Europe Digital Lending Platform Market

Market Size in USD Million

CAGR :

%

USD

1,238.83 Million

USD

4,981.81 Million

2021

2029

USD

1,238.83 Million

USD

4,981.81 Million

2021

2029

| 2022 –2029 | |

| USD 1,238.83 Million | |

| USD 4,981.81 Million | |

|

|

|

Europe Digital Lending Platform Market Analysis and Size

The market for digital lending platforms is anticipated to generate significant amounts of revenue as there has been rise in demand of lenders and borrowers to lend money in a digital or electronic format. Moreover, the financial institutions' vigorous efforts to enhance the client experience, tight government regulations for digital lending, the proliferation of smartphones, and the advancement of technology are other drivers that will fuel market progress.

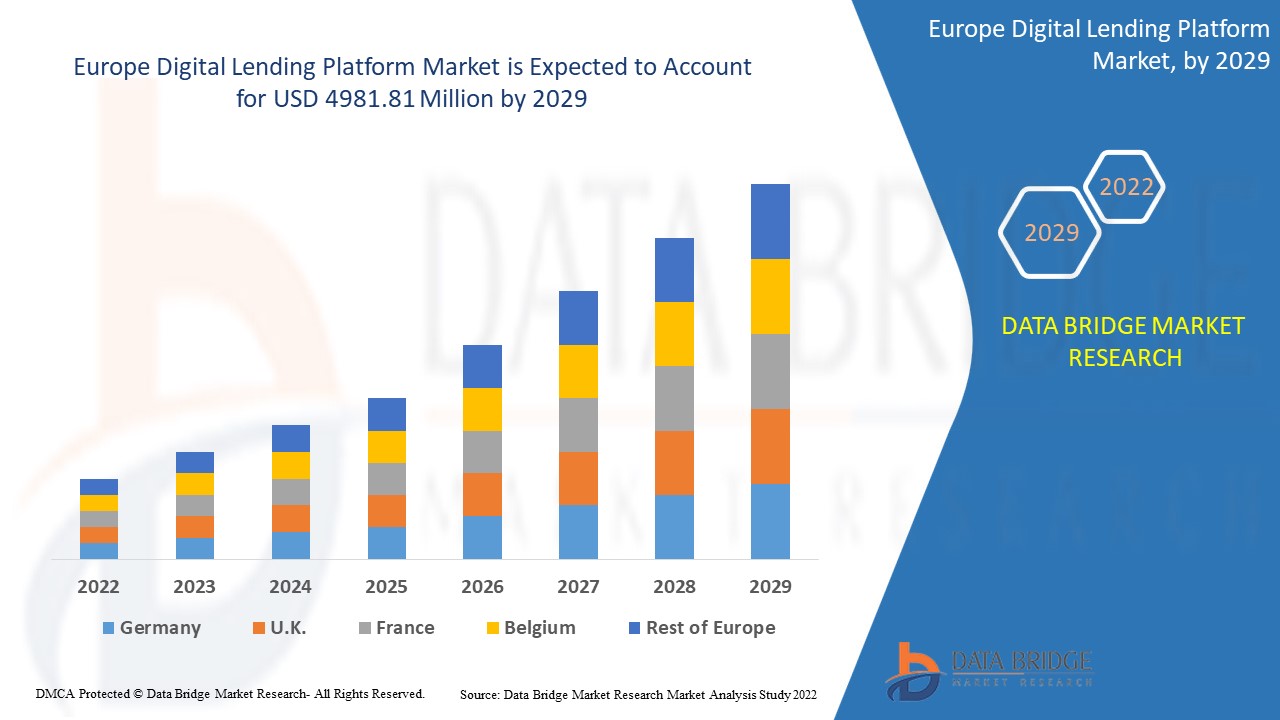

Europe digital lending platform market was valued at USD 1238.83 million in 2021 and is expected to reach USD 4981.81 million by 2029, registering a CAGR of 19.00% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Europe Digital Lending Platform Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) |

|

Countries Covered |

Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe |

|

Market Players Covered |

General Electric (U.S.), IBM (U.S.), PTC (U.S.), Microsoft (U.S.), Siemens (Germany), ANSYS, Inc (U.S.), SAP SE (Germany), Oracle (U.S.), Robert Bosch GmbH (Germany), Swim.ai, Inc. (U.S.), Atos SE (France), ABB (Switzerland), KELLTON TECH (India), AVEVA Group plc (U.K.), DXC Technology Company (U.S.), Altair Engineering, Inc (U.S.), Hexaware Technologies Limited (India), Tata Consultancy Services Limited (India), Infosys Limited (India), NTT DATA, Inc. (Japan), TIBCO Software Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

The digital lending platform makes it possible for lenders and borrowers to lend money in a digital or electronic format, improving user experience, making it easier to use, and reducing costs because client verification takes less time. The procedure begins with user registration and continues with the collecting of online paperwork, client identification and verification, loan approval, distribution of loans, and loan recovery.

Digital Lending Platform Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Burgeoning Use of Online Baking Services

As a result of globalisation and the rising use of internet banking, lending procedures are quickly become digital. This is one of the most crucial aspects that affects how DLP is used in the banking, financial services, and insurance (BFSI) sector to make better decisions, provide better client experiences, and save a lot of money. In addition, financial institutions worldwide are increasingly using digital channels to lend money and address pandemic issues due to the coronavirus illness (COVID-19) outbreak. The increased usage of banking services further boost the market’s overall growth.

- High Penetration of Smartphones

DLP provides the advantages of e-signing and quick accessibility, and the industry is also expanding due to rising smartphone dependence and internet penetration rates. DLP requires little paperwork, which lowers the possibility of human error, therefore it also helps the increased emphasis on digital automation contribute to the expansion of the global market. A number of businesses are incorporating cutting-edge fraud prevention technologies, which is driving the market's expansion. Additionally, the prevalence of cyber dangers is rising, hastening its global acceptance.

Furthermore, the factors such as growing adoption of digitalization in the BFSI sector will accelerate the overall market expansion during the forecast period. Additionally, the need for better customer experience is anticipated to drive the growth rate of the digital lending platform market. The growing demand for digital lending platforms among MSMEs will further positively impact the market's growth rate during the forecast period.

Opportunities

- Emergence of the Technologies

The emerging technologies such as the artificial intelligence, machine learning, and block chain further enhance digital lending platforms' capabilities, which estimated to generate lucrative opportunities for the market, which will further expand the digital lending platform market's growth rate in the future.

- Surging Growth for Lending Analytics

Additionally, the surging growth of the loan analytics has further offered various growth opportunities to the market. Lenders can examine consumer segmentation and maximize client acquisition using lending analytics. Additionally, it helps lenders cut expenses while enhancing efficiency and profitability. As part of their efforts to enhance their performance, a number of loan analytics solution providers are pursuing strategies including mergers and acquisitions and strategic partnerships, among others.

Restraints/Challenges

- Lesser Acceptance and Low Awareness

Many businesses favor the time-consuming and laborious traditional loan methods. They are unable to adopt innovations due to their fixed customer base and established methods of credit underwriting. Therefore, less acceptance of the digital lending platform is further expected to obstruct market growth over the forecast period. Additionally, the main reasons for the low adoption of automated and advanced digital lending processes are a lack of knowledge about digital lending and a lack of training and skill sets to manage them. These factors will largely hamper the market growth.

- Privacy Concerns and Other Challenges

It is anticipated that issues like data security and privacy protection will constrain industry expansion. Many countries have already started taking action to address issues with data security and privacy protection related to online lending platforms. Additionally, because all digital platforms significantly rely on internet connectivity and backend infrastructure, any system bugs, power outages, or connectivity problems could make digital platforms unavailable to end users. These factors will pose as a significant challenge for the digital lending platform market over the forecast period.

This digital lending platform market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital lending platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Digital Lending Platform Market

The digital lending platform market was moderately impacted by the outbreak of COVID-19. Numerous nations have stringent lockdowns, closures, and mobility restrictions as a result of the COVID-19 outbreak to stop the virus from spreading. The COVID-19 crisis has resulted in growth across the board for FinTech, including payment investments, lending, and general banking. Although lending platforms have fewer users overall, they have seen a 25% rise in users despite having fewer people overall. This is primarily because many enterprises required speedy loan approvals to maintain their operations during the difficult times. People have begun to choose contactless transactions to stop the virus from spreading. Also, the credit unions and banks are especially improving their digital banking services to better serve their consumers. Furthermore, during the COVID-19 pandemic, banks have been using digital channels more frequently to disburse loans under the Paycheck Protection Program. Small businesses can get funding for up to 8 weeks under the Paycheck Protection Program in the US. Numerated, a digital lending platform supplier, reports that 82% of American businesses elect to apply for PPP loans online at COVID-19 instead of through conventional methods.

Recent Developments

- In January 2022, American regulators gave Online lender SoFi Technologies the go-ahead to transform into a bank holding company. Therefore, the market is seeing fresh growth due to the rise in digital lenders with banking licences.

- In July 2021, Newgen Software introduced the one and only comprehensive digital transformation platform, NewgenONE , in order to handle the messiest information, streamline even the most complicated company processes, and increase customer interaction based on shifting demands.The NewgenONE platform for digital transformation unites the company's current process automation, content offerings, and communication management capabilities. With the help of the platform, businesses may create and publish sophisticated, content-driven, and user-friendly business apps in the cloud.

Europe Digital Lending Platform Market Scope

The digital lending platform market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Software

- Services

Loan amount size

- Less than US$ 7,000

- US$ 7,001 to US$ 20,000

- More than US$ 20,001

Organization size

- Large Organization

- Small & Medium Organization

Deployment

- On-premise

- Cloud

Subscription type

- Free

- Paid

Loan type

- Automotive Loan

- SME Finance Loan

- Personal Loan

- Home Loan

- Consumer Durable

- Others

Vertical

- Banking

- Financial Services

- Insurance Companies

- P2P (Peer-to-Peer) Lenders

- Credit Unions

- Saving

- Loan Associations

Digital Lending Platform Market Regional Analysis/Insights

The digital lending platform market is analyzed and market size insights and trends are provided by country, component, deployment model, loan amount size, subscription type, loan type and vertical as referenced above.

The countries covered in the digital lending platform market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey and Rest of Europe in Europe.

U.K. is dominating the European region for digital lending platform market due to the huge investments in research and development for advanced technologies. Moreover, the ability of the economy to support the digital infrastructure of online platform and internet services within the region will also aid the region al market’s growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Lending Platform Market Share Analysis

The digital lending platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital lending platform market.

Some of the major players operating in the digital lending platform market are

- General Electric (U.S.)

- IBM (U.S.)

- PTC (U.S.)

- Microsoft (U.S.)

- Siemens (Germany)

- ANSYS, Inc (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Swim Inc. (U.S.)

- Atos SE (France)

- ABB (Switzerland)

- KELLTON TECH (India)

- AVEVA Group plc (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc (U.S.)

- Hexaware Technologies Limited (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (India)

- NTT DATA, Inc. (Japan)

- TIBCO Software Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE DIGITAL LENDING PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE DIGITAL LENDING PLATFORM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE DIGITAL LENDING PLATFORM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CASE STUDIES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 VALUE CHAIN ANALYSIS

6 EUROPE DIGITAL LENDING PLATFORM MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 BUSINESS PROCESS MANAGEMENT

6.2.2 LOAN MANAGEMENT

6.2.3 LENDING ANALYTICS

6.2.4 OTHERS

6.3 SERVICES

6.3.1 DESIGN & IMPLEMENTATION

6.3.2 RISK ASSESSMENT

6.3.3 CONSULTING

7 EUROPE DIGITAL LENDING PLATFORM MARKET, BY TYPE

7.1 OVERVIEW

7.2 DECISION AUTOMATION

7.3 LOAN ORIGINATION

7.4 RISK AND COMPLIANCE MANAGEMENT

7.5 COLLECTIONS AND RECOVERY

7.6 UNDERWATER CLEANING AND REPAIRS

7.7 MAIN ENGINE MAINTENANCE REPAIRS

7.8 OTHERS

8 EUROPE DIGITAL LENDING PLATFORM MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 ON-PREMISE

8.3 CLOUD

8.4 HYBRID

9 EUROPE DIGITAL LENDING PLATFORM MARKET, BY END-USER

9.1 OVERVIEW

9.2 BANKING INSTITUIONS

9.2.1 BY OFFERING

9.2.1.1. .SOLUTIONS

9.2.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.2.1.1.2. .LOAN MANAGEMENT

9.2.1.1.3. .LENDING ANALYTICS

9.2.1.1.4. .OTHERS

9.2.1.2. .SERVICES

9.2.1.2.1. .DESIGN & IMPLEMENTATION

9.2.1.2.2. .RISK ASSESSMENT

9.2.1.2.3. .CONSULTING

9.2.1.2.4.

9.3 CREDIT UNIONS

9.3.1 BY OFFERING

9.3.1.1. .SOLUTIONS

9.3.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.3.1.1.2. .LOAN MANAGEMENT

9.3.1.1.3. .LENDING ANALYTICS

9.3.1.1.4. .OTHERS

9.3.1.2. .SERVICES

9.3.1.2.1. .DESIGN & IMPLEMENTATION

9.3.1.2.2. .RISK ASSESSMENT

9.3.1.2.3. .CONSULTING

9.4 INSURANCE COMPANIES

9.4.1 BY OFFERING

9.4.1.1. .SOLUTIONS

9.4.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.4.1.1.2. .LOAN MANAGEMENT

9.4.1.1.3. .LENDING ANALYTICS

9.4.1.1.4. .OTHERS

9.4.1.2. .SERVICES

9.4.1.2.1. .DESIGN & IMPLEMENTATION

9.4.1.2.2. .RISK ASSESSMENT

9.4.1.2.3. .CONSULTING

9.5 PEER-TO-PEER LENDING

9.5.1 BY OFFERING

9.5.1.1. .SOLUTIONS

9.5.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.5.1.1.2. .LOAN MANAGEMENT

9.5.1.1.3. .LENDING ANALYTICS

9.5.1.1.4. .OTHERS

9.5.1.2. .SERVICES

9.5.1.2.1. .DESIGN & IMPLEMENTATION

9.5.1.2.2. .RISK ASSESSMENT

9.5.1.2.3. .CONSULTING

9.6 SAVINGS & LOAN ASSOCIATIONS

9.6.1 BY OFFERING

9.6.1.1. .SOLUTIONS

9.6.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.6.1.1.2. .LOAN MANAGEMENT

9.6.1.1.3. .LENDING ANALYTICS

9.6.1.1.4. .OTHERS

9.6.1.2. .SERVICES

9.6.1.2.1. .DESIGN & IMPLEMENTATION

9.6.1.2.2. .RISK ASSESSMENT

9.6.1.2.3. .CONSULTING

9.7 OTHERS

9.7.1 BY OFFERING

9.7.1.1. .SOLUTIONS

9.7.1.1.1. .BUSINESS PROCESS MANAGEMENT

9.7.1.1.2. .LOAN MANAGEMENT

9.7.1.1.3. .LENDING ANALYTICS

9.7.1.1.4. .OTHERS

9.7.1.2. .SERVICES

9.7.1.2.1. .DESIGN & IMPLEMENTATION

9.7.1.2.2. .RISK ASSESSMENT

9.7.1.2.3. .CONSULTING

10 UROPE DIGITAL LENDING PLATFORM MARKET, BY REGION

EUROPE DIGITAL LENDING PLATFORM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 TURKEY

10.1.8 BELGIUM

10.1.9 NETHERLANDS

10.1.10 SWITZERLAND

10.1.11 REST OF EUROPE

11 EUROPE DIGITAL LENDING PLATFORM MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 MERGERS & ACQUISITIONS

11.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.4 EXPANSIONS

11.5 REGULATORY CHANGES

11.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 EUROPE DIGITAL LENDING PLATFORM MARKET, SWOT AND DBMR ANALYSIS

13 EUROPE DIGITAL LENDING PLATFORM MARKET, COMPANY PROFILE

13.1 FIDELITY INFORMATION SERVICES (FIS), INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 TEMENOS AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ABRIGO, INC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 FISERV, INC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 WIZNI, INC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TAVANT TECHNOLOGIES

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 PEGASYSTEMS, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 ROOSTIFY, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 NEWGEN SOFTWARE TECHNOLOGIES LTD

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 SIGMA INFOSOLUTIONS, LTD

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 ELLIE MAE, INC

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 ORACLE CORPORATION

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 DECIMAL TECHNOLOGY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 SAP SE

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.