Europe Automotive Magnet Wire Market

Market Size in USD Million

CAGR :

%

USD

989.03 Million

USD

1,322.64 Million

2024

2032

USD

989.03 Million

USD

1,322.64 Million

2024

2032

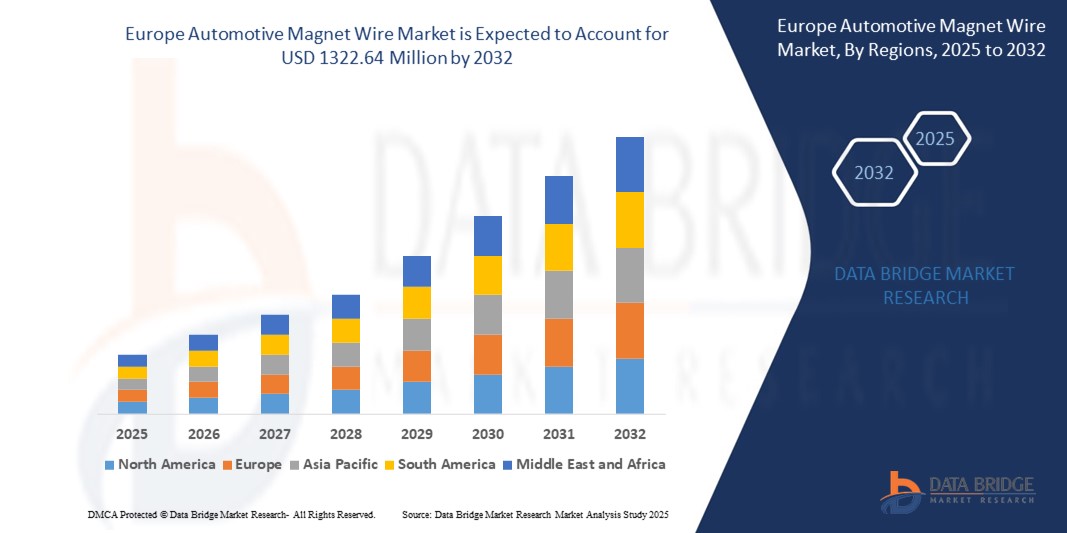

| 2025 –2032 | |

| USD 989.03 Million | |

| USD 1,322.64 Million | |

|

|

|

|

Automotive Magnet Wire Market Size

- The Europe automotive magnet wire market size was valued at USD 989.03 million in 2024 and is expected to reach USD 1322.64 million by 2032, at a CAGR of 3.7% during the forecast period

- The market growth is largely fueled by the rising production of electric and hybrid vehicles, which require high-efficiency motors and power systems, driving demand for advanced automotive magnet wires with superior conductivity, thermal resistance, and durability

- Furthermore, increasing focus on vehicle electrification, stringent emission regulations, and growing integration of electronic components across powertrains, ADAS, and infotainment systems are significantly accelerating the need for high-performance magnet wires in modern automotive architectures

Automotive Magnet Wire Market Analysis

- Automotive magnet wires are specialized insulated conductors used in vehicle components such as electric motors, alternators, transformers, and actuators to enable efficient power transmission, electromagnetic function, and heat resistance in demanding environments

- The growing demand for electric mobility, miniaturized high-power motor systems, and enhanced in-vehicle electronics is fueling the adoption of magnet wires with advanced insulation technologies, precise winding properties, and improved thermal stability, particularly in EVs and hybrid models

- Germany dominated the automotive magnet wire market in 2024, due to its strong automotive manufacturing base, advanced electric vehicle production capabilities, and deep-rooted expertise in high-efficiency motor technologies

- France is expected to be the fastest growing region in the automotive magnet wire market during the forecast period due to national initiatives supporting EV production, a rapidly evolving supply chain for electric mobility components, and increasing localization of key auto parts manufacturing

- Round magnet wire segment dominated the market with a market share of 76.8% in 2024, due to its ease of winding, cost-effectiveness, and broad compatibility with standard motor and coil designs. Round wires are widely used across various automotive systems due to their adaptability to different insulation types and production scalability

Report Scope and Automotive Magnet Wire Market Segmentation

|

Attributes |

Automotive Magnet Wire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Magnet Wire Market Trends

“Growing Emphasis on Sustainable Materials”

- Sustainability has shifted from a niche initiative to a primary market driver in the automotive magnet wire industry. Manufacturers are investing in next-generation materials and processing methods that lower lifecycle emissions, reduce hazardous byproducts, and align with circular economy principles. The emphasis is on “green” claims and also on measurable improvements in carbon footprint throughout the automotive supply chain

- For instance, Essex Furukawa and Superior Essex have introduced magnet wires utilizing solvent-free, plant-based enamel coatings that eliminate volatile organic compound (VOC) emissions traditionally produced during wire insulation. Their sustainable product lines have set new industry benchmarks and are sought by eco-conscious automakers for use in electric motor windings

- The adoption of closed-loop copper recycling solutions is accelerating, helping manufacturers lower environmental impact and insulate their operations from raw material price volatility. Biodegradable insulation is under R&D across top firms, reflecting growing anticipation of future regulations around electronics waste

- Automakers now explicitly include sustainability criteria in supplier selection, leading suppliers to secure certifications for responsible sourcing, traceability, and emissions transparency—creating a competitive advantage for proactive companies

- The market is also seeing increased collaboration between wire manufacturers, chemical producers, and automotive OEMs on joint projects designed to further raise insulation efficiency and reduce environmental liability

- These efforts, including high-profile international initiatives are helping establish new global standards for magnet wire, giving leading firms early-mover benefits and a positive public image with environment-focused stakeholders

Automotive Magnet Wire Market Dynamics

Driver

“Increased Demand for Electric and Hybrid Vehicles”

- The accelerating shift toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) is fundamentally transforming the automotive magnet wire market, as these vehicles require larger quantities and higher grades of magnet wire for their electric motors, battery systems, and auxiliary electrified components. The demand is especially acute for wire with enhanced heat resistance, electrical conductivity, and durability to ensure vehicle efficiency and longevity

- For instance, Essex Furukawa supplies specialized High Voltage Winding Wire (HVWW) to flagship Tesla and Ford EV models, supporting core propulsion and charging functions with advanced insulation and superior thermal performance. Their magnet wire products exemplify the high technical standards and partnerships now typical in the sector

- Leading manufacturers are scaling up capacity, modernizing processes, and investing heavily in R&D for new insulation materials and improved winding technologies, anticipating both surging volume requirements and ever-stricter OEM quality demands

- Policy and consumer momentum toward decarbonization, including government emissions mandates and lucrative green incentives in the U.S., EU, China, and beyond, are further inflating magnet wire demand as automakers fast-track new EV launches

- Tight collaboration between wire producers and automakers has become the norm, with co-development of application-specific magnet wires designed to meet unique powertrain architectures, voltage ratings, and operating environments in next-generation vehicles

Restraint/Challenge

“Disruptions in Copper Supply Chain Pose Risks”

- Copper, the primary conductor material for magnet wire, faces persistent supply chain risk due to global mine disruptions, limited production scalability, and complex logistics. Price volatility in copper directly impacts input costs for magnet wire producers and can threaten production continuity for automakers, especially during industry upswings

- For instance, copper supply interruptions throughout 2024 caused operational and financial challenges for companies such as Furukawa Electric and Prysmian Group, compelling them to intensify usage of recycled copper, secure alternative sourcing contracts, and re-evaluate their risk management strategies. These supply shocks reverberate through the automotive sector and have forced a reevaluation of long-term raw material strategies

- As input costs climb, some producers have increased adoption of aluminum magnet wire for specific applications. However, aluminum typically requires design modifications due to lower electrical conductivity compared to copper, which can limit its use in high-performance or compact applications and underscores the continued importance of copper

- Market volatility complicates inventory and production planning for both suppliers and OEMs, potentially causing delays in vehicle launches, supply constraints, and margin compression across the value chain

- With electric vehicle production ramping up and competition for copper intensifying across multiple industries (including power, infrastructure, and electronics), supply stability and price management remain among the highest-priority challenges facing the automotive magnet wire market

Automotive Magnet Wire Market Scope

The market is segmented on the basis of type, product type, shape, insulation type, technology focus type, integration framework type, application, distribution channel, and end user.

- By Type

On the basis of type, the automotive magnet wire market is segmented into copper wire and aluminium wire. The copper wire segment dominated the largest market revenue share in 2024, attributed to its superior electrical conductivity, high thermal resistance, and mechanical strength, making it the preferred choice for critical automotive applications such as motors and alternators. Copper magnet wires ensure stable performance under demanding thermal and mechanical stresses, which is crucial for the reliability and efficiency of EV and ICE vehicles alike.

The aluminium wire segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for lightweight solutions in electric vehicles. Aluminium’s lower density and cost advantages over copper are prompting OEMs to adopt it in applications where weight reduction and cost optimization are key, particularly in high-volume wire harnesses and secondary windings.

- By Product Type

On the basis of product type, the market is categorized into enamelled wire and covered conductor wire. The enamelled wire segment accounted for the largest revenue share in 2024, driven by its compact insulation layer, high thermal endurance, and excellent dielectric strength, which are essential for space-constrained and high-temperature environments in automotive components. Its widespread usage in traction motors, power steering systems, and HVAC blowers enhances its demand.

The covered conductor wire segment is projected to register the fastest growth rate during the forecast period due to growing adoption in heavy-duty applications requiring mechanical abrasion resistance and thermal insulation, especially in commercial vehicles and hybrid architectures.

- By Shape

On the basis of shape, market is segmented into round magnet wire, round bondable magnet wire, rectangle magnet wire, and square magnet wire. In 2024, the round magnet wire segment led the market with a share of 76.8% owing to its ease of winding, cost-effectiveness, and broad compatibility with standard motor and coil designs. Round wires are widely used across various automotive systems due to their adaptability to different insulation types and production scalability.

The rectangle magnet wire segment is poised for the fastest growth, mainly due to rising applications in high-efficiency motors, where tighter coil packing and reduced air gaps enhance energy density and motor performance. Their increasing usage in high-performance EV drive motors is a key factor driving this demand.

- By Insulation Type

The insulation type segmentation includes polyamide-imide (PAI), polyimides (PI), polyetherimide (PEI), polyether ether ketone (PEEK), and others. The polyamide-imide (PAI) segment dominated the market in 2024, backed by its excellent thermal class rating (up to 240°C), high mechanical durability, and superior chemical resistance, making it suitable for harsh automotive environments.

The polyether ether ketone (PEEK) segment is anticipated to exhibit the highest CAGR due to its exceptional thermal and electrical properties, lightweight nature, and emerging adoption in EV-specific applications where both miniaturization and high thermal stability are required.

- By Technology Focus Type

On the basis of technology focus type, market is segmented into neodymium technology, samarium cobalt technology, ferrite technology, and others magnet technology. The neodymium technology segment led the market in 2024 due to its superior magnetic energy density, which is critical for compact, high-efficiency electric motors in modern EVs and hybrid systems.

The ferrite technology segment is expected to grow at the fastest pace, particularly due to cost-sensitive applications in low-power motors, actuators, and auxiliary systems where resistance to demagnetization and affordability outweigh compactness.

- By Integration Framework Type

On the basis of integration, the market includes soft magnet, hard magnet, and semi-hard magnet. The hard magnet segment accounted for the largest market share in 2024, driven by increasing deployment in permanent magnet motors used in electric propulsion systems where high coercivity and remanence are required.

The soft magnet segment is projected to expand at the highest growth rate, supported by its growing use in transformer cores and sensor applications where high permeability and low coercivity are essential for energy-efficient performance.

- By Application

On the basis of application, the market is segmented into motors, transformers, inductors, braking, battery harness, starter alternator harness, EDS power supply, battery cables, HV power cables, LVDS/HDS, coax, windows, door locking, seating, stability, and other electrical devices. The motors segment dominated the market in 2024 due to the growing electrification of drivetrains and auxiliary systems requiring magnet wires for optimal torque and power delivery.

The battery harness segment is anticipated to witness the fastest growth, driven by expanding EV production, which demands complex and high-capacity wiring solutions for safe and efficient energy transmission between battery packs and power units.

- By Distribution Channel

On the basis of distribution channel, the market is divided into direct sales and indirect sales. The direct sales segment accounted for the largest share in 2024, supported by OEM preferences for long-term supplier relationships ensuring quality, customization, and cost control.

The indirect sales segment is forecast to grow more rapidly due to increasing involvement of third-party distributors and aftermarket suppliers catering to replacement and repair markets, especially in developing economies.

- By End User

On the basis of end user, the market includes motor industry, sensor industry, actuators industry, lighting industry, passenger vehicles, energy, home appliances, transformer, signalling and supply, data, and others. The motor industry led the segmental revenue in 2024, owing to the surging demand for high-efficiency motors in EVs, HVAC systems, and ADAS-enabled vehicles.

The sensor industry is projected to register the fastest growth through 2032 due to the expanding role of magnetically actuated sensors in modern vehicles for real-time monitoring, safety automation, and performance diagnostics.

Automotive Magnet Wire Market Regional Analysis

- Germany dominated the automotive magnet wire market with the largest revenue share in 2024, driven by its strong automotive manufacturing base, advanced electric vehicle production capabilities, and deep-rooted expertise in high-efficiency motor technologies

- The country’s leadership is reinforced by the presence of leading automakers, a robust EV component supply chain, and ongoing investment in R&D for lightweight, thermally resilient magnet wire materials suited for high-voltage automotive applications

- Germany’s regulatory push toward e-mobility, combined with large-scale electrification programs and strong export demand for premium electric vehicles and hybrid systems, positions it as the cornerstone of magnet wire consumption and innovation in the European automotive sector

U.K. Automotive Magnet Wire Market Insight

The U.K. automotive magnet wire market is expected to grow steadily from 2025 to 2032, supported by a shift toward electric vehicle adoption, expanding investments in green mobility, and the resurgence of domestic EV assembly operations. The country’s growing demand for high-performance components in traction motors, battery systems, and ADAS applications is boosting interest in advanced magnet wire technologies, particularly those supporting compact and energy-efficient motor designs.

France Automotive Magnet Wire Market Insight

France is projected to register the fastest CAGR in the Europe automotive magnet wire market during the forecast period of 2025 to 2032. Growth is driven by national initiatives supporting EV production, a rapidly evolving supply chain for electric mobility components, and increasing localization of key auto parts manufacturing. The rise of domestic EV brands, strong environmental policies, and the country's focus on sustainable transport are collectively accelerating demand for innovative and thermally robust magnet wire solutions.

Automotive Magnet Wire Market Share

The automotive magnet wire industry is primarily led by well-established companies, including:

- ACEBSA (Spain)

- Cividale S.p.A. (Italy)

- Craig Wire Products LLC (U.S.)

- Device Technologies, Inc. (U.S.)

- Ederfil Becker (Germany)

- ELEKTRISOLA (Germany)

- Fujikura Ltd. (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- Hitachi Metals, Ltd. (Japan)

- LS Cable & System Ltd. (South Korea)

- Ewwa (Germany)

- MWS Wire Industries, Inc. (U.S.)

- Ningbo Jintian Copper (Group) Co., Ltd. (China)

- Rea (Italy)

- Sam Dong (South Korea)

- Sumitomo Electric Industries, Ltd. (Japan)

- Superior Essex Inc. (U.S.)

- Synflex Elektro GmbH (Germany)

- TaYa Electric Wire & Cable Co., Ltd. (Taiwan)

- Tongling Jingda Special Magnet Wire Co., Ltd. (China)

- Wenzhou Jogo Imp & Exp Co., Ltd. (China)

Latest Developments in Europe Automotive Magnet Wire Market

- In June 2024, Sumitomo Electric acquired a majority stake in German cable manufacturer Südkabelto support two major HVDC projects with Amprion, advancing Germany's energy transition. This acquisition boosts Sumitomo Electric’s European presence and production capabilities, particularlyin high-voltage cables. By leveraging this expertise, the company can indirectly strengthen its automotive magnet wire production, which plays a crucial role in electric vehicle systems, aligning with the growing demand for sustainable energy and automotive solutions

- In January 2024, Hitachi Metals has rebranded as Proterial, Ltd. following its acquisition by Bain Capital, and is proposing its NMF 15 ferrite magnets as a potential alternative to neodymium magnets in electric vehicle (EV) traction motors, aiming to reduce reliance on rare earth elements. This development positions Proterial to offer more sustainable solutions for EV motors by integrating their ferrite magnets, potentially reducing resource risks and costs while expanding their product offerings in the automotive magnet wire market

- In May 2023, Essex Furukawa announced a USD 60 million investment to establish a new manufacturing facility dedicated to producing magnet wire for electric and hybrid vehicles. This strategic expansion is expected to significantly strengthen the company’s production capacity and position in the automotive segment, enabling it to meet the accelerating demand for magnet wire driven by global EV adoption

- In February 2022, LWW Group consolidated its magnet wire operations under the new Dahren brand, integrating Dahrentrad AB, Dahren Poland, and LWW Slaska. This brand unification is aimed at enhancing operational efficiency and expanding its product offerings across winding wire categories. The move is set to improve the group's competitiveness and service capabilities for automotive applications across Europe

- In October 2020, Furukawa Electric Co. Ltd and Superior Essex Holding Corp formed Essex Furukawa Magnet Wire LLC, a global joint venture combining their heavy magnet wire and polyimide tube businesses. This collaboration has bolstered their global market presence and technological capabilities, enabling a more integrated supply chain to serve the growing needs of electric vehicle manufacturers and component suppliers worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.