Europe Bulk Acoustic Wave Sensors Market Analysis and Size

Micro-meter-sized airborne particles can be detected using bulk acoustic wave (BAW) devices. A piezoelectric substance sandwiched between two electrodes makes up the resonator of a BAW device. To create a mechanical wave in the resonator, an alternating electric field is applied to the piezoelectric layer using the two electrodes. The resonator displays a resonance frequency that, among other things, is influenced by the mass load. A frequency-sensitive circuit may identify the shift in resonant frequency that results from particles touching the resonator by measuring the change in mass load.

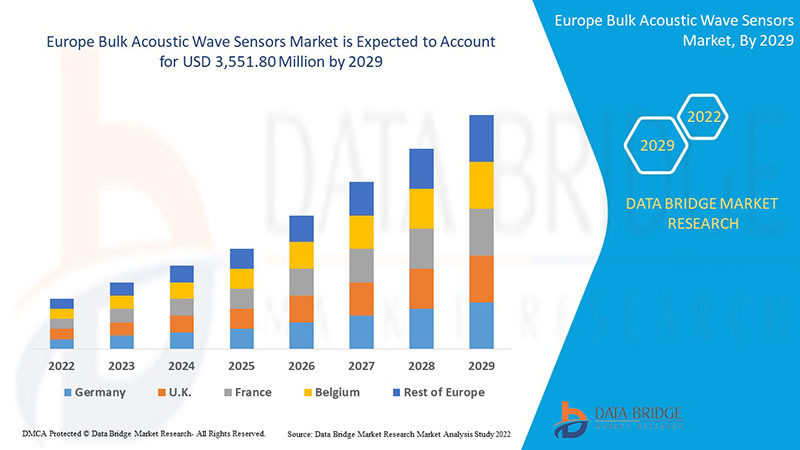

Data Bridge Market Research analyses that the Europe bulk acoustic wave sensors market is expected to reach the value of USD 3,551.80 million by 2029, at a CAGR of 13.2% during the forecast period. The bulk acoustic wave sensors market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Film Bulk Acoustic Resonator (FBAR), Shear Bulk Acoustic Wave (S-BAW), Longitudinal Bulk Acoustic Wave (L-BAW), Lamb Wave), Raw Material (Aluminum Nitride (AlN), Zinc Oxide (ZnO), Lead Zirconium Titanate (PZT), SiO2, Lithium Niobate (LiNbO3), Lithium Tantalate (LiTaO3), Silicon Carbide (SiC), Gallium Arsenide (GaAs), Langasite (LGS), Polyvinylidene Fluoride (PVDF), Others), Sensing Parameter (Temperature, Pressure, Chemical, Humidity, Others), End-User (Telecommunications, Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Industrial, Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe |

|

Market Players Covered |

Sorex, Teledyne Defense Electronics, Broadcom, Taiyo Yuden Co., Ltd., Qorvo, Inc, Nihon Dempa Kogyo Co., Ltd., quartzpro.com, Fortiming Corporation, Texas Instruments Incorporated, Balluff Gmbh, AWSensors , MACOM, Biolin scientific |

Market Definition

A standing acoustic wave is known to be produced by an electrical signal in the bulk of a piezoelectric material in an electromechanical device known as a bulk acoustic wave sensor. This device is in its most basic form, consisting of two metallic electrodes and a piezoelectric substance. The thickness and natural frequency of the material are used as design criteria to achieve the desired operating frequency. More complex designs will employ a ladder or lattice topology for better control over operating frequencies. The ladder or lattice architecture will be used in more complicated systems to control operating frequencies better.

Europe Bulk Acoustic Wave Sensors Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

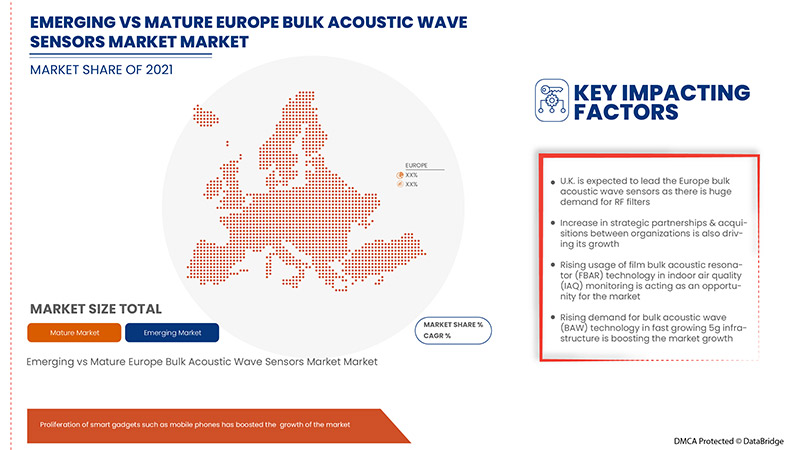

- Proliferation of smart gadgets such as mobile phones across the region

As the world is getting digitalized, the penetration of smartphones and mobile phones is rapidly increasing. Communication has become simpler with the presence of mobile phones and other smart gadgets in the market. The mobile network has made it simpler to connect with anyone globally through telecom networks. These telecom industries are improving their communication network with the adoption of bulk acoustic wave technology which is further expected to drive the demand for bulk acoustic wave sensors market significantly.

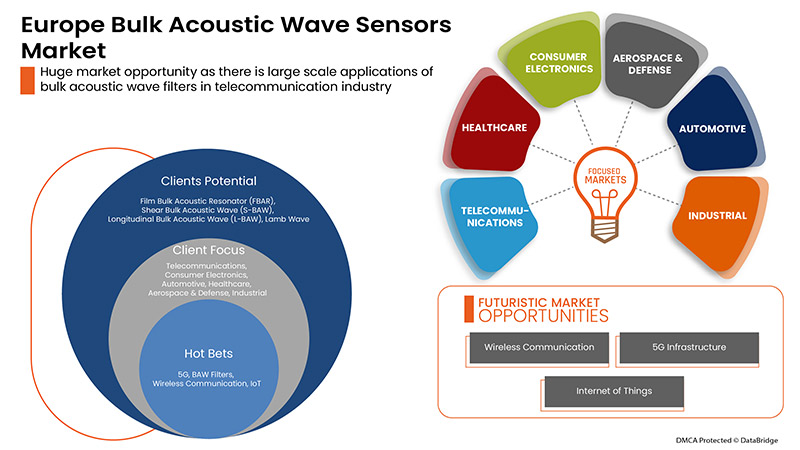

- Adoption of bulk acoustic sensors in automobile and other commercial industries

Bulk acoustic wave devices have been in commercial use for many years now. These include automotive applications (torque and tire pressure sensors), medical applications (chemical sensors), and industrial and commercial applications (vapor, humidity, temperature, and mass sensors). Bulk Acoustic Wave (BAW) resonators and filters are extensively used in radiofrequency (RF) front-end filtering at UHF frequencies. Their small size, good power handling capabilities, and high-quality factors make them ideal for applications such as duplexers for WCDMA and PCS1900 and front-end filters for DCS1800 and many 2.4GHz ISM bands standards.

As automobile sectors started acquiring more digital capabilities, they are relying on a growing number of wireless technologies to communicate with the outside world. Furthermore, many vehicles have implemented the support of LTE data connections and operate as small Wi-Fi hotspots. Over the next few years, the long-planned goal of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2X) communications is finally expected to become a reality with the usage of higher-frequency RF bands.

Opportunities

- Rising demand for bulk acoustic wave (BAW) technology in fast-growing 5G infrastructure

Bulk acoustic wave (BAW) technology is being used to create a new generation of radio frequency filters (RF filters) due to the higher frequencies and broader bandwidths associated with 5G. BAW filters are piezoelectric-based acoustic resonators in which the characteristics of a thin film piezoelectric material control the frequency and bandwidth of the filter. The film's thickness, the piezoelectric element's geometry, and characteristics of the accompanying electrodes play a role in determining the band-pass frequency of the RF filter in BAW devices. Due to the band-pass frequency's reliance on film thickness, BAW devices can filter frequencies higher than conventional surface acoustic wave (SAW) RF filters. BAW filters are therefore widely employed at frequencies between 2.2 and 6.0 GHz, where SAW filter technology is severely constrained.

The global rollout of 5G and the rapid expansion of the Internet of Things is creating significant challenges in RF filtering technologies. Many market players have recently introduced BAW filters for 5G enabled front-end modules for better performance and higher reliability.

Restraints/Challenges

- Higher cost of bulk acoustic wave sensors in the market

With the wide boom of 4G LTE and wireless networks around the globe, the new wave spectrum is needed to handle the massive wireless traffic. BAW sensors generally deliver superior performance with lower insertion loss at higher frequency levels. However, the cost of BAW sensors is much higher compared to other acoustic sensors such as SAW (Surface Acoustic sensor). And the expensive nature of the BAW sensors is impeding the market's growth to a certain extent.

- Technical challenges related to BAW devices

The development of 5G has numerous challenges in terms of data speeds, coverage, and size minimization. First of all, 5G phases use higher radio frequencies, but the working frequency of BAW filters causes significant increases in acoustic and ohmic losses. Secondly, the N78, N79, and N77 of 5G NR frequency bands require 500, 600, and 900 MHz of bandwidth, respectively, while obtaining a relatively large bandwidth, up to 10%, is also a difficult problem for a BAW filter based on aluminum nitride (AlN). Thirdly, considering the complete RF system, the future will undoubtedly see an increase in input power and a decrease in module size. So module miniaturization will become a technical challenge in the near future.

Post-COVID-19 Impact on Europe Bulk Acoustic Wave Sensors Market

COVID-19 negatively impacted the Europe bulk acoustic wave sensors market due to lockdown regulations and the shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the Europe bulk acoustic wave sensors market to an extent negative manner. However, increasing adoption of 5G technology worldwide has helped the market grow after the pandemic. Also, the growth has been high since the market opened after COVID-19, and it is expected that there will be considerable growth in the sector owing to the higher demand for biosensors in the medical field.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the bulk acoustic wave sensors. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for the use of automation technology have led to the market's growth

Recent Development

- In February 2022, TAIYO YUDEN INC., a subsidiary of Japan's TAIYO YUDEN CO., LTD., announced a partnership with TTI., Inc., a global electronic components distributor. This partnership will allow TAIYO YUDEN INC. to broaden its presence and have an impact in sectors including the automotive and electrification industries, communication infrastructures, and more. This development will enhance the global customer reach of the company

Europe Bulk Acoustic Wave Sensors Market Scope

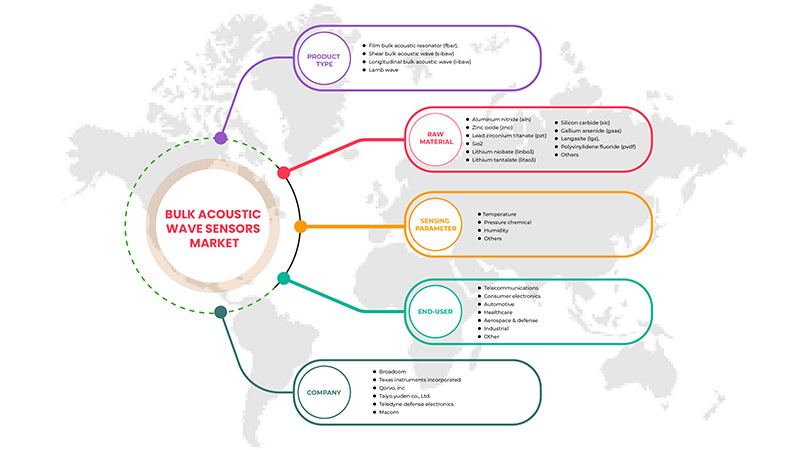

Europe bulk acoustic wave sensors market is segmented on the basis of product type, raw material, sensing parameter, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Film Bulk Acoustic Resonator (FBAR)

- Shear Bulk Acoustic Wave (S-BAW)

- Longitudinal Bulk Acoustic Wave (L-BAW)

- Lamb Wave

On the basis of product type, the global bulk acoustic wave sensors market is segmented into film bulk acoustic resonator (FBAR), shear bulk acoustic wave (S-BAW), and longitudinal bulk acoustic wave (L-BAW), lamb wave.

Raw Material

- Aluminum Nitride (AlN)

- Zinc Oxide (ZnO)

- Lead Zirconium Titanate (PZT)

- SiO2

- Lithium Niobate (LiNbO3)

- Lithium Tantalate (LiTaO3)

- Silicon Carbide (SiC)

- Gallium Arsenide (GaAs)

- Langasite (LGS)

- Polyvinylidene Fluoride (PVDF)

- Others

On the basis of raw material, the Europe bulk acoustic wave sensors market has been segmented into aluminum nitride (AlN), zinc oxide (ZnO), lead zirconium titanate (PZT), SiO2, lithium niobate (LiNbO3), lithium tantalate (LiTaO3), silicon carbide (SiC), gallium arsenide (GaAs), langasite (LGS), polyvinylidene fluoride (PVDF), others.

Sensing Parameter

- Temperature

- Pressure

- Chemical

- Humidity

- Others

On the basis of sensing parameters, the Europe bulk acoustic wave sensors market has been segmented into temperature, pressure, chemical, humidity, and others.

End-User

- Telecommunications

- Consumer Electronics

- Automotive

- Healthcare

- Aerospace & Defense

- Industrial

- Others

On the basis of end-user, the Europe bulk acoustic wave sensors market is segmented into telecommunications, consumer electronics, automotive, healthcare, aerospace & defense, industrial, and others.

Europe Bulk Acoustic Wave Sensors Market Regional Analysis/Insights

Europe bulk acoustic wave sensors market is analysed, and market size insights and trends are provided by country, material type, manufacturing process, and end-use industry, as referenced above.

The countries covered in Europe bulk acoustic wave sensors market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe. Germany dominates in Europe due to the rapid deployment of 5G and the research work on 6G technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Bulk Acoustic Wave Sensors Market Share Analysis

Europe bulk acoustic wave sensors market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the bulk acoustic wave sensors market.

Some of the major players operating in the global bulk acoustic wave sensors market are Sorex, Teledyne Defense Electronics, Broadcom, Taiyo Yuden Co., Ltd., Qorvo, Inc, Nihon Dempa Kogyo Co., Ltd., quartzpro.com, Fortiming Corporation, Texas Instruments Incorporated, Balluff Gmbh, AKOUSTIS, AWSensors, MACOM, Biolin scientific, Resonant Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BULK ACOUSTIC WAVE SENSORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET END-USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN PROMINENT PLAYERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PROLIFERATION OF SMART GADGETS SUCH AS MOBILE PHONES ACROSS THE REGION

5.1.2 ADOPTION OF BULK ACOUSTIC SENSORS IN AUTOMOBILE AND OTHER COMMERCIAL INDUSTRIES

5.1.3 PENETRATION OF BAW SENSORS IN THE BIOMEDICAL FIELD

5.2 RESTRAINTS

5.2.1 HIGHER COST OF BULK ACOUSTIC WAVE SENSORS IN THE MARKET

5.2.2 SCARCITY AND DISRUPTION OF SEMICONDUCTOR RAW MATERIALS SUCH AS SENSORS AND FILTERS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC PARTNERSHIPS & ACQUISITIONS AMONG ORGANIZATIONS

5.3.2 RISING USAGE OF FILM BULK ACOUSTIC RESONATOR (FBAR) TECHNOLOGY IN INDOOR AIR QUALITY (IAQ) MONITORING

5.3.3 RISING DEMAND FOR BULK ACOUSTIC WAVE (BAW) TECHNOLOGY IN FAST-GROWING 5G INFRASTRUCTURE

5.3.4 INCREASING RESEARCH & DEVELOPMENT IN QUARTZ CRYSTAL MICROBALANCE (QCM) TECHNOLOGY

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING BULK ACOUSTIC WAVE (BAW) DEVICES

5.4.2 TECHNICAL CHALLENGES RELATED TO BAW DEVICES

6 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 FILM BULK ACOUSTIC RESONATOR (FBAR)

6.2.1 BY TYPE

6.2.1.1 WIRE THICKNESS SHEAR MODE (TSM)

6.2.1.2 THICKNESS EXTENSIONAL MODE (TEM)

6.2.1.3 LATERAL FIELD EXCITATION (LFE)

6.2.2 BY STRUCTURE

6.2.2.1 BACK TRENCH TYPE

6.2.2.2 BRAGG ACOUSTIC MIRROR TYPE

6.2.2.3 AIR-BAG TYPE

6.3 SHEAR BULK ACOUSTIC WAVE (S-BAW)

6.4 LONGITUDINAL BULK ACOUSTIC WAVE (L-BAW)

6.5 LAMB WAVE

7 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ALUMINUM NITRIDE (AIN)

7.3 ZINC OXIDE (ZNO)

7.4 LEAD ZIRCONIUM TITANATE (PZT)

7.5 SIO2

7.6 LITHIUM NIOBATE (LINBO3)

7.7 LITHIUM TANTALATE (LITAO3)

7.8 SILICON CARBIDE (SIC)

7.9 GALLIUM ARSENIDE (GAAS)

7.1 LANGASITE (LGS)

7.11 POLYVINYLIDENE FLUORIDE (PVDF)

7.12 OTHERS

8 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER

8.1 OVERVIEW

8.2 TEMPERATURE

8.3 PRESSURE

8.4 CHEMICAL

8.5 HUMIDITY

8.6 OTHERS

9 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER

9.1 OVERVIEW

9.2 TELECOMMUNICATIONS

9.3 CONSUMER ELECTRONICS

9.4 AUTOMOTIVE

9.5 HEALTHCARE

9.6 AEROSPACE & DEFENSE

9.7 INDUSTRIAL

9.8 OTHERS

10 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 FRANCE

10.1.4 SPAIN

10.1.5 ITALY

10.1.6 RUSSIA

10.1.7 NETHERLANDS

10.1.8 SWITZERLAND

10.1.9 BELGIUM

10.1.10 TURKEY

10.1.11 REST OF EUROPE

11 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 BROADCOM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 TEXAS INSTRUMENTS INCORPORATED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 QORVO, INC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 TAIYO YUDEN CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 TELEDYNE DEFENSE ELECTRONICS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AKOUSTIS

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 AWSENSORS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BIOLIN SCIENTIFIC

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 BALLUFF GMBH

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 FORTIMING CORPORATION

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 MACOM

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 NIHON DEMPA KOGYO CO., LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 QUARTZPRO.COM

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 RESONANT INC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 SOREX

13.15.1 COMPANY SNAPSHOT

13.15.2 SOLUTION PORTFOLIO

13.15.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 LIST OF SUPPLY CHAIN PROMINENT PLAYERS

TABLE 2 COST COMPARISON FOR VARIOUS BAW SENSORS

TABLE 3 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE SHEAR BULK ACOUSTIC WAVE (S-BAW) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE LONGITUDINAL BULK ACOUSTIC WAVE (L-BAW) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE LAMB WAVE IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ALUMINUM NITRIDE (AIN) IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE ZINC OXIDE (ZNO) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LEAD ZIRCONIUM TITANATE (PZT) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SIO2 IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LITHIUM NIOBATE (LINBO3) IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE LITHIUM TANTALATE (LITAO3) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SILICON CARBIDE (SIC) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE GALLIUM ARSENIDE (GAAS) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE LANGASITE (LGS) IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE POLYVINYLIDENE FLUORIDE (PVDF) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE OTHERS IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 23 EUROPE TEMPERATURE IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE PRESSURE IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE CHEMICAL IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE HUMIDITY IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 29 EUROPE TELECOMMUNICATIONS IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE CONSUMER ELECTRONICS IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE AUTOMOTIVE IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HEALTHCARE IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AEROSPACE & DEFENSE IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE INDUSTRIAL IN BULK ACOUSTIC WAVE SENSORS MARKET , BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE OTHERS IN BULK ACOUSTIC WAVE SENSORS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 41 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 42 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 43 GERMANY BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 47 GERMANY BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 48 GERMANY BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 U.K. BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.K. FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 52 U.K. BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 53 U.K. BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 54 U.K. BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 55 FRANCE BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 58 FRANCE BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 FRANCE BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 60 FRANCE BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 61 SPAIN BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SPAIN FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SPAIN FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 64 SPAIN BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 65 SPAIN BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 66 SPAIN BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 67 ITALY BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 ITALY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 ITALY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 70 ITALY BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 71 ITALY BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 72 ITALY BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 73 RUSSIA BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 RUSSIA FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 RUSSIA FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 76 RUSSIA BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 77 RUSSIA BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 78 RUSSIA BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 82 NETHERLANDS BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 83 NETHERLANDS BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 84 NETHERLANDS BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 85 SWITZERLAND BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 SWITZERLAND FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SWITZERLAND FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 88 SWITZERLAND BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 SWITZERLAND BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 90 SWITZERLAND BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 91 BELGIUM BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 BELGIUM FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 TURKEY BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 TURKEY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 TURKEY FILM BULK ACOUSTIC RESONATOR (FBAR) IN BULK ACOUSTIC WAVE SENSORS MARKET, BY STRUCTURE, 2020-2029 (USD MILLION)

TABLE 100 TURKEY BULK ACOUSTIC WAVE SENSORS MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 101 TURKEY BULK ACOUSTIC WAVE SENSORS MARKET, BY SENSING PARAMETER, 2020-2029 (USD MILLION)

TABLE 102 TURKEY BULK ACOUSTIC WAVE SENSORS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 103 REST OF EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: SEGMENTATION

FIGURE 2 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: EUROPE VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: SEGMENTATION

FIGURE 11 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE BULK ACOUSTIC WAVE SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR BULK ACOUSTIC WAVE SENSORS MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE PROLIFERATION OF SMART GADGETS SUCH AS MOBILE PHONES ACROSS THE REGION IS EXPECTED TO DRIVE THE EUROPE BULK ACOUSTIC WAVE SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 FILM BULK ACOUSTIC RESONATOR (FBAR) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BULK ACOUSTIC WAVE SENSORS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF EUROPE BULK ACOUSTIC WAVE SENSORS MARKET

FIGURE 16 NO. OF SMART PHONE USERS EUROPELY (IN BILLIONS) FOR THE YEARS 2017-2022

FIGURE 17 NUMBER OF RESEARCH PAPER PUBLISHED RELATED TO QCM TECHNOLOGY

FIGURE 18 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, PRODUCT TYPE, 2021

FIGURE 19 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, RAW MATERIAL, 2021

FIGURE 20 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, SENSING PARAMETER, 2021

FIGURE 21 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET, END-USER, 2021

FIGURE 22 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 27 EUROPE BULK ACOUSTIC WAVE SENSORS MARKET: COMPANY SHARE 2021 (%)

Europe Bulk Acoustic Wave Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Bulk Acoustic Wave Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Bulk Acoustic Wave Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.