Europe Artificial Turf Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

6.95 Billion

2024

2032

USD

1.48 Billion

USD

6.95 Billion

2024

2032

| 2025 –2032 | |

| USD 1.48 Billion | |

| USD 6.95 Billion | |

|

|

|

|

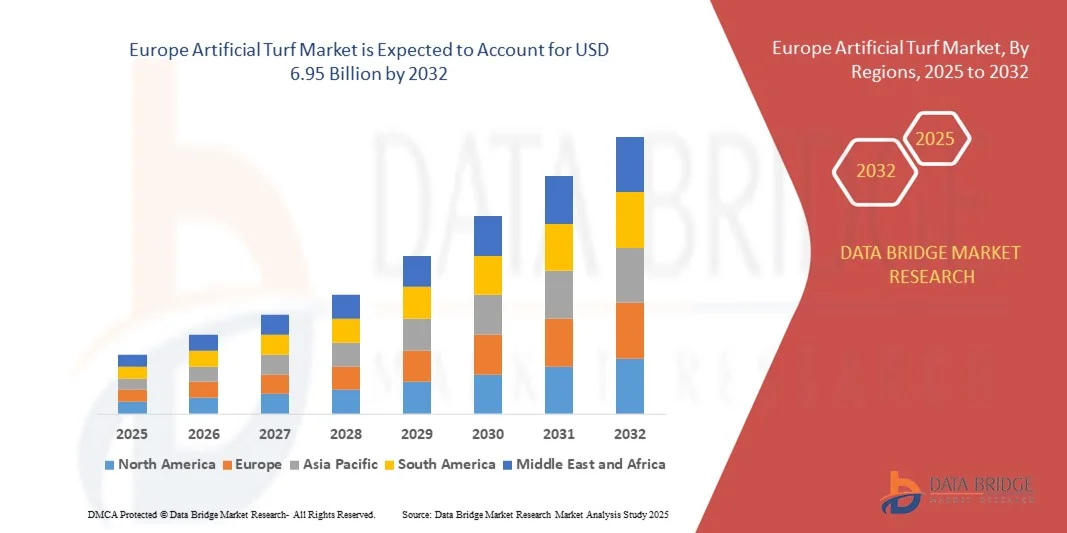

What is the Europe Artificial Turf Market Size and Growth Rate?

- The Europe artificial turf market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 6.95 billion by 2032, at a CAGR of18.5% during the forecast period

- The easy installation, environment friendly and low maintenance requirements which will increase the production of artificial turf products drives the market. With the increase in the growing demand from sports clubs and different venues will also boosts the demand of the artificial turf market

- The stringent regulations regarding usage of artificial turf in several European countries will restrain the demand of the artificial turf market

What are the Major Takeaways of Artificial Turf Market?

- The increase in the demand for the third-generation artificial turf will act as an opportunity for the artificial turf market. The difficulty in maintaining a high field temperature due to the raw material and infill material acts as the challenge for the artificial turf market

- Germany dominated the Europe Artificial Turf market in 2024, capturing the largest revenue share of 35.7%, driven by high demand from sports facilities, landscaping projects, and commercial developments

- The France artificial turf market is witnessing the fastest growth rate of 11.3%, supported by rising demand for premium landscaping, recreational facilities, and sports complexes

- The Polyethylene segment dominated the market in 2024 with a market share of 45.3%, driven by its high durability, UV resistance, and cost-effectiveness, making it the preferred choice for both sports fields and landscaping applications

Report Scope and Artificial Turf Market Segmentation

|

Attributes |

Artificial Turf Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Artificial Turf Market?

Eco-Friendly and High-Performance Turf Solutions

- A major trend shaping the artificial turf market is the development of eco-friendly, durable, and high-performance synthetic turf solutions designed to reduce environmental impact while maintaining athletic and aesthetic performance. Growing awareness of sustainability and resource efficiency is driving manufacturers to innovate greener turf products

- Companies are increasingly using recycled polymers and biodegradable infill materials to minimize environmental footprint without compromising on durability or performance

- In addition, the design of lightweight turf systems is gaining traction, allowing easier installation, lower transportation costs, and reduced maintenance requirements

- A notable instance is Tarkett Group (France), which introduced its GreenFields Eco range, a sustainable artificial turf line utilizing recycled yarns and reduced water consumption, demonstrating the market’s shift toward environmentally conscious solutions

- This trend toward sustainability, combined with performance optimization, is transforming the market and encouraging continuous investment in greener, cost-effective, and long-lasting turf solutions globally

What are the Key Drivers of Artificial Turf Market?

- Rising awareness of environmental sustainability and the demand for low-maintenance sports and landscaping surfaces are primary drivers of the artificial turf market

- For instance, in 2024, Polytan GmbH (Germany) expanded production of its eco-friendly synthetic turf systems, catering to professional sports stadiums and municipal landscaping projects with recycled and durable materials

- The market benefits from growing demand for premium, all-weather surfaces that reduce water usage, maintenance costs, and chemical fertilizers

- Moreover, governments and municipalities are promoting synthetic turf adoption for sports facilities, parks, and schools to save resources and improve playability

- Innovations such as hybrid systems combining natural grass with artificial turf, antimicrobial coatings, and UV-resistant fibers are further boosting adoption and enhancing the overall value proposition in residential, commercial, and sports applications

Which Factor is Challenging the Growth of the Artificial Turf Market?

- High initial installation costs and concerns about surface heat retention remain significant challenges impacting market expansion. Synthetic turf systems require specialized materials and labor-intensive installation, raising capital expenditure compared to natural grass alternatives

- For instance, in 2024, rising raw material costs for polymers and backing materials affected CCGrass (China) and other key manufacturers, slightly constraining profit margins

- Environmental concerns regarding microplastic leaching and end-of-life disposal of synthetic turf are also limiting broader adoption

- Companies such as TenCate Grass (Netherlands) and Act Global (U.S.) are addressing these issues through recyclable turf solutions, bio-based fibers, and improved drainage systems to reduce environmental impact and heat retention

- Achieving a balance between sustainability, performance, and cost-effectiveness remains a persistent challenge, requiring continuous R&D and strategic investment to ensure long-term market growth

How is the Artificial Turf Market Segmented?

The Artificial Turf market is segmented on the basis of raw material, infill materials, pile height, distribution channel, and end-user.

- By Raw Material

On the basis of raw material, the Artificial Turf market is classified into Nylon, Polypropylene, Polyethylene, Polyamides, Jute, Rubber, and Others. The Polyethylene segment dominated the market in 2024 with a market share of 45.3%, driven by its high durability, UV resistance, and cost-effectiveness, making it the preferred choice for both sports fields and landscaping applications. Polyethylene turf also offers softer texture and enhanced safety for children and athletes, supporting its widespread adoption.

The Nylon segment is projected to register the fastest CAGR from 2025 to 2032, fueled by demand for high-strength, wear-resistant turf in professional sports stadiums and high-traffic commercial areas. Nylon’s superior resilience under heavy footfall and harsh weather conditions is making it increasingly popular in premium installations, driving innovation and investment in nylon-based synthetic turf solutions globally.

- By Infill Materials

Based on infill materials, the Artificial Turf market is segmented into Petroleum-Based, Organic, Sand (Silica), and Others. The Sand (Silica) infill segment dominated the market in 2024 with a market share of 38.7%, owing to its cost efficiency, natural feel, and excellent drainage properties, making it ideal for sports and landscaping applications. Sand infill also helps stabilize the turf fibers and reduces maintenance requirements.

The Organic infill segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by sustainability initiatives and increasing adoption of biodegradable and eco-friendly infill materials. Organic infills, such as cork and coconut husk, reduce environmental impact, improve water retention, and provide softer playing surfaces, making them attractive to environmentally conscious consumers and sports facilities.

- By Pile Height

On the basis of pile height, the Artificial Turf market is segmented into Less Than 10 mm, 10–30 mm, 30–50 mm, 50–70 mm, 70–100 mm, and More Than 100 mm. The 10–30 mm segment dominated the market in 2024 with a market share of 42.1%, as this height range is widely used for residential lawns, commercial landscaping, and low-intensity sports applications. It offers an optimal balance of comfort, aesthetics, and maintenance efficiency.

The 50–70 mm segment is projected to record the fastest CAGR from 2025 to 2032, driven by demand for professional sports fields, golf courses, and high-performance recreational areas. Taller pile heights provide better cushioning, natural grass-such as appearance, and enhanced durability under heavy usage, making them ideal for premium installations.

- By Distribution Channel

Based on distribution channels, the Artificial Turf market is segmented into Direct Sales/B2B, E-Commerce, Specialty Stores, Convenience Stores, and Others. The Direct Sales/B2B segment dominated the market in 2024 with a market share of 44.5%, driven by large-scale installations in sports facilities, commercial landscaping, and government projects. Direct channels provide bulk orders, customization options, and professional support, making them preferred for institutional and commercial buyers.

The E-Commerce segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by increasing consumer preference for online shopping, easy comparison of products, and doorstep delivery. E-commerce platforms also support smaller businesses and residential customers seeking convenient access to synthetic turf products.

- By End-User

On the basis of end-user, the Artificial Turf market is segmented into Households, Sports & Leisure, Restaurants, Hotels, Airports, Commercial Offices, Pet Areas, and Others. The Sports & Leisure segment dominated the market in 2024 with a market share of 47.6%, driven by growing investments in professional and recreational sports facilities, schools, and stadiums requiring durable, low-maintenance surfaces. Synthetic turf provides consistent performance, safety, and aesthetic appeal in sports applications, supporting its widespread adoption.

The Households segment is projected to record the fastest CAGR from 2025 to 2032, fueled by increasing urbanization, rising disposable incomes, and consumer preference for low-maintenance, water-saving lawn solutions. Residential adoption is further accelerated by easy installation kits and eco-friendly turf options.

Which Region Holds the Largest Share of the Artificial Turf Market?

- Germany dominated the Europe Artificial Turf market in 2024, capturing the largest revenue share of 35.7%, driven by high demand from sports facilities, landscaping projects, and commercial developments

- The country’s advanced manufacturing infrastructure, technological expertise, and strong sustainability policies support large-scale artificial turf production. Germany’s focus on eco-friendly materials and recyclable synthetic fibers, coupled with innovation in low-maintenance turf systems, strengthens its leadership in the regional market. The dominance is further enhanced by EU regulations promoting sustainability, energy efficiency, and reduced environmental impact. Leading companies are investing in durable, recycled, and lightweight turf solutions to meet climate goals

- Overall, Germany’s commitment to sustainable production, R&D investments, and robust industrial base has solidified its position as the leading player in Europe’s Artificial Turf market

France Artificial Turf Market Insight

The France artificial turf market is witnessing the fastest growth rate of 11.3%, supported by rising demand for premium landscaping, recreational facilities, and sports complexes. French manufacturers are focusing on eco-friendly synthetic fibers, lightweight infill materials, and innovative turf designs to enhance durability and sustainability. Government initiatives promoting recycling and resource efficiency have accelerated the adoption of greener turf solutions. Collaborations with international suppliers and technology firms are improving production efficiency, quality, and aesthetic appeal. With growing awareness of environmental impact and performance requirements, France continues to play a crucial role in shaping the European Artificial Turf market’s growth trajectory.

Italy Artificial Turf Market Insight

The Italy artificial turf market is expanding steadily, driven by increasing investments in sports fields, golf courses, and commercial landscaping projects. Italy’s strong manufacturing heritage, combined with expertise in precision-engineered synthetic fibers, supports market growth. Companies are adopting automation, energy-efficient production processes, and recycled materials to reduce environmental footprint and enhance quality. The growing export of Italian artificial turf solutions across Europe further boosts demand. In addition, collaborations with premium sports and landscaping brands are fostering innovation in durable, high-performance, and visually appealing turf systems. As a result, Italy remains a significant contributor to the Europe Artificial Turf market.

U.K. Artificial Turf Market Insight

The U.K. artificial turf market is growing rapidly, fueled by rising adoption in residential, commercial, and recreational applications. Increasing focus on sustainable alternatives to natural grass, including recycled fibers and biodegradable infill materials, is driving market expansion. The country’s recycling infrastructure and support for circular economy initiatives further enhance artificial turf adoption. Manufacturers are embracing smart turf technologies, modular turf systems, and advanced installation techniques to meet evolving consumer needs. Partnerships with international suppliers and sports organizations are promoting innovation in lightweight, low-maintenance, and durable turf solutions. Consequently, the U.K. is emerging as a leading innovator within Europe’s Artificial Turf landscape.

Which are the Top Companies in Artificial Turf Market?

The artificial turf industry is primarily led by well-established companies, including:

- Tarkett Group (France)

- Victoria PLC (U.K.)

- SYNLawn Artificial Grass (U.S.)

- Polytan GmbH (Germany)

- SpectraTurf, Inc. (U.S.)

- Italgreen S.p.A. (Italy)

- Dow (U.S.)

- Royal Grass (Netherlands)

- SIS Pitches (U.K.)

- Condor Group (Turkey)

- Act Global (U.S.)

- Nurteks (Turkey)

- LIMONTA SPORT S.p.A. (Italy)

- TenCate Grass (Netherlands)

What are the Recent Developments in Europe Artificial Turf Market?

- In June 2023, the MHC Weesp, a hockey club near Amsterdam, manufactured a unique, dry, and zero-water artificial turf surface, becoming the first club in the world to install a full-size hockey field using TenCate’s sustainable turf technology, demonstrating innovation in water-saving sports solutions

- In May 2023, SYNLawn Artificial Turf installed a new outdoor amphitheater for a town square, featuring a lawn for concerts and festivities, a community playground with a splash pad, and fire pits for social gatherings, highlighting the versatility of artificial turf in public spaces

- In September 2022, TenCate Grass, in collaboration with Exxon Mobil and Cyclyx, launched the TenCate Turf Recycling Solutions initiative to enable the effective recycling of synthetic turf into feedstock for new turf production, emphasizing sustainability in artificial turf lifecycle management

- In April 2022, Victoria completed the acquisition of Belgium-based Balta Group, whose products are manufactured across nine locations and sold in 136 countries worldwide, strengthening Victoria’s global footprint and expanding its artificial turf and flooring portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Artificial Turf Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Artificial Turf Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Artificial Turf Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.