Europe Diabetes Care Devices Market

Market Size in USD Billion

CAGR :

%

USD

6.12 Billion

USD

9.67 Billion

2022

2030

USD

6.12 Billion

USD

9.67 Billion

2022

2030

| 2023 –2030 | |

| USD 6.12 Billion | |

| USD 9.67 Billion | |

|

|

|

|

Europe Diabetes Care Devices Market Analysis and Size

According to the IDF, 21,600 children are added to the type 1 diabetic population pool each year. According to these figures, diabetes accounts for approximately 9% of total healthcare expenditure in Europe. Various government initiatives, such as the National Service Framework (NSF) programme in the United Kingdom, are improving services by establishing national standards to drive up service quality and address variations in care. In the first forum of its kind, the Association of British HealthTech Industries (ABHI) launched a diabetes section, allowing diabetes technology companies to collaborate. The ABHI group is for any health technology company with a diabetes care interest, from CGM and insulin pumps to apps. Such benefits have contributed to the increased adoption of these products in the market.

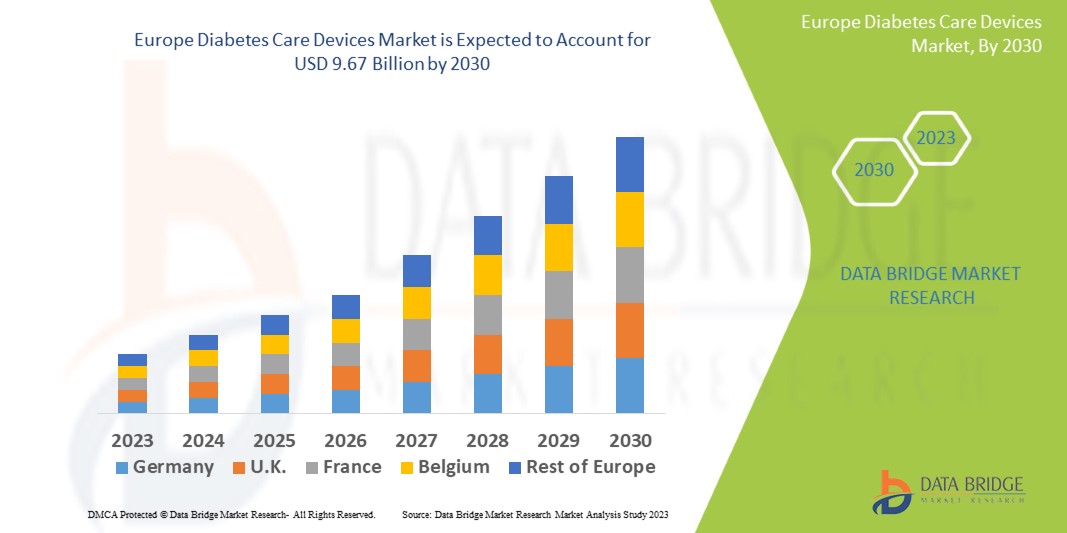

Data Bridge Market Research analyses that the diabetes care devices market which is USD 6.12 billion in 2022, is expected to reach USD 9.67 billion by 2030, at a CAGR of 5.88% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Europe Diabetes Care Devices Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Blood Glucose Monitoring Devices, Insulin Delivery Devices), Device Type (Self-monitoring and Diagnostic), Delivery Type (Pumps, Pen, Syringes, Injectors, Cartridges in Reusable pens, Disposable Pens, and Jet Injectors), Distribution Channel (Institutional Sales, Retail Sales) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Abbott (U.S.), PHC Holdings Corporation (Japan), WellDoc, Inc (India), Sanofi (France), Dexcom, Inc (U.S.), DarioHealth Corp. (U.S.), Medtronic (Ireland), B. Braun SE (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Insulet Corporation (U.S.), Ascensia Diabetes Care Holdings AG (Switzerland), Tidepool (U.S.), Medtronic (Ireland), Tandem Diabetes Care (U.S.), LifeScan (U.S.), AgaMatrix (U.S.), Glooko Inc. (U.S.), DarioHealth (Israel) |

|

Market Opportunities |

|

Market Definition

Diabetes develops when the pancreas is unable to produce insulin from blood. Untreated diabetes is caused by elevated blood sugar levels. Diabetes drugs are specifically used to treat diabetes. Diabetic treatment aims to increase blood glucose levels. Diabetes care gadgets are used to monitor diabetics' blood glucose levels. A continuous glucose monitor (CGM) is a medical device that tracks and monitors diabetes patients' blood glucose levels throughout the day. This wearable device will benefit diabetics by assisting them in managing their glucose levels.

Europe Diabetes Care Devices Market Dynamics

Drivers

- Rise in obesity

Obesity is one of the leading causes of diabetes in individuals. According to the WHO, approximately 50% of the European population was overweight in 2014, with over 20% of the population obese. Obesity is more common in men. Risk factors, such as the rising prevalence of obesity, are directly linked to the rising prevalence of diabetes, resulting in a high diabetes prevalence. As a result, the diabetes device market is growing.

- Rising awareness about diabetes management

Increasing diabetes patient pool and rising awareness about diabetes management and control are among the factors expected to contribute to this market's growth over the forecast period. According to the International Diabetes Federation Report for 2017, approximately 66.0 million people in Europe have diabetes, with this figure expected to rise to 81.0 million by 2045. The top five diabetic countries in Europe are Germany, the United Kingdom, France, Spain, and Italy.

Opportunities

- Government initiatives and awareness campaigns

Several government initiatives and awareness campaigns are also driving market growth. The UK DESMOND education programme is a structured patient education and management programme for newly diagnosed type 2 diabetes patients. Its goal is to help people identify early health risks. There has also been an increase in government funding for healthcare. Diabetes-related healthcare spending is rapidly increasing, according to the International Diabetes Federation. Diabetes healthcare expenditure in the adult population was USD 207.0 billion in 2017 and is expected to reach 214.0 billion by 2045. Diabetes device demand is expected to be driven by such supportive initiatives and rising awareness over the forecast period.

Restraints/Challenges

- Expensive and Difficulty to Operate Diabetes Care Devices

Diabetes is a chronic illness that necessitates frequent blood glucose testing to maintain normal blood sugar levels. The glucose testing device is costly and can be painful. Furthermore, the results of diabetes care devices are not always accurate. Furthermore, some factors impede market expansion. This includes painful sensor insertions and the difficulty of fitting multiple devices on small bodies. In addition, disruptive alerts lost signals, resulting in data gaps, skin irritation and adhesive issues, and an abundance of information generated by diabetes care devices that was difficult to interpret.

This diabetes care devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the diabetes care devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Diabetes Care Devices Market

The COVID-19 pandemic hampered the growth of the diabetes care devices market. Patients infected with COVID-19 had an increase in blood glucose levels. The stress of infection and the use of steroids for COVID-19 treatment contributed to an increase in blood glucose levels, which increased the number of patients. This undoubtedly created opportunities for market leaders. Many players have launched new advanced diabetes care devices and signed diabetes care device collaborations and agreements because of the rising prevalence of diabetes. However, due to lockdowns and travel restrictions, the market experienced a supply chain disruption, resulting in a scarcity of diabetes care devices; however, this only temporarily impacted the diabetic care devices market.

Recent Developments

- In 2021, NHS (National Health Service) England announced that hybrid closed-loop systems, also known as artificial pancreas, will be available to adults and children on the NHS in England.

- In 2021, Medtronic received a CE mark for its InPen smart insulin pen and Guardian 4 sensor for better diabetes management.

- In 2021, Medtronic launched the Medtronic Extended infusion set in selected European countries, making it the first and only one that can be worn for up to 7 days. This advancement doubles the time an infusion set can be worn, allowing users to safely continue on insulin pump therapy with fewer interruptions and insertions while adding convenience and comfort to their diabetes management routine.

Europe Diabetes Care Devices Market Scope

The diabetes care devices market is segmented on the basis of product type and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Blood Glucose Monitoring Devices

- Testing strips

- Blood glucose meters

- self-monitoring blood glucose meters

- continuous blood glucose monitoring devices

- Lancets

- Others

- Insulin Delivery Devices

Device Type

- Self-monitoring

- Diagnostic

Delivery Type

- Pumps

- Pen

- Syringes

- Injectors

- Cartridges in Reusable pens

- Disposable Pens

- Jet Injectors

Distribution Channel

- Institutional Sales

- Hospitals

- Clinics

- Others

- Retail Sales

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Diabetes Care Devices Market Regional Analysis/Insights

The diabetes care devices market is analyzed and market size insights and trends are provided by country, product type and distribution channel as referenced above.

The countries covered in the diabetes care devices market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the diabetes care devices market because of the presence of well-developed healthcare infrastructure and favourable reimbursement policies in the region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 owing to the growing incidence of cancer such as bladder, esophagus, liver, pancreas, and others, high presence of major manufacturers across the U.S. Furthermore, technological advancements and rising foreign investment.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The diabetes care devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for diabetes care devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the diabetes care devices market. The data is available for historic period 2011-2021.

Competitive Landscape and Diabetes Care Devices Market Share Analysis

The diabetes care devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to diabetes care devices market.

Some of the major players operating in the diabetes care devices market are:

- Abbott (U.S.)

- PHC Holdings Corporation (Japan)

- WellDoc, Inc (India)

- Sanofi (France)

- Dexcom, Inc (U.S.)

- DarioHealth Corp. (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Insulet Corporation (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Tidepool (U.S.)

- Medtronic (Ireland)

- Tandem Diabetes Care (U.S.)

- LifeScan (U.S.)

- AgaMatrix (U.S.)

- Glooko Inc. (U.S.)

- DarioHealth (Israel)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.