Europe Automated Liquid Handling Market

Market Size in USD Million

CAGR :

%

USD

393.84 Million

USD

723.58 Million

2025

2033

USD

393.84 Million

USD

723.58 Million

2025

2033

| 2026 –2033 | |

| USD 393.84 Million | |

| USD 723.58 Million | |

|

|

|

|

Europe Automated Liquid Handling Market Size

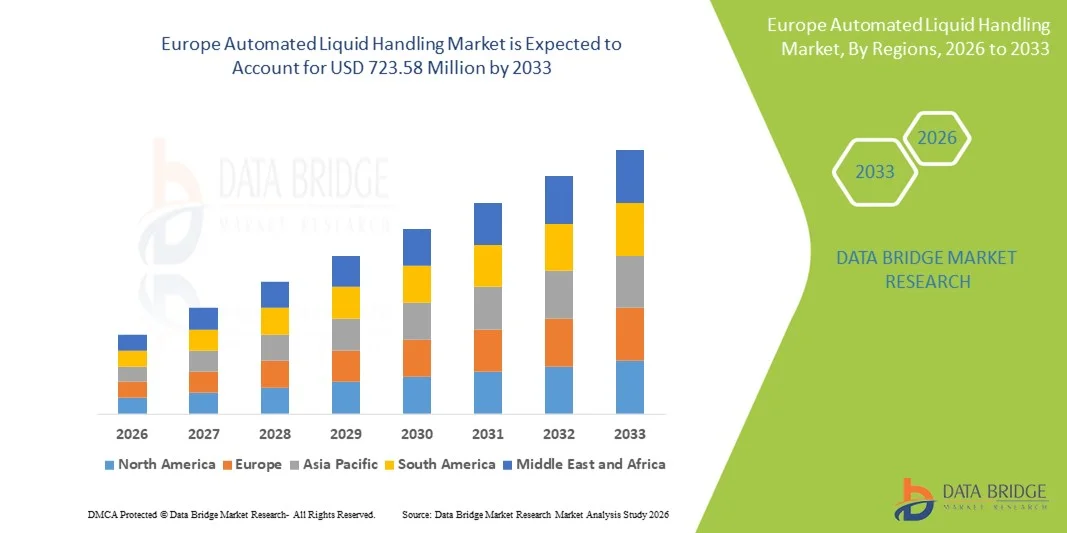

- The Europe automated liquid handling market size was valued at USD 393.84 million in 2025 and is expected to reach USD 723.58 million by 2033, at a CAGR of 7.9% during the forecast period

- The market growth is largely fueled by increasing adoption of laboratory automation technologies, strong research and development activities across biotechnology and pharmaceutical sectors, and rising demand for high‑throughput liquid handling solutions in genomics and clinical diagnostics

- Furthermore, rising investment in advanced workstations and reagents, increasing focus on precision and reproducibility in laboratory workflows, and strong presence of research institutes and pharmaceutical companies across Europe are driving demand for automated liquid handling platforms. These converging factors are accelerating the uptake of automated liquid handling systems, thereby significantly boosting the industry’s growth

Europe Automated Liquid Handling Market Analysis

- Automated liquid handling systems, offering precise and reproducible liquid transfer and sample processing, are increasingly vital components of modern laboratories in both research and clinical settings due to their enhanced accuracy, high-throughput capabilities, and seamless integration with laboratory automation workflows

- The escalating demand for automated liquid handling is primarily fueled by the growing adoption of laboratory automation technologies, increasing R&D activities in pharmaceutical and biotechnology sectors, and a rising need for faster, more reliable, and contamination-free sample processing

- Germany dominated the automated liquid handling market with the largest revenue share of 38.2% in 2025, characterized by advanced research infrastructure, strong government support for life sciences, and a high concentration of key industry players

- Italy is expected to be the fastest growing country in the automated liquid handling market during the forecast period due to expanding biotech research, increasing laboratory investments, and rising demand for automation in pharmaceutical and diagnostic applications

- Automated liquid handling workstations segment dominated the Europe market with a market share of 42.9% in 2025, driven by their established reputation for versatility, accuracy, and seamless integration into existing laboratory workflows

Report Scope and Europe Automated Liquid Handling Market Segmentation

|

Attributes |

Europe Automated Liquid Handling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Automated Liquid Handling Market Trends

Enhanced Efficiency Through Integration with Robotics and AI

- A significant and accelerating trend in the Europe automated liquid handling market is the growing integration with robotic systems and artificial intelligence (AI), enabling laboratories to perform complex workflows with minimal human intervention and higher reproducibility

- For instance, the Tecan Fluent Automation Workstation integrates AI-driven pipetting protocols with robotic plate handling, allowing researchers to streamline high-throughput screening and sample preparation processes

- AI integration in automated liquid handling enables features such as predictive error detection, optimization of liquid transfer paths, and adaptive protocol adjustments based on sample type. For instance, Hamilton Microlab STAR platforms use AI to reduce pipetting errors and improve throughput in genomics applications

- The seamless integration of automated liquid handling systems with broader laboratory information management systems (LIMS) and robotic platforms allows centralized control over multiple processes, including PCR setup, plate replication, and high-throughput screening

- This trend towards more intelligent, precise, and interconnected laboratory automation solutions is fundamentally reshaping workflow efficiency and reproducibility standards. Consequently, companies such as Agilent Technologies are developing AI-enabled automated liquid handlers capable of predictive scheduling and adaptive liquid handling protocols

- The demand for automated liquid handling systems that offer AI and robotics integration is growing rapidly across biotechnology, pharmaceutical, and clinical research sectors, as labs increasingly prioritize speed, accuracy, and automation of complex workflows

- Miniaturization and modularity of automated liquid handling instruments are becoming popular, allowing smaller laboratories to adopt scalable systems while maintaining precision and throughput for diverse applications

Europe Automated Liquid Handling Market Dynamics

Driver

Rising Need Due to Expanding Biotech R&D and Laboratory Automation

- The increasing investment in biotechnology research and pharmaceutical R&D, coupled with growing demand for high-throughput laboratory automation, is a key driver for automated liquid handling adoption

- For instance, in March 2025, Beckman Coulter announced the deployment of automated liquid handling systems in European genomic laboratories to accelerate drug discovery and gene sequencing workflows

- As laboratories seek faster, more reliable, and contamination-free liquid handling, automated systems provide advanced features such as multi-channel pipetting, programmable protocols, and integration with LIMS, offering a compelling upgrade over manual technique

- Furthermore, the rising trend of personalized medicine and genomics research is making automated liquid handling an integral component of laboratory workflows, enabling reproducible and scalable sample processing

- The ability to perform complex procedures such as PCR setup, serial dilution, and high-throughput screening with minimal human intervention is propelling the adoption of automated liquid handling systems across research institutes, hospitals, and pharmaceutical companies

- Increasing regulatory requirements for reproducibility and data traceability in clinical and diagnostic labs are also driving automated liquid handling adoption, ensuring compliance with EU and international standards

- Growing collaborations between universities, research institutes, and pharmaceutical companies are accelerating investments in automated liquid handling solutions to improve efficiency and shorten drug discovery timelines

Restraint/Challenge

High Capital Cost and Technical Expertise Requirement

- The relatively high initial investment required for automated liquid handling platforms, combined with ongoing maintenance costs, poses a challenge to broader adoption, particularly for small or budget-constrained laboratories

- For instance, some European academic institutes have delayed implementing advanced liquid handling workstations due to the substantial upfront expenditure and need for dedicated laboratory space

- Addressing these challenges through scalable modular systems, leasing options, and shared service models is crucial to expand adoption. Additionally, automated liquid handling requires trained personnel for setup, programming, and troubleshooting, which can limit deployment in resource-limited labs

- While automation improves efficiency and reproducibility, the learning curve associated with complex systems can slow implementation, particularly in institutions transitioning from manual workflows

- Overcoming these challenges through simplified interfaces, staff training programs, and cost-effective system designs will be vital for sustained growth of automated liquid handling adoption across Europe

- Compatibility issues with legacy laboratory equipment and software can pose integration challenges, requiring additional investment in system upgrades or custom interfaces

- Market adoption can also be hindered by limited awareness among smaller laboratories regarding the benefits of automation, necessitating targeted marketing and educational initiatives by suppliers

Europe Automated Liquid Handling Market Scope

The market is segmented on the basis of product, type, procedure, modality, application, end user, and distribution channel.

- By Product

On the basis of product, the Europe automated liquid handling market is segmented into automated liquid handling workstations, reagents & consumables, and others. The automated liquid handling workstations segment dominated the market with the largest revenue share of 42.9% in 2025, driven by their high versatility and ability to automate complex workflows across PCR setup, serial dilution, and high-throughput screening. Research and clinical laboratories increasingly prefer workstations for their ability to reduce human error, improve reproducibility, and handle large sample volumes efficiently. Workstations also integrate with robotic platforms and LIMS, enabling centralized control and workflow optimization. The segment’s leadership is further reinforced by continuous innovations in pipetting accuracy, protocol customization, and AI integration. Additionally, the strong presence of key players offering modular and scalable solutions contributes to sustained dominance.

The reagents & consumables segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising number of high-throughput genomic and proteomic studies requiring precise, contamination-free tips, plates, and reagents. Consumables are essential for proper system functioning, and recurring demand ensures steady revenue growth. Increasing focus on quality, standardization, and pre-validated consumables also drives adoption. Emerging biotech and diagnostic labs in Europe, particularly in countries like Italy and Spain, are investing in compatible reagents and consumables to enhance workflow efficiency. The convenience of pre-packaged kits and the need for traceable reagents further accelerate growth.

- By Type

On the basis of type, the Europe automated liquid handling market is segmented into automated liquid handling systems and semi-automated liquid handling. The automated liquid handling systems segment dominated the market in 2025 due to their full automation capabilities, enabling large-scale, high-throughput laboratory processes with minimal human intervention. These systems are widely adopted in pharmaceutical R&D, genomics, and clinical diagnostic labs where speed, reproducibility, and traceability are critical. Automated systems reduce errors, allow protocol standardization, and integrate with LIMS and robotic platforms for centralized control. The segment is further supported by technological innovations such as AI-based predictive adjustments, multi-channel pipetting, and adaptive liquid transfer paths. Established companies are continuously upgrading their systems to enhance efficiency and compatibility with diverse laboratory workflows, reinforcing market dominance.

The semi-automated liquid handling segment is expected to witness the fastest growth from 2026 to 2033, driven by demand from medium-sized laboratories and academic research institutions that require partial automation at a lower cost. Semi-automated systems provide flexibility, allowing users to manually intervene while still benefiting from speed and accuracy enhancements. They are also easier to integrate into existing lab workflows and require less specialized training compared to fully automated systems. The rising adoption of hybrid laboratory setups in Europe and the increasing availability of modular semi-automated platforms are fueling this growth.

- By Procedure

On the basis of procedure, the Europe automated liquid handling market is segmented into PCR setup, plate replication, serial dilution, high-throughput screening, plate reformatting, cell culture, whole genome amplification, array printing, and others. The PCR setup segment dominated the market in 2025, driven by the widespread use of PCR in genomics research, clinical diagnostics, and infectious disease testing. Automation enhances throughput, minimizes human error, and ensures reproducibility in sensitive nucleic acid amplification protocols. European diagnostic laboratories prioritize PCR automation to handle large testing volumes, comply with regulatory standards, and reduce contamination risk. Continuous innovations in robotic pipetting and AI-guided protocol optimization further strengthen dominance.

The high-throughput screening segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing demand in drug discovery and proteomics research. Pharmaceutical companies and biotech firms require automated liquid handling to efficiently process thousands of samples, accelerate lead identification, and improve assay reproducibility. The growth is supported by rising investments in compound libraries, personalized medicine, and AI-driven screening platforms. Emerging European markets are increasingly adopting high-throughput systems to reduce R&D timelines and costs.

- By Modality

On the basis of modality, the Europe automated liquid handling market is segmented into disposable tips and fixed tips. The disposable tips segment dominated the market in 2025, driven by their ability to reduce cross-contamination risk, ensure precise liquid handling, and comply with stringent regulatory requirements in clinical and genomic applications. Disposable tips are preferred in high-throughput labs due to their convenience, reliability, and ease of replacement. Continuous innovation in tip design, including low-retention and filtered tips, supports widespread adoption. The segment also benefits from recurring demand, as consumables are integral to daily laboratory operations, ensuring sustained revenue growth.

The fixed tips segment is expected to witness the fastest growth from 2026 to 2033, particularly in cost-sensitive labs and academic institutions seeking long-term investments with reduced recurring consumable expenses. Fixed tips are durable, enable repeated use with proper cleaning, and are increasingly being integrated with modular automated systems. Growing awareness about sustainable lab practices and reducing plastic waste in laboratories further accelerates the adoption of fixed-tip systems in Europe.

- By Application

On the basis of application, the Europe automated liquid handling market is segmented into genomics, drug discovery, clinical diagnostics, proteomics, and others. The genomics segment dominated the market in 2025 due to the increasing number of sequencing projects, gene expression studies, and personalized medicine research across Europe. Automated liquid handling ensures reproducibility, high-throughput sample preparation, and minimal contamination in sensitive genomic assays. Governments and private research institutions are heavily investing in genomics infrastructure, reinforcing segment dominance.

The drug discovery segment is expected to witness the fastest growth from 2026 to 2033, driven by rising R&D expenditure by pharmaceutical companies and biotechnology firms. Automated liquid handling systems accelerate screening, compound testing, and assay development, reducing timelines and operational costs. The growing emphasis on precision medicine and biologics development further fuels adoption. Emerging research hubs in Spain, Italy, and the Nordic countries are investing heavily in automated drug discovery platforms, contributing to rapid growth.

- By End User

On the basis of end user, the Europe automated liquid handling market is segmented into biotechnology and pharmaceutical industries, research institutes, hospitals and diagnostic laboratories, academic institutes, and others. The biotechnology and pharmaceutical industries segment dominated the market in 2025, driven by extensive adoption for drug discovery, biologics development, and high-throughput screening. These organizations prioritize automation to improve workflow efficiency, reproducibility, and regulatory compliance. Continuous investment in R&D and expansion of laboratory facilities reinforces dominance.

The academic institutes segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing research funding, collaborations with industry, and the adoption of semi-automated systems for training and experimentation. Academic laboratories are investing in automation to improve throughput, minimize errors, and provide hands-on experience to students in modern research techniques. Government initiatives supporting innovation in life sciences further drive segment growth.

- By Distribution Channel

On the basis of distribution channel, the Europe automated liquid handling market is segmented into direct tender, retail sales, and third-party distributor. The direct tender segment dominated the market in 2025, driven by preference among large hospitals, diagnostic laboratories, and pharmaceutical companies for direct procurement from manufacturers to ensure system customization, maintenance support, and long-term service agreements. Direct tender also allows bulk purchase agreements, faster delivery, and technical support, which is critical for high-throughput labs.

The third-party distributor segment is expected to witness the fastest growth from 2026 to 2033, particularly in emerging European markets where smaller laboratories rely on distributors for access to affordable systems, consumables, and service contracts. Distributors also provide training, on-site support, and flexible financing options, making automation more accessible to a wider customer base. Growth is further supported by distributors providing bundled solutions, consumables, and maintenance services alongside automation platforms.

Europe Automated Liquid Handling Market Regional Analysis

- Germany dominated the automated liquid handling market with the largest revenue share of 38.2% in 2025, characterized by advanced research infrastructure, strong government support for life sciences, and a high concentration of key industry players

- Laboratories in Germany highly value the precision, reproducibility, and high-throughput capabilities offered by automated liquid handling systems, which streamline complex procedures such as PCR setup, serial dilution, and high-throughput screening while minimizing human error

- This widespread adoption is further supported by government funding for R&D, strong regulatory compliance standards, and collaborations between research institutes and industry, establishing automated liquid handling systems as a preferred solution for academic, clinical, and industrial laboratories

The Germany Automated Liquid Handling Market Insight

The Germany automated liquid handling market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced research infrastructure, strong government support for life sciences, and the presence of key industry players. Germany’s emphasis on innovation and efficiency promotes the adoption of automated liquid handling systems, particularly in genomics, drug discovery, and clinical diagnostics. Integration with laboratory information management systems (LIMS) and robotics is becoming increasingly prevalent, enabling high-throughput processing with minimal human intervention. The growing focus on reproducibility and quality control aligns with local laboratory standards, driving market growth.

U.K. Automated Liquid Handling Market Insight

The U.K. automated liquid handling market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing R&D activities in biotech and pharmaceutical sectors and the rising demand for automation in academic and clinical laboratories. Concerns regarding sample integrity, workflow efficiency, and regulatory compliance are encouraging laboratories to adopt automated liquid handling solutions. The U.K.’s robust research ecosystem and supportive government initiatives for innovation are expected to further stimulate market expansion.

France Automated Liquid Handling Market Insight

The France automated liquid handling market is expected to expand steadily during the forecast period due to growing adoption in pharmaceutical R&D and clinical diagnostic laboratories. Laboratories in France are increasingly implementing automated systems for high-throughput screening, PCR setup, and serial dilution to enhance efficiency, reproducibility, and traceability. Government support for life sciences and collaborations between research institutes and private companies are driving system integration and adoption. Increasing investments in genomic research and personalized medicine further contribute to market growth.

Italy Automated Liquid Handling Market Insight

The Italy automated liquid handling market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biotechnology research, increasing laboratory investments, and the rising need for automation in clinical and academic labs. Italian laboratories are adopting automated liquid handling systems to improve sample throughput, reduce human error, and comply with stringent EU regulations. Additionally, the growing presence of pharmaceutical and diagnostic companies seeking efficient workflows is propelling demand. The availability of modular and semi-automated systems also supports adoption across a wider range of laboratory sizes.

Europe Automated Liquid Handling Market Share

The Europe Automated Liquid Handling industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Hamilton Company (U.S.)

- Tecan Group Ltd. (Switzerland)

- PerkinElmer (U.S.)

- Eppendorf SE (Germany)

- Beckman Coulter, Inc. (U.S.)

- Analytik Jena GmbH (Germany)

- BioTek Instruments (U.S.)

- Gilson, Inc. (U.S.)

- Hudson Robotics, Inc. (U.S.)

- INTEGRA Biosciences AG (Switzerland)

- Sartorius AG (Germany)

- Aurora Biomed Inc. (Canada)

- Labcyte, Inc. (U.S.)

- METTLER‑TOLEDO International Inc. (U.S.)

- Corning Incorporated (U.S.)

- QIAGEN (Netherlands)

- SPT Labtech Ltd. (U.K.)

- Diagenode Diagnostics (Belgium)

What are the Recent Developments in Europe Automated Liquid Handling Market?

- In June 2025, SPT Labtech’s firefly NGS automation platform was recognised by the Illumina Qualified Methods programme, underscoring industry validation of its automated liquid handling workflows for Illumina DNA Prep kits, which boosts reproducibility and reduces hands‑on time in sequencing labs

- In May 2024, SPT Labtech’s firefly® liquid handling platform was chosen by Colossal Biosciences to accelerate next‑generation sequencing (NGS) capabilities, highlighting how automated liquid handlers are being deployed beyond traditional labs to support large‑scale genomics and biodiversity research with improved throughput and precision

- In February 2024, SPT Labtech released firefly+, an expansion of its all‑in‑one genomics liquid handling platform that integrates an on‑deck thermocycler and increased labware capacity, enabling complete hands‑free NGS library preparation workflows for labs with limited space and staffing

- In November 2023, SPT Labtech launched enhancements to its firefly platform for Laboratory Developed Tests (LDTs), empowering clinical laboratories to streamline and accelerate NGS library preparation liquid handling with user‑friendly software and workflow automation tailored for regulated environments

- In May 2023, Opentrons introduced the Opentrons Flex robot, a new generation of inexpensive, simple‑to‑program liquid handling lab robot designed to broaden access to automated workflows, particularly in research and smaller lab environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.