Europe Drug Device Combination Market

Market Size in USD Billion

CAGR :

%

USD

4.99 Billion

USD

10.46 Billion

2025

2033

USD

4.99 Billion

USD

10.46 Billion

2025

2033

| 2026 –2033 | |

| USD 4.99 Billion | |

| USD 10.46 Billion | |

|

|

|

|

Europe Drug-Device Combination Market Size

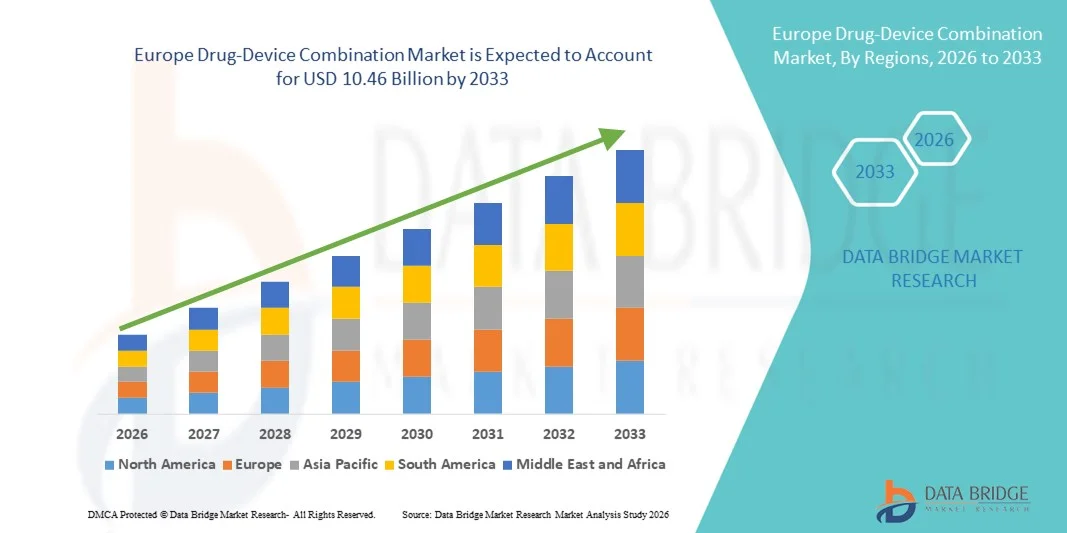

- The Europe drug-device combination market size was valued at USD 4.99 billion in 2025 and is expected to reach USD 10.46 billion by 2033, at a CAGR of 9.70% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases strong healthcare infrastructure across European countries, and continuous technological advancements in drug‑enabled medical devices, which together are driving increased adoption of integrated drug‑device therapies and delivery systems

- Furthermore, favourable regulatory frameworks supportive reimbursement policies, and increasing demand for innovative, patient‑centric treatments are encouraging development and uptake of combination products across hospitals, ambulatory care, and home care settings. These converging factors are accelerating the uptake of drug‑device combination solutions, thereby significantly boosting the industry’s growth across Europe.

Europe Drug-Device Combination Market Analysis

- Drug‑device combination products, integrating pharmaceutical therapies with medical devices to optimize drug delivery, are becoming increasingly essential in Europe due to their ability to enhance treatment efficacy, improve patient adherence, and enable personalized healthcare solutions across chronic and acute conditions

- The growing adoption of these products is primarily driven by the rising prevalence of chronic diseases such as diabetes, respiratory disorders, and cardiovascular conditions, along with increasing demand for innovative, patient‑centric therapies and advancements in device technologies that facilitate precise, controlled drug administration

- Germany dominated the Europe drug‑device combination market in 2025 with a 25.3% revenue share, owing to its well-established healthcare infrastructure, supportive regulatory frameworks, and high healthcare expenditure, with adoption across hospitals, ambulatory care, and homecare settings

- Poland is expected to be the fastest-growing country in the Europe drug‑device combination market supported by expanding healthcare access, rising awareness of combination therapies, and increasing investment in advanced medical technologies

- Smart inhaler segment dominated the market with a 38.5% share in 2025, driven by its convenience, accurate drug delivery, real-time monitoring capabilities, and widespread adoption for chronic respiratory diseases such as asthma and COPD

Report Scope and Europe Drug-Device Combination Market Segmentation

|

Attributes |

Europe Drug-Device Combination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Drug-Device Combination Market Trends

Advancements Through Smart Inhalers and Connected Devices

- A significant and accelerating trend in the Europe drug‑device combination market is the increasing integration of digital and connected features in drug delivery devices, including smart inhalers and prefilled injection pens, which enable real-time monitoring, dosing reminders, and improved patient adherence

- For instance, Propeller Health smart inhalers track usage patterns and sync with mobile apps, providing patients and healthcare providers actionable insights to optimize therapy. Similarly, Teva’s Digihaler platform allows remote monitoring of inhalation technique and adherence

- Connected drug‑device solutions allow for personalized therapy adjustments, automated alerts for missed doses, and integration with patient health platforms, improving overall treatment outcomes. For instance, smart insulin pens record dose history and sync with mobile apps to provide clinicians with accurate dosing data

- These devices also enable healthcare providers to monitor chronic disease management remotely, facilitating proactive interventions and reducing hospitalizations, thus enhancing continuity of care

- This trend towards digitalization and connected drug delivery systems is reshaping patient expectations for therapy management. Consequently, companies such as AstraZeneca are developing smart inhalers with integrated sensors, real-time monitoring, and app connectivity

- The demand for drug-device combinations with digital connectivity and real-time monitoring capabilities is growing rapidly across hospitals, clinics, and homecare settings, as both patients and clinicians prioritize adherence, convenience, and comprehensive disease management

- Increasing partnerships between pharmaceutical companies and technology providers are accelerating innovation, enabling development of next-generation combination devices that combine AI analytics, sensors, and cloud-based monitoring for smarter therapy delivery

Europe Drug-Device Combination Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Demand for Personalized Therapy

- The increasing prevalence of chronic conditions such as asthma, diabetes, and cardiovascular disorders, coupled with the growing focus on patient-centric and personalized therapies, is a major driver for the Europe drug-device combination market

- For instance, in March 2025, AstraZeneca launched an upgraded smart inhaler with connected features to monitor patient adherence and optimize respiratory therapy in European clinics. Such strategies by key companies are expected to drive market growth in the forecast period

- As patients seek more convenient, accurate, and safe drug delivery solutions, drug-device combinations offer advantages such as precise dosing, adherence tracking, and integrated monitoring

- Furthermore, healthcare providers are increasingly adopting these solutions for enhanced disease management, remote patient monitoring, and integration with digital health platforms

- The convenience of connected dosing, real-time monitoring, and patient data integration are key factors propelling the adoption of these products in hospitals, clinics, and homecare settings across Europe

- Rising awareness among patients and caregivers about therapy adherence and disease management is increasing demand for devices that provide guidance and reminders, further supporting market growth

- Government initiatives promoting digital health adoption, remote patient monitoring, and chronic disease management programs are also fueling the uptake of smart drug-device combinations across Europe

Restraint/Challenge

Regulatory Hurdles and Device Integration Complexities

- Concerns surrounding complex regulatory compliance and device approval requirements across multiple European countries pose a significant challenge to faster market adoption. Drug-device combinations must meet both pharmaceutical and medical device regulations, complicating market entry

- For instance, navigating EU Medical Device Regulation (MDR) and EMA guidelines simultaneously can delay product launch timelines, making companies cautious in rolling out innovative devices

- Ensuring consistent device performance, accuracy in drug delivery, and integration with digital health platforms is critical, as any malfunction or data error could compromise patient safety and adherence

- In addition, relatively high development and manufacturing costs for advanced combination devices can be a barrier, particularly for smaller companies or for devices targeting price-sensitive segments

- Overcoming these challenges through regulatory harmonization, robust device validation, and cost-effective design will be vital for sustained market growth and broader adoption across Europe

- Interoperability issues between devices and existing hospital IT infrastructure can limit seamless integration and slow adoption in clinical settings

- Data privacy and cybersecurity concerns related to connected drug-device systems pose additional hurdles, as compliance with GDPR and other regional data protection laws is essential to maintain patient trust

Europe Drug-Device Combination Market Scope

The market is segmented on the basis of product, application type, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into auto-injector, microneedle patch, digital pill, smart inhaler, drug delivery hydrogels, drug-eluting lens, and others. Smart Inhaler segment dominated the market with the largest revenue share of 38.5% in 2025, driven by its widespread use in managing chronic respiratory diseases such as asthma and COPD. Patients and healthcare providers prefer smart inhalers for their ability to improve medication adherence through real-time usage tracking and app integration. The connected features allow remote monitoring by physicians, providing data on inhalation patterns, missed doses, and therapy optimization. Smart inhalers also reduce hospitalizations and emergency interventions by enabling timely therapeutic adjustments. The ease of use, portability, and compatibility with patient health apps further reinforce their popularity. In addition, regulatory support and reimbursement policies in Europe enhance adoption across clinics and hospitals.

Microneedle Patch segment is anticipated to witness the fastest growth at a CAGR of 14.2% from 2026 to 2033, fueled by its pain-free, minimally invasive delivery of vaccines, insulin, and biologics. Microneedle patches improve patient compliance, particularly among pediatric and geriatric populations who often experience difficulty with conventional injections. The technology allows self-administration at home, reducing hospital visits and healthcare costs. Pharmaceutical companies are increasingly investing in R&D to expand the applications of microneedle patches for chronic disease management. Integration with smart monitoring devices further supports personalized dosing and remote adherence tracking. Its scalability, ease of manufacturing, and growing awareness of non-invasive therapies contribute to strong market growth.

- By Application Type

On the basis of application type, the market is segmented into orthopedic diseases, respiratory diseases, diabetes, oncology, cardiovascular diseases, and others. Respiratory Diseases segment dominated the market with a 32.7% share in 2025, primarily due to the high prevalence of asthma and COPD in Europe. The adoption of smart inhalers and connected delivery devices allows continuous monitoring, optimized dosing, and reduced exacerbation events. Patients benefit from enhanced therapy adherence and convenience, while healthcare providers gain actionable data for personalized treatment plans. Public health initiatives promoting chronic respiratory disease management have further increased uptake. The availability of reimbursement schemes and insurance coverage in countries such as Germany, France, and the U.K. supports market penetration. Integration with digital health platforms enhances patient engagement and overall treatment outcomes.

Diabetes segment is expected to witness the fastest growth at a CAGR of 12.8% from 2026 to 2033, driven by rising prevalence and the increasing adoption of smart insulin pens and connected auto-injectors. These devices provide accurate dosing, real-time glucose monitoring, and remote patient management capabilities. Patients gain improved adherence and reduced risk of complications, while clinicians can track therapy remotely through connected apps. Technological advancements, such as integration with continuous glucose monitoring systems and predictive analytics, support proactive disease management. Homecare delivery and self-administration solutions are further driving adoption. Increasing awareness of digital health solutions and chronic disease management programs fuels market expansion.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, home care settings, ambulatory care centers, and others. Hospitals segment dominated the market with the largest revenue share of 40.2% in 2025, as they remain the primary sites for administration of complex drug-device combination therapies. Hospitals provide access to advanced delivery systems such as auto-injectors, smart inhalers, and digital pills, ensuring proper handling, dosing accuracy, and patient monitoring. Integration with hospital IT systems and electronic health records allows seamless tracking of therapy adherence and outcomes. Specialized healthcare staff can train patients on device use, enhancing therapy effectiveness. Government-funded hospital programs and reimbursement coverage further drive adoption. The trend of adopting connected and smart devices in tertiary care facilities continues to support growth.

Home Care Settings segment is anticipated to witness the fastest growth at a CAGR of 13.6% from 2026 to 2033, fueled by increasing patient preference for self-administration and remote monitoring. Smart auto-injectors, microneedle patches, and connected inhalers enable patients to manage chronic conditions from home, reducing hospital visits and associated costs. Digital tracking and app-based feedback improve therapy adherence and outcomes. Telemedicine integration allows physicians to monitor patients remotely and intervene when necessary. The expansion of homecare services and insurance coverage for self-administration devices further supports growth. Convenience, patient comfort, and enhanced disease management capabilities are key adoption drivers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. Direct Tender segment dominated the market with a 45.5% revenue share in 2025, primarily due to large-scale procurement by hospitals, clinics, and government healthcare programs. This channel ensures reliable supply, cost efficiencies, and compliance with regulatory standards for high-volume purchases. Pharmaceutical companies benefit from predictable demand and streamlined logistics. Direct tender agreements also allow access to advanced, high-cost combination devices that may not be widely available in retail channels. Long-term contracts support consistent adoption and integration in healthcare facilities. Governments and large hospital networks in countries such as Germany, France, and the U.K. prefer direct tender for centralized procurement.

Retail Sales segment is expected to witness the fastest growth at a CAGR of 11.9% from 2026 to 2033, driven by increasing availability of drug-device combination products through pharmacies and online platforms. Patients can purchase smart inhalers, auto-injectors, and microneedle patches for home use, enhancing convenience and self-management of chronic conditions. The rise of e-pharmacies and digital health marketplaces has further accelerated accessibility. Marketing efforts by pharmaceutical companies and awareness campaigns promote adoption in retail channels. The growth of patient preference for at-home therapies and connected devices contributes to rising retail sales. Affordability, convenience, and improved patient autonomy are key factors driving market expansion.

Europe Drug-Device Combination Market Regional Analysis

- Germany dominated the Europe drug‑device combination market in 2025 with a 25.3% revenue share, owing to its well-established healthcare infrastructure, supportive regulatory frameworks, and high healthcare expenditure, with adoption across hospitals, ambulatory care, and homecare settings

- Patients and healthcare providers in Germany highly value the accuracy, safety, and connected features offered by smart drug-device combinations such as smart inhalers, auto-injectors, and digital pills, which improve adherence and enable remote monitoring of chronic diseases

- This widespread adoption is further supported by government healthcare programs, favorable reimbursement policies, a technologically advanced medical ecosystem, and increasing awareness of patient-centric therapies, establishing combination products as the preferred solution for chronic disease management across clinical and homecare settings

The Germany Drug‑Device Combination Market Insight

The Germany drug‑device combination market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s well-developed healthcare infrastructure, high healthcare expenditure, and advanced adoption of smart drug delivery technologies. German patients and healthcare providers increasingly value devices that offer accurate dosing, real-time monitoring, and integration with digital health platforms. The country’s focus on innovation, patient safety, and regulatory compliance supports adoption across hospitals, clinics, and homecare settings. Smart inhalers and connected auto-injectors are witnessing strong uptake, particularly in respiratory and diabetes management. Germany’s emphasis on sustainable, technology-driven healthcare solutions further drives market expansion.

U.K. Drug‑Device Combination Market Insight

The U.K. drug‑device combination market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of chronic disease management, increasing adoption of digital health tools, and the trend toward home-based care. Patients and healthcare providers are increasingly adopting smart inhalers, auto-injectors, and digital pills that improve therapy adherence and outcomes. Government support for digital health initiatives, combined with a robust healthcare infrastructure and a strong telemedicine ecosystem, is expected to continue stimulating market growth. The U.K. market is seeing increasing integration of connected devices into standard treatment protocols across respiratory, diabetes, and oncology care.

France Drug‑Device Combination Market Insight

The France drug‑device combination market is expected to grow at a healthy CAGR, supported by strong healthcare infrastructure, high prevalence of chronic conditions, and increasing investments in digital health solutions. French healthcare providers and patients are adopting combination products such as smart inhalers and auto-injectors to optimize therapy adherence and clinical outcomes. National healthcare policies and reimbursement frameworks favor advanced therapy adoption in hospitals and clinics. The integration of drug-device solutions with electronic health records and telemedicine platforms further drives market penetration. The market growth is prominent in respiratory, diabetes, and cardiovascular therapy areas.

Poland Drug‑Device Combination Market Insight

The Poland drug‑device combination market is expected to witness the fastest growth during the forecast period, driven by expanding healthcare access, increasing awareness of chronic disease management, and adoption of digital drug delivery solutions. Patients and healthcare providers are increasingly using smart inhalers, auto-injectors, and microneedle patches for homecare and clinic-based therapies. Government initiatives supporting telemedicine, remote monitoring, and digital health programs are further boosting adoption. Polish hospitals and clinics are rapidly integrating combination devices to enhance patient adherence and treatment outcomes. The growing availability of affordable, connected drug-device solutions and rising patient preference for home-based therapies contribute significantly to market expansion. The market is especially gaining traction in respiratory, diabetes, and cardiovascular applications.

Europe Drug-Device Combination Market Share

The Europe Drug-Device Combination industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Novartis AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Terumo Corporation (Japan)

- West Pharmaceutical Services, Inc. (U.S.)

- Bayer AG (Germany)

- Merck KGaA (Germany)

- B. Braun SE (Germany)

- WuXi AppTec Co., Ltd. (China)

- Meril Life Sciences (India)

- Dr. Reddy’s Laboratories Ltd. (India)

What are the Recent Developments in Europe Drug-Device Combination Market?

- In July 2025, AstraZeneca’s Trixeo Aerosphere received a positive opinion from the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) as the first inhaled triple‑combination COPD therapy reformulated with a next‑generation, ultra‑low global warming potential propellant. This endorsement supports transitioning the product across the EU to reduce both clinical burden and environmental impact while retaining therapeutic efficacy

- In January 2025, the 2025 Combination Products Summit convened 150 global regulators, health authorities, notified bodies, and industry partners in Brussels to drive innovation, collaboration, and regulatory alignment for drug‑device combination products across Europe spotlighting the need for coordinated regulatory approaches and streamlined pathways for combination products

- In April 2024, the European Commission granted marketing authorization for Emblaveo® (aztreonam‑avibactam), the first EU‑approved β‑lactam/β‑lactamase inhibitor antibiotic combination for complicated intra‑abdominal infections, hospital‑acquired pneumonia (HAP), and complicated urinary tract infections (cUTI); this fixed‑dose combination targets multidrug‑resistant Gram‑negative bacteria, addressing a critical treatment gap in antimicrobial resistance

- In March 2024, the European Medicines Agency adopted a positive opinion recommending EU marketing authorization for Emblaveo (aztreonam‑avibactam) as part of efforts to expand therapeutic options in multidrug‑resistant infections, a significant public‑health priority due to rising resistance rates across Europe

- In April 2023, Teikoku Seiyaku Co., Ltd. and Kowa Company, Ltd. launched ALLYDONE patches (27.5 mg and 55 mg) intended for managing Alzheimer’s‑related dementia, expanding the scope of drug‑device combination therapies to neurodegenerative conditions and representing diversification beyond traditional respiratory or chronic disease uses

- https://www.astrazeneca.com/content/astraz/media-centre/press-releases/2025/trixeo-aerosphere-receives-positive-eu-chmp-opinion-first-inhaled-medicine-using-next-generation-propellant-with-near-zero-global-warming-potential.html

- https://www.pfizer.com/news/press-release/press-release-detail/european-commission-approves-pfizers-emblaveor-patients

- https://www.ema.europa.eu/en/news/new-antibiotic-fight-infections-caused-multidrug-resistant-bacteria

- https://www.diaglobal.org/es-la/resources/press-releases/2025/01-30-raps-emea-postevent

- https://www.pharmiweb.com/press-release/2025-12-15/drug-device-combination-products-market-analysis-highlights-increasing-adoption-across-laboratories-and-research-institution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.