

14.1.1.2. FRANCE

14.1.1.3. U.K.

14.1.1.4. ITALY

14.1.1.5. SPAIN

14.1.1.6. RUSSIA

14.1.1.7. TURKEY

14.1.1.8. BELGIUM

14.1.1.9. NETHERLANDS

14.1.1.10. SWITZERLAND

14.1.1.11. REST OF EUROPE

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 EUROPE ELECTRIC ENCLOSURE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT & APPROVALS

15.4 EXPANSIONS

15.5 REGULATORY CHANGES

15.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 EUROPE ELECTRIC ENCLOSURE MARKET , SWOT & DBMR ANALYSIS

17 EUROPE ELECTRIC ENCLOSURE MARKET, COMPANY PROFILE

17.1 RITTAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 SCHNEIDER ELECTRIC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 ABB LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EATON CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 EMERSON CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AZZ INCORPORATED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 LEGRAND SA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 SOCOMEC GROUP SA

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 FIBOX

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 TAKACHI ELECTRONICS ENCLOSURE CO. LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 DELTRON ENCLOSURES

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 ERNTEC PTY LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 ROSE SYSTEMTECHNIK GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 BOPLA GEHÄUSE SYSTEME GMBH

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 OKW GEHÄUSESYSTEME

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 SCHULER PRESSEN GMBH

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 DACHSER GMBH & CO. KG

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 MUELLER HEINRICH MASCHINENFABRIK

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 GUENTHER SPELSBERG

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 ELDON SRL

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 RUHSTART GMBH

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Electric Enclosure Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Electric Enclosure Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Electric Enclosure Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.