Europe Artificial Blood Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

27.18 Billion

2025

2033

USD

4.65 Billion

USD

27.18 Billion

2025

2033

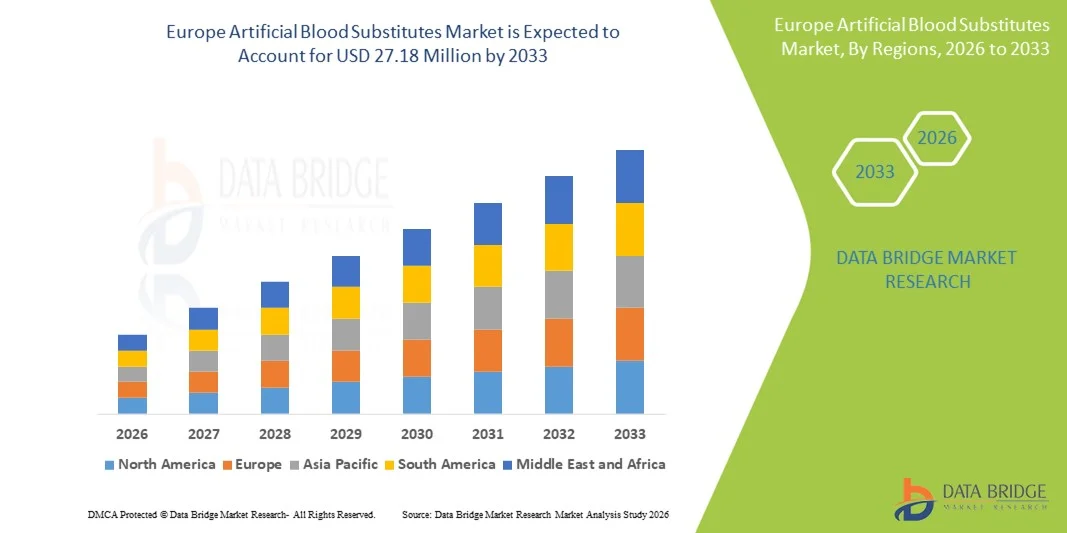

| 2026 –2033 | |

| USD 4.65 Billion | |

| USD 27.18 Billion | |

|

|

|

|

Europe Artificial Blood Substitutes Market Size

- The Europe artificial blood substitutes market size was valued at USD 4.65 billion in 2025 and is expected to reach USD 27.18 million by 2033, at a CAGR of 24.7% during the forecast period

- The market growth is largely fueled by increasing demand for alternatives to traditional blood transfusions, technological advancements in oxygen‑carrying therapeutics, and rising investments in research and development to overcome donor blood shortages

- Furthermore, stringent healthcare regulations, growing clinical applications and rising adoption in hospitals and emergency care settings are driving increased uptake of artificial blood substitutes across Europe’s established healthcare systems

Europe Artificial Blood Substitutes Market Analysis

- Artificial blood substitutes, designed to replicate or enhance the oxygen-carrying capacity of human blood, are increasingly critical in addressing blood shortages, improving trauma care, and supporting surgeries and emergency medical treatments across Europe

- The rising demand for artificial blood substitutes is primarily fueled by growing awareness of blood transfusion risks, technological advancements in hemoglobin-based oxygen carriers and perfluorocarbon-based products, and increasing investments in research and clinical trials

- Germany dominated the Europe artificial blood substitutes market with the largest revenue share of 25.8% in 2025, driven by advanced healthcare infrastructure, higher healthcare expenditure, and strong adoption of innovative therapeutics in hospitals and trauma centers

- France is expected to be the fastest growing country in the market during the forecast period, supported by increasing investments in healthcare modernization, expansion of surgical and trauma care facilities, and growing clinical adoption of artificial blood substitutes

- Hemoglobin-Based Oxygen Carries (HBOCs) segment dominated the Europe artificial blood substitutes market with a market share of 45.3% in 2025, attributed to their proven clinical efficacy, longer shelf life, and ease of administration compared to other oxygen-carrying substitutes

Report Scope and Europe Artificial Blood Substitutes Market Segmentation

|

Attributes |

Europe Artificial Blood Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Artificial Blood Substitutes Market Trends

Advancements in Oxygen-Carrying Therapeutics and Clinical Applications

- A significant and accelerating trend in the Europe artificial blood substitutes market is the development of next-generation hemoglobin-based and perfluorocarbon-based products, enhancing oxygen delivery in trauma care, surgeries, and emergency medicine

- For instance, Hemopure, a hemoglobin-based oxygen carrier, is increasingly adopted in hospitals across Germany and France to manage critical blood shortages during high-risk surgeries and emergency procedures

- Innovations in product stability, longer shelf life, and reduced immunogenicity are enabling wider clinical adoption and easier stockpiling for hospitals and emergency centers. Furthermore, artificial blood substitutes are being integrated into specialized care units to support patient safety in scenarios with limited donor blood availability

- The seamless integration of these substitutes with hospital protocols and clinical guidelines facilitates centralized blood management, ensuring timely administration and reducing dependency on donor blood supply chains

- This trend toward safer, more efficient, and readily deployable blood substitutes is fundamentally reshaping expectations for critical care management, prompting manufacturers such as Sangart and Baxter to invest in products with improved oxygen-carrying capacity and reduced side effects

- The demand for artificial blood substitutes with enhanced clinical efficacy and compatibility is growing rapidly across hospitals, trauma centers, and surgical facilities, as healthcare providers increasingly prioritize patient safety and operational readiness

Europe Artificial Blood Substitutes Market Dynamics

Driver

Rising Need Due to Blood Shortages and Surgical Demand

- The increasing prevalence of blood shortages and the rising number of surgical procedures are significant drivers for the heightened demand for artificial blood substitutes

- For instance, in 2025, Sangart reported increased adoption of its hemoglobin-based products in French and German hospitals to support trauma and elective surgeries, addressing local donor blood shortages

- As healthcare providers face growing pressure to maintain adequate blood supplies, artificial substitutes provide a reliable alternative, reducing dependency on human donors and minimizing transfusion-related risks

- Furthermore, the growing adoption of minimally invasive and high-risk surgical procedures is making artificial blood substitutes a critical component of perioperative care, offering improved oxygenation during complex surgeries

- The convenience of long shelf life, rapid availability, and ease of storage further contributes to market growth, enabling hospitals and emergency centers to maintain readiness without relying on conventional blood banking

- Increasing government initiatives and public-private partnerships to develop emergency-ready healthcare supplies are further propelling the adoption of artificial blood substitutes in Europe

- Rising clinical awareness and training programs for healthcare professionals on the benefits and administration of artificial blood substitutes are improving acceptance and integration into hospital protocols

Restraint/Challenge

Safety Concerns and Regulatory Hurdles

- Concerns surrounding potential side effects, immunogenic reactions, and regulatory approvals pose significant challenges to broader market adoption in Europe. Artificial blood substitutes must meet strict clinical and safety standards before widespread use

- For instance, reported adverse events in early clinical trials have made some hospitals cautious about integrating certain oxygen carriers into routine practice

- Addressing these safety concerns through rigorous clinical testing, transparent reporting of adverse events, and robust regulatory compliance is crucial for building trust among healthcare providers. In addition, high development and production costs of advanced substitutes can limit adoption, particularly in smaller hospitals or cost-sensitive healthcare systems

- While some hemoglobin-based and perfluorocarbon products are becoming more accessible, premium substitutes with enhanced oxygen-carrying capacity or reduced side effects often come with higher costs, hindering adoption in certain markets

- Overcoming these challenges through enhanced clinical validation, regulatory alignment, and development of cost-effective products will be vital for sustained growth of the Europe artificial blood substitutes market

- Limited awareness among some healthcare providers about proper usage protocols can slow adoption rates, necessitating ongoing education and training initiatives

- Variations in regulatory frameworks across European countries, including differing approval timelines and safety requirements, can delay product launch and expansion, creating barriers for manufacturers targeting multiple markets

Europe Artificial Blood Substitutes Market Scope

The market is segmented on the basis of product type, source, application, and end user.

- By Product Type

On the basis of product type, the Europe artificial blood substitutes market is segmented into Perfluorocarbon (PFCs) and Hemoglobin-Based Oxygen Carriers (HBOCs). The HBOCs segment dominated the market in 2025, holding the largest revenue share of 45.3% due to their proven clinical efficacy and wider acceptance in hospitals and trauma centers. Hemoglobin-based substitutes closely mimic the oxygen-carrying capacity of human blood, making them suitable for high-risk surgeries, trauma management, and emergency care. Hospitals in Germany, France, and the U.K. often prefer HBOCs because of their ease of administration and longer shelf life compared to conventional blood. In addition, HBOCs can be stored and transported without extensive refrigeration, reducing logistical challenges in critical care. Their integration into hospital protocols ensures consistent oxygen delivery, enhancing patient safety and treatment outcomes. The segment’s dominance is further reinforced by strong regulatory approvals and ongoing clinical trials that validate efficacy and safety.

The Perfluorocarbon (PFCs) segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by innovations in synthetic oxygen carriers and rising adoption in niche clinical applications. PFCs are particularly useful in surgeries requiring temporary blood substitutes or for patients with rare blood types, offering advantages in oxygen solubility and tissue delivery. Advances in nanoparticle-based formulations and reduced side effects are driving interest among European hospitals. PFCs are also gaining traction in emergency and battlefield medicine due to their long shelf life and low risk of disease transmission. Increasing R&D investment by biotech companies in PFC formulations is accelerating commercialization. Growing awareness among clinicians about their clinical benefits and improved storage solutions further contributes to the rapid adoption of PFC-based substitutes.

- By Source

On the basis of source, the Europe artificial blood substitutes market is segmented into human blood, animal blood, microorganism-based recombinant HB, synthetic polymers, and stem cells. The Microorganism-Based Recombinant HB segment dominated the market in 2025, attributed to its high safety profile, reduced immunogenic risk, and scalable production process. Hospitals and blood banks in Germany, France, and Italy increasingly prefer recombinant hemoglobin derived from microorganisms due to consistent quality and lower contamination risk. The ability to produce large volumes without relying on donor blood mitigates shortages and supports emergency care needs. In addition, recombinant HB products comply with stringent European regulations, facilitating adoption across multiple healthcare settings. Their clinical efficacy in trauma care and surgical procedures has been validated through extensive trials, making them a reliable alternative to conventional transfusions. The segment’s dominance is also supported by growing investments from biotech firms in recombinant technology.

The Synthetic Polymers segment is expected to witness the fastest growth from 2026 to 2033, driven by innovations in biocompatible polymer-based oxygen carriers. Synthetic polymers offer customizable oxygen delivery, low immunogenicity, and extended shelf life, making them attractive for hospitals and surgical centers. Advances in polymer engineering allow precise control over oxygen release rates and reduced side effects. Rising interest in synthetic solutions for neonatal care, organ transplantation, and critical care settings is boosting adoption. Research collaborations between European universities and biotech companies are accelerating product development. The scalability and safety profile of synthetic polymers make them increasingly preferred in regions facing donor blood shortages or regulatory constraints.

- By Application

On the basis of application, the Europe artificial blood substitutes market is segmented into cardiovascular diseases, malignant neoplasma, injuries, neonatal conditions, organ transplant, and maternal condition. The Injuries segment dominated the market in 2025, driven by the high prevalence of trauma cases requiring rapid blood replacement in emergency and surgical settings. Hospitals and trauma centers in Germany, France, and the U.K. increasingly rely on artificial blood substitutes to manage severe injuries where donor blood may be unavailable or delayed. Rapid oxygen delivery, minimal storage requirements, and reduced transfusion risks make substitutes essential in trauma care. In addition, increasing road accidents and surgical interventions in Europe are driving the consistent demand for substitutes in emergency protocols. Integration into hospital trauma management guidelines ensures timely administration and improved patient outcomes. The segment’s dominance is further strengthened by clinical validation of efficacy in critical care scenarios.

The Organ Transplant segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising transplant surgeries and the need for reliable oxygen carriers during perioperative care. Artificial blood substitutes ensure consistent oxygenation during transplant procedures, minimizing complications and improving graft survival. Hospitals in France, Germany, and Italy are increasingly integrating substitutes into transplant protocols. Advances in oxygen delivery formulations and reduced immunogenicity enhance suitability for transplant patients. Rising organ transplant initiatives and clinical collaborations are also accelerating adoption. The segment benefits from growing awareness among surgeons and transplant centers about the potential of substitutes to improve patient outcomes.

- By End User

On the basis of end user, the Europe artificial blood substitutes market is segmented into hospitals & clinics, blood banks, and others. The Hospitals & Clinics segment dominated the market in 2025, driven by the high adoption of artificial blood substitutes in trauma care, surgeries, and emergency departments. Hospitals in Germany, France, and the U.K. prioritize substitutes for critical procedures due to reliability, ease of storage, and regulatory compliance. The integration of substitutes into hospital protocols and emergency preparedness plans ensures timely access and patient safety. Clinical training programs and increasing awareness of transfusion risks further support hospital adoption. The segment’s dominance is reinforced by partnerships between biotech companies and hospital networks to supply advanced substitutes efficiently. The availability of high-quality substitutes with proven efficacy also contributes to strong hospital uptake.

The Blood Banks segment is expected to witness the fastest growth from 2026 to 2033, fueled by the need to maintain emergency-ready supplies and reduce dependence on donor blood. Artificial blood substitutes enable blood banks to stockpile oxygen-carrying products with extended shelf life and minimal refrigeration requirements. Increasing collaborations between blood banks and biotech firms in Germany, France, and Italy are facilitating rapid distribution to hospitals during crises. Enhanced supply chain management and clinical education programs are further supporting adoption. Rising investments in emergency preparedness and trauma response initiatives are driving blood bank utilization of substitutes. The segment also benefits from government and public-private partnerships promoting artificial blood substitutes as strategic reserves.

Europe Artificial Blood Substitutes Market Regional Analysis

- Germany dominated the Europe artificial blood substitutes market with the largest revenue share of 25.8% in 2025, driven by advanced healthcare infrastructure, higher healthcare expenditure, and strong adoption of innovative therapeutics in hospitals and trauma centers

- Hospitals and emergency care centers in the country increasingly rely on artificial blood substitutes to manage critical surgeries, trauma cases, and situations with limited donor blood availability, ensuring timely oxygen delivery and patient safety

- This widespread adoption is further supported by robust regulatory frameworks, strong clinical validation, and continuous R&D investments, establishing artificial blood substitutes as a preferred solution in both public and private healthcare facilities

The Germany Artificial Blood Substitutes Market Insight

The Germany artificial blood substitutes market captured the largest revenue share in Europe in 2025, fueled by advanced healthcare infrastructure, high healthcare expenditure, and the adoption of innovative therapeutics. Hospitals and trauma centers in Germany are integrating hemoglobin-based substitutes into emergency and surgical care protocols, ensuring rapid and reliable oxygen delivery when donor blood is limited. Ongoing R&D and strong regulatory support enable hospitals to adopt substitutes with confidence. The market is further strengthened by increasing clinical trials and collaborations between biotech companies and hospitals. Artificial blood substitutes are used in both elective and emergency procedures, reinforcing patient safety and operational readiness. Germany’s focus on quality healthcare services and technological adoption continues to drive sustained market growth.

France Artificial Blood Substitutes Market Insight

The France artificial blood substitutes market is expected to witness the fastest growth during the forecast period, driven by increasing healthcare investments, expansion of surgical and trauma care facilities, and rising awareness among clinicians about the benefits of substitutes. Hospitals and specialized care centers in France are rapidly adopting both hemoglobin-based and perfluorocarbon-based products to manage high-risk surgeries and emergencies where donor blood may be limited. Collaborations between biotech firms and medical institutions are accelerating commercialization. Government initiatives supporting emergency preparedness and blood management are also encouraging adoption. Improved distribution networks and training programs for healthcare professionals further enhance clinical confidence. The increasing emphasis on patient safety and clinical efficiency is fostering the widespread use of artificial blood substitutes across France.

U.K. Artificial Blood Substitutes Market Insight

The U.K. artificial blood substitutes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for safer transfusion alternatives and a growing number of surgical and trauma procedures. Hospitals and emergency care centers are increasingly adopting substitutes to manage blood shortages and improve perioperative outcomes. Awareness of transfusion risks and preference for standardized oxygen-carrying products support market growth. The U.K.’s robust healthcare system, combined with clinical trials and collaborations with biotech companies, facilitates faster adoption. Substitutes are being incorporated into both routine and high-risk procedures, enhancing operational efficiency. Government support and training programs for healthcare providers further strengthen adoption.

Italy Artificial Blood Substitutes Market Insight

The Italy artificial blood substitutes market is witnessing steady growth due to rising hospital demand for donor-independent blood alternatives, increasing trauma and surgical procedures, and growing investments in clinical research. Italian hospitals are prioritizing substitutes for critical care and emergency interventions, particularly in urban centers. The adoption is supported by favorable regulations, continuous R&D, and collaborations between biotech firms and healthcare institutions. Artificial blood substitutes offer longer shelf life, ease of storage, and rapid administration, which are key advantages for hospital protocols. Increasing awareness among clinicians about their efficacy and safety further drives usage. The integration of substitutes into perioperative and trauma care workflows reinforces Italy’s market growth.

Europe Artificial Blood Substitutes Market Share

The Europe Artificial Blood Substitutes industry is primarily led by well-established companies, including:

- HEMARINA (France)

- Aurum Biosciences (U.K.)

- Octapharma AG (Switzerland)

- Grifols, S.A. (Spain)

- CSL Behring (Germany)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- Kedrion Biopharma (Italy)

- Biotest AG (Germany)

- LFB Group (France)

- Macopharma (France)

- Bio Products Laboratory (U.K.)

- Sanguine Biosciences (France)

- HemoBioTech, Inc. (Germany)

- PharmaCon GmbH (Germany)

- Hemocare GmbH (Germany)

- ProBlood Ltd. (U.K.)

- CellMed AG (Switzerland)

- Vifor Pharma (Switzerland)

- Abzena Ltd (U.K.)

What are the Recent Developments in Europe Artificial Blood Substitutes Market?

- In March 2024, HbO2 Therapeutics LLC received approval from the European Medicines Agency to initiate Phase I clinical trials for its next‑generation hemoglobin‑based oxygen carrier, designed to evaluate safety and efficacy in trauma care across multiple European countries. This milestone signals a critical step toward clinical validation of advanced artificial blood substitutes for emergency medicine in Europe, enhancing research momentum and potential emergency care applications

- In March 2023, Hemarina’s HEMO2life® oxygen carrier technology, derived from natural hemoglobin, was recognized as a pioneering oxygen therapeutic solution, gaining attention for its utility in organ preservation and potential clinical impact. The development represents one of the first functional artificial oxygen carriers acknowledged for medical use in the EU, underscoring innovative progress in blood substitute technologies in Europe

- In March 2023, Hemarina published news on clinical utilization and expanded applications of its HEMO2life® oxygen carrier, including use in reconstructive surgery and improved organ graft preservation outcomes. These real‑world updates illustrate ongoing clinical activity and adoption of artificial blood technology in European healthcare settings

- In January 2023, the EIC‑Pathfinder SynEry project was launched under the European Union’s Horizon Europe programme to create an artificial blood substitute, bringing together research institutions from Belgium, Spain, France, and Italy to develop scalable synthetic erythrocytes that mimic key features of natural red blood cells and address unmet needs in safe blood supply and transfusion medicine

- In September 2022, Hemarina obtained CE certification for its HEMO2life® technology, allowing it to be marketed across European Union markets, marking a regulatory achievement for an artificial oxygen carrier and enabling broader clinical application in organ transplantation and preservation. This certification demonstrates a significant regulatory endorsement of artificial blood substitute technology in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.