Europe Closed System Transfer Devices Market

Market Size in USD Million

CAGR :

%

USD

302.78 Million

USD

1,169.33 Million

2025

2033

USD

302.78 Million

USD

1,169.33 Million

2025

2033

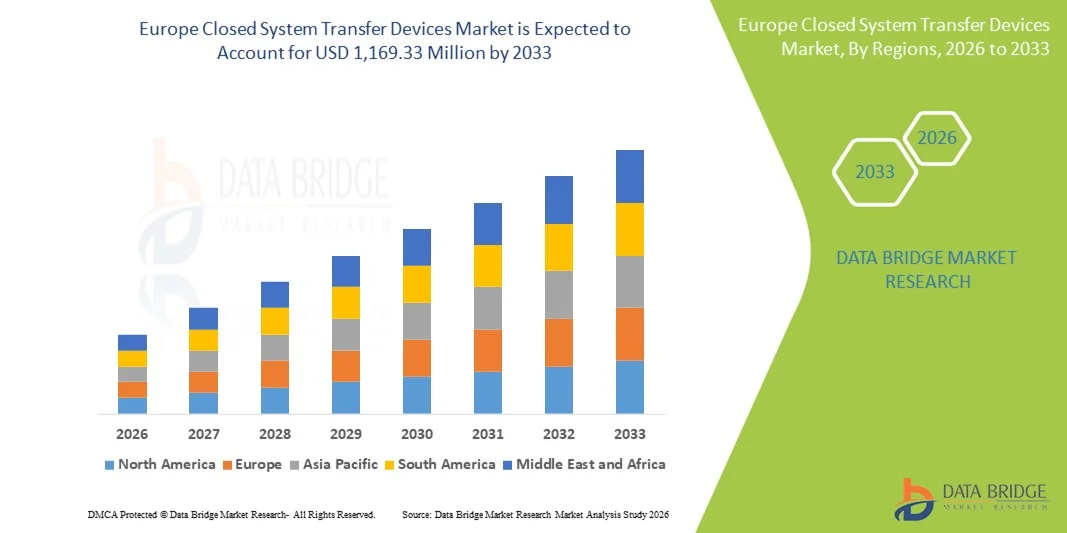

| 2026 –2033 | |

| USD 302.78 Million | |

| USD 1,169.33 Million | |

|

|

|

|

Europe Closed System Transfer Devices Market Size

- The Europe closed system transfer devices market size was valued at USD 302.78 million in 2025 and is expected to reach USD 1,169.33 million by 2033, at a CAGR of 18.4% during the forecast period

- The market growth is largely driven by the increasing emphasis on occupational safety in healthcare settings and the rising adoption of closed system transfer devices to prevent hazardous drug exposure among healthcare workers

- Furthermore, stringent regulatory guidelines, growing oncology drug usage, and heightened awareness regarding safe drug handling practices are positioning closed system transfer devices as a critical component of modern healthcare infrastructure, thereby significantly boosting the market’s growth

Europe Closed System Transfer Devices Market Analysis

- Closed system transfer devices (CSTDs), designed to prevent the escape of hazardous drugs and protect healthcare workers from exposure during drug preparation and administration, are increasingly critical components of oncology and pharmacy safety protocols across hospitals and healthcare facilities in Europe

- The rising demand for closed system transfer devices is primarily driven by the growing prevalence of cancer, increasing use of hazardous injectable drugs, and heightened awareness regarding occupational safety among healthcare professionals

- Germany dominated the Europe closed system transfer devices market with the largest revenue share of 28.4% in 2025, supported by stringent occupational safety regulations, high healthcare expenditure, and widespread adoption of advanced drug handling technologies

- Poland is expected to be the fastest growing country in the Europe closed system transfer devices market during the forecast period due to expanding oncology care infrastructure, rising healthcare investments, and increasing compliance with EU-level safety and handling guidelines

- The membrane-to-membrane systems segment dominated the Europe closed system transfer devices market with a market share of 46.8% in 2025, driven by its high containment efficiency, strong regulatory acceptance, and broad compatibility with commonly used drug preparation and administration systems

Report Scope and Europe Closed System Transfer Devices Market Segmentation

|

Attributes |

Europe Closed System Transfer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Closed System Transfer Devices Market Trends

Stricter Enforcement of Occupational Safety and Hazardous Drug Handling Standards

- A significant and accelerating trend in the Europe closed system transfer devices (CSTDs) market is the tightening enforcement of occupational safety regulations aimed at reducing healthcare worker exposure to hazardous drugs during preparation and administration

- For instance, several European healthcare systems are increasingly aligning hospital pharmacy practices with EU occupational safety directives and international guidelines, leading to higher adoption of CSTDs in oncology wards and compounding pharmacies

- The growing focus on minimizing surface contamination, aerosol generation, and accidental spills is driving demand for advanced CSTD designs with improved sealing mechanisms and contamination control capabilities

- Manufacturers are increasingly focusing on developing CSTDs that are compatible with a wide range of drug vials, syringes, and infusion systems, enabling smoother integration into existing hospital workflows

- The trend toward centralized and automated pharmacy compounding across European hospitals is further encouraging the adoption of standardized closed system transfer solutions to ensure consistent safety practices

- Growing collaboration between device manufacturers and hospital pharmacies to co-develop workflow-optimized CSTD solutions is enhancing product acceptance and clinical usability

- This increasing emphasis on regulatory compliance, worker safety, and standardized drug handling processes is reshaping procurement decisions, with hospitals prioritizing clinically validated and regulator-approved CSTD solutions

Europe Closed System Transfer Devices Market Dynamics

Driver

Rising Cancer Burden and Mandatory Healthcare Worker Safety Requirements

- The increasing incidence of cancer across Europe, coupled with rising volumes of hazardous injectable drug administration, is a major driver fueling demand for closed system transfer devices

- For instance, national healthcare authorities in countries such as Germany and France are reinforcing guidelines that recommend or mandate CSTDs in oncology drug preparation to reduce occupational exposure risks

- As hospitals and oncology centers seek to protect pharmacists, nurses, and other healthcare professionals, CSTDs offer effective solutions by preventing drug leakage, vapor release, and environmental contamination

- Furthermore, heightened awareness among healthcare administrators regarding long-term health risks associated with hazardous drug exposure is accelerating investments in advanced drug safety technologies

- Expanding geriatric population across Europe is contributing to higher cancer prevalence, thereby increasing the volume of hazardous drug handling and demand for CSTDs

- Rising medico-legal concerns related to occupational exposure incidents are prompting healthcare providers to proactively adopt CSTDs to mitigate liability and compliance risks

- The expansion of hospital-based chemotherapy services and outpatient oncology clinics is further contributing to increased adoption of CSTDs across Europe

Restraint/Challenge

High Product Costs and Workflow Integration Complexity

- The relatively high cost of closed system transfer devices compared to conventional drug transfer methods presents a notable challenge to market growth, particularly for smaller hospitals and budget-constrained healthcare facilities

- For instance, some healthcare providers delay large-scale CSTD adoption due to the cumulative cost impact across high-volume oncology drug administrations

- Integrating CSTDs into established pharmacy and nursing workflows can require additional staff training and process adjustments, which may temporarily reduce operational efficiency

- Variability in hospital procurement policies and inconsistent enforcement of safety regulations across European countries can also limit uniform market penetration

- Limited availability of standardized reimbursement policies for CSTDs across European healthcare systems can discourage rapid adoption, particularly in cost-sensitive public hospitals

- Resistance to change among clinical staff accustomed to traditional drug transfer methods may slow implementation, requiring sustained training efforts and change-management initiatives to ensure effective device utilization

- Overcoming these challenges through cost optimization, simplified device designs, and clear demonstration of long-term safety and liability reduction benefits will be critical for sustained growth of the Europe closed system transfer devices market

Europe Closed System Transfer Devices Market Scope

The market is segmented on the basis of type, component, closing mechanism, technology, end user, and distribution channel.

- By Type

On the basis of type, the Europe closed system transfer devices market is segmented into membrane-to-membrane systems and needle-free closed system transfer devices. The membrane-to-membrane systems segment dominated the market with the largest market revenue share of 46.8% in 2025, driven by its proven effectiveness in preventing hazardous drug leakage during drug preparation and administration. These systems provide high containment efficiency, minimizing vapor release and surface contamination in oncology settings. European hospitals widely adopt membrane-to-membrane systems due to strong clinical validation and regulatory acceptance. Their compatibility with commonly used vials, syringes, and infusion systems ensures seamless workflow integration. Healthcare professionals favor these systems for their reliability in high-volume chemotherapy environments. Extensive safety data and long-term usage history further reinforce their dominance.

The needle-free closed system transfer devices segment is expected to witness the fastest growth rate during the forecast period, fueled by increasing concerns regarding needlestick injuries among healthcare workers. These systems eliminate sharps-related risks, improving occupational safety in oncology pharmacies and clinics. Rising awareness of staff safety regulations is accelerating adoption across Europe. Needle-free designs also reduce accidental punctures and handling complexity. Their ease of use supports faster drug preparation workflows. Ongoing product innovation is further driving rapid market growth.

- By Component

On the basis of component, the market is segmented into devices and accessories. The devices segment held the largest market revenue share in 2025, as these components represent the primary functional elements of closed system transfer devices. Hospitals prioritize core CSTD devices to comply with strict occupational safety standards. Increasing chemotherapy drug volumes directly drive higher demand for devices. These products undergo extensive regulatory validation, supporting higher pricing and revenue contribution. Their essential role in hazardous drug containment ensures consistent procurement. This makes devices the dominant component segment.

The accessories segment is anticipated to witness the fastest growth during the forecast period, driven by their frequent replacement and recurring usage across healthcare facilities. Accessories such as vial adaptors and connectors are often single-use, leading to continuous demand. Rising chemotherapy procedures across Europe are increasing consumption volumes. Hospitals are standardizing accessory usage to maintain safety compliance. Improved compatibility across multiple device platforms supports adoption. This recurring demand pattern accelerates segment growth.

- By Closing Mechanism

On the basis of closing mechanism, the market is segmented into push-to-turn systems, color-to-color alignment systems, luer-lock systems, and click-to-lock systems. The luer-lock system segment dominated the market in 2025, supported by its widespread familiarity among healthcare professionals. Luer-lock mechanisms provide secure and leak-resistant connections during drug transfer. Their compatibility with standard medical connectors enhances usability. Minimal training requirements improve operational efficiency. Hospitals prefer these systems due to their reliability and consistency. Their established presence across Europe supports sustained dominance.

The click-to-lock systems segment is expected to witness the fastest growth during the forecast period, driven by their intuitive design and reduced handling complexity. These systems provide audible and tactile confirmation of secure connections, enhancing user confidence. Click-to-lock mechanisms help minimize human error during drug transfer. Growing adoption in high-throughput oncology pharmacies is supporting growth. Their ergonomic advantages align with workflow optimization initiatives. As hospitals seek safer and faster connections, demand for click-to-lock systems is increasing.

- By Technology

On the basis of technology, the market is segmented into diaphragm-based devices, compartmentalized devices, and air cleaning/filtration devices. The diaphragm-based devices segment accounted for the largest share in 2025, due to their superior sealing and containment performance. These devices effectively prevent the escape of hazardous drug vapors. Their compatibility with membrane-based systems supports widespread adoption. Hospitals rely on diaphragm-based devices for proven safety outcomes. Regulatory validation further strengthens confidence. This positions diaphragm-based technology as the dominant segment.

The air cleaning/filtration devices segment is expected to be the fastest growing during the forecast period, driven by rising awareness of airborne contamination risks. These systems actively filter hazardous aerosols during drug transfer. Increasing focus on environmental safety is boosting demand. Technological advancements are improving filtration efficiency. Adoption is expanding in centralized compounding pharmacies. Enhanced protection requirements support rapid growth. This focus on enhanced protection positions air filtration devices as a high-growth segment.

- By End User

On the basis of end user, the market is segmented into hospitals, oncology centers & clinics, ambulatory surgical centers, and academic and research institutes. The hospitals segment dominated the market in 2025, driven by high chemotherapy drug preparation volumes. Hospitals operate under stringent occupational safety regulations. Centralized pharmacy departments increase CSTD utilization. Strong budget allocations support procurement. Hospitals lead in standardized safety practices. This ensures continued dominance.

The oncology centers & clinics segment is expected to witness the fastest growth during the forecast period, due to the expansion of specialized cancer treatment facilities. Increasing outpatient chemotherapy delivery supports adoption. Clinics prioritize staff safety amid rising drug handling volumes. Smaller facilities prefer user-friendly CSTD solutions. Growth of private oncology centers supports demand. This accelerates segment expansion. Growing private oncology networks further support growth. This segment benefits from focused cancer care expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2025, as CSTDs are mainly procured through centralized hospital purchasing systems. Government and public hospital tenders drive bulk orders. Long-term supplier contracts ensure steady supply. Tender-based procurement supports regulatory compliance. Cost efficiency strengthens dominance. This channel remains primary. Large-volume buying further strengthens this channel’s dominance. Cost efficiency remains a key advantage.

The retail sales segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing adoption among private clinics. Retail channels offer greater procurement flexibility. Expansion of outpatient oncology services supports demand. Improved distributor networks enhance accessibility. Faster purchasing cycles benefit smaller facilities. These factors drive rapid growth. Digital ordering platforms are also supporting growth. This channel benefits from decentralized healthcare expansion.

Europe Closed System Transfer Devices Market Regional Analysis

- Germany dominated the Europe closed system transfer devices market with the largest revenue share of 28.4% in 2025, supported by stringent occupational safety regulations, high healthcare expenditure, and widespread adoption of advanced drug handling technologies

- Healthcare providers in Germany place strong emphasis on compliance with safety guidelines, effective containment of cytotoxic drugs, and the use of clinically validated closed system transfer devices within hospital pharmacies and oncology departments

- This widespread adoption is further supported by Germany’s advanced healthcare infrastructure, high healthcare expenditure, and heightened awareness of long-term occupational exposure risks, establishing closed system transfer devices as a critical safety solution across the country’s hospitals and clinics

The Germany Closed System Transfer Devices Market Insight

The Germany closed system transfer devices market dominated Europe in 2025, fueled by strict occupational safety enforcement, high volumes of oncology drug preparation, and well-established hospital pharmacy infrastructure. German healthcare institutions prioritize adherence to EU and national safety regulations, driving consistent CSTD adoption. The focus on protecting healthcare professionals from cytotoxic exposure promotes the selection of clinically validated, high-containment devices. Hospitals and oncology centers increasingly integrate CSTDs into daily workflows to enhance safety and operational efficiency. Innovation in device design and compatibility with multiple drug delivery systems further supports market growth. Germany’s strong healthcare expenditure and regulatory oversight make it the leading market in the region.

Poland Closed System Transfer Devices Market Insight

The Poland closed system transfer devices market is expected to be the fastest growing country in Europe during the forecast period, driven by rapid expansion of oncology care infrastructure and rising awareness of occupational safety standards. Hospitals and clinics are increasingly adopting CSTDs to comply with EU guidelines and protect healthcare workers from hazardous drug exposure. Growing investments in outpatient oncology centers and modernization of hospital pharmacies are supporting demand. Limited historical adoption is resulting in significant growth potential for new installations. Increased government focus on healthcare worker safety and training initiatives further accelerates adoption. The adoption of both membrane-to-membrane and needle-free systems is expected to rise sharply across the country.

U.K. Closed System Transfer Devices Market Insight

The U.K. closed system transfer devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of healthcare worker safety and increasing chemotherapy administration volumes. Hospitals and oncology centers are adopting CSTDs to comply with strict occupational health standards. Growing investment in oncology infrastructure and outpatient clinics is encouraging market penetration. The U.K.’s emphasis on modern, safe drug compounding processes supports adoption in both public and private healthcare facilities. Increasing staff training and standardization of pharmacy practices further stimulate demand. The integration of CSTDs into hospital safety protocols remains a key growth driver.

France Closed System Transfer Devices Market Insight

The France closed system transfer devices market is expected to expand steadily, supported by rigorous drug safety regulations and rising cancer treatment volumes. French hospitals and oncology centers are emphasizing occupational exposure mitigation, driving demand for membrane-to-membrane and needle-free CSTDs. Integration into pharmacy workflows and compliance with national guidelines ensures widespread adoption. Growing awareness among healthcare workers about long-term risks of cytotoxic exposure contributes to market growth. Continuous innovation in device safety features is promoting confidence in adoption. The government’s support for modernizing hospital safety protocols further accelerates market expansion.

Europe Closed System Transfer Devices Market Share

The Europe Closed System Transfer Devices industry is primarily led by well-established companies, including:

- EQUASHIELD (U.S.)

- Simplivia (Israel)

- ICU Medical, Inc. (U.S.)

- B. Braun SE (Germany)

- Vygon (France)

- BD (U.S.)

- Baxter (U.S.)

- Terumo Corporation (Japan)

- CODAN Medizinische Geräte GmbH & Co KG (Germany)

- Corning Incorporated (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Yukon Medical LLC (U.S.)

- Corvida Medical Inc. (U.S.)

- Cardinal Health (U.S.)

- Caragen Ltd. (Ireland)

- JMS Co., Ltd. (Japan)

- Practivet, Inc. (U.S.)

- Amsino International, Inc. (U.S.)

- NIPRO CORPORATION (Japan)

- VICTUS Inc. (U.S.)

What are the Recent Developments in Europe Closed System Transfer Devices Market?

- In June 2025, industry analysis noted that Europe’s growth in closed system transfer devices was significantly driven by the enforcement of EU Directive 2004/37/EC on hazardous drug exposure limits, with Germany and France accounting for a large share of the regional CSTD market as hospitals prioritized compliance with standardized safety guidelines

- In May 2025, EQUASHIELD® announced its CSTD was clinically proven to protect healthcare professionals from hazardous drug exposure and was ranked as the top CSTD solution, reinforcing its position in key European and global markets. This recognition highlights ongoing clinical validation efforts and industry acceptance of high‑containment transfer systems

- In November 2024, a study was conducted to assess the impact of using closed system transfer devices on environmental contamination and handling safety during chemotherapeutic drug preparation, underlining academic and clinical interest in validating CSTDs’ effectiveness beyond theoretical benefits

- In September 2024, a case study reported that several German hospitals successfully implemented EQUASHIELD closed system transfer devices to improve hazardous drug handling safety, documenting positive impacts on workplace contamination and staff protection, particularly in oncology pharmacy settings. This reflects broader clinical adoption and evaluation of CSTD safety performance in leading European healthcare institution

- In June 2024, the European Commission highlighted new worker‑protection requirements under the Chemical Agents Directive (CMD 2022), mandating that all EU Member States adopt technical measures such as closed system drug‑transfer devices (CSTDs) to minimize hazardous medicinal product exposure among healthcare professionals, significantly impacting safety practices across European healthcare facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.